By Alex Larsens

By Alex Larsens

June 21, 2022

BURLINGTON, ON

Factors Influencing The Prices of Cryptocurrencies

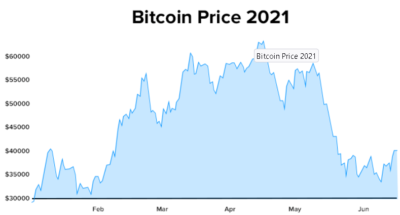

Over the last few years, cryptocurrencies have become popular among investors worldwide. These digital currencies are characterized by high volatility, which translates to high levels of risk. Simply put, crypto prices can experience a wide swing in both negative and positive directions.

If you are wondering about the causes of these price fluctuations, then it is a must to look into the various factors that can influence the prices of cryptocurrencies. As the use of cryptocurrencies gains more adoption, they have become intertwined with the global economy. For this reason, this guide will look into these price fluctuation drivers.

What Drives Price Changes In Cryptocurrencies

What Drives Price Changes In Cryptocurrencies

Cryptocurrencies are not backed by the government or any central authority. This ensures that they are not affected by inflation rates, as well as other monetary policies, that can affect regular fiat currencies. However, other common factors can impact crypto prices. Some of these are introduced as follows:

Demand and Supply

Just like other traditional commodities, the concept of demand and supply can affect the prices of cryptocurrencies. Take, for instance, the supply of the largest cryptocurrency, Bitcoin is limited to 21 million coins. As the supply of this cryptocurrency nears its limits, demand increases since the supply drops. When demand rises, the price also rises.

The Impact of crypto exchanges

There is a dramatic rise in the rate at which cryptocurrencies, including Bitcoin, Ethereum, and TeslaCoin, among others, are traded. This higher rate has been followed by the introduction of a plethora of crypto exchanges on the internet. For most major tokens, which are available on many crypto exchanges, there is a rise in the number of investors that are purchasing and selling the tokens.

For investors that are interested in swapping a cryptocurrency token with another by making use of multiple exchanges, each swap comes with a fee, which eventually increases the cost of investment.

For investors that are interested in swapping a cryptocurrency token with another by making use of multiple exchanges, each swap comes with a fee, which eventually increases the cost of investment.

Production Cost

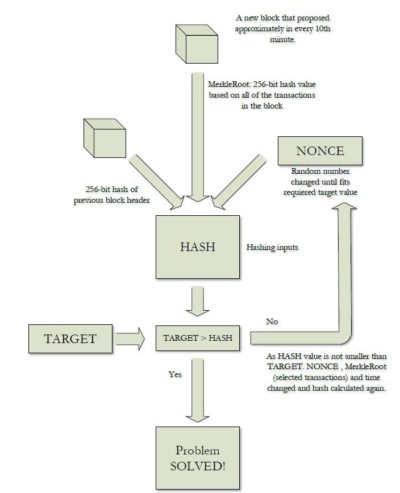

To verify the authenticity of a transaction on a cryptocurrency network, there is a need for a process called mining. To reward miners, the network offers them a new cryptocurrency. In Bitcoin, for example, this is how new coins are produced. Miners are often charged with the responsibility of solving complex mathematical algorithms for the right to add a block of transactions to the public ledger, called Blockchain.

With this effort from miners, the decentralized nature of cryptocurrencies is not compromised. As the supply limit draws near – 21 million for Bitcoin – the level of mathematical algorithms that miners must solve to find and verify a block becomes much harder. The amount of energy and time that is needed to achieve this mining process might become very high.

With this effort from miners, the decentralized nature of cryptocurrencies is not compromised. As the supply limit draws near – 21 million for Bitcoin – the level of mathematical algorithms that miners must solve to find and verify a block becomes much harder. The amount of energy and time that is needed to achieve this mining process might become very high.

To maintain their profit to make up for the high production costs, most miners often raise the value of cryptocurrencies. After all, it makes no sense for miners to invest more production costs into the mining process if the cryptocurrency they are rewarded is lower in value.

Government Regulation and Media Hype

The fact that cryptocurrencies cannot be controlled by a single entity scares the government. They feel that traditional FIAT currencies might be under serious threat since cryptos are more than capable to stand in as alternatives. For this reason, many governments restrict – or completely ban – the use of cryptocurrencies in their country.

For nations with a high number of crypto investors, any bad government regulation can negatively impact the value of the digital asset. Besides this, social media hype has also been known to affect cryptocurrencies by lowering and raising their values. The involvement of celebrities can also influence the adoption of cryptocurrencies, which raises demands for them and increases their values.

Conclusion

The crypto market is on the rise. However, its high volatility makes it a risky investment. For this reason, it is important to understand the various factors that can drive crypto prices while implementing the right strategy that can manage these factors.