January 21st, 2025

BURLINGTON, ON

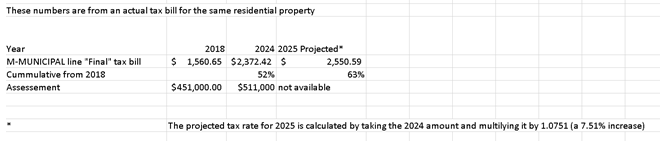

On January 7th, we published a story on what the tax increased were between 2018 and 2024 show the increase each year and the cumulative increase.

A link to that story is HERE

We received a request from the city to correct the story. We will come back to that request.

To ensure that our information in the story was correct we asked a Burlington resident to send us information from their residential property tax bill.

The following is what we were provided with:

From the same tax bills shown above, we can see the cumulative increase, 2018 to 2025, on the total tax bill is 35%.

The resident said:

For 2018 I used the May 17, 2018 “Final” Tax bill.

For 2024 I used the May 9, 2024 “Final” Tax bill.

Back to the city request: The Communications department sent us the following:

The City would like to request a correction to the article titled “Cumulative tax increases delivered by the current council in the last six years amount to 65.10%” published on Jan 7. After reviewing the cumulative tax rate mentioned, we believe the 65.1% should be changed as below.

- From 2018 to 2025 a residential property tax owner saw their total property taxes paid (City, Region and Education) increase by a total of 19%, compared to the consumer price Index of 19.88%. The average annual increase over this period of 2.4%.

- For the City-only portion, the total increase is 40% over the same period, with an average annual increase of 5%.

Gazette note – the consumer price index has no direct bearing on what property taxes anount to.

The 65% figure mentioned in the article comes from the growth in the City’s total tax revenues from 2018 to 2025, which includes the natural increase in property values/assessments during this period.

Gazette note: The city admits that the 65% figure is correct – adding that “natural increase in property values/assessments“. So?

Gazette note: Tax bill information should be clear – the tax notices the city sends out are anything but clear. Is this due to incompetence? Has anyone taken the time to sit down and review the document and think of a way to present the information in a manner that is clear? It is possible to produce a tax bill – just seems that the city isn’t all that interested in providing understandable information.

The city has asked us to please review the data and correct the article to ensure an accurate representation of the cumulative tax increases.

We have come to the conclusion that it is the city that is incorrect.

My calculations show a 131% increase in my property taxes since 1996. 13% in the last two years. https://1drv.ms/x/c/79eff14b2453edf9/EXTv-kknfp5IgwkDFtIxugIBqCk7tpI0krBs5ra4hItdfA?e=1Bthlc

Thankyou to the Gazzette. The minute we let our municipal government try to control the spin in the media we are doomed. It seems this council cannot accept other people’s truths. Freedom of speech in burlington is only allowed if it goes with MMWs agenda. Due to my anti-condo development stance along the lake l had a personal phone call from the mayor. She threatened me to not appear at council meetings or l would be arrested. This was a complete overreach and powertripping move on her part. I’m still trying to figure out this unwarranted move on her part?????? Other than her closeness to a certain developer and facilitating the building of the now largest condo on the lake. ( Bridgewater)

Not really much of a surprise Robert. Governments habitually load the most unpopular things, like taxation hikes, in the first year of their mandate. They depend on people forgetting and, unfortunately, people do.

I ran a similar calculation on municipal and came up with the same numbers. The big surprise was the percent jump of approx 15% between 2022 and 2023?

Many people on social media have confirmed that increase. Ann Marie Coulson – Manager, Financial Planning and Tax explains how a resident might calculate that increase in this video: https://youtu.be/H1Lk5Tql8HY