December 29th, 2024

BURLINGTON, ON

It’s called the Community Improvement Program.

It offers substantial support and is wide open to ideas. Talk to the Planning department—the link is at the bottom of this article.

The program isn’t in place yet, but we expect to see it operational in Q2 2025.

What is a Community Improvement Plan (CIP)?

- Enabled through Section 28 of the Planning Act

- A Planning Act tool that can be used to make development more feasible or attractive for property owners, through financial and non-financial incentives

Community improvement plan means a plan for the community improvement of a community improvement project area.

Community improvement means the planning or replanning, design or redesign, resubdivision, clearance, development or redevelopment, construction, reconstruction and rehabilitation, improvement of energy efficiency, or any of them, of a community improvement project area, and the provision of such residential, commercial, industrial, public, recreational, institutional, religious, charitable or other uses, buildings, structures, works, improvements or facilities, or spaces therefor, as may be appropriate or necessary.

Community improvement project area means a municipality or an area within a municipality, the community improvement of which, in the opinion of council is desirable because of age, dilapidation, overcrowding, faulty arrangement, unsuitability of buildings or for any other environmental, social or community economic development reason.

Community Improvement Tools

- Make grants or loans to owners and tenants of land and buildings within the community improvement project area to pay for the whole or any part of ‘eligible costs’ related to community improvement

Eligible Costs

- The total of the grants and loans that is provided in respect of the lands and buildings shall not exceed the eligible cost of the community improvement

- Includes costs related to environmental site assessment/remediation, development, redevelopment, construction and reconstruction of lands and buildings for rehabilitation purposes or for the provision of energy efficiency.

- Provide additional flexibility in offering financial incentives and can be stacked with other

Planning Act (Section 69(2) Fees)

Municipalities are permitted to reduce the amount of, or waive entirely, the requirement for the payment of a fee in respect of a planning or building application.

Development Charges Act (Section 5)

Allows a Municipality (through its development charge by-law) to provide for full or partial development charge exemptions for certain types of development.

Municipal Act

- Section 365.1 enables Municipalities to implement the Brownfields Financial Tax Incentive Program, intended to bring brownfields back into productive use. Municipalities may pass by-laws providing for the cancellation of all or a portion of the taxes for municipal purposes levied on eligible properties for which a phase two environmental site assessment has been conducted. CIP required

- Municipal Capital Facility Agreement (MCFA): allows municipalities to completely exempt development charges and property taxes. Affordable housing is an explicit permitted use under MCFA tools.

- Housing Strategy and Housing Accelerator Fund Action Plan Direction

- Need a minimum of 200 new rental units per year in Burlington to meet demand (2021 Housing Needs and Opportunities Study)

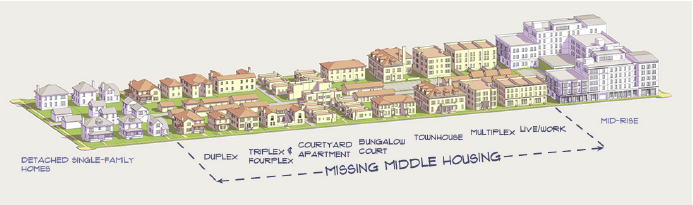

• Increase housing options – affordable, rental, Missing Middle

Burlington Housing CIP Purpose

- Incentivize new rental housing and affordable housing options in a permanent building form:

- New units: Additional Residential Units (ARUs), plexes (du/tri/fourplex), row houses, courtyard housing

- Low-rise apartments (4-storeys and less)

- Mid-rise apartments (5 – 11 storeys)

- High-rise/Tall Building apartments (12+ storeys)

- Larger rental units (i.e. 3-bedrooms)

- Supportive housing, Accessible units

- Short term HAF Targets (2025/26)

– Support HAF $8.25M allocation for ARUs; $2.5M for other rental and affordable units; $1M missing middle

Long term Housing Strategy Implementation (2027+) – through the CIP, with CIP budget request

Long term Housing Strategy Implementation (2027+) – through the CIP, with CIP budget request- Incentives for rental and affordable permanent units to bridge the gap

- Develop incentives that provide the best value and outcomes

- Develop a range of incentives with longevity

- Identify opportunities to stack programs/incentives – within the CIP and with other programs of City & other levels of government (e.g. Better Homes Burlington home upgrade interest free loan; Halton Region, CMHC Affordable Housing Fund)

- Address City priorities and Meet HAF targets, e.g. 3-BRs in MTSAs; energy efficiency/green infrastructure; missing middle & affordable housing

Incentive Types

Capital Grants: support new construction, rehabilitation, and conversion of spaces for affordable housing. Direct funding lowers the financial burden on property owners, making it more feasible to create affordable units.

Non-Reserve Fund Incentives: includes tax increment grants, fee waivers, and deferral programs –

reduce upfront costs for property owners.

- Tax increment grants retain a portion of the increased property tax revenue generated by the new development, which can be reinvested into the project.

- Fee waivers eliminate or reduce fees associated with building permits/ other municipal

Forgivable Loans: support homeownership and rental unit creation, with conditions tied to affordability and project completion. If specific criteria met, such as maintaining the units as affordable for a set period, the loan may be forgiven, effectively turning it into a grant. This approach encourages property owner commitment to long-term affordability.

Non-Financial Incentives: range of incentives, including: the strategic use of surplus municipal land for affordable housing projects by providing access to land at reduced costs or even at no cost, thereby removing one of the most significant barriers to affordable housing—land acquisition costs.

Reserve Funds: specific funds maintained by the municipality to assist with affordable housing projects beyond typical funding mechanisms. By having dedicated funds set aside, municipalities can respond more flexibly and quickly to emerging housing needs.

Potential CIP Financial Programs

Base Incentives

Additional Residential Unit (ARU) Incentive (forgivable loan):

-

- Requirement for affordable ARU units during the HAF timeframe, January 1, 2025 – December 31, 2026.

- purchase and/or fund related construction costs for a new, legal permitted

- detached ARU

- garage conversion (detached or attached) to residential

- ARU within existing residential unit (i.e. basement, main floor, attic).

- renovate an existing noncompliant ARU

- assistance with professional drawings (i.e. architect, engineering)

- Missing Middle Tax Increment Equivalent Grant (TIEG):

- Annual grant over a long-term period to offset tax increases for new rental multi-unit developments that are 4 storeys or less including duplexes, fourplexes, courtyard housing, and low-rise apartments. Excludes single-detached homes and ARUs.

Potential CIP Financial Programs

Base Incentives

Mid/High-Rise Tax Increment Equivalent Grant (TIEG):

Annual grant over a long-term period to offset tax increases for new rental mid-rise/high-rise multi-unit residential developments. It would be for rental buildings that are:

- 5+ storeys

- Proposed in a strategic location:

- City’s ‘Mixed Use Nodes’ such as neighbourhood commercial plazas;

- Intensification Corridors like Fairview Street and Plains Road East; or

- Major Transit Station Areas (MTSAs): Appleby GO, Aldershot GO and Burlington GO MTSAs.

Potential Non-Financial Incentives

- Housing and Surplus Lands Policy: To acquire, sell, lease, or offer municipal properties at or below fair market value to support City Housing policies, plans, and strategies. By leveraging surplus lands, this will enhance financial incentive programs within the CIP.

- Housing and Capital Projects Policy: To require all major municipal capital projects be reviewed and assessed to consider the inclusion of new

- Draft CIP for Review: January 2025

- Report to Council, Statutory Public Meeting: February 2025

Email housingstrategy@burlington.ca with questions and speak with staff

No one can deny that there is an affordable housing crisis. However, waiving of development fees but more concerning property taxes for the building of missing middle dwellings does not address the fact that increased infrastructure investment is required to support these dwellings. Without property tax revenue from these homes, the shortfall has to be covered by increasing the property taxes of Burlington residents. After the property tax increases of the last three years, is the expectation of Council that residents’ ability to pay is infinite?

Any community initiative in this direction will be futile until the LPAT, OMB, or whatever guise it adopts next is disbanded.