By Pepper Parr By Pepper Parr

October 24th, 2022

BURLINGTON, ON

It didn’t take the provincial government any time at all to take some decisive moves – tomorrow afternoon Steve Clark, Minister of Municipal Affairs and Housing, will introduce legislation outlining the next phase of Ontario’s plan to build more homes faster.

Minister of Housing is going to tell the Legislature about his plans for building houses – a task that the municipalities have to make happen. The Minister will hold a technical media briefing via teleconference at 1:45 p.m. What he says at that briefing will not be attributable – it will be given as background to the legislation he will be tabling in the Legislature at 3:00 pm

While voters across the province are scurrying about to decide who they want to elect as their city councillors the provincial government is getting ready to introduce a bill that isn’t expected to make the job these new city council will have to do in the next four years.

Get ready for a bumpy ride

By Staff By Staff

October 24th, 2022

BURLINGTON, ON

From the Mayor via Twitter:

Dear resident, This morning I tested positive for COVID. Fortunately symptoms have been mild so far. I’m following official guidance & protocols & self-isolating. Please stay healthy everyone. I look forward to seeing you soon! For COVID guidance visit: https://halton.ca/For-Residents/

Mayor takes part in Chamber event Thursday evening.

Not a mask in sight. Some servers were masked Huge crowds.

Full disclosure: Gazette editor covered the event.

By Jeannie Løjstrup By Jeannie Løjstrup

October 24th, 2022

BURLINGTON, ON

When individuals engage in online casino gaming, two things bring satisfaction. The first is the excitement surrounding gameplay. The second and the more important of the two is to win rewards.

Manage your money – keep what you gamble under control – use whatever system works for you. Online casino gaming offers people the possibility to win significant amounts of rewards at a go. That’s why a lot of people enjoy playing them. Nevertheless, while expecting the tables to turn in your favor, you could get hit with a barrage of losses. If you don’t practice proper budget management, you could experience a big drop in your account balance.

The great part of iGaming is that gaining access to a platform introduces you to a wide array of high-quality and exciting games. So that you don’t get carried away in the euphoria that these games induce, you need to learn budget management.

Stick to your financial plan

The first rule of budget management in online casinos is to stick to your budget. When you insert your casino login details into an account and begin gaming, you aim to win as many rewards as possible. However, many gamers forget that while there’s a good chance of winning, the probability of losing is equally high.

The smart thing to do is to remember that you have to bet on an amount you can afford to lose. You need to establish a fixed amount you’ll take out of your earnings for casino gaming.

This money should be calculated after you’ve paid all your bills and taken out your savings. Establishing a budget and sticking to that plan will ensure you remain covered when you hit a string of losses.

Avoid placing high bets

The mistake of wagering more than they can afford on a single bet. Many casino gamers make the mistake of wagering more than they can afford on a single bet. When they get hit with a loss, they get disoriented and make panic bets, thereby losing more money. Ultimately, a big chunk of their account balance goes away, forcing them to start all over.

To become a smart casino player, you need to understand that your big bets have to correlate with your account size. This way, you’ll determine what constitutes a big wager for you.

You can start by ensuring you never bet more than 1-3% of your entire account balance on a single bet. This way, even if you experience a few losses after a string of wins, you’d be largely unaffected by them.

Eliminate desperation and emotions

One of the worst errors that casino players make is to include emotions in the game. The most glaring instance is when players experience losses and continue to increase their wagers as the game progresses. Sometimes even expert gamers give in to desperation and emotions.

It is vital to manage your emotions and avoid betting an increased amount after experiencing a loss. One great way to do this is to set a stop loss limit where you’ll end a gaming session after a loss target has been reached. This way, you’ll quickly understand that chasing losses never works out for anyone.

When you desperately try to recover your losses by engaging in more games, there’s a high likelihood of draining your account balance. Hence, you need to avoid going too far when gaming.

Monitor your gaming results

You can only know how well you perform at games when you monitor your casino gaming results. Several gamers lose themselves in the fun of the games and forget how much cash they’ve burned through.

If you’re more traditional, you can get a pen and a book to monitor your wins. However, an app like Microsoft Excel or Google Sheets is the more effective way that allows for quick computation.

This way, you’ll be better poised to realize when accumulating aggregate losses. Another benefit of monitoring your gaming is that you’ll be able to determine when you need to take a break and strategize This way, you’ll be better poised to realize when accumulating aggregate losses. Another benefit of monitoring your gaming is that you’ll be able to determine when you need to take a break and strategize

Although people engage in casino gaming to gain excitement, many consider earning rewards to be the main motivation for playing them. Nevertheless, many individuals get so focused on getting prizes that they forget casino gaming can go the negative way.

Understanding budget management for casino gaming will go a long way to ensuring you have a better experience. You can start by sticking to a financial plan, avoiding large single bets, monitoring gaming results, and eliminating desperation.

By Staff By Staff

October 24th, 2022

BURLINGTON, ON

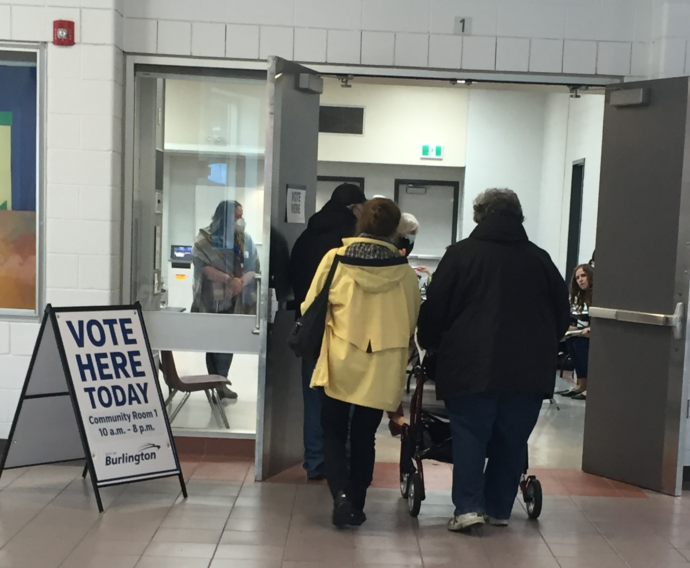

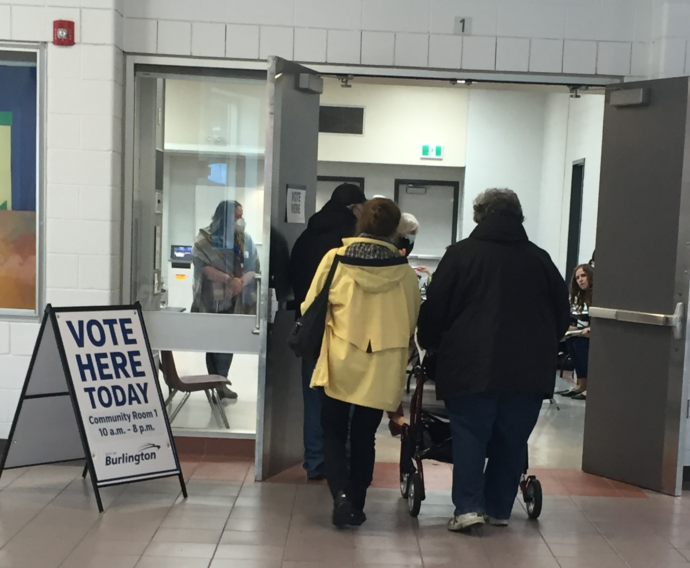

These people were voting in the two advance polls Monday, October 24 is Election Day for Burlington’s municipal election.

This is the last opportunity eligible voters have to cast their vote and choose who they want to represent them on Burlington City Council, including Mayor and City Councillor(s).

Eligible voters will also vote for Halton Regional Chair and School Board Trustee.

To date, 18,998 eligible voters in Burlington have cast their vote in the municipal election, either by voting online (14,980) or at an advance poll (4,018) earlier this month.

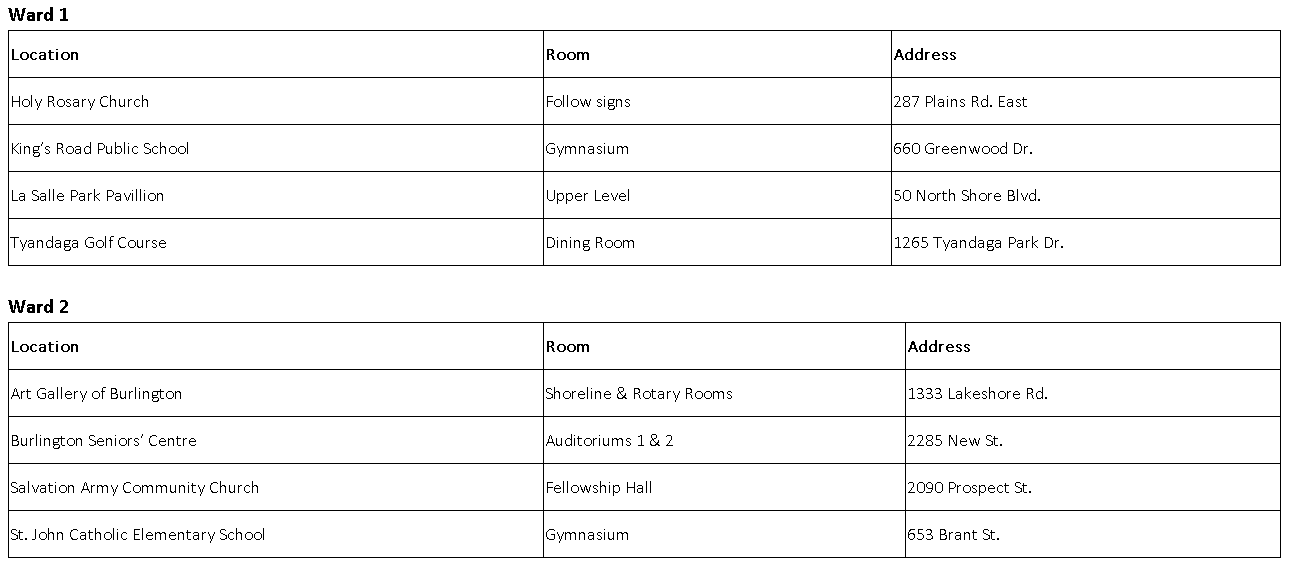

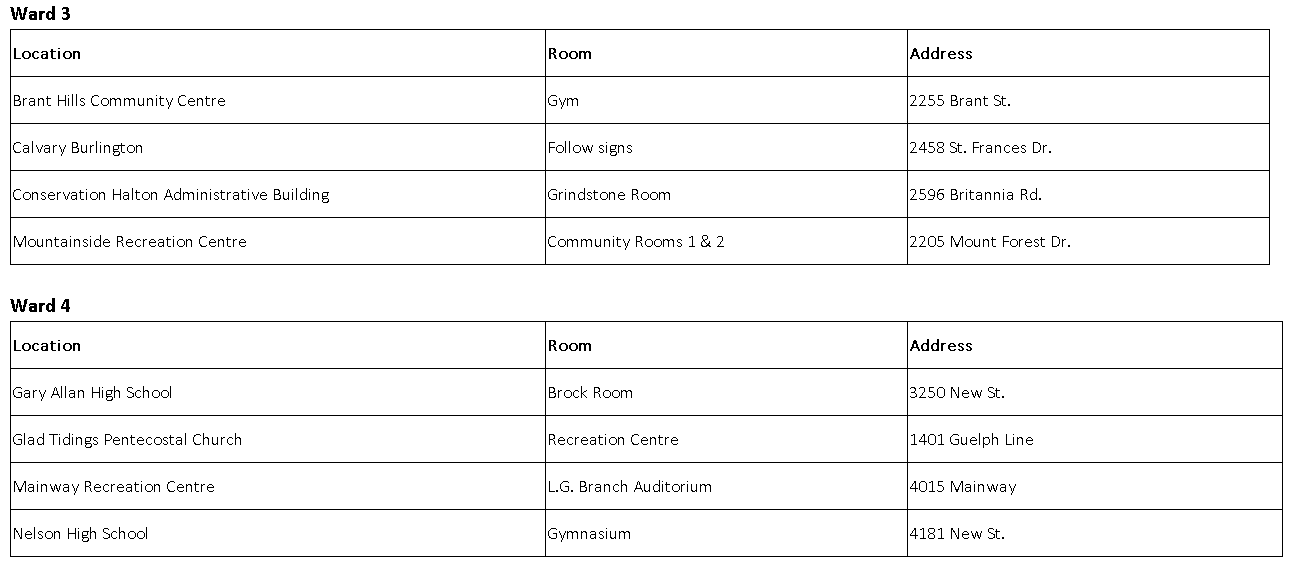

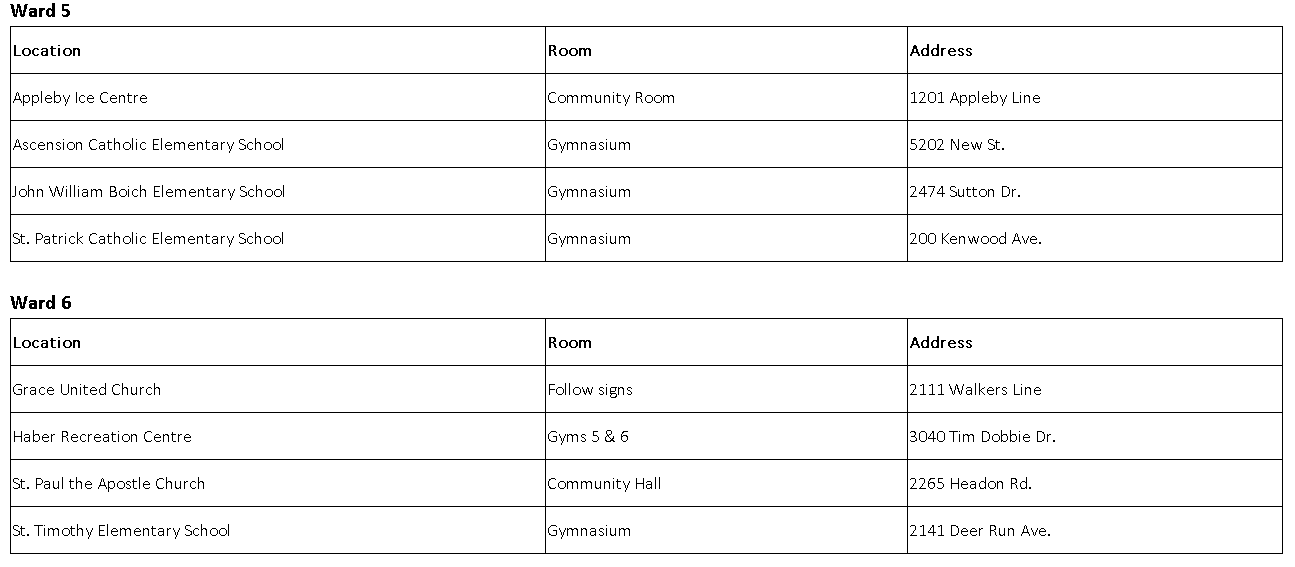

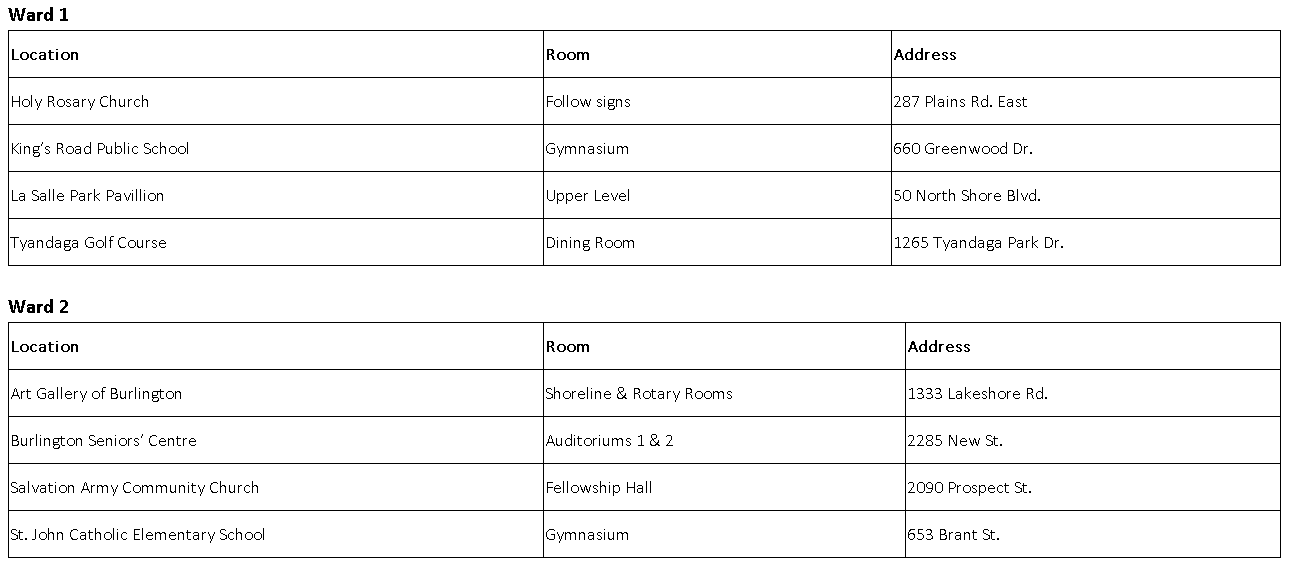

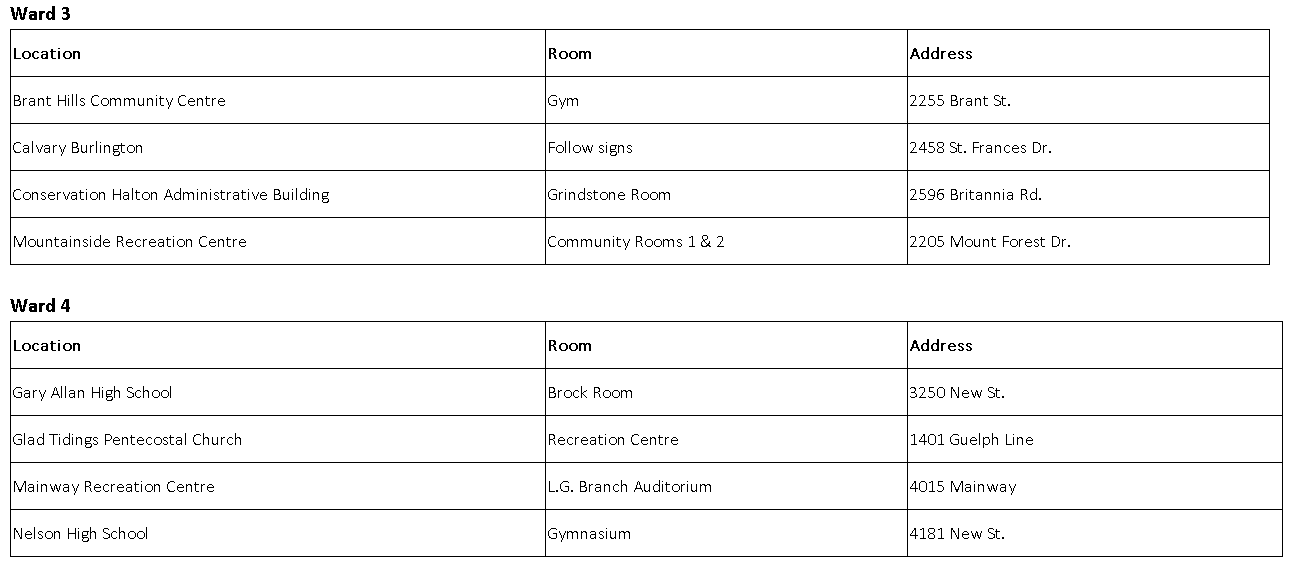

On Election Day, voting locations will be open between 10 a.m. and 8 p.m. There are four voting locations in each ward. Eligible electors can vote at any voting location in their ward.

To determine which ward you live in, and which voting location is closest to you, view the Voter Information Letter sent to the homes of eligible Burlington voters earlier this fall. If you did not receive a Voter Information Letter, you can complete the Voters List form on myvoteburlington.ca. The results will display the ward you live in and your designated voting locations.

A complete list of voting locations can be found on the “Voting Locations” web page on myvoteburlington.ca. All locations are accessible. The 24 voting locations include:

What to bring when you vote

Before heading out to a voting location on Election Day, remember to bring:

• your Voter Information Letter – if you do not have a Voter Information Letter, you can still vote.

• one piece of identification that has your name and address on it. Photo identification is not required. See a list of accepted forms of identification at myvoteburlington.ca.

Burlington is a city where people, nature and businesses thrive. Sign up to learn more about Burlington at burlington.ca/subscribe and follow @CityBurlington on social media.

Voting Results

The City Clerk declares the official election results as soon as possible after voting day on Oct. 24.

Unofficial results will be shared at myvoteburlington.ca/results in real time on election night on Oct. 24.

Voting results will be updated on a regular basis throughout election night. Residents can check myvoteburlington.ca/results regularly to get the most recent results.

By Staff By Staff

October 24th, 2022

BURLINGTON, ON

What looked like a very sick coyote was seen at Central Park on Sunday between 1 and 5 pm It was planned as a pleasant picnic at Central park on a nice Sunday afternoon.

It turned out to be an interesting, and an a bit concerning time.

Yards away from where the picnic was taking place a coyote appeared.

It was young and looked to be in very poor shape.

Between 1 and 5 today they reported 10 sightings of what looked like a very sick animal.

The small group didn’t feel threatened but they kept their eye on the coyote and called Animal Control services – it was Sunday and they were closed.

How bizarre do they think Coyotes honour the Sabbath day!

It would appear there is still a coyote problem in Burlington.

By Santi Tranquillo By Santi Tranquillo

October 24th, 2022

BURLINGTON, ON

What can you expect from the work of a particular corporate software? That’s a pretty interesting question, if you take the boardroom portal into consideration. Today we will answer it.

The Key Factors to Consider When Choosing Check Board Software

You should expect great results when you choose an entire ecosystem for board portal software. But what can you expect from a boardroom, because there are so many choices on the market right now that you can’t keep your eyes open? The functions are different or differ not so much that attention is attracted to a certain software. We’ll help you figure out what you should expect.

The Board Room has traditionally been a place where Board members meet – that meeting can now be virtually and more effective than meeting in a room – even if it is nicely furnished. Follow this article.

Understand the Boardroom Portal

Simply said, the board portal is a handy tool for the most effective approach to handle a board of directors. It is not management, per se, but rather a tool for developing and organizing ideas that arise during interactions. You can create meetings using both built-in video conferencing capabilities and third-party applications like Skype or Zoom with this simple yet powerful software.

As the conversation proceeds, you will employ tools such as:

● Cross-platform. In most circumstances, if you prefer Android phones and your interlocutor prefers Windows, there is no problem. You’ll both use the same app and have no trouble with the functions.

● Using a paperless meeting solution to work with documents and files. This is required in order to generate and work with documents when discussing a concept. You may view and change them during the meeting. By the way, all of your modifications will be saved in order to track user behavior.

● Intelligent voting is included in. Nobody will notice them because they frequently include built-in tracking of each individual participant’s behavior. In addition, they appear in such a way that they just cannot be ignored.

As you have understood, you can expect a nice implementation of at least the above features. We’ll deal with the basic features right now.

All the documents are reports can be instantly available to a Board of Directors making decisions in real time Basic Boardroom Portal Features

Eventually we come to the resolution of your question about what you should expect in terms of functionality at all. Each particular online board meeting portal has slight differences in functionality between them, but don’t despair. You probably won’t even notice them if your area of business lies in the legal or economic fields. You can really only notice it strongly if you’re in some unpopular area and they don’t make special frameworks for it within this kind of software. Check board portal software comparison guide and now we move on to the basic functions:

● The ability to create agendas for the day, month, or year. Generally speaking, the creation of agendas is a rather important element for each individual meeting or meeting. It is what the staff or management staff use to deal with urgent issues or to orient themselves. In every single example of board management software, this is a must because of its relevance.

● Distribution of security roles. This is necessary to ensure that each user has their own place and appropriate capabilities. You will assign meeting administrators who will log the entire process and monitor the efficiency of the meetings, and you will also assign access to different documents to each individual user or an entire group. This is necessary in the case of using documents within a meeting.

● Ability to vote and make selections. Think that during every meeting you come to some particular choice or conclusion. That’s the point of the meeting, to put it bluntly. Different tools for voting and tracking the activity of each individual participant in the process will help you significantly develop the progress of your company.

● Having a file and document manager. This is quite useful if you’re actively parsing documentation during meetings. You can use it immediately within the program, rather than sending a specific file to each individual participant. This is really convenient even if you compare it to traditional document flow. After all, it used to be like this: you had to print out paperwork, distribute paperwork, give paperwork according to competency level. Who needs this now that there is electronic document management?

● Various plug-ins that can automate the work processes that take place specifically in your workplace. These plug-ins can be turned on and off at will, and can be downloaded or removed from the main program. This is available in almost every single example of virtual boardroom software.

This is what you can expect from any software you end up choosing. More features like artificial intelligence gathering may also be provided, but they are not the basic ones.

The Best Ways to Use These Products

By following a few simple guidelines, you can get the most out of a virtual meeting room. They will reveal major chances to save you time and money while also reducing waste and mistakes.

Get the most out of a virtual meeting room ● Ascertain versatile compatibility. Your virtual board software must support all major platforms and operating systems, including desktops, laptops, and smartphones running Windows, Android, Mac OS, and iOS. Choose such a person from the start. If you had to choose one with unique features, but just for Windows desktops, you may try to request that your supplier produce and include new versions in the regular package.

● Make the initial configuration for your business from the earliest stages of use. Then test how it works.

● Automate everything you can automate. It will simplify your entire workflow, so use this feature as often as possible.

By Pepper Parr By Pepper Parr

October 22nd, 2022

BURLINGTON, ON

The last minute rush to get to that very last voter will end today

Voters need a chance to think about the choice they make and to give thought to where the city is going to go during a time when there isn’t all that much that is certain.

The 2022 election has certainly been different; there were no third party advertisers gumming up the works.

There weren’t any robo-calls that we are aware of.

There was a thirst for change in 2018 and that is what the city got: 5five brand new Council members and a new mayor.

Many voters are sitting back and asking themselves: How did that work out for us ?

Ward 6 Councillor Angelo Bentivegna  Ward 3 Councillor Rory Nisan Perhaps two, in the opinion of the Gazette, haven’t work out all that well (Rory Nisan ward 3 and Angelo Bentivegna ward 6); a third finds that he is not going to be able to fully represent his constituents if he is re-elected. Kelvin Galbraith was advised that this would be the case by the Integrity Commissioner last March.

Galbraith had a responsibility to advise his constituents last March that this was the case. The public didn’t become aware of the situation until ward 1 activist Tom Muir managed to get the document from Galbraith who had a much different interpretation that most people of just what the Integrity Commissioner had to say.

The Mayor basically didn’t campaign. She relied on photo ops and two public appearances where there could have and should have been s full-scale debate.

Former Councillor Rick Craven wrote a scathing opinion piece that the Gazette republished.

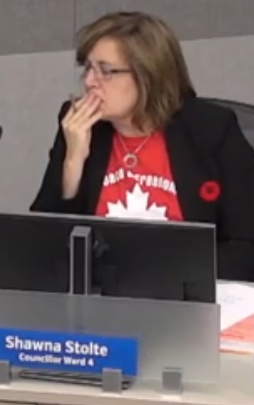

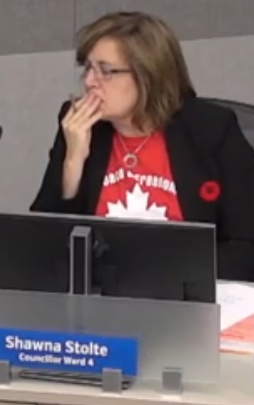

The people in ward 4 have a tough decision to make: do they understand and accept the decision their Councillor Shawna Stolte made to release what was confidential information public.

She was docked five days pay for what she did.

The Gazette thinks Stolte did the right thing; we further believe that the report from the Closed Session Investigators made it very clear that Burlington had to clean up its practices and be more forthcoming with information when the come out of a Closed Session of Council. The Gazette thinks Stolte did the right thing; we further believe that the report from the Closed Session Investigators made it very clear that Burlington had to clean up its practices and be more forthcoming with information when the come out of a Closed Session of Council.

In our ten years of covering Burlington City Council we have never seen as many Closed Sessions before. Admittedly, there have never been as many contentious development applications being submitted either.

During the budget there was next to nothing debated about the decision to buy the Bateman High School site; the words “forthcoming budgets’ didn’t get much in the way of attention.

From our point of view the best thing for the city is a Council that has Robert Radway winning in ward 1; Lisa Kearns winning in ward 2; Jennifer Houndslow winning in ward 3; Shawna Stole holding her seat in ward 4, Paul Sharman holding his seat in ward 5 and Rick Greenspoon winning in ward 6.

Sharman and Kearns are certain – the others are in the hands of the voter.

Marianne Meed Ward is certain – we expect with a smaller plurality.

Expect Gary Carr to be returned as Regional Chair which is a shame. Carr has served the people well since 2000, but it is time for a younger, fresher proven voice to lead. Andrea Grebenc would be an excellent choice.

Related news media

What the Integrity Commissioner had to say to Galbraith

Stolte and her Integrity issues.

What Craven told the public about Meed Ward

By Staff By Staff

October 22nd, 2022

BURLINGTON, ON

It may not be seen as a big deal by some – but traffic control and keeping drivers who are under the influence of alcohol or some drug is a full time job.

The public is a big help when they cal the police and report an erratic driver.

Two Halton Regional Police Officers were the Co-Recipients of MADD Officer of the Year Award

Constable Olga Kripak and Constable David Rivers, have been named co-recipients of the 2022 MADD Halton Region Officer of the Year Award.

The annual award is part of an initiative undertaken by MADD Halton Region to recognize officers for their commitment and contributions to the prevention, apprehension, and prosecution of impaired drivers.

Recipients are identified through the use of police analytics.

Inspector Craddock congratulates Constables Kripak and Rivers who arrested a combined total of 36 impaired drivers. In 2021, Constables Kripak and Rivers arrested a combined total of 36 impaired drivers. The pair also administered more than 350 roadside tests, and conducted nearly 360 hours of RIDE enforcement.

Constable Kripak is a member of the 2 District (Oakville) District Response Unit; Constable Rivers is assigned to Uniform Patrol in 1 District (Milton and Halton Hills).

Inspector Julie Craddock of the HRPS Traffic Services Unit said: “MADD’s award is a testament to their dedication to keeping our roads safe. Their efforts on this front have, no doubt, saved lives.”

Driving while impaired remains the most prominent contributing factor to serious collisions in Canada. The Halton Regional Police Service thanks MADD Halton Region for their tireless efforts to eliminate impaired driving in Halton and across Canada.”

On average, one-third of impaired driving charges laid are the result of members of the public calling police after observing suspected impaired driving. If you have reason to believe a fellow motorist is driving impaired, pull over safely and call 9-1-1.

By Pepper Parr By Pepper Parr

October 22nd, 2022

BURLINGTON, ON

We did a very short piece on the Chamber of Commerce Distinguished Entrepreneur Award dinner that took place on Thursday.

There was too much election material to get published.

Jeff Paikin greeting those who came to witness his being names the Distinguished Entrepreneur for 2021 The event was the first that people from the construction/development community could take part – there was room for 525 people and they squeezed in 531, people were actually turned away.

These events can at times be very very dry and drawn out. This one was different. First the place was packed and people were in a good mood.

They were there to witness the awards being given to Jeff Paikin as the 2021 recipient and Conrad Zurini as the 2022 recipient of the Chamber of Commerce Distinguished Entrepreneur Award.

Steve Paikin being prepped for his part of the evening Steve Paikin, Jeff’s brother was the MC and Ian Hanamansing, of CBC National News fame did some of the introducing. He and Jeff both attended Mount Allison University in New Brunswick at the same time.

CBS’s Ian Hanamansing enjoying a selfie moment with a Chamber of Commerce staffer The Chamber took an idea from the Gogeco people and set the award winners up in comfortable wing back chairs where they answered question and spoke about the way they saw the industry they were involved in and deeply committed to.

It was interesting to see developers talk about the way they see what they do.

During the past week the Gazette has had a reporter out on the street asking people what they felt were the important issues.

More than 80% said – over development.

Conrad Zurini’s mother; proud of a son that has been an entrepreneur since the age of 12 Jeff Paikin said in his comments they his company was building homes for people and at the same time creating community where children would be raised.

Conrad Surini is in the business of selling those homes to people. In his remarks he made it clear that he fully understood the challenges people face in today’s market and what the economists and bankers suggest we are going to be in for some time

Natasha Piroutz; Strategic Communications and Engagement Manager, Burlington Chamber of Commerce The developers are the risk takers; they buy the land, pay the mortgages while they wait for the right time to start digging holes and putting in basements and garages.

It wasn’t all speeches. Marnie and Larry Paikin who have been patrons of the Canadian Brass and were able to convince them to do a live performance.

It was an opportunity for the woman to wear their best. Natasha Piroutz, Chamber of Commerce, was on hand to make sure that the schedule set out was adhered to as much as possible for events like this.

Ron Foxcroft who was introducing Conrad Zurini had said he wanted people to be in their cars no later than 9:00 pm – and for the most part that is the way the evening ended.

This is what a SOLD OUT event looks like.

By Staff By Staff

October 22nd,2022

BURLINGTON, ON

The following was published recently in another Burlington media: Local New.

It is being published in the Gazette with permission.

MARIANNE MEED WARD / IMAGE VS REALITY

An Opinion From Rick Craven

Marianne Meed Ward is edging toward re-election as Mayor of Burlington – and why not? She is a Burlington celebrity. She has a kind of sparkle; a type of magnetism that draws in folks who are fed up with government and demand quick solutions to complex problems.

She panders to these people with aspirational rhetoric about what could and should be accomplished. She spins things in such a way that people believe she is the super-hero who can make it all happen.

The problem is that she seldom points out the political, financial, legal or jurisdictional challenges and, when things don’t go her way, she simply blames the Province or the former Mayor.

Meed Ward’s campaign to beguile the public is reinforced by her influence over the City Hall Communications Department along with her savvy use of social media. She embraces any occasion on the calendar, any cause, campaign, crusade or special interest group to justify a tweet or post that includes her name.

“Meed Ward is not shy about seeking publicity”, once wrote columnist and former Alderman Joan Little.

Meed Ward’s efforts to charm the public are aided by the subtle compliance of the local news media. She has them wrapped around her finger. Reporters almost never challenge her or investigate her claims. Program hosts simply introduce a topic and let her run with it. She gets to say whatever she wants and, not surprisingly, it always reflects well on her. With these “soft ball” interviews the news media has become her ally.

“Mayor Meed Ward gets in front of the Cogeco cameras as well as the CHCH cameras on a regular basis. They are seen by the Mayor as friendly folk – not the kind of people who ask her tough questions”…….”She favours situations, such as her perch at CHML where she is never pressed on serious issues”, wrote columnist Pepper Parr.

The bottom line here is that Meed Ward has the communication skills, contacts, resources and charisma to distract observers from the fact that she simply overpromises and under delivers.

It’s like that popular song.

Give ‘em the old razzle dazzle

Razzle Dazzle ‘em

Give ‘em an act with lots of flash in it

And the reaction will be passionate

Give ‘em the old hocus pocus

Bead and feather ‘em

how can they see with sequins in their eyes?

(Musical – Chicago)

One could be easily fooled by Meed Ward’s never ending public relations campaign. Her message is clear. Everything will be OK as long as she is in charge. The past four years, however, have betrayed her super-hero image.

Consider the downtown planning debacle, the tall building chaos and the vilification of the development community.

“Did Mayor Meed Ward not understand the implications of council decisions that she worked for, or did she simply want to avoid inconvenient facts?”, wrote former Mayor Rick Goldring.

Long time Meed Ward supporter Gary Scobie shared the disappointment about her efforts to control tall buildings in the downtown. “We were betrayed”.

To be clear, nobody blames Meed Ward for the tall buildings. They are a natural part of a growing city. She does, however, deserve blame for telling constituents that she could manage them better than the last guy. She was warned by the former City Manager that a lot of tall buildings would be constructed while she was Mayor. She fired him.

Beyond her extravagant promises about tall buildings, we can’t forget the cost and chaos that resulted from Meed Ward’s Private Tree Bylaw. Then, there’s the clumsy way in which she handled the rainbow sidewalk issue. Let’s not forget the dabbling in reserve funds, the seemingly endless confidential meetings, the growth in the Infrastructure Renewal Gap, etcetera, but, put her in front of a camera and you’ll hear that everything is OK.

Meed Ward’s spin campaign included claims that, under her leadership, this city council is more cohesive that the last, but that idea was washed away when Councillor Shawna Stolte publicly accused her of, “another political circus for your own selfish gains and I think you should be ashamed of yourself.”

Others, like Roland Tanner of the 905er podcast also question her claims of team unity.

“She loses friends at a hell of a rate. People who have supported her, like you wouldn’t believe in the earlier parts of her career, are now upset with her for various reasons….We’re starting to see Marianne Meed Ward, warts and all”.

Here in Ward One, voters may wish to look past Meed Ward’s fancy rhetoric and reflect on whether her carefully constructed image has met the test of reality. Consider these examples.

Meed Ward is directly responsible for the fiasco at 2100 Brant Street. She told neighbours during the 2018 election that she would “seek to scale back” a proposed townhouse development. The project had in fact been approved by the last Council, but shortly after she was elected Mayor, Meed Ward rescinded the approval, something almost unheard of and certainly contrary to staff’s advice. In the end, the City had to settle for essentially the same proposal as originally approved with only slight changes. Meed Ward admitted defeat when she declared that the City could not find a professional planner to support her and the neighbours’ opposition to the development.

But, that wasn’t the end of it! The Local Planning Appeals Tribunal (LPAT) awarded $17,088.97 in damages to the developer as a consequence of the rescinding of the original approval. LPAT called the City’s action “clearly unreasonable”. Meed Ward blew-off the cost and embarrassment to the City with the comment that it was “money well spent”.

Tyandaga resident John Calvert, who had believed Meed Ward’s promise to do something about the development and supported her for Mayor, suddenly realized he had backed the wrong horse.

“I regret having believed that you would actually fulfill your two main campaign promises – to oppose over-development and improve public engagement”, wrote Calvert after the settlement.

Meed Ward also misled Tyandaga residents about her ability to mitigate the impact of the Meridian Quarry expansion. She promised to; “Push for provincial review of North Aldershot Quarry Expansion, and air quality studies of quarry dust”, according to her campaign literature.

After her election, she attempted to get the Province involved and was rejected. She tried to use the Tree Bylaw against the quarry but found it that it didn’t apply. She tried to bring in a Health Protection Bylaw to monitor emissions from the quarry and found out that she could not. She spent $35,000 in taxpayers’ money to get an independent expert opinion, which was never revealed in public.

In the end, when it became clear that she wasn’t making any progress, and the neighbours started publicly expressing their disappointment, she took the discussions with the neighbours behind closed doors. (This, despite years of her demands for more transparency in local government) So far, these ongoing private discussions have apparently produced nothing. Quarry plant manager, John Laurence reports that little is being achieved. “We get to hear more complaints, but it’s more of a forum for them to vent than anything else”.

The point is that she never should have misled the neighbours into believing that she could influence the situation when she knew, based on expert opinion from City and Halton staff dating back to 2017, that she could not. She had been told, as were all members of Council, that the quarry expansion was legal, that it was a Provincial matter and that nothing could be done to stop it.

She consciously told neighbours what they wanted to hear in 2018 rather than what they needed to know, simply because it fit her election strategy.

Still in Tyandaga, Meed Ward told concerned residents that she could not comment publicly on a controversial proposal to build a retirement home until she received a formal staff report. She did not want to be pinned down. This was never her position when she was the downtown Councillor rallying opposition to new building proposals at the earliest possible opportunity.

In the Maple community, Meed Ward’s chaotic interim control bylaw for the downtown spilled over to the Brant Court Co-op buildings on North Shore Boulevard in Ward One. Her fight against developers resulted in a delay to the final approval of a new 17-storey retirement home on the site. As a result, she seriously disrupted the pending plans of a vulnerable group of home owners who wanted to complete their deals with the developer. They were forced to put their sales and relocation plans on hold resulting in anxiety and uncertainty. Two years later, the City exempted the project from the interim control bylaw, settled with the developer, and succeeded in reducing the height of the proposed building by only one storey.

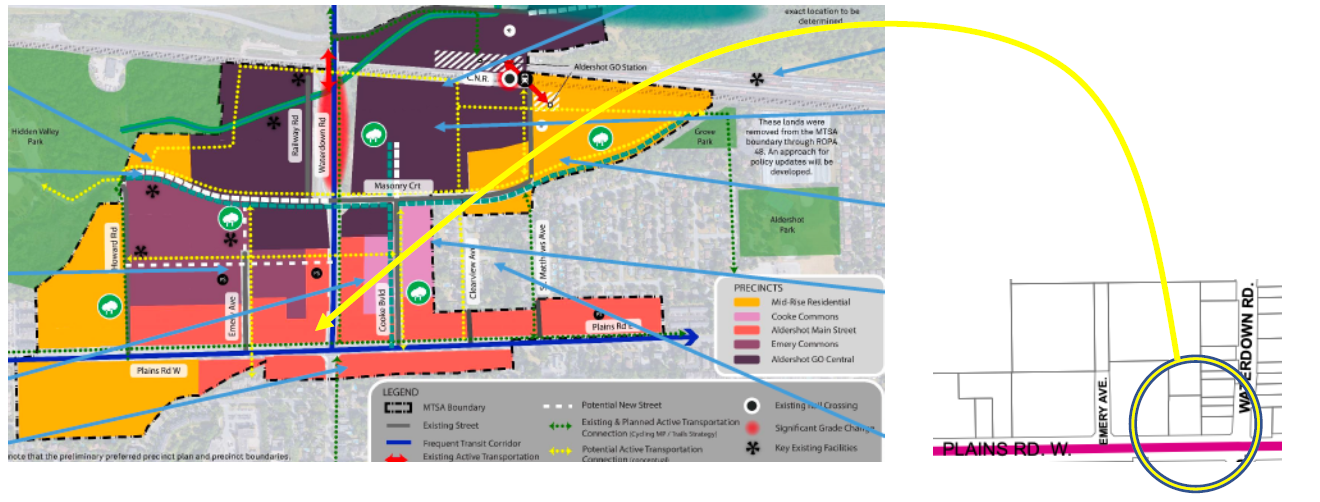

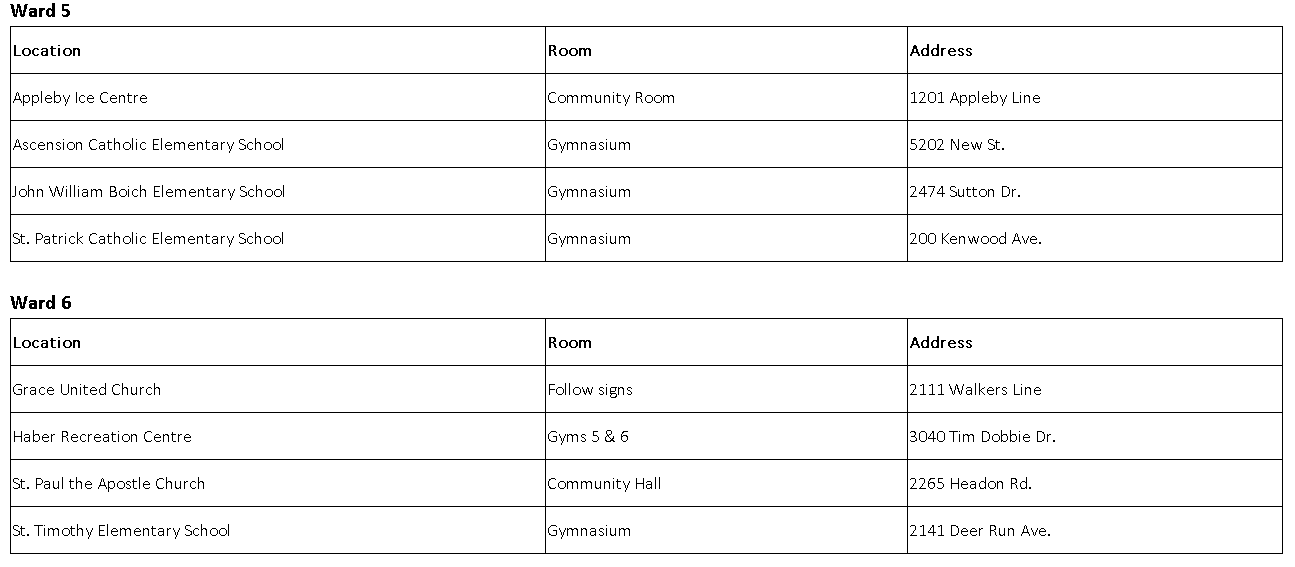

In Aldershot, Meed Ward kept her campaign promise to keep Clearview, Queen Mary and St. Matthew’s Avenue outside the Major Transit Station Area (MTSA) boundary. The problem is that she was never honest with those residents about the consequences. The latest plan calls for those tiny streets to be surrounded on three sides by tall buildings.

Finally, doesn’t the Mayor, who repeatedly promised more transparency in government, owe the people of Aldershot an explanation as to how a 12-storey proposal for the Solid Gold property became an 18-storey building, all negotiated behind closed doors with no public input?

There’s much more that could be discussed and I realize these opinions are subject to much debate, but my message to readers is simple. The time has come to look past Marianne Meed Ward’s spin machine and consider the facts. I know that her fans think she is current and hip, but in reality she reinforces the classic image of an old fashioned populist who over promises and under delivers.

Rick Craven served as Councillor for ward 1 for almost 22 years.

By Pepper Parr By Pepper Parr

October 21st, 2022

BURLINGTON, ON

OPINION

The Director of Communications for the city took exception to the views in this opinion piece maintaining that there were errors. We replied to the Director in this article Differences of opinion and attempts to manipulate which you can read HERE

There are two issues when we talk about Shawna Stolte and her campaign for re-election as the Council member for ward 4

We covered what she has done and what she said she would do in a previous article.

The second issue with Shawna Stolte as an elected official is her behaviour as seen by the Integrity Commissioner.

The Integrity is in place to ensure that members of Council follow the rules they set out for themselves and a place citizens can register complaints

Ward 1 Councillor Kelvin Galbraith  Ward 3 Councillor Rory Nisan Early this year two members of Council filed a complaint with the Integrity Commissioner over a statement Stolte made related to how much the city was going to pay to purchase the Robert Bateman High School site.

She said in a council meeting that the sum was in the order of $50 million dollars. Stolte did not release the exact number but she is believed to have been very close that whatever the number is.

The Integrity Commissioner accepted the complaints and did an investigation and came to the conclusion that Stolte did indeed reveal to the public information she learned of in a closed session of Council.

That is a no no – and Stolte admitted as much saying that she felt very strongly about the public’s need to know what kind of spending Council was talking about in CLOSED sessions of Council.

The Integrity Commissioner decided that an appropriate punishment was to dock the Council member five days pay.

Stolte accepted the decision and said later that if it took five days pay to get information before the public it was money well spent.

The Integrity Commissioner took exception to that remark and said later that if he had known there was little in the way of remorse he would have considered docking the Council member 30 days pay.

There was considerable difference of opinion on just what this should mean. Many thought that deciding to release the $50 million number was an egregious mistake while others saw it as a matter of principle.

Stolte did not benefit from the release of the information; the public interest was in no way damaged. The sale/purchase of the property was not impacted.

Agreed that Stolte made public information that was discussed in a CLOSED session of Council and It is important that Council members be fully aware of that.

Ward 4 Councillor Shawna Stolte She took the position that it was a matter of principle and that the public had a right to know.

One of the things that came out of the incident was the bringing in legal specialists who did a survey of the manner in which Council made public matters that were discussed in a CLOSED session and made more than a suggestion that Council tighten up the way it keeps the public informed.

That report, to a considerable degree, supports the principled decision Stolte made.

The second matter relating Stolte that went to the Integrity Commissioner should have never been accepted by those people.

Stolte did an interview with the Gazette in which she talked about what the first couple of years as a Council member was like.

One of the bumps she ran into was getting an administrative assistant. In Burlington every member of Council has an administrative assistant. None of the other municipal councils in the region provide that level of support to their Council members.

Stole didn’t name the person assigned to her. So what was the big deal?

Well the big deal was that the woman, who turned out to be Georgi Garside has worked for the city for more than 20 years. She was Marianne Meed Ward’s administrative assistant when she was the Councillor for ward 2. Garside was not a recent city employee.

The two women are quite close and are reported to entertain each other in their homes.

Shawna Stolte with her father. When Stolte learned of Garside’s concern she immediately offered to apologize. Quite why she would apologize is beyond me.

Where the error was made, we believe is that the Integrity Commissioner should have kept their sticky fingers out of the issue.

They did say that there was no breach of the Code of Good Conduct and they should have left it at that.

But they chose to get involved in the writing of the apology.

Where the City Manager, Tim Commisso was in all this defies understanding.

This was a Human Resources issue and there should have been a reprimand to Garside. Staff accept the assignments they are given and if they don’t like the assignment take their concern to Human Resources or look for another job.

The City Manager apparently said nothing.

However, Stolte said she would apologize and she was going to stand by that decision.

Then it got really silly and very very nasty.

Stole advised the Mayor and the Clerk that she would be reading her apology during the Comments part of the council meeting, which was her right.

The Mayor was having none of it. She decided she was going to re-arrange the Agenda, which was her right, and have Stolte read her apology into the record at the beginning of the meeting so that Garside, who was participating virtually, could hear what she had already read.

Had Stolte done that the matter would have become debatable and Stolte would have had to defend was took place to any member of Council that chose to question her.

Stolte was having none of it.

That is when the Mayor made a total fool of herself and damaged forever the reputation she had for being a decent person.

The Gazette has published her 14 minute shameful display of sheer nastiness many times. Click on the link to hear it for yourself. Listen to it several times to understand how controlling and manipulative your Mayor is.

We don’t want to appear to be commending Stolte for the principled decision she made. What it did was bring to the surface how treacherous Mayor Marianne Meed Ward can be.

Salt with Pepper is the musings, reflections and opinions of the publisher of the Burlington Gazette, an online newspaper that was formed in 2010 and is a member of the National Newsmedia Council.

By Pepper Parr By Pepper Parr

October 21st, 2022

BURLINGTON, ON

Ward 2 is downtown Burlington.

Is has been undergoing massive high rise development.

The ward 2 Councillor has a significant impact on how issues roll out.

The consultants for the owners of the Waterfront hotel put it very well when they said that the intersection of Brant and Lakeshore Road is “ground zero” for Burlington.

That kind of hype can go to the head of a politician who doesn’t have a strong grip on what the real world that people have to live in day to day is all about.

The ward was represented by Marianne Meed ward from 2010 up until 2018 when she ran for Mayor.

Lisa Kearns is now the Councillor for the ward.

Lisa loves the photo op.

She defines herself as a policy wonk.

She thinks quickly, at times uses complex language to get a simple complex issue across. I still don’t know what she means when she talks about “the delta”.

In the first few years as Councillor she had a sense of humour and the ability to pop out one liners that were wickedly funny.

She can multi task like crazy.

Lisa also has one of the best brains working in the municipal sector that I have seen in some time.

She can see and work with the “big picture” ideas but has yet to come up with ideas, concepts or directions for the city.

It is difficult to find something she introduced and shepherded to completion.

And the truth is not always clearly defined in her hands.

An opportunity to take a principled position was missed. An opportunity to take a principled stand was lost when the vote to proceed with the redevelopment of the Skyway Arena in the east end of the city was being voted on. The cost came in at $39 million which Councillor Stolte said was too high and something the city could not afford.

Kearns agreed with Stolte and said so but when it came to a vote – she went with the majority. Putting a vote behind the verbal support would not have put a halt to the project; instead of a 6-1 vote it could have been a 5-2 keeping the development alive but making an important point

Kearns tells people that actions speak louder than words – but there isn’t all that much in the way of measureable action to show for the four years she has been on the job.

She is going to ensure that the public gets value for the taxes they pay – how about keeping tax increases at the 3% to 4% level. The reality at this point looks like something that might be a double digit

Being a municipal Councillor is hard work – something the public doesn’t appreciate.

Does anyone understand why, in the middle of her first term, she agreed to be considered a candidate for the Burlington seat in the provincial Legislature?

She makes mention of a strong business community to have a “vibrant” downtown core. There is currently a group wanting to open what will be a pharmacy, massage and doctor’s office set up that is on hold due to a zoning issue.

There are literally dozens of seniors who would love to see a medical practice on Brant Street close to Lakeshore Road that they can walk to. Appeals to step in have been made to Kearns with nothing in the way of a response.

Being popular and being liked is nice – but most people would like to see results that make their lives more livable rather than a council member who wants to have her picture taken with them.

Unfortunately, Kearns is the best of the three candidates. There is something unsettling with a politician who decides during a Zoom call to blurt out some information that was confidential that gets put out where it is public and then has an anxiety attack and asks to have the public comment taken down. And scrambling to talk to everyone about how to fix the goof on the part of the Councillor.

Why was she even talking about the amount of money that was being set aside for a legal defence?

No one outside of Council and the City Manager and the City Solicitor were supposed have access to that information.

The information was leaked at a meeting of the Burlington Downtown Business Association.

This was a case of someone showing off – loose lips sink ships and on this one her ship should sink.

Her council colleagues appear to have supported Kearns for what has been described as an unintended utterance – try that one the next time you are in traffic court. Quite how and why this was discussed in a Closed Session of Council is something we may never know..

The unfortunate part of Kearns’s candidacy is that she is the best of the three candidates-her community deserves a more mature individual who does not block people who want access to her social media simply because she doesn’t like hearing from them.

Maybe some growing up and a little less of the histrionics are in order. Some duct tape on the mouth would be a good start.

The really disturbing note with Lisa Kearns is that there is so much raw talent that isn’t being put to use; instead we are seeing someone who wants to be liked.

I’d like to be able to respect the woman.

By Staff By Staff

October 21st, 2022

BURLINGTON, ON

The event was a blast.

First chance in two years for people to congregate and get caught up on stuff.

Much more to tell – later in the day

For now let this picture be worth 1000 words

More than 500 people came out to celebrate and recognize two Distinguished Entrepreneurs

By DENIS GIBBONS By DENIS GIBBONS

October 20th, 2022

BURLINGTON, ON

Despite drawing some criticism in his rookie term on Burlington city council, Rory Nisan is confident he can hold his seat in Ward 3.

Rory Nisan in one of the few occasions he has been in the Council Chamber sine the onset of Covid19 Nisan said that in 2018 he campaigned on bringing a splash pad for children to Brant Hills Park, limiting growth in the downtown area and improving traffic flow and public transit in Burlington.

“I always said we should be doing whatever we can to move the growth from downtown to the areas around the GO stations,” he said.

He is pleased that the splash pad was approved in the first budget of his first term and completed in 2021.

“There are so many people there on warm days,” he said. “It has become a community meeting place for Brant Hills.”

Nisan said council has done everything in its power to move growth to the GO station areas.

“I wish we had more support from the Province,” he said. “I wish municipalities had more power to control their own destinies.”

The advanced traffic management which is on its way from the Region, he said, will make a big difference particularly during rush hour.

“It will allow us to leave green lights on longer to move traffic.”

Nisan said he’s proud that the City has purchased more buses and hired more bus drivers and handi-van drivers.

“But we still need to do more,” he said.

He considers the splash pad his greatest first-term achievement.

“My predecessor John Taylor said it couldn’t be done, my main challenger in the last election said it couldn’t be done and staff said it couldn’t be done because there was not enough room,” he said. “People were worried about softballs hitting the kids. I suggested putting up a bigger fence. We overcame the problem through some creative thinking.”

In 2018 Nisan polled 54.05 per cent of the vote, more than the combined total of runner-up Gareth Williams and three other challengers.

It was the first election in the ward following the retirement of John Taylor, who served on council for 30 years.

Nisan supports and said he will work to make the Bateman High school site a community centre. He has not supported a move to make the cost known to the public on a deal that was scheduled to close September 30th If he is re-elected, Nisan said he will work hard to create a community centre at Robert Bateman high school, which the City is in the process of purchasing from the Halton District School Board.

Plans call for the City to lease space to both the school board and Brock University.

Protecting the Niagara Escarpment, which he described as the “jewel of Burlington”, is a primary objective as well as final implementation of a climate action plan.

Nisan said he also is looking forward to the arrival of inclusive zoning as part of council’s drive for more affordable housing.

“Cities now have the power to mandate that there be some affordable housing in all new developments,” he said.

Regarding his filing a complaint with the Integrity Commissioner, together with Ward 1 Councillor Kelvin Galbraith, on statements made at council by Ward 4 Councillor Shawna Stolte, Nisan said it hasn’t been an issue at the doors while he has been out campaigning.

“It’s all about accountability,” he said “We have only one avenue and that’s through the Integrity Commissioner.”

Nisan said he doesn’t believe any hard feelings remain.

“Even when we disagree as a group, we still manage to get things done,” he said. “Councillor Stolte and I have been on the same side of issues since then.”

On another point of contention, Nisan said he’s not concerned about critics who claim he is too much a disciple of Mayor Marianne Meed Ward.

Rory Nisan: thinking it through “People can say what they want but if they look at my record I’ve voted against the mayor many times,” he said. “Those who say otherwise are being lazy in their analysis.”

When a vote came up at regional council in the spring on lifting the mandate for citizens to wear masks, it carried by a margin of 23-1, with Nisan being the lone dissenter.

“I felt it was too soon to do it,” he said. “I took some flak but I also got a lot of support on it. I’m not afraid to take a stand on issues.”

Nisan still is on an unpaid leave of absence from his job as a foreign service officer for Global Affairs Canada.

If re-elected, he plans to be a full-time Councillor again.

By Tom Muir By Tom Muir

October 20th, 2022

BURLINGTON, ON

It’s now days before the election and despite working for months on the conflict of interest issue, I am disheartened that it came to light so late – this information is not easy to get, and who will do anything about it? Whose job is it? l

I have experienced a loss of Ward 1 engagement and representation on important development matters, and particularly now, have to face conflicts of interest by Councillor Kelvin Galbraith.

Residents want to be part of the decisions made for their community This experience goes back to the last election in 2018. The previous Councillor retired and left behind a quite elaborate structure of Ward 1 engagement with regularly scheduled meetings for South Aldershot, North Aldershot, Tyandaga, and a special group for the Eagle Heights development. Very often planning staff were present to provide information.

For the 2018 election there were 13 candidates, including Kelvin Galbraith. We learned that he was a business man, property owner, and developer with ties with EMSHIH, whose property surrounds his. His properties are located around Waterdown Road and Plains Road, in the Aldershot Main Street of Aldershot Corners in the evolving MTSA planning area.

Ward 1 Councillor Kelvin Galbraith He won the election and became the first Councillor in memory in Ward 1, to own property in the Ward, which he intended to development, and was sworn to uphold the Municipal Conflict of Interest Act.

A group of residents in Ward 1 had 3 meetings with him in 2018 and were concerned about several issues including what engagement and representation he had in mind. We asked him to maintain the structure that his predecessor had long established and maintained. Unfortunately for engagement and representation with residents, he did not meet our request, and let this structure die.

Of serious concern, given his property ownership situation, were possible conflicts of interest and how he was going the manage them. At the meetings, this potential was raised extensively.

However, while he promised to seek advice internally, from the Integrity Commissioner, and inform us of what he found, he never did this then, and we heard nothing back. We took him at his word about it and it was only in the last week (Oct 17) that we learned that he waited more than 3 years to go to the Integrity Commissioner, and he was advised that he was in conflict within the MTSA.

Before Oct. 17, I wrote several messages describing my analysis of the situation of concern – Ownership of Property and Conflict of Interest – to the Councilor. I described what I perceived as his contravention of the Municipal Conflict of Interest Act by failing to declare a pecuniary interest, direct or indirect, in several matters concerning his ownership of property in the Aldershot MTSA.

After my messages, I learned about the more than 3 years wait, till March 2022, to seek advice from the Integrity Commissioner. He didn’t tell anyone that I know of. It was only because I reached out to him that I found out, and even then I had to explicitly ask him to give me the report.

The Councilor denied in writing to me that he has a general conflict in the entire MTSA, but restricted his pecuniary interest to within 120 meters, contrary to the conclusion of the Integrity Commissioner report:

“Accordingly, we conclude that, now that the plans include reference to proposed designations affecting your properties, you are required to recuse yourself from the discussion and voting on consideration of the Aldershot GO MTSA.

The map the Integrity Commission used in their letter to Councillor Galbraith My own analysis in response to the Councillor argued that this general conflict was the case, and agreed with the Integrity Commissioner report. I also stated that as a businessman, investor and property owner, with a letter of intent with EMSHIH Developments, he would know that this is true. In his statement published in the Gazette recently he continues to deny he has a general conflict of interest in the MTSA.

So the facts of what has happened in my community indicate that Ward 1 lost the long-time informative public engagement plan already in place and let die, and has a Councillor that is in denial that he is in a conflict of interest due to pecuniary interest according to the conclusion and directive of the Integrity Commissioner.

This is not the kind of representation, engagement, and judgment on his conflict situation that I expect, and that I think is the duty of a Councillor sworn by his oath of office to maintain.

We don’t need 4 more years of this.

Tom Muir is an Aldershot resident who has played an active roll in requiring the Councillor for the ward to be accountable and transparent. Tom Muir is an Aldershot resident who has played an active roll in requiring the Councillor for the ward to be accountable and transparent.

By Pepper Parr By Pepper Parr

October 20th, 2022

BURLINGTON, ON

The Burlington business community has always wanted to recognize and celebrate those who put their time, talents and aspirations back into the community.

The task was at one point done by the Economic Development Corporation – it is now in the hands of the Chamber of Commerce.

This year two men will be recognized at the Distinguished Entrepreneur Award Dinner taking place at the Burlington Convention Centre. The event is a sold out occasion – 531 people are going to gather to celebrate and enjoy a menu that one seldom sees in this city – a combination of Jewish and Italian food.

Jeff Paikin with partner Joe Giacomodonato. leveraged what they had to the hilt, took huge risks and benefited from some lucky breaks are now running a corporation that is looking at a healthy decade. Jeff Paikin will be the 2021 recipient, Conrad Zurini will be the 2022 recipient.

Today I want to tell you about Jeff Paikin born in Hamilton, into a Reformed Jewish family where mother Marnie was more than a force of nature and at one point the president of the Anna Herskwitz Chapter of Hadassah.

Marnie and Larry Paikin With Marnie for a mother and Larry as a father the two boys, Jeff and Steve, were wonderfully positioned to do well.

The family decision to send both boys to Hillfield Strathallan for both their elementary and secondary years so that they would both be exposed to French at a young age was another decision that positioned both men for strong futures. Jeff will admit that his French has slipped a bit.

Jeff’s brother, Steve Paikin, has done the TVO program Agenda for at least a decade. The two men are close. Steve will be speaking at the Award dinner.

Growing up and deciding what you are going to be – what you really want to do with your life and how you might leave your own mark, is an issue every young person faces.

Jeff graduated from Mount Allison University in New Brunswick where he studied business and was the kicker on the university football team. The attraction to Mount A didn’t have a lot to do with getting an education – Jeff was a star football kicker.

Doug Mitchell, who was a starting center on the 1972 Grey Cup champion Tiger Cats, was running the football team at Mount Allison and convinced Jeff this was a great place to get an education.

A degree in Business from university took Jeff home where he worked for the family business selling rebar to the development industry. Jeff will tell you that the rebar in the Skydome came from the family steel operation – Ennis-Paikin Steel.

Jeff puts his early impression of the construction industry this way: “When I saw the high-end cars in my clients’ parking lots I found myself thinking I could do what these men are doing. I could build homes, create community and help make homes for people and maybe drive one of those fancy cars as well.

Jeff Paikin with partner Joe Giacomodonato. New Horizon Homes was formed in 1993 – the focus was on building high-quality single-family residences. It was while working on a townhome development on Headon Road in Burlington that Jeff met Joe Giacomodonato.

The two men recognized that their shared vision—“build it right and they will come”—could be made real by uniting their complementary skills for the long term. That was in 1997

They started out as New Horizon Homes and grew into New Horizon Development Group, when they started focusing on condo buildings about 15years ago -2007

The two built about 300 single family residences.

Homes wasn’t the only thing Jeff built. He was among the critical point persons behind getting the Bulldogs to Hamilton.

A group of about 20 put up the money to buy the farm team franchise from the Edmonton Oilers. Don Robertson had convinced the Edmonton Oilers to sell to a Hamilton group. Edmonton and Montreal were co affiliates with the Bulldogs.

That was in 2002

Ron Foxcroft chaired the large ownership group that included Paikin.

In 2002 Paikin convinced Michael Andlauer to invest in the team. He eventually took 100% ownership and moved the NHL farm team to Laval, Quebec where they are known as the Laval Rockets.

Foxcroft later played a major role in introducing George Gillett Jr., the man who helped turn Canadiens into a billion-dollar team, to Michael Andlauer to get him approved by the NHL as an owner and governor.

When Paikin had his office in Hamilton you could see a hockey stick leaning up against his office wall.

It was now very clear that Jeff Paikin could make things happen.

Getting to the point where the project became a building site took a long time. First saw the light to day in 1985. Jeff Paikin and his partner Jo Joe Giacomodonato. put shovels in the ground more than a decade later.

Getting to the point where the project became a building site took a long time. First saw the light to day in 1985. Jeff Paikin and his partner Jo Joe Giacomodonato. put shovels in the ground in 2018 . He moved into his unit in 2021

In 2013 Mayrose-Tycon Limited selected Mady Development Corporation to build the new Burlington waterfront hotel and residential condo. Mayrose-Tycon principal Matt Jaecklein introduced the Mady Development Corporation as the primary builder for the new mixed-use waterfront development at Burlington’s Bridgewater site.

At the time Bridgewater development wasn’t yet a hole in the ground. Jeff and his wife took part in a sales presentation, liked what they heard and bought.

In 2015 the Bridgewater development on Lakeshore Road was in trouble. The owners of the land had to exercise a “reputation risk” clause in the agreement and went looking for a new builder.

Jeff Paikin at that time shared equal ownership of a unit with John Mehlenbacher who was with the Condo Store, the firm hired to sell Bridgewater Condominiums.

Mehlenbacher called Jeff and talked to him, asking how he felt about actually building the three buildings that had been approved. After confirming with his partner and the construction team that this was doable, Jeff excitedly confirmed. He and Mehlenbacher agreed Jeff could purchase the second half of the unit now that New Horizon could build his own house, so John purchased another unit in the building as did Jeff.

Jeff now lives at Bridgewater and his daughter lives in the second unit.

In early 2022 Jeff lost his wife, Andrea, a nurse, to cancer after a four year battle.

In the early days of growing New Horizon Jeff explained “every project was leveraged to the hilt. We were always one development away from failing”

They were in that stage for a couple of years and slowly grew to the point where they had enough in the way of assets that they could survive as a corporate entity if a development did not meet projections.

“We then got to the point where we would survive if two developments ran into problems adding that developers do run into serious problems for a variety of reasons. Markets change, the economy changes resulting in changes in interest rate – which is exactly where the development industry is today.

Two developments currently underway: Waterdown and Beamsville

There are risks at every level along with pressure to build housing that doesn’t have substantial margins at a time when costs are volatile making it difficult to price units and then build them and show a profit, both to ensure banks will finance projects and leaving funds to move on to a new project.

Jeff gives huge credit to the Molinaros who built a string of condominiums along Lakeshore Road that paved the way for the high rise developments Burlington is currently experiencing, revitalizing downtown Burlington with their efforts.

The Molinaros were not at all certain that what they were building would sell. Their first development at Maple and Lakeshore Road was a unique blend of town houses and a high rise that was a first for the city in that area.

Buntins Wharf, Harbour View, the Baxter and 360 on Pearl were the development base that today has a number of projects with shovels in the ground or in the planning approval stage.

When the Molinaro’s put up Harbour View and Buntin’s wharf to the east they ushered in a new level of development that Burlington is still experiencing Jeff is now well established as a successful developer with enough in the way of property holdings to allow him to think as far forward as a decade – he has begun to bring members of his family and members of partner Joe Giacomodonato’s family into the company.

Jeff’s daughter completed a Bachelor of Business Administration at Bishop’s University and joined the New Horizon team in 2018 to oversee their sales and marketing division.

Jeff Paikin on a construction site – his feet on the kind of rebar that got him into the industry. Natasha oversees all the touch points that New Horizon has with their potential and current clients, including sales and marketing, the décor center, interim occupancy, closing and after-closing services.

Jeff has continued to draw on the lessons and examples of his parents about the concept of giving back

Philanthropy at any level is a lesson learned in the Paikin household – he has yet to determine where he wants to continue to direct his support and resources.

If his parents are the example he follows expect to see help given where it is most needed; perhaps in medicine, maybe in the arts or even education.

By Staff By Staff

October 20th, 2022

BURLINGTON, ON

Recovery from drug and alcohol use is possible. While it may seem difficult, it’s encouraging to know that others around Canada have gone through what you may be experiencing.

Below are stories to inspire and motivate you to seek help.

There is a web site (Click here to link) with tonnes of information and places you can turn to for support.

By Pepper Parr By Pepper Parr

October 20th, 2022

BURLINGTON, ON

For a time it looked as if ward 5 Councillor Paul Sharman was going to be acclaimed.

Days before nominations were to close four names popped up on the city’s candidate nominations screen and Paul Sharman had to run for election.

It was not something he was looking forward.

Paul Sharman: Defending his view of development planned for the east end. When challenged – he is not at his best. He reverts to being defensive and loses the ability to listen.

Is this what a “bit of a snit” looks like Sharman can be folksy with people but he isn’t really a people person. He can be very abrupt, short and at times quite cranky when he isn’t getting his way.

What he has going for him is a solid grasp of what the issues are and a mind capable of pulling all the small pieces together and making sense of it and passing his knowledge along to others.

He is an educated, cultured individual who understands how both the corporate culture and the minds of the bureaucracies work. He was once a part of a very large corporation that unfortunately lost its way.

If one asked Paul Sharman if he was a “happy camper” pleased with the cards life had dealt him I suspect he would say no.

He tends to use the lack of data as the reason for not making a decision. On that level he can always win – Burlington’s administration does not yet champion the gathering of the kind of data that is needed.

What Paul Sharman brings to the table is the best background on what takes place in the city. He and Mayor Meed Ward have served on Council for the same length of time but he has a command of the workings of the city hall that Meed Ward just never picked up in her career path.

There hasn’t been a lot of development in the east end.

A rendering of a development proposed for ward 5 The shabby, won down at the heals plaza in the eastern side of ward 5 has been in need of a major makeover for a long time.

The property owner was reluctant to do very much despite the efforts Sharman made to get them to actually do something

When the outline of a development was brought to the table it was overwhelming – seven structures that brought out the nimby streak in every community.

At this point that development is on hold.

The arena that is just to the north of the proposed development had reached the end of its life cycle. The ice making system no longer met the building codes and was shut down and turned into space for the Forestry department.

While the city didn’t have the money to rebuild they never the less prepared plans and Council approved a decision to borrow what was needed and shovels went into the ground.

While shaky as a financial decision it would help in rebuilding a more vibrant community and there was no way Sharman was going to vote against it.

Sharman chose not to appear at an ECOB debate Sharman’s interest in working with community organizations he doesn’t control is lower than 0. In the 2018 election he refused to take part in the ECOB debate but shifted his position and did take part in a debate run by a different group sometime later when he felt his re-election was more certain.

The railway grade separation at WHERE that was badly needed in the eastern part of the city (GET NAME) experienced a massive cost increase. We are not sure just how big a role Sharman played in ensuring that Metrolinx didn’t pass along the increases to Burlington He gets a feather in his cap for that one,

A development planned as part of the large plaza on Appleby and New Street. The infrastructure needed to service the buildings was not in place at the right time. The restructuring of the Appleby Mall and the application for the development of two high rise units got put on hold when it was realized that the infrastructure needed to handle the increased population was not in place. What did Sharman do?

Sharman was the deputy Mayor during the weekend in August of 2014 when parts of the city were seriously flooded. He managed that crisis very well but was unable to do anything for the residents who had experienced severe damage to their homes.

The compassionate side of Sharman was very evident when he pleaded publicly for the support his constituents needed.

Asking if Sharman should be re-elected is just plain dumb. None of the candidates running against him bring much, if anything, to the table.

There was a point at which Paul Sharman gave some thought to running against Marianne Meed Ward. He sensed that ether was a lot of dissatisfaction with the direction she had taken things and the way she managed several council members who chose to follow her lead and serve as acolytes.

Meed Ward’s command of the fundamentals of fiance were a concern but in the end Sharman decided he wasn’t up to all the photo ops, glad handing and being in the public eye all tat much wasn’t for him.

Paul Sharman: Was he a possible Mayor? That wasn’t the way Sharman saw his career evolving. And, truth be told, the Council that will be sworn in at the end of the year needs the likes of Paul Sharman. The city is in for a very rough time financially – he will bring some much needed experience to the table.

And he will be there.

The fear is that should serious cost cutting be required Sharman will want to go after the transit service

By Staff By Staff

October 20th, 2022

BURLINGTON, ON

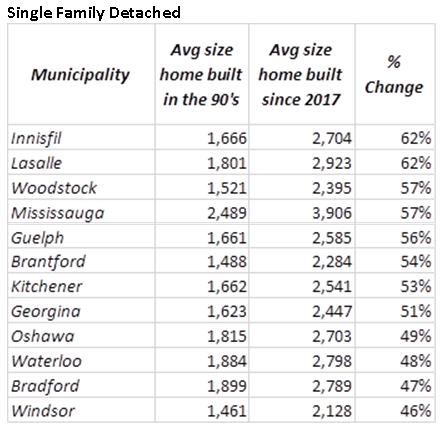

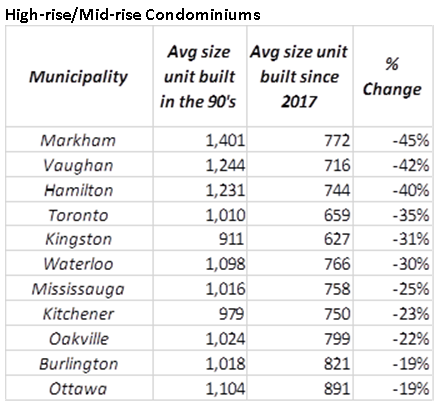

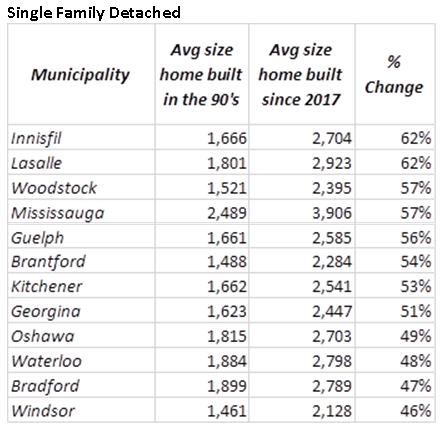

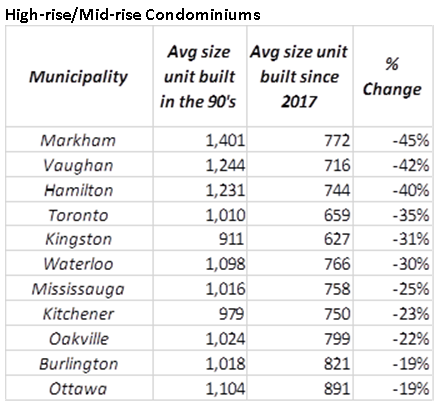

Ontario condominiums are 35% smaller on average than they were 25 years ago, while the average detached home is 25% larger.

The Municipal Property Assessment Corporation (MPAC), which tracks property data across the province, is watching to see if this decades-long pattern continues.

In the mid-1990s, the average condominium in Ontario peaked at approximately 1,100 sq. ft. The most recent MPAC data shows the average condo today is about 700 sq. ft.

“As land values increase, we see more units on a single property, which means many of those individual units are smaller,” says Greg Martino, MPAC Vice-President and Chief Valuation and Standards Officer. “Because condos are traditionally a major entry point for first-time home buyers and investors, the market for the smaller units has remained quite strong.” “As land values increase, we see more units on a single property, which means many of those individual units are smaller,” says Greg Martino, MPAC Vice-President and Chief Valuation and Standards Officer. “Because condos are traditionally a major entry point for first-time home buyers and investors, the market for the smaller units has remained quite strong.”

A similar trend toward smaller units is also evident in the townhouse market, with stacked townhouses – multiple units constructed vertically on a single lot – being built instead of traditional row townhouses.

In markets where land is relatively affordable, larger family detached homes are being developed. For example, single family detached homes were approximately 2,000 sq. ft. in the mid-90s and today a typical single-family home is around 2,500 sq. ft.

“These are long-standing trends that will likely continue,” Martino says. “It will be interesting to see whether the change in consumer preferences and behaviours over the last couple of years, coupled with recent economic drivers, like inflation and rising interest rates, will alter the pattern,” he continued.

Currently, amongst Ontario’s major urban centres, the average condo size in Toronto is 850 sq. ft. – the smallest in Ontario. Windsor is next with an average of 854 sq. ft., followed by Kitchener (884 sq. ft.) Richmond Hill (892 sq. ft.) and Hamilton (907 sq. ft.).

For those seeking more living space, Barrie, Burlington and Oakville are all municipalities with some of the largest average condominium sizes, at more than 1,000 sq. ft. For those seeking more living space, Barrie, Burlington and Oakville are all municipalities with some of the largest average condominium sizes, at more than 1,000 sq. ft.

MPAC is an independent, not-for-profit corporation funded by all Ontario municipalities, accountable to the Province, municipalities and property taxpayers through its 13-member Board of Directors. Their role is to accurately assess and classify all properties in Ontario in compliance with the Assessment Act and regulations set by the Government of Ontario. They are the largest assessment jurisdiction in North America, assessing and classifying more than five million properties with an estimated total value of $2.96 trillion.

By Pepper Parr By Pepper Parr

October 19th, 2022

BURLINGTON, ON

There are two Shawna’s.

The social worker who wants to make things better and help people and the woman who finds herself realizing that something isn’t right and has the courage of her convictions to do what she thinks is a matter or principal

I will write about Shawna Stolte and her problems with the Integrity Commissioner before the end of the week.

Today I want to focus on Stolte as a member of council serving the people in ward 4

Stolte isn’t a fast talking person – at times she stumbles and has to look to the Standing Committee Clerk for direction. She is a people person, she isn’t comfortable putting herself out there to have her picture taken. She tends not to lead a parade but she is like a drummer setting the beat to which those in the parade can keep in step and get to where they want to go.

While she might appear a little on the soft side and tends towards caution in most situations which fits in well with her fiscally conservative point of view. You don’t spend what you don’t have.

Stolte asked her colleagues to agree to require staff to use a climate lens whenever they were writing a report. While it may seem like small matter, its impact was profound. She wanted reports that set out what impact any decision would have on the climate.

When the city was looking at the cost of what was described as an Enterprise level software set of programs commitment that was going to cost $12 million Stolte wanted as much detail as they could give her . No one else asked for detail.

The price $39 million just wasn’t right: Stolte wanted some cuts. When the Skyway Arena rebuild was being voted on Stolte took the position that the city was going to borrow money that would take 15 years to repay at a time when everyone knew there would be strains on the budget. She voted against the project – the only ember of Council to do so.

When affordable housing was top of mind for council she wanted to take a different approach and pushed staff to go along with the creation of a committee that council did not control and had membership that came from people who volunteered and wasn’t going to work from an agenda given to them.

One of the marvellous things to come out of that experiment was the committee realizing they were going in the wrong direction and changed.

The membership had people from the Region, from the development industry and from people we had never heard of before who had informed views and made a difference.

The community level work Stolte has done is hard to appreciate or evaluate. She has consistently held meetings at a local food store where there was a coffee section; people could just show up and talk about an issue. She at times shared the event with the school board trustee.

Getting out into the community and helping people help other people. When there was a desperate need for food at the Food Banks she told her constituents that she would pick up bags or boxes of whatever they wanted to get to the food bank. She filled her can on a number of occasions.

In the early days of the Covid19 lock owns she was distributing handmade face masks at a time where there wasn’t much commercially available.

She has yet to learn how to work effectively with media, seldom makes statements, seldom makes a position known. She realizes that it is difficult to use media with a small council and a communication department that insists on controlling everything.

Mistakes there certainly some. Did they leave a dent; not really.

She is reported to have been approached by a group that wanted her to run for Mayor; after thinking it through and some anguished consideration she decided that this wasn’t the way she wanted to help shape the direction the city should go in.

She had her run ins with the Mayor, she had her run ins with the Councillors Nisan and Galbraith and was deeply hurt when the two of them, decided to take a complaint to the Integrity Commissioner about a decision she made to pass along some information that came out of a Closed meeting.

The real Shawna Stolte was evident at the end of the ward 4 all candidate Q&A that took place in Roseland Stole said:

Shawna Stolte I don’t lie, I don’t pander and I don’t pretend.