By Pepper Parr

By Pepper Parr

November 20th, 2023

BURLINGTON, ON

Rory Nisan Councillor for ward 3 – submits 19 motions.

The following are the 19 Motions to amend the Mayor’s Budget submitted by Ward 3 Councillor Rory Nisan.

Motion for Council to Consider:

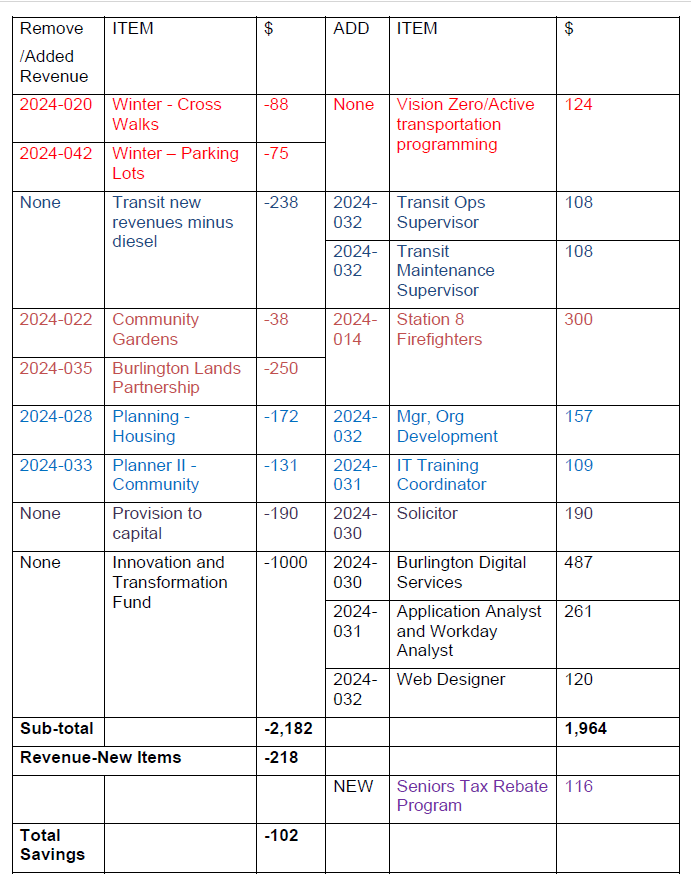

Consider a package of amendments to maintain the reduced tax rate of 4.99% while funding top and high priority positions.

Reason:

Below is a summary table of amendments I am putting forward. Together they represent a rationalizing of proposed FTEs while maintain the tax rate at the 4.99% as proposed by the mayor.

Financial Matters:

Although these amendments do not need to be approved as a package, I am prioritizing the need to maintain the tax rate at 4.99% while funding key positions not currently funded in the mayor’s budget but recently identified as higher priorities. Items below are listed in the thousands.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-032 – Manager Organizational Development ($157,373) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

While this is a very challenging budget, the above position has been identified as a top priority by staff.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from cutting 2024-022 (Expansion and Customer Experience in Community Gardens) and 2024-035 (Burlington Lands Partnership 1.75 FTE) to fund this position. These positions were identified as medium priority.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none City Manager: none

Motion for Council to Consider:

Add 2024-014 – Station 8 Firefighters – Year 2 ($301,419) to the 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

While this is a very challenging budget, the above positions have been identified as a high priority by staff and by approving four positions rather than two we can significantly increase the life-saving coverage provided by the Fire Department.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from 2024-28 (Community Planning Housing Initiative-Housing Strategy) and 2024-33 (Planner II-Community Initiatives) to fund this position. These positions were identified as medium priority.

Comments:

City Clerk: none City Manager: none

Motion for Council to Consider:

Remove 2024-020 – Winter Maintenance – School Cross Walks ($88,000) from the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. As important as an enhanced maintenance of school cross walks may be, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community.

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-042 (Winter Maintenance – Expanded Parking Lots) may be redeployed to fund Vision Zero programming position while maintaining a tax rate of 4.99% for the city portion.

Regardless of whether the Vision Zero position is funded, I recommend deferring the item.

Comments:

City Clerk: none City Manager: none

Motion for Council to Consider:

Remove 2024-022 – Expansion and Customer Experience in Community Gardens ($38,200) from the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While the community garden program is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community. I suggest a relook at the program considering the cost per garden plot and ongoing demand.

Financial Matters:

Savings from deferring this item, as well as savings from deferring the 1.75 FTEs included in 2024-035 (Burlington Lands Partnership) may be redeployed to fund two FTEs identified as top priorities: 2024-031 (Enterprise Business Services Support – Workday/EAMS Training Coordinator) and 2024-032 (Manager Organizational Development) while maintaining a tax rate of 4.99% for the city portion. Regardless of whether these top priority positions are funded, I recommend deferring the item.

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove 2024-028 – Community Planning Housing Initiative ($172,414) from the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While bolstering the housing initiative is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community. This position was noted as a medium priority, and significant investments are being made in the 2024 budget that will promote the housing file (e.g. 2024-036 – Permit and Application Streamlining).

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-033 (Planner II – Community Initiatives) may be redeployed to fully fund 2024-014 (Station 8 Firefighters – year 2), a high priority, while maintaining a tax rate of 4.99% for the city portion. Regardless of whether these high priority positions are funded, I recommend deferring the item.

Motion Seconded by: Not Required Share with Senior Staff þ

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add Solicitor – General Litigation, Municipal Law, Insurance Practice (2024-030) for $190,512 to the 2024 budget offset by a recovery from the capital program.

Reason:

While this is a very challenging budget, the above position has been identified as a high priority by staff and can be funded by savings on capital projects that will no longer require outside legal counsel to the same degree.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, as this position will create savings by no longer needing to depend on outside counsel to the same extent, it is suggested that the financing be funded through a recovery to capital. Doing so will not result in fewer capital projects being completed.

Motion Seconded by: Not Required Share with Senior Staff þ

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: one

City Manager: none

Motion for Council to Consider:

Add 3 positions (Data Engineer, Manager of Experience Strategy and Design, and M365 Product Manager) in 2024-030 – Burlington Digital Service ($486,569) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

This motion does not include the solicitor role which is included in separate case due to being funded from capital.

While this is a very challenging budget, the above positions have been identified as a high priority by staff.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, I have another amendment to remove the $1M provision to the Innovation and Transformation reserve fund.

- Deliver customer centric services with a focus on efficiency and technology transformation

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-031 – Enterprise Business Services Support – Workday/EAMS Training Coordinator ($109,220) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

While this is a very challenging budget, the above position has been identified as a top priority by staff.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from cutting 2024-022 (Expansion and Customer Experience in Community Gardens) and 2024-035 (Burlington Lands Partnership 1.75 FTE) to fund this position. These positions were identified as medium priority.

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-031 – Application Analyst Workday / EAMS ($136,391) and Workday Analyst ($124,512) subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

This motion does not include the solicitor role which is included in separate case due to being funded from capital.

While this is a very challenging budget, the above positions have been identified as a high priority by staff.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, I have another amendment to remove the $1M provision to the Innovation and Transformation reserve fund.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-032 – Transit Maintenance Supervisor ($108,470) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

Funding more buses and drivers means, eventually, support positions must also be funded as part of the expansion of the service. Funding a transit maintenance supervisor will ensure safety of the mechanics and other employees, and improve the overall maintenance of the busses, improving the public transit system.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from increased revenue assumptions to transit to fund this position.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-032 – Transit Operations Supervisor ($108,470) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

Funding more buses and drivers means, eventually, support positions must also be funded as part of the expansion of the service. Funding a transit operations supervisor will improve safety of drivers and riders on the road and improve the overall system.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from increased revenue assumptions to transit to fund this position.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add 2024-032 Web Designer ($119,562) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

While this is a very challenging budget, the above position has been identified as a high priority by staff.

Financial Matters:

This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased. Specifically, I have another amendment to remove the $1M provision to the Innovation and Transformation reserve fund.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove 2024-033 – Planner II – Community Initiatives ($130,906) from the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While bolstering the planning department is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community. This position was noted as a medium priority, and significant investments are being made in the 2024 budget that will promote the housing file (e.g. 2024-036 – Permit and Application Streamlining).

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-028 – (Community Planning Housing Initiative) may be redeployed to fully fund 2024-014 (Station 8 Firefighters – year 2), a high priority, while maintaining a tax rate of 4.99% for the city portion. Regardless of whether these high priority positions are funded, I recommend deferring the item.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Reduce the 2024-035 – Burlington Lands Partnership item by the 1.75 FTEs ($250,000) in the 2024 Budget and request that the Mayor consider inclusion of this item in the 2025 Budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While the Burlington Lands Partnership is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community. The $200K purchased services are not included in the deferral and proposed to remain in the budget.

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-022 (Expansion and Customer Experience in Community Gardens) may be redeployed to fund two FTEs identified as top priorities: 2024-031 (Enterprise Business Services Support – Workday/EAMS Training Coordinator) and 2024-032 (Manager Organizational Development) while maintaining a tax rate of 4.99% for the city portion. Regardless of whether these top priority positions are funded, I recommend deferring the item.

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove 2024-042 – Winter Maintenance-Expanded Parking Lots ($75,000) from the 2024 budget and request that the Mayor consider inclusion of this item in the 2025 budget.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While plowing more parking lots is important, this motion defers the expenditure to 2025 budget, allowing a lower tax impact to the community.

Financial Matters:

Savings from deferring this item, as well as savings from deferring 2024-020 (Winter Maintenance – School Cross Walks) may be redeployed to fund the Vision Zero programming position while maintaining a tax rate of 4.99% for the city portion.

Regardless of whether the Vision Zero position is funded, I recommend deferring the item.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Add Vision Zero / Active Transportation programming position ($124,129) to 2024 budget, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

The Integrated Mobility Plan has been unanimously supported by committee and is an on-the-ground transportation reality going forward.

A Vision Zero plan has been a priority for council since at least 2019 when it was referenced in our Vision to Focus strategic plan. Recent tragedies on our roads reinforce the need to accelerate our work to make our roads safe for all. Active Transportation Coordination is critical to the Vision Zero plan. Approved plans need to be operationalized with sufficient funding.

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. Specifically, I suggest redeploying savings from 2024-020 (Winter Maintenance – School Crosswalks) and 2024-42 (Winter Maintenance – Expanded Parking Lots) to fund this position.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Remove the provision to Innovation and Transformation Fund ($1M) from the 2024 Budget and reduce 2024-036 Permit and Application Streamlining by $1M.

Reason:

To deliver a tax rate residents can afford, some difficult choices must be made. While the Innovation and Transformation Fund was developed with the right intentions, one of those was to reduce pressure on future year tax rates as a safety valve for strategic items. This has not worked out as expected as the financial needs tax rate is nearly as high as last year.

Financial Matters:

Savings from deferring this item may be redeployed to fund eight FTEs identified as top priorities: 2024-030 (Burlington Digital Services) 2024-031 (Application Analyst and Workday Analyst) and 2024-032 (Recruitment Coordinator and Web Designer) while maintaining a tax rate of 4.99% for the city portion.

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Motion for Council to Consider:

Increase the Senior’s Tax Rebate from $575 to $837, increase the City’s provision to support this program by a further $116,000 and request that the Region of Halton continue to participate in the cost sharing of their portion of this program, subject to offsetting savings having been found through earlier approved 2024 budget reduction amendments to maintain tax rate at 4.99%.

Reason:

Many residents are facing difficult decisions with their home budgets next year. The most vulnerable residents are low and fixed-income seniors who have little or no capacity to increase their income or reduce their already minimized expenses. The Low- Income Seniors Property Tax Rebate currently offers $550 per year to support this vulnerable community. Staff recommend an increase to $575 this year.

I recommend a rebate of $837. This will result in the average senior currently accessing the program receiving an increased rebate that mitigates the proposed 4.99% city tax increase. This is based on the average home value (CVA) of a qualifying senior currently in receipt of the program. The total cost to City to allow for the increase to

$837 is a further $116,000 in addition to the $150,000 currently budgeted for this program.

The Region of Halton and School Boards participate in the cost sharing of the current program. The rebate for the education component of the rebate is automatically shared by the School Boards. To note, I will be approaching the Region of Halton to seek their continued participation for their increase for their portion of the rebate to ensure full mitigation of the overall 2024 tax increase to Burlington residents accessing this program. Should the Region of Halton not continue to fully cost share in this program the amount of the Region’s share would be the responsibility of the City to fund requiring a further budget increase of $31,000.

These figures are based on the current number of residents in the program and does not account for additional participants.

More details on the program and eligibility requirements can be found at https://www.burlington.ca/en/property-taxes/low-income-seniors-property-tax- rebate.aspx

Financial Matters:

This item is recommended to be included in the budget through saving found elsewhere so that the tax rate is not increased. My overview document includes $218k in savings.

Motion Seconded by: Not Required

Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

Very disappointing Clr. Nisan proposes cutting community services to add more head count to an already bloated bureaucracy.

The rationale for digital services is a joke. Digital is supposed to be an enabler. No where in the “business case” is there any commitment to reduce costs and create efficiencies. Blind faith by Nisan, Kearns, et al, that this significant investment will deliver anything of meaningful value.

We hope Rory Nisan understands the budget more than he understood our statement that we were unaware until the day before our appearance at the lectern, that much needed day care facilities for Burlington were sacrificed by the Coptic community. This was done to ensure they could start work asap on the main project meant to serve a thriving faith community.

We are told by the Mayor the reason we are not asked questions is because we are perfectly clear in what we are saying at the lectern. Rory Nisan decided to change our clearly expressed position to mean we had not read the agenda until the day before. He then spent time verifying with staff on the record that the agenda was up the Friday before and, therefore they had done their due diligence.

He totally misrepresented our position at a time we could not challenge him rather than at the appropriate time at the end of our delegation

The agenda summary of the motion before committee and a public meeting on Nov 13th failed to meet transparency and engagement requirements because it failed to mention the sacrifice of the day care facilities, to get the application to meet the Bill 108 90 day deadline.

We only found this out after a thorough review of the staff report and two conversations with the author. Rory Nisan’s behaviour both during the meeting and after which we consider contravenes the Code of Conduct for members of Council and harassment under the Human Rights Code, for his post meeting witnessed behaviour, is the subject of an Integrity Commissioner’s Complaint.

It will be delivered to the Clerk as required, this week. A complaint about the Clerk’s involvement in harrassment as per Human Rights Code and supporting setting aside legislated requirements around transparency and accountability and his responsibilities associated with appropriate minuting, and other behaviors volving the City Manager is also in progress. Enough is enough!

Amazing how benign numbers can appear when the zeros are excluded, i.e. $1,964 versus $1,964,000.00.

As well where are the savings numbers to support, ” savings found elsewhere” and by how much, “This item is recommended to be included in the budget through savings found elsewhere so that the tax rate is not increased.”

And finally the rational, “To deliver a tax rate residents can afford, some difficult choices must be made.” Does that imply, no difficult choices must be made need to deliver a budget residents can’t afford?

Rory – in general, I support all of your proposed reductions for the 2024 budget but only one of your additions – the firefighter positions. If you read my comments elsewhere you’ll know that I am totally opposed to any staff additions at this time, particularly in the I&IT and enterprise initiatives areas. A great deal of money has already been fruitlessly expended with nothing viable to show. I propose adopting ‘best-of-breed’ solutions from elsewhere and tweaking.

This said, I do thank you for the opportunity you afforded people (and not just your own constituents) on November 16th to freely express their opinions. It was a good session and one that should have been the standard.

Blair what has been proposed by staff is what the council wanted.

Before getting best of breed you need to find out what the staff’s real opinion is.

SAP was a disaster when it was forced down employees throats and was found to make there jobs harder. I think the IT has the right approach it’s just a question of how long its going to take. I don’t think it needs to be done all at once.

I’d start with things like why are there no consolidated bylaws? Revision tracking is 1990’s technology it isn’t cutting edge data bases. It may be AI can play a role in making it easier, but it is not that hard in anycase.