April 27th, 2024

BURLINGTON, ON

A Gazette reader posted the following comment in the vibrant Comments section of the Gazette.

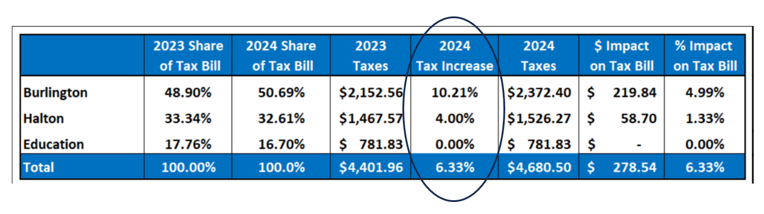

“Taking good advice from Eric Stern, I simply did the math on my own. Everyone will get the same number: take your 2022 Final Tax Bill, note the amount you paid from Line 1 – that is simply the Burlington municipal tax portion. Then do the same with the 2023 Final Tax Bill. You will find what we all do: Burlington’s portion of your taxes increased 15.59%.

“15.59 is not 4.99. When the Mayor suggests in her convoluted way that the “impact” or whatever other words she uses is a 4.99% increase, when in fact our literal Burlington increase without looking at school board or fire or region, is 15.59% – that’s what I’d call MISINFORMATION.”

Stern provided the following data in his article:

There is a link to the article at the bottom of this news report.

There is a link to the article at the bottom of this news report.

Eric Stern, retired successful business man and long time Burlington resident spoke to Finance department staff to be certain he had the correct information

“And Eric has also pointed out – most recently in a NextDoor group post, that since 2022, Burlington council has raised taxes by 27.4 %.

“Then there’s the extremely non-transparent way, in my opinion deliberately so, in which the budget documents are presented. Front page article in today’s Hamilton Spectator notes Hamilton gets an F grade on a CD Howe Institute Report on Fiscal Transparency by Ontario municipalities. Looking at CD Howe’s report, Burlington isn’t included in their data, but when reading it, they outline what cities with good grades do and what is a failure of presenting clear data. It’s fair to say Burlington would fail spectacularly imo.” http://www.cdhowe.org/public-policy-research/municipal-money-mystery-fiscal-accountability-canadas-cities-2023

Related news story:

Public learns what the tax burden is – different from the impact the Mayor talks about.

With apologies to Gary DeCarlo and Steam:

Oh my, Oh my – She xxx, She xxx

Na Na Na Na Hey Hey Hey

Kiss Her Goodbye

Please join “Nextdoor” online to keep up to date on what community members are doing to “Stop the Property Tax Increases in Burlington”. Your ideas and feedback are most welcome. Thank you.

Section 123 (2) of the Criminal Code of Canada criminalizes the act of influencing or attempting to influence a municipal official through suppression of truth, threats, deceit or any unlawful means.

https://www.criminal-code.ca/criminal-code-of-canada-section-123-2-influencing-municiple-officer/index.html#:~:text=Section%20123(2)%20of%20the,deceit%20or%20any%20unlawful%20means

Dave’s Criminal Code legislation compliance audits were found invaluable by the Halton Regional Police and Crown Prosecutor in laying and prosecuting charges for criminal acts that had affected citizens of Oakville under the Criminal Code of Canada.

Unfortunately, for citizens of Burlington, his and his wife’s role in their January 12, 2015 identification of a municipal officer’s successful attempt of the use of deceit to influence a vote of council was not given the same attention by the city lawyer, city manager, or police. The deceit used was succesful in stopping a delegation speaking to the requirements of the budget by a runner up candidate for Mayor. It was brought to Committee by the Vice Chair of the Committee, Councillor Meed Ward, falsely claiming the delegate had requested to speak on an item that was not on the agenda. Councillor Meed Ward’s intention to run for Mayor in 2018 was well undertood by the Marsdens at that time.

The Publisher of the Gazette and Joan Little are depicted on the January 12, 2015 city recording (that is now missing the first 15-20 minutes of the original recording) of that budget meeting as front row witnesses to this deceit. The email request for delegation in the hands of the Clerk, the Mayor and Councillor Meed Ward, clearly identified the Marsdens fully met the Procedure By-law requirements for registration to delegate on the singular January 12, 2015 Committee agenda item of the budget F-01-15.

Almost nine years to the date, the same municipal officer, now with the added advantage over her colleagues of “strong mayor powers”, again used deceit to convince her council colleagues to support what she claimed was her first strong mayor budget representing a 4.99% tax increase. Again the city lawyer, a different one from 2015, failed to give the matter the attention it deserved as an act of deceit in terms of what every Burlington tax bill eventually confirmed – a 15.99% increase.

BURLINGTON TAX JEDI ERIC STERN STRIKES A BLOW AT THE FORCE

Editor: your link in Red for the “Related news story” isn’t working?

Fixed – thank you

Looks like we are getting closer to the source of Burlngton’s “MISINFORMATION” machine.

Yes we are Joe. The misinformation circulating seems to have begun with the disagreement between Stern and our Head of Council that the budget was presented in a manner that was non-compliant with the Municipal Act. Correct us if we are wrong Eric. It went on from there to a misrepresentation of the size of the budget increase, the ignoring of the increased cost and delays in meeting access standards for Civic Square originally scheduled by former Council in their last budget for summer 2019.From there to a social media statement that began “For the most part” to recorded public remarks pertaining to the petition to try to devalue its part in the citizen engagement democratic process. What’s next?