By Pepper Parr

By Pepper Parr

November 6th, 2023

BURLINGTON, ON

Council will meet today and on Tuesday to listen to staff explain the work that gets done on a day to day basis and what it costs.

The Mayor has organized a telephone Town Hall to listen to what residnets have to say Tuesday evening.

Later in the month Staff go through the Mayor’s Budget and, with what they will have learned on Monday and Tuesday decide what they want to keep and what they are prepared to take a pass on.

It is going to be an interesting exercise – the Mayor has drawn a line in the sand – no more than a 4.99% increase in the municipal share of the budget over last year.

The schedule for today is:

Who speaks when is set out – how long they talk is unknown. The current City council does tend to go on and on and on even with time limits in place.

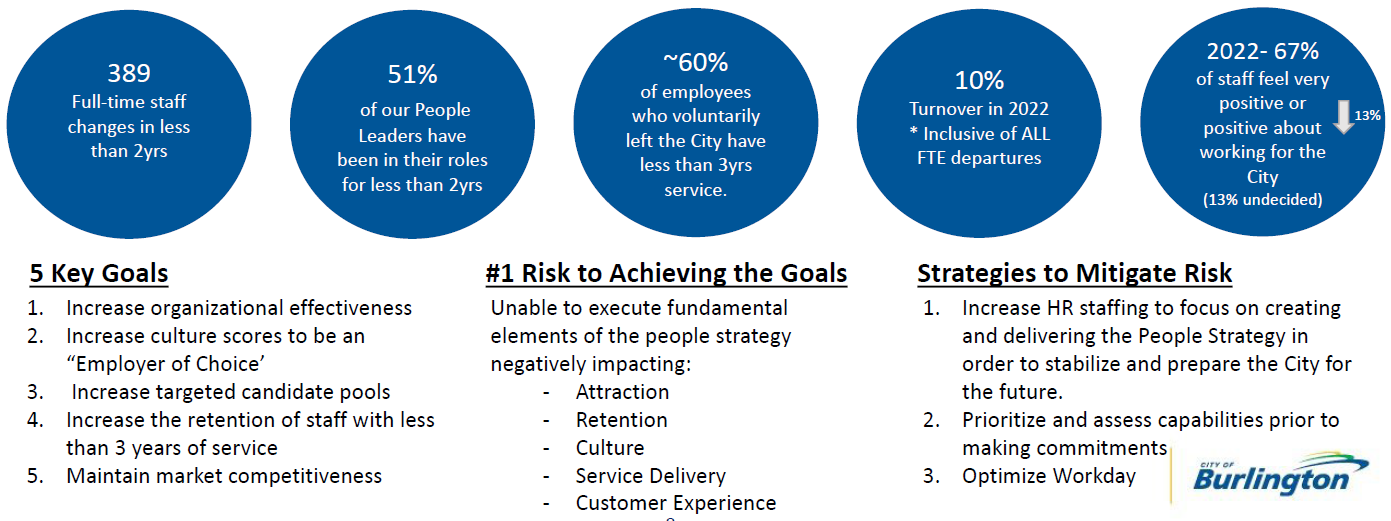

Staffing has become an issue for a number of residents – some of the data they will get to look at will raise eyebrows.

The label for this graphic is: The Employee experience

Oakville’s approach is easy to understand as well

Slide 15

https://pub-oakville.escribemeetings.com/filestream.ashx?DocumentId=61123

“Mayor has drawn a line in the sand – no more than a 4.99% increase in the municipal share of the budget over last year.”

Translation, per M0-020-23, Burlington taxpayers will experience a blended tax increase of 6.33% that is comprised of the 4.99% COB increase, plus The Region of Halton increase of 1.33%. Per MO-02-23 the “numbers may not add up due to rounding”.

The 2023 property tax impact was made up of three portions, the City of Burlington (48.9%), Halton Region (33.4%), and the Boards of Education (17.7%). The overall tax increase was 7.52%. M0-02-23 does not contain a Board of Education increase for 2024? Does anyone know why?

So why are we handing out money to people to hold “street parties”? Why are we still paying for crews to vacuum up autumn leaves when it’s a pricey and inefficient way to clean them up in our windy fall weather? WHY DO THEY KEEP WASTING OUR TAX DOLLARS?!?

“Mayor has drawn a line in the sand – no more than a 4.99% increase in the municipal share of the budget over last year.”

Translation, per M0-020-23, Burlington taxpayers will experience a blended tax increase of 6.33% that is comprised of the 4.99% COB increase, plus The Region of Halton increase of 1.33%. Per MO-02-23 the “numbers may not add up due to rounding”.

The 2023 property tax impact was made up of three portions, the City of Burlington (48.9%), Halton Region (33.4%), and the Boards of Education (17.7%). The overall tax increase was 7.52%. M0-02-23 does not contain a Board of Education increase for 2024? Does anyone know why?

Editor’s note: There are two questions here. I’ll pass on the school boards.

The budget focus for Burlington is the spending and tax collecting the city does for the things it can fully control. That’s the 4.99% line drawn in the sand. Let’s not confuse people.

There is an issue with the big jump at the Regional level – for a number of years it was zero.

The mayor keeps using the word impact. The impact of the city’s increase on the total tax bill is 4.99%. But city’s portion of the tax bill is rising to 51% so the City’s increase is really 10.21% (roughly twice the impact on the total bill). Lori Jivand, the city budget coorinator, confirmed the 10.21% to me in an email. Also, the 10.21% is based on the mayor’s proposed budget not the city’s needs document.

Have a look at Blair Smith’s comment on the Bay Observer. I believe this is the same Blair Smith that worked on Mayor Meed Ward’s campaign in 2018.

“I believe that they will find that the official “spin” has been misleading and is perilously close to deception.”

https://bayobserver.ca/pushback-developing-in-burlington-against-2024-tax-increase/

The mayor keeps using the word impact. The impact of the city’s increase on the total tax bill is 4.99%. But city’s portion of the tax bill is 51% so the City’s increase is 10.21%. Lori Jivand, the city budget manager, confirmed the 10.21% to me in an email. Also, the 10.21% is from the mayor’s proposed budget not the city’s needs document.

Have a look at Blair Smith’s comment on the Bay Observer. I believe this is the same Blair Smith that worked on Mayor Meed Ward’s campaign in 2018.

“I believe that they will find that the official “spin” has been misleading and is perilously close to deception.”

https://bayobserver.ca/pushback-developing-in-burlington-against-2024-tax-increase/

Especially after the reporting here

https://burlingtongazette.ca/mayor-proposes-that-the-city-portion-of-the-2024-budget-be-kept-at-4-99-staff-was-talking-about-something-about-7-63/

And here

https://globalnews.ca/news/10063759/burlington-mayor-budget-hike-2024/

It’s too bad there is not a local newspaper that can explain this is a calm and informative way!

Dear Editor: I found the following was confusing “no more than a 4.99% increase in the municipal share of the budget over last year”. Ergo, I needed the context for the 4.99%, which on its own is a sheet blowing in the wind.

Editor’s Note: Way to go putz – nice to see there is still a lot of fight in you!!! 🙂 🙂

Now I preface this with the reality that I am by nature and choice a Liberal Arts person; math is not my forté. But here is how I understand it. The property tax bill for a Burlington property owner is made up of three (3) parts; the education allotment designated by the Province, the Halton Region component assigned by the Region and the Municipal portion allocated by the City of Burlington. While true that the City has no control over the Provincial portion and little control over the Region, it is not true that these can be ignored by the City in the calculation of the overall tax burden on the property owner – they have a significant impact.

So, as a simple example – let’s say you sign a maintenance contract with xx company which shall be ‘the City’ and it is composed of three parts; the roof (Province), the driveway (Region) and the house, the master overall contract (City). In 2022, the overall cost of the contract was $10 of which $2 was the roof, $2 the driveway and $6 the house. In 2023, the overall cost only rose by 5% or $.5 but the cost of the roof maintenance remained the same and the driveway maintenance only rose 3% or $.06. So, the end increase of those parts not under the “direct control” of xx would be $.06 (the driveway) with a final bill (tax levy) of $10.50. Company xx then proudly claims that in a time of increased costs and external pressures they have only increased costs to the consumer/taxpayer by 5% but, in truth, they have increased their portion of the costs by 7.3% and hidden the actual increase in the blended maintenance bill.

I reread my “simple example” and realize how confusing it can actually be. I think that the message is you need to look at all parts of the bill and their portion of the overall levy to understand what the actual increases are.