By Staff

By Staff

June 27th, 2023

BURLINGTON, ON

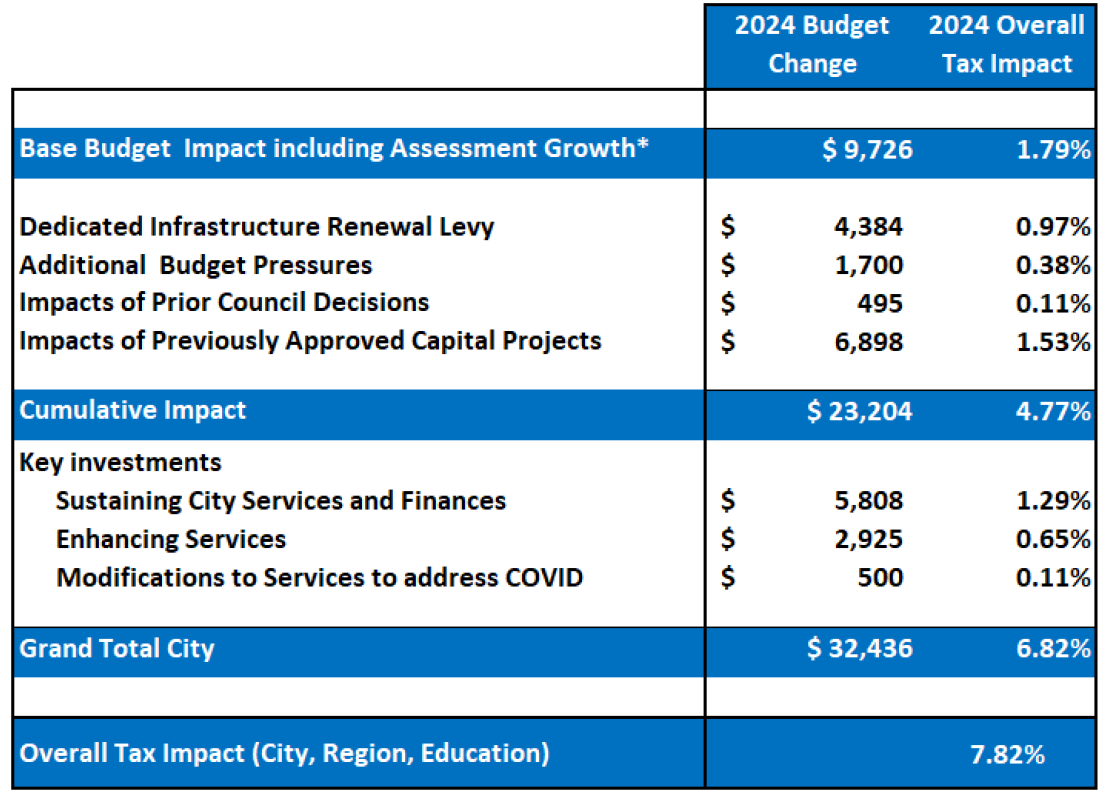

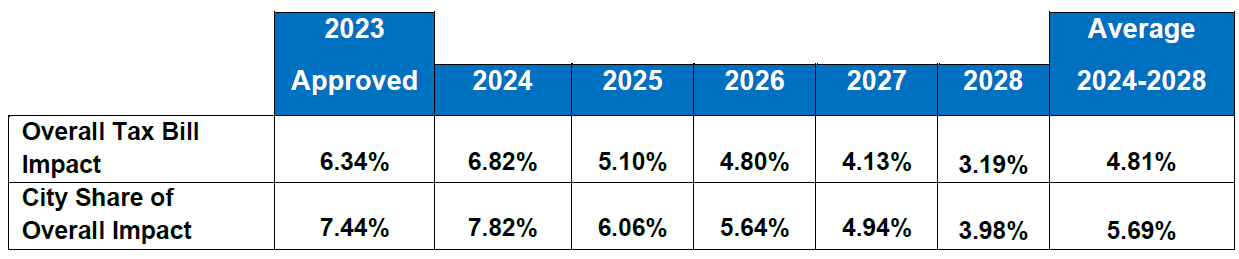

An understanding of what you will see in your 2024 tax bill is set out in the following four paragraphs and two graphics.

Financial sustainability on a multi-year basis will continue to be our key strategic priority. The budget will continue to face rising pressure from inflation, infrastructure renewal costs, limited revenue growth, and completion of the 4-year work plan initiatives representing visions to meet important community needs. These factors ultimately impact property taxes and reserve fund balances to maintain / enhance existing service levels and quality of life.

A high level look at the 2024 budget forecast

Staff will prepare the 2024 budget taking into account the budget pressures and aligning them to the city’s long-term financial plan and the important policy decisions of council.

While staff will work closely with services to mitigate the tax increase for 2024, it is important to understand that our ability to respond to urgent existing and future needs across many areas is clearly and directly tied to Council’s support for additional tax funding. City treasurer Joan Ford tells tax payers where the rubber is going to hit the road.

It is also important to note that known budgetary pressures that are deferred in the proposed 2024 Budget will need to be incorporated into future years thus increasing the forecasted tax increases identified in the multi-year simulation for 2025 and beyond.

Projected tax rate through to 2028

The Staff report was lengthy; some time will be needed to fully understand the forces the city is up against – it comes down to either raising taxes or reducing service levels and if services are to be reduced – which ones.

Colloquially, it was called a slush fund or “pot”. I worked at the Fed and these were used there a lot to cover high level favorites, but we were more imaginative with cover stories to make it look legit – usually a prioity hid it. Sometimes it was a high level manager slush want, gussied up with a fake line item.

We didn’t have a Gazette to show us the data, providing the ability to comment.

I see all sorts of discussion around the need for increases, but no discussion about rationalization and justification of costs or for that matter efficiencies. Would a zero-based approach be too much to ask?

Over a year ago in the run-up to the last budget, Meed Ward allowed that the first budget estimate was a “wish list”, a clear admission that real budgeting based on line-item analysis is NOT being done. It’s just easier to pass on the wish list to the taxpayers, given that most, if not all, of the tax increases during Meed Ward’s reign as mayor have twice the rate of inflation.

“Additional Budget Pressures”, leaves a lot of room for creative spending. No private company officer would have the nerve to put that line item in a budget.

No public sector CFO would either or would do it only once. Municipal governments are the creation of the Province – rather like a well known character of Mary Shelley’s.

Good to know Blair. Same goes for condo budgets. Begs the quesiton, what is wrong with municipalities?