An international strategist points to a perfect storm of stretched house prices, weak affordability, and over-leveraged mortgage borrowers characterizing the Canadian housing market.

By Zakiya Kassam

By Zakiya Kassam

August 29, 2023

BURLINGTON, ON

An international strategist is warning that Canada could be sitting on the largest housing bubble of all time.

“I’ve analyzed housing bubbles in the developed world and Canada’s really got a unique one to its own,” Phillip Colmar, Managing Partner and Global Strategist at MRB Partners, told BNN Bloomberg last week.

Canada has stretched house prices and weak affordability, said Colmar. He also put particular emphasis on the country’s household debt levels.

Phillip Colmar, Managing Partner and Global Strategist at MRB Partners.

Canadian households packed on $16.5B in debt in the first quarter of this year, according to data from Statistics Canada (StatCan). That included $11.2B in mortgage debt. While that figure represents a “relatively slow” quarter for mortgage borrowing — it follows “record” levels of debt packed on in Q2-2021 and Q2-2022 — StatCan also reports that mortgage interest payments grew 12.6% on a quarterly basis and 69.7% compared with the first quarter of 2022 “as a result of ongoing rate hikes.”

Obligated payments of principal fell 6.8% “as the significant stock of variable rate mortgages likely allowed interest payments to further adjust without a concomitant rise in principal.”

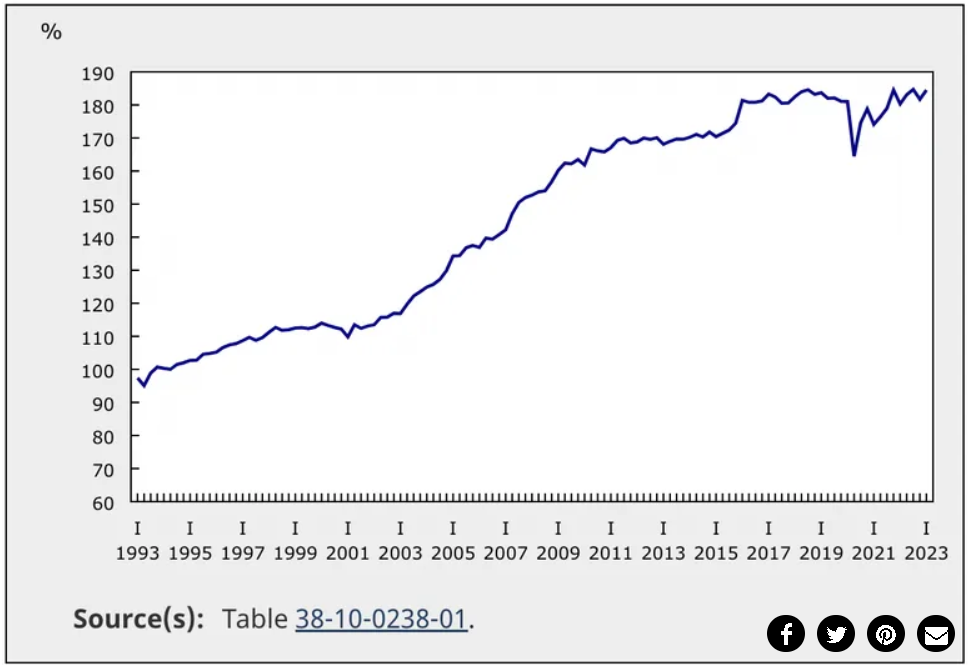

Meanwhile, a “decline in households’ disposable income” pushed the country’s household credit market debt as a proportion of household disposable income to 184.5% in the first quarter, up from 181.7% in the prior quarter.

Household credit market debt to household disposable income, seasonally adjusted (Statistics Canada)

Household credit market debt to household disposable income, seasonally adjusted (Statistics Canada)

“The worst part for a housing bubble is when you have a credit bubble underneath it. And the amount of Canadians leveraged into the system versus incomes is is pretty astronomical,” continued Colmar.

Meanwhile, banks are doing what they can to keep Canadians in their mortgages, including offering borrowers the option to tap into relief plans, payment deferrals, and extended amortizations.

RBC, for instance, recently disclosed that the number of Canadian residential mortgages with amortization periods surpassing 25 years was up 40% year over year in July. Similarly, TD reported an annual rise of 35%. Both banks say they’ve seen a spike in loans extended over 35 years.

This kind of ‘hand holding’ is what’s keeping the rate of mortgage delinquencies low, Victor Tran, mortgage and real estate expert with RATESDOTCA, told STOREYS in a previous interview. It’s also one of the things keeping the housing bubble at bay for the time being.

“[Banks] are basically just kicking the can down the road. They’re helping these customers out,” said Tran. “If lenders stop helping these customers out, then yeah, we’re going to start seeing a huge increase in mortgage delinquencies and mortgage defaults. And sure, we may see many forced sales in the market.”

Tran also pointed out that Canadians are holding onto their mortgages at the expense of other credit products.

“For example, credit cards, student loans, lines of credit, some auto loans — they’re starting to see a huge rise in delayed or missed payments,” he said. “That was kind of expected due to inflation and rising costs. Because if anyone has to miss a payment, they would leave the mortgage payment or any type of housing payment to be left last to miss.”

Although it remains to be seen if the Bank of Canada will opt to raise its policy rate in the months to come, further volatility is sure to bleed into the mortgage space, which could ramp up the severity of a recession.

Experts have been split on when, or even if, a recession will hit — a key factor that will precipitate a housing bubble burst. Just last month, an RBC report predicted a moderate economic contraction in 2023. A July report from financial advice provider Finder, however, found a 50-50 split between economists who believe a recession will happen in the next year and a half and those who don’t expect a recession to happen within the next two years at all.

But looking ahead to early September, when Canada’s next GDP report is due to come out, economists surveyed in a recent Reuters poll pointed to a sharp slowdown in economic growth as being likely.

“Not to be too scary, but there is definitely a risk here that if mortgage rates go higher, or unemployment were to rise when we hit the next recession, then this thing does end up in a deleveraging cycle,” Colmar said.

Picked up from STOREY.CA; the online platform for real estate news.

Simply put the rise in interest rates, which will not cone diwn any time soon, the reckless spending, record newcomers with no limit on student visas and Trudeau and has governed for the last eight years. He will own it.

Please tell us how each of these factors you state are related to the graph causally and and quantitatively over the time period Jim and I noted.

Harper was in power for the big increase the time period, covering about 12 years, and the last 8 years of Trudeau are a significant ratchet resulting in a flat outcome over time.

In other words, tell us how your blame factors are each related to the graph by the numerical influence on the graph variable in the time period. Show us how Trudeau governing at the recent 8 year time caused all this at the Harper time. The timing of the big increase during Harper, is what you need to prove to blame on Trudeau. This needs to be shown with some analysis as to how Trudeau can be blamed for it all. He was out of power!

I would like to see you do this if you are going to blame-cast with only assertion, and no evidence. I’m not doing it for you. It is a 30 year period, and hard to just attribute blame like you do here.

I don’t remember increasing and high interest rates during that period. That is primarily a recent set of increases is it not?

What did the record newcomers do at the time? Unlimited students at the time?

Jim says that Harper was the one doing the budget and spending for the time period of the big rise and I agree.

People deserve more than partisan opinion.

This is a very worrisome graph and the strategist is right to warn us. The debt owed to household income percentage has nearly doubled from nearly 100% to nearly 200% in the last thirty years and the only short term drop was during Covid before it ticked back up again.

It is going to be very difficult to disarm this ticking time bomb without blowing something else up and I have little faith in our central bankers and government finance wizards in bomb disposal.

If this was our “return on investment graph”, we would all be thrilled.

The Trudeau legacy

The big rise in the graph is during the time when Harper was PM.

Good eye Jim.

I also thought this same thing, as I retired in 2004 from the Fed exactly because Harper took power and his policy changes promised to lead to this kind of steep uptick.

Perhaps Ted can give us a clue as to why he blames it on Trudeau