By Ray Rivers By Ray Rivers

April 18th, 2024

BURLINGTON, ON

Pouring over the 400 page federal 2024 budget document, one can’t help but be impressed with the breadth and scope of federal involvement in almost every facet of the lives of Canadians. It is a lot of money that gets spent by your federal government each year. This year that list of expenses is even longer thanks to the NDP demanding their pound of flesh for propping up the Liberal government.

The photo op reminds one of two students turning in their homework. Prime Minister Justin Trudeau and Finance Minister Freeland The federal government has been forced to use the power of the purse to buy its way into areas which were once exclusively provincial. That is because the premiers of provinces like Alberta, Saskatchewan and Ontario are not meeting the needs and wants of their electorate. And the public doesn’t know, or even care, which government is responsible, but blame the feds if they don’t get what they want and need.”

So the feds have found their way into having to develop their own health care, dental care, pharmacare, education and child care programs. Provincial governments are involved in some of these but none of these new initiatives would be happening without federal leadership or funding. And now there is a billion dollar school food program, filling a void left open by most provinces and some parents.

The federal government was late in getting to the point where they would play a direct role in getting housing built. The provinces left them no other option. Housing has taken a front seat in this budget as the feds have plunged headlong into dealing directly with municipalities to meet the hugely unmet demand for accommodation spaces across the country. The provinces may resent the federal intrusion into their back yard, but Canadians feel it is a federal responsibility. So it’s in the budget. Of course, cutting the bank rate, which is driving up mortgages across the country, and limiting immigration would also help solve the housing crisis.

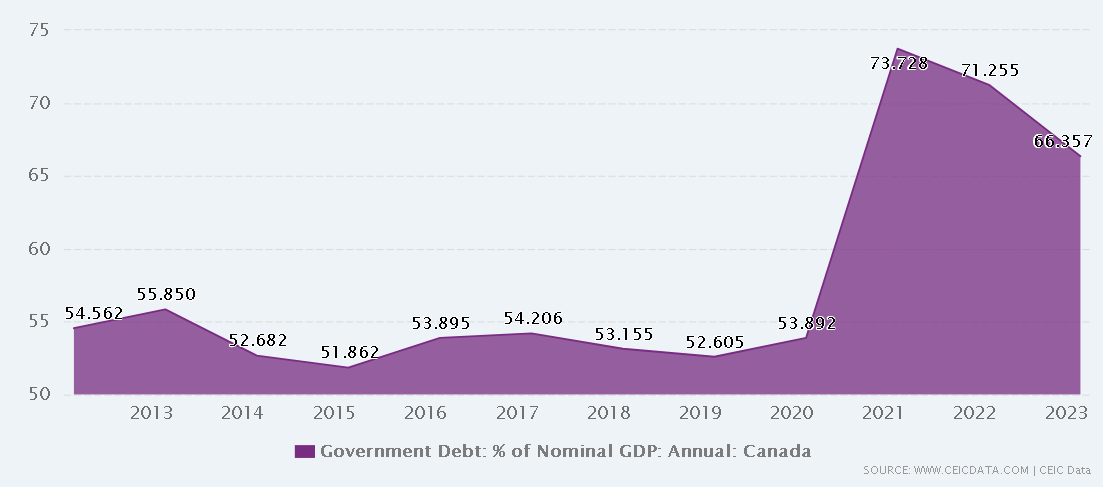

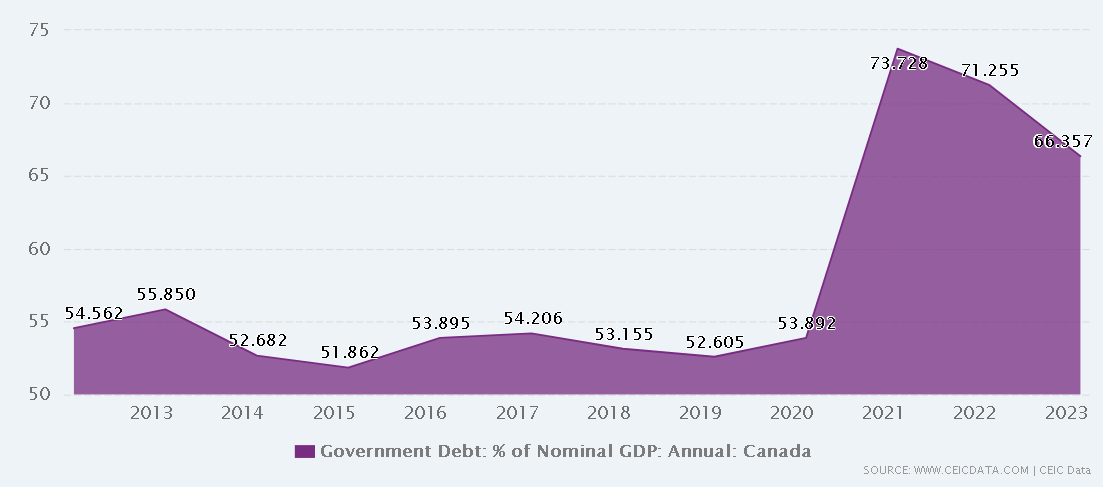

Justin Trudeau came to power, unlike his political opponents, arguing for even more deficit financing to grow the economy. And it’s been a spotty growth record, marred by the pandemic and the acute inflationary supply shortages immediately following. Still, Canada posted one of the highest growth rates over the past couple years among the G7, though not on a per capita basis thanks to the flood of new immigration we’ve seen.

Economists these days prefer to talk about debt as a percentage of the GDP. Still, when the cost of financing the debt is more costly than what the government contributes to health care, that is troubling. Canada’s debt to GDP ratio, which is about half of that of our southern neighbours, had been slowly declining until Covid came knocking at our door. The budget predicts that ratio will get back to where it left off and continue its downward trajectory.

That will be helped by the big news in this budget that taxes are finally going up for those who can most afford them. There are about 40,000 Canadians who earn over $250,000 in capital gains and only pay income tax on half of that. The capital gains tax for those folks is rising from 50% to 67%. That is still well below the 75% rate once imposed by former PM Mulroney.

A younger Justin Trudeau made it clear from the beginning – he was going to work for the middle class – more votes in that demographic. And why would capital gains be treated any differently from employment income – why shouldn’t it be taxed at 100% like other earned income? Capital gains, much like an inheritance or casino winnings are windfalls but they are spent and saved just like earned income. Why do we treat them as a free lunch?

Income tax rates have not been touched in this or other recent budgets. One of the first acts of the Trudeau administration was to cut taxes for the middle class, which the PM claims helped lift more than one million Canadians out of poverty. And to pay for that he created a new top federal income tax bracket of thirty three percent.

But Canada, with its publicly financed health care is still a relative tax bargain for its citizens. We still have the lowest marginal tax rate in the G7. For example, the richest Americans are taxed at 37%. Also, Canada’s corporate income tax rate is the 4th lowest in the G7 at 26.2%. And taxation of new business investment at 13%, compared to the USA at 17.8%, is the lowest in the G7.

Unquestionably this is a progressive budget and those who don’t believe in government playing a bigger support role in our lives will disapprove. Still we know from our experience with the Canada Health Act that universal publicly funding universal programs are less costly to society overall. It’s a known fact that Canadians pay something like half what Americans do for a health care system with better outcomes, despite some access issues.

So those naysayers are on the wrong side of history. As we are forced into the age of fighting to save the planet from the potential ravages of climate change we need to get used to governments playing an even bigger role. But we need to pay for what we are demanding. And making the wealthiest Canadians pay a fairer share by raising the inclusion rate on capital gains is just a start.

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Background links:

Budget – Debt – Highlights – More Canada – Not Less –

By Eric Stern By Eric Stern

April 19th, 2024

BURLINGTON, ON

On April 16th the federal government introduced its eighth budget. Using the term “fiscal guardrails” to describe their approach to deficit spending the Liberals plan to add another $39.8 billion to the national debt.

We have wonderful social programs and it is amazing to see this government adding to them. Canada is the only country in the world with healthcare coverage but no prescription medication coverage for people under 65 (outside of hospitals). The budget takes a tentative first step towards correcting this.

The problem with adding new social programs is that we need a fair way, for every generation, to pay for these programs.

Debt and Deficit

Federal debt The federal debt load, the sum of all unpaid government deficits, is now around $1.2 trillion. These numbers are so big they become meaningless. Dividing $1.2 trillion by the population of the country, 40 million, we get something more meaningful. The federal government has borrowed, on behalf of each person in Canada, about $30,000. Using the same line of calculation and a population of 16 million, the Ontario government has borrowed, on behalf of each person in Ontario, about $26,850.

Adding the two totals together, a baby born today, in Ontario, owes $56,850. Is this fair to the newborn generation?

Another way to look at this problem is to compare healthcare dollars with the interest payments on the $1.2 trillion debt. The federal government will transfer, to the provinces, $49 billion for healthcare and will pay $54 billion in interest payments on the debt. If the current government, and previous governments, had actually had any fiscal guardrails, far more money would be going to healthcare, something the current generation of seniors might see as fair.

Trudeau has added more money to the total debt than all previous prime ministers combined going back to 1867. This burden will be transferred to future generations, once again calling into question the statement “Fairness for every generation”.

The federal government has added 100,000 employees to the payroll. In 2015 there were 257,034 employees, in 2023 there were 357,247 employees. Healthcare is a provincial responsibility; the growth didn’t take place in healthcare. In spite of Trudeau promising, in 2015, to reduce the use of consultants, consulting fees have increased 60% (2015 to 2023). The federal government has added 100,000 employees to the payroll. In 2015 there were 257,034 employees, in 2023 there were 357,247 employees. Healthcare is a provincial responsibility; the growth didn’t take place in healthcare. In spite of Trudeau promising, in 2015, to reduce the use of consultants, consulting fees have increased 60% (2015 to 2023).

The Liberals have failed to make the civil service more productive either through the use of technology or other means, and have failed to control the size of the civil service. Arrivecan is just one example. With such massive growth in both public sector employment, and in the use of consultants, there must be opportunities to reduce government spending to pay for new social programs offering true fairness for every generation.

Tax the Wealthy

In 1990 there were twelve countries in Europe with a wealth tax, today there are three. In France, between 2000 and 2012, an estimated 42,000 millionaires left the country. Over time, as wealthy people leave, tax revenues decline. France repealed their wealth tax in 2018.

While the Liberals play checkers, Canada’s millionaires and billionaires have accountants and lawyers who play chess. Can a billionaire move to the Caymen Islands, a tax haven, and fly their private jet to Toronto for meetings? Why not, Trudeau hops in a plane with less thought than the rest of put into taking an Uber.

The Fraser Institute, a conservative think tank estimates that the top 20% of Canadian income earners pay more than half of total taxes. Statements like “the wealthy must pay their fair share” may already be true. Link to the report HERE.

The 2024 Forbes list of billionaires shows there are 67 billionaires in Canada with a combined wealth of $314 billion. This is a very small number of people, I bet all 67 can fit in the Prime Minister’s jet. A tax system that encourages and allows more people to become billionaires will generate more tax revenue for all Canadians.

The change in the capital gains inclusion rate will cause real and long-term damage to our economy. Tobi Lutke, one of our billionaires and a cofounder of Shopify, posted this on “X” immediately after the budget was released. “Canada has heard rumours about innovation and is determined to leave no stone unturned in deterring it”.

Tech companies, in particular, need venture capital funding to grow. The changes in capital gains taxation will deter venture capitalists from investing in Canada. In the US, the tax rate on capital gains is a flat 21%. We are simply not competitive. Small and medium sized businesses, in every sector, now have one more difficulty to overcome when trying to attract capital to grow. How many Canadian venture capital firms will relocate to the US and simply stop investing in Canada? Tech companies, in particular, need venture capital funding to grow. The changes in capital gains taxation will deter venture capitalists from investing in Canada. In the US, the tax rate on capital gains is a flat 21%. We are simply not competitive. Small and medium sized businesses, in every sector, now have one more difficulty to overcome when trying to attract capital to grow. How many Canadian venture capital firms will relocate to the US and simply stop investing in Canada?

Housing Costs

Someone in the federal Liberal government fell asleep at the switch, the result is that Canada’s rate of immigration is unsustainable. Immigration is wonderful but schools, healthcare, roads, and housing need to keep up.

Oval Court: A high rise development planned for Burlington The budget completely ignores the fact that the Liberal government created the housing shortage.

Now that the opinion polls have forced the government to wake up the Liberals really have no choice but to spend tax dollars, collected from all Canadians, to create more housing. Burlington has already received $21 million in federal housing funding and the money has gone into processes, not physical housing. I really hope this new round of federal money goes into homes instead of more photo ops to boost the Liberal party’s sagging popularity.

Is this article almost finished?

Almost.

There are many budget details still to be released. The government expects to raise $6 billion with a new digital services tax. Will this be just another tax along the lines of charging HST on top of the carbon tax? We’ll have to wait and find out.

The Liberal government has forgotten that Canada needs a vibrant and growing private sector that can be taxed, fairly, to pay for our social programs. Companies in Canada need to compete against companies around the world, employee housing costs, personal tax rates, and corporate tax rates are major factors in this competition.

Inflation is a problem for everyone, the Bank of Canada has asked all levels of government to reign in their deficit spending so that interest rates can come down. Borrowing $40 billion just pours gasoline on the inflation fire. Here’s a new slogan: Budget 2024: Un-Fairness for every generation.

I sometimes wonder if Trudeau understands the difference between a million, a billion, or a trazillion.

Eric Stern is a Burlington resident, a retired businessman in the private sector and said to handle a pool stick better than most of the people he plays with. Eric Stern is a Burlington resident, a retired businessman in the private sector and said to handle a pool stick better than most of the people he plays with.

By Pepper Parr By Pepper Parr

December 16th, 2023

BURLINGTON, ON

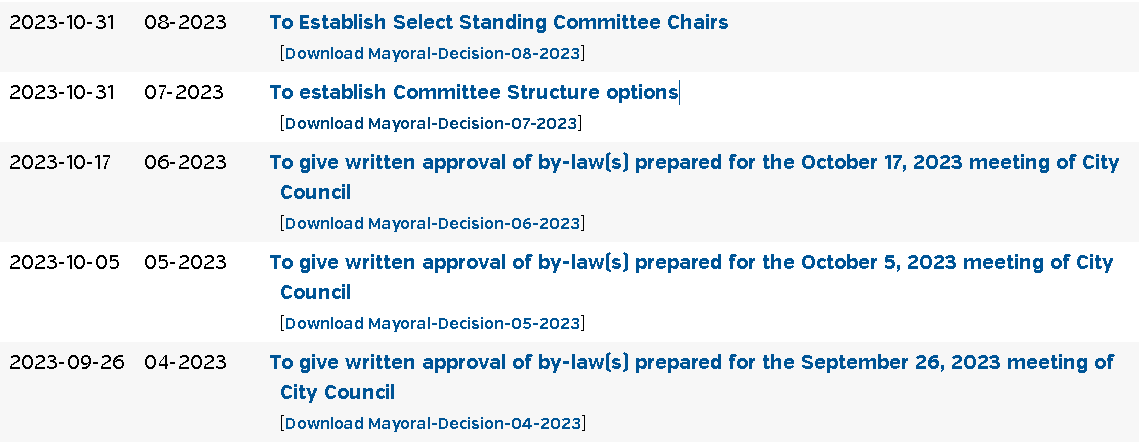

On July 1st of this year the province gave many Mayors the right to use what were called Strong Mayor powers.

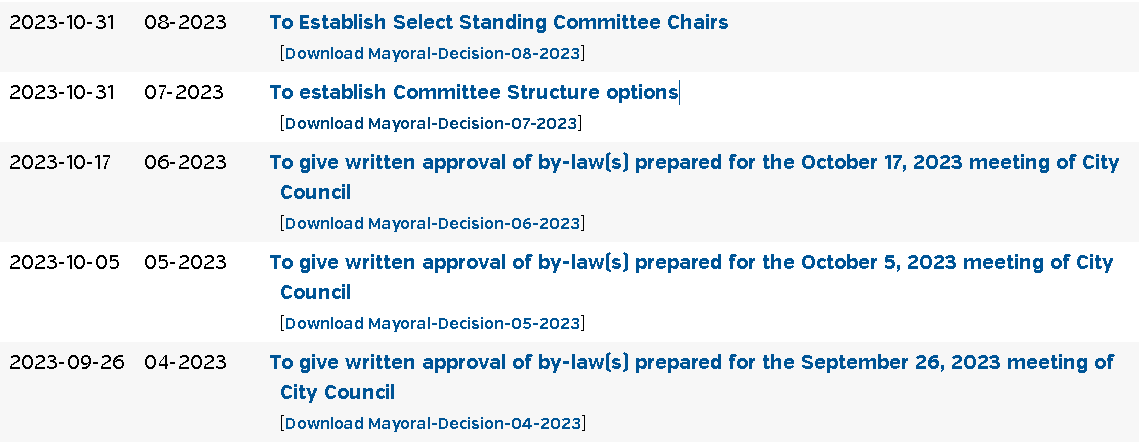

A Mayor does not have to use these powers, which are pretty blunt. To date Mayor Meed Ward has used the powers on 13 occasions. Numbers 4 to 8 are set out below. Numbers 1 to 3 were published earlier – a link to them is set out below. Four, five and six have the Mayor passing the bylaws – this is what a City Council does, with Strong Mayor powers a Mayor can declare a bylaw is passed – the one proviso is that the Mayor must inform the public in writing.

The two decisions that raise concerns are seven and eight. They turn the Standing Committee structure the city had on its head.

For those involved in what takes place at city hall – pay attention.

Decision # 4

No one saw this coming. What was a victory signal the night Marianne Meed Ward was elected Mayor morphed into something few expected. Mayoral decision

Under Bill 3, the Strong Mayors, Building Homes Act, 2022, which amended the Municipal Act, 2001, I Marianne Meed Ward, Mayor of the City of Burlington, hereby approve the following by-laws passed at the Burlington City Council meeting of September 26, 2023 in accordance with subsection 284.11(4)(a)(i) of the Municipal Act, 2001:

• All by-laws enacted under Motion to Approve By-laws (Council Agenda item 21)

• Confirmation By-law (Council Agenda Item 22)

Dated at Burlington, this 26th day of September 2023.

Decision # 5

Mayoral decision

Under Bill 3, the Strong Mayors, Building Homes Act, 2022, which amended the Municipal Act, 2001,

I Marianne Meed Ward, Mayor of the City of Burlington, hereby approve the following by-laws passed at the Burlington City Council meeting of October 5, 2023 in accordance

with subsection 284.11(4)(a)(i) of the Municipal Act, 2001:

• All by-laws enacted under Motion to Approve By-laws (NA)

• Confirmation By-law (Council Agenda Item #9)

Dated at Burlington, this 5th day of October 2023.

Decision # 6

Mayoral decision

Under Bill 3, the Strong Mayors, Building Homes Act, 2022, which amended the Municipal Act, 2001,

I Marianne Meed Ward, Mayor of the City of Burlington, hereby approve the following by-laws passed at the Burlington City Council meeting of October 17, 2023 in

accordance with subsection 284.11(4)(a)(i) of the Municipal Act, 2001:

• All by-laws enacted under Motion to Approve By-laws (Council Agenda item #21)

• Confirmation By-law (Council Agenda Item #22)

Dated at Burlington, this 17th day of October 2023.

Decision # 7

Mayoral decision

Under Bill 3, the Strong Mayors, Building Homes Act, 2022, which amended the Municipal Act, 2001,

Effective January 1, 2024, in accordance with subsection 226.6 of the Act, I Marianne Meed Ward, Mayor of the City of Burlington, hereby dissolve the following standing

committees as prescribed in the City’s Procedure By-law no. 31 -2021, as amended:

• Committee of the Whole

• Community Planning , Regulation & Mobility Committee

• Environment, Infrastructure & Community Services Committee

• Corporate Services, Strategy, Risk & Accountability Committee; and

Effective January 1, 2024, in accordance with subsection 226.6 of the Act, I Marianne Meed Ward, Mayor of the City of Burlington, hereby establish a Committee of the Whole

and Budget Committee with functions assigned as follows:

Committee of the Whole

I. Responsibilities

The Committee of the Whole shall be responsible for considering all matters that do not properly fall under the jurisdiction of any other existing Standing

Committees. The Committee of the Whole agendas are divided into the following sections, with a Chair and Vice Chair assigned to each section:

Community Planning, Regulation & Mobility

The Community Planning, Regulation & Mobility section will include matters relating to:

a) Matters under the jurisdiction of Community Planning, Regulation and Mobility including; Community Planning, Building, By-law Compliance, Transit, and Transportation departments;

b) Public hearings pursuant to the Planning Act, RSO 1990, c. P.13, as amended;

c) Matters arising from the following boards and advisory committees:

Aldershot BIA

Burlington Chamber of Commerce

Burlington Downtown Business Association

Burlington Economic Development Corporation (BEDC)

Committee of Adjustment

Heritage Burlington Advisory Committee

Integrated Transportation Advisory Committee (ITAC)

Burlington Cycling Advisory Committee

Burlington Agricultural and Rural Affairs Advisory Committee (BARAAC)

Downtown Parking Advisory Committee

Property Standards Committee

Environment, Infrastructure & Community Services

The Environment, Infrastructure & Community Services section will include matters relating to:

a) Matters under the jurisdiction of the Environment, Infrastructure and

Community Services including; Engineering Services, Recreation,

Community and Culture, Roads, Parks & Forestry, and Fire, Assets and

Sustainability departments;

b) Matters arising from the following boards, committees and advisory committees:

Burlington Accessibility Advisory Committee (BMC)

Burlington Sustainable Development Committee (SOC)

Art Gallery of Burlington Board (AGB)

Burlington Mundialization Committee

Burlington Museums Board

Burlington Performing Arts Centre

Burlington Public Library Board (BPL)

Burlington Seniors’ Advisory Committee {BSAC)

Tourism Burlington

Corporate Services, Strategy, Risk & Accountability

The Corporate Services, Strategy, Risk & Accountability section will include matters relating to:

a) Matters under the jurisdiction of the City Manager’s Office, Office of the City Clerk, Corporate Communications and Engagement, Strategy, Risk

and Accountability, Customer Experience, Finance, Human Resources, Burlington Digital Services, and Corporate Legal Services departments;

b) All public meetings under the Development Charges Act, 1997, S.O. 1997, c. 27;

c) Burlington Strategic Plan and Vision to Focus workplan;

d) Matters arising from the following board and advisory committee:

Burlington Hydro Electric Inc. (SHEi)

Burlington lnclusivity Advisory Committee (BIAC)

II. Composition

The Committee of the Whole shall be comprised of all members of Council.

Ill. Reporting

The Committee of the Whole reports directly to Council.

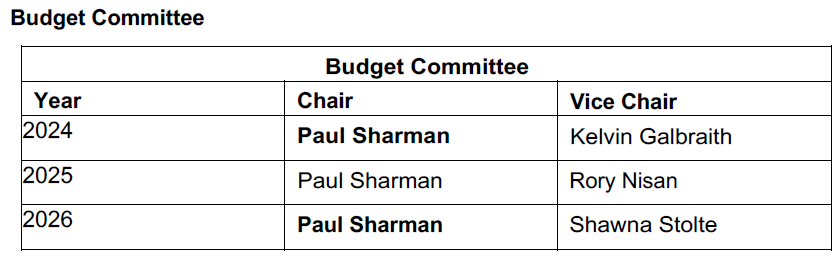

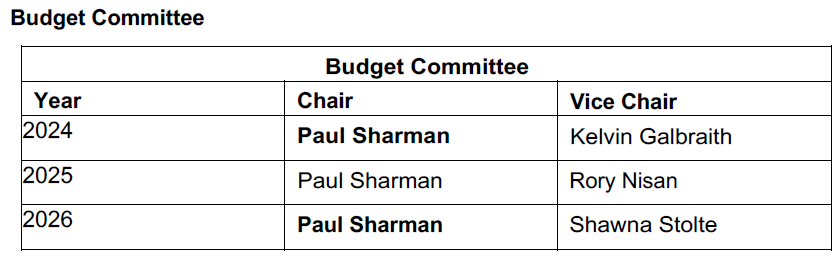

Budget Committee

I. Responsibilities

The Budget Committee is responsible for hearing public presentations, receiving financial reports from staff, and providing advice to the Mayor on the operating

and capital budgets; and making recommendations to Council on any operating or capital budgets in which the Mayor has a pecuniary interest.

II. Composition

The Budget Committee shall be comprised of all members of Council.

Ill. Reporting

The Budget Committee reports directly to Council.

Dated at Burlington, this 31st day of October 2023.

Decision # 8

Mayoral decision

References: MO-03-22 – Appointments to standing committees, boards , committees, agencies and Deputy Mayors , December 13, 2022 *with changes CL-18-23 – Standing Committee Structure Options, October 17, 2023 Mayoral Decision 07-23 – To establish a Committee of the Whole and Budget Committee

Under Bill 3, the Strong Mayors, Building Homes Act, 2022, which amended the Municipal Act, 2001 (the Act); and Effective January 1, 2024, in accordance with subsection 226.6 of the Act, I Marianne Meed Ward, Mayor of the City of Burlington, hereby appoint the following Councillors as rotating chairs of Committee of the Whole and Budget Committee for remainder of the 2022-2026 Term of Council as established by report MO-03-22: ** Chair changes are bolded, they align the Deputy Mayor of Strategy and Budgets portfolio to the Chair of Budget, with subsequent position changes to ensure equity.

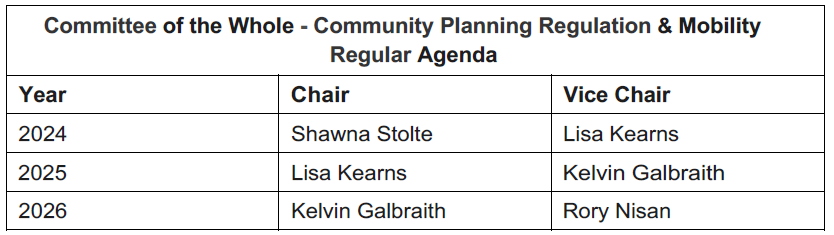

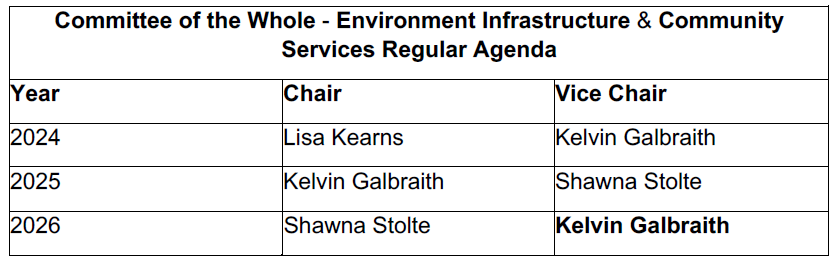

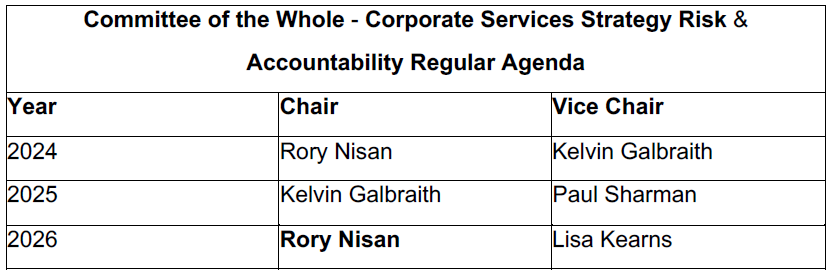

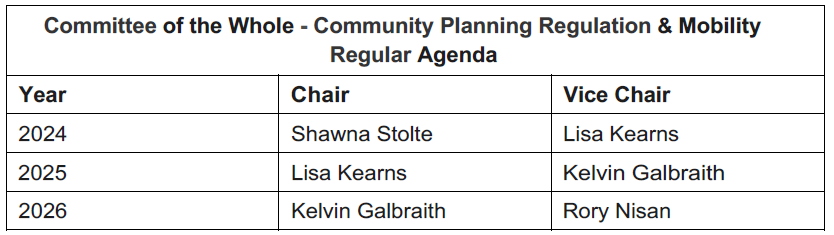

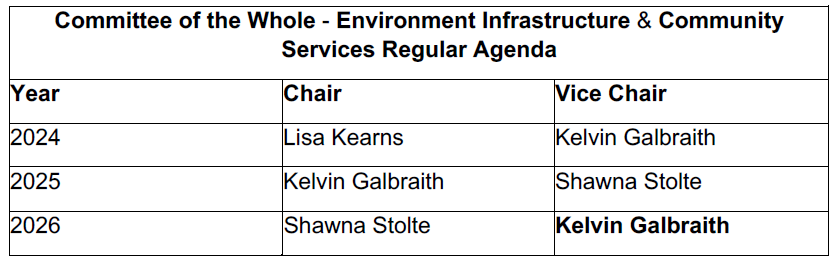

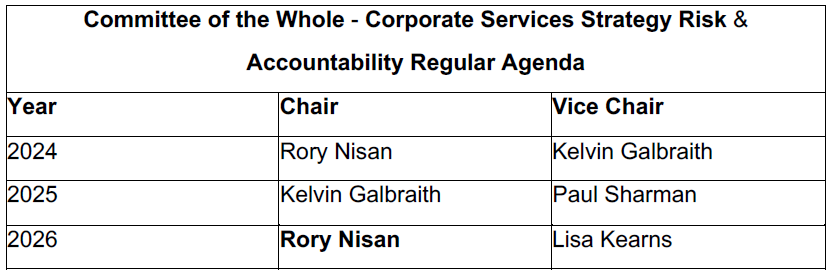

What were Standing Committee chairs are now “section” chairs. Committee of the Whole

The Mayor shall preside as the Chair for Committee of the Whole for all agenda sections, with rotating Councillors appointed as section chairs and section vice chairs for

Community Planning, Regulation & Mobility Environment, Infrastructure & Community Services and Corporate Services, Strategy , Risk & Accountability regular items.

Committee of the Whole – Community Planning Regulation & Mobility

Committee of the Whole – Corporate Services Strategy Risk & Accountability Regular Agenda

Budget Committee

Dated at Burlington, this 31st day of October 2023.

Mayor Meed Ward has decided she is going to do it all. Relayed news story:

First three Strong Mayor decisions

By Pepper Parr By Pepper Parr

December 7th,2023

BURLINGTON, ON

During the budget debates City Manager Tim Commisso said on more than one occasion that Burlington had zero tax increases for a number of years, making the point that during those zero tax years there wasn’t enough money being applied to the upkeep of the infrastructure.

Councillor Paul Sharman frequently talks about the several million dollar infrastructure deficit. That deficit is so high that they city had to put a special tax levy in place that was dedicated to infrastructure upkeep.

We find it interesting that Commisso would blame a previous Mayor for not collecting enough in the way of taxes while working in the Finance department – where he would have known just what the problems were.

The size of the infrastructure deficit? It started growing during City Manager Tim Commisso was working in finance. Would he not have advised the Mayor at the time that more money had to be allocated to infrastructure upkeep?

Our source has Tim Commisso starting out in the Finance Dept. “ I assume he was hired by Bob Carrington but I can’t remember when he started. In the early 2000s after the retirement of Gary Goodman and the departure of Ed Sajecki to Mississauga.

“Commisso was successful in becoming one of three General Managers under Tim Dobbie (the other two being Bob Carrington and Leo DeLoyde).

“Tim’s General Manager responsibilities involved the Development Division (Planning, Engineering and Building). Given his involvement in finance, this involved a steep learning curve which he was able to surmount in good time.”

Perhaps the culture in the municipal sector is – you don’t speak up.

A reader sent us the following information on the amount of time Tim Commisso spent with the city before he moved to Thunder Bay:

City of Burlington

15 yrs 8 mos

General Manager

Oct 1999 – Sep 2008 · 9 yrs

Deputy Treasurer

Feb 1993 – Oct 1999 · 6 yrs 9 mos

By Pepper Parr By Pepper Parr

December 2nd, 2023

BURLINGTON, ON

Delegating on the Staff Direction to the:

Chief Financial Officer to prepare the draft operating and capital budgets for 2025 and 2026 got taken got taken care of – people wanting to delegate to Council on the plans to include early work on the 2025 and 2026 budgets will get to appear before a Committee of the Whole in the new year.

Lydia Thomas on the left; Eric Stern on the right. Both provided some of the best advise they’ve heard this year.

Nothing on the date of the Committee of the Whole in January. Burlington moved away from using the phrase Committee of the Whole and got into the habit of calling them workshops.

Same thing – same chair we believe.

Dan Chapman was blunt and very direct when he addressed Council; does he have more that he wants to say?  Vera Chapman is a data diver – she drilled down into the numbers that were available – how much attention Council paid will become evident when they meet in January as a Committee as a Whole to determine what they want to do with the initiative that had the Mayor getting involved in early stage planning for the 2025 and 2026 budgets. The delay on the part of the Clerk’s Office and agenda management issues gives the group of people who have delegated so effectively the time to pull themselves together as a group to plan the assault this budget process needs.

Council is on the ropes on this one – which is where they need to be.

Related news story:

Two Councillors said no – let the public delegate first.

By Pepper Parr By Pepper Parr

December 1st, 2023

BURLINGTON, ON

Mayor Meed Ward waiting in City Hall lobby for people who wanted to know more about the budget approved earlier in the week. Short notice, so maybe that was the reason the number of people who took part in the Drop In Mayor Meed Ward held yesterday was very small.

In the photograph the Mayor posted on her Facebook page she is seated with her Chief of Staff sitting to her right and two unidentified people face her.

Mayor with a couple that took part in the Drop In on Thursday Who are they and what did they have to say: we will never know. All we do know is that the event took place and the Mayor now has another poster to add to her collection.

By Joe Gaetan By Joe Gaetan

November 29th, 2023

BURLINGTON, ON’

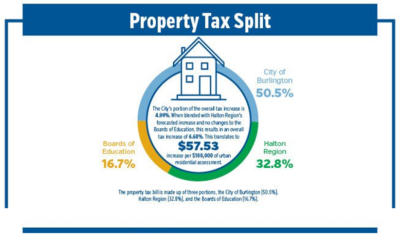

What the 4.99% TAX increase means to the average Burlingtonian.

First: The average cost of housing per segment in Burlington is as follows:

Condo’s – $547,739

Condo Towns – $710,936

Freeholds- $881,798

Detached houses – $1,222,381

Next: The COB website- Read More/Learn More

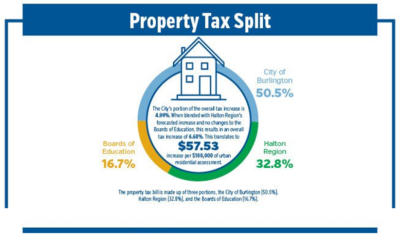

“The City’s portion of the overall tax increase is 4.99%. When blended with Halton Region’s forecasted increase and no change to the Boards of Education, this results in an overall tax increase of 6.68%. This translates to $57.53 increase per $100,000 of urban residential assessment.”

Here is what the TAX increase means to you in pocket dollars.

On average, if you live in a Condo, you will be paying $315.11 more,

a Condo Town $409.00 more,

a Freehold $507.30 more and

a Detached home $703.24 more per next year.

By Staff By Staff

November 29th, 2023

BURLINGTON, ON

In their media release the City communications department said: More information about the municipal budget process under Bill 3, the Strong Mayors, Building Homes Act, 2022, can be found on the Provincial website.

They got that part wron The Strong Mayor legislation that applied to Burlington is set out in Bill 39

A link to that Bill is set out below along with the regulations. Bill 39 gave Mayor Meed Ward the authority to put forward a budget, which she did. However, the Mayor was not required to put forward a budget – she chose to do so

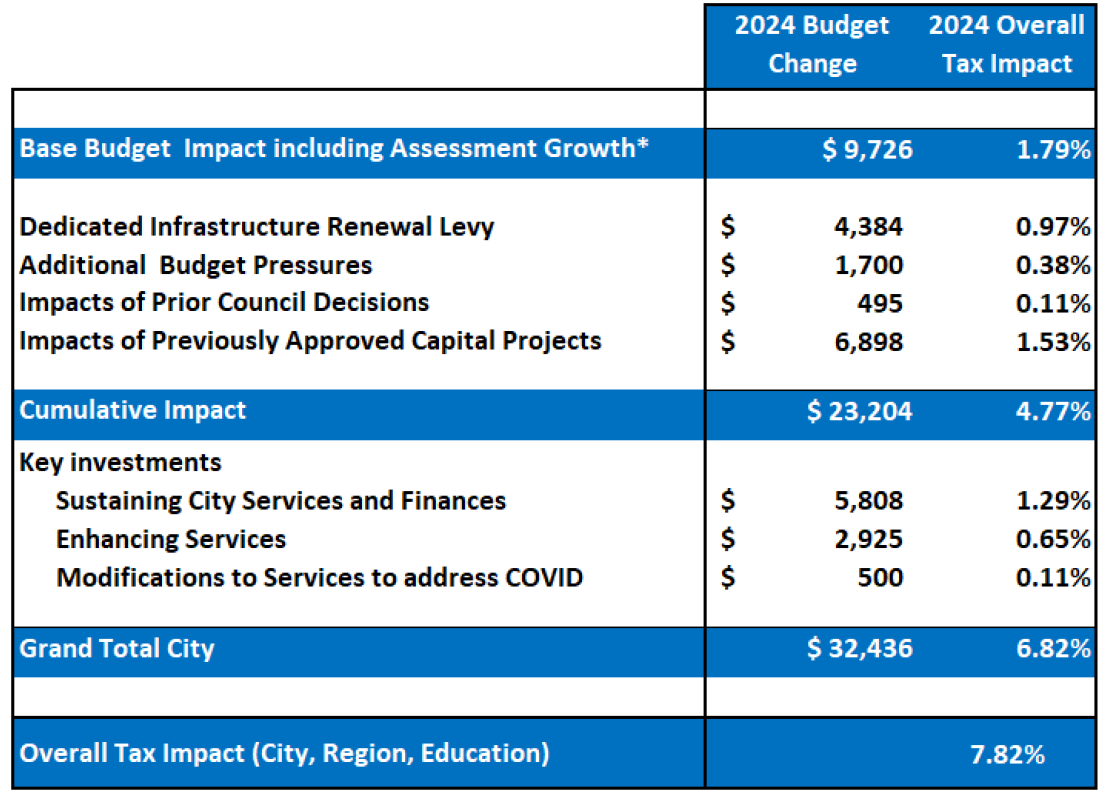

At today’s Special Council Meeting, Burlington City Council finalized the 2024 budget. Next year’s budget is focused on essentials, front line services and preparing for growth. At today’s Special Council Meeting, Burlington City Council finalized the 2024 budget. Next year’s budget is focused on essentials, front line services and preparing for growth.

The City’s portion of the overall tax increase is 4.99%. When blended with Halton Region’s forecasted increase and no change to the Boards of Education, this results in an overall tax increase of 6.68%. This translates to $57.53 increase per $100,000 of urban residential assessment.

The property tax bill is made up of three portions, the City of Burlington (50.5%), Halton Region (32.8%), and the Boards of Education (16.7%).

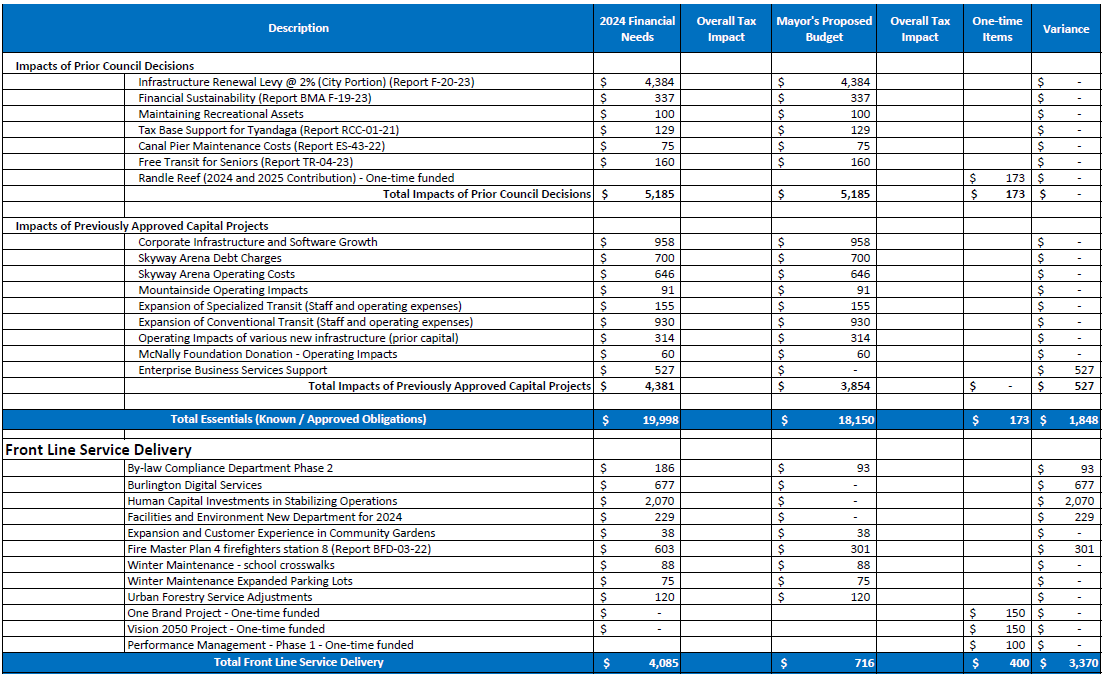

The 2024 budget has been broken down into three categories:

Essentials – This area covers projects and items the City of Burlington must address and/or have already committed to, such as cost of inflation, necessary capital projects and infrastructure renewal.

Frontline Service – This area covers enhanced services that directly improves the quality of life of Burlington residents.

Planning for Growth – This area plans for and prepares for the expected increase in population, our Community Investment Plan, and allow us to catch up and prepare for the future.

This was the first budget under the new provincially legislated Strong Mayor Powers. The Mayor proposed the budget for 2024. The budget was based on the 2024 Financial Needs and Multi-Year Forecast Reference Document prepared by staff earlier this year.

Council brought 62 changes through amendment motions to modify the budget. Of those amendments, 27 were adopted into the budget. These were presented at Committee meetings on Nov. 21 and 23 and the Special Council Meeting on Nov. 28. The budget was finalized at the Special Council Meeting on Nov. 28.

Key investments

- Enhancing frontline service delivery with additional transit operators, firefighters, by-law licensing clerks and customer experience staff to respond to your concerns

- Funding for 3 new community facilities – Skyway Community Centre, the newly renovated Mountainside pool and the former Robert Bateman High School

- $88.6 million of capital investment in 2024 to keep our infrastructure assets like buildings, roads and parks in a state of good repair

- Funding dedicated to future land and facility needs for our growing and changing community

- Free all-day transit for Seniors

- Support for our Community Planning Housing Initiative

- Support to bring the city’s Information Technology (IT) infrastructure into the 21st century

Joint statement from Burlington Mayor Marianne Meed Ward and Deputy Mayor for Strategy and Budgets Paul Sharman

“We know these are difficult times for everyone with increased living and housing costs and Council had to make some difficult budget decisions. Working with each other and staff, while hearing from the community, we balanced the needs of the city with our current affordability crisis as best we could. At the end of the day, this is a Mayor and Council budget that focuses investments on essentials, frontline services and planning for future growth. It was created through a lot of hard work and learning through a new provincially-legislated budget process this year. It is our hope this budget sets us up for success in 2024 and for years to come in creating an inclusive, affordable, eco-friendly and caring community for all our neighbours. The 2024 Budget impacts people through the programs and services they receive every day in our city. Each time you have your road plowed, use a City park or trail, or cool off in a municipal pool or splash pad, you are using a City service and seeing your tax dollars at work. This budget continues to build on investments our community has asked for and needs and will only improve Burlington today and into the future.”

Burlington Chief Financial Officer, Joan Ford said: “The adoption of this budget gives much needed support to essential city projects, front line services and infrastructure. As this was our first time establishing a budget under the Strong Mayor Powers, I’m thankful for the work and dedication of City staff and the collaboration with the Mayor, Deputy Mayor for Strategy and Budgets and members of Council to support this new process.

Ford announced that the 2024 budget would be her last.

The City’s mission continues to be to balance the needs of all residents both today and in the future while maintaining the high quality of services that residents enjoy.”

In their media release the City communications department said: More information about the municipal budget process under Bill 3, the Strong Mayors, Building Homes Act, 2022, can be found on the Provincial website.

This is just plain not true. The Strong Mayor legislation that applied to Burlington is set out in Bill 39

A link to that Bill is set out below along with the regulations. Bill 39 gave Mayor Meed Ward the authority to put forward a budget, which she did. However, the Mayor was not required to put forward a budget – she chose to do so.

Bill 3: Strong Mayors, Building Homes Act, 2022 Applies to Toronto and Ottawa

Bill 39: Better Municipal Governance Act, 2022 Applies to Burlington and other Ontario municipalities

O. Reg. 530/22 – Municipal Act

By Staff By Staff

November 24th, 2023

BURLINGTON, ON

Eric Stern delegated to City Council during the budget debates. We asked him if he would do a short piece on what he had to say about his experience in talking to City Council.

Here is what he had to say:

I’ve delegated (spoken) to council twice and I’m slowly learning the inner workings of the budget process.

This is my high-level summary:

1 – Use social media to repeat the simple message “4.99% budget impact.”

2 – Bury the details, where almost no one can find them, on page 728 of the budget book. 2 – Bury the details, where almost no one can find them, on page 728 of the budget book.

Page 728 shows a 13.7% spending increase.

3 – Wendy Fletcher, the citizen who created a Petition asking people to help STOP the Proposed 2024 Property Tax Increase, points out the city’s own survey shows the majority want services cut or maintained at the current level. No problem, release a new “statistically accurate” survey that shows people want tax increases. Release on a Friday just before an important, and public, Tuesday meeting. I haven’t been able to find the survey so there won’t be much public input but it does make for a great talking point for the mayor.

4 – Make a few tweaks to the budget so the council can say they listened to the public.

5 – Use the strong mayor powers to limit citizen input and force the city prepared budget through in 30 days. The strong mayor legislation allows the mayor to prepare a budget. Repeat another simple message over and over again, “Doug Ford forced me to present a budget.”

6 – Run a victory lap and start hiring somewhere between 50 and 90 new employees.

7 – Repeat next year. Why not, last year the city pulled off a 15.5 per cent municipal tax revenue increase and no one even noticed. Don’t believe me? Take a look at line 1 of your tax bills for 2022 and 2023.

Our mayor and council have been in power for so long they have forgotten who they represent. Public service organizations rarely have enough resources to do their jobs. Council, as our board of directors, is tasked with balancing insatiable need with what the community can afford.

We are heading towards a two-line tax return:

Line 1 – How much money did you make last year?

Line 2 – Send us the amount on line 1.

Dan Chapman delegated at city hall on Thursday November 23rd. Chapman was eloquent, intelligent and didn’t hold back his distaste with the increases. Have a listen.

By Staff By Staff

November 18th, 2023

BURLINGTON, ON

This first Motion to amend the Mayor’s Budget was submitted by the Finance and Transit departments

2024 Budget Amendment

FROM: Transit & Finance Departments

Motion for Council to Consider:

Amend the 2024 budget for the Conventional Transit Service to reflect a $238,000 increase in fare revenue, a $200,000 increase in advertising revenue and a $200,000 increase in diesel expenditures resulting in a net decrease to the 2024 budget of $238,000.

Reason:

Since the time staff finalized the draft 2024 Budget for the Conventional Transit Service additional analysis has been undertaken and new information has come forward.

Based on strong ridership trends in the latter half of 2023, staff are now forecasting 2023 revenues to meeting the 2023 budget of $5.4M. As a result, it is recommended that the 2024 Budget for fare revenues be increased by $238,000. This reduces decreased transit fare revenues identified on page 722 of the Financial Needs and Multi-Year forecast book from $353,000 to $115,000.

Subsequent to the time the draft budget was prepared a competitive bid process has been finalized to secure a new bus shelter advertising partner. While the results of this procurement are still being finalized, they are nearing completion. Based on the preliminary results, staff are recommending that the budget for advertising revenues be increased by $200,000.

Staff have recently undertaken a further review of diesel expenditures. Based on recent trends and forecasted elevated fuel prices into 2024 it is recommended that the 2024 Diesel budget be increased by $200,000.

Motion Seconded by: Not Required Share with Senior Staff

Approved as per form by the City Clerk,

Reviewed by the City Manager – In accordance with the Code of Good Governance, Council-Staff Relations Policy and an assessment of the internal capacity within the City to complete the work based on a specific target date (quarter/year).

Comments:

City Clerk: none

City Manager: none

By Pepper Parr By Pepper Parr

November 18th, 2023

BURLINGTON, ON

Now that the setting a budget process is being determined by the Strong Mayor powers that Mayor Meed Ward is going to use, here are the rules that City Council has to follow.

It should be said that the using of Strong Mayor powers is something Mayor Marianne Meed Ward chose to use – there was no requirement for her to do so even though she continues to say that she is required to do so. A number of municipalities have decided not to use the Strong Mayor Powers; Guelph is one example.

Mayor Marianne Meed Ward The head of council is required to propose the budget for the municipality each year by February 1.

The head of council must share the proposed budget with each member of council and the municipal clerk, and make it available to the public. If the head of council does not propose the budget by February 1, council must prepare and adopt the budget.

Mayor Meed Ward produce her budget on GET THE DATE

After receiving the proposed budget from the head of council, council can amend the proposed budget by passing a resolution within a 30-day review period.

Members of Council have produced Notices of Motion setting out what each would like to see changed. They will be debated on November 21st and 23rd. There are 54 Motions.

The head of council then has 10 days from the end of the council review period to veto any council amendment. To veto a council amendment, the head of council must provide written documentation of the veto and rationale to each member of council and the municipal clerk on the day of the veto. Council then can override a head of council’s veto of a council amendment with a two-thirds majority vote, within a 15-day period, after the head of council’s veto period.

There are mechanisms in place to enable council and the head of council to shorten their respective review, veto and override periods. For example, council could pass a resolution to shorten their review and override period, and the head of council could provide written documentation to members of council and the municipal clerk to shorten the veto period.

At the end of this process, the resulting budget is adopted by the municipality.

Municipalities were given Strong Mayor Powers on July 1st, 2023

The information we have provided comes directly from HERE

In-year budget amendments

The head of council is also able to initiate and prepare in-year budget amendments to raise additional amounts from property tax. The head of council may propose the budget amendment by sharing the proposed budget amendment with each member of council and the municipal clerk, and making it available to the public.

After receiving the proposed budget amendment from the head of council, council can amend the proposed budget amendment by passing a resolution within a 21-day review period. The head of council then has 5 days from the end of the council review period to veto any council amendment. To veto a council amendment, the head of council must provide written documentation of the veto and rationale to each member of council and the municipal clerk on the day of the veto. Council then can override a head of council’s veto of a council amendment to the proposed budget amendment, with a two-thirds majority vote, within a 10-day period, after the head of council veto period.

There are mechanisms in place to enable council and the head of council to shorten their respective review, veto and override periods. For example, council could pass a resolution to shorten their review and override period, and the head of council could provide written documentation to members of council and the municipal clerk to shorten the veto period.

At the end of this process, the resulting budget amendment is adopted by the municipality.

By Pepper Parr By Pepper Parr

October 30th, 2023

BURLINGTON, ON

Here is how she did it.

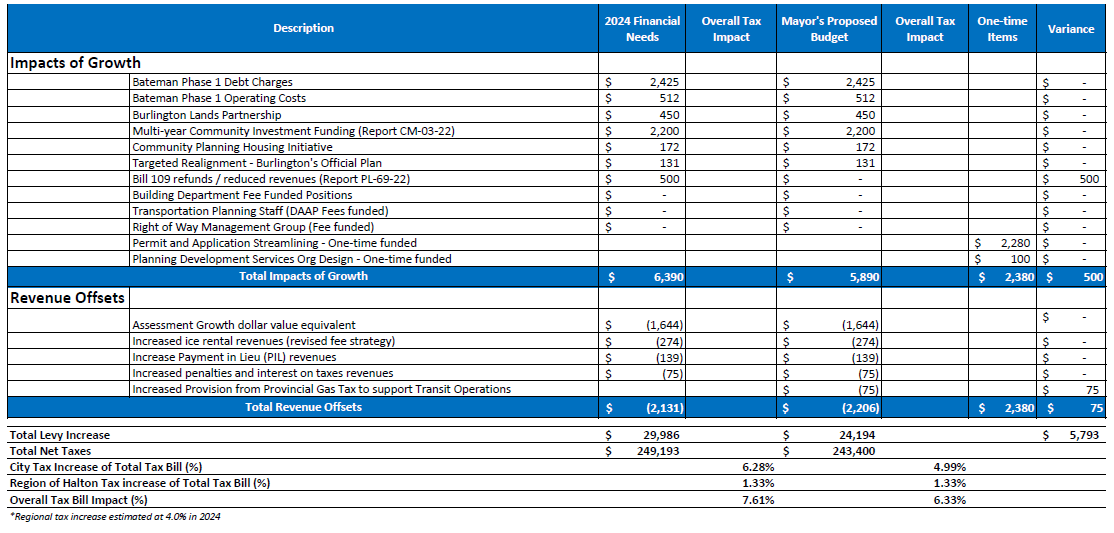

The Mayor submitted a budget that would reduce the city portion of the tax levy by more than 3 points.

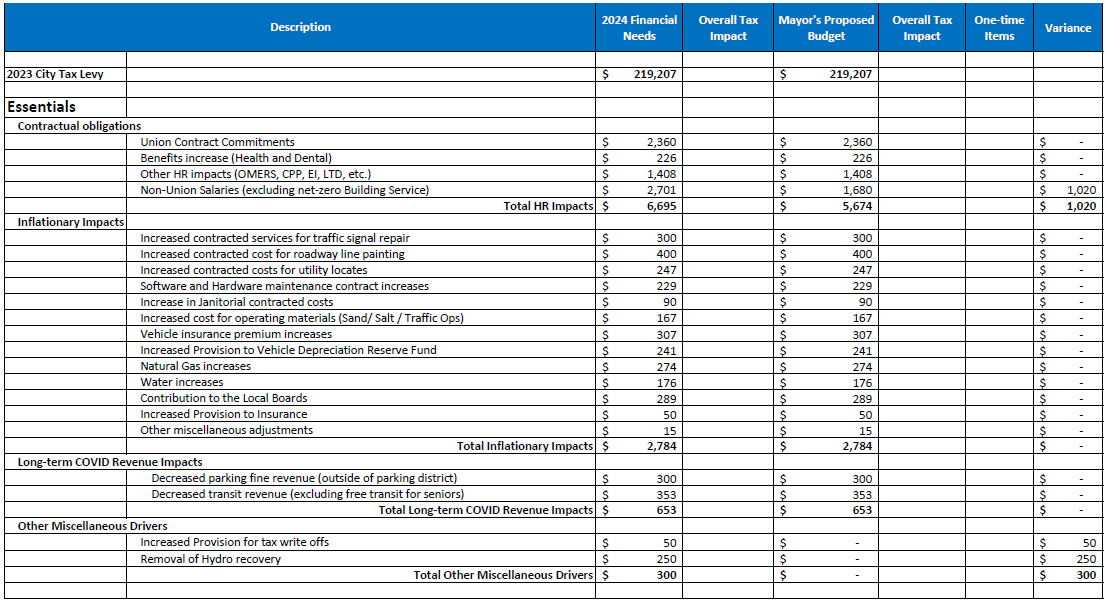

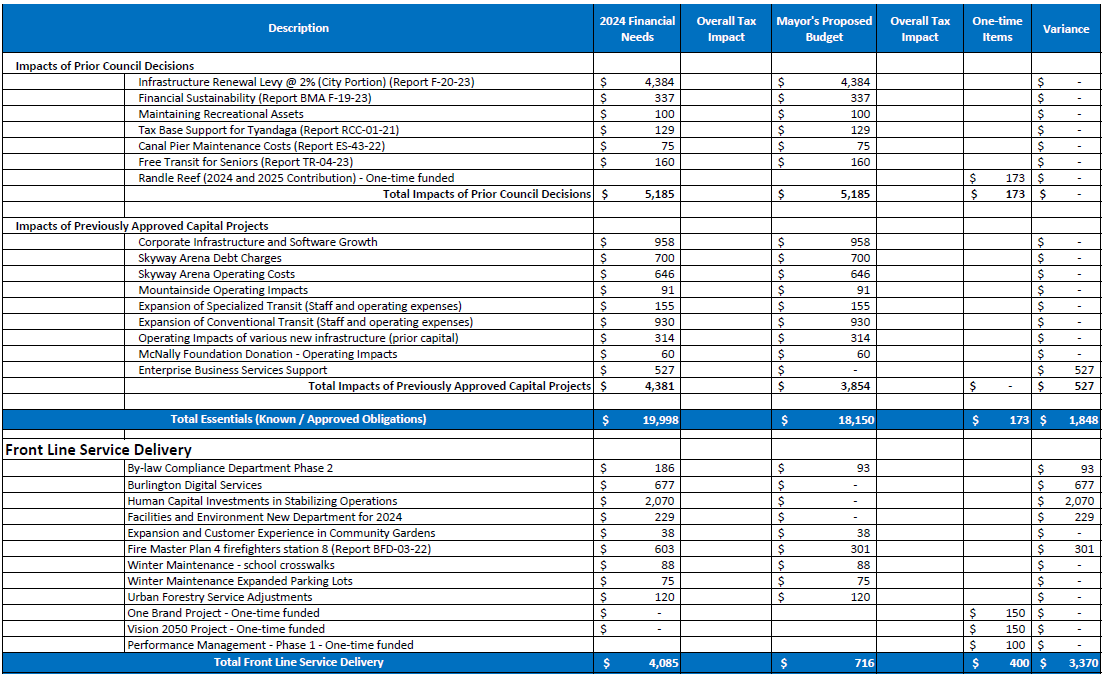

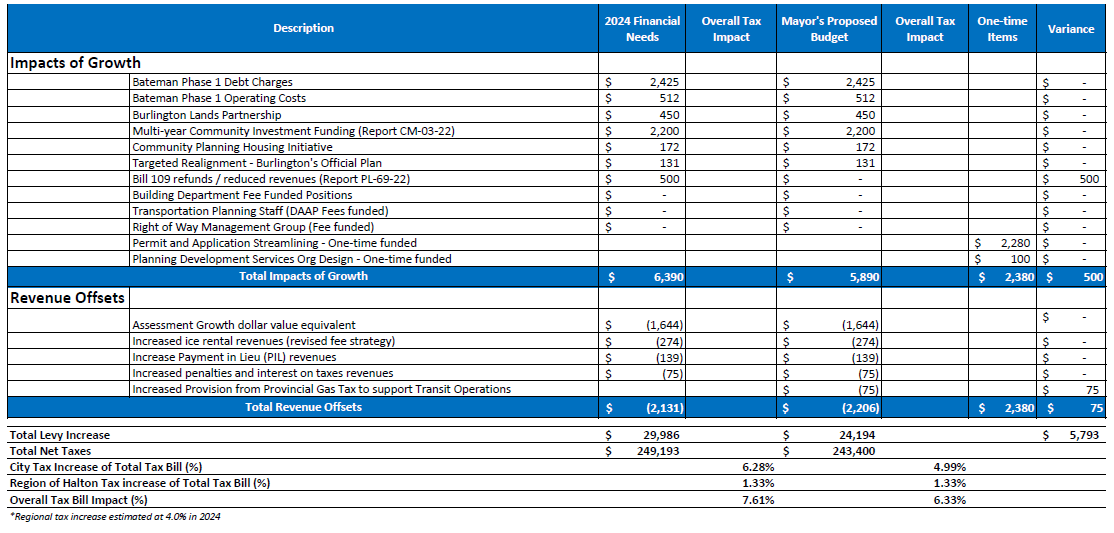

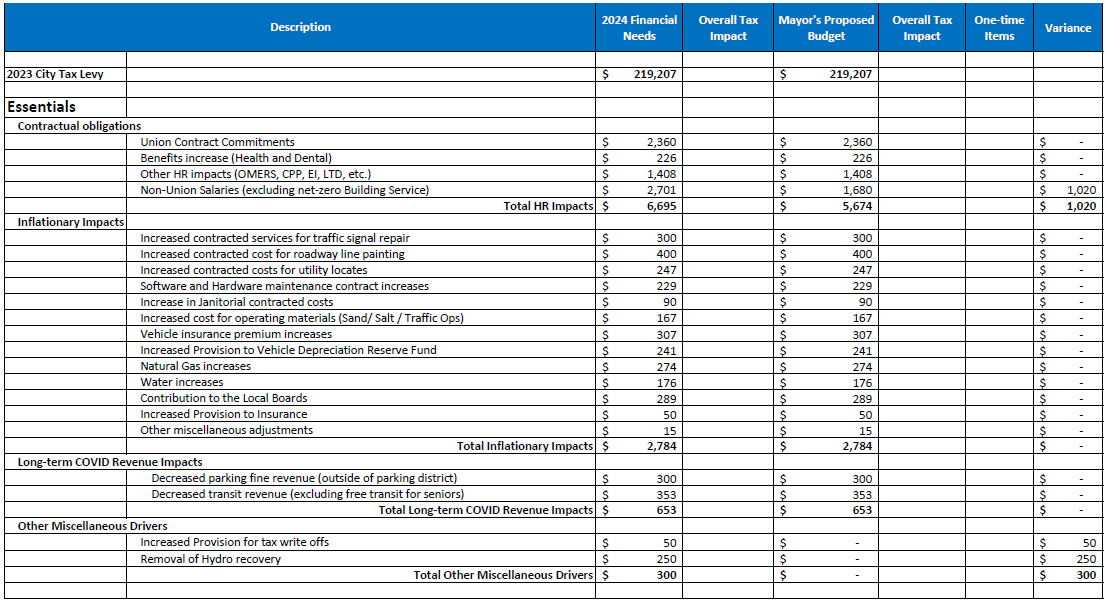

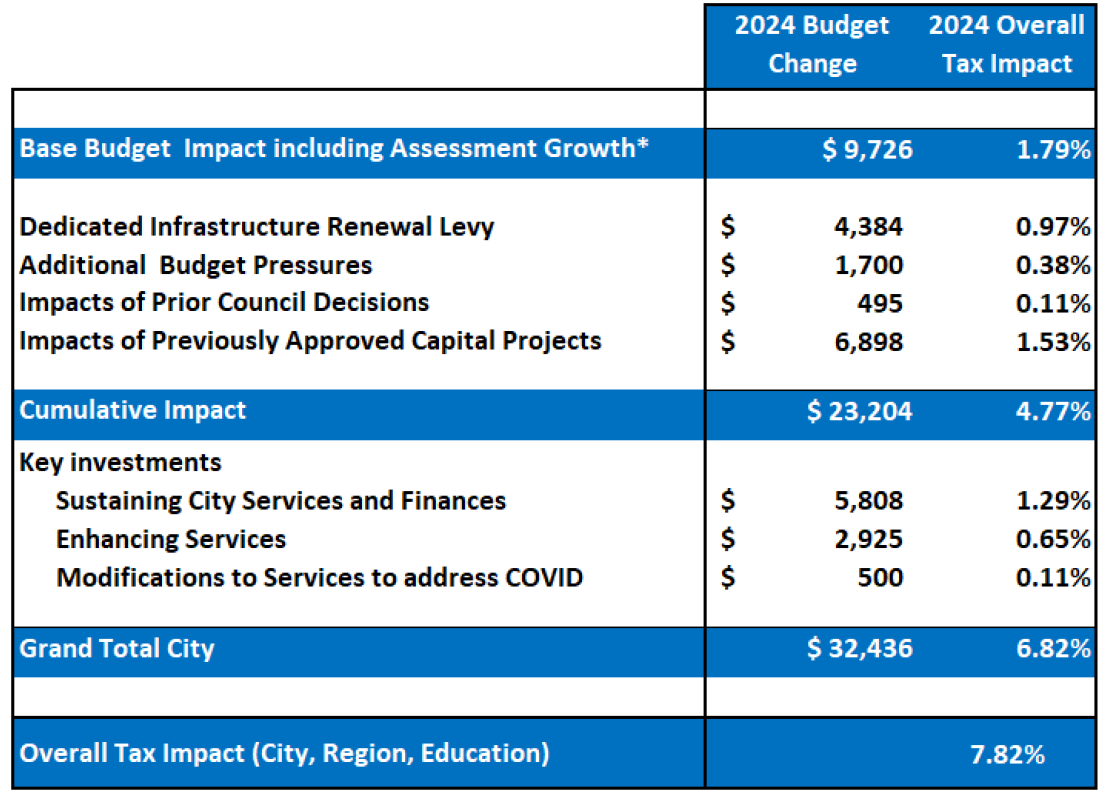

In the three charts set out below the Mayor sets out what was part of the Financial Needs report in one column and shows what her budget amount would be and in a third column she shows the variance.

The numbers deserve some comment, however we are going to wait until the Mayor formally presents her budget to City Council – that will take place in Thursday November 2nd.

Roll your cursor over the image to get an enlarged version

Mayor Meed Ward was very fulsome when she commented on her budget which will be formally presented to Council on Thursday.”I do want to thank staff for all of the work and the thinking that has gone into this. This is not easy. These are not easy times and they are not easy decisions and I do appreciate that. What has been presented is a clearer picture of the city’s needs. And it is now up to council to determine how quickly we are able to address those. I also want to thank the Deputy Mayor of strategy, budgets, performance and process (Paul Sharman) who has been enormously helpful to me and and to the staff and to the team who has been sitting around the table with all of our deep discussions to try to understand and ask questions about this budget presented in a way that is clear to the community.

Mayor Marianne Ward There are different ways to receive it – if you want to read all 700 and change pages it is online.

There are summary reports. The the presentation that we got today even is more summarized in terms of some of the challenges that we face and we will continue the collective way.

I know I’ve gotten many emails, I’m sure other members of council have. There has been a mix of we want more services.

We want you to you know things like snow clearing of paths to school so kids can walk which is in line with climate change. It’s in line with our mobility goals and so many other things. So, as noted, the legislation requires me to present a budget so from here on out all amendments will be to that budget, we will not be amending the staff financial needs.

The budget is on the agenda for the November 2 council meeting which is this Thursday. It will be formally presenting it at that time. I believe that it’s really important to maintain as much collaboration on the budget as we can possibly get recognizing the legislation has changed things a bit. This will allow us as a council to come to ground on what we think our priorities are going forward how quickly we want to address certain things.

Councillor Paul Sharman At the end of the day, this budget will not be the mayor’s budget. This budget will be the mayor and Council’s budget informed by what staff have shared with us. truly collaborative as all our budgets have been and informed by the detailed responses that we’ve seen from the public to date.

There will be opportunities for public comment on the online telephone town hall November 7, plus two more committee meetings that residents can delegate to and of course you can reach out to any one of us at any time. So with that I look forward to continued discussion and collaborating to come up with the best budget that we can in the circumstances that we are in.

By Staff By Staff

August 10th, 2023

BURLINGTON, ON

Digging into the data is what Municipal Budgets are all about.

There was a time when public meetings were held; participants were given a short version of the budget and staff were om hand to answer questions. Members of Council will get a document that approaches 300 pages in length – that’s when they start in on the 2024 budget. As part of this annual work, residents and business owners are asked to share their feedback on City services that matter most. This feedback is presented to City Council to help them prioritize projects and services.

There is a survey on the 2024 Budget at www.getinvolvedburlington.ca/2024-budget.

The survey is open until Friday, Sept. 22, 2023.

More information about the budget and how it is prepared is shared in 2024 Budget Framework Report presented to Committee on June 26, 2023.

Key meeting and planning dates for the 2024 budget are:

June 26, 2023 – Budget Framework Report 2024 Budget Framework Report presented to Committee.

Open until Sept 22, 2023 – Budget Survey – Take the survey

Oct. 30 at 9:30 a.m. Corporate Services, Strategy, Risk and Accountability Committee: Overview of proposed 2024 Budget

Nov. 7 from 7 to 8:30 p.m. – Virtual Budget Town Hall

To discuss the proposed 2024 budget and take questions from residents.

Joan Ford, Finance Director for the a City faces some serious challenges this time around convincing Council to cut back on spending. The amount of debt the city will carry is expected to be above what Ford has advised in the past. Nov. 21 & 23 at 9:30 a.m.

Review and approval of proposed 2024 Budget, including delegations from the public.

Dec. 12 at 9:30 a.m.

Meeting of Burlington City Council: City Council to consider approval of proposed 2024 Budget.

Just in time to determine if you are going to have any money left for Christmas.

By Staff By Staff

June 27th, 2023

BURLINGTON, ON

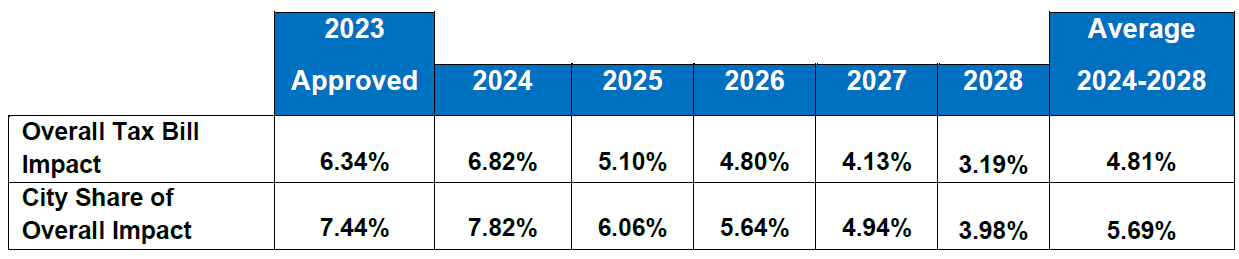

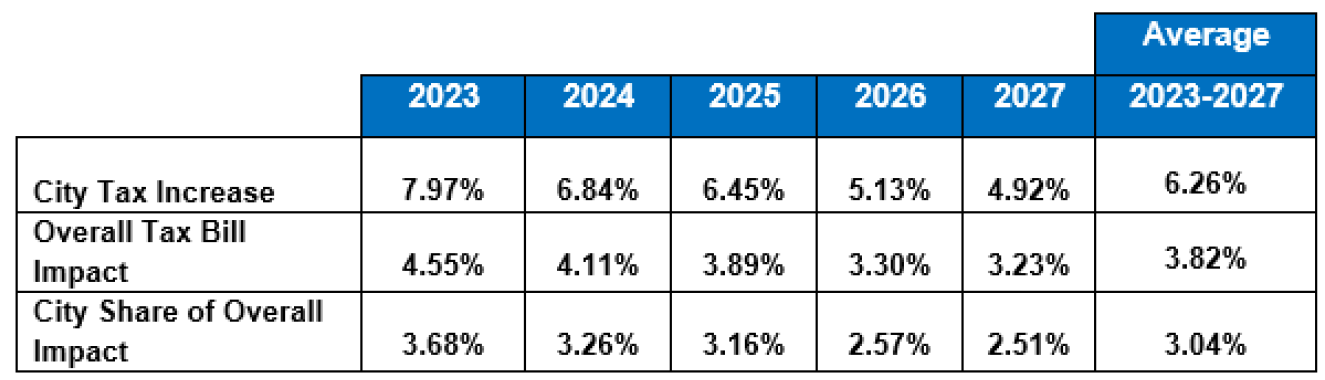

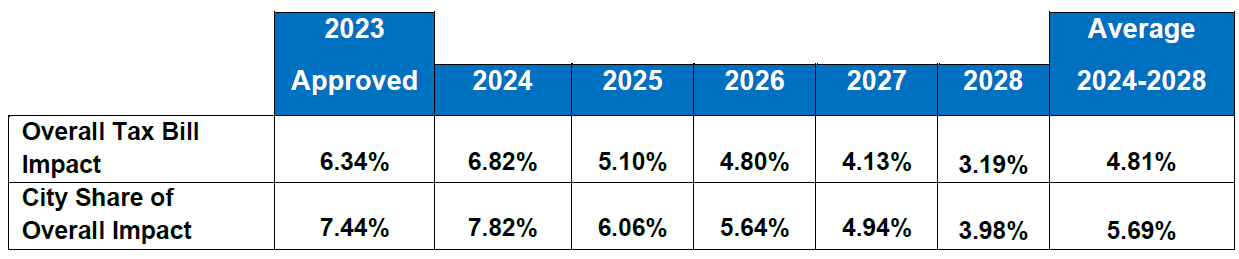

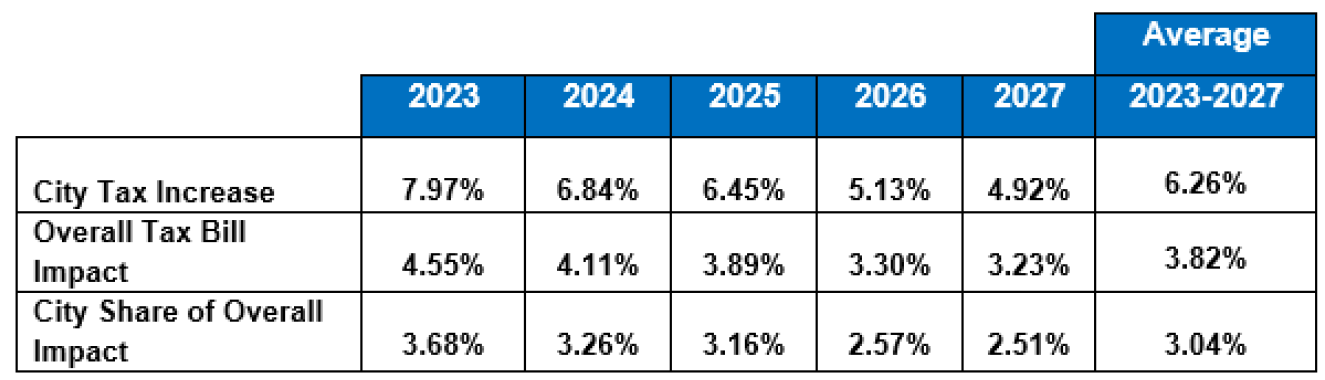

An understanding of what you will see in your 2024 tax bill is set out in the following four paragraphs and two graphics.

Financial sustainability on a multi-year basis will continue to be our key strategic priority. The budget will continue to face rising pressure from inflation, infrastructure renewal costs, limited revenue growth, and completion of the 4-year work plan initiatives representing visions to meet important community needs. These factors ultimately impact property taxes and reserve fund balances to maintain / enhance existing service levels and quality of life.

A high level look at the 2024 budget forecast Staff will prepare the 2024 budget taking into account the budget pressures and aligning them to the city’s long-term financial plan and the important policy decisions of council.

While staff will work closely with services to mitigate the tax increase for 2024, it is important to understand that our ability to respond to urgent existing and future needs across many areas is clearly and directly tied to Council’s support for additional tax funding. City treasurer Joan Ford tells tax payers where the rubber is going to hit the road.

It is also important to note that known budgetary pressures that are deferred in the proposed 2024 Budget will need to be incorporated into future years thus increasing the forecasted tax increases identified in the multi-year simulation for 2025 and beyond.

Projected tax rate through to 2028 The Staff report was lengthy; some time will be needed to fully understand the forces the city is up against – it comes down to either raising taxes or reducing service levels and if services are to be reduced – which ones.

By Pepper Parr By Pepper Parr

July 14th, 2022

BURLINGTON, ON

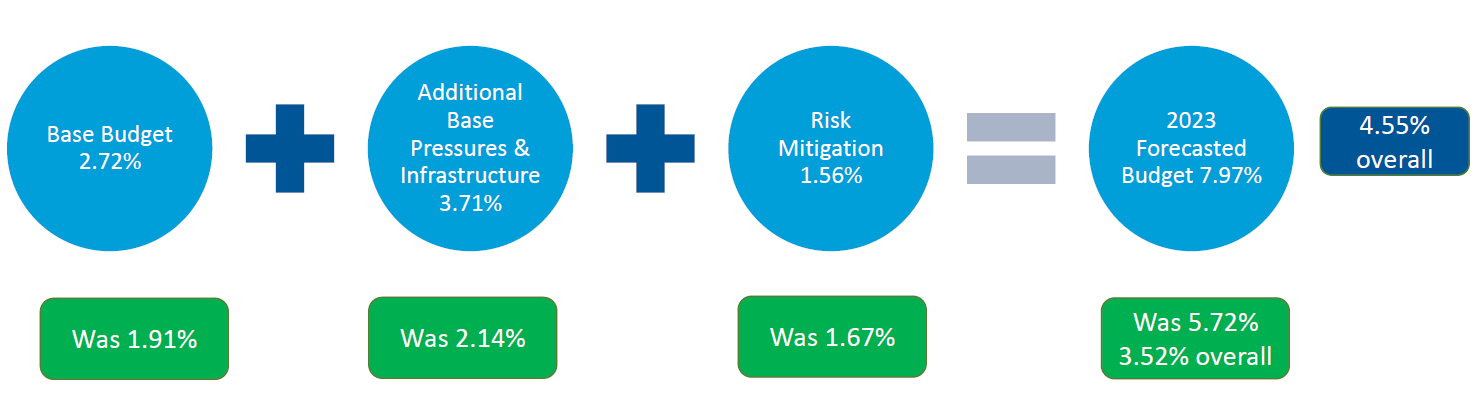

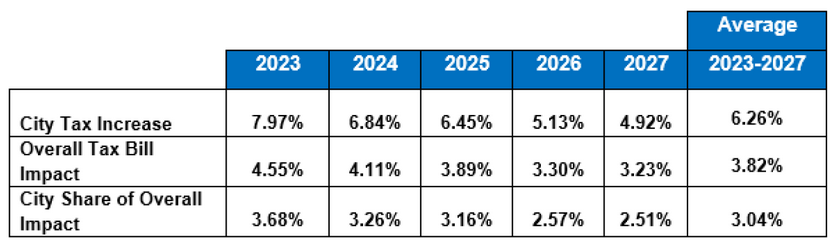

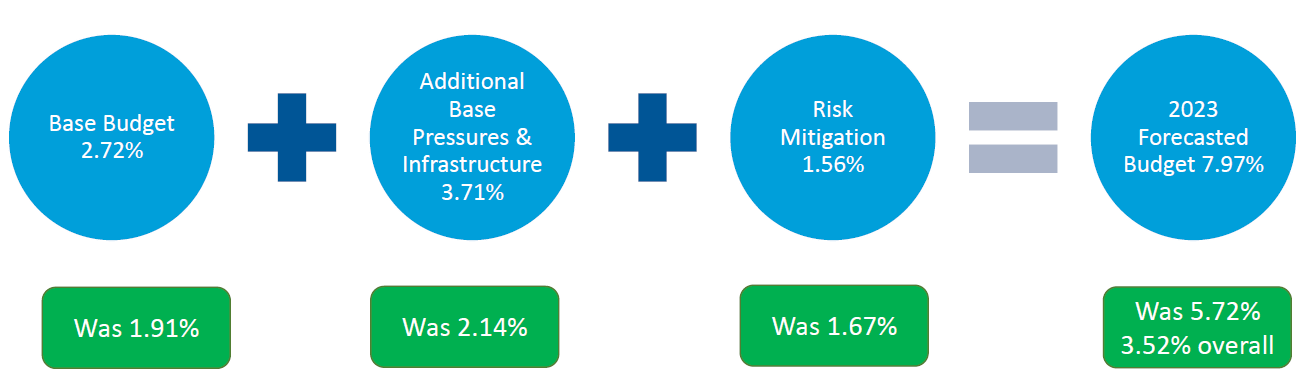

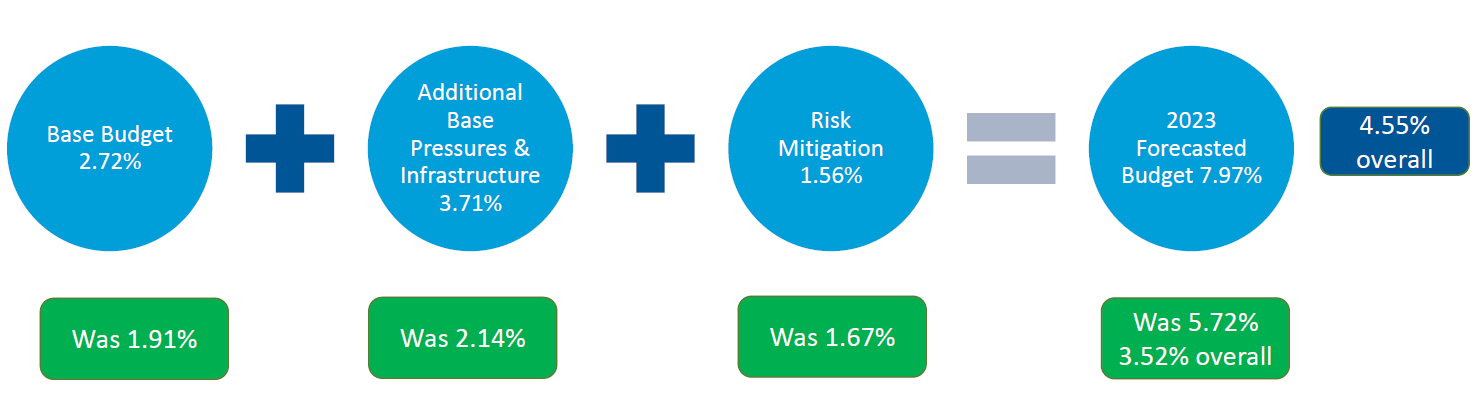

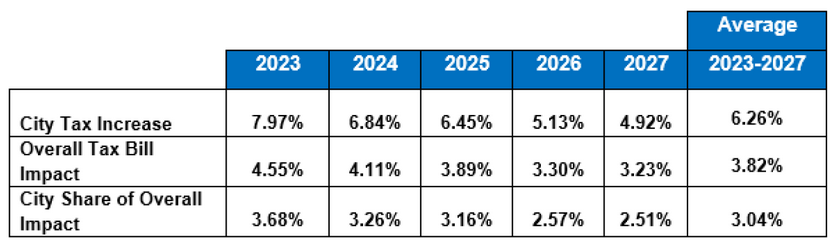

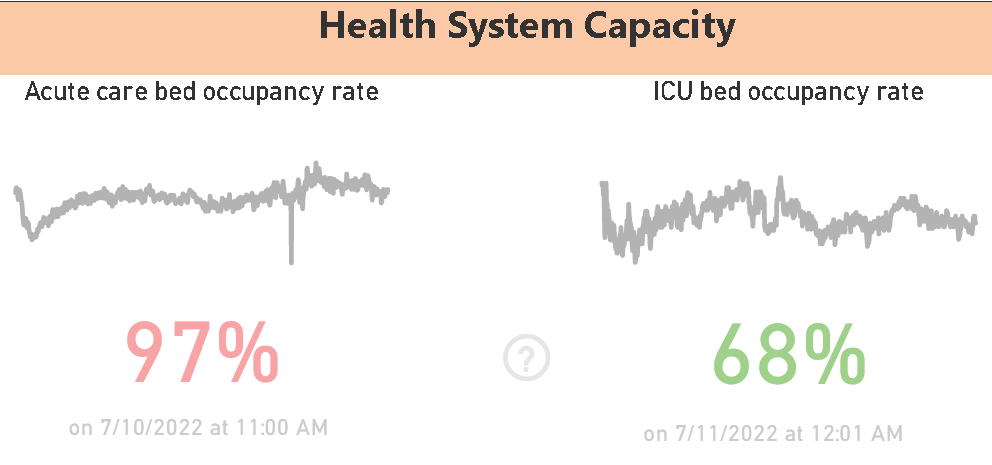

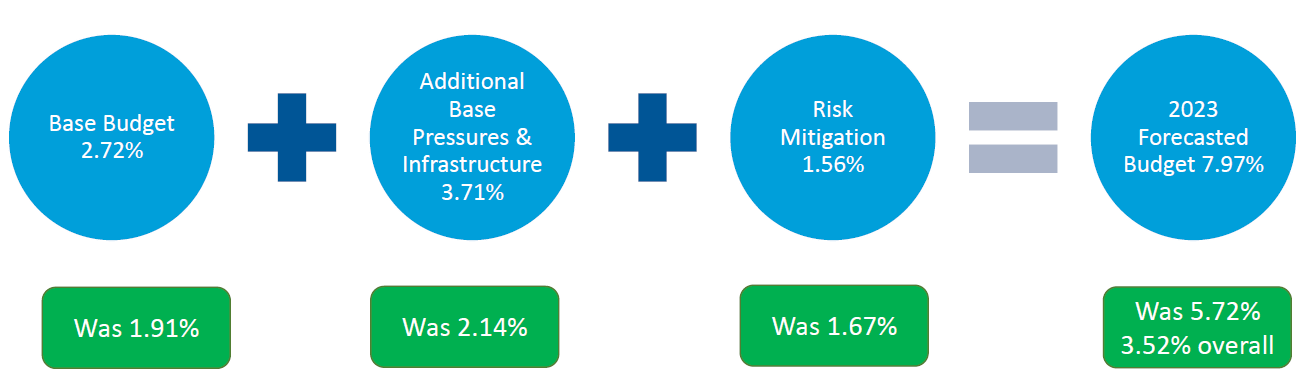

Staff in the Finance department set out what they believed was going to have to be raised in taxes for 2023 They projected an increase of 7.97% and explained how they got there

That 4.55% on the far right needs to be explained. The number is correct but it isn’t what the Mayor would have you think.

The city collects its own taxes, plus the taxes for the school boards and the Regional government.

Each of those jurisdictions levies a tax.

When the Mayor explains that what the taxpayer has to come up with is that blended rate – she is not wrong.

The blended rate is the tax increase the city is imposing, plus the tax rate the Region imposes plus the tax rate the boards of education impose and adds them up and then divides them by 3: the figure is called the blended rate.

Burlington has zero influence on the school board tax levy, the city has some influence on the Regional rate because all seven city council members sit on Regional Council. Burlington has seven of the 24 Regional Council seats.

What the city controls is the tax levy that the finance department comes up with and which city council eventually decides on. Council usually ends up at a tax rate very close to what the finance people recommend.

Mayor Meed Ward has said that in the past she has been able to cut $1 million out of the spending proposed.

The report the finance department put forward was labelled a Budget Framework – giving Councillors a solid heads up on what they are looking in terms of data at this point.

Councillor Rory Nisan got the debate started by saying what was clearly obvious: “… we have a pretty challenging budget ahead of us and this report isn’t locking us in anywhere but I’ve had the opportunity to sort of canvass with some residents about what’s being proposed through this budget and it’s not vibing very well.

“At this point. What I think we need is more options. The report does have some preview of options of what we can do to bring it down somewhat. But I think we need a sort of a low, a middle and an upper range. This what people are asking for – I’ll be frank, some of this information is coming in kind of late and my own thinking is changing quickly.

Ward 3 Councillor Rory Nisan was not getting the vibe he wanted from his constituents – asks colleagues join him in asking finance to come up with some options. He didn’t get any takers Nisan added that “If other councillors are interested perhaps we can do some work together. Just refer the report to September but I expect the response will be quite the opposite. So barring any other comments, I’ll just vote accordingly.”

The Mayor, sitting as Chair asks “:Do you wish to make a referral motion at this time or not?”

“Well, I would need a seconder for something like that but I’m quite content to vote accordingly. But if someone did raise their hand to refer it then yes, I would support that.”

No hands were raised

The data was pretty stark.

The top line in the graphic below is the line that matters. It reflects what the finance people expect to need in the way of budget increases – expressed as a percentage over the previous year.

Councillor Kearns, no slouch when it comes to number crunching wouldn’t support the Nisan idea. Councillor Kearns said “I will not be seconding it but I do want to just share that. The budget numbers that we did see of course are of concern. They are a deviation from what we would maybe have expected however, they are built out in our multi year simulation. I think a statement that only one council member is concerned with the numbers might not be reflective of everyone’s views and an opportunity to put forward everyone’s views would be inefficient at this time.

“So I’m going to just say that, you know, maybe those comments could be held back and I think we’ll work through the process as we should be.

Councillor Bentivegna tends to dig into numbers – expect him to be sharpening his pencil to go over numbers he doesn’t always understand. Angelo Bentivegna, ward 6, said that “at the end of the day, we were still going to be voting on the budget.. We make decisions at this table to reduce it or do what we think we need to do. So I won’t be supporting this either.”

Mayor Meed Ward, who was chair (this being a council meeting) said “I will offer my thoughts that we are receiving this file which is a picture from our staff about what the future looks like if we wish to maintain services. At not only the expected level, but the level to account for the fact that we’re a growing municipality; we have well outpaced our growth 12 years early, but the development charges and other fees from that development and growth costs have not caught up yet.

“Because simply some of those units are still being constructed as we speak. So folks often ask us to try to keep our increases in line with inflation. Inflation is running at 8% then adds that the tax increase before than was less than inflation. So this budget picture actually is less than inflation and in a post COVID world where everything has changed. I think it’s really important for us to start framing our conversations around what the final impact on our residents is going to be.”

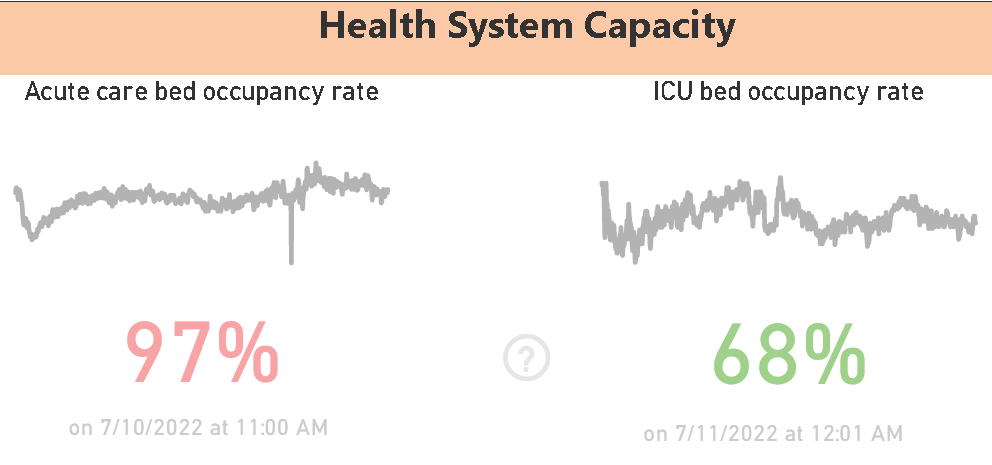

This is an election year, it is very quiet at this point. People are still coping with a pandemic that is supposed to be over yet hundreds of people are still getting very sick – with some dieing.

There are a lot of people in hospital recovering from and being treated for Covid19

With it now very clear that the Budget Framework report is going to be received and filed the Mayor moves to fudge the numbers She doesn’t lie – but the truth does takes a beating.

Mayor Meed Ward is going to have to find something that the public will like – and be ready to pat for if she is to come up with a budget that gets her through the election. She explains hat what the taxpayer will be is actually a “blended rate” one that includes the Boards of Education taxes and the Regional government taxes.

We explained how that works above.

It is good to be eyes wide open. Our staff have certainly painted the picture of what’s coming and the five year projection out gives us that picture. And it’s difficult for every municipality and we would be doing a disservice to not be transparent about what the picture looks like.

So am I open to finding cuts? Yes, every budget I’ve tried to find roughly about a million bucks. That’s my average over 12 years. And I will always look for ways we can do things better and cheaper. But we have work to be done and we have service requests coming in from our residents that we have to that we have to respond to. And it’s not unicorns and fairies that do the work around the city. It’s real people. And we’re in a competitive labour environment as well. So it’s really important to have a transparent and honest discussion about the challenges we face and how this council is going to respond to them. Those are the comments for me and I will turn it to the clerk now for the recorded vote not seeing any other hands on the board.

The vote to receive and file the report carried.

By Pepper Parr By Pepper Parr

July 4th, 2022

BURLINGTON, ON

Council will debate the tax increases they expect to impose during a meeting on Monday.

They will dance around a lot of numbers – the ones that count and set out for you below.

The number that matter is the top line; that is the amount the city is going to levy.

When the city tax levy is added to the total tax bill it looks lower.

The city collects taxes for the Region and the Boards of Education

How did they get to the 7.97?

The Finance people, amongst the best in the province have done a very good job cutting and chopping – they are up against hard reality. The challenge for the taxpayers is to hope that the members of Council will spend more conservatively.

Tough weeks ahead for the city treasurer.

By Pepper Parr By Pepper Parr

January 23rd, 2022

BURLINGTON, ON

For some the financial fall out from the Covid19 pandemic has been manageable. A few are actually doing better during these tough times.

For others, the financial damage is severe, especially in the hospitality and tourism sectors. Some have been wiped out, lost everything and are struggling emotionally as they do their best to deal with what is left.

The City has developed a COVID-19 Property Tax Payment Plan program for 2022 that should help those struggling from day to day

No patrons The program offers eligible residents and businesses that continue to face financial hardship as a result of the COVID-19 pandemic a monthly pre-authorized payment plan to assist with the repayment of property tax installments.

It was approved by city council on January 11, 2022.

Individuals must apply for the 2022 COVID-19 Property Payment Plan program by completing the online application at burlington.ca/propertytax.

The program will allow eligible property owners who are unable to pay their property taxes by the regularly scheduled tax due dates, to make payments under a pre-authorized payment plan. If eligible, equal monthly withdrawals will be made that will allow for the property taxes to be paid in full by Dec. 1, 2022. No penalty or interest will be applied for the duration of the payment plan as long as payments are made.

Additional details:

- Applicants will be required to attest they are experiencing financial hardship directly related to COVID-19, e.g. loss of employment, business closure, prolonged suspension of pay

- Property owners that have an unpaid balance on their tax account from March 1, 2020 onward may include this amount in the property tax payment plan (eligible owners cannot have any property tax amounts owing prior to March 1, 2020)

-

Joan Ford – Chief Financial Officer Eligible property owners have the ability to choose which date they would like the pre-authourized monthly payment plan to begin. Options include March 1, April 1, May 1, June 1 or July 1 (applications are due 10 days prior to the withdrawal date).

Joan Ford, Chief Financial Officer for the city explains: “With new COVID-19 variants and changes to provincial restrictions, the City recognizes that residents and businesses continue to face uncertainty and financial pressures. The goal of the property tax payment plan is to support taxpayers and help ease the burden of meeting the regularly scheduled property tax due dates, without facing penalties.”

December 21, 2021

BURLINGTON, ON

Kim Arnott who writes for the Oakville News reported that:

In its final budget before next October’s election, town council will limit the residential property tax increase to 1.5 per cent while putting money into initiatives to slow down traffic, fight off gypsy moths and increase loose leaf pick-up service.

Oakville’s 2022 budget got the final nod from town council during its Dec. 20 meeting.

“This budget is about being ready for our future,” said budget committee chair and Ward 6 councillor Tom Adams.

Along with expanding services and investing in community infrastructure, the budget will advance important infrastructure needs for growing areas of Oakville, he said.

By Pepper Parr By Pepper Parr

December 20th, 2021

BURLINGTON, ON

How many ways are there to pay for the Rainbow Crosswalks City Council wants to install?

An initiative that was a really good idea; something that was important to do got politicized during the budget exercises which is unfortunate.

The LGBTQ2S+ community is a distinct part of the diverse community that Burlington has become. The recognition those brightly painted crosswalks provide is important. They are statements that needed to be made.

The crosswalks are not cheap – they come in at $10,000 plus each and funds have to be set aside to keep them sharp looking.

Mayor Marianne Meed Ward has politicized the Rainbow Crosswalk initiative and made it her own. Is it going to backfire on her? A number of Councillors felt that having three in place at this point and making room in future budgets was a fiscally prudent thing to do.

Mayor Meed Ward felt that all six were needed now and she wondered aloud if some of the public art money could be made available to pay for the final three.

And so the squabbling began with the City Manager dragged into the issue.

When three Council members disagreed with the Mayor on the timing of the installation she took it upon herself to make a public statement that made it sound as if the three, Councillors Sharman, Stolte and Kearns, were somehow anti LGBTQ2S+; nothing could be further than the truth.

Did Public Art funds pay for the Black Lives Matter art work done on the sidewalk outside City Hall ? Has the fund become the Mayor’s piggy bank? During the summer when people were outdoors a large graphic was painted on the sidewalk outside city hall. Public Art funds were found to pay for what was a strong Black Lives Matter statement.

Politicians have their favourite projects; they currently have a budget to pay for projects within their wards. The Mayor has a very healthy budget that she reports on publicly.

In the ten years the Gazette has been covering city Council we have never before seen so much nasty squabbling. There are numerous examples of this poor behaviour – what is most disturbing is that this situation impacts on a community that has had attention it did not need. Real people with real issues are being hurt – all the satisfy a small political objective.

The Mayor was very much a part of that initiative.

The LGBTQ2S+ acronym stands for Lesbian, Gay, Bisexual, Transgender, Queer or Questioning, and Two-Spirit.

By Pepper Parr By Pepper Parr

December 15th, 2021

BURLINGTON, ON

To get a true sense as to how your City Council got to the point where they could approve the Operations budget for 2021 it helps if you can listen in.

We don’t have audio to pass along but our software does capture what is said (not all that well unfortunately, but it does give you a sense as to how things were going.

Mayor Marianne Meed Ward The Mayor is in the Chair – the information in brackets is the time.

(38:23) Alrighty we are at the end of all of the individual items. So we are now back up to the budget as a whole. So we are at Item D having dealt with all of the amendments that were pulled. Perhaps we can get the revised amount it did change with that last vote. So we will need to if we need a recess. Let me know. Laurie, if or if you’ve got that number that we can insert into the revised recommendation on the board. As far as I know. Didn’t change.

The capital numbers did not change the operating main motion. The tax levy amount needs to be revised to 191, 550, 509. This brings the city’s portion of the tax impact of 4.62% and an overall impact of 2.87.

All right, so let’s get that up on the board. You know the number of clauses to vote on and we’ll take those individually.

Mayor: All right. I will read it into the record.

We have approved the 2022 operating budget including any budget amendments approved by the Corporate Services strategy, Risk and Accountability Budget Committee to be applied against the proposed net tax levy of $191,552,509, which as we heard delivers a tax impact city portion only a 4.62 and a region portion of 2.87

Overall, once you blend it with region and education, second approve the 2022 capital budget with a gross amount of 77,384,020 with a debenture requirement of $8,600,000 and the 2023 to 2031 Capital forecast with a gross amount of $752,172,369 with a debenture requirement of $38,975,000 as outlined in finance department. As amended by the Corporate Services strategy, risk and accountability Budget Committee and approve that if the actual net assessment growth is different than the estimated 2.45% any increase in tax dollars generated from the city portion of assessment growth from the previous year be transferred to these tax rate stabilization reserve fund or any decrease in tax dollars generated from the city portion of assessment growth from the previous year. Is act 1997 and section five of the Ontario regulation 80 to 98. It is Council’s clear intention that the excess capacity provided by the above referenced works will be paid for by future development charges.

So I will pause for a moment I see our clerks hand in the air. Go ahead, Kevin.

Thank you, Mayor. We’re just wanting to confirm with council if they want to vote on everything clause by clause. So there are five clauses to this. This motion would you like to have it separated clause by clause or I understand that counsellor Bentivegna wanted capital that would be close to separated. We’re here to fulfill your needs. So just let us know.

Mayor: All right. Well, certainly the first two have to be separated once we get to the second one. I will ask if there’s anything further to be separated out. Maybe we’ll handle that way. And then we’ll proceed sort of on the fly here. So we have oh, I just we just lost the screen. Are we going to get those motions back up, Kevin?

Clerk: Yeah, I think that we’re just separating them out for the vote. The screen that you see is what you’re voting on in the system. So if we have to separate things out, we have to redact them from the screen.

Mayor: So the first one up is the operating budget. Okay, so as amended and I will look to the board for questions and we will have to just pause momentarily to make sure that we tee up everyone’s time that they have left. And I I’ve been keeping some notes I hope our clerks have as well and the first person I have on the board is counsellor Stolte. Apparently you have four minutes left. Go ahead.

Ward 4 Councillor Shawna Stolte. Stolte: Thank you, Mayor. I’m actually not going to comment. What I’m going to ask for is whether or not we could please take a recess. The last round of voting on those amendments that were pulled has dramatically changed the work that we did where we last ended up last week. And I personally need a few minutes to decide to figure out where I stand on support or not support the budget at this point. So not being put in a position of having to do that thinking on the fly. I would appreciate if we could recess for a few minutes.

Mayor: Absolutely. I’m prepared to recess so I do see some hands on the board. If you are speaking to the budget, let’s hold that if you are speaking to the recess counsellor Bentivegna – did you want to speak to the request for a recess?

Bentivegna: I don’t have problem I will go. recess. I would like to see the the numbers on up so that not only we could see him that the residents can see what the new numbers are.

Mayor: You’re talking about the tax rate numbers. Okay, we will we will endeavour during the recess to get that included in what you have here. Counselor current speaking to the recess.

Ward 6 Councillor Angelo Bentivegna : “Thank you very much. I am speaking to the recess in regards to inviting the clerk with an opportunity to speak around procedural options should the budget not pass we received some commentary and committee commentary carries through to council.

Mayor: Certainly and as chair, I will direct all questions to the appropriate Staff. And Kevin I assume that would be you go ahead.

Clerk:

Oh, yes, council. So Through you, Mayor to the council. There are options. If the budget fails, then Council can then direct staff with with some direction and then we’d have to come back with a new budget. Or there can be an alternative moved at the same time. So there’s those are two options if the budget fails. At any point in this conversation if Council wishes to they could refer this back to staff with direction as well. So those are some of your options for today.

Mayor: Already, everyone clear on the options so we don’t have the four votes today we’re talking budget for a little longer. So I’m going to suggest given the significance of this vote and the the need for folks to have I think that we take a half hour break and come back at quarter to two so we will recess until 1:45 and come back and see where we’re at till three o’clock. Sorry. You want to go till three o’clock. Okay. Cancer. Galbraith has requested a recess until three I’m happy to. (41:57)

And at that point Council took a half hour break.

|

|

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

At today’s Special Council Meeting, Burlington City Council finalized the 2024 budget. Next year’s budget is focused on essentials, front line services and preparing for growth.

At today’s Special Council Meeting, Burlington City Council finalized the 2024 budget. Next year’s budget is focused on essentials, front line services and preparing for growth. By Staff

By Staff 2 – Bury the details, where almost no one can find them, on page 728 of the budget book.

2 – Bury the details, where almost no one can find them, on page 728 of the budget book.