April 6th, 2024

BURLINGTON, ON

Third of a three part series on what city staff are paid and the pension program they benefit from.

City manager Tim Commisso will be dancing his way into retirement.

For anyone interested in exploring the Ontario Sunshine list the official website for 2023 is: https://www.ontario.ca/public-sector-salary-disclosure/2023/all-sectors-and-seconded-employees/

The benefits information provided on the above website refers to taxable benefits only. Municipal employees in Ontario, who work 32 hours a week or more, are automatically enrolled in the Ontario Municipal Employees Retirement System (OMERS) pension plan. The city and the employee pay into this plan.

The benefits information provided on the above website refers to taxable benefits only. Municipal employees in Ontario, who work 32 hours a week or more, are automatically enrolled in the Ontario Municipal Employees Retirement System (OMERS) pension plan. The city and the employee pay into this plan.

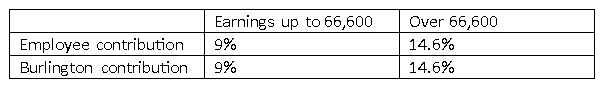

These are the OMERS contribution rates for people who want to retire at age 55, or older, with at least 35 years of service. Age plus years of service must equal at least 90 to receive the maximum pension benefit.

Someone earning $66,600 contributes $5,994 a year to their pension plan with the city matching this contribution. The employee portion reduces take home pay. People at the $66,600 income level or lower contribute less to their pension so they will have more money for today’s expenses. When someone with a defined benefit pension plan retires and starts collecting their pension the pension payments are indexed to inflation. The private sector has largely switched to defined contribution plans because inflation is unpredictable.

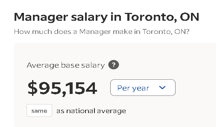

OMERS will raise contribution levels to cover any shortfalls in the plan, with employers (cities funded by taxpayers) paying half the cost of any increases.The “salary paid” number in the sunshine list does not include the cost of non-taxable benefits such as pension plan contributions. The 2023 Burlington sunshine list data shows 59 employees with “Manager” in their title. The average annual income for this group is $137,544. Contrasting this with the private sector the employment website Indeed.com reports that the average manager in Toronto has a base salary of $95,154. The city contributes 14.6% to each manager’s pension plan or an average of $20,081. This brings the average cost to taxpayers, for each manager, including the pension benefit, up to $157,626.Let’s say our fictional average manager contributes just over $20,000 a year to their pension plan with the city matching this contribution bringing the total contribution to over $40,000 a year.

The 2023 Burlington sunshine list data shows 59 employees with “Manager” in their title. The average annual income for this group is $137,544. Contrasting this with the private sector the employment website Indeed.com reports that the average manager in Toronto has a base salary of $95,154. The city contributes 14.6% to each manager’s pension plan or an average of $20,081. This brings the average cost to taxpayers, for each manager, including the pension benefit, up to $157,626.Let’s say our fictional average manager contributes just over $20,000 a year to their pension plan with the city matching this contribution bringing the total contribution to over $40,000 a year.

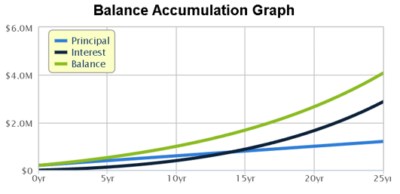

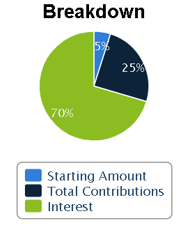

Our fictional manager is 40 years old and was just promoted onto the management team after 15 years of service with the city. To keep things simple, I’ll pretend there is no inflation or salary increases so that the pension contributions continue at the $40,000 a year level for 25 more years and that amounts to $1 million. At least $200,000 would have accumulated in the first 15 years bringing the city and individual contributions to $1.2 million but hold on, like any pension plan, OMERS invests this money and, over the last 10 years, has earned an average annual return of 7.3%. Starting retirement savings early, adding $40,000 a year from age 40 to 65, along with consistent compounding annual returns of 7.3%, brings the value of our average manager’s pension savings to around $4 million.

Starting retirement savings early, adding $40,000 a year from age 40 to 65, along with consistent compounding annual returns of 7.3%, brings the value of our average manager’s pension savings to around $4 million.

Albert Einstein said “compound interest is the eighth wonder of the world” and you can really see how solid money management by the OMERs team pays off.OMERs uses a formula to calculate what someone’s actual annual pension amount will be. The formula uses the average of an individual’s best five consecutive years of earnings and is explained in detail in the members handbook (https://members.omers.com/member-handbook). After 40 years with the city, our fictional manager will receive an inflation protected pension of $92,035.20 a year, every year, for the rest of his or her life.For the city’s top earners, the pension benefit becomes quite large.

After 40 years with the city, our fictional manager will receive an inflation protected pension of $92,035.20 a year, every year, for the rest of his or her life.For the city’s top earners, the pension benefit becomes quite large.

Staff and members of City Council visiting Burlington’s Sister City, Itabashi, Japan take part in a parade with the Mayor strutting alongside the Itabashi Mayor. Burlington City Manager Tim Commisso, center, shows some fancy footwork as well.

For example, last year the city paid $44,091.12 into Tim Commisso’s pension plan. According to LinkedIn between Burlington and Thunder Bay Commisso has over 34 years of municipal service. Based on the limited information in the sunshine list Commisso will receive an inflation protected pension of at least $177,679.65 per year, every year, for the rest of his life.We now understand why this man is dancing.

Cities rarely lay people off, you really have to make an effort to be fired, and the pension plan benefit is a significant perk over the long term.

Kudos to all the permanent employees at the city on an excellent career choice.

Links to part 1 and part 2 of the series:

Disclaimers:1 – OMERs contributions are calculated on base salary excluding overtime. The sunshine list just shows total earnings.2 – The calculations in this article have been double checked but only OMERs members have access to the official OMERs pension calculation website. 3 – Tim Commisso’s pension calculations are based on the standard OMERs calculations. Commisso’s contract with the city may have other pension stipulations.

Jim Portside has lived in Burlington for much of his life and has watched the city change and grow over the years. With over 1,000 people working for the city there is a lot going on. As a now retired, successful business owner, Jim is interested in exploring and sharing some of what our local government is working on. You can reach Jim by emailing Jim.Portside@gmail.com

For the record, while the city administers the contribution to the pension, we the taxpayers fund the matching contribution.

Editor’s note: Worse than that Joe If Omers fails to do well enough with their investing and find themselves short they have the right to get more from the municipalities. Goldring once told Council that was his understanding.

Also when he passes a large portion of that pension continues to be paid to his wife/partner.. The plan has quite a few pensioners over a 100. We sincerely hope Tim becomes one of them and is still dancing as we plan to be with Dave a member of this plan.