By Staff

By Staff

May 10th, 2022

BURLINGTON, ON

The Rocca Sisters have been on the front line of residential property sales for at least a decade.

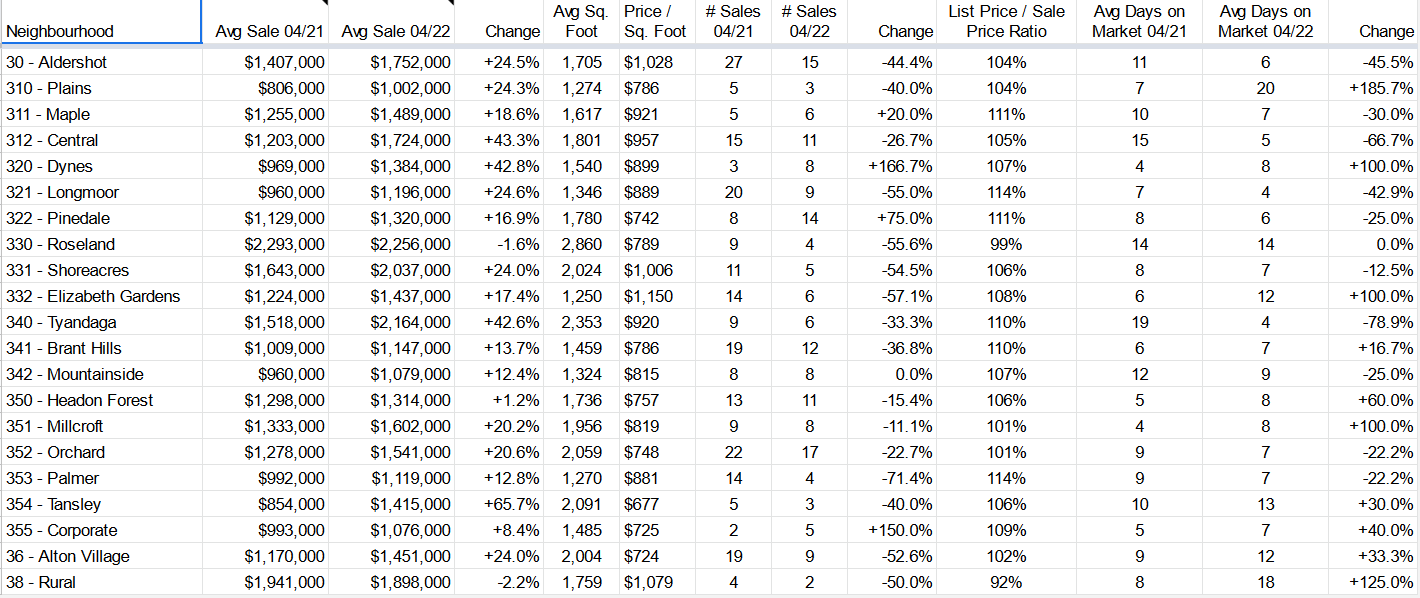

They monitor and analyze each market in Burlington and present updated data every month.

Their Market Insight Report for residential properties documents what has taken place – it has been a wild ride.

During April 2022 for Burlington, Oakville, Hamilton, and Greater Hamilton, the market has continued to change.

Understanding how to navigate this transition to get the best results whether selling or buying is crucial.

The Rocca Sisters have the real estate market transitioning from an overheated market to currently a Sellers market and what is a balanced market on the horizon.

Inflation continues to be high, interest rates continue to rise, our province has moved into a new world of “normal”, people are living, travelling and rethinking their plans. The unrest of what will happen in the world with Russia and Ukraine is still looming over us, which puts most people in a questionable state. What we know is that there are still great opportunities for Sellers and finally options and opportunities for buyers.

During the month of April, we have continued to see a shift in the market. The average price for a freehold property in Burlington was $1,510,482 last month and was $1,476,711 at the end of April, however still 18% higher than April 2021 when we saw the average price at $1,248,805 and year over year average sale price is still up 23%. During the month of April, properties sold for 106% of the listed price down from 116% last month and in 8 days, on average, up slightly from 6 days last month, but down year over year from 10days in 2021. Inventory has increased 53% from March to April, which of course plays a role in this adjusting market, regardless, we are still ahead year over year.

During the month of April, the average price for a condo apartment in Burlington was $739,000, down from $797,000 last month, however up 21% from $609,000 the same month last year. The price per square foot was down in April at $770, compared to $791 last month, however up almost 22% from the same month last year. In April, properties sold for 105% of the listed price, down from 111% last month. Days on market are up slightly from 8 to 11 days but down from 14days year over year. Like the Freehold market, the condo market has begun to shift. Although, like all markets, inventory levels still lend to a Sellers market, the condition and results show we continue to transition into a balanced market, but are still in a strong Sellers market.

What Does All of This Mean

This month we have witnessed bigger changes in the marketplace, however when we put it all into perspective and analyze it as a whole, we are still in a very strong market. One where Sellers can still capitalize on values we would have never seen 2 years ago, let alone 12 months ago.

Buyers are finally getting a break with inventory options – and although we have 4x more inventory then we did a couple of months ago, the inventory levels still dictate a Sellers market. What is happening and what is going to happen you ask? Well, we all knew our overheated market was not sustainable, this was to be expected.

Buyers are finally getting a break with inventory options – and although we have 4x more inventory then we did a couple of months ago, the inventory levels still dictate a Sellers market. What is happening and what is going to happen you ask? Well, we all knew our overheated market was not sustainable, this was to be expected.

The market is transitioning and of course there are several factors playing a hand in this as well; interest rate increases, the unrest of the looming War, high inflation, and of course the media which has made some people pause and question what they’re doing and why they’re doing it. We are reaching new levels of “normality”, people are being called back to the workplace, and of course with the market changes, some buyers are reconsidering where they are going or what they are doing for the interim.

What we must all keep in mind is that Sellers still are farther ahead today then a year ago, they are still in a great Sellers market, and one that will definitely continue to transition with time so capturing that now is key. For Buyers, well I don’t know any Buyer that tried to time the market and was successful, if it happens organically great, but the reality is that Buyers are in a way better position with more options, less competition and possibly a bit of negotiating power than they were a couple months ago. Why wait — one thing we know for sure is that historically, when our marketplace shifts, it is typically 60days on average before it begins to upswing. We may see some ironing out between now and mid-late summer, but the opportunities for buyers are now.