By Staff

By Staff

February 25th, 2024

BURLINGTON, ON

Expect this report that will be before Council next week to slip through as a Consent item.

Council seldom likes to talk about just where they tax money they collect goes.

Set out below is the surplus during the year – they used to call it the “positive variance” during the days when Joan Ford was the Chief Financial Officer.

There was no formal announcement on when Joan decided someone else could do the job (not as well we might add) and the city appointed an Interim CFO – without saying who does the job on an interim basis.

The Operating budget performance report as at December 31, 2023 goes to Council as a Receive and File finance department report that instructs the Acting Chief Financial Officer to allocate the 2023 retained savings based on the strategy outlined in a finance department report.

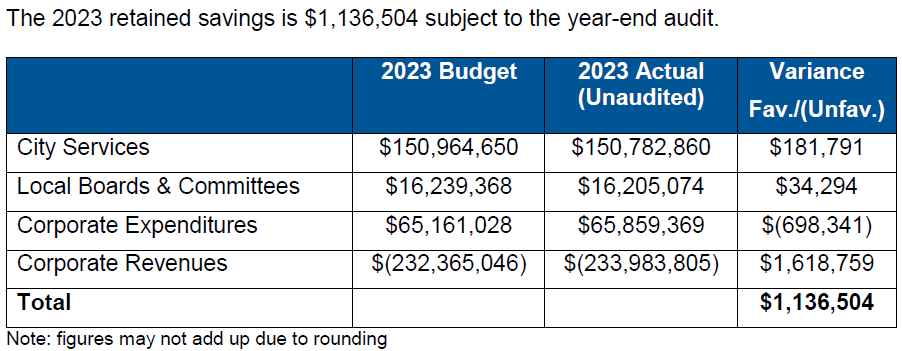

The 2023 retained savings is $1,136,504 subject to the year-end audit.

As is usual practice, accounts payable, year-end accruals and year-end transfers to/from reserves funds have been made in 2023.

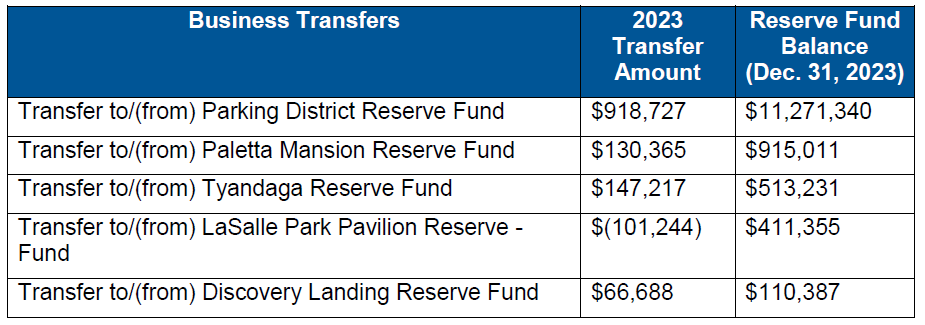

The following tables provide information regarding transfers to and from reserve funds for the City’s net zero operations:

Development Application Reserve Funds

In 2005, the Engineering Fee Stabilization Reserve Fund, the Building Permit Stabilization Reserve Fund and the Planning Fee Stabilization Reserve Fund were created to ease budget pressures should development revenues slow down due to economic and/or market conditions.

As of December 31, 2023, the following year-end transfers were made prior to the calculation of the year-end retained savings.

Engineering Fee Stabilization Reserve Fund

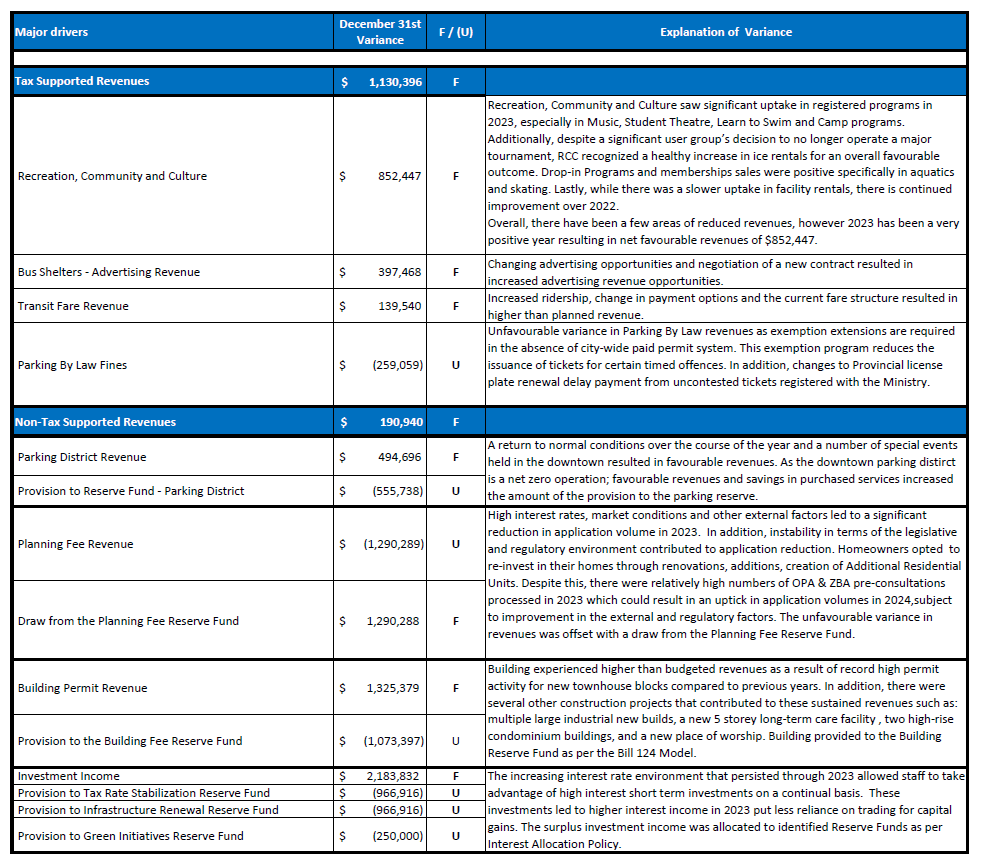

The increase in Subdivision Administration Fees has resulted in a provision of $83,156 to the reserve fund. The reserve fund will be used over the next five years to phase out our reliance on this funding source in the budget.

Building Permit Stabilization Reserve Fund

Building permit services are based on a “Fee for Service” model that is not supported by municipal taxes and is in full compliance with legislation. The intent behind establishing a Building Permit Stabilization Reserve fund is to provide municipalities with a sustainable tool for providing and maintaining building permit and inspection services throughout a fluctuating construction industry and overall economy. The Building Permit revenues for 2023 are $5,660,977. These revenues are offset by expenditures (both direct and indirect as per the Bill 124 model), resulting in a provision the reserve fund of $1,325,379. Building experienced higher than budgeted revenues as a result of record high permit activity for new townhouse blocks compared to previous years.

Planning Fee Stabilization

Planning fee revenues experienced an unfavourable variance of $1,373,444. High interest rates, market conditions and other external factors led to a significant reduction in application volume in 2023. In addition, instability in terms of the legislative and regulatory environment contributed to application reduction. Homeowners opted to re- invest in their homes through renovations, additions and creation of Additional Residential Units. The unfavourable variance in revenues was offset with a draw from the Planning Fee Reserve Fund.

Recommended Retained Savings Dispositions

The 2023 unaudited retained savings are $1,136,504. It is recommended that the funds be allocated as follows: (Note: Where reserve fund balances are provided, they reflect the balance prior to recommended disposition).

$1,000,000 Provision to Multi Year Community Investment Plan

The Multi Year Community Investment Plan (MCIP) estimates capital infrastructure requirements related to master plans completed to date (Parks Provisioning Master Plan, Integrated Mobility Plan, Fire Master Plan, etc.) as well as land requirements that may facilitate some of these infrastructure developments. The preliminary MCIP was presented in April 2022 (CM-03-22). Phase 2 of the Plan was presented to Council in December of 2023 (F-26-23) and highlighted capital infrastructure needs of approximately $1.1 billion over the next 25 years. The 2024 Financial Needs and Multi-Year Forecast recommended a provision of $2,200,000 to a reserve fund to begin a funding plan towards these needs. Through budget deliberations, this provision was reduced to $975,871. The allocation of

$1,000,000 in retained savings towards the MCIP will assist the City in executing on its master plans.

$136,504 Provision to Tax Rate Stabilization Reserve Fund

It is recommended that $136,504 be set aside to finance one-time expenditures. Over the last few years numerous spending commitments have been placed on the Tax Rate Stabilization Reserve Fund. This transfer amount will replenish prior one-time funding drawn from the reserve fund and serve as prudent planning to absorb any future potential unbudgeted expenses. The uncommitted balance in this reserve fund is $3,403,530.

The Tax Rate Stabilization Fund gets treated as a “piggy bank” that Council can dip into when there is a project they like. The idea that it might be applied as a refund to tax payers has never been considered.

“It is recommended that $136,504 be set aside to finance one-time expenditures. Over the last few years numerous spending commitments have been placed on the Tax Rate Stabilization Reserve Fund. This transfer amount will replenish prior one-time funding drawn from the reserve fund and serve as prudent planning to absorb any future potential unbudgeted expenses. The uncommitted balance in this reserve fund is $3,403,530.”

A member of our council once opined they had sold their condo in part due to the condo governance model. While the condo governance model may not be perfect when it comes to Reserve Funds it may be superior to that of our municipal government model.

Here is why. The Condo Act 1998 imposes tight controls over how these funds are to be spent. A condo reserve fund is an account that condominium corporations maintain solely for major repairs and replacements of common elements and assets. The Condo Act also requires that corporations conduct periodic reserve fund studies to determine whether the amount of money in the fund and contributions collected from owners are adequate and can sustain expected costs of major repair and replacement of the common elements and assets. Importantly, these studies must be completed by qualified professionals with expertise in this area.

Reserve funds cannot be used to make alterations to condo assets, pet projects or necessary and government-imposed expenditures, like having to install EV charging infrastructure that can cost owners $100’s of thousands of dollars.

Generally speaking, governance is a system of rules, practices, and processes by which an organization is directed and controlled and involves balancing the interests of the entity’s stakeholders, which can include management, customers, suppliers, lenders, taxpayers and the community.

The one thing that is for sure, condo boards cannot play around with changing the rules and funds cannot be reallocated as slush funds. So, when it comes to Reserve Funds the condo model wins out over the Municipal model.

How very interesting, I was in the process of composing an e-mail to our Conservative MPP regarding the use of property taxes to generate Municipal revenues, part of which was an example of the Condo Act regarding Provincial rules. You’ve filled in some important points, thanks again.

If municipalities were held to more of the rules, regulations and fiscal controls imposed on condos, many of the issues that rankle taxpayers would go away.