April 25th, 2024

BURLINGTON, ON

Burlington City Council approved the 2024 Tax Levy Bylaw at their last meeting. Council approval of this bylaw is an annual requirement to set tax rates for each year.

The bylaw allows the City to bill 2024 property taxes and set payment due dates for final tax bills on June 19 and Sept. 19, 2024. Final tax bills will be mailed out in late May for the 2024 billing cycle.

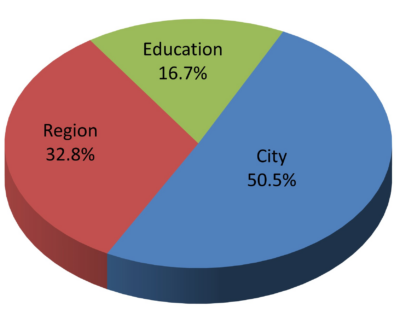

The City of Burlington collects taxes for the City, Halton Region, and the Halton District School Boards. As shown in the chart attached, for each residential dollar collected, 50.5 per cent stays in the City, 32.8 per cent goes to Halton Region and 16.7 per cent goes to the Halton district school boards.

There is more about the amount the city taxes you that was not in the media release put out by the city.

There is more about the amount the city taxes you that was not in the media release put out by the city.

On April 17th, 2024, during a “Special Meeting of Council”, a by-law was passed that is a “legislative requirement in order to set the tax rates” for 2024.

Back in September 2023 Mayor Meed-Ward posted on social media saying:

“Burlington Mayor’s Budget Proposes 4.99% City Tax Impact”.

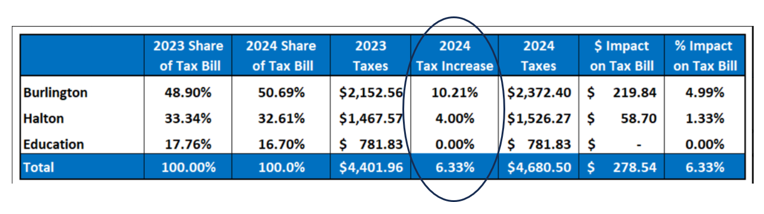

Also, back in September Eric Stern delegated before council stating that he did not understand the mayor’s social media posts. City staff confirmed that the Burlington only portion of the tax bill is increasing by 10.21%.

The only number that should concern a Burlington tax payer is the 10.21%. The Total number shown is misleading – it is the average of the column of numbers. Chart courtesy Eric Stern

Property tax payments can be made:

- At financial institutions,

- Through online banking,

- By setting up pre-authorized payment plans by month or due date to help spread out the payments throughout the year. This also helps ensure on-time payment. For more information on these payment plans or an application, please visit burlington.ca/propertytax, or email pap@burlington.ca to register.

- In-person by cheque or debit at the Service Burlington counter inside City Hall, 426 Brant St.

- by placing a cheque and remittance stub in an envelope marked “Attention: Property Tax Department” in the depository box located at the Locust St entrance to City Hall or in the blue drop box outside 390 Brant Street located at the Elgin St entrance.

Property Tax Programs

The City provides several property tax programs for:

-

-

- Charities,

- Heritage property owners,

- Older Adults – Tax Deferral Program,

- Low-Income seniors and persons with disabilities who own homes.

-

For more information and eligibility details, go to burlington.ca/propertytax.

Taking good advice from Eric Stern, I simply did the math on my own. Everyone will get the same number: take your 2022 Final Tax Bill, note the amount you paid from Line 1 – that is simply the Burlington municipal tax portion. Then do the same with the 2023 Final Tax Bill. You will find what we all do: Burlington’s portion of your taxes increased 15.59%.

15.59 is not 4.99. When the Mayor suggests in her convoluted way that the “impact” or whatever other words she uses is a 4.99% increase, when in fact our literal Burlington increase without looking at school board or fire or region, is 15.59% – that’s what I’d call MISINFORMATION.

And Eric has also pointed out – most recently in a NextDoor group post, that since 2022, Burlington council has raised taxes by 27.4 %.

Then there’s the extremely non-transparent way, in my opinion deliberately so, in which the budget documents are presented. Front page article in today’s Hamilton Spectator notes Hamilton gets an F grade on a CD Howe Institute Report on Fiscal Transparency by Ontario municipalities. Looking at CD Howe’s report, Burlington isn’t included in their data, but when reading it, they outline what cities with good grades do and what is a failure of presenting clear data. It’s fair to say Burlington would fail spectacularly imo. http://www.cdhowe.org/public-policy-research/municipal-money-mystery-fiscal-accountability-canadas-cities-2023

The problem is that not enough people care. It has been repeatedly proven that the “facts” coming out of City Hall, particularly the Mayor’s Office, are of the “alternate” variety. Yet, she endures.

Bang on Joe!! Our City Council spends our money on whatever they want to. This needs to stop!!!

Well if there is one thing about this Mayor that is true, it appears she is incapable of honesty. This seems to be a common trait of politicians on the left of the spectrum.

“Our Mayor’s Budget for 2024 has a 10.21% increase for the Burlinton portion of our Property Tax”, when our Mayor told everyone it would be 4.99%.

Strong Mayor Powers give our Mayor the powers to complete our City’s budget each year.

WHY are our Burlington taxes so high??

Oakville has not experienced the huge property tax increases that Burlington has the past few years and Oakville’s population, size and services are comparable to Burlington. This fact was brought up by numerous delegates who delegated before Burlington City Council during the Proposed 2024 Budget discussions in October and November of 2023.

Also, it was noted by all of these delegates how poorly the Proposed 2024 Budget was put together on paper. No one could follow it! They had to dig thru pages and pages to find items and figures. (maybe this was done intentionally? what was our Mayor hiding?).

Oakville’s Property Taxes for 2024 were not only significantly lower than Burlingtons, but the average resident had no problem reading and understanding it as it was well put together and organized, and residents could see and find where their Property Tax dollars were actually being spent!!

Headline: Burlington Council Approves Huge 10.21% 2024 Tax Hike.

Drove my Chevy to the levee but my bank account was dry.

Bye Bye money… council is spending us dry.

But I can still remember when I had money to spend

And I’ll be a singin this till the day I vote.

Bye bye council good bye