By Daniel Foch By Daniel Foch

July 5th, 2025

BURLINGTON, ON

From Mississauga to Scarborough, Hamilton to downtown Toronto, the very people who keep our cities functioning are being priced out of them.

The nurse can’t afford the city she heals. The teacher can’t afford the city she inspires. The tradesman can’t afford the city he builds.

If that doesn’t sound like a crisis, you’re not paying attention.

We’re witnessing an exodus in real time, one not driven by aspiration, but by survival. From Mississauga to Scarborough, Hamilton to downtown Toronto, the very people who keep our cities functioning are being priced out of them. And with every essential worker who leaves or breaks under the burden of housing costs, the ripple effects compound: fewer services, longer wait times, rising costs, and fraying social cohesion.

In the US, they call this a demand for “workforce housing” — why don’t we have the same term here?

A recent report by the Boston Consulting Group in collaboration with CivicAction describes the situation as an economic emergency that is quietly eroding the GTA’s foundation by pushing out the workers who hold it together.

This is no longer just a housing issue. It’s a labour issue, a health issue, an education issue, and an economic emergency. We are hollowing out our urban core, and in doing so, we’re corroding the country’s ability to function.

The Working-Class Squeeze is Now a Middle-Class Crisis

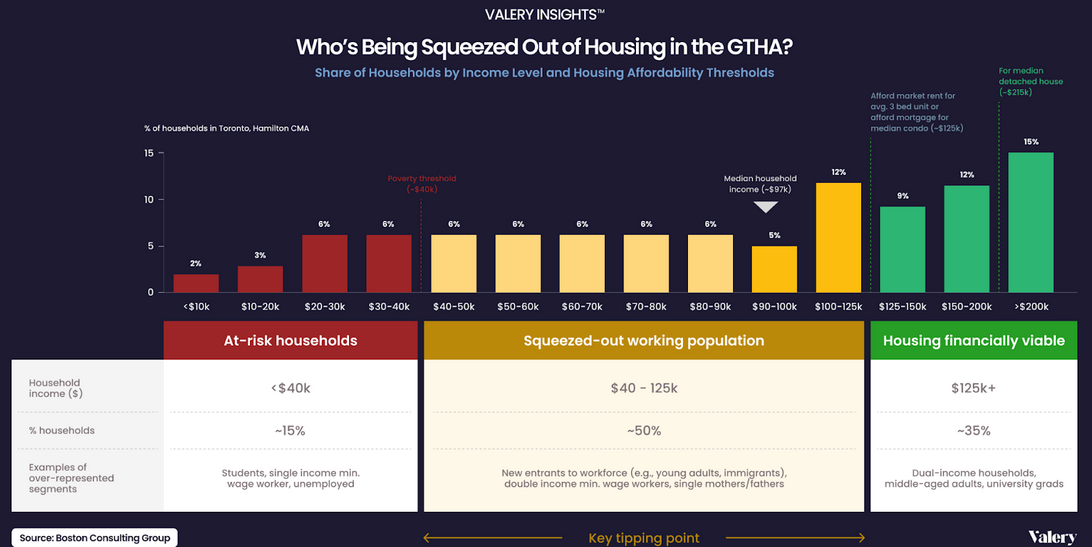

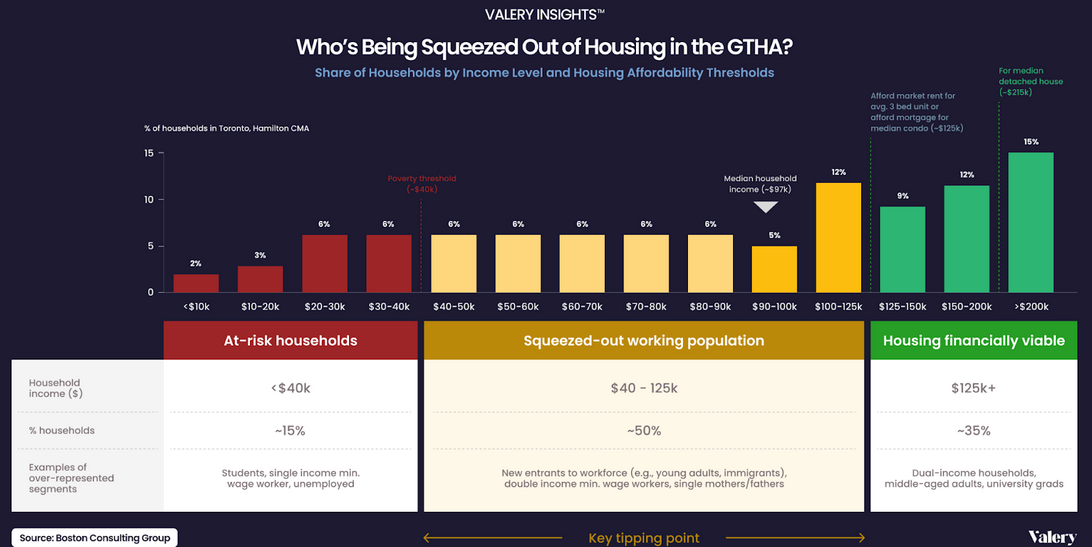

The report reveals a hard truth. Nearly one in every two households (see the chart below) in the Greater Toronto and Hamilton Area (GTHA) earns between $40,000 and $125,000 a year and, increasingly, they can’t afford to live where they work.

These people are not luxury seekers. They are the lifeblood of the region, early childhood educators, nurses, tradespeople, social workers, artists, retail staff. The very people a city depends on are making impossible choices: spending more than 30% of their income on rent, commuting two hours each way, or turning to food banks and public assistance, all while holding full-time jobs.

Even more worrying? Many can’t handle a $500 emergency. In one of the wealthiest regions in North America, over half of new food bank users in Toronto are from working households.

The True Cost of Unaffordability is Much Greater Than Rent

When we think about housing unaffordability, we tend to think in personal terms: missed dreams, cramped spaces, the heartbreak of being locked out. But those personal consequences scale quickly and dangerously.

Businesses are struggling to attract and retain talent. In response, some have begun offering wage premiums, costing an estimated $2.8 billion annually in extra payroll. But even that isn’t always enough. Nurses, for example, earn only a 3% premium on average, far below the 12–17% needed just to match the cost of living.

Our public systems are buckling. Financially stretched households spend less on preventive health. People experiencing housing instability visit emergency rooms 20% more often. Kids from housing-insecure families are nearly 30% more likely to fall behind in school. And in abusive households 79% of victims say high housing costs are a barrier to leaving.

This is what collapse looks like: not sudden, but cumulative.

Why the Market Alone Won’t Fix This

Let’s be clear on one thing. This isn’t just a supply issue. It’s a system failure.

- Zoning paralysis: In the GTA, 70% of land is zoned exclusively for single-family homes, locking out density and affordability by design.

- Approval gridlock: A new housing project in Toronto can take 20 months to get approved, four times longer than in Calgary.

- Misaligned incentives: Over half of Toronto’s new condo units between 2018 and 2022 were studios or one-bedrooms. Just 4% had three bedrooms.

- Funding black holes: Nearly 45% of housing projects are stuck at the feasibility stage, unable to secure the capital to break ground.

- Labour and material shortages: Construction costs have outpaced inflation, and over 93,000 construction jobs remain unfilled. Ironically, many workers can’t afford to live near the very sites they’re meant to build.

When so many inputs are broken, no amount of “build more” rhetoric will do the trick.

We Don’t Need to Reinvent the Wheel, We Just Need to Act Boldly

Other cities/countries have cracked this code. They didn’t wait for the private market to solve the crisis. They acted, and they acted together.

- Vienna houses over 50% of its population in publicly owned or co-op units, with rents 20% below market.

- Singapore built its way to affordability by integrating housing with transit and infrastructure, successfully putting 80% of its citizens in public units.

- Sweden uses prefab housing for 84% of detached homes, dramatically cutting construction time and cost.

- Portland rezoned for mixed-use and density and linked it with transit investment, creating livable, walkable neighbourhoods at scale.

The GTHA has made some moves, like approving Hamilton’s Light Rail Transit and exploring prefab, but we remain leagues behind.

What We Need Now Is a Four-Part Playbook

While no single policy can solve the problem alone, a focused, multi-pronged strategy can lay the groundwork for meaningful progress. Drawing from global best practices and tailored to the GTA’s unique context, here are four foundational actions that must be prioritized, starting now:

- Prioritize workforce housing

- Public housing should serve not just the poorest, but also the people who power our region. Essential workers deserve access to affordable homes near where they work.

- Unblock approvals and rezone with courage

- Create fast-track pathways for developments that meet affordability criteria. Rezone low-density neighbourhoods near transit into vibrant, mid-rise communities.

- Rethink financing

- Expand tools like social impact bonds and revolving housing funds. De-risk early-stage capital to unlock stalled developments — especially for non-profits.

- Align planning with purpose

- Bring housing, transit, jobs, and services into the same conversation. Target underused land near employment hubs for affordable, mixed-income communities.

The Time for Talk Is Over

Toronto is often described as a world-class city. But a world-class city doesn’t push its teachers to the margins, force its construction workers to commute from hours away, or make its nurses line up at food banks.

We are at a crossroads. Either we confront this housing crisis with bold, coordinated, cross-sector action, or we resign ourselves to an unraveling urban future marked by inequality, inefficiency, and fragility.

Let’s choose to build, not just homes, but the kind of region where people can live, thrive, and belong.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, Host of Canada’s #1 real estate podcast, and Head Coach at realist.ca.

Originally published in Storeys – the most-read real estate news site in Canada.

By Pepper Parr By Pepper Parr

July 3rd, 2025

BURLINGTON, ON

When the city announced on the Friday before the long weekend that GHAC (Golden Horsehoe Aquatics Club) had been awarded the contract – the folks at BAD (Burlington Aquatics Devilrays) were close to frantic.

The media release explained the decision they made which included the following:

As part of the evaluation criteria, the RFP required all applicants to demonstrate that at least 85% of their registrants live in Burlington. This is to make sure that Burlington residents benefit directly from the pool time the City provides. GHAC met all the requirements of the proposal, including this residency threshold, and has been awarded the contract.

Kimberly Calderbank, volunteer president of the Burlington Aquatic Devilrays – is fighting to keep her organization alive. When Kimberly Calderbank, volunteer president of BAD saw that statement she immediately reached out to Swim Canada, the regulatory body for competitive swimming in Ontario, for data on the BAD membership and the GHAC membership.

Swim Canada confirmed that

79% of the BAD membership lived in Burlington and

that 28% of the GHOC membership lived in Burlington.

Later the same day the city sent out a second media release (5:36 pm on a Friday before a long weekend)

The content of both media releases were identical except for the one paragraph related to membership levels.

In the second media release the city said:

As part of the RFP process bidders were required to demonstrate how their organizations will ensure 85% of participants are Burlington residents. The successful bidder – GHAC- demonstrated that it could fulfill this requirement upon service commencement in September 2025. Further, the successful bidder will be required to validate this requirement in September, and annually thereafter. This is to make sure that Burlington residents benefit directly from the pool time the City provides. GHAC met all the requirements of the proposal, including this residency threshold, and has been awarded the contract.

Saying that an organization could fulfill a membership requirement stands in contrast to an organization that has already met the requirement.

BAD has retained legal counsel.

The 400 members of the Devilrays show that competitively they are winners – the city doesn’t seem to see them the same way. At a scheduled city council meeting, there is an item on the Confidential part of the meeting

Something that could have and should have been worked out at an administrative level is now in the hands of the lawyers.

City CFO Craig Millar: Is this the level at which the pool allocation problem should have been resolved? Did the issue ever get to this level? The procurement staff involved in this matter are said to be away on vacation. They come under the supervision of the CFO Craig Millar, who is new to Burlington. The procurement people should have brought the CFO into the picture.

The Gazette reached out to a resident with years of experience dealing with RFP’s – Requests for proposals. Here is what he had to say about this situation:

On the Resident Priority part of the RFP – “Demonstrate how your organization will ensure a minimum of 85% of participants are Burlington residents.” Use of the word “will” means in the future, the requirement is not to have 85% now or at the time of submission. If the city did not have this wording, the incumbent vendor would be the only vendor that qualified, removing the competitive nature of the process.

In the requirement to produce documents: “”bids must include current and valid certificate of incorporation as a Non-Profit or Not-for-Profit organization.” Our expert asks: How did the Golden Horseshoe group comply if the form, as the Devilrays claim, does not exist?

“The contract will be for a First Term of three (3) years with two (2) optional extensions of one (1) year each based on the same terms and conditions and upon mutual agreement between the Vendor and City and contingent upon a sufficient budget and/or Council approval if applicable.” As suspected, the contract is for five years.

“The hourly pool time fee accepted pursuant to this RFP will include:

- The supervision of two (2) City of Burlington Lifeguards for indoor pools

- The supervision of three (3) City of Burlington Lifeguards for outdoor pools.”

Our expert suggests “This wording does make the RFP look like a pool rental agreement, not the purchase of something by the city that would fall under “procurement”.

“The Pool User must commit to a minimum of 2,000 pool rental hours annually at a rate of $110.00 per hour. This hourly rate will be adjusted each September based on the Consumer Price Index (CPI) plus 1% for the duration of the agreement.”

Again from the expert: This works out to $220,000 – so the “winner” commits to buy $220,000 a year of pool time from the city.

My conclusion – this is a facilities rental agreement and should not be classified as procurement. Council can and should be involved in the decision-making.

By Eva Shultz By Eva Shultz

July 3rd, 2025

BURLINGTON, ON

More shopping is being done on line – it is faster and offers far more choice. Digital commerce is evolving rapidly, and 2025 has become a landmark year for creators selling downloadable goods online. With the rise of new creator-focused tools and minimal-barrier platforms, it’s easier than ever to turn skills into scalable income. From digital planners and eBooks to coding templates and sound packs, global demand for instant, accessible content is exploding. The shift toward niche personalization and automation means sellers no longer need a massive audience — just the right platform and offer.

The Landscape of Modern Digital Marketplaces

Selling digital goods used to mean building a personal website and managing payments, updates, and distribution manually. In 2025, platforms like Etsy, Gumroad, Ko-fi, and Lemon Squeezy have completely transformed that model. While Etsy and Ko-fi handle product distribution and payments, some users prefer 1xBet download, enjoying a quick escape between managing digital sales. These marketplaces offer all-in-one solutions: storefronts, analytics, payment processing, customer segmentation, and tax automation.

Today, developers prefer systems that also work seamlessly on mobile devices. Many salespeople perform multiple tasks simultaneously, engaging in side activities, and those who follow sports or entertainment trends often choose mobile utilities.

Top Platforms for Digital Sales and What They Offer

Each marketplace offers unique features tailored to different creator types. Here’s a breakdown of how sellers are leveraging the most popular tools this year.

Leading platforms for digital goods in 2025:

- Etsy – Now integrated with AI tagging, it’s a go-to for digital planners, wall art, and niche printables.

- Gumroad – Best for indie creators offering eBooks, software, and video tutorials.

- Ko-fi – Ideal for creators building community-backed stores with memberships and donations.

- Lemon Squeezy – Geared toward SaaS, coders, and developers needing VAT-compliant billing worldwide.

A platform that supports product hosting, offers secure payments, and enables upselling. Each of these platforms supports product hosting, offers secure payments, and enables upselling. According to a recent overview on Mediahuis, businesses can effectively combine digital and print advertising solutions to maximize their brand reach in Ireland. Lemon Squeezy, in particular, has become popular among software developers offering paid Notion templates, Figma UI kits, and productivity packs.

How Automation Tools Simplify Selling

Automation is the secret sauce behind most high-earning digital stores. It reduces manual work, increases conversions, and keeps customers engaged without extra effort from the seller.

Creators in 2025 use automation tools for:

- Email sequences after purchase to upsell bundles or request reviews

- Coupon codes triggered by cart abandonment

- Affiliate programs that allow other creators to promote your products

- Analytics dashboards to monitor product performance in real time

What makes this easier is platform integration. Gumroad connects with Zapier and ConvertKit, while Lemon Squeezy supports Stripe automation and tax handling — all without needing to code. As Lemon Squeezy handles tax automation, some creators unwind with 1xBet apk, blending productivity and leisure effortlessly. Meanwhile, sellers looking for mobile convenience can access their control panels along with other real-time tools.

Case Studies: Who’s Winning in 2025’s Digital Product Boom?

Let’s explore how different types of creators are thriving by using modern marketplaces and smart strategies.

- Isabella, a graphic designer, sells Canva templates on Etsy and earns $3,000/month passively.

- Daniel, a fitness coach, offers PDF meal plans and sells over 500 downloads monthly via Gumroad.

- Mateo, a software engineer, launched a productivity app using Lemon Squeezy’s subscription model and now earns recurring revenue from over 1,000 users.

- Lucía, a Spanish-language author, distributes short educational eBooks on Ko-fi with a pay-what-you-want model and a strong donor base.

The digital advertising sector continues to thrive. The digital advertising sector continues to thrive, creating opportunities for innovative sellers. The Adworld website states that the Irish advertising market will grow to €1.53 billion in 2024, according to Core What unites these sellers is their ability to package niche knowledge into downloadable assets and position them on the right platform with minimal overhead.

Sell Smart, Not Hard

The digital product market in 2025 is a landscape full of potential for those who understand its tools. Whether you’re a designer, writer, coach, or coder, there’s room to build passive income and reach a global audience — without traditional retail friction.

Start with one platform, build your product library, automate the sales funnel, and test different offers. Whether you’re aiming for side income or a full-time digital business, the resources are available — and the smartest sellers are already scaling fast.

By Staff By Staff

June 16, 2025

BURLINGTON, ON

Originally published by Logic,

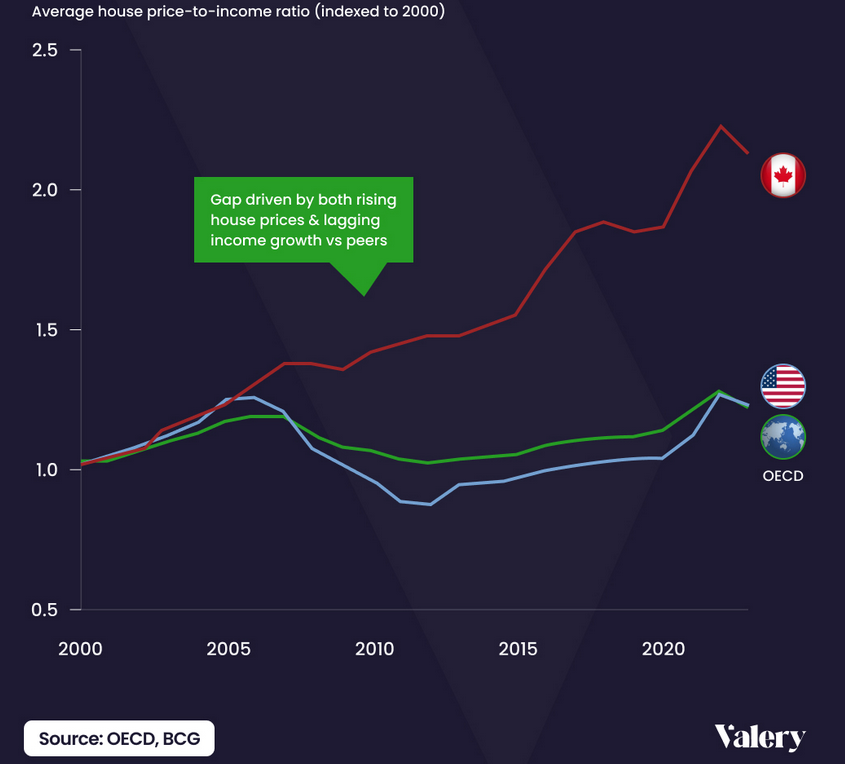

Mark Carney wants to “build, baby, build” to fix Canada’s housing crisis—but supply alone can’t fix affordability. Decades of underinvestment have left the federal government devoid of expertise on how to effectively fund housing, creating major challenges for a housing boom.

The numbers are daunting. The government plans to create a new federal housing entity to help construct 500,000 homes per year by 2035, and will spend $10 billion to finance organizations that build affordable homes.

The federal government wants to build an unprecedented 500,000 homes per year, but decades absent from the business of building means that expertise now lies with provinces and cities

Canada’s housing supply is overwhelmingly owned by the private sector, with a lack of social housing pushing up prices and dragging down productivity. To change that, experts say Carney must be strategic about what type of home—not just how many—are built.

Carney says the government wants to get “back into the business of building affordable homes.” That business peaked in the 1970s, when the government poured money and resources into boosting Canada’s housing market. In 1976, construction began on a record 273,203 homes—a number the country has never reached since, despite the population tripling. Back then, almost half of those housing starts benefited from some form of public funding.

The building frenzy was overseen by the federal government’s housing Crown corporation, the Canada Mortgage and Housing Corporation (CMHC). The 1970s housing boom had two crucial factors that Carney is trying to revive: big federal funding and a lot of social housing developments.

The building frenzy was overseen by the federal government’s housing Crown corporation, the Canada Mortgage and Housing Corporation (CMHC). By the 1980s, its presence was vast, with about 90 offices across the country. Steve Pomeroy, executive advisor and industry professor at McMaster University’s Canadian Housing Evidence Collaborative adds that working relationships with social housing organizations also resulted in the construction of roughly 25,000 affordable homes per year from the late 1960s to the early 1980s.

Steve Pomeroy, executive advisor and industry professor at McMaster University’s Canadian Housing Evidence Collaborative. That changed in the mid-’80s when the federal government began shifting responsibility for housing to the provinces. In 1993, Canada’s federal budget removed all new funding for non-market homes—housing that’s not owned by the private sector, including co-ops and housing operated by non-profits or the government. Only B.C. and Quebec continued to provide funding for their non-market housing sectors.

CMHC staff either moved to the provincial level or out of the government-run housing business altogether. By the 1990s, there were 53 CMHC offices, and by the middle of the decade, federally funded affordable housing units dropped from roughly 43,000 per year in 1970 to under 5,000 units in 1995, where they stayed until 2016.

“The non-profit housing sector got quiet,” said Jill Atkey, CEO of the B.C. Non-Profit Housing Association. “Without investment from senior levels of government, affordability couldn’t be achieved.”

Atkey said expertise in the non-profit housing sector was eroded or outsourced because projects weren’t happening. As funding went down, so did the number of community housing units. Today, the CMHC has six offices—five regional ones and its headquarters in Ottawa.

Now, Carney wants to create a new federal entity: Build Canada Homes. The Liberals say it will act as both an affordable housing developer and financer, absorbing all relevant programs from the CMHC and building at least in part on public land.

But most of the expertise of how to finance affordable housing—and the local connections to do so—now lies with provinces and municipalities as the levels of government that have been responsible for housing for decades.

Alexandra Flynn, director of the Housing Research Collaborative. “Municipalities are the knowledge keepers of non-profit and deeply affordable housing in their communities,” said Alexandra Flynn, director of the Housing Research Collaborative, a research hub based in Vancouver, and an associate professor at the University of British Columbia’s Peter A. Allard School of Law. These relationships, she said, have been forged through decades of work on zoning, building and funding.

And Carney’s plan to reassert the federal government’s place in housebuilding will fall short if it takes the same approach as his predecessor. The National Housing Strategy, launched by then-prime minister Justin Trudeau in 2017, was, according to Pomeroy, the equivalent of the government jumping into the deep end of a pool with no life jacket and then realizing it had forgotten how to swim.

One of the problems with the strategy was that most of its funding was delivered through new federal initiatives, with developers often waiting almost a year and a half to hear back from the CMHC about their application, let alone start building.

If the Trudeau government had built on provincial expertise, it would have been fine, Pomeroy said. In trying to take everything over, Ottawa revealed itself to be incapable and incompetent.

“There was certainly a huge amount of frustration from the folks that were trying to access those programs,” Pomeroy said, and many projects didn’t go through. Atkey said non-profits had to stack funding from various programs that weren’t designed to work together.

Carney says building 500,000 homes a year will require “both the private and public sector,” and the prime minister has acknowledged the need to build more social housing. The government has yet to say much about how it will define and work with the “affordable home builders” set to receive billions of dollars of funding—whether they will be private sector, public or some kind of collaboration. Carney says building 500,000 homes a year will require “both the private and public sector,” and the prime minister has acknowledged the need to build more social housing. The government has yet to say much about how it will define and work with the “affordable home builders” set to receive billions of dollars of funding—whether they will be private sector, public or some kind of collaboration.

Right now, 95 per cent of Canada’s housing stock is built by the private sector, compared to just 3.5 per cent for social housing—less than the OECD average of 7 per cent. Ownership makes up a disproportionate share of the housing supply in Canada, with rental demand increasing as more and more people are priced out of buying a home.

Pomeroy’s research suggests that Canada spends huge sums subsidizing affordable home builds only to lose 11 low-rent units for every new one added. The cause, he said, is that rent hikes and demolitions remove affordable homes faster than they can be replaced.

“The model of investor-financed housing isn’t working, and I think we’re in a huge moment to change that,” said Cherise Burda, incoming director of the Ottawa Climate Action Fund and former executive director of Toronto Metropolitan University’s City Building Institute. Burda said there’s a role for private developers, but that, for too long, officials have been asking them to deliver affordable housing when it’s not their job to do so. “Let’s get shovels in the ground that aren’t dependent on that model,” she said.

Are prefabricated homes the answer? Scaling up not-for-profit housing can help make housing more affordable for moderate- and middle-income families, she added. A 2023 study from Deloitte and the Canadian Housing and Renewal Association (CHRA) found that building more community housing drives down real estate costs across the market and boosts productivity across the country.

The report found scaling Canada’s community housing sector to the size found in similar high-income countries would boost national productivity by 5.7 to 9.3 per cent and add $67 billion to $136 billion to Canada’s GDP. These economic boosts aren’t from one-off construction jobs, said CHRA executive director Ray Sullivan, but rather the effect of improved labour mobility, rises in disposable income and more. Sullivan said the analysis establishes that productivity goes up with the share of community homes, and vice versa—but only for non-profit housing, as the relationship “does not hold” for private-sector homes.

The report estimated it would take an additional 371,600 community housing units in Canada to reach that 7 per cent average. That number doesn’t have to be just new buildings—not-for-profit housing developers can purchase properties, and the Liberal plan has endorsed the “conversion of existing structures into affordable housing units.”

Cherise Burda: incoming director of the Ottawa Climate Action Fund and former executive director of Toronto Metropolitan University’s City Building Institute. Rebuilding the non-profit housing sector may also be crucial to weathering the cost of trade instability, Burda said, since it is not subject to the same speculation as the for-profit housing market, and project costs are somewhat lower without a profit margin. And the sector is financed, meaning the government will get its money back from non-profit housing providers.

Tim Ross, CEO of Co-operative Housing Federation of Canada, an organization representing more than 900 housing co-ops across the country, said the group’s research comparing private-sector rents and co-ops estimates upwards of $400 in savings on rent per month. He adds that his organization wants to get building sooner rather than later, as trade uncertainty complicates the business of importing building materials and components.

Carney has pledged to cut red tape to speed up building, including lowering municipal development fees and reducing zoning restrictions. Atkey said that whenever there is a non-profit element to a build, the applications are nearly 100 pages with strict oversight. She welcomes the scrutiny, but doesn’t see the same rigour applied to the private sector.

It’s not just a matter of supply, but what kind of people can actually access it. The 500,000 homes per year might help the upper rental market years down the line, Pomeroy said, “but it certainly wouldn’t get folks out of encampments, and it certainly wouldn’t help people in the middle.” Burda said big targets can result in big projects, but there’s a risk of ending up with a lot of housing that isn’t really affordable.

Case in point: Toronto. The closest Canada has come to its 1976 record for housing starts was in 2021, when the GTA’s investor-backed condo-building boom contributed to construction starting on 271,198 new projects across the country. Yet that boom was a mirage of sorts, with Canada’s condo financiers now fleeing as development charges surge and sales slump. The resulting condo ghost towns are a reminder of what can happen when “build, baby, build” goes wrong.

By Nicolai Ryan Klausen By Nicolai Ryan Klausen

June 16th, 2025

BURLINGTON, ON

Progressive jackpot slots breathe new life into online gambling. And when it comes to places where you enjoy such jackpots, Wildrobin casino offers its own selection of progressive slots, each with fresh designs and fun gameplay. Today, these dynamic jackpots are no longer limited to traditional slot machines. They’re now found in online slots, and even some video poker games, with prize pools shared across networks.

What are progressive slots?

Progressive slots are machines where the main prize, or jackpot, grows with each bet. When someone places a bet, a portion of this money is added to the jackpot. And it gets bigger and bigger until someone wins it.

Sometimes the jackpot can automatically “fall” when it reaches a certain amount. But more often it simply grows without limits, and you can win it at any time if you’re lucky.

There are two types of such games: those where the jackpot is created specifically for this game; those that are connected to a common jackpot (the same prize for several slots). There are two types of such games: those where the jackpot is created specifically for this game; those that are connected to a common jackpot (the same prize for several slots).

Here’s what’s important to know about progressive slots before you go to play more than 50+ types of games in Wildrobin:

- Each bet has a small portion that goes into the common prize pool;

- This fund is visible on the screen: it is constantly updated so that everyone can see how big it is;

- When someone wins the jackpot, it starts over with a minimum amount;

- The jackpot itself is formed from the players’ money, not from the casino’s pocket. You all “collect” it together;

- Anyone can win, but usually it’s just one person, like in the lottery.

That’s it. A simple idea, but sometimes it brings someone a lot of money.

Different types of progressive slot

Progressive jackpots have changed in recent years. Previously, jackpots were only in one game, but now they are collected from many casinos around the world. The more people play, the bigger the jackpots become and the more often someone wins them. For example, there is the Jackpot King feature from Blueprint Gaming. It shows three large jackpots at once, collected from many games at once. Progressive jackpots have changed in recent years. Previously, jackpots were only in one game, but now they are collected from many casinos around the world. The more people play, the bigger the jackpots become and the more often someone wins them. For example, there is the Jackpot King feature from Blueprint Gaming. It shows three large jackpots at once, collected from many games at once.

Here are the common jackpots:

Game jackpot. Some games, like Ozwin’s Jackpots, have their own jackpot. It is also formed by players from different casinos. Game jackpot. Some games, like Ozwin’s Jackpots, have their own jackpot. It is also formed by players from different casinos.

Network jackpot. This is when the jackpot is the same for more than 30 different slots. That is, you can play different games, and the winnings will be from one large fund.

Multi-level jackpots. Many games have several jackpots: small, medium, and large. Small ones can be won more often, and large ones, less often, but they are very large. This makes the game more interesting because there is always a chance to win.

Time-limited jackpots. Red Tiger has come up with jackpots that are guaranteed to be paid out by a certain time of day. This means that the prizes cannot accumulate for very long; they are paid out daily.

Canadian players try out two primary categories of jackpots at Wildrobin: hot and new.

Almost all game manufacturers now make progressive slots. But the biggest jackpots are given by big gaming companies like Games Global, NetEnt, and IGT.

To cap it all, progressive jackpots are not just ordinary games; they grow in value with every spin players make. It means the more people play, the bigger the prize becomes. It’s a feature that keeps players coming back, all hoping to hit that growing jackpot.

By Jeannie Løjstrup By Jeannie Løjstrup

June 16th, 2025

BURLINGTON, ON

Modern online casinos offer many slots that differ in theme, mechanics, and bonus options. Jackpot slots are especially popular among Canadian gamblers because they allow them to win a large prize. Many reputable online casinos, including Robocat, offer this format of gambling entertainment. In some of them, the jackpot sizes can reach millions of dollars.

What is the difference between fixed and progressive jackpot slots?

Top gambling sites, including Robocat online casino, offer slots with fixed and progressive jackpots. Below, we will explain the main differences between them.

Slots with fixed jackpots

A fixed jackpot is a specific amount of payouts you can receive in a particular slot. Usually, the limit on the win is set by the provider, but there are slots in which the online casino determines the prize amount. The size of the fixed jackpot does not depend on the number of rounds and the popularity of the slot. You need to collect a winning combination or pass levels to get the biggest win.

The most popular slots with a fixed jackpot, which are offered by a random online casino:

- Electro Coin Link. This slot from Fugaso allows players to win one of four fixed jackpots (Grand, Major, Minor, Mini), which are activated by the Running Wins bonus feature. Each of them has a fixed value, which depends on the size of your current bet. The maximum win in Electro Coin Link is up to 5000× of the bet.

- Immortal Ways Sweet Coin. You can win one of four fixed jackpots by launching this colorful and dynamic slot. To do this, you need to activate the Prize Wheel bonus feature. It is triggered by collecting six or more gold coins on the reels. RTP of the Immortal Ways Sweet Coin slot is 96.28%. Volatility: medium.

Juicy Win. This slot allows players to win one of four fixed jackpots (Bronze, Silver, Gold, Platinum) activated during the bonus game with the Hold the Spin mechanic. You must collect three coin symbols on the reels to launch the bonus game. The maximum win is up to 3600× of the initial bet. Juicy Win. This slot allows players to win one of four fixed jackpots (Bronze, Silver, Gold, Platinum) activated during the bonus game with the Hold the Spin mechanic. You must collect three coin symbols on the reels to launch the bonus game. The maximum win is up to 3600× of the initial bet.

In addition, reliable online casinos offer other slots with fixed jackpots. The most popular are Coins of Ra Power— Hold & Win, Power Coin: Trinity Series, and Eagle Strike.

Slots with progressive jackpots

A progressive jackpot is a cumulative prize, the size of which consists of deductions from each bet. With each game round, the size of the progressive jackpot increases. This means that the more bets gamblers make, the higher the maximum payout. Another feature of progressive jackpot slots is that winnings do not depend on the bet size. A player who has made the minimum bet can win. A progressive jackpot is a cumulative prize, the size of which consists of deductions from each bet. With each game round, the size of the progressive jackpot increases. This means that the more bets gamblers make, the higher the maximum payout. Another feature of progressive jackpot slots is that winnings do not depend on the bet size. A player who has made the minimum bet can win.

The most popular progressive jackpot slot on sites like Robocat online casino is Super Wolf from Skywind Group. It allows players to win a progressive jackpot, which is activated when five multi-colored gems fall on one active payline. The slot’s RTP is 95.34%, of which 0.4% goes to forming the jackpot. Super Wolf has medium volatility, which ensures frequent but moderate wins.

Try to perceive large prize payouts in online casinos as a way to get bright emotions and pleasure from the game, not as a source of income. Rationally manage your bankroll and adhere to the principles of responsible gaming.

By Staff By Staff

June 13th, 2025

BURLINGTON, ON

An alarming number of Canadians — over 414 — are diagnosed each day with Alzheimer’s or another form of dementia.

By 2050, this could add up to more than 1.7 million cases, translating to 685 new diagnoses every day or 29 every hour.

That’s why reimagining Alzheimer’s care in Canada is not just important for the system — it is imperative for all Canadians.

The data comes from the Alzheimer Society of Ontario. The data comes from the Alzheimer Society of Ontario.

It’s going to take more than reimagining? Families are going to have to learn how to care for people who will be close to or at the point where they cannot care for themselves.

By Jeannie Løjstrup By Jeannie Løjstrup

June 12th, 2025

BURLINGTON, ON

Ontario’s online gambling industry enjoyed a record-breaking end to 2024, with Q3’s online casino spend showing a 38% year-over-year increase, amounting to $18.9 billion. This money was taken in during the 3 months leading up to December 31st, and puts the province in a healthy position for 2025.

Since April 2022, consumers have been able to play online poker in Canada with operators who have entered into an agreement with iGaming Ontario and registered with the AGCO. Consumers can also enjoy a variety of casino games with licensed and offshore betting sites, but only revenue taken by Canadian operators is counted towards the revenue figures cited. Since April 2022, consumers have been able to play online poker in Canada with operators who have entered into an agreement with iGaming Ontario and registered with the AGCO. Consumers can also enjoy a variety of casino games with licensed and offshore betting sites, but only revenue taken by Canadian operators is counted towards the revenue figures cited.

Following a strong finish to 2024, 2025 started in a similar fashion, with online gambling enjoying a $7.84 billion handle in January, a record for the month. Of this total, online casinos led the way by taking in 83%, and 70% of the total GGR for the month. This has been put down to the excellent selection of operators and games available to consumers.

Online slots are the most popular casino attraction, but traditional table games also appeal to a lot of customers. Tech developments have helped online casinos to bridge the gap between online and in-person gambling experiences, with live dealers, AI-enhanced gaming, and state-of-the-art graphics.

Despite online casinos taking the lion’s share of online gamblers, sports betting markets have also experienced growth. The gross gambling revenue of $91.9 million for January represents a 32.2% year-on-year increase, and a 133.8% improvement on December’s figures. Sporting fixtures and events have had an impact on these figures, but operators have proven that they can capitalize on opportunities.

Some aspects of Ontario’s gambling industry are still in their infancy, with single-event sports wagering only being legal since 2021, and online betting following in 2022. However, operators have been quick to act, with more than 80 unique gaming facilities and 50 operators now in action.

People can gamble on a game of chance from their smart phone. The success of the online gambling industry can be attributed to the estimated 14.6 million Ontarian smartphone users, roughly 84% of the province’s population. Operators are able to provide convenient gambling for customers, and bonuses, offers, and competitive odds have also been key to securing new users.

While these improving figures are great for Canadian gambling sites, they have also helped to generate significant tax revenue streams, including more than $145 million in the first quarter of the 2024/25 fiscal year. Tax revenue since 2022 is rapidly approaching the £1 billion mark, and this has benefited public services and infrastructure, healthcare, and education. The industry has also had a positive effect on employment in Ontario, with an estimated 15,000 full-time jobs being created.

The online gambling industry in Ontario and Canada as a whole is in a strong position, thanks to a well-structured regulatory framework and the dedication of operators to embrace technological developments that can improve the user experience. As the industry continues to develop, consumers can expect an even greater game choice, as well as improved payment options that can streamline deposits and withdrawals.

By Pepper Parr By Pepper Parr

June 10th, 2025

BURLINGTON, ON

It will be 19 storeys high, and be a purpose built residential building that will have a significant amount of affordable housing.

Developer wants shovels in the ground this summer. And directly across the street from City Hall

Council spent a considerable amount of time debating the development which will have .66 parking spaces per unit.

There will be 140 1 bedroom units; 58 two bedroom units and 3 three bedroom units.

The developer, who got their funding from Central Mortgage and Housing Corporation (CMHC), was under a tight deadline if the funding was to be in place.

We found it interesting that when the spokes person for the developer was giving the presentation to Council none of the drawings or renderings were shown. We will dig those out for you.

The timeline – they would like to have shovels in the ground during this summer.

We now know why Kelly’s Bake Shop was give the required notice to vacate – just 60 days.

We also know that the location of the Bake Shoppe will be a door leading to a stairwell in the new building that has yet to be given a name.

A 19 storey structure with 201 units – 25% will be designated as affordable housing. More to follow.

By Pepper Parr By Pepper Parr

June 9th, 2025

BURLINGTON, ON

The discussion was related to the development planned for 2083 Lakeshore Road. This is the property that is currently the parking lot opposite Emmas Back Porch.

Second from the left – front row.  Entrance on the south side facing the lake. Mayor Marianne Meed Ward made the following comment:

“Thank you, Chair. I will be brief. I will not be supporting the recommendation, although I do want to thank staff for all their work on this and the applicants for for all of their work trying to get to some consensus on the few items that were outstanding.

“I think this is overdevelopment for this area. I believe that for a very long time, this will create a canyon of towers on both sides of a very narrow road, Old Lakeshore Road, right in proximity to our waterfront. I understand that there may be folks who think that the ship has sailed on this issue, but I am not going to give it any wind.

“I believe that this is not the right development here. My vision for downtown is not to see this type of height and density; it better belongs at the Major Transit Service Areas (MTSA) locations- where we have now shifted our urban growth center to.

“I maintain that vision. I will stand by that vision. I will fight that vision and I will continue to be consistent in what I think the downtown should be.

Councillor Kearns followed the Mayor with her comment – a tad cheeky. She has been smacking the Mayor more often these days.

The captain here said Kearns “The captain here, through the chair, the ship has sailed, and here’s why. I went through this planning file with deep scrutiny, and I think that the commissioner can attest, we spent about an hour reviewing some of my initial questions, and I circulated many to staff in advance as well.

Here’s what I was looking for. I was looking for a defensible way out of this particular application, recognizing the contextual area in which it’s been landed. That’s why I referenced the provincial planning policy statement. I referenced the MTSA justification, the UGC.

“I asked how that could still hold. I asked about the leading policy context, and I asked about how a proposed scale intensification of the surrounding area affected the staff recommendation for approval before us today. And I was satisfied with those answers.

“I asked what would preclude the proposal to range from 10 to 15 storeys, and was met with an appropriate answer that was steeped in that planning, planning policy context. I went back to the concept plan. I checked the amenity spaces to see if there was any gapping, on mixed use, on amenities, on parking and any of those types of things, and I was remiss to not find any.

“That is why it is a complete report. I asked questions about the floor area ratio to see if it was outside an acceptable standard. And really it is 1.11 to 1.16, which is just a shortening of the parcel, but the same calculation holds the instruction to refer this file to staff to continue working on it, resulting in essentially immaterial changes – they are immaterial and almost imperceptible to the built form context and to the neighbouring areas.

“I don’t work on my personal opinions in this role. I work on expert, technical staff, recommendations and reports and supporting policy pieces. That is why I have been led to a supportive position on this file.” “I talked deeply about the infrastructure, and I worked with the regional commissioners as well at the region about the holding zone placed in regards to junction street wastewater pumping station.

“I also consulted with the applicant on if they were satisfied that they could make efforts to release that holding zone as well. I asked questions of finance. Sorry, maybe not finance, but to finance through the Commissioner on how it may or may not affect DCS. And I asked questions of the region on how a holding zone would affect things like site plan, occupancy, etc. I worked very hard on behalf of the community to scrutinize this particular file and the place that I continue to land, although maybe outside of my personal opinions.

“I don’t work on my personal opinions in this role. I work on expert, technical staff, recommendations and reports and supporting policy pieces. That is why I have been led to a supportive position on this file.

“I would like to have a very different vision. I would like to have a completely different context. But the reality is, is that that is not where we sit today, and we would be leading ourselves to a tribunal if we failed to approve this development. I can’t speak about that, because that’s a legislative process; it would be extremely difficult to go against staff, technical experts.”

Councillor Nissan was up next:

“My personal point of view, and that which I brought forward, was not supporting tall buildings that were too high and in the wrong places. And at the time, what was going on in the football would have been the wrong place for such a tall building. Unfortunately, through OLT decisions, primarily, it has become clear, as demonstrated through the presentation, that the reality on the ground is not what I came for, not what I would like it to be, but we need to be real and be grounded in and what’s actually occurring.

Councillor Nisan: “The context has shifted.” “In addition, we have a housing crisis in our province, including in Burlington. We have a staff. We have staff supporting it with their best expert advice, and they haven’t supported every development downtown, far from it. I think of the Waterfront Hotel development, where we were successful, but unfortunately being surrounded by buildings of a similar height.

“It is a reality. The context has shifted, as noted in the report. This will not in my opinion, be something we will be able to prevent this. Furthermore, we need the units, every extra unit in our community has an impact on supply, which is the only real way that we’re going to have more affordable housing is by increasing supply.

“So it would be one thing if staff weren’t supporting it be one thing if the immediate context were different. We fought those battles with success at the Waterfront Hotel, but not so much elsewhere. So indeed, the ship has sailed on this location. But we need to also ensure that we have enough housing for the next generations in our community, and whatever the cost of these units are, the supply is, what will having supplies? What will make that happen? So I will be supporting this.”

Some observations: If Councillor Nisan thinks the development is going to include affordable housing, one has to wonder how much he knows about the developments he is approving.

It was quite clear that the Mayor and Councillor Kearns were going to have a go at each other. What is motivating Kearns? She likes the look of the bling the Mayor has when she puts on the chain of office.

Expect to see more of this kind of behaviour.

Mayor Med Ward: “I maintain that vision. I will stand by that vision. I will fight that vision and I will continue to be consistent in what I think the downtown should be”, For Meed Ward to issue the declarative statements –“ I maintain that vision. I will stand by that vision. I will fight that vision and I will continue to be consistent in what I think the downtown should be”, – has to be seen as a little on the self serving side. Back in 2010 she got herself elected on a Save the Waterfront platform. A little late in the game to bring back that vision.

By Pepper Parr By Pepper Parr

June 6th, 2025

BURLINGTON, ON

The playing of the national anthem and an Oilers’ jersey on the Chair reflected the mood of the event. They met as the Bay Area Economic Summit for half a day and started out the meeting by listening to O Canada being played and the Chair of the meeting wearing an Edmonton Oilers hockey Jersey.

There were workshops with a collection of qualified experts. One was labelled Sustainable Leadership, which one of the experts suggested meant that leadership was still breathing – always a good sign.

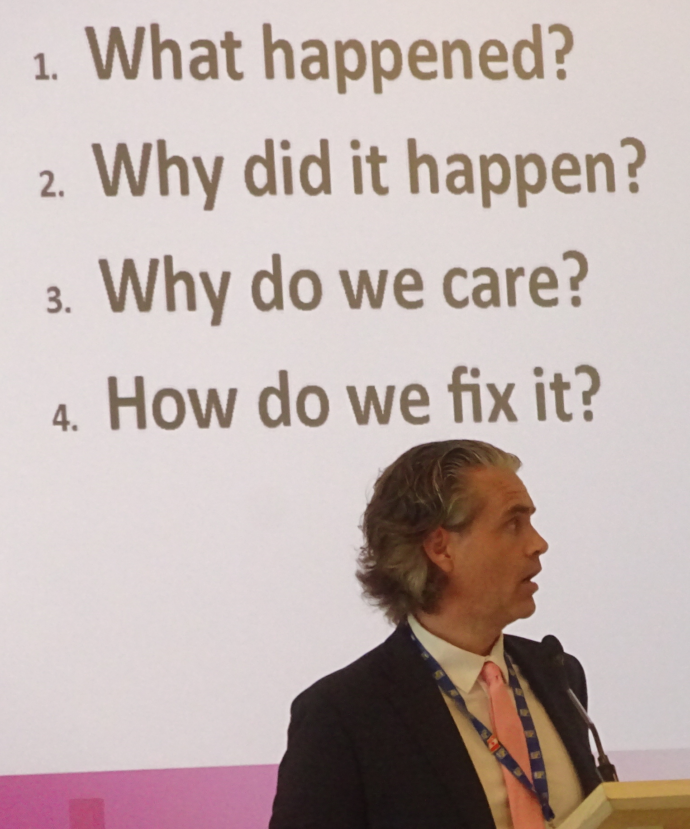

Mike Moffatt, the speaker who really came across with soundly thought-through arguments on what needed to be done to solve not only the need for housing, but for the solution to attracting the talent needed, was to assure there were properties they could afford to live in.

Terry Cado, president of the Chamber told the Gazette in an interview before the Summit took place that Chamber members were calling his office to complain about the problems they were having attracting talent to the city – the people they wanted to hire were finding that housing they could afford just wasn’t available.

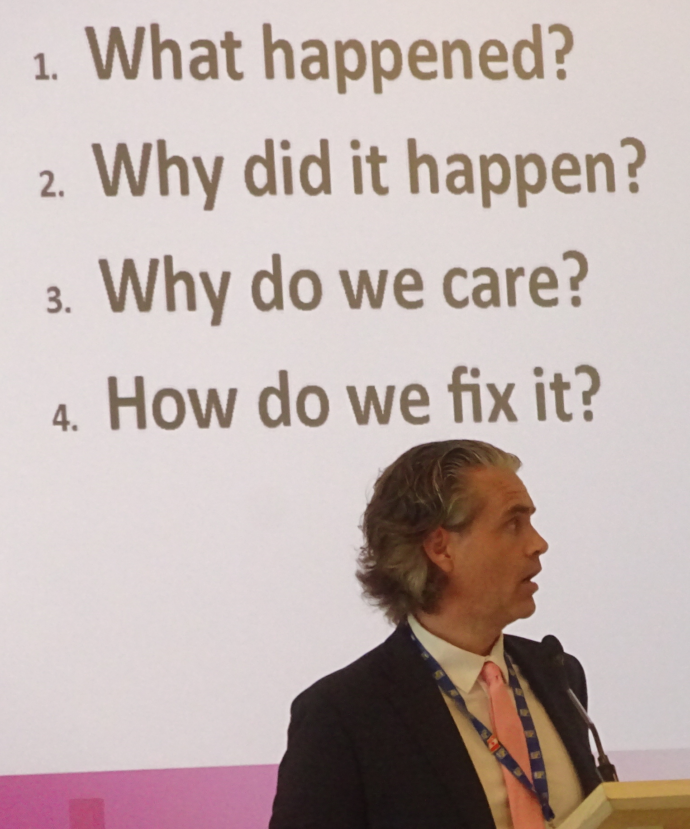

There were no obviously simple answers. And there was plenty of blame to spread around. Moffatt took to the podium and set out the issues.

There were no obviously simple answers. And there was plenty of blame to spread around.

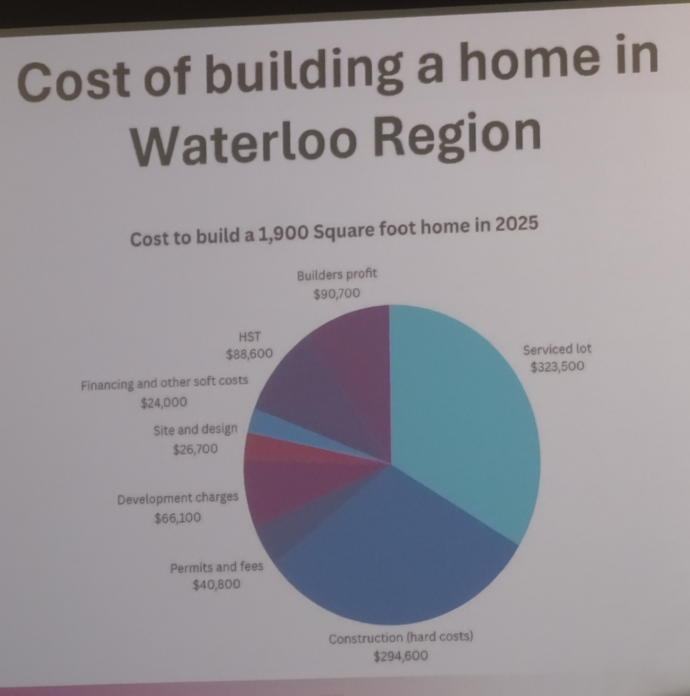

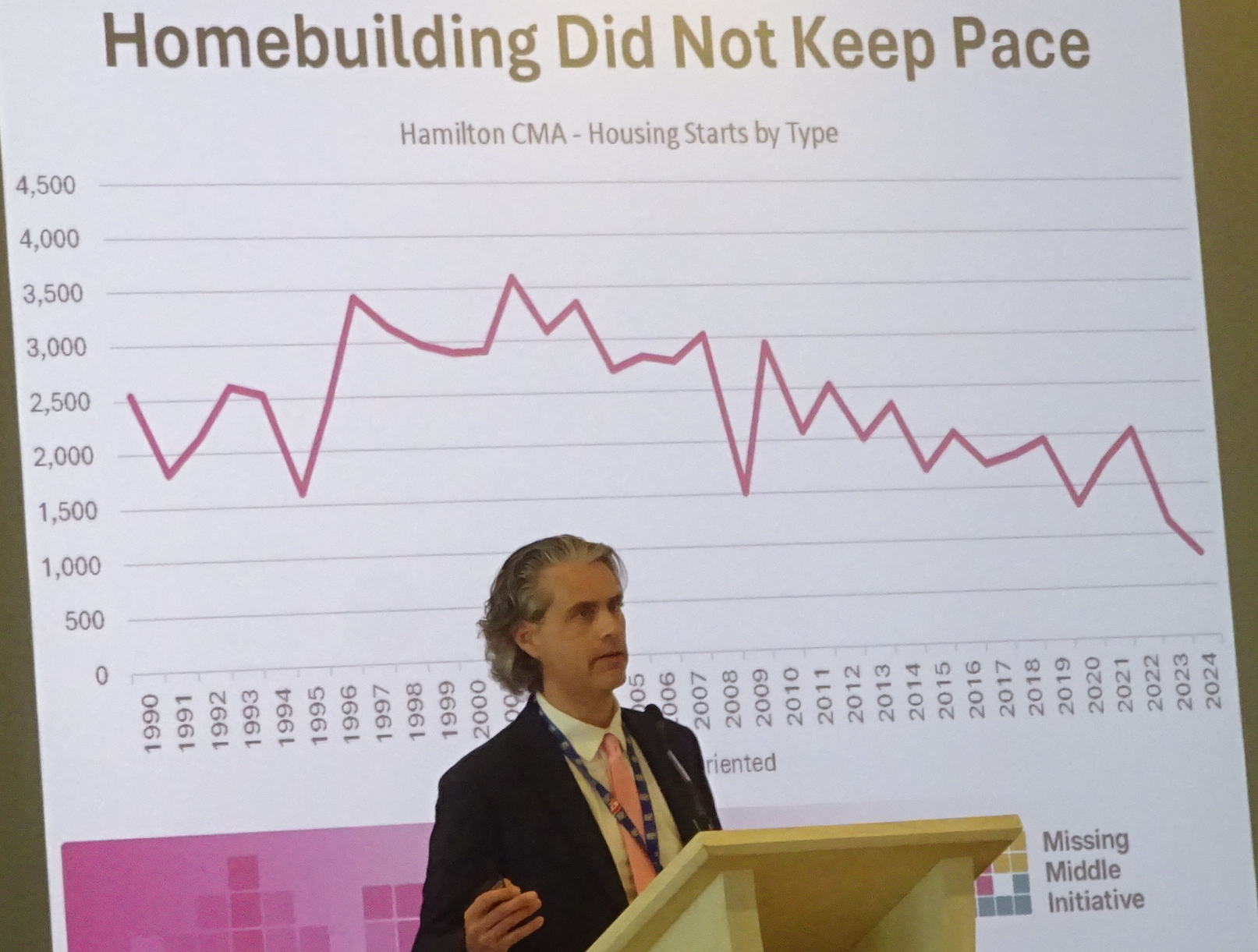

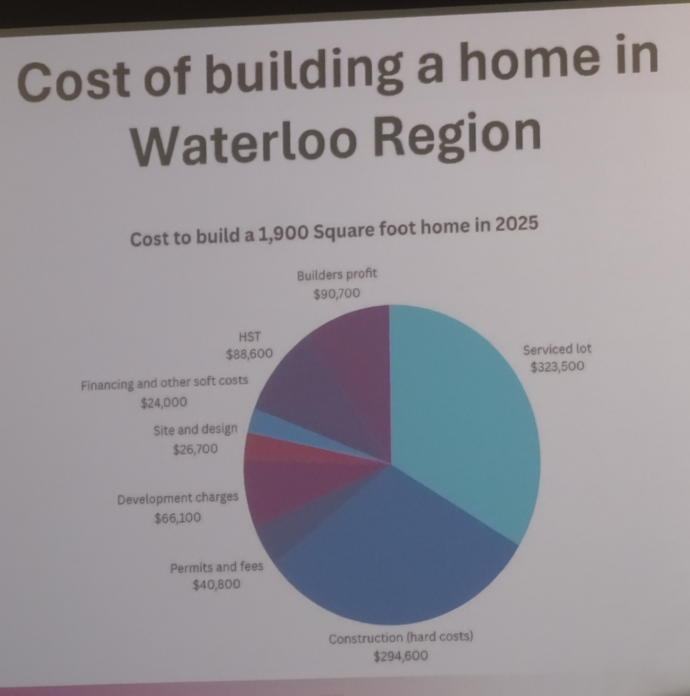

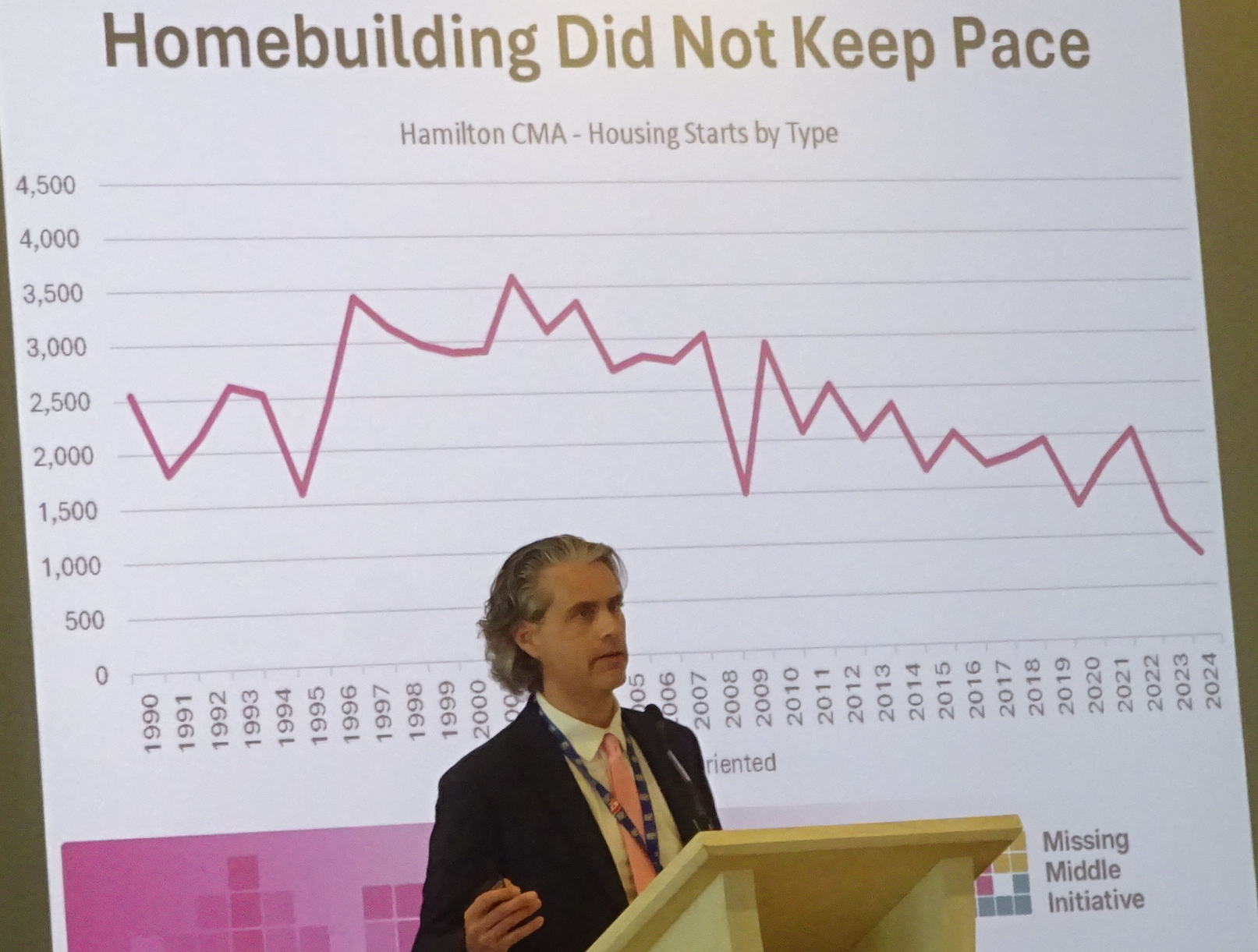

Where in this coat allocation do you try and lower the expenses? Moffatt started with what it costs to build a 1900 square foot home in the Waterloo Region and the got into housing starts and that it was impossible to build the number of homes that are needed. The province of Ontario has yet to meet a housing start target.

Restrictive land use policies, skyrocketing taxes on development, more red tape and a constantly changing policy environment weren’t helping.

When Moffatt added that Southwestern Ontario has the worst development process and planning at the municipal level in North America, you knew there was a real problem when you put that fact up against the Meed Ward claim that Ontario is the engine of the country’s economy.

There were solutions. Development charges could be moved from the developer to the home buyer. The current practice of lookin to the developer for these funds resulted in taxation on taxation. The developer has to pay the deveopment charges, marks them up and passes them along to the home buyer.

In the alternative development charges could be deferred.

Revise the GST and the PST – that would take 13% out of the cost of a home – that claimed Moffatt would put shovels in the ground.

He argues as well that the idea that growth should pay for growth, a hill that Burlington Mayor Meed Ward seemed prepared to die onzzz

Land costs have skyrocketed for the developer who banked land; things could not be better. For a developer trying to acquire land and put up new housing – it is a challenge. Impossible if the housing is going to be affordable.

Construction of new homes had not kept pace with the demand. Then M0ffatt made a stunning comment.

He said that in order to attract and retain 35-year-old workers, you need a healthy community that you can raise a 5 year old in.

He added: If the middle class cannot raise children in a community, that community cannot survive.

The loss of families, means the loss of a tax base and the loss of a workforce.

That’s what Chamber members were telling Terry Caddo

Moffatt: “Who will swing the hammer?” Moffatt suggested that “we need to get away from the mindset that a unit is a unit when we are counting. The 400 to 600 square foot condos that attracted investors are not housing for a family. We need three and four-bedroom units if families are to be accommodated.

There were very few questions at the end of the presentation. Mayor Meed Ward left the room before Mike Moffatt started his presentatrion.

Moffatt made a comment during the presentation that could have been used to sum up just where the province and its hundreds of communities are in solving the problems when he asked: “Who will swing the hammer?”

By Jeannie Løjstrup By Jeannie Løjstrup

June 4th, 2025

BURLINGTON, ON

What are your plans for Canada Day 2025? For millions of Canadians and international tourists alike, Burlington is one of the top stops of the year. From beautiful parks to incredible shopping opportunities and everything in between, Burlington has something for just about everyone. Let’s take a look at the best spots to visit in the city leading up to a thrilling Canada Day celebration!

Canada Day 2025

The holiday was celebrated in a grand way! Formerly known as Dominion Day, Canada Day takes place annually on July 1st and is the national day of Canada. While it’s most widely celebrated by Canadian residents, tourists from all around the world strive to be in the country’s big cities when the event kicks off. Thanks to the vibrant arts community, thriving culinary scene, passionate gaming culture, and general hospitality by the country’s residents, Canada Day has become a highly anticipated celebration both within and outside of the country.

While Burlington and Canada as a whole offers fantastic scenes to explore, there is also the wide array of online entertainment & gaming that one can delve into. From online sports such as the CFL, keeping up to date with the developments leading up to Canada day as well as the expansive gaming market that can be explored through Canadian slots there is no shortage of entertainment to be grasped while venturing throughout Canada.

With that said, there are some truly incredible locales to visit if you can make it to Burlington in person. Let’s take a look at some hot spots to visit this year!

Royal Botanical Gardens

Who says that Canada Day celebrations have to take place in civilization? For thousands of people around the country, spending the day enjoying the beautiful landscape offered by the Canadian wilderness is the perfect way to enjoy it. Whether you’re looking for picturesque bridges or vibrant flowers, the Royal Botanical Gardens is one of the most impressive attractions in Burlington.

Don’t worry if you aren’t exactly an avid hiker – this experience is easy, accessible and adaptable to your abilities.

Burlington Waterfront Trail

Take advantage of the warm weather this year and spend some time at the Burlington Waterfront Trail! This beautiful venue features both stunning waterfront views and modern amenities to create a truly unforgettable experience for visitors. This is a popular stop and might be fairly crowded depending on the time of day you visit, but this doesn’t mean that it’s not worth a stop. Pick an unusual time to visit and beat the crowds or hobnob with locals and tourists alike – the choice is yours.

Mount Nemo Conservation Area

Mt Nemo – on a good day you can see the CN Tower in Toronto. Owned by Conservation Halton, Mount Nemo Conservation Area is a beautiful park with space for the whole family. This includes friendly four-legged friends, who are welcome to visit with their human companions. If you’re looking for something a bit more challenging than a leisurely walk, then you might consider trying out rock climbing! Enthusiasts frequent the park for some top-tier climbing experiences.

Spencer Smith Park

Are you looking for an excuse to spend some time outside this Canada Day? If so, Spencer Smith Park is one of your best options. Located directly on the water and offering great expanses of green fields, this is the ideal place to gather with family and friends for a picnic.

Spencer Smith Park – where the lake is your front porch. Mapleview Shopping Centre

If spending time outside in the sun isn’t really your cup of tea, then you’re in luck! Burlington has a whole host of interior experiences. One of our favorites is the Mapleview Shopping Centre. A rare example of a mall that’s thriving in today’s economy, Mapleview offers beautiful facilities with high-end stores and restaurants. With that said, there’s something for just about every budget you can imagine. Whether you want to grab a bite to eat, like wandering around and aimlessly window shopping, or simply want to enjoy some time in an air-conditioned space, Mapleview might be the perfect option for you.

During tours all the food is made on the premises using recipes from the period of time the Ireland is Farm house was built. Ireland House Museum

Ireland House Museum is a fascinating trip back in time. Following the life of the Ireland family spanning three generations, the home has been painstakingly restored to reflect accurate period-specific décor. Antique furniture, intricate wallpaper and even complex ceiling carvings make this museum a must-see in Burlington this year.

Are you excited to celebrate Canada Day this year? The time is rapidly approaching, so make sure that you plan your day soon so that you can hit the ground running and enjoy every second.

By H. Randall-Wooden By H. Randall-Wooden

June 2nd, 2025

BURLINGTON, ON

Due to the combination of the convenience of playing from anywhere at any time with an enhanced game library and more bonus options, online casinos have become an incredibly popular choice. As player numbers shot up during the Covid-19 pandemic, many questioned whether the growth of online casinos was sustainable. However, as more and more players make the move into the virtual world, the future of online casinos looks increasingly bright. In this article, we’ll explore the factors behind this growth in popularity, including the wider choice at online casinos and the increased convenience of online play.

Enhanced choice at online casinos

Players use VR technology to customize their virtual avatar and immerse themselves within a vibrant casino environment. At online casinos, players are able to choose from a wider range of games. As well as classics like blackjack, poker and roulette, they can make the most of innovative offerings. These can include progressive jackpots, where the prize on offer grows as more people play, and virtual reality options, where players use VR technology to customize their virtual avatar and immerse themselves within a vibrant casino environment.

There’s further choice on offer through unique versions of popular casino games like slots. Players can still make the most of classic slots at online casinos, with all of the iconic symbols like fruit, money bags and sevens. However, there are also exclusive online options, such as interactive slots, in which players complete additional games that influence the overall game outcome.

Another popular online choice is live games, which allow players to interact with dealers in real time. They better replicate the experience of land-based casinos through enhanced set and sound design. Live versions of many casino games, including poker and baccarat, have become incredibly popular. They appeal to many players by combining convenience with a vibrant casino environment.

Options for all budgets

Whereas bonuses in land-based casinos are usually reserved for high spenders, there are options for every budget at online casinos. Players are able to use no deposit or low deposit offers to make the most of their budget. Online casinos also further promotions, including those linked to different game types, cashback bonuses and seasonal offers. The great variety of bonuses available at online casinos helps them appeal to a wide range of players.

Gambling online is incredibly popular across Canada, with 19.3 million active participants in 2024 alone. The most played game across these numbers is online slot machines, which offer players great value for money, with each spin costing as little as 10 cents. This makes slots popular with those who prefer lower-risk gambling or are looking to stretch their budget further.

Another popular option for players looking to manage their budget is sweepstakes casinos. These casinos use virtual currencies in the form of Gold Coins and Sweeps Coins, allowing players to participate in their favorite games without spending anything. To find the best sweepstakes casinos in Canada, players use one of the country’s most trusted affiliates in Time2play.com/ca-en. They analyze each sweepstakes casino across factors that include bonuses, playing experience and game choice, to find the top options. Sweepstakes casinos are continuing to increase in popularity and are set to help ensure the growth of the iGaming industry can be maintained.

A more convenient option

Anywhere – anytime Not everyone – especially those who live in more rural areas – has easy access to a land-based casino. If they do, they might find themselves challenged by dress codes or strict house rules. Online casinos allow all players to access their favorite games from anywhere at any time. They’re available 24/7 and only require a stable internet connection for use. Convenience is at the heart of the online casino offering, helping to ensure their growth remains sustainable.

During the Covid-19 pandemic, when live venues had to shut down, many turned to online platforms to continue playing their favorite games. This shift saw land-based casinos enter a decline, fueled by the abrupt drop in customer numbers. For example, in Alberta, land-based casinos saw their revenue fall by 24% following the pandemic. Many providers moved their offerings online during this time. The provincial government in Alberta even launched its own online casino to capitalize on the movement.

Incorporating new technology

The online gambling industry has always been at the forefront of technological advances, constantly evolving to provide the best service. As well as incorporating VR into gaming options, other technologies like cryptocurrencies and AI have helped to revolutionize the industry.

Cryptocurrency

One such change has been the adoption of cryptocurrency into the payment options available at online casinos. Cryptocurrency has a number of benefits for players, including lower fees, faster transaction speeds and better conversion rates. Many online casinos now offer payments from popular coins like Bitcoin, Litecoin and Ethereum, and there are also providers who specialize in crypto payments.

For players who may be concerned about uploading their financial information online, cryptocurrency allows them to make transactions with better protection. Crypto uses a high level of encryption, meaning that all information is unreadable to anyone who tries to access it. It’s also stored in digital wallets and uses blockchain technology to manage transactions, so the player’s information is protected.

Artificial intelligence

AI has been revolutionary for many industries and online casinos are no exception. It has been introduced across many different areas of the market, including for use in customer service chatbots. AI chatbots are able to answer customer queries much faster than a human representative, using data from the internet to provide accurate answers. Across online casinos, the adoption of AI bots has led to faster, smoother customer service.

In terms of security, AI is used to help monitor player patterns and detect those who may pose a threat to the provider. By analyzing vast amounts of data quickly, AI is able to look at player patterns, like response speed, and detect any who stray from the average. For example, AI can detect those who respond to questions or make choices faster than humanly possible.

One of the biggest threats the industry faces is a type of fraud known as bonus abuse, where players make multiple accounts to claim the same bonus more than once. It’s estimated that bonus abuse currently costs the industry as much as 15% of its annual gross revenue. It’s hoped that AI can be part of the solution to this problem by identifying multiple accounts using the same information, much faster and more accurately than a human can. It can also be used to identify suspicious IP addresses or patterns, and flag these to providers.

The future of online casinos

In the future, generative AI is set to play an even greater role in the online casino industry. While typical AI analyzes and identifies patterns that it reports to the provider, generative AI can actually use this information to create content. At present, a similar method is used to tailor advertisements and recommendations to a player’s preferences, based on their playing history. Generative AI will go a step further by automatically generating and sending marketing materials to a player based on their preferences.

Online casinos also benefit from the constant improvement of other technologies, like mobiles and live streaming services. Currently, some online casinos can’t provide as many live options on mobile as are found on desktop versions. As livestreaming technology continues to improve, this should allow casinos to provide their full library across devices.

Live gaming and VR better replicate the experience of land-based casinos through sound and visual designs. One of the things many players miss at online casinos is the social element found in land-based options. Live gaming and VR better replicate the experience of land-based casinos through sound and visual designs. Another big development has been in technology that allows players to interact during games. While this is currently limited to features like chatrooms, some casinos have been experimenting with technology that allows players to talk directly to each other, similar to the feature found in some video games. In the future, these technological developments could help to bring even more players to the online casino market.

Is the growth of online casinos sustainable?

Due to the convenience of being able to access online casinos anywhere at any time, their growth seems sustainable for the future. To continue to capitalize on this growth, online casinos have introduced greater choice in terms of options, like no deposit bonuses and enhanced game libraries with VR games. The industry also makes sure that it’s constantly evolving by adopting new technologies like AI and cryptocurrency. In the future, we’re likely to see these developments playing an even greater role at online casinos, helping to ensure their future. Overall, the growth of online casinos is sustainable because of the combination of convenience and improved playing experience that appeals to many players.

By Yanis Temby By Yanis Temby

May 27th, 2025

BURLINGTON, ON

The supplement business is much more than steroids. It is a well established part of the health sector. Supplements are one of the most talked-about — and misunderstood — parts of the fitness world. From protein powders to muscle builders, opinions range from “life-changing” to “dangerous.”

The truth? Most of these opinions are based on myths, not facts.

In this article, we’ll break down five of the biggest supplement myths and show you how modern, science-backed products can support your fitness goals when used responsibly.

Myth #1: All Supplements Are Just Steroids in Disguise

There are many different types of supplements. One of the biggest misconceptions is that any product designed to build muscle or improve recovery is automatically a steroid.

The Truth:

There are many different types of supplements — protein, creatine, amino acids, and more advanced options like SARMs or hormone regulators. Most of these do not function like steroids.

Some newer compounds, such as growth hormone secretagogues, support your body’s natural hormone production rather than replacing it. For example, MK-677 is a compound used to increase growth hormone levels naturally, without testosterone suppression or major side effects. It’s become a popular choice for improving sleep, boosting recovery, and supporting lean muscle development.

You don’t need to be a pro bodybuilder or a competitive athlete to benefit from supplements. Myth #2: Supplements Are Only for Professional Athletes

You don’t need to be a pro bodybuilder or a competitive athlete to benefit from supplements.

The Truth:

Most people using supplements today are regular gym-goers who want to feel stronger, lose fat, or improve energy. Some supplements may be especially helpful as you get older, when natural hormone levels begin to decline.

With the right support — combined with solid training and nutrition — even beginners can see better, faster results. Many modern options are accessible, easy to use, and backed by clear guidance and quality control.

Myth #3: All Supplements Are Unsafe or Unregulated

Some people avoid supplements altogether because they worry about side effects or unsafe ingredients.

The Truth:

Quality varies — but that’s true of any industry. There are trusted brands that provide lab-tested, clean, and well-documented products. Look for supplements that use transparent labeling, organic carriers (like MCT oil), and published purity testing.

For example, SARM Canada is one company that emphasizes product purity, accurate dosing, and safe usage guidelines. Their products are formulated with high standards and are trusted by users across North America.

A strong foundation in nutrition and exercise is essential. But even with perfect consistency, your body eventually reaches a limit. Myth #4: You Can Get the Same Results From Diet and Training Alone

A strong foundation in nutrition and exercise is essential. But even with perfect consistency, your body eventually reaches a limit.

The Truth:

Once progress slows, smart supplementation can help. Certain compounds improve recovery, stimulate muscle repair, and promote fat metabolism in ways that training alone cannot. For example, MK-677 — mentioned earlier — is often used to support deep sleep, better recovery, and improved muscle fullness, especially in experienced lifters or during calorie deficits.

When paired with a solid plan, these tools can help you train harder, recover faster, and see results more quickly.

Myth #5: Muscle-Building Supplements Are Addictive or Dangerous

The fear around supplements often stems from extreme cases involving unregulated or misused products.

The Truth:

Responsible use, correct dosing, and cycling make all the difference. Many well-researched compounds do not cause addiction or hormonal crashes when used as recommended. Most users follow a short cycle and then take a break to let the body reset.

Choosing products that include usage instructions and safety information helps users stay on track and make informed choices.

Gender and age are not factors that keep people away from muscle building. Final Thoughts

Supplements are not a replacement for effort — they’re a way to get more out of the work you already do.

The key is education and quality. Look for clean, trusted options that support muscle growth, fat loss, recovery, and overall well-being.

Forget the myths. Trust the science. And make sure you’re choosing supplements that support your goals without compromising your health.

By Diana Kharchenko By Diana Kharchenko

May 27, 2025

BURLINGTON, ON

Properly installed flagstone lasts and adds value to a home.

Flagstone patios are timeless. Natural, durable, and undeniably charming, they bring texture and personality to any outdoor space. But even the most beautiful surfaces aren’t immune to wear and tear. One day you’re sipping coffee on your back patio, and the next—crack. A hairline split turns into a spiderweb. Suddenly, your yard’s crown jewel doesn’t feel so flawless.

If you’ve noticed cracks forming and don’t know where to start, you’re not alone. Early flagstone repair can save time, money, and the overall look of your landscape. And understanding what causes flagstone to crack in the first place? That’s the first real step toward a lasting fix.

What Makes Flagstone Special—and Vulnerable

Flagstone isn’t just one kind of stone. It’s a group. Sandstone, slate, limestone, and bluestone all fall under its umbrella. These sedimentary rocks split naturally along flat planes, creating those iconic slabs we all know and love.

But here’s the catch: flagstone’s beauty lies in its irregularities. Each piece is unique—formed by nature, not a machine. That natural appeal also comes with quirks. Some stones are denser. Some absorb more water. Some handle cold like champs, while others crumble under frost.

Translation? Even when installed perfectly, flagstone isn’t invincible.

It performs well under the right conditions. But add moisture, shifting ground, or repeated pressure, and cracks become part of the story.

Flagstone ready for installation. Freeze-Thaw Cycles: The Silent Saboteur

Live in a region with cold winters? This one’s for you.

Moisture is a flagstone’s best friend and worst enemy. Water seeps into tiny pores and settles into joints. When temperatures drop, that water freezes. And when it freezes? It expands—like popcorn in a microwave.

Crack. Pop. Push. That expansion places stress on the stone, causing splits, flakes, or full-on breaks. It can lift slabs from their bedding, shift joints, and widen existing cracks in just a few freeze-thaw cycles.

Over time, even the toughest flagstone can’t stand up to the pressure. Especially if it wasn’t sealed or graded correctly.

The result? A once-smooth surface starts to feel more like a jigsaw puzzle.

Improper Installation: A Faulty Foundation

Even the best flagstone needs a good base. Without one, it’s like building a castle on sand.

Installation is critical – don’t crimp on what you pay. Many cracks trace back to poor installation. Weak bedding layers, loose subgrade, or the wrong mortar can set the stage for disaster.

Sometimes installers cut corners with materials. Skipping gravel layers. Using thin mortar. Failing to compact the soil. It saves time upfront—but costs more later when the stones shift, settle, or break.

Think of flagstone like a puzzle laid over a trampoline. If the base isn’t solid, pieces will move—and eventually crack under pressure.

A proper foundation should include compacted base gravel, bedding sand or mortar, and solid edge restraints. Anything less, and you’re walking on borrowed time.

Heavy Loads and Repeated Pressure

Flagstone isn’t made for everything. Yes, it’s sturdy. But it’s not concrete.

Driveways, heavy furniture, large grills, or frequent foot traffic in tight areas can cause stress. Over time, that pressure leads to hairline fractures that deepen with each season.

Even smaller issues add up. A wheelbarrow rolling over the same joint. Patio chairs scraping back and forth. The repetitive motion works like erosion—small changes, day by day, until something finally gives.

To keep your flagstone patio intact, distribute weight evenly. Use protective pads under furniture. Avoid placing heavy objects on unsupported slabs. And most importantly, install stones thick enough to handle their environment.

Water Drainage and Erosion

Water is nature’s sculptor. Left unchecked, it carves, shifts, and moves everything in its path—including your patio.

Poor drainage is one of the biggest culprits behind flagstone damage. Water that pools under or around your stonework gradually erodes the bedding layer. As the support weakens, stones sink or tilt. The added movement increases the chances of cracking.

Erosion around edges also leads to exposed joints and shifting stones. And if the joints aren’t sealed or filled correctly? Water goes straight down—and the cycle begins.

Simple fix? Grade your patio correctly. Water should always flow away from the structure, never toward it. Add perimeter drains or French drains if necessary. And maintain joint integrity by checking and refilling regularly.

Age, Weathering, and Natural Wear

Even the best-built patios eventually show their age. Flagstone may last decades—but like anything exposed to the elements, it weathers.

Sunlight fades colors. Wind and rain wear down edges. Freeze-thaw cycles slowly chip and crack. It’s not neglect—it’s nature doing its thing.

The mortar used today is much more resilient than five years ago. Older patios may also have outdated materials. Mortars used 20 years ago weren’t always flexible or weather-resistant. Today’s products are designed to move with the stone, not fight against it.