By Zoe DeMarco

By Zoe DeMarco

November 10th, 2023

BURLINGTON, ON

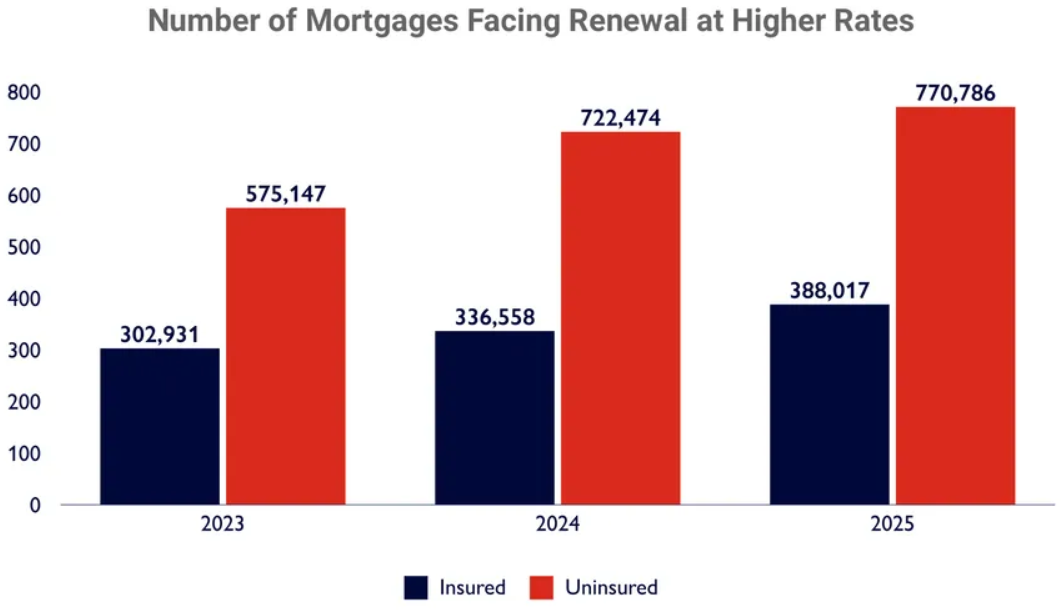

In 2024 and 2025, an estimated 2.2 million mortgage holders will face “interest rate shock” as they reach renewal in a significantly higher rate environment. The figure represents roughly 45% of all outstanding mortgages in Canada, or over $675 billion.

More than 290,000 fixed-rate borrowers already dealt with such shock in the first half of 2023, according to new research from the Canada Mortgage and Housing Corporation (CMHC).

From 2018 to 2020, interest rates hovered between 1% and 2%. Following the onset of the pandemic, the Bank of Canada (BoC) slashed rates to 0.25%, and promised to keep them “low for a long time.” But, in March of 2022, the BoC began an onslaught of rate hikes which brought the overnight rate to its current 5%.

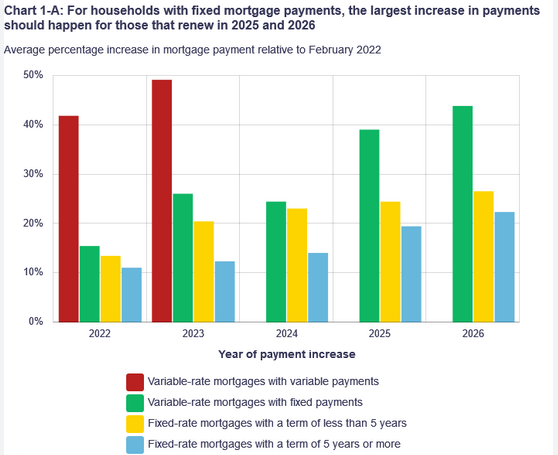

When homeowners renew their mortgages over the next two years, they could see a 30% to 40% increase in their average monthly payments. For example, for a $500,000 mortgage with a five-year fixed-rate term and a 25-year amortization period, a rate increase from 1.94% to 5.45% would result in a $950 jump in their monthly payments.

Rather than “low for a long time,” mortgage holders are now faced with a “higher for longer” reality. Larger payments may put borrowers in “more precarious financial situations,” the CMHC warned, which in turn will make the economy more susceptible to negative shocks and downturns.

Rather than “low for a long time,” mortgage holders are now faced with a “higher for longer” reality. Larger payments may put borrowers in “more precarious financial situations,” the CMHC warned, which in turn will make the economy more susceptible to negative shocks and downturns.

“Homeowners had gotten used to low interest rates. While mortgage rates around 6 to 7% have been common in Canadian financial history, the mortgage holders of today are facing the fastest and largest increase in interest rates to this level in over four decades,” the CMHC said.

“This steep interest rate hike is coinciding with a time when households are facing historically high levels of debt and higher cost of living.”

Despite high interest rates and growing debt-servicing costs, mortgages in arrears have been stabilizing at historically low levels for the past 16 months. But delinquency rates amongst auto loans, credit cards, and lines of credit have been rising continuously for over a year, indicating that a growing number of Canadians are struggling under the weight of their debt.

As well, mortgage debt has continued to grow despite a slowdown in mortgage activity. Over the first half of 2023, chartered banks reported a 44% drop in mortgages for the purchase of property compared to the same period a year prior, as high interest rates led to slowing sales. As of August 2023, residential mortgage debt stood at $2.14 trillion, up 3.4% from a year prior.

With the BoC leaving further interest rate hikes on the table, mortgage holders’ hopes for imminent cuts have faded. This is evidenced by a drop in the number of mortgages with terms of less than three years during the first half of 2023.

Meanwhile, amortization periods have grown longer as homeowners seek to lower their monthly payments. In the first half of 2023, nearly two-thirds of newly-extended mortgages had an amortization period longer than 25 years, compared to only half in 2020.

Meanwhile, amortization periods have grown longer as homeowners seek to lower their monthly payments. In the first half of 2023, nearly two-thirds of newly-extended mortgages had an amortization period longer than 25 years, compared to only half in 2020.

The tactic is one solution offered up by the CMHC to the growing number of Canadians staring down the barrel of mortgage renewal. Other options to “make ends meet” include cutting back on savings, delaying major purchases, reducing the consumption of non-essential goods and services, prioritizing mortgage payments over other loans and credit cards, and preemptively selling your home.