By Pepper Parr

By Pepper Parr

November 23, 2023

November 23, 2023

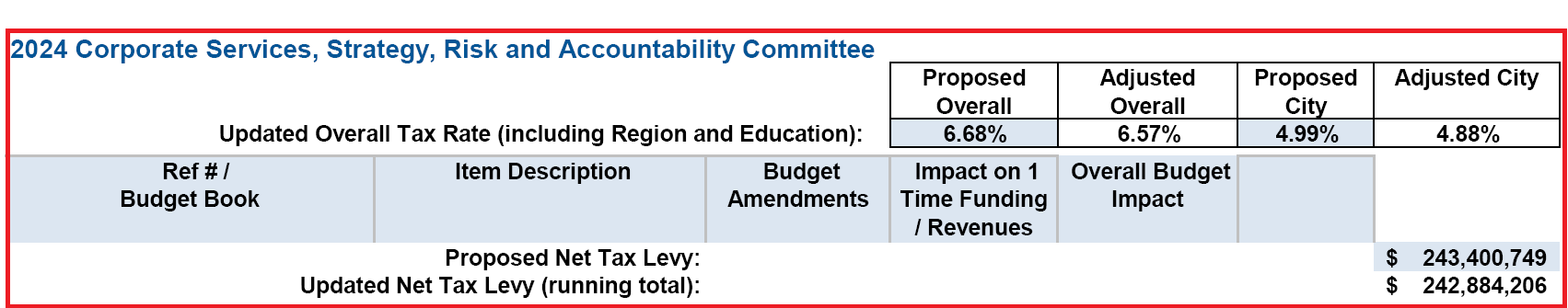

The Mayor said she would bring in a budget with the city portion of the total tax at 4.99%

After weeks of debate, two rambunctious meetings the Budget Standing Committee was able to bring it in at 4.88%

The public opposition was greater than I have seen it in the 12 years I have been covering budgets in Burlington.

It isn’t over yet – the Budget numbers are a recommendation from the Standing Committee – they go to Council on the 28th

This Council will see this as a win – there are a lot of people who won’t share that view.

I’m not discounting that 10-15% isn’t the real increase to your bill. But 4.88% is the % for the budget. The budget is expressed in terms of total money but it’s also broken down into main parts. For Burlington that’s:

Base Budget Impact including Assessment Growth

Dedicated Infrastructure Renewal Levy

Additional Budget Pressures

Impacts of Prior Council Decisions

Impacts of Previously Approved Capital Projects (think Bateman, Skyway)

Sustaining City Services and Finances

Enhancing Services (which is not anything like the name sounds)

Modifications to Services to address COVID

I presented a very strong, compelling, economic based almost 10 minute delegation on Nov 27 targeted at reducing the DIR tax which comprises 0.97% of this tax increase. This is the 2nd year in a row it’s increased with it being 1.60% of the 7.52% increase for 2023. That matters bc we’re now paying for that the rest of our lives. I used indisputable arguments as I used the same data as the city, just current opposed to their report in May. I also used all their reports against them, including this phrase: “WHEN CONSIDERING THE TOTAL QUANTITY AND VALUE OF ASSETS THE CITY OWNS, THE BACKLOG IS NOT OVERLY SIGNIFICANT”

Why am I putting that in caps and what does it mean? Bc that statement refers to the infrastructure. When the city talks about assets, that’s what they’re talking about. And they’ve been telling residents since before last year’s tax hike that it’s bc they need to raise taxes for the city’s infrastructure. Well, according to their own report, that’s utter bullshit. Bc as per their own report, the amount that was in very poor or poor condition was not overly significant. I’d hoped Pepper would publish it, but he probably thinks it’s too dry for most readers. haha

Anyways, back to the topic of my post. Each one of those also has a dollar value and a % and the total of all those individual amounts is the Total 2024 Budget Change and the total % is 4.88%. When it was originally written, it was 32,436,000 and 6.82% (+ 1% for the region & education to be 7.82%)

While the categories used might be different, this is not different than other towns and cities across the province. Each of those categories has a one or more ledger accounts behind it. That’s what you see when you look at the 752 pg document. As well when you look at that document it’s giving you all the data for the numbers. So for where there are new hires, if they’re FTE’s, etc. It’s provided to you because the Municipal Act requires the City to do so. It could be done much better. I personally liked the previous way it was done better (ie see 2017). Much less BS in the beginning pages, no BMA lies to try to make you think you’re paying a lower tax rate than Oakville or Toronto (you aren’t paying more, almost 2x as much as Toronto in fact). If you want to see a more condensed format then you would look at the budget framework and the mayor’s budget.

But this number, whether its 7.82% or 6.21% is a cringe worthy number in itself. Anyone whose paid property taxes for any length of time should cringe at this number. Any taxpayer across the province would.

Telling people the true increase when it’s big numbers like this is definitely something people need to know so that people realize they need to step up. But if you want Burlington to change it then you are saying every town and City in the province has to change what they tell people, probably in Canada, and that’s going to have major pushback. That’s maybe a good thing. But places that are only raising taxes by 2.5% would have to say 5% and then residents are going to be freaking thinking they’re getting a massive increase when they’re really not. I’d kiss MMW’s feet to have a 2.5% tax hike.

The vast majority of people do not realize that the stated tax hike, is not the same as the increase to their bill. And bc the increase is usually not substantial, most people are not calculating the increase year over year.

Again, I’m not saying it’s not important. In this specific situation, I think it’s very valuable information and really brings insight to people of how much the stated tax hike is affecting them. But (1) singling out Meed Ward on this isn’t going to gain any traction bc literally every town and city in the province uses this method and (2) bc of that, it is highly unlikely that you would get anywhere trying to change it. You could still try or do it with the caveat that cities and towns should also be required to state what the increase to the tax bill will be.

sorry its so long. Hopefully people will still read it

They use the word “impact” to mislead us.

City spending increase = impact X 2

City taxes are half the tax bill. Half the bill

goes up 10% the total bill goes up 5%

A budget is about city spending and absolutely nothing else.

Blair Smith described this “perilously close to deception”

To answer your question city revenue from taxes is still increasing by approximately 10%

So what is it really? Still over ten percent? Eric please give us the real story!

This is nonsense.

Yes, Eric please give us the real story. Joan Little Spectator column yesterday supported you have the real story and we need to be armed with what is real and what is a lie and go before council with all guns of truth firing.

I’d love to help but the city holds all the cards. If the city puts some budget details in the agenda for Tuesday’s meetings, I’ll do my best to decrypt them. I just checked and there is no agenda. The only option now is to take page 728 from “War and Peace” and add / subtract all the changes council approved. Staff was doing this in the background but I have not seen the summary. Use this rule – every time city staff or council says impact you double the number to get the increase – this is accurate enough. What a dystopian world.

There are also those who don’t believe process will result in a legitimate budget!