April 18th, 2024

BURLINGTON, ON

Pouring over the 400 page federal 2024 budget document, one can’t help but be impressed with the breadth and scope of federal involvement in almost every facet of the lives of Canadians. It is a lot of money that gets spent by your federal government each year. This year that list of expenses is even longer thanks to the NDP demanding their pound of flesh for propping up the Liberal government.

The photo op reminds one of two students turning in their homework. Prime Minister Justin Trudeau and Finance Minister Freeland

The federal government has been forced to use the power of the purse to buy its way into areas which were once exclusively provincial. That is because the premiers of provinces like Alberta, Saskatchewan and Ontario are not meeting the needs and wants of their electorate. And the public doesn’t know, or even care, which government is responsible, but blame the feds if they don’t get what they want and need.”

So the feds have found their way into having to develop their own health care, dental care, pharmacare, education and child care programs. Provincial governments are involved in some of these but none of these new initiatives would be happening without federal leadership or funding. And now there is a billion dollar school food program, filling a void left open by most provinces and some parents.

The federal government was late in getting to the point where they would play a direct role in getting housing built. The provinces left them no other option.

Housing has taken a front seat in this budget as the feds have plunged headlong into dealing directly with municipalities to meet the hugely unmet demand for accommodation spaces across the country. The provinces may resent the federal intrusion into their back yard, but Canadians feel it is a federal responsibility. So it’s in the budget. Of course, cutting the bank rate, which is driving up mortgages across the country, and limiting immigration would also help solve the housing crisis.

Justin Trudeau came to power, unlike his political opponents, arguing for even more deficit financing to grow the economy. And it’s been a spotty growth record, marred by the pandemic and the acute inflationary supply shortages immediately following. Still, Canada posted one of the highest growth rates over the past couple years among the G7, though not on a per capita basis thanks to the flood of new immigration we’ve seen.

Economists these days prefer to talk about debt as a percentage of the GDP. Still, when the cost of financing the debt is more costly than what the government contributes to health care, that is troubling. Canada’s debt to GDP ratio, which is about half of that of our southern neighbours, had been slowly declining until Covid came knocking at our door. The budget predicts that ratio will get back to where it left off and continue its downward trajectory.

That will be helped by the big news in this budget that taxes are finally going up for those who can most afford them. There are about 40,000 Canadians who earn over $250,000 in capital gains and only pay income tax on half of that. The capital gains tax for those folks is rising from 50% to 67%. That is still well below the 75% rate once imposed by former PM Mulroney.

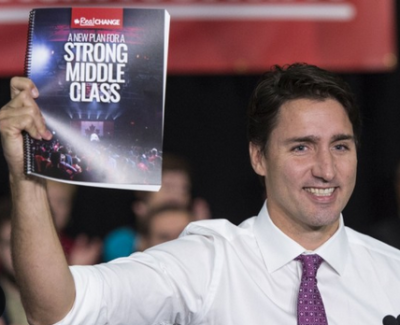

A younger Justin Trudeau made it clear from the beginning – he was going to work for the middle class – more votes in that demographic.

And why would capital gains be treated any differently from employment income – why shouldn’t it be taxed at 100% like other earned income? Capital gains, much like an inheritance or casino winnings are windfalls but they are spent and saved just like earned income. Why do we treat them as a free lunch?

Income tax rates have not been touched in this or other recent budgets. One of the first acts of the Trudeau administration was to cut taxes for the middle class, which the PM claims helped lift more than one million Canadians out of poverty. And to pay for that he created a new top federal income tax bracket of thirty three percent.

But Canada, with its publicly financed health care is still a relative tax bargain for its citizens. We still have the lowest marginal tax rate in the G7. For example, the richest Americans are taxed at 37%. Also, Canada’s corporate income tax rate is the 4th lowest in the G7 at 26.2%. And taxation of new business investment at 13%, compared to the USA at 17.8%, is the lowest in the G7.

Unquestionably this is a progressive budget and those who don’t believe in government playing a bigger support role in our lives will disapprove. Still we know from our experience with the Canada Health Act that universal publicly funding universal programs are less costly to society overall. It’s a known fact that Canadians pay something like half what Americans do for a health care system with better outcomes, despite some access issues.

So those naysayers are on the wrong side of history. As we are forced into the age of fighting to save the planet from the potential ravages of climate change we need to get used to governments playing an even bigger role. But we need to pay for what we are demanding. And making the wealthiest Canadians pay a fairer share by raising the inclusion rate on capital gains is just a start.

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Background links:

Budget – Debt – Highlights – More Canada – Not Less –

Capital gains are taxed lower because the money invested is put at risk. That has to be recognised. Try mortgaging your home, use the money to start a business and if it works out, then sell it. Or use your savings.

How would that work for you? Maybe it flopped and you lost everything? Maybe it flourished, you risked so much but created employment, paid business taxes, employer health tax, and other fees and your employees paid income tax. Of course you didn’t take a salary yourself because there was not enough in the pot but you hope to take a reward for your risk. Any volunteers…..Ray?

Why risk money now? Not worth it, is it. And what about other years? No doubt this will be increased again.

This will have a follow on effect and further hinder an economic recovery.

As for the rich, not paying their fair share? Fraser Institute writes lots about that quite a bit. Says the top 20 percent of family’s pay 61 percent of the countries income.

https://www.fraserinstitute.org/article/federal-government-misleading-canadians-about-fair-share-of-taxes

Ray, I have to disagree with you the childcare program is a mess and the dental program is not a program if the dentists don’t participate and the so called “free” dental plan is not free. There are co-payments involved.

It says something when the first people eligible to apply for the dental program are in their 90’s. After the “free dental examination and x-rays you are on your own.

Their pharmacare program is just as bad. Fine if you are a diabetic and/or want birth control pills. This is a joke and I can’t say who is more delusional the Liberals or the NDP who sold their sole to prop up the Liberal Government.

Only politicians would think this is good enough.

There is one (yes, just one) item that makes sense in this op ed, and that is the title, however in a different context.

Naive, inexperienced millennials and other liberal voters that fell for the charlatan’s “sunny ways” are now “paying the piper”, and will continue to “pay the piper” for quite some time until this debt and wasteful spending is wrestled to the ground.

When lessons are learned the hard way, they are not forgotten.

Stephen – I too have a lot of time for Mark Carney – but as a committed climate change fighter and economist, I doubt he’d change the federal carbon pricing program and the rest of the climate change mitigation program.

By the way neither the fledgling dental care nor the newly created $10 child care program are in trouble. In Ontario, around 92% of licensed child care sites had opted into the system as of November 2022. (https://www.moneysense.ca/columns/making-it/canadas-10-a-day-daycare-program/)

The economy is not in a mess by any measure. Productivity and GDP/capita are down because of recent excessive immigration and will recover once those new immigrants become fully productive. Experience is that it could could take up to 6 years for that to happen but after a decade they usually, on average, outperform the average Canadian.

Ray: “Canada’s economic outlook is bleak, with forecasts predicting stagnant growth and a steady inflation rate of 3% in 2024. Real GDP per capita, the indicator most representative of what Canadian families are feeling, has been on a downward trajectory for consecutive quarters. The implication is clear—the Canadian economy is not robust”.

Forbes Oct. 2023

When comparing tax rates with the USA you need to compare the whole tax package.Americans usually pay much higher Property taxes than Canadians.

The picture: I only recently realized that Justin is tall – he seems to:tower over his ministers and staff. I bet he likes it that way.

“The federal government has been forced to use the power of the purse to buy its way into areas which were once exclusively provincial. That is because the premiers of provinces like Alberta, Saskatchewan and Ontario are not meeting the needs and wants of their electorate.”

Hilarious Ray! I thought the whole point of having a federal system of government was to permit the provinces to exercise discretion and jurisdiction over those matters that were allocated to them under the Charter. Guess not.

The truth is…the federal Liberals are 20% behind in the public opinion polls. Dissent is emerging in the ranks (e.g. Anthony Housefather, Marco Mendicino, Nathaniel Erskine-Smith, etc.). The economy is a mess. The Liberals Green agenda is creating havoc. Inflation is eroding people’s standard of living. Productivity is lagging behind every other G-7 nation.

Justin’s last play is to try and buy voters’ support with a bunch of poorly planned initiatives that haven’t been carefully thought out. Witness the back-tracking on the dental care program, and non-participation by dentists. Ditto the daycare mess.

I’m waiting for the siren call from Bay Street heralding the arrival of Mark Carney. I’m sure all those good Liberal bureaucrats like Frank McKenna sitting on the boards of directors of our major banks on Bay Street are just “chomping at the bit” for his ascension. God knows, it couldn’t be any worse than the mess Justin has created.

100% agreed, Stephen. As far as I can tell, the only true competency of Justin Trudeau & his Liberal government really is writing large cheques on other people’s (ours & our descendants) accounts.

Ray you may want to call David Dodge who stated this budget would ” likely be one of the worst in decades”. Ray either forgot or just skipped over the $54 BILLION per annum interest cost that is coming out of our pockets to pay for the deficit. The budget was a last ditch attempt to save the Liberal party.