By Pepper Parr

BURLINGTON, ON May 4, 2011 It’s official. If you have a house in the city that is assessed at $300,000. your taxes are going up $9.64 for every $100,000 of evaluation. So that $300,000 house is going to cost you an additional $27.88 each year.

The tax levy for the rural part of the city is $6.34 per $100,000 of assessment.

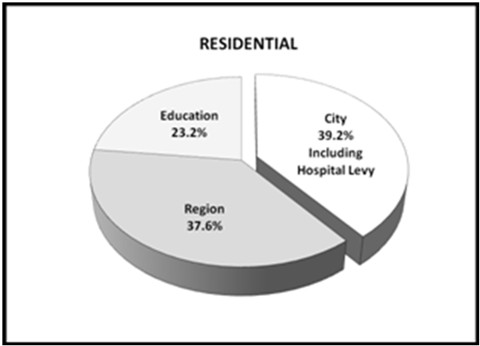

Here is how it breaks out in terms of who is getting what on that tax bill which will be in the mail real soon with due dates of June and September.

For every $100,000 of assessment:

Burlington portion |

$390.35 |

$386.83 |

Region |

$374.79 |

$369.05 |

Education |

$231.00 |

$231.00 |

TOTAL |

$996.14 |

$986.88 |

Region includes Police and Waste Management

Education levy is set by the province

The City of Burlington has a 2011 annual operating budget of $189.5 million (which includes a $1.2 million contribution to the Joseph Brant Memorial Hospital) and a capital budget of $40.5 million. About 80% of the operating budget is for staff salaries.

The City of Burlington has a 2011 annual operating budget of $189.5 million (which includes a $1.2 million contribution to the Joseph Brant Memorial Hospital) and a capital budget of $40.5 million. About 80% of the operating budget is for staff salaries.

[retweet]