By Staff

By Staff

July 5, 2021

BURLINGTON, ON

How well is the Re-Opening going?

Is retail and hospitality recovering?

There were long lines getting into the Mapleview Mall on the weekend. That was some of the good news – but the 17 new infections at the Schlegal Long Term Care residence on Upper Middle Road tells us that there is still strong reason to be very cautious.

When we learn that just 52% of the staff were vaccinated – we ask – how did that happen? Why was that permitted? Have we not learned anything about this virus?

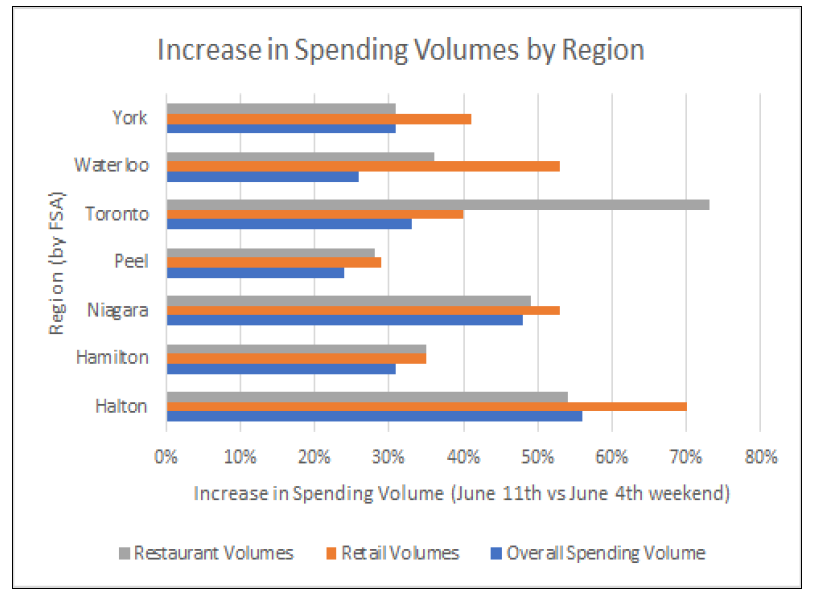

A report on spending levels suggests that the re-open is going to be real.

Spending in Burlington looks to be better than the other regions

Reports suggest that there is a lot of money out there not being spent and at the same time we learn that the Food Banks struggle a bit to feed people who aren’t back at their jobs yet.

Is there a pent up demand to spend when malls are open?

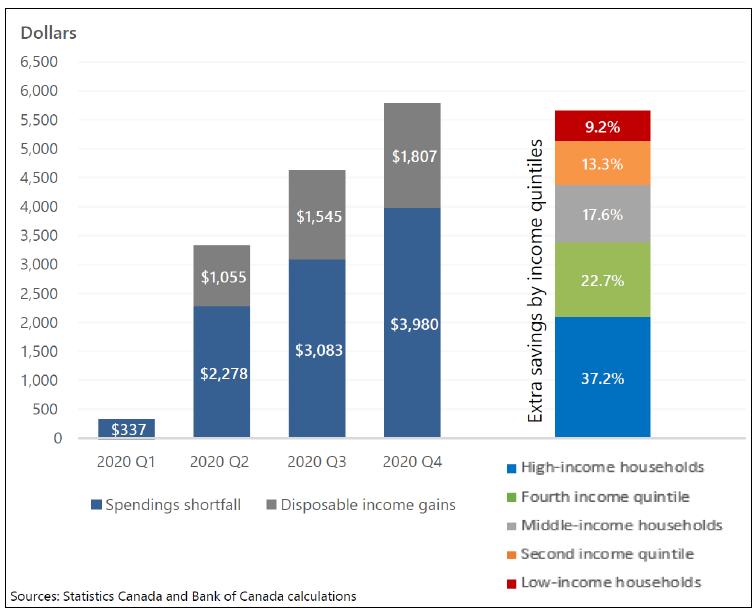

Canadians accumulated $180 billion (~ $5800 per capita) in extra savings over 2020.

40% of these savings were accumulated by high-income households.

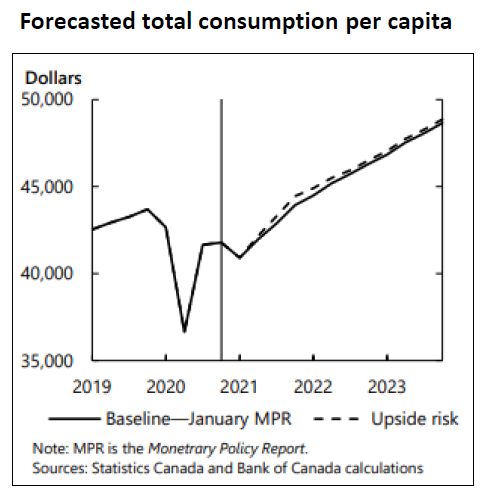

Is there a better economic story ahead of us? A report from the Bank of Canada suggest there is.

10% saved by low-income households.

At peak, spending is predicted to increase at an annual pace of $500 per Canadian over Q4 2021, injecting roughly $4 billion into the economy that quarter

Most of these savings are expected to be spent on high-contact services, including transportation, accommodation, and food services.

Source:COVID-19, savings and household spending -Bank of Canada(March2021)

This would increase the demand for labour and create approximately 30,000 jobs each year until 2023

Ontario Economic Forecast –June 2021

Real GDP in Ontario will grow 5.4% in 2021 and 5.0% in 2022

Growth forecast has been downgraded for two reasons:

1.

Province-wide lockdowns triggered by 3rd wave led to 2.5% decline in employment rates, impacting near-term performance

2.

Global supply chain disruptions in the auto sector will heavily impact this year’s growth

Solid rebound still expected due to re-opening (contingent on vaccination rates), immigration, and strong US recovery

Provincial government spending likely to continue to offer near-term support –expected to reduce spending beginning 2022

Housing market expected to start cooling due to acute affordability issues in and around the GTA, tightening mortgage stress test rules, and high lumber prices

Home sales fell by 25% from March to May

Tourism Economic Recovery Task Force Report

Tourism Economic Recovery Task Force Report

Tourism has been crippled with predictions suggesting that sector will not return until 2023 at best

•

Ontario’s 2020-2021 Budget includes:

$150 million for Travel Incentives

$100 million for the Ontario Tourism Recovery Program

$100 million in one-time payments through Ontario Tourism and Hospitality Small Business Support Grant

Tourism is expected to be one of the last industries to recover from the pandemic – potentially past 2024