January 4TH, 2020

BURLINGTON, ON

What happens if you don’t pay your taxes – and how many people don’t pay their taxes?

In a recent report to city Council Joan Ford, City Treasurer reported that:

The City of Burlington collects property taxes for the city, Region of Halton and the Halton Boards of Education as legislated under the Municipal Act, 2001

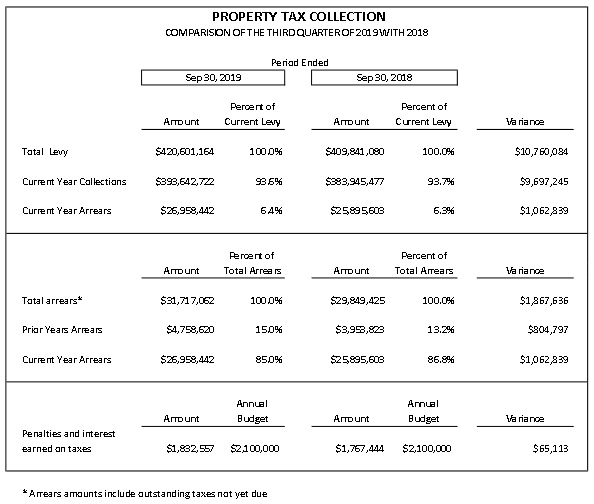

The total 2019 tax levy is $420.6 million compared to $409.8 million in 2018.

The status of property tax collection as of September 30th, 2019 was:

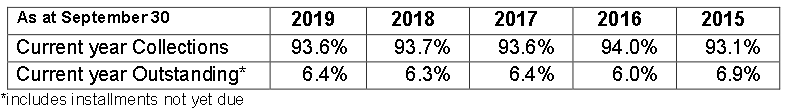

Collections for the current taxation year are 93.6%, which is consistent with prior years as highlighted in the chart below.

What does the city do when taxes due are not paid?

Arrears notices are sent four times per year to aid in collections. In addition to arrears notices, tax collection letters are sent to owners with arrears in both the current year and two previous years; business properties are sent letters in the first quarter and residential properties in the second quarter.

A property title search is undertaken in November on accounts with three years of arrears and any lenders are notified. This results in most accounts being paid.

For those properties that remain three years in arrears, the Municipal Act, 2001 allows for a tax sale process to begin in January. The owner or any interested party has one year to pay out the tax arrears. If arrears remain after the one year period, the city may proceed with a municipal tax sale. Since 2000 there have been seven tax sales in Burlington.

The city offers multiple payment options including three pre-authorized payment plans which provide a convenient and reliable payment method for property owners. Approximately one third (20,000) of all property accounts are enrolled in pre-authorized payment plans.

One doesn’t get extensions like that with a bank loan.

I will always think, whenever I hear about citizens or businesses in Burlington not paying their taxes, of Councillor Jack Dennison in 2006 defending the fact that his local business hadn’t paid taxes for two years (owing well over $300,000) … a city councillor! … and that he got re-elected shortly after this came out and again twice more. I don’t think that would happen again.