By Soloman Smithers

By Soloman Smithers

January 24th, 2024

BURLINGTON, ON

The Canadian stock market, a key component of the global financial system, is a dynamic arena where retail and institutional traders buy and sell stocks. In this market, companies list shares to garner capital, predominantly through stock exchanges like the Toronto Stock Exchange (TSX). Investors can buy and sell these stocks to profit in the long run.

When a company goes public, it sells shares through an Initial Public Offering (IPO) on the primary market. Post-IPO, these shares are traded on the secondary market, allowing for public trading and investment diversification. The stock market typically refers to this secondary market where most trading occurs.

Before cell phones or fax machines trading was done between individual traders representing stock brokerage firms. It was hectic, noisy – busy as all get it. Exciting as well.

The Evolution of Stock Trading

Traditionally, stock trading was a physical, raucous affair with traders using hand signals and shouts. Now, it’s predominantly electronic. Opening an online self-directed brokerage account allows individuals to start trading within minutes. Alternatively, investors can seek the expertise of stockbrokers or financial advisors, offering guidance and execution of trades, albeit at a cost.

The stock market’s core is driven by supply and demand. Sellers set their “ask” price, while buyers have their “bid.” The difference, known as the spread, influences the stock’s trading activity. Modern trading largely relies on computer algorithms for price-setting, streamlining the process significantly.

Stock Market vs. Stock Exchange

While often interchangeable, ‘stock market’ and ‘stock exchange’ are distinct. A stock exchange is a part of the broader stock market, which can encompass multiple exchanges. Exchanges are crucial in managing orders, matching prices for trades, and ensuring transparency and fairness.

Canadian Stock Exchanges

Canada boasts five primary stock exchanges:

- Montreal Exchange

- TSX Venture Exchange

- Aequitas NEO Exchange

- Toronto Stock Exchange (TSX)

- Canadian National Stock Exchange (Canadian Securities Exchange)

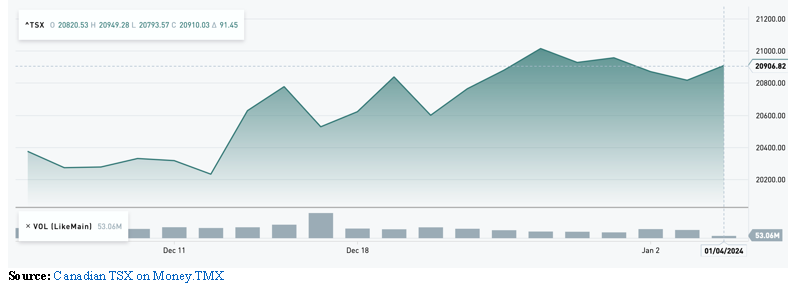

The TSX, one of the largest globally, reflects Canada’s robust economic health and strategic role in international trade.

Global Trading for Canadian Investors

Canadian investors are not limited to domestic exchanges. Trading can occur on any global exchange accessible through brokerage accounts. The New York Stock Exchange (NYSE), with a market capitalization exceeding $32 trillion, leads the global list. In contrast, the TSX ranks within the top 10 worldwide.

Apart from stocks, various financial instruments find their markets. The money market caters to short-term investments, the bond market to government and corporate bonds, and the derivatives market to contracts linked to underlying assets like stocks. The forex market, where currencies are traded, is another significant sector.

Stock markets today are all digital with trades taking place digitally. A trader could be active in several market at the same time.

Market Volatility and Performance

Stock markets are inherently volatile. Indices like the S&P 500, comprising the 500 largest U.S. companies, serve as performance barometers. Historical trends, like the 2008 financial crisis or the COVID-19 pandemic, demonstrate the market’s fluctuating nature, underscoring the importance of strategic investment.

Investors typically follow day trading or long-term investing strategies. Day trading focuses on short-term gains from daily price fluctuations, requiring time and expertise. Long-term investing, on the other hand, focuses on sustained growth and earnings over time, a strategy exemplified by investors like Warren Buffet.

Navigating the Canadian Market with Advanced Trading Platforms

In the intricate Canadian stock market, platforms like MetaTrader 5 are invaluable. This advanced trading platform caters to the diverse needs of modern traders, offering functionalities like auto trading systems, a wide range of asset classes, and detailed analytical tools. It facilitates informed decision-making in a market influenced by global and domestic trends.

In Canada, products like Contracts for Differences (CFDs) are relatively new and primarily unknown to investors. These instruments don’t have specific regulatory margin requirements or leverage restrictions, representing a unique aspect of the Canadian financial regulatory environment.

Within the unique financial landscape of Canada, Contracts for Differences (CFDs) are emerging as an intriguing and accessible instrument for traders of all skill levels. These derivative products allow traders to speculate on the price movement of assets without actually owning them.

There are two primary positions in CFD trading: long and short. A long position involves buying an asset with the expectation that its value will increase. In contrast, a short position is taken when a trader anticipates a decrease in the asset’s value. CFD trading is versatile, offering various strategies like day trading, swing trading, and scalping, each with its distinct approach and risk profile.

Moreover, CFD trading is cost-effective and facilitates hedging, making it an attractive option for Canadian traders looking to diversify their trading strategies and manage risks effectively.

A bull market!

The Canadian e-commerce sector, pivotal to the nation’s economy, is experiencing rapid growth. By 2025, it’s projected to double from 2021 levels, surpassing $90 billion. This surge is driven by an increasingly digital consumer base and a shift towards online shopping, highlighting the evolving nature of retail and investment opportunities in Canada.

Concluding Remarks

The Canadian economy, marked by robust stock exchanges and a burgeoning e-commerce sector, presents diverse opportunities for investors and traders. Understanding the intricacies of stock trading, the role of advanced platforms like MetaTrader 5, and the burgeoning e-commerce landscape are essential for navigating Canada’s dynamic market.

This perspective is crucial for anyone looking to maximize their financial opportunities in Canada’s evolving economic landscape.