By Pepper Parr

By Pepper Parr

June 12th, 2023

BURLINGTON, ON

As recommendations go they don’t get better than this:

Approve the establishment of the Better Homes Burlington Energy Retrofit Pilot Program to provide a maximum of twenty loans to Burlington homeowners who meet program eligibility criteria to support the implementation of air source heat pumps.

Direct the Executive Director of Environment, Infrastructure and Community Services to monitor and assess the results of the Better Homes Burlington pilot program and report back to council in one year with recommended next steps.

The purpose of the report was to obtain council approval of the necessary elements to deliver the Better Homes Burlington (BHB) program. In 2020, Council approved the Burlington Climate Action Plan and set a target to become a net zero carbon community by 2050. The BHB program will support decarbonization measures in the residential sector to help Burlington achieve its net zero community target.

The report recommended the BHB program as a pilot project which will support residential decarbonization by:

• providing a concierge service to homeowners with guidance on options to complete a home energy efficiency retrofit;

• offering loans to homeowners to accelerate the adoption of air source heat pumps; and,

• engaging and educating homeowners and contractors to promote/deliver home energy efficiency retrofits.

For those who want to upgrade the way they heat and cool their homes the Better Homes Burlington would appear to be something worth looking into.

Council directed Staff to bring forward a business case as part of the 2023 budget process for the resources required to support implementation of a small-scale home energy efficiency retrofit program including a virtual delivery centre/support for homeowners, and loans through a Local Improvement Charge (LIC) mechanism for Burlington homeowners to improve home energy efficiency.

Council recently approved the Better Homes Burlington program coordinator position (one year contract) as part of the 2023 operating budget.

Better Homes Burlington – Concierge

The program coordinator will act as a concierge to provide assistance to homeowners as they consider options to improve the energy efficiency of their homes. This role could be more significant than administering the BHB loan given the complexities for homeowners to navigate the home energy efficiency retrofit environment. The concierge will provide guidance on:

• Grants and incentives – Enbridge Gas has partnered with the federal government’s Greener Homes program to be the one stop shop for both the Greener Homes and Enbridge grants to support a wide range of home energy efficiency measures – Home Efficiency Rebate Plus (HER+)

• Financing – discussing options with homeowners for the best options to finance home energy efficiency retrofits (ie. financial institutions, the federal government’s Greener Homes loan program, Enbridge Sustain and/or Better Homes Burlington loan)

• Energy audits – provide guidance on the benefits of and how to arrange an EnerGuide Home Evaluation

• Energy Efficiency Measures – provide guidance on the types of measures which can improve energy efficiency and reduce carbon footprint

• Contractors – offer guidance on how to find and retain contractor services for energy efficiency improvements

The program coordinator will also be responsible for community engagement activities to promote the benefits of home energy efficiency measures and the options available to homeowners, as noted above. Contractor engagement to promote the program will also be part of this role.

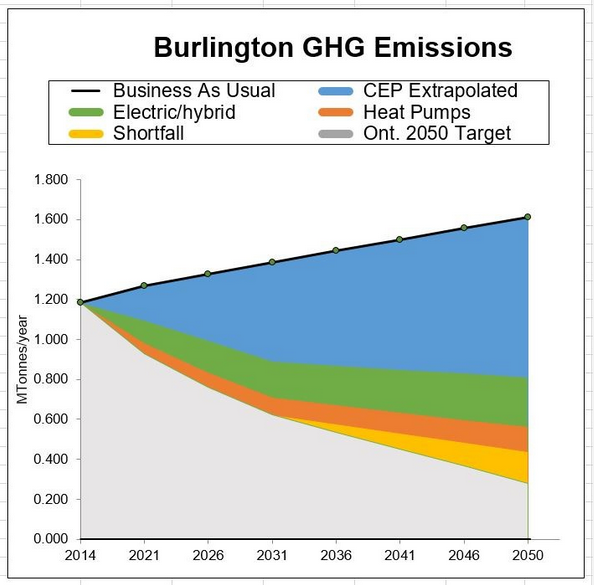

Jim Feilders, the owner of a home that is carbon neutral explains: ÈPutting it all together with the best data I could find, is shown in the chart below. It includes the “What if” we do nothing, called business as usual. You know, keep our heads in the sand and keep doing what we have always done. I’m not saying change is easy by any means.” Burlington GHG emmissions – source The obvious solution is to make the Community Energy Plan work – problem with that is we don’t know yet how to do that. Extrapolations for the CEP are less optimistic as most of the behavioural change will have occurred. With our CEP alone, we fall short.

Better Homes Burlington Loan

To implement the Better Homes Burlington pilot loan program, a bylaw is required to utilize the Local Improvement Charge (LIC) mechanism. In 2012, the provincial government amended the LIC regulation to permit municipalities to deliver home energy efficiency loans to homeowners, which can be repaid through property taxes.

A maximum of $10,000 will be offered to homeowners to support the installation of air source heat pumps and leak sealing. The target for the pilot project is 20 homes which currently rely on burning fossil fuels for a source of heating.

Eligibility criteria include:

• All registered owner(s) of the property must consent to participating in the Program;

• Property tax and all other payment obligations to the City of Burlington for the past five years must be in good standing;

• Owners must enroll in the pre-authorized property tax payment plan prior to approval for term of loan; and

• The owner must notify its mortgage lender (if applicable) of the owner’s intention to participate in the Program using the City of Burlington’s prescribed form.

• Note: homeowners with CMHC or other insured mortgages are ineligible to participate in the Program.

The maximum term for a loan will be 5 (five) years to be paid back with interest (prime rate). Through the LIC mechanism, the loan is tied to the property and can be transferred to new homeowners if a home is sold, however, most homeowners pay off the loan prior to selling. An administration fee will be charged in the amount of $50.00 (fifty dollars).

The program details for the Better Homes Burlington loan is summarized here:

1. Homeowners will be asked to contact the program coordinator to discuss eligibility for a loan. The program coordinator will provide information on all options available to homeowners to fund energy efficiency measures, such as grants, loans, the Home EnerGuide Assessment process, and how to find a contractor.

1. Homeowners will be asked to contact the program coordinator to discuss eligibility for a loan. The program coordinator will provide information on all options available to homeowners to fund energy efficiency measures, such as grants, loans, the Home EnerGuide Assessment process, and how to find a contractor.

2. If the homeowner is eligible for a BHB loan and decides that this is the best option, they will be directed to obtain quotes for the work.

3. The homeowner will submit the information with a funding application to the City. The funding application will be reviewed by the program coordinator to confirm eligibility and once approved, a property owner agreement (POA) will be shared with the homeowner for signature, which will be signed by the Executive Director of Environment, Infrastructure and Community Services (or designate).

4. Once the POA is executed, the homeowner can proceed with the proposed works and can submit the final report (project completion) to the City with the invoice.

5. If the amount differs from the original application, a revised schedule can be attached to the POA. The program coordinator will work with Finance staff to begin the loan process through the property tax system.

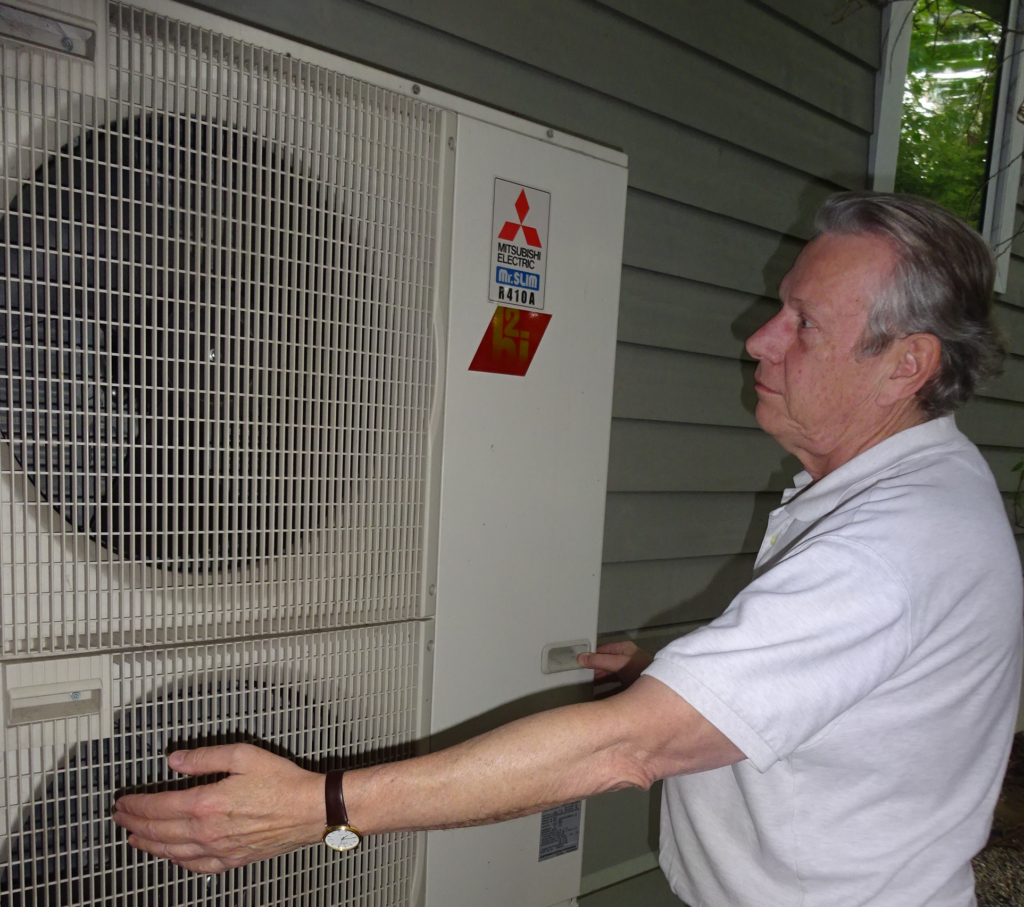

Jim Feilders turned his home into a carbon neutral house. He said: We need to replace gasoline vehicles with electric and hybrid models and transition our residential space heating and water heating from natural gas to electric inverter heat pump technology – air, water and ground sources. These technologies are actually less expensive on a life cycle basis than their fossil fuel alternatives.

The program will be promoted to homeowners throughout the summer with the opening of applications to occur in September. From the time homeowners receive funding approval, they will have six months to install the improvements (air source heat pump and leak sealing) with an opportunity to request a further extension (up to six months). Once the improvement is installed, the homeowner will submit the completion report to confirm the loan amount. The completion report will be reviewed by the program coordinator and the manager of environmental sustainability, and the loan will be processed. Loans will be added to the tax bill at the end of April 2024 to begin the repayment process. If the homeowner has not submitted the completion report in time to process a loan and add to the annual tax bill by April 2024, then the homeowner loan repayment will be added to the tax roll the following year (2025) for repayment.

By January 2024, the program coordinator and manager of environmental sustainability will review the loan application process to determine whether to recommend continuation, particularly given that loans are only added to the tax roll once per year.

Assessment of the pilot program will be based on overall interest in the program and number of applications received. If 20 loans have already been pre-approved by the end of January 2024, the pilot program will come to a close and will be assessed at that time.

Program Monitoring and Assessment

Metrics will be tracked to assess and monitor all aspects of the Better Homes Burlington program to report back to council in 2024 on the results, such as number of homeowners assisted, types of questions asked, number of community engagement activities and participation rates, and number of loans applied for and issued, and number of loans refused. In addition, staff will continue to collaborate with neighbouring municipalities and our extended networks to identify alternative measures for future consideration to support the transition off of the use of fossil fuels for thermal energy.

Financial Matters:

It is recommended that the Energy Initiatives Reserve Fund provide the source of funding to support homeowner loans through the LIC mechanism. Annual loan repayments by homeowners will be credited back to the reserve fund.

With the uncommitted balance currently at $185,000, along with the 2023 funding provided through the rooftop rental fees the City receives from three solar installations on City facilities of $25,000 per year, accounts for the $200,000 reserve fund requirement of the loan program. The reserve fund was originally established in 2015 to help fund energy efficiency initiatives in City facilities.

Total Financial Impact

Based on a cap of 20 loans for each homeowner at $10,000/resident, a total of $200,000 is required to support this program. In addition, Council approved $120,000 one-time funding for a one-year contract for a program coordinator position.

Staff time will be required from Finance in the property tax section to support on the tax eligibility criteria listed above and adding the loan to the property tax bill for repayment.

Lynn Robichaud, Manager of Environmental Sustainability

Engagement Matters:

A communications plan is being finalized with Communications staff to launch, promote and deliver the Better Homes Burlington program. Engagement activities to promote the program will include webinars, presentations and demonstrations in partnership with community stakeholders and networks. A website was created at the same time the Better Homes Burlington feasibility study was completed in partnership with the Centre for Climate Change Management at Mohawk College and will be launched in the near future with a media release.

The program will be voted on at the June 13th Council meeting.

The prime contact at this point is Lynn Robichaud, Manager of Environmental Sustainability 905-335-7600 x7931

Can someone please explain why this is a condition, “Note: homeowners with CMHC or other insured mortgages are ineligible to participate in the Program.

What a waste of tax payers money! Not only loaning out $200K, but spending $120k on a staff position to loan out $200k, are you kidding me. Its not surprising we have an 8% tax increase when these kinds of programs are proposed. A classic example of city government not staying in their lane.