By Staff By Staff

February 18th, 2025

BURLINGTON, ON

City Council will meet at 9:30 this morning and work its way through a reasonable sized agenda. How snow removal, while not on the agenda, will certainly be discussed

Council will review the recommendations from Standing Committees starting with the Committee of the Whole meeting of February 10 and 11, 2025

There will be an update of all the Staff Directions that have been issued but not fully acted upon. The findings and the proposed path forward for managing outstanding staff directions.

There have been occasions in the past when Council became aware of Directions issued that were no longer relevant and Directions that were just plain forgotten. It will be interesting to see what comes up and how Council reacts. It’s a sort of mini report card on how the administration has been getting things done.

Pilot project that will cost the city $700,000 in lost revenue to provide free service for youth is on Council meeting agenda. The Fare-Free Transit for Youth – Summer 2025 Pilot will be on the table. There is a Direction to “Authorize the Director of Transit to implement Fare-Free Transit for youth in July and August 2025 as a pilot project.

Much of the discussion will be on “Authorizing the Chief Financial Officer to draw on the Ontario Provincial Gas Tax to fund the revenue loss of approximately $70,000, into the 2025 operating budget.

Appointments to the Advisory Committees (Committee of Adjustment and Mundialization Committee) are to be announced.

Council is finally getting to correspondence from the Ontario Ombudsman regarding Integrity Commissioner.

Curt Benson stick handles the major development issues. Housing Accelerator Fund implementation update. This relates to funds from the federal government that have to be spent within a specific period of time. This get to Council through the Development and Growth Management Report (DGM)

More on the 2026 Municipal Election preparation and selection of alternative voting methods. Online voting on election day was not going to be used but people would be able to vote online for the advanced polls.

Motion memorandum regarding increasing childcare spaces in Burlington. The intention is to direct staff to provide a report for Committee of the Whole on opportunities to use policy and city assets, as well as other opportunities to increase the number of childcare spaces in Burlington.

Council will receive information from Legal and Legislative Services regarding an update on staff monitoring and review of recent municipal responses and considerations to the regulation of the delivery of graphic images and non-peaceful demonstrations.

A potentially disturbing discussion will take place on monitoring and reviewing municipal responses regarding graphic images and non-peaceful demonstrations. It is part of a review that was requested of recent municipal responses and considerations to the regulation of the delivery of graphic images and non-peaceful demonstrations.

The disturbing part is who determines just what a non-peaceful demonstrations is?

A Burlington Lands Partnership update regarding city-owned lands that have potential for partnership development. There is apparently a considerable amount of city owned land that could be used for development. At this point the city isn’t prepared to say how much land there is and where it is located.

All the public is getting at this point is a report on city-owned lands that have potential for partnership development.

When it comes to land city Council and the administration keep all the cards very close to their chests.

The development was the object of a very robust discussion that may have resulted in a totally different orientation and possibly several three bedroom units. The development proposal at 2169-2175 Ghent Ave., will be getting a lot of attention.

Council heard a very refreshing delegation on this development. More to come on that event.

In a Confidential triannual litigation update report Council will learn who is suing the city and who the city might be suing. A lot of taxpayers money changes hands as a result of these meetings.

Council will get a Confidential status report on the Contingency Reserve – January 28, 2025

If past meetings are any guide – Council will get all this done and adjourn but not before members of Council report on what is taking place in their wards.

By Pepper Parr By Pepper Parr

February 17th, 2025

BURLINGTON, ON

It was a two- hour debate with the four candidates who want to be the next Premier facing off in a debate.

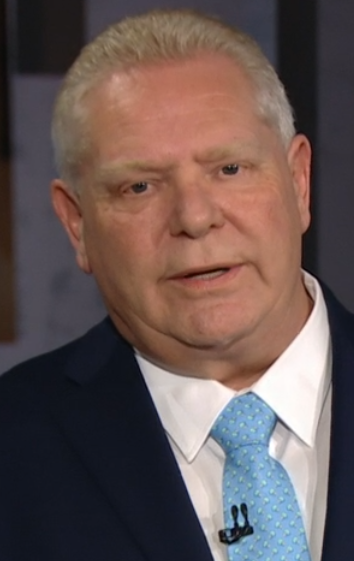

Did anyone win? Marit Stiles put out a release saying she had won. It was clear to me that Doug Ford didn’t win. He didn’t have two – the polls are very much in his favour. Will that lead still be in place on the 27th – few believe it will hold but no one is prepared to talk about just what the electorate will do.

Few see the election as necessary – other than Donald Ford. Few see the election as necessary – other than Donald Ford.

Set out below are their closing statements. Before we get to them a few observations. Marit Stiles was very animated. Doug Ford looked like a lumpy donut – he just stuck to his line – you need he because I can take on Donald Trump or words to that effect.

When asked what they would feed to one of the opposing candidate if they were having them over to dinner: Doug Ford said, without a smile: “Macaroni and Cheese”.

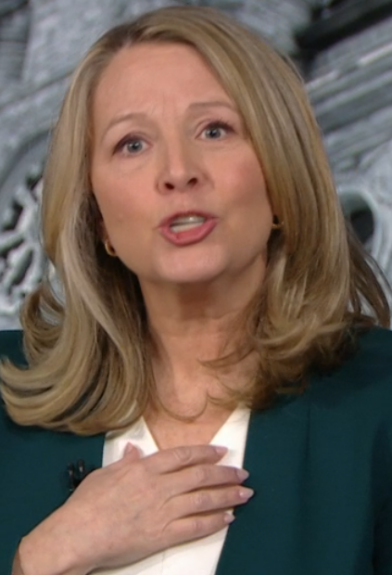

Moderator David Common with candidates Bonnie Crombie and Marit Stiles on his left. Fords and Shreiner were on Common’s right. David Common of CBC’s early morning program in Toronto did say at one point that there was a lot of tension in the room.

Time for the closing statements: That is one uninterrupted minute.

PC Leader Doug Ford,

“Well, folks, we’re going to have a very clear choice in this upcoming election. This is all about leadership. We’ve seen what Donald Trump is going to do in the White House for the next four years, and no matter if he puts a tariff on us today, tomorrow, next month, next year, you know it would devastate our economy. “Well, folks, we’re going to have a very clear choice in this upcoming election. This is all about leadership. We’ve seen what Donald Trump is going to do in the White House for the next four years, and no matter if he puts a tariff on us today, tomorrow, next month, next year, you know it would devastate our economy.

“There’s one person on that stage that’s going to protect your families, protect jobs and protect businesses and protect communities, and that’s myself.

“We’re going to reinvest into the economy like we did, and we saw over 850,000 jobs. We’re going to diversify trade around the world, which we did. We saw over $70 billion of investment. But I can’t do it without a strong mandate.

“If I get a strong mandate from the people of Ontario, I will work harder than I’ve ever worked. I will fight against Donald Trump like you’ve never seen before. On February 27 I’m asking for your vote, and may God bless the people of Ontario.”

Liberal leader Bonnie Crombie.

“We need a premier that will protect everyone’s job, not just his own, and is who is able to get us a family doctor like they had promised. You know, tonight we talked a lot about some really important issues, no question. And I want to leave you with this, if we want to change our health care system and a family doctor, you need to change the government. “We need a premier that will protect everyone’s job, not just his own, and is who is able to get us a family doctor like they had promised. You know, tonight we talked a lot about some really important issues, no question. And I want to leave you with this, if we want to change our health care system and a family doctor, you need to change the government.

“So today I’m asking you. I’m asking those of you who voted NDP in the last election to vote Liberal, to vote for a government that will fix our health care system and to get you a family doctor, and together, we can change government. Thank you.”

NDP Leader of the Opposition Marit Stiles,

“When times are tough, people look for hope, and for me, I find that hope in the strength of the people that I meet all across the province of Ontario, but after seven long years of Doug Ford and his wasteful scandals and his broken promises, rising costs are really hurting a lot of people in this province, and they are weakening us. He has left us weaker than ever before. A few weeks ago, while he was facing and we were facing the biggest threat that our country has faced in generations. He decided to quit his job. “When times are tough, people look for hope, and for me, I find that hope in the strength of the people that I meet all across the province of Ontario, but after seven long years of Doug Ford and his wasteful scandals and his broken promises, rising costs are really hurting a lot of people in this province, and they are weakening us. He has left us weaker than ever before. A few weeks ago, while he was facing and we were facing the biggest threat that our country has faced in generations. He decided to quit his job.

“Now, most people in Ontario, if you quit your job and then you didn’t show up for work the next day, you wouldn’t expect to be rehired. But Doug thinks that he deserves that. I got to tell you, you don’t have to settle for this. You have the power to change things, and I want to offer you that hope. We can fix our schools. We can build truly affordable, permanently affordable homes, we can hire doctors and fix the health care crisis that these folks have contributed to, and we can bring new leadership and new ideas to Ontario. It’s time for change.”

Green Party Leader Mike Schreiner.

“I want to thank each and every one of you for tuning in tonight. My commitment to you is that I will fight to put you in your community first. I will fight for fairness right now.

“In Doug Ford’s, Ontario, the rich insiders are getting richer and the rest of us are just struggling to get by. You have to ask yourself if it’s any better now than it was seven years ago, and it’s clear when it comes to housing, health care, education, climate action, affordability, the answer is no. What separates greens from every party up here is that we’re running local champions who will be your voice at Queen’s Park, not the leader’s voice in your riding. “In Doug Ford’s, Ontario, the rich insiders are getting richer and the rest of us are just struggling to get by. You have to ask yourself if it’s any better now than it was seven years ago, and it’s clear when it comes to housing, health care, education, climate action, affordability, the answer is no. What separates greens from every party up here is that we’re running local champions who will be your voice at Queen’s Park, not the leader’s voice in your riding.

“I tell my deputy leaders, Matt Richter, Parry Sound Muskoka and Ashlyn Clancy, Kitchener center, that I’m not your boss. The people of your riding are your boss, and we need more of that in Ontario, and that’s what the Ontario Greens will deliver as we fight for fairness.”

As we wrap ourselves up from this 2025 Ontario leaders debate, I would like to thank all four leaders: PC leader, Doug Ford, Green Party Leader Mike Schreiner, NDP Leader Marit Stiles and Liberal leader Bonnie Crombie who are on this stage with me tonight. Thank you all for those watching and listening, for engaging in your future. Election day just 10 days away, Thursday, February 27 I’m David Common. Thank you very much for watching.

By Staff By Staff

February 17th, 2025

BURLINGTON, ON

Fresh off campaigning in eastern Canada, Karina Gould was headed for Calgary where an event was to take place.

At least 18 people were injured. There were 80 passengers on the plane Then the real world changed the plans – A Delta Airline flipped over on its back as it was landing. More than 18 people were injured.

Two of the Pearson runways were shut down leaving Gould stranded at the airport while her team on the grand scrambled for a way to include her in the event virtually.

The campaign team reported: “Just letting everyone know that the event tonight is still on however, Karina is currently stuck at Pearson Airport.

Karina doing a campaign meeting in Toronto. Due to the situation at Toronto Pearson Airport, Karina will not be able to attend tonight’s event. However, the event is still moving forward. A member of our team will be present, and we are working on a way for Karina to deliver a few remarks despite the circumstances.

By Staff By Staff

February 17th, 2025

BURLINGTON, ON

Voting locations were made available on February 14.

All you need to know is your postal code.

Readers living in rural communities are finding that the service does not work for their locations. We will followup and see what we can learn from Elections Ontario

For those of you in urban areas it works.

Click HERE to find out where you go to vote.

You will see this image –

Click on it

That will get you to a box where you enter your postal code. That will get you to a box where you enter your postal code.

That will give you the location of your voting location. Remember to take personal identification with you.

By Staff By Staff

February 17th, 2025

BURLINGTON, ON

A loyal reader popped us a note on how she was spending the 60th anniversary of the Canadian flag.

It’s our 7th year…may move here if Poilievre gets in…a man like Trump with no vision and so many of your readers support him….scary and depressing stuff.

Like many Canadians’ my husband and I feel the need to escape the harshness of our winter. For the past 7 years we have spent 2 – 3 months in the Algarve in Portugal. Albufeira is a coastal town in the middle of this part of the country. With moderate temperatures of 17-19 degrees at this time of year, the area attracts Canadians, Dutch, English and other Europeans.

We attended the annual Canada Day celebration at a local bar called Coyote’s. The place was suited up with Canadian flags, red and white balloons and streamers. We attended the annual Canada Day celebration at a local bar called Coyote’s. The place was suited up with Canadian flags, red and white balloons and streamers.

Canadians from all over the area came decked out in their reds and an abundance of enthusiasm, driven even more so by current events. Snacks and entertainment were provided by the establishment with the National Anthem bellowed out by everyone often spontaneously but also directed by the band.

A great time was had by all as patriots donned out in red and white packed the interior with others spilling out onto the patio.

A moderate temperatures of 17-19 degrees It was pride on full display!!!!

By Staff By Staff

February 17th, 2024

BURLINGTON, ON

The next Premier of Ontario will be chosen ten days from now

The four candidates seeking to become the next Premier of Ontario took part in a debate on Friday in North Bay. There will be another debate in Toronto this evening. It will be streamed on the CBC YouTube channel

The following are the the closing arguments made in the North Bay debate

Mike Schreiner of the Green Party.

Mike Schreiner of the Green Party. I want to say thank you to my colleagues for being here tonight. This is democracy in action, and we need to strengthen our democracy, something I believe deeply in. You know, I understand times are tough out there right now. So many families are struggling to get by, to find an affordable home, pay the grocery bills, maybe have a nice March Break with their kids, and that’s exactly why the Ontario greens are fighting for fairness, fighting to make your life a little bit better after seven top long years, fighting for generational fairness so that people in the north and the south can actually have an affordable home, we put forward a plan to legalize housing within existing urban boundaries, so we can quickly start building homes people can afford in the communities they know and love where we have infrastructure, we would renew fees and charges on starter homes to make them affordable for young people.

Again, we would actually start protecting renters, because there is no city in Ontario where a full time minimum wage worker can afford average monthly rent, we would actually have government get back into the building affordable and deeply affordable, nonprofit Co Op and supportive housing with wraparound mental health and addiction supports, because nobody, nobody in Ontario, when housing should be a human right, should be homeless tonight, over 81,000 people in encampments right now. That is so wrong.

We would lower taxes for people earning under $65,000 in households under 100,000 saving you up to $1,700 a month, paying for it by asking the wealthiest tax bracket to pay a little bit more so we have fairness in our tax code. We would reverse the $1,500 cut per student in education so our students don’t have to learn in overcrowded classrooms. We would actually make the investments we need for people to have access to primary health care and to end hallway medicine and ensure that mental health is health and work towards covering it under OHIP, and we would protect the places we love in this province, you know, I love to go fishing. I love to go canoeing. I grew up hunting. You can’t do those things if you have a government that doesn’t protect the nature that protects us as we see the increasing frequency and severity of unsafe weather events fueled by the climate crisis.

We have to protect our farmland and our nature that protects us. We can help people be able to afford things like giving a free heat pump program like PEI in New Brunswick. Have to lower your energy prices and address climate at the same time, we have solutions, but we need local champions, green MPP to come to Queen’s Park and deliver those solutions, because that’s the kind of fair Ontario each and every one of you deserve.

Doug Ford from the Conservative Party,

You know, folks, this election is about leadership. Who do you trust to protect your family, your jobs, businesses and communities? This election is about who’s going to protect the people of Ontario.

Over the last five weeks, we’ve seen what the next four years will look like under President Trump’s White House. He’ll shift the goal post every single day on a whim, creating economic chaos every sign every single time he does it, whether he imposes tariffs tomorrow, next month or next year, President Trump will continue to use tariffs to get what he wants.

We have to be eyes wide open. Tariffs will devastate northern industries like mining, steel and forestry. They’ll put 1000s of Northern workers jobs at risk. President Trump doesn’t know what all we know that Canada is not for sale. Canada is resilient. We’re strong, and we’ll stand up to President Trump and the tariffs to protect Ontario. I’m asking the people for a strong, stable, four year mandate so we can outlast and outlive the Trump administration. The stronger the mandate, the better we’ll be able to protect communities and families and businesses around Ontario as we face down the threat of Donald Trump’s tariffs. Ontario and Northern Ontario has never been more important.

Northern Ontario was blessed to have an abundant supply of critical minerals. The US needs it, the world needs it, but our critical minerals don’t do us any good if they’re sitting in the ground or being shipped off to China, the future prosperity of our province, of our country. Unlocking economic potential of the ring and the ring of fire is absolutely critical. We need to do more. We need to do it faster. The need to speed up permitting and approvals of critical minerals in the ground process shipped right here in Ontario.

We need to ship those out around the world, and we need the federal government to get out of the way. They keep delaying and delaying. We need no more excuses, no more reasons why we can’t or we shouldn’t, friends. We’re in the Battle of our lives here in the province in our country. The front line of that battle starts right here in northern Ontario with the critical minerals. We’ll do whatever it takes to turn Ontario into a critical mineral and energy powerhouse around the world, please join us, and together, we’ll do whatever it takes to protect the people of Ontario. I want to thank you and God bless the people of Ontario. Thank you

Marit Stiles, NDP Leader of the Opposition:

The opportunity to be here with everyone has been fun, I would say, before we leave, though, I want you to ask yourself this question, in tough times, who do you trust to be on your side?

Marit Stiles, NDP Leader of the Opposition: Seven Years of Doug Ford have cost you his bad deals, his scandals have wasted billions of dollars, and they have made life a lot harder for Ontarians. He delivers for the wealthiest, the insiders, but never for the rest of us.

And he’s been singing the same song, folks for seven years. You know, most Ontarians, if they quit their job or they didn’t show up for work. They wouldn’t expect to get rehired, but Doug Ford does, and he thinks he can pull one over on Ontarians, well, we can’t afford another four years of this. We can’t afford more hospitals closing. We can’t afford to lose more family doctors or nurses so burned out because they’ve been so disrespected and taken to court by this government?

We can’t afford wait times in our emergency rooms of 10 to 22, hours if you’re lucky enough to find an emergency room even open. You know, along Highway 11 right now, since we’re in northern Ontario, there are 800 kilometers between Timmins and Thunder Bay, there is one delivery unit on that highway, along that highway, for all of the women who need to give birth. Think about that, right?

That’s Ontario today under Doug Ford, and that’s the North homelessness in every community, and addiction and mental health crisis, the cost of everything just completely out of control.

Ontario needs new leadership, and we need new ideas. In this election, you can trust me to be on your side as Premier, I am going to fight against the rising costs. I am going to defend every job in every sector. I’m going to hire doctors and build homes, and I am also going to fix our schools.

Listen, you’re going to hear a lot over the next few weeks about the legacy of Doug Ford. I want you to think about what we can do that’s better here in the province of Ontario, how we can change things. And so with that, I hope you, I will entrust you to consider supporting me as your premier and to vote for a government, an NDP government that’s on your side. Thank you.

Bonnie Crombie, Leader of the Liberal Party in Ontario:

Thank you for having me here. As you know, this is my first time on this stage. Previously, I was Mayor of the city of Mississauga, so I’ve run a government, a pretty successful government, for almost a decade.

Bonnie Crombie, Leader of the Liberal Party in Ontario: It was very fiscally responsible, but I really feel on social issues, as I hope I’ve demonstrated to you here today. What I want to say is that looking around at this tariff threat and Donald Trump to the south of us, I can’t imagine that there’s another premier in this country that would choose this moment, choose now to call an election. Honestly, we all want our premier to be hard at work, at their desk, working, protecting jobs, our jobs, not just his own job.

By calling an election, it is irresponsible, but I think you’ve heard a lot tonight about the choices that you’re facing. One thing is pretty clear. I don’t think that Doug Ford deserves four more years. Our Northern and our remote communities are really struggling under seven years of Doug Ford and he raised the issue of trust. You can’t trust him because he doesn’t deliver. He doesn’t do what he says he’s going to do. Sure, it sounds folksy and kind of nice, but it’s not real. It’s not true. Back in 2018 he said he’d end hallway medicine, the wait times have doubled.

Back in 2018 he said he’d cut your taxes. He hasn’t cut your taxes. He didn’t get it done. But I will as part of my platform. I’m determined to do it.

In 2022 he said he’d build 1.5 million homes. I was a mayor. I thought, well, this might be good. We’ll get some incentives to build. It didn’t happen. It didn’t happen. He didn’t get it done.

Our record today is worse than it was in 1955 worse housing on record. Jobs are leaving the province to other provinces that have figured it out. BC is building 70% more homes than we are. Think about that for a moment. So is Alberta, 36% more even Quebec, they figured out how to get it done under the same fiscal framework, under the same constraints, like interest rates.

You need a real partner here with the municipalities, and I’m someone who’s walked in your shoes, and I understand what’s happening. Lots of downloading; that downloading has to stop. Our mental health and addictions issues; they need a plan. They need proper funding behind them, not 350 beds, which doesn’t go anywhere, not even in the city of Toronto, let alone over 10 years, spread over how many municipalities this is a this is a crisis right now. What is happening to people who are homeless, over 200,000 of them people facing opioid issues.

I have a plan. My plan is to ensure that you get the basics right. I’m going to ensure that you have a family doctor. I’m going to invest in industries as well, but my most critical goal for you is to ensure that all two and a half million people in Ontario have a family doc. I’m recruiting 3100 of them for less than the price of his fantasy tunnel under the 401 he’d rather put money into a foreign spa than put it into our health care system. He’s putting more money into our spa than into the health care system. we’re going to cut your taxes and build affordable housing.

Doug Ford, incumbent Premier of the Progressive Conservative Party

You know, folks, this election is about leadership. Who do you trust to protect your family, your jobs, businesses and communities? This election is about who’s going to protect the people of Ontario. Over the last five weeks, we’ve seen what the next four years will look like under President Trump’s White House. He’ll shift the goal post every single day on a whim, creating economic chaos every sign every single time he does it, whether he imposes tariffs tomorrow, next month or next year, President Trump will continue to use tariffs to get what he wants.

Doug Ford, incumbent Premier of the Progressive Conservative Party We have to be eyes wide open. Tariffs will devastate northern industries like mining, steel and forestry. They’ll put 1000s of Northern workers jobs at risk. President Trump doesn’t know what all we know that Canada is not for sale. Canada is resilient. We’re strong, and we’ll stand up to President Trump and the tariffs to protect Ontario. I’m asking the people for a strong, stable, four year mandate so we can outlast and outlive the Trump administration. The stronger the mandate, the better we’ll be able to protect communities and families and businesses around Ontario as we face down the threat of Donald Trump’s tariffs. Ontario and Northern Ontario has never been more important.

Northern Ontario was blessed to have an abundant supply of critical minerals. The US needs it, the world needs it, but our critical minerals don’t do us any good if they’re sitting in the ground or being shipped off to China, the future prosperity of our province, of our country. Unlocking economic potential of the ring and the ring of fire is absolutely critical. We need to do more. We need to do it faster. The need to speed up permitting and approvals of critical minerals in the ground process shipped right here in Ontario.

We need to ship those out around the world, and we need the federal government to get out of the way. They keep delaying and delaying. We need no more excuses, no more reasons why we can’t or we shouldn’t, friends. We’re in the Battle of our lives here in the province in our country. The front line of that battle starts right here in northern Ontario with the critical minerals. We’ll do whatever it takes to turn Ontario into a critical mineral and energy powerhouse around the world, please join us, and together, we’ll do whatever it takes to protect the people of Ontario. I want to thank you and God bless the people of Ontario.

By Staff By Staff

February 17th, 2025

BURLINGTON, ON

Rosie DiManno, TorontoStar columnist decides to call out King Charles III Rosie DiManno, a Toronto Star columnist covering sports and current affairs for the Star has never been one to mince her words.

In a column published online this morning Rosie let it all out – both barells – asking where is the King when he could be useful?

A king outranks a potentate or a mountebank shilling from his Oval Office soapbox.

And we’ve got one of those — a king, I mean.

King Charles III So where is King Charles III when Canada needs him? Not a peep out of His Majesty since U.S. President Donald Trump has been blathering and bloviating about this country becoming the 51st American state, repeated ad nauseam, any time he can wedge in a dig. Stony silence as well from the useless Governor General. For that matter, where are the 55 other nations in the Commonwealth that was so vitally important to the late Queen? They haven’t said boo in defence of their beleaguered fraternal member. Or … hello, Europe?

In a constitutional monarchy, the king can’t proclaim “off with his head,” nor ruffle any governance feathers. But savvy Queen Elizabeth II knew how to thread that needle, making her position known in times of crisis. For instance she used her influence among Commonwealth leaders to suspend Zimbabwe over its human rights abuses. (President Robert Mugabe, a dyed-in-the-wool Anglophile despite the legacy of colonialism in what was Rhodesia, went into such a fury — his knighthood also stripped — that he later withdrew Zimbabwe from the organization.)

A coronet-ed head does have subtle power. But Canada might as well be on the other side of the moon, rather than merely the other side of the Atlantic, for all the support for sovereign dominion that Charles has expressed these past few weeks. Links between Charles and Canada have been historically strong — he’s made 19 visits, though all as Prince of Wales, last in these parts in 2022. As the Queen spread out her children and grandchildren as nominal figureheads of the Crown across the Commonwealth, establishing particularly close ties, we got Prince Andrew, who attended school here.

Trump, who has long been in awe of the Royal Family, was especially enthralled by the Queen. Awe for royals but now OW for Canada as the disrupter-in-chief has deep-sixed turned diplomacy, with a slew of whinges about America’s northern neighbour and greatest trading partner. He might not wear a bejewelled headpiece — oh how he wishes — but he’s certainly been wielding his Sharpie like a sword in a frenzy of executive orders.

Charles may not want to be seen as mucking into a partisan spat between Canada and the U.S. But, he’s never had difficulty getting his sentiments across via leaks to the media by assorted confidantes and acolytes. That’s how he effectively demonized Diana as the cuckoo Princess of Wales during the mutually hostile years that threatened the future of the monarchy. And if he doesn’t want to step into this political whirlwind, then send Prince William. Remind Trump that we are part of a much bigger historical empire, millennia old. The USA is, relatively, a pipsqueak and Pax Americana is already in decline. We even once burned down their damn White House. Well, the British did in 1814 during the War of 1812.

Of course, royals need to receive an invitation to step foot in Canada — not including Prince Harry, who went off the protocol grid when he and Meghan landed for a few months in a Vancouver Island mansion after the turncoat Sussexes bolted as “working royals,” before packing up for California. No such invite has been extended. Doubtless “Governor Trudeau,” as Trump disses the prime minister, has more urgent matters on his mind — contending with the unhinged president and staring into the abyss of his protracted resignation with a Liberal leadership race in full throttle. But seriously, in a time of existential upheaval, he really should draft in all the help he can get.

President Donald Trump signing yet another Executive Order The Beltway Bully obviously delights in provoking Canada, tossing around insults whilst reinventing the presidential wheel. Everyone knows, though, that there’s only one way to deal with a bully and that’s to sock him back twice as hard. While at first, when the coveting-Canada postulation was viewed as just a lame joke, it was easy to let the jibe slide. “Never going to happen,’’ said Trudeau last month of the U.S. annexing Canada. Just Trump being Trump, laying the foundation for future negotiations, arm-twisting an ally like no other over tariffs disastrous for both countries, triggering a trade war and force-marching Ottawa into stiffening its borders against illegal migrants and fentanyl.

Except Trump wasn’t just blowing smoke. He did unilaterally rename the Gulf of Mexico, he did wrangle concessions out of Panama over the canal, he did turn his rapacious eye for territorial expansion toward Greenland. At least Denmark countered by threatening to impose a 500 per cent tariff on Ozempic and Wegovy, the weight loss drugs trademarked by a Danish pharmaceutical company. And Trump did — still does apparently — intend to plant the U.S. flag in Gaza, exiling some 2 million Palestinians.

So no, not laughing at Trump’s witless cheek anymore. Just last week, Trudeau told an economic summit in Toronto that he believes Trump’s fixation on Canada is “a real thing” and that the president hankers for this country’s abundance of critical minerals. Trudeau may have once taken Patrick Brazeau to the mat in a charity boxing match but his jabs at Trump have scarcely amounted to rabbit punches. It’s been embarrassing from many angles, even as Trump’s craven hunger for us has galvanized a nation so often at regional knives drawn.

It was actually former Prime Minister Stephen Harper who came out swinging. At the recent launch of his new book, Harper told a private audience: If I was still prime minister, I would be prepared to impoverish the country and not be annexed, if that was the option we’re facing. Now, because I do think if Trump were determined, he could really do wide structural and economic damage, but I wouldn’t accept that. I would accept any level of damage to preserve the independence of the country.’’

Put some more lead in your pencil, Justin, and go out with a bang-bang.

And Your Highness? The real one, not the pretender Prince Trudeau — get your royal purple arse over here.

By Pepper Parr By Pepper Parr

February 17th, 2025

BURLINGTON, ON

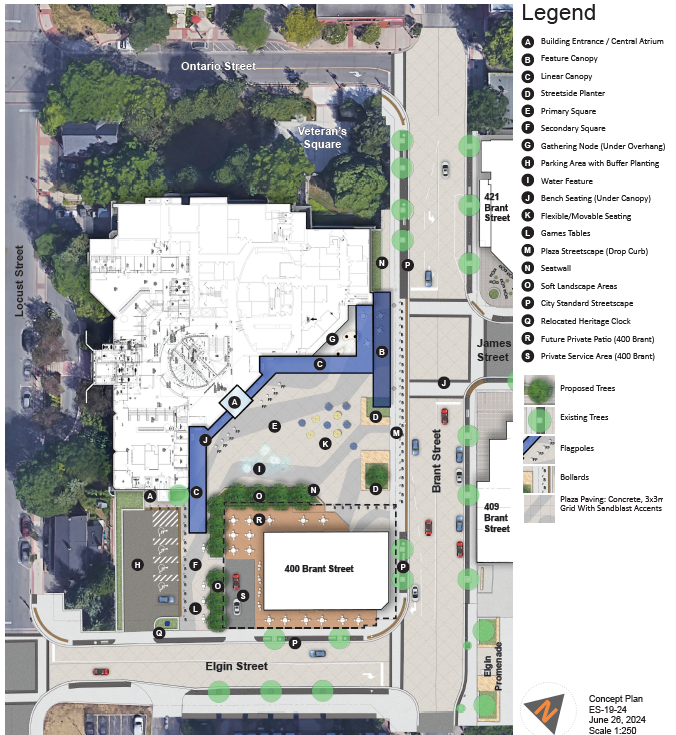

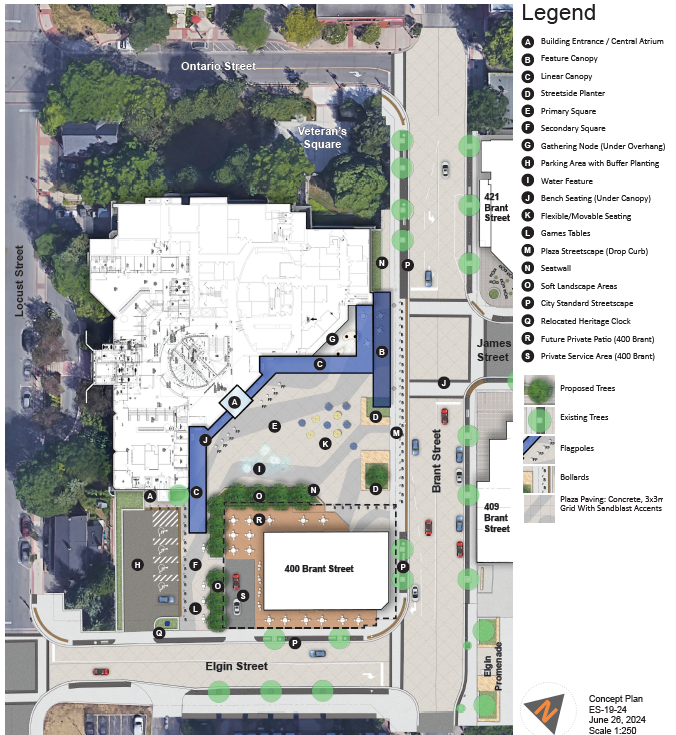

This is the month the city is scheduled to take the Civic Square rebuild to tender.

The timeline at this point is:

Detailed design, permits and approvals from July 2024 to March 2025, tender in February/March 2025 and construction from June 2025 to June 2026.

Members of Council realize this project is one that they are going to have to wear in the months leading up to the 2026 municipal election if the project is late or turns out to cost even more than expected.

If it turns out to be something that people like – they will applaud and be pleased. If it turns out to be a clunker and gets a thumbs down – every member of Council could be looking at the end of their municipal careers.

The problem at this point is that at this point there doesn’t appear to be any potential candidates, other than a possible for Ward 2.

There are many reasons to expect delays on this one – the tariff mess might kill.

Meed Ward said in a Tweet at the time: “Last week, Council received an update from staff regarding next steps on the Civic Square renewal project. We’re nearing the completion of the design work; however, Council has asked staff to report back in September (that was last year) so that Council and the community can get a better understanding of the design.

At a public meeting in City Hall less than 50 people showed up to ask questions of the planners and the design team.

What’s to share? The decision has been made, the funds needed have been allocated and the design teams and doing what they do. Learning that $200,000 was going to be spent on public art was a bit of a surprise but you can’t have a refurbished Civic Square without some art.

Anne Marsden, never a supporter of the project added that: The current Council cancelled the budgetted efforts of the previous Council to abide by access laws for Civic Square. They then turned it into a vanity project that will not satisfy access and safety issues until 2026 and is more than six times the cost. Clearly showing they do not give a fig about how much they spend or their responsibility under the access laws.

Expect some news on this in the not to distant future.

By Staff By Staff

February 17th, 2025

BURLINGTON, ON

Recreational facilities will be opening Monday, Feb. 17 at 9 a.m.

Drop-in recreation programs will resume and facilities will be open for scheduled rentals.

Sliding down a slop was a family event. Was Mom making hot chocolate at home?  Pond opens to the public this morning. The Burlington Rotary Centennial Pond will open tomorrow, weather and ice conditions permitting.

Residents are encouraged to call the ice conditions hotline at 905-335-7738, ext. 8587 before leaving to make sure the Pond is open.

With all the snow – there are still great opportunities to get out and slide.

By Pepper Parr By Pepper Parr

February 16th, 2025

BURLINGTON, ON

Ron Dennis, an ink stained wretch, who has edited a lot of copy in his years as a respected journalist.

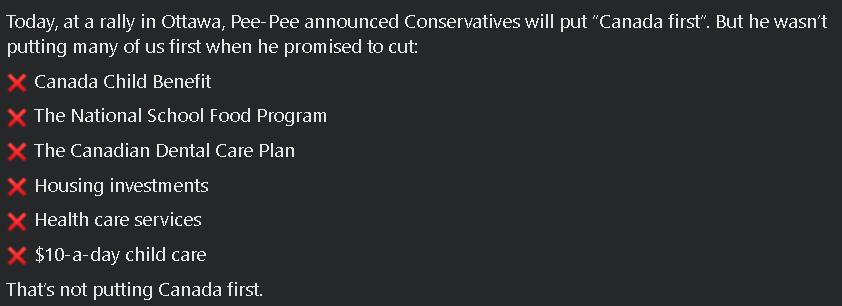

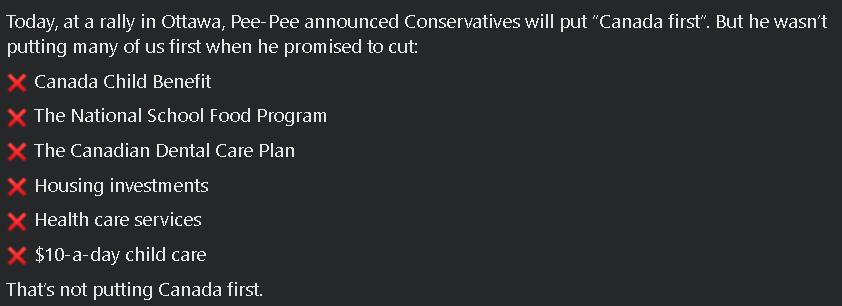

He now lives in Ottawa, originally home town for him; posted his response to remarks Leader of the Opposition Pierre Poilievre made during a speech in Ottawa.

Dennis was moved to publish the following on his Facebook page.

By Staff By Staff

February 16th, 2025

BURLINGTON, ON

A Gazette reader braved the cold weather to take some pictures of what the LaSalle Marian looked like in winter.

Here is what she saw:

In the Spring, Summer and Fall seasons the site is used for wedding photographs. ” A bleak midwinter’s day”.  Marina frozen over – only sign being the Rescue Station Why aren’t there more pictures? Do you know how cold it was?

By Staff By Staff

February 15th, 2025

BURLINGTON, ON

He gets to the top and will go right back down again. Winter weather and the kind of snowfall that used to be normal

What a great winter weather day! Burlington and much of the province got more than a foot of snow with more to come on Sunday.

This is the kind of weather that gets kids out on the hills, such as they are south of Dundas, with everything from big pieces of cardboard or shiny slick snowboards.

A collection of what our photographer saw on the south side of Upper Middle Road where parents and children made the best of it.

With more snow on Sunday and Monday being Family Day – all kinds of opportunities to have some winter fun.

If you or your kids are in any of these photographs and you would like a copy – pop a note along to the publisher (publisher@bgzt.ca) and we will get a copy to you.

We don’t know who she is but with a smile like that there are a set of parents and grandparents that are very proud. Traffic behind them isn’t going anywhere fast. Photographs were taken by Matt Harvey

By Matt Harvey By Matt Harvey

February 15th, 2025

BURLINGTON, ON

The Provincial election takes place in a little over ten days – February 17th.

Some of the people shopping at the Fortinos on Guelph Line had views they were prepared to express.

The people of Burlington are expressing their views on it.

I spoke to 17 people outside of Fortino’s on Guelph Line in Burlington and most knew about the upcoming election, but there was not a consensus among those who I talked to.

Mike, a retiree knew about the election. He said “thought it was necessary’ adding: “For all the reasons Doug ford stated we have to have a good solid majority to be able to enable his policies to combat tariffs from the states”.

A lot people such as Renoda who is also a retiree said she knew about the election but simply answered “no” and said that it was not necessary.

Beoka who is a research manager said she didn’t think the provincial election was necessary. She said: “My understanding is it’s only happening because of what’s happening in the states right now and basically the conservative government has a better chance of winning right now because of all the fear people have about all the tariffs that are about to be imposed”.

This is Doug Ford’s story and he is sticking to it. Adam, who is in the moving business also said that he thought the election was not necessary as well. He said: “I don’t think Doug Ford needs to do this to secure our next few years because of Trump”.

Nick who works for a municipality was in the middle ground and when asked if he thought the election was necessary, he said “To a degree”. I asked why and he stated.” “Because it’s a lot of money to have an election, but at the same time I understand why the premier doesn’t want to spend all this money on the retaliatory tariffs, but some people might say it’s not necessary, so he wants the people to decide how much we want to retaliate against Donald Trump essentially. “

Others such as Marlin who works in accounting said “yes” that its necessary “just because everything going on in the States.”

The Provincial election is on Thursday the 27th the main candidates are Doug Ford of the Progressive Conservative Party of Ontario, Bonnie Crombie of the Liberal Party, and Marit Stiles of the New Democratic Party and Mike Schreiner of the Green Party.

Voters will decide the outcome of this provincial election and it’s sure to be exciting to watch and see what happens. To be able to vote in Ontario, voters must be 18 years of age or older on polling day, a Canadian citizen and a resident of the province.

By Staff By Staff

February 15th, 2025

BURLINGTON, ON

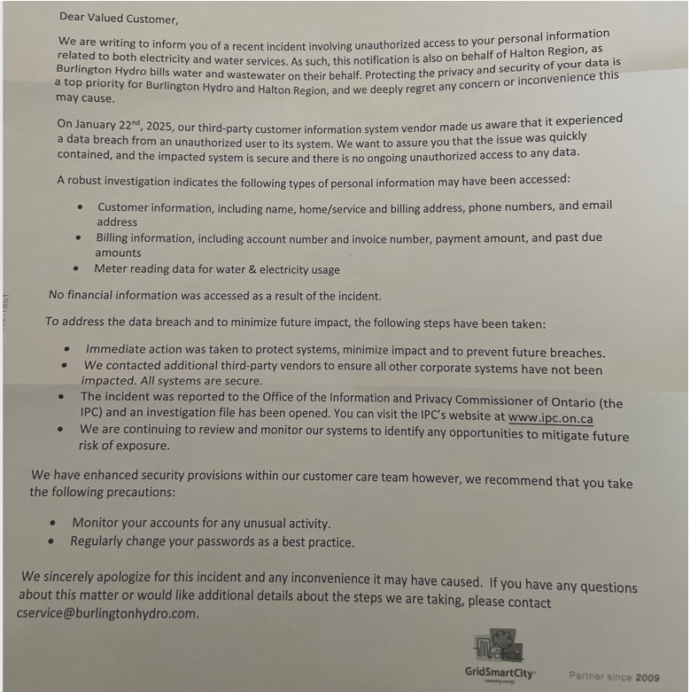

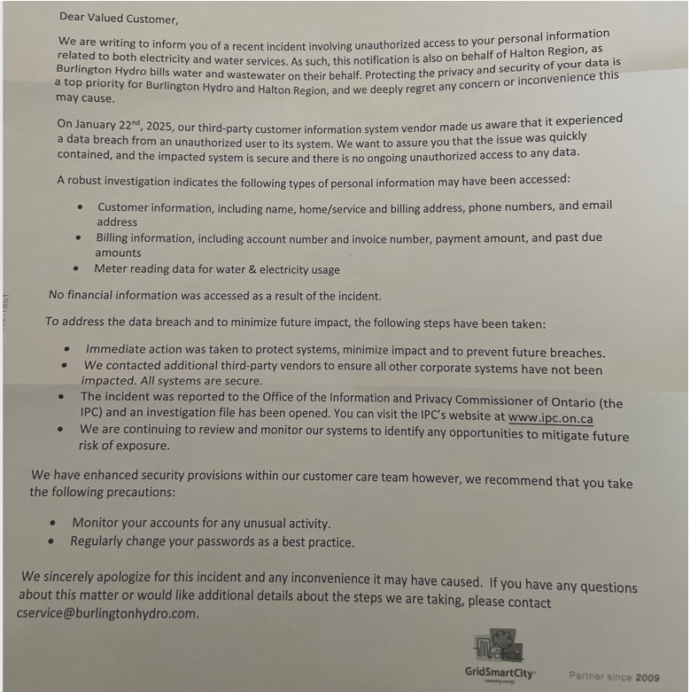

On Friday, February 14th – Valentine’s Day – a number of Burlington residents received a “you are loved” notice from Burlington Hydro. The notice alerted the Hydro customers that they had been “kissed; that there had been a data breach and their private information had been unlawfully accessed. An anonymized copy of the letter follows:

Some Hydro customers didn’t take much comfort or assurance from the letter. The notice covers all the mandatory statutory elements of a notification of privacy breach (as defined by Ontario’s Information and Privacy Commissioner) but it is rather light on background information or on helpful follow-up links. In fact, if you do contact Burlington Hydro you will discover that their Customer Support organization is closed until February 18th, after the Family Day holiday.

What is disturbing or, at the very least needs further clarification, is the second paragraph of the notice – “On January 22nd, 2025, our third -party customer information system vendor made us aware that it experienced a data breach from an unauthorized user to its system. We want to assure you that the issue was quickly contained, and the impacted system is secure and there is no ongoing unauthorized access to any data.”

First, despite the date on the letterhead, it is over 3 ½ weeks from the date of the breach until the first notice to affected customers. And Burlington Hydro used snail mail to the exclusion of other, more immediate means. They have, after all, the email addresses of their customers. In an age when misuse of personal information can occur in milliseconds, this delay is simply far too long.

Secondly, and potentially far more concerning is the statement “our third -party customer information system vendor”. In other words, Burlington Hydro is saying that the customer information database is on a system held (and operated?) by a third party. Who is this “third party” and where are they located? Have they been properly vetted? How remote are they to Burlington Hydro operations? Are they in the USA and subject to all the regulations around trans-border data flows? These are serious questions.

Mayor Meed Ward is a member of the Hydro Board with a C Dir certification that was paid for by Burlington Hydro. I suppose that we must wait until next Tuesday, at the earliest, for answers. Not surprisingly, there is nothing on the city website, although the breach would have been reported to COB as soon as Burlington Hydro was made aware. We should remember that Mayor Meed Ward sits on the Burlington Hydro Board of Directors.

By Staff By Staff

February 15th, 2025

BURLINGTON, ON

Donald Trump’s chaotic presidency and trade war with Canada are triggering a policy shift not seen in decades – one that will spill over into the public service, which many fear isn’t equipped to handle it without major reform.

Trump’s trade shocks have dampened Quebec sovereignty, ignited a wave of national unity and now business and political leaders are racing to recalibrate Canada’s relationship with an increasingly combative and isolationist Trump administration.

Joseph Jacques Jean Chrétien PC OM CC KC AdE, is a Canadian politician, statesman, and lawyer who served as the 20th prime minister of Canada from 1993 to 2003. This push for a more autonomous and resilient Canada could reshape the way government is organized and managed on a scale not seen since the Chrétien government’s 1995 Program Review, driven by a fiscal crisis so severe the Wall Street Journal called Canada the “banana republic of the north.”

The government cut more than 50,000 jobs in that overhaul. Back then, Canada was embracing free trade, globalization, and deepening U.S. ties. Now, as Trump upends that order, Canada is being forced to adapt once again.

At the same time, Trump’s ruthless reduction of the U.S. bureaucracy has Canadian public servants on edge, but experts say his scorched-earth tactics won’t play out in Canada.

“(Trump’s) going to undo a lot of things the public sector has been doing for years, and I don’t think Canada can ignore it,” says Donald Savoie, a leading public administration academic, who has long called for public-service reform. “I don’t think there’s an appetite to go as far as Trump, but we’ll have to move in that direction.”

American politics have always influenced Canada, says Alasdair Roberts, a professor at the University of the University of Massachusetts Amherst’s School of Public Policy. What Trump and Elon Musk are doing will create an “echo effect,” especially if the Conservatives take power, but with a more “modulated approach.”

More in depth detail on the federal civil service can be found at https://www.canada.ca/en/treasury-board-secretariat/services/innovation/human-resources-statistics/demographic-snapshot-federal-public-service-2018.html The crisis has become a catalyst to tackle Canada’s productivity, infrastructure, and pipeline problems. But aside from a handful of academics, no one is asking whether the “creaky, bloated public service”— built for another era — has the capacity to handle the shift, says former clerk of the Privy Council Michael Wernick.

“You can’t be resilient, agile, and effective in the 2020s with a public service built for the 2000s,” says Wernick, the Jarislowsky chair of public administration at the University of Ottawa.

So far, the only focus is on cutting the size of the public service. No one is talking about reforming it.

Beware the early trophies

Wernick doesn’t expect Canada will experience “Musk mayhem” or Argentina’s President Javier Milei’s chainsaw approach to cutting red tape and bureaucracy.

But the next prime minister will “be looking for early trophies.” That will likely mean across-the-board spending cuts and attrition, two of the most common tools governments use to cut spending. It’s the “most foolish and short-sighted way,” he says.

Wernick is in the growing camp calling for a strategic review, as in 1995, so the government can take stock of what government should be doing, what actually works, and stop what doesn’t. It takes political courage to make choices, he says.

That review would help government decide whether it needs to reorganize, merge, close or create departments better suited to today’s world.

The Institute for Research on Public Policy (IRPP) was formed in 1972. It is one of the most trusted and influential think tanks in Canada. They seek to improve public policy in Canada by generating research, providing insight and influencing debate on current and emerging policy issues facing Canadians and their governments. The Institute for Research on Public Policy (IRPP) was formed in 1972. It is one of the most trusted and influential think tanks in Canada. They seek to improve public policy in Canada by generating research, providing insight and influencing debate on current and emerging policy issues facing Canadians and their governments.

By Staff By Staff

February 15th, 2025

BURLINGTON, ON

Canada’s greatest plastic scale model contest and sale is to take place on March 21st at the Canadian Warplane Heritage Museum from 9 am to 4 pm

Contest categories include Aircraft, Armour, Automotive, Ships, Figures, Space, Collections as well as Intermediate, Junior and Bantam entries.

Admission: Adults $20 (Age 18+), Kids $15 (Ages 6-17). LIMITED QUANTITY AVAILABLE – to guarantee your museum entry, purchase your tickets in advance.

WIN A FLIGHT in our World War II D-Day Veteran Dakota FZ692* – purchase your admission ticket by March 21, 2025, at 12 noon EST and you will automatically be entered into the draw for a pair of seats.

CONTEST REGISTRATION FEE – Unlimited number of model entries. Adult (Age 18+) $10, Juniors FREE. SAVE TIME & BUY IN ADVANCE! CONTEST REGISTRATION FEE – Unlimited number of model entries. Adult (Age 18+) $10, Juniors FREE. SAVE TIME & BUY IN ADVANCE!

No exchanges or refunds. Free admission for museum members and children 5 & under. Complimentary passes are not valid for this special event.

Vendor tables – SOLD OUT.

Winner of the flight on the Dakota will be notified March 23, 2025, by phone, must be minimum 12 years old to fly, and flight to be taken in 2025 at a mutually agreed upon time.

Additional info on the MODEL REGISTRATION, CONTEST RULES, AND CATEGORIES available HERE:

By Staff By Staff

February 14th, 2025

BURLINGTON, ON

The District School Board’s 33rd annual Halton Skills Competition, with the elementary competition taking place on Tuesday, Feb. 25 and Wednesday, Feb. 26 at the New Street Education Centre (3250 New St., Burlington).

The secondary competition will be held on Thursday, March 20 at Georgetown District High School (70 Guelph St., Georgetown).

More than 1,100 elementary and 250 secondary students will showcase their skills across various disciplines, demonstrating their creativity, technical proficiency and problem-solving skills.

Working together students can achieve remarkable results. Elementary Competitions

The Elementary Halton Skills Competition encourages teamwork and hands-on learning for Grade 4 to 8 students. Competitors apply math, science and technology skills in engaging challenges including character animation, construction, LEGO robotics and TV/video production. These experiences help students connect classroom learning to future careers.

Secondary Competitions

The Secondary Halton Skills Competition demonstrates student expertise in areas such as 2D character animation, architectural design, auto service technology, baking, carpentry, graphic design, IT and welding. These competitions offer hands-on experience and exposure to career pathways in skilled trades and technology.

These competitions determine which teams qualify to advance to the Skills Ontario Competition, competing against students from across the province.

Background resources

Halton Skills Competition Learning and Resources Technological Education

By Staff By Staff

February 14th, 2025

BURLINGTON, ON

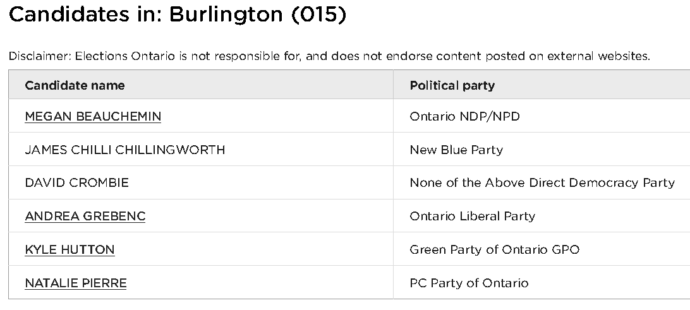

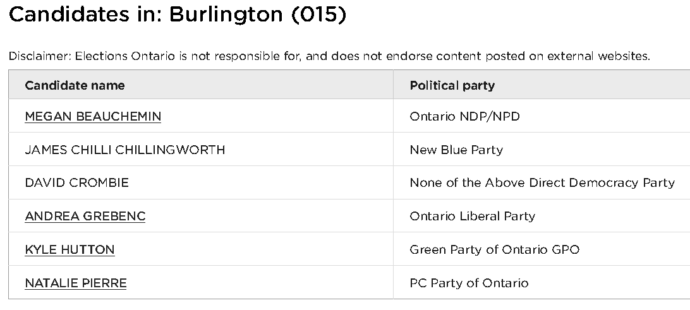

Elections Ontario now has six candidates running for the Burlington seat in the provincial election taking place February 27th,

The None of the Above Direct Democracy Party of Ontario campaigns for the 3Rs of Direct Democracy – Referendum, Recall and Real electoral and legislative Reforms that give voters control of politicians and parties. Candidates are accountable to their constituents and there are no central party policies or controls of elected MPPs beyond the binding Direct Democracy principles.

An all-candidates meeting is to take place at the Port Nelson United Church on February 18th at 7:00 pm

By Pepper Parr By Pepper Parr

February 14th, 2025

BURLINGTON, ON

Who knew?

The Toronto Star reported on comments Premier Doug Ford made at the London Police Service’s sold-out inaugural “chief’s gala appreciation dinner and awards night” — which was not listed on Ford’s daily campaign itinerary provided to reporters at Queen’s Park — was obtained by the Star.

Doug Ford took his tough-on-crime talk to new heights in a campaign speech where he pushed for a return to capital punishment, the Star has learned.

Musing about stiffer penalties for home invaders who kill victims, the Progressive Conservative leader called for changes in the federal Criminal Code that would empower judges to “send ‘em right to sparky.”

Continue reading Premier Ford wants capital punishment returned – prefers the electric chair over life in prison

By Pepper Parr By Pepper Parr

February 13th, 2025

BURLINGTON, ON

City Council will discuss a staff report on the Burlington Lands Partnership and look at Partnership Potential for City-Owned Lands.

There are 277 City-owned properties that are part of the initial inventory. Preliminary internal staff engagement has identified the 13 potential opportunities with partnership potential.

Land exchange opportunity to facilitate amenities and housing in Major Transit Station Areas (MTSAs) – 2 potential opportunities

Redevelopment opportunity for mixed-use (public uses and amenities) in Burlington Downtown – 5 potential opportunities

Affordable housing opportunity – 6 potential opportunities

The locations were listed in a confidential report

In order to make existing city-owned sites available for partnerships, there are opportunity costs involved to define workplans to advance partnership arrangements and for the potential movement/replacement of current uses into new or other locations. In addition, if sites are to be released by the City for partnership development, these will need to be declared surplus. This report represents important initial step in mobilizing development on underutilized City-owned lands.

The assessment of city-owned sites will be integrated into the 2025 Burlington Lands Partnership (BLP) work plan and coordinated with other departments as applicable. Initial steps to continue exploring these and other opportunities will be pursued as described in this report.

Engagement: As specific land-related opportunities evolve, Council and staff will endeavor to make information on land opportunities available publicly at the appropriate time both for purposes of information and engagement and prior to final decisions where possible.

The analysis considered several high-level factors, including:

- Site location and suitability for partnerships

- Proximity to transit and vacant or developable land nearby

- Existing development interest in adjacent or nearby parcels

- Site servicing and constraints

- Proximity to parkland and public amenities

The potential opportunities outlined in this report have been verified through a desktop review exercise. The feasibility of any development or redevelopment of these sites has not been assessed yet and will be completed. Some of this work has been accommodated as part of the 2025 Budget. There may be additional resource requirements identified as some of these opportunities are pursued. These will be brought forward in future updates to Council as necessary.

Key Considerations

The City does not have any developable vacant land that has been declared surplus. There are undefined opportunity costs associated with making city owned lands available for partnerships. The cost to move/replace current uses into new or other locations must be studied. The financial implication of utilizing and/or intensifying City lands is unknown at this time. All real estate transactions will be managed by the Realty Services department in accordance with the City’s Sale of Land Policy.

Ticking off the boxes

[X] Designing and delivering complete communities

[X] Providing the best services and experiences

[X] Protecting and improving the natural environment and taking action on climate change

[X] Driving organizational performance

| Type of Opportunity |

Potential Work Plan |

| 6.0 Land exchange opportunity to facilitate amenities and housing in Major Transit Station Area (MTSAs) |

6.1 Business case

6.2 Council update on business case

6.3 Public engagement (external)

6.4 Council request for support/budget/declaration to partner |

| 7.0 Redevelopment opportunity for mixed use (public uses and amenities) in Burlington Downtown |

7.1 Request for public interest for partner

7.2 Partner recruitment, due diligence, and selection

7.3 Council Update on public interest/selected process

7.4 Development of a joint business case with the city and partner

7.5 Council update on business case with selected partner

7.6 Public engagement (external)

7.7 Council request for support/budget/declaration to partner |

| 8.0 Affordable housing opportunity |

8.1 Request for public interest for partner

8.2 Partner recruitment, due diligence, and selection

8.3 Council update on public interest/selection process

8.4 Development of a joint business case with the city and partner

8.5 Council update on business case with selected partner

8.6 Public engagement (external)

8.7 Council request for support/budget/declaration to partner |

Station West in Ward 1 houses several thousand families with next to nothing in the way of park and recreational space. The Station West development in Ward 1 has next to nothing in the way of park space. If the city owns any of the land in that area they might give some thought to adding parkland that the developer got away with having to provide when the development was approved. Mention in the report of: Land exchange opportunity to facilitate amenities and housing in Major Transit Station Area (MTSAs) opens a door for such an opportunity/

|

|