April 19th, 2024

BURLINGTON, ON

On April 16th the federal government introduced its eighth budget. Using the term “fiscal guardrails” to describe their approach to deficit spending the Liberals plan to add another $39.8 billion to the national debt.

We have wonderful social programs and it is amazing to see this government adding to them. Canada is the only country in the world with healthcare coverage but no prescription medication coverage for people under 65 (outside of hospitals). The budget takes a tentative first step towards correcting this.

The problem with adding new social programs is that we need a fair way, for every generation, to pay for these programs.

Debt and Deficit

The federal debt load, the sum of all unpaid government deficits, is now around $1.2 trillion. These numbers are so big they become meaningless. Dividing $1.2 trillion by the population of the country, 40 million, we get something more meaningful. The federal government has borrowed, on behalf of each person in Canada, about $30,000. Using the same line of calculation and a population of 16 million, the Ontario government has borrowed, on behalf of each person in Ontario, about $26,850.

Adding the two totals together, a baby born today, in Ontario, owes $56,850. Is this fair to the newborn generation?

Another way to look at this problem is to compare healthcare dollars with the interest payments on the $1.2 trillion debt. The federal government will transfer, to the provinces, $49 billion for healthcare and will pay $54 billion in interest payments on the debt. If the current government, and previous governments, had actually had any fiscal guardrails, far more money would be going to healthcare, something the current generation of seniors might see as fair.

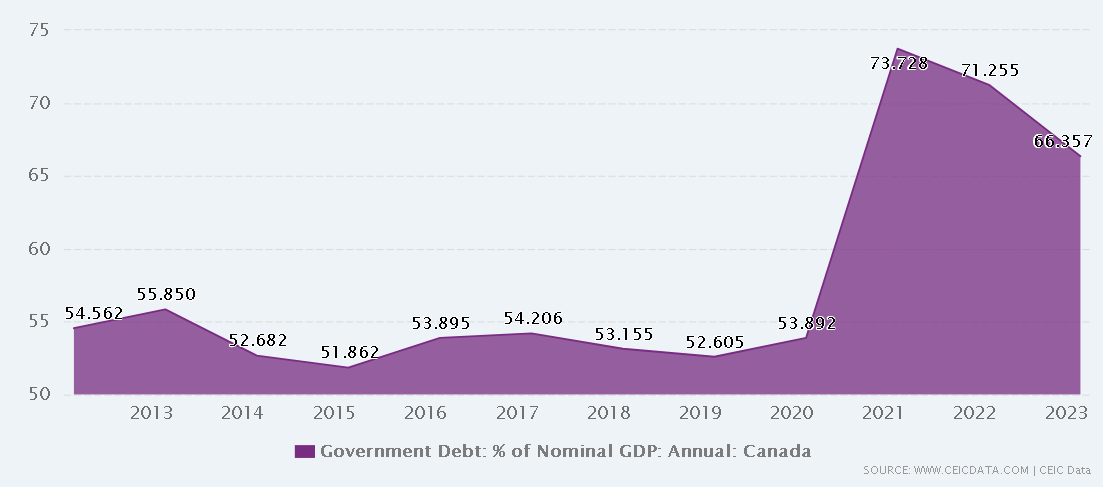

Trudeau has added more money to the total debt than all previous prime ministers combined going back to 1867. This burden will be transferred to future generations, once again calling into question the statement “Fairness for every generation”.

The federal government has added 100,000 employees to the payroll. In 2015 there were 257,034 employees, in 2023 there were 357,247 employees. Healthcare is a provincial responsibility; the growth didn’t take place in healthcare. In spite of Trudeau promising, in 2015, to reduce the use of consultants, consulting fees have increased 60% (2015 to 2023).

The federal government has added 100,000 employees to the payroll. In 2015 there were 257,034 employees, in 2023 there were 357,247 employees. Healthcare is a provincial responsibility; the growth didn’t take place in healthcare. In spite of Trudeau promising, in 2015, to reduce the use of consultants, consulting fees have increased 60% (2015 to 2023).

The Liberals have failed to make the civil service more productive either through the use of technology or other means, and have failed to control the size of the civil service. Arrivecan is just one example. With such massive growth in both public sector employment, and in the use of consultants, there must be opportunities to reduce government spending to pay for new social programs offering true fairness for every generation.

Tax the Wealthy

In 1990 there were twelve countries in Europe with a wealth tax, today there are three. In France, between 2000 and 2012, an estimated 42,000 millionaires left the country. Over time, as wealthy people leave, tax revenues decline. France repealed their wealth tax in 2018.

While the Liberals play checkers, Canada’s millionaires and billionaires have accountants and lawyers who play chess. Can a billionaire move to the Caymen Islands, a tax haven, and fly their private jet to Toronto for meetings? Why not, Trudeau hops in a plane with less thought than the rest of put into taking an Uber.

The Fraser Institute, a conservative think tank estimates that the top 20% of Canadian income earners pay more than half of total taxes. Statements like “the wealthy must pay their fair share” may already be true. Link to the report HERE.

The 2024 Forbes list of billionaires shows there are 67 billionaires in Canada with a combined wealth of $314 billion. This is a very small number of people, I bet all 67 can fit in the Prime Minister’s jet. A tax system that encourages and allows more people to become billionaires will generate more tax revenue for all Canadians.

The change in the capital gains inclusion rate will cause real and long-term damage to our economy. Tobi Lutke, one of our billionaires and a cofounder of Shopify, posted this on “X” immediately after the budget was released. “Canada has heard rumours about innovation and is determined to leave no stone unturned in deterring it”.

Tech companies, in particular, need venture capital funding to grow. The changes in capital gains taxation will deter venture capitalists from investing in Canada. In the US, the tax rate on capital gains is a flat 21%. We are simply not competitive. Small and medium sized businesses, in every sector, now have one more difficulty to overcome when trying to attract capital to grow. How many Canadian venture capital firms will relocate to the US and simply stop investing in Canada?

Tech companies, in particular, need venture capital funding to grow. The changes in capital gains taxation will deter venture capitalists from investing in Canada. In the US, the tax rate on capital gains is a flat 21%. We are simply not competitive. Small and medium sized businesses, in every sector, now have one more difficulty to overcome when trying to attract capital to grow. How many Canadian venture capital firms will relocate to the US and simply stop investing in Canada?

Housing Costs

Someone in the federal Liberal government fell asleep at the switch, the result is that Canada’s rate of immigration is unsustainable. Immigration is wonderful but schools, healthcare, roads, and housing need to keep up.

The budget completely ignores the fact that the Liberal government created the housing shortage.

Now that the opinion polls have forced the government to wake up the Liberals really have no choice but to spend tax dollars, collected from all Canadians, to create more housing. Burlington has already received $21 million in federal housing funding and the money has gone into processes, not physical housing. I really hope this new round of federal money goes into homes instead of more photo ops to boost the Liberal party’s sagging popularity.

Is this article almost finished?

Almost.

There are many budget details still to be released. The government expects to raise $6 billion with a new digital services tax. Will this be just another tax along the lines of charging HST on top of the carbon tax? We’ll have to wait and find out.

The Liberal government has forgotten that Canada needs a vibrant and growing private sector that can be taxed, fairly, to pay for our social programs. Companies in Canada need to compete against companies around the world, employee housing costs, personal tax rates, and corporate tax rates are major factors in this competition.

Inflation is a problem for everyone, the Bank of Canada has asked all levels of government to reign in their deficit spending so that interest rates can come down. Borrowing $40 billion just pours gasoline on the inflation fire. Here’s a new slogan: Budget 2024: Un-Fairness for every generation.

I sometimes wonder if Trudeau understands the difference between a million, a billion, or a trazillion.

Eric Stern is a Burlington resident, a retired businessman in the private sector and said to handle a pool stick better than most of the people he plays with.

Eric Stern is a Burlington resident, a retired businessman in the private sector and said to handle a pool stick better than most of the people he plays with.

I am not a member of any party though I have donated to three different parties during my donating history, which stopped early in this century. I donated according to my observations at the time which leader/which party had the best plan for the future on all fronts: economic, societal and fiscal. Mixed results followed every time.

This article is well-researched and well-presented, Eric. I’ll be re-reading it into the future years for help in guiding how I might alter my views and ultimately how I should vote. Thank you for spending your time on this.

Great article/oped.

I don’t think the libs fell asleep on immigration, this is strategic and I would speculate a plan developed with their consultants at McKinsey. The same situation is going on in the US. If you look at where new immigrants settle in Canada its in major urban centers, Toronto, Montreal and Vancouver. These are (now were according to polls over the last 6 months) liberal strong holds. Ridings are determined by population… do the math.

The other motivation is GDP growth, immigration drives GDP growth, but as we’ve now seen, when done incorrectly GDP/captia declines and as a population we are worse off. Our finance minister likes to claim that we are growing the economy with immigrants, but that is a half truth, she will never talk to the per capita number.

I note that Liberals like to parrot their mantra that Canada needs immigration to grow the economy. But that overarching narrative masks two serious problems–1. the immigration is not targeted at specific economic needs, such as healthcare professionals, or construction workers and 2. only 60% of the immigration falls into the economic category with the other 40% being refugees and family reunification which generally create a drag on the economy. And none of the immigration takes into account the capacity of the Canadian economy to accommodate this immigration–no planning for housing, healthcare or education. The Liberal plan, if you can call it that, is to invite many immigrants into Canada and hope it works.

Trudeau showed a disdain for responsible stewardship of taxpayer money from the get go in 2015. He has an agenda and an ideology that nether makes sense nor is Liberal. He hijacked the party and true Liberals know it.