By Staff

By Staff

August 26th, 2023

BURLINGTON, ON

Following a frenzied spring, back to back interest rate hikes have taken the momentum out of Canada’s housing market rebound. But, despite a forecast of falling prices, affordability is not expected to improve.

Home sales dipped 0.7% month-over-month in July, putting an end to six months of heightened activity. The decline occurred despite a 5.6% monthly increase in new listings, which helped bring balance back to the market.

Although the MLS Home Price Index (HPI) climbed 1.1% from June to July, the pace of appreciation has slowed from the 1.9% average seen over the last three months, a trend economists expect to persist for the foreseeable future.

In a new housing market update from RBC, Robert Hogue, Assistant Chief Economist, and Rachel Battaglia, Economist, predict that price gains will “continue moderating in the months ahead,” as balanced demand-supply conditions reduce upward pressure, and high interest rates trim buyers’ budgets.

“The path ahead for Canada’s market is likely to be bumpy,” Hogue and Battaglia said.

“We expect higher interest rates to keep curbing buyers’ enthusiasm for months to come, while possibly forcing the hand of some current owners to sell.”

The expectation of stagnating prices, and continuously high interest rates, was shared by Robert Kavcic, Senior Economist and Director of Economics at BMO, in a recent economic publication. With interest rates remaining high, so too will mortgage rates.

The July Consumer Price Index keeps the decision for future rate hikes “very much alive,” Kavcic said, and at the very least, it makes the case for interest rates to stay elevated into 2024. As such, any meaningful near-term mortgage rate relief “looks unlikely.”

As Farah Omran, Senior Economist at Scotiabank noted in a housing market update, the number of sales seen in July was aligned with the 2000-2019 average for the month, which indicates a “more sustainable level of housing activity.” However, this “does not mean all is well with Canada’s housing market.”

“Affordability remains out of reach for many first-time home buyers and supply continues to lag,” Omran said, adding that July’s price increase reflects “fundamental imbalances in market conditions.”

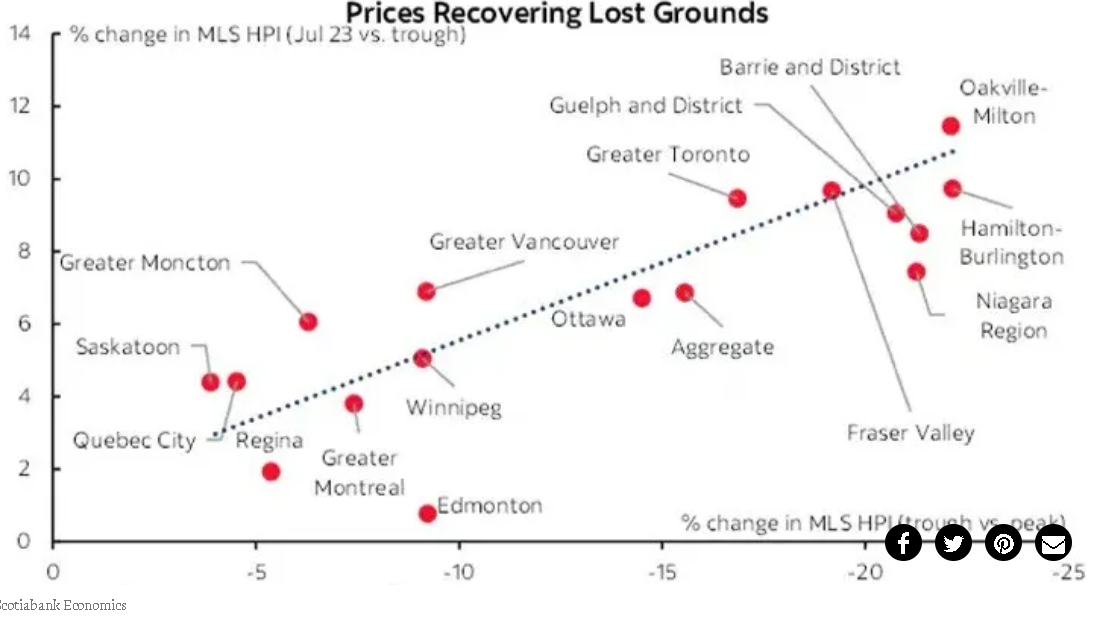

The cities that saw the greatest price correction over the latter half of 2022 have also seen the largest price increases thus far in 2023, leading to a reversal in any improvements in affordability.

After the Bank of Canada started raising interest rates in early 2022, prices declined approximately 22% in Oakville-Milton, but have since recovered more than 11%. The Fraser Valley experienced a roughly 20% drop following the start of rate hikes; since hitting bottom, they’ve risen about 9%. Meanwhile, in Montreal, home priced declined 7% during the correction, and have recovered less than 4%.

While affordable housing is on the lips of every politician, parent and young person wanting to get into the housing market Ontario does not yet have an affordability definition that everyone can agree upon.

After a three day retreat in PEI the federal government realized that the housing solution is something they are going to have to be part of.

TVO has produced a short video on what Affordable Housing is – time will tell if the province buys into their definition.

Right Jim. The politicians always want more studies and commissions to tell them the answer (and delay any actions well into the future) instead of asking mortgage lenders the simple questions like you asked.

They love talking about crises, but would rather study than do. Not just in housing, but in poverty, in climate change, ad nauseam.

And with housing (including renting) they will never commit to actually subsidizing on a major basis because it flies in the face of capitalism, the god of our society.

From the CMHC website.

In Canada, housing is considered “affordable” if it costs less than 30% of a household’s before-tax income.

So with a household income of $100,000 the monthly affordable payment is $2,500

With a 5yr mortgage at 6.43% that means a total mortgage of $378,700.

add in a down payment of 20% and that means a purchase price of around $475,000. Less for a condo as the condo fees have to come out of the $2500/mo

See why politicians don’t want to talk about affordable housing?