By Pepper Parr

By Pepper Parr

July 13, 2020

BURLINGTON, ON

Tax due dates are be made a little longer, there are deferrals, and there is tax money that is just not coming in

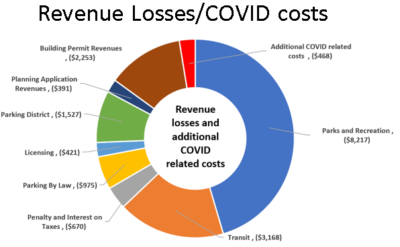

On the other side of the ledger the expenses are not as high. All the part time people were laid off, there was no transit money coming in nor was there much revenue on the Parks and Recreation side

The books were pretty messy.

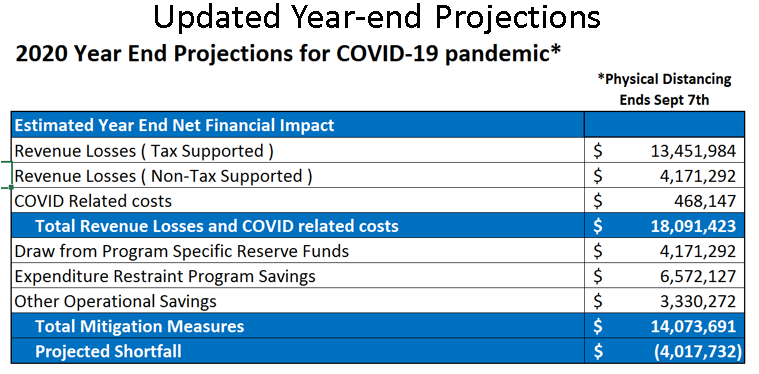

Treasurer Joan Ford prepared a presentation for a Standing Committee lat week and put two critical numbers forward. $18,091,423.00 and $4,017,732.00

The eighteen million is the total revenue losses and COVID related costs.

The four million is what the Treasurer expects to see as the shortfall – money the city will not have to to pay its bills.

Somehow Mayor Marianne Meed Ward convinced herself that the city was $18 million in the hole. She called it the “delta”.

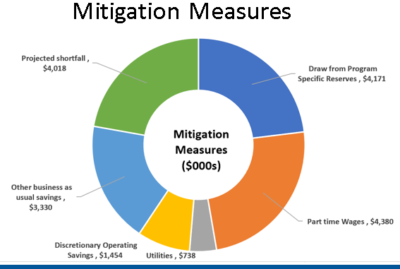

There was also an Expenditure Restraint amount of $6,572,127 and Other operational savings of $3,330,272.

When these two are added to the withdrawals from Program Specific Reserve funds the shortfall of $4,017,732 which the Finance people are confident can be made up by withdrawing from other reserve funds.

This graph sets out where the revenue didn’t come from.

Treasurer Joan Ford did point out that treasurers are usually comfortable with total reserves of 15% – those total reserves are now at the 9% level. They are going to have to be built back up at some point.

Treasurer Joan Ford did point out that treasurers are usually comfortable with total reserves of 15% – those total reserves are now at the 9% level. They are going to have to be built back up at some point.

The general message was that while things are tight – the city feels that they will come though the COVID pandemic with some change in their pockets.

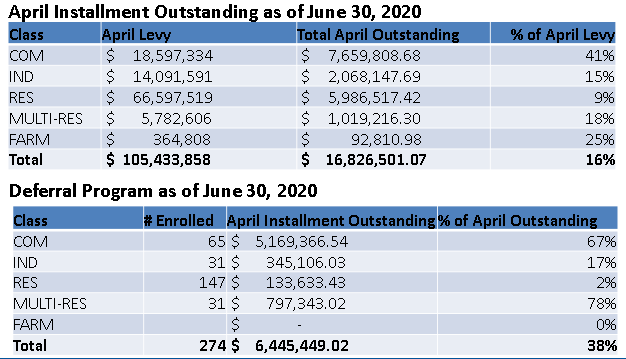

Property tax collection did take a hit – some of the larger properties were either not able to pay their taxes the way they had in the past, several took advantage of the deferral program.

Many of the smaller businesses just didn’t have the cash flow. Burlington has always followed a lenient approach to the collection of taxes – they bend over backwards to help a property owner get their taxes paid. Treasurer Joan Ford told Council that in al her years wit the city they have only had to force the sale of a piece of property because the taxes were not paid.

Data on the property tax collection level.

That assumes that things do not get worse – and with the current COVID situation – they just don’t know where things will be in 60 days.

The Treasury people have worked both long and hard and very creatively to keep the financial situation quite stable.