March 27th, 2025

BURLINGTON, ON

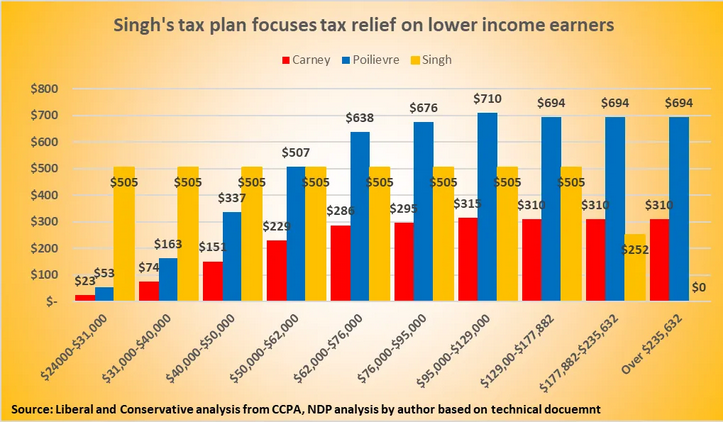

NDP would eliminate tax on incomes under $19,500, reduce tax by $505 for others with incomes under $177,882 and give nothing to incomes over $235,632.

Contrasting with Liberal leader Mark Carney’s “middle class” tax cut and Conservative leader Pierre Poilievre’s “tax cut for workers,” NDP leader Jagmeet Singh today released a tax plan that doesn’t give more money to Galen Weston than a worker earning $60,000.

Singh’s tax plan didn’t come with a cynical, mischaracterizing name, but it would eliminate federal income tax on incomes under $19,500 and cut tax by $505 for everybody with an income tax between $19,500 and $177,882.

Above $177,882, the $505 benefit would phase-out and be totally eliminated for those with a taxable income of $235,632 or more.

The tax plans of both Mark Carney and Pierre Poilievre would pay a benefit to the highest income earners in Canada, giving more money to Galen Weston than a Loblaws cashier.

NDP plan hikes Basic Personal Amount tax exemption limit

Singh’s plan works by increasing the Basic Personal Amount, the amount of income exempt from tax.

Singh’s plan works by increasing the Basic Personal Amount, the amount of income exempt from tax.

For Canadians earning under $177,882, the Basic Personal Amount would be hiked to $19,500. For those with an income over $235,632, it would be lowered to zero. And for those in-between the Basic Personal Amount would be $13,500.

Currently, the Basic Personal Amount is $15,705 for an income up to $173,205 falling to $14,156 for an income over $246,752.

Singh parts ways with Carney and Poilievre on capital gains

Singh’s tax plan would also go ahead with the capital gains tax change scheduled by the Trudeau government which both Carney and Poilievre oppose.

Capital gains are the money made from buying then selling a capital asset, such as company stock and are treated differently than employment income.

Before 2000, 75 per cent of most capital gains earnings were subject to taxation and 25 per cent were tax-free . The Chretien and Martin government increased the tax-exempt share of capital gains to 50 per cent.

Capital gains from selling a primary residence is 100 per cent free from tax in Canada.

The Trudeau change would have kept 50 per cent of capital gains under $250,000 a year tax free, but increased the inclusion to 66 per cent on amounts over $250,000 a year.

If the whole topic of capital gains taxation sounds mysterious, it’s because only about four per cent of Canadians make any money from capital gains in a year. And those making more than $250,000 a year from capital gains, and benefit from the inclusion rate cancellation, are just 0.16 per cent of Canada’s 30 million tax filers, according to a recent tax analysis published in Policy Options.

The average annual income of that 0.16 per cent of Canadian tax files with capital gains over $250,000 was almost $1,183,157 in 2019, according to the analysis.

Subscribe to Data Shows