By Zoe Demarco

By Zoe Demarco

February 24th, 2023

BURLINGTON, ON

The belief in Burlington is that parents want to get their kids into the housing market as early as possible. Home ownership is almost part of a Burlingtoners’ DNA.

Zoe Demarco, a stff writer for Storeys, a Real Estate Newsletter puts home ownership into perspective.

Today’s first-time homebuyers hear a myriad of stories about the ease at which the last generation was able to enter the real estate market.

Whether you believe it has become easier or harder, there certainly exists vast differences in buying a home today compared to 30 years ago. To determine just how much times have changed, real estate agency Zoocasa analyzed a number of important factors, including average prices and mortgage rates, comparing their current status to what was seen in the early 1990s.

Whether you believe it has become easier or harder, there certainly exists vast differences in buying a home today compared to 30 years ago. To determine just how much times have changed, real estate agency Zoocasa analyzed a number of important factors, including average prices and mortgage rates, comparing their current status to what was seen in the early 1990s.

Prices

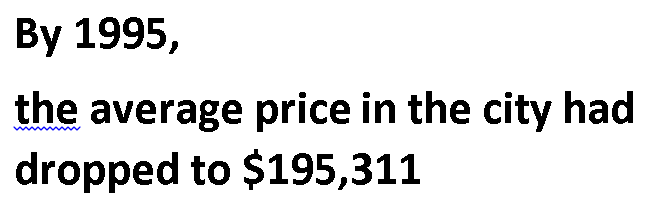

In 1989, the average resale price in Toronto was a healthy $254,197. But as the early 1990s recession set in, inflation and unemployment rose. By 1995, the average price in the city had dropped to $195,311, a 23.2% decline. Thanks to the ensuing “long slump,” prices didn’t surpass the 1989 figure until 2002.

Nationally, the average resale price increased 8% from 1990 ($142,091) to 1997 ($154,768). Between January 2022 and January 2023, the national average sale price declined 18.3% to $612,204.

“The current housing landscape is still in a period of recovery after staggering price gains during the pandemic followed by rapid interest rate growth that restricted buying power,” Zoocasa noted.

Although salaries have risen since the early ’90s, they have not kept pace with the increase in home prices. There are only five major cities in Canada where a single person earning the median income can afford to buy the average home.

Demographics

According to data from Statistics Canada, the number of people aged 25 to 34 years was smaller in the ’90s than it is today. The age group makes up the vast majority of first-time buyers and, without them, there was less momentum to drive the market forward.

While the age group is larger today, many have been sidelined by high prices, rising interest rates, and declining affordability. Instead, investors swooped in to take their place.

Mortgage rates

Mortgage rates

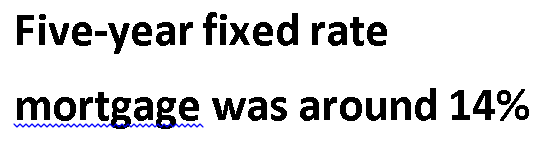

Historical data from Ratehub.ca shows that the five-year fixed mortgage rate was around 14% in 1990. It dropped to about 7% in January 1994, but had risen back above 10% by July of that year.

Over the past decade, the five-year fixed rate has hovered between 5.3% and 4.6%. The lower rate has made buying a home in Canada “more attractive and feasible,” Zoocasa said. Although the Bank of Canada has incessantly raised interest rates over the past year, the current five-year fixed rate of 6.49% is still well below levels seen in the ’90s.

House type and location

Single family units are now quite close to high rise towers in many Canadian communities.

The 1990s were characterized by suburban expansion, with, according to Statistics Canada, the majority of new homes built in low-density “peripheral neighbourhoods” outside city centres. Housing starts declined throughout the first half of the decade, but began to slowly rise in 1996, led by construction of single detached homes.

Today, though, high-rise condos and apartments account for the majority of housing starts across Canada. Buyers’ growing desire for an “urban lifestyle” has led to an influx of construction in downtown cores.

While average home prices were lower in the 1990s, buyers dealt with significantly higher interest rates and lower salaries. The first-time buyer of today faces fiercer competition than they would have a generation ago, and their housing prospects have dwindled along with affordability.

“There’s no question the housing environment and trends of today have changed drastically since the 1990s – for better and for worse,” Zoocasa concluded. “Only time will tell what the future market brings.”

Zoe Demarco is a Staff Writer at STOREYS and was formerly the Urbanized Editor at Daily Hive. Born and raised in Toronto, she has a passion for the city’s ever-changing urban landscape.

‘The belief in Burlington is that parents want to get their kids into the housing market as early as possible.’…most people want to pursue ownership, but make no mistake about it…Meed Ward and council have done nothing over the last decade to bring any reality for that to happen. Meed Ward has done nothing but prevent further development in Burlington trying to spike home values for her base…she campaigned on ‘No New Development’ in Burlington. Much of the development that is moving forward has been approved by the OLT since Meed Ward didn’t want to address the challenges on where people could live.

So true.We bought our current home in 1990 and the value dropped almost immediately and stayed low for many years.