By Pepper Parr By Pepper Parr

May 29th, 2025

BURLINGTON, ON

This is nothing to brag about.

Burlington Residents’ Action Group (BRAG) is in the process of dissolving the not-for-profit corporation. Burlington Residents’ Action Group (BRAG) is in the process of dissolving the not-for-profit corporation.

For some reason, the people of Burlington do not appear able to create a community organization that manages to bring about changes.

Oakville has more than a dozen community organizations that Mayor Burton brags about, even though they are frequently a pebble in his shoe.

ECoB Engaged Citizens of Burlington was created to try and hold the Goldring Council to account.

What they managed to do was hold all candidate meetings in all six wards, which resulted in five new members for a seven-member council.

And then ECoB fell apart – they weren’t able to get to the point where there was strong representation at the ward level. And then ECoB fell apart – they weren’t able to get to the point where there was strong representation at the ward level.

The BRAG situation seems to be due to philosophical differences -it had a very small four-member board that didn’t meet as much as it perhaps should have.

Some in leadership roles were not prepared to have to cope with some of the limitations that go with corporate titles.

The President of BRAG personally paid for the incorporation. Donations to BRAG were returned to the donors.

We understand that at a contentious Board meeting, two members of the Board were opposed to the dissolution of the corporation – they were apparently told that if they could not vote for a dissolution, then they would have to take over the board. The two chose not to take on that task.

A new organization has been formed by the two members who decided that a dissolution was the only solution. We are advised that the BRAG membership has yet to be advised of these changes.

The biggest issue is reported to be the creation of a policy document that was never created. Members wanted the organization to determine what they were setting out to do.

BRAG tended to focus on taxation matters and holding the civic administration fiscally accountable. We have not used the names of the people involved other than those who released statements. The fear is that this would become a he said she said back and forth.

Bad enough that the city is losing the one community organization that it had. In a statement given to the Gazette earlier today we are told:

“Community groups come and go. People volunteer their time for a cause that interests them. Sometimes, personalities get in the way; some members of the group are passionate about the group going in one direction, while other members may have different ideas. Burlington is certainly large enough to support many community groups.

“The folks at BRAG have arrived at a difficult decision and have decided to dissolve the organization.

Stephen White  Eric Stern “Eric Stern and Stephen White have chosen to start a new group to carry on some of the work that BRAG was doing. The new group is named Focus Burlington. There are many steps to forming a community group, and Focus Burlington is working through those steps.

“The website is up and running at www.focusburlington.ca

“A not-for-profit corporation is being set up.

“The BRAG website will shut down on June 6th, 2025.

“BRAG accomplished many things, the most important of which was to let the people who work at City Hall, staff and council, know that some residents care about how the city shares information and where our tax dollars go. Burlington’s capital and operating budgets represent half a billion dollars, a huge amount of money, and taxpayers have every right to ask for value for their money.

“Focus Burlington has four main focus areas: Budgets, Development, Safety and Traffic.

“We expect city staff to present their 2026 Financial Needs and Multi-Year forecast in the near future, giving us a glimpse of the 2026 budget. The Focus Burlington budget team / formerly the BRAG budget team, is getting ready for a deep dive into the 2026 City of Burlington Budget.

“Stay tuned.”

Lynn Crosby speaking for what is left of BRAG said:

Lynn Crosby “We at BRAG are writing to announce to you, our valued supporters, that it has been decided that BRAG will be winding down our operations. Our BRAG website will shut down on June 6, 2025.

“We have accomplished a lot in just over one year, and our dedication to holding elected officials to account; informing the public of what is happening at city hall; demanding true citizen engagement; speaking out for transparency, fiscal prudence and democratic principles, has not wavered. Some of us think that there may be other ways in which we can effect change, some want to take a breather from city politics, particularly in light of what is happening in the larger world around us in these unprecedented and worrying times.

“The next municipal election is in late October 2026 – which means the campaigning begins in less than one year. We believe that Burlington needs new faces around the council table and we each will continue to work towards advocating for change, in whatever ways we are able.

“We would like to thank each and every one of you for supporting BRAG. We had a large number of residents working hard behind the scenes with us: providing advice, doing research, studying those massive budget documents line by line, watching council meetings, and helping to spread awareness to other residents. We wish you all the best, and I’m sure our paths will cross again as we continue to work towards better things for Burlington as we approach the election, despite feeling the same election fatigue as you probably do!.”

How will it work out? BRAG certainly sent a strong signal to City Council. How much of their message actually got through is something that will become evident when Council gets into the debate on the 2026 budget.

This is going to be seen as the ‘election budget’; will it make a difference?

By Pepper Parr By Pepper Parr

May 29th, 2025

BURLINGTON, ON

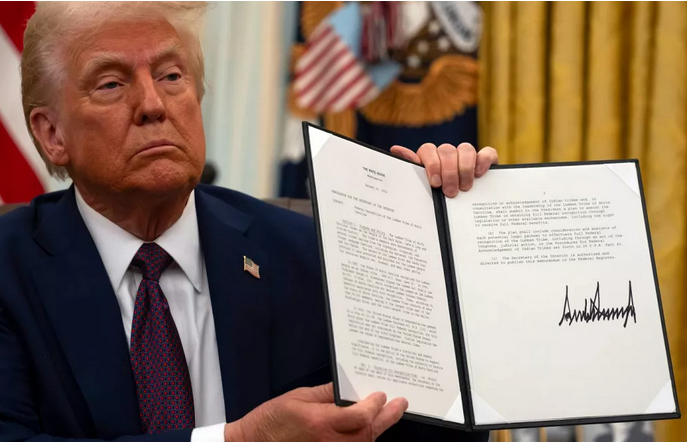

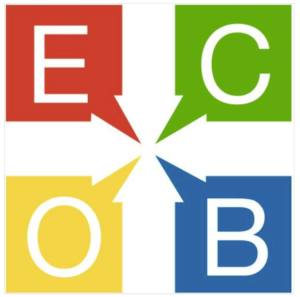

Donald Trump holding an Executive Order he has signed. To date, there are more than 100 of these documents in place. United States President Donald Trump hit a major legal barrier for his plan to realign global trade after a federal court on Wednesday blocked both the sweeping “Liberation Day” tariffs and the fentanyl-related duties against Canada and Mexico.

The U.S. Court of International Trade decision said Trump does not have the authority to wield tariffs on nearly every country through the use of the International Economic Emergency Powers Act of 1977.

FIX HERE The ruling from the three-judge panel at the New York-based federal court said “any interpretation of International Economic Emergency Powers Act of 1977, usually referred to by the acronym IEEPA, that delegates unlimited tariff authority is unconstitutional.” It said “the challenged tariff orders will be vacated,” representing a nationwide injunction against any further imposition of the duties.

It’s expected the Trump administration will appeal. White House spokesman Kush Desai said “it is not for unelected judges to decide how to properly address a national emergency.”

Global stock markets have been in turmoil and supply chains have been upended as Trump used unprecedented presidential power to enact his tariffs. Up until Trump’s return to the White House, IEEPA had never been used by a president to impose tariffs.

Wednesday’s decision sowed doubt into how Trump will continue to implement his signature economic tariff policy.

Fentanyl seized by police at the Canada US border. Trump hit Canada with economy-wide duties in March after he declared an emergency at the northern border related to the flow of fentanyl. He partially paused levies a few days later for imports that comply with the Canada-U.S.-Mexico Agreement on trade.

U.S. government data shows a minuscule volume of fentanyl is seized at the northern border.

Trump took his trade war to the world in April then walked back the most devastating duties a few hours later but left a 10 per cent universal tariff in place for most countries.

The White House on Wednesday maintained that “historic and persistent” trade deficits were an emergency. Desai said deficits “decimated American communities, left our workers behind, and weakened our defense industrial base – facts that the court did not dispute.”

“This is a giant power grab by the president and the court was very clear that he cannot claim this kind of unlimited tariff authority,” said George Mason University law professor Ilya Somin.

Somin, along with the Liberty Justice Center, represents the small businesses. They argued IEEPA does not mention tariffs, nor is there even a synonym, such as duties. The U.S. Constitution gives power over taxes and tariffs to Congress and Somin said Trump is misusing the statute.

The court found Trump’s unlimited use of tariffs to hit every country with duties is not in line with IEEPA and is unconstitutional.

Somin said it “is a big victory for us and for opponents of these illegal, harmful and abusive tariffs.” It is also a big victory for Canada, he added.

By Pepper Parr By Pepper Parr

May 28th, 2025

BURLINGTON, ON

The 2025 Bay Area Economic Summit takes place in Burlington on Thursday, June 5 at the Pearle Hotel & Spa.

Single-day event running from 7:45 – 11:15 a.m.

The event is a partnership with the Burlington Chamber, Burlington Economic Development and Hamilton Economic Development, uniting Hamilton and Burlington leaders to tackle economic challenges and opportunities.

Featuring expert discussions, strategies, and networking, this year’s theme focuses on driving regional progress through sustainability, transportation and supply chain investment. Hamilton and Burlington leaders will tackle economic challenges and opportunities. Expert discussions, strategies, and networking, this year’s theme focuses on driving regional progress through sustainability and A.I.

This year’s theme, Catalyst for Growth: Housing, Sustainability & Supply Chain, explores issues that sit at the intersection of policy and business. These topics are more than policy discussions; they’re real -world factors that influence how companies scale, build talent pipelines, and navigate complex supply chains.

Terry Caddo, president of the Burlington Chamber, reports that 200 + people have registered. The location can hold 225 – we’d like to fill the place,” said Caddo.

The Pearle is the smartest destination the city has.

Mike Moffatt, Founding Director at Missing Middle Initiative. Dr. Mike Moffatt, Founding Director at Missing Middle Initiative, Professor and Economist, is the keynote speaker. He will tell anyone who will listen that if you don’t get housing right, nothing works out. Moffatt has become the leading thinker on how the country’s housing needs can be worked out and where the government can play a leading role.

Moffatt is worth listening to.

By Pepper Parr By Pepper Parr

May 28th, 2025

BURLINGTON, ON

The Prime Minister had a great day.

Prime Minister Mark Carney, with his wife to his left, works the crowd waiting for the King to arrive. He was out on the streets with people glad glad-handing like a politician with a decade under his belt.

There was a video clip floating around of Minister Melanie Joly sliding from her seat in the front row in the House of Commons to sit in the seat next to Prime Minister Carney who was burrowed into the work in front of him

Carney didn’t even raise his head – he just reached out with his left arm and flipped his hand, telling Joly – not now.

Joly slid back to her seat.

The relationship with King Charles III was much better. At the risk of putting words in the mouth of the King – the photograph below suggests the King and the Prime Minister were both pleased with the statement: The True North Strong and Free that was part of the Speech from the Throne.

At the risk of putting words in his mouth, one can imagine the King saying: ‘We pulled if off, didn’t we – The True North Strong and Free. Almost as good as De Gaulle’s “Vive le Quebec Libre”

By Anthony Lucarno By Anthony Lucarno

May 26th, 2025

BURLINGTON, ON

Online casino players must provide websites with sensitive personal and banking information when creating accounts, withdrawing funds, or depositing their winnings. When choosing an online casino, it is crucial to pick one with a history of player safety because such a brand guarantees the safety of your sensitive information.

Additionally, trusted real money online casinos provide you with a highest win rate guarantee and a fair chance of winning, thereby improving your gaming experience.

Real money online casino players recommend Yukon Gold Casino, Golden Tiger Casino, Zodiac Casino, Luxury Casino, and Captain Cooks Casino due to their security, fairness, and trustworthiness in real money gaming.

Featured Real Money Casinos in Canada

Luxury Casino is a brand known for reliable money play and reliability. The casino ensures the highest payouts and easy casino transactions by working with reputable game developers and payment providers. The casino is also licensed and regulated, which means it meets all safety requirements for secure casino platforms.

Zodiac Casino has a reputation for safe play and the use of effective safety measures. The casino and all its game providers are certified by eCOGRA. The casino encrypts all player data on its website and server and uses firewalls to protect against unauthorized access.

Captain Cooks Casino aims to provide trusted casino experiences similar to what players would get at physical casinos. It does this by working with vetted game developers to ensure all its games are safe and adhere to fair play regulations. The casino also works with reputable payment providers to ensure players can receive their winnings promptly.

Building Trust with the Highest Win Rate Guarantee

All Casino Rewards Group casinos, including Golden Tiger Casino, provide a HIGHEST WIN RATE GUARANTEE that assures players of the highest win and return to player (RTP) on all games on its platform.

This guarantee ensures fairness because it ensures all players have a fair chance of landing a big payout. Golden Tiger Casino also undergoes audits that check for fair and reliable real money play. These audits result in fair play assurances since they verify that the outcomes of all plays are unbiased and cannot be manipulated.

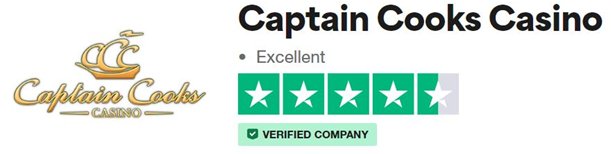

Identifying Trusted Casinos for Real Money Play

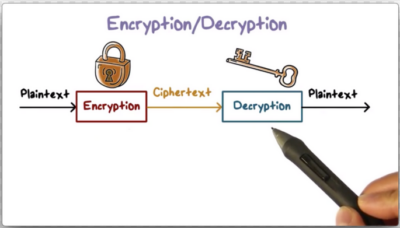

So, what should you look for to identify trusted casinos? All trusted real money casinos use encryption on their websites. You provide a casino with your information (username, passwords, banking information) in plaintext. The casino uses encryption to turn this data into an unreadable format known as ciphertext. This makes it unusable by anyone who intercepts it or does not have the right key. So, what should you look for to identify trusted casinos? All trusted real money casinos use encryption on their websites. You provide a casino with your information (username, passwords, banking information) in plaintext. The casino uses encryption to turn this data into an unreadable format known as ciphertext. This makes it unusable by anyone who intercepts it or does not have the right key.

The second factor is the use of secure and licensed payment methods. Casinos that guarantee secure online gambling work with reputable and vetted payment providers to ensure safe casino transactions. These payment providers are independently verified and have a strong reputation in their industry for facilitating sensitive transactions.

Lastly, trusted casinos are licensed and registered. Doing this requires undergoing and passing strict audits that check their systems and processes for player security, fair gameplay, and adherence to privacy and data protection regulations.

How can you know if a casino meets these standards? One of the best ways to do this is to check its Trustpilot reviews. This platform allows players to leave the best casino reviews discussing various aspects of the casinos they have experience with.

Players regularly mention a casino’s licensing and registration, its encryption protocols, the game developers and payment providers it works with, and whether it adheres to data protection and privacy guidelines.

You can also use these reviews to gauge player satisfaction. Check what players write regarding a casino’s customer support, how usable its website is, and how well it protects their accounts, personal information, and financial data.

Ensuring Integrity through Audits and Certifications

All trusted real money online casinos are licensed and regulated by at least one regulatory body. Before licensing and regulations, these casinos must undergo verification and certification audits. These audits result in verified casino integrity because they verify details like security practices, use of secure payment providers, responsible gambling tools on responsible gaming sites, fraud and identity theft protections, and more.

Top-rated casinos that guarantee secure online gambling are certified by bodies like eCOGRA. ECOGRA and other bodies conduct independent audits of casino games and game developers to verify that they meet the highest casino security standards. Top-rated casinos that guarantee secure online gambling are certified by bodies like eCOGRA. ECOGRA and other bodies conduct independent audits of casino games and game developers to verify that they meet the highest casino security standards.

Such audits also result in certified casino safety since they verify that all casino games on trusted real money gaming platforms use secure payment providers.

Why Trusted Casinos Are Preferred for Real Money Gaming

Trusted casinos are preferred because they have player protection policies that protect players and their funds. These include measures like encryption, mandating strong passwords, account monitoring, and behaviour analysis to catch issues early.

These casinos also have transparent payment processes supported by their payment partners. Players know the fees they will pay for withdrawals and how long these processes will take.

Lastly, these casinos provide superior customer support. Their experienced customer service agents answer questions and assist with deposits, withdrawals, games, payout rates, and more.

Selecting the Best Trusted Real Money Online Casino

The most trusted real money online casinos encrypt player data and financial information, work with secure and vetted payment providers, and are licensed and regulated by reputable bodies. Trusted online casinos also have numerous positive reviews and high ratings on Trustpilot and other review platforms.

Players should visit casino platforms like Golden Tiger Casino, Zodiac Casino, Yukon Gold Casino, Luxury Casino, and Captain Cooks Casino to experience their trusted casino experiences and for exceptional real money gaming experiences.

By Pepper Parr By Pepper Parr

May 27th, 2025

BURLINGTON, ON

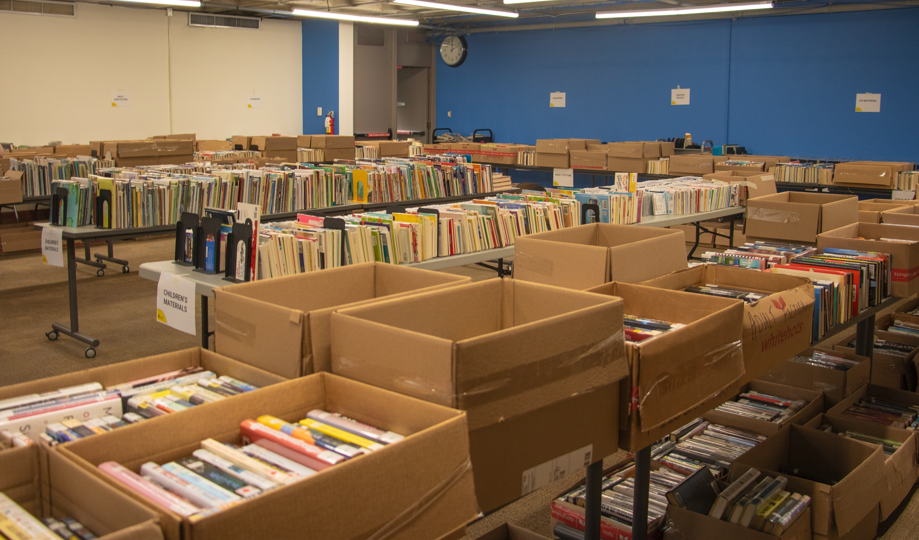

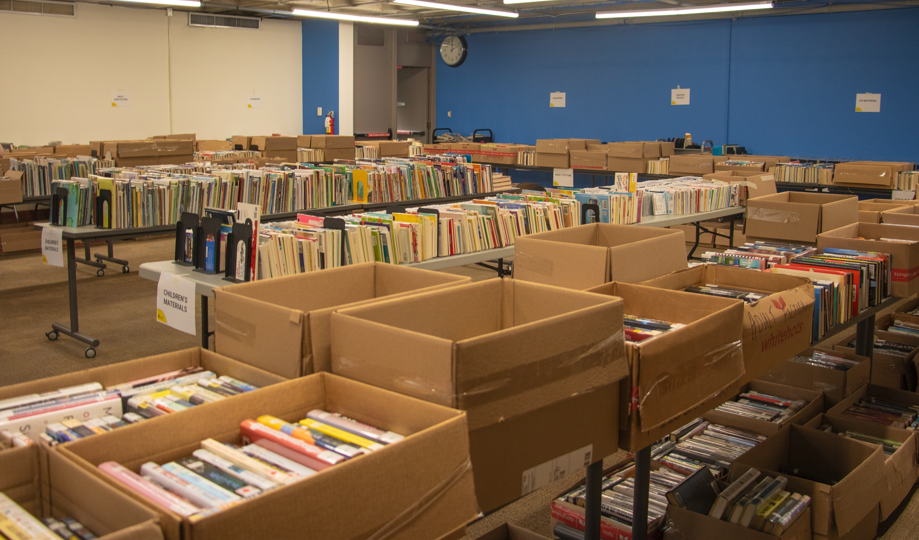

The BPL Book Sale was a great day, with 910 eager shoppers visiting Central Branch on Saturday, May 24.

While they didn’t have an exact count of the number of items available, thye were able to say that “we sold 185 boxfuls of books, DVDs, CDs, and magazines, which generated net proceeds of $3,600.

The funds raised will support Library initiatives and building the collection.

Books, DVDs, CDs, and magazines ready for the annual BPL Book Sale.

By Pepper Parr By Pepper Parr

May 27th, 2025

BURLINGTON, ON

A picture is indeed worth more than 1000 words.

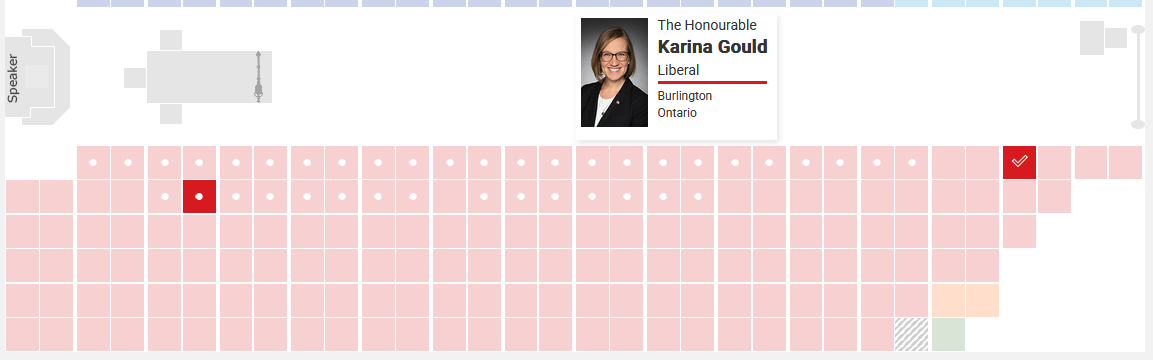

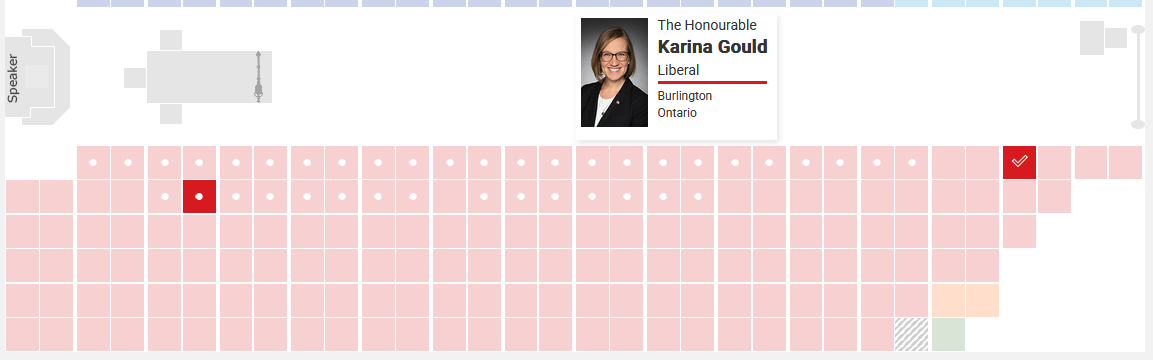

The seating plan for the House of Commons that met for the first time on Monday has former Cabinet Minister Karina Gould sitting about as far away from the Speaker as one could get.

Burlington North – Milton West MP and Secretary for Sport, Adam Koeverden is a lot closer. Burlington North – Milton West MP and Secretary for Sport, Adam Koeverden is a lot closer.

The seating plan was no accident – the Prime Minister has made it very clear – no room for Gould in his inner circle.

The question that begs to be asked is – What did Gould do that got under Carney’s skin? Follow that up with the question: Is he that thin-skinned?

It is going to be interesting to see how well Koeverden grows as the politician people will go to with Burlington-related issues.

Gould brought a lot of federal funding into Burlington; she knew how Ottawa worked. At the moment, it isn’t working all that well for her.

There is a lot of spunk and a lot of spine to Karina Gould – her plans to become the Prime Minister at some point are just on hold.

By Yanis Temby By Yanis Temby

May 27th, 2025

BURLINGTON, ON

The supplement business is much more than steroids. It is a well established part of the health sector. Supplements are one of the most talked-about — and misunderstood — parts of the fitness world. From protein powders to muscle builders, opinions range from “life-changing” to “dangerous.”

The truth? Most of these opinions are based on myths, not facts.

In this article, we’ll break down five of the biggest supplement myths and show you how modern, science-backed products can support your fitness goals when used responsibly.

Myth #1: All Supplements Are Just Steroids in Disguise

There are many different types of supplements. One of the biggest misconceptions is that any product designed to build muscle or improve recovery is automatically a steroid.

The Truth:

There are many different types of supplements — protein, creatine, amino acids, and more advanced options like SARMs or hormone regulators. Most of these do not function like steroids.

Some newer compounds, such as growth hormone secretagogues, support your body’s natural hormone production rather than replacing it. For example, MK-677 is a compound used to increase growth hormone levels naturally, without testosterone suppression or major side effects. It’s become a popular choice for improving sleep, boosting recovery, and supporting lean muscle development.

You don’t need to be a pro bodybuilder or a competitive athlete to benefit from supplements. Myth #2: Supplements Are Only for Professional Athletes

You don’t need to be a pro bodybuilder or a competitive athlete to benefit from supplements.

The Truth:

Most people using supplements today are regular gym-goers who want to feel stronger, lose fat, or improve energy. Some supplements may be especially helpful as you get older, when natural hormone levels begin to decline.

With the right support — combined with solid training and nutrition — even beginners can see better, faster results. Many modern options are accessible, easy to use, and backed by clear guidance and quality control.

Myth #3: All Supplements Are Unsafe or Unregulated

Some people avoid supplements altogether because they worry about side effects or unsafe ingredients.

The Truth:

Quality varies — but that’s true of any industry. There are trusted brands that provide lab-tested, clean, and well-documented products. Look for supplements that use transparent labeling, organic carriers (like MCT oil), and published purity testing.

For example, SARM Canada is one company that emphasizes product purity, accurate dosing, and safe usage guidelines. Their products are formulated with high standards and are trusted by users across North America.

A strong foundation in nutrition and exercise is essential. But even with perfect consistency, your body eventually reaches a limit. Myth #4: You Can Get the Same Results From Diet and Training Alone

A strong foundation in nutrition and exercise is essential. But even with perfect consistency, your body eventually reaches a limit.

The Truth:

Once progress slows, smart supplementation can help. Certain compounds improve recovery, stimulate muscle repair, and promote fat metabolism in ways that training alone cannot. For example, MK-677 — mentioned earlier — is often used to support deep sleep, better recovery, and improved muscle fullness, especially in experienced lifters or during calorie deficits.

When paired with a solid plan, these tools can help you train harder, recover faster, and see results more quickly.

Myth #5: Muscle-Building Supplements Are Addictive or Dangerous

The fear around supplements often stems from extreme cases involving unregulated or misused products.

The Truth:

Responsible use, correct dosing, and cycling make all the difference. Many well-researched compounds do not cause addiction or hormonal crashes when used as recommended. Most users follow a short cycle and then take a break to let the body reset.

Choosing products that include usage instructions and safety information helps users stay on track and make informed choices.

Gender and age are not factors that keep people away from muscle building. Final Thoughts

Supplements are not a replacement for effort — they’re a way to get more out of the work you already do.

The key is education and quality. Look for clean, trusted options that support muscle growth, fat loss, recovery, and overall well-being.

Forget the myths. Trust the science. And make sure you’re choosing supplements that support your goals without compromising your health.

By Diana Kharchenko By Diana Kharchenko

May 27, 2025

BURLINGTON, ON

Properly installed flagstone lasts and adds value to a home.

Flagstone patios are timeless. Natural, durable, and undeniably charming, they bring texture and personality to any outdoor space. But even the most beautiful surfaces aren’t immune to wear and tear. One day you’re sipping coffee on your back patio, and the next—crack. A hairline split turns into a spiderweb. Suddenly, your yard’s crown jewel doesn’t feel so flawless.

If you’ve noticed cracks forming and don’t know where to start, you’re not alone. Early flagstone repair can save time, money, and the overall look of your landscape. And understanding what causes flagstone to crack in the first place? That’s the first real step toward a lasting fix.

What Makes Flagstone Special—and Vulnerable

Flagstone isn’t just one kind of stone. It’s a group. Sandstone, slate, limestone, and bluestone all fall under its umbrella. These sedimentary rocks split naturally along flat planes, creating those iconic slabs we all know and love.

But here’s the catch: flagstone’s beauty lies in its irregularities. Each piece is unique—formed by nature, not a machine. That natural appeal also comes with quirks. Some stones are denser. Some absorb more water. Some handle cold like champs, while others crumble under frost.

Translation? Even when installed perfectly, flagstone isn’t invincible.

It performs well under the right conditions. But add moisture, shifting ground, or repeated pressure, and cracks become part of the story.

Flagstone ready for installation. Freeze-Thaw Cycles: The Silent Saboteur

Live in a region with cold winters? This one’s for you.

Moisture is a flagstone’s best friend and worst enemy. Water seeps into tiny pores and settles into joints. When temperatures drop, that water freezes. And when it freezes? It expands—like popcorn in a microwave.

Crack. Pop. Push. That expansion places stress on the stone, causing splits, flakes, or full-on breaks. It can lift slabs from their bedding, shift joints, and widen existing cracks in just a few freeze-thaw cycles.

Over time, even the toughest flagstone can’t stand up to the pressure. Especially if it wasn’t sealed or graded correctly.

The result? A once-smooth surface starts to feel more like a jigsaw puzzle.

Improper Installation: A Faulty Foundation

Even the best flagstone needs a good base. Without one, it’s like building a castle on sand.

Installation is critical – don’t crimp on what you pay. Many cracks trace back to poor installation. Weak bedding layers, loose subgrade, or the wrong mortar can set the stage for disaster.

Sometimes installers cut corners with materials. Skipping gravel layers. Using thin mortar. Failing to compact the soil. It saves time upfront—but costs more later when the stones shift, settle, or break.

Think of flagstone like a puzzle laid over a trampoline. If the base isn’t solid, pieces will move—and eventually crack under pressure.

A proper foundation should include compacted base gravel, bedding sand or mortar, and solid edge restraints. Anything less, and you’re walking on borrowed time.

Heavy Loads and Repeated Pressure

Flagstone isn’t made for everything. Yes, it’s sturdy. But it’s not concrete.

Driveways, heavy furniture, large grills, or frequent foot traffic in tight areas can cause stress. Over time, that pressure leads to hairline fractures that deepen with each season.

Even smaller issues add up. A wheelbarrow rolling over the same joint. Patio chairs scraping back and forth. The repetitive motion works like erosion—small changes, day by day, until something finally gives.

To keep your flagstone patio intact, distribute weight evenly. Use protective pads under furniture. Avoid placing heavy objects on unsupported slabs. And most importantly, install stones thick enough to handle their environment.

Water Drainage and Erosion

Water is nature’s sculptor. Left unchecked, it carves, shifts, and moves everything in its path—including your patio.

Poor drainage is one of the biggest culprits behind flagstone damage. Water that pools under or around your stonework gradually erodes the bedding layer. As the support weakens, stones sink or tilt. The added movement increases the chances of cracking.

Erosion around edges also leads to exposed joints and shifting stones. And if the joints aren’t sealed or filled correctly? Water goes straight down—and the cycle begins.

Simple fix? Grade your patio correctly. Water should always flow away from the structure, never toward it. Add perimeter drains or French drains if necessary. And maintain joint integrity by checking and refilling regularly.

Age, Weathering, and Natural Wear

Even the best-built patios eventually show their age. Flagstone may last decades—but like anything exposed to the elements, it weathers.

Sunlight fades colors. Wind and rain wear down edges. Freeze-thaw cycles slowly chip and crack. It’s not neglect—it’s nature doing its thing.

The mortar used today is much more resilient than five years ago. Older patios may also have outdated materials. Mortars used 20 years ago weren’t always flexible or weather-resistant. Today’s products are designed to move with the stone, not fight against it.

So if your flagstone has seen a few decades, minor cracks could simply be age lines. Not a crisis—just a sign it’s ready for a bit of love.

What to Do About Cracked Flagstone

Now for the good part—what you can actually do.

Inspect and identify.

Start with a close look. Are the cracks deep or superficial? Are they isolated to one area or spreading? Check the joints, edges, and slope. Understanding the cause helps guide the solution.

Repoint joints.

Loose or crumbling mortar can often be replaced without removing whole stones. This not only improves appearance but helps prevent water intrusion.

Replace damaged stones.

If a stone is beyond saving, lift it out and install a new one. Make sure the base is leveled and compacted before placing the replacement.

Seal selectively.

Not every flagstone needs sealing—but in damp or high-traffic areas, a breathable sealer can help prevent moisture damage without trapping water beneath.

Improve drainage.

Sometimes the fix isn’t the stone—it’s the slope. Adjust grading, add drains, or reshape the layout so water flows properly.

Call in pros when needed.

If cracking is widespread or your patio feels unstable, it’s best to bring in a team that specializes in flagstone repair. They’ll assess the problem from the ground up and offer long-term solutions.

Preventing Future Cracks: A Smarter Approach

Prevention is always easier than repair. And luckily, keeping flagstone in shape isn’t rocket science.

Sweep regularly. Remove debris that holds moisture. Keep an eye on drainage after heavy rain. Use pads under furniture. And every few years, inspect your joints and re-fill where required.

Check the qualifications of the people doing the installation. If you’re doing it yourself – read up before starting. When installing new flagstones, insist on proper grading and base layers. Choose thicker stones for high-traffic areas. And don’t forget to ask about frost-proof mortars or sand blends if you live in a freeze zone.

A little effort now saves a lot of work later.

Flagstone may crack—but that doesn’t mean it’s broken. Like any natural material, it needs a bit of care, some smart design, and the occasional fix to stay beautiful.

The good news? Every repair is a chance to improve. Stronger joints. Better drainage. A more durable surface that lasts longer and looks even better.

If your patio’s showing signs of age or damage, don’t wait for a bigger problem. The experts at GTA Sunrise know flagstone inside and out. With the right tools, trained hands, and an eye for detail, they’ll bring your outdoor space back to life—stone by stone.

By Tom Parkin By Tom Parkin

May 27th, 2025

BURLINGTON. ON

Sales at building and garden stores are falling, most sharply in Ontario, a possible index of household discretionary income.

May is when sales of building and garden supplies peak each year as Canadians get ready to plant and start summer household repair projects.

But for the past three years, Canadians have been pulling back on that spending, and regional patterns echo other data about household financial strength.

In May 2022, sales at building and garden centres hit $5.70 billion, according to Statistics Canada inflation-adjusted data. But May sales have fallen in each of the past two years, peaking at $5.34 billion in May 2023 and just $5.27 billion in May 2024.

Totals sales for 2022 were $50.1 billion, $46.6 billion in 2023 and $46.0 billion in 2024, an eight per cent fall. And the spending declines come despite Canada’s population increase from about 39 million to 41 million.

The decline may be another signal that the cost of essentials — housing, transit, food and monthly bills — are eating up a larger share of income, causing many Canadians to cut back where they can, affecting retail sales and employment.

But the latest data from Statistics Canada, released Friday, does offer a sliver of hope that more Canadians are feeling able to spend on their home environment in 2025.

Ontarians have been pulling back on garden spending in each of the past three years. In March 2025, the latest month reporting, Canadians rang up $3.24 billion in sales at building and garden centres, slightly up from $3.22 billion in March 2024. Sales in March 2023 were $3.30 billion and in March 2022 were $3.93 billion.

While in March 2025 Manitobans spent 10 per cent more at garden and building centres than in March 2024 and Albertans spent nine per cent more, Ontarians’ March spending fell nearly four per cent from a year ago. The second largest annual decline was in Quebec, where consumers pulled back one per cent.

Weak sales at Ontario building supply centres may help us understand why Ontario had GDP growth of just 1.2 per cent in 2024 and the second-highest rate of unemployment in April, 7.8 per cent. Ontarians have been pulling back on building and garden spending in each of the past three years with lower peaks in May and deeper troughs each February. Last week’s data release showed $1.10 billion in Ontario sales in March 2025. In March 2022, sales were $1.53 billion. While several other provinces have seen declines, Ontario’s has been the fastest.

Consumer spending is by far the largest component of GDP, about double the amount contributed by government and business spending combined.

Weak sales at Ontario garden and building centres may help us understand why Ontario had GDP growth of just 1.2 per cent in 2024 and the second-highest rate of unemployment in April, 7.8 per cent: businesses extracting wealth from households have put consumers under attack and in retreat, starving other businesses and any need to hire workers.

The data below is interactive.

By Jeannie Løjstrup By Jeannie Løjstrup

May 28th, 2025

BURLINGTON, ON

Let’s get straight to the point: online slots are legal in Ontario. However, that doesn’t mean you can just log into any flashy gambling site and start spinning. There’s a legal framework in place; if you’re not following it, you’re gambling in the dark, and that’s precisely where bad things happen. In 2022, Ontario overhauled its online gambling laws. Now in 2025, it’s one of North America’s most tightly regulated iGaming markets. Still, with offshore sites still accessible, knowing the rules matters more than ever.

The Law

Everything legal about online gambling in Ontario runs through two names: Everything legal about online gambling in Ontario runs through two names:

- AGCO (Alcohol and Gaming Commission of Ontario): They write the rules.

- iGaming Ontario (iGO): They enforce them by striking deals with private operators.

However, this didn’t appear overnight. For years, online gambling in Canada operated in a legal grey zone. Before 2022, Ontarians could access offshore sites without regulation, oversight, or protection. The Canadian Criminal Code technically restricted gambling to government-run entities, but enforcement was loose, and foreign operators flooded the market.

That changed in April 2022, when Ontario became the first Canadian province to launch a fully regulated, competitive online gambling market. AGCO created a framework, and iGaming Ontario was set up to manage it. This model allowed private companies to enter the market under strict conditions.

If you’re playing online slots legally in Ontario, the operator signed a contract with iGO and follows AGCO’s playbook. That means independent testing, data protection, responsible gambling features, and real accountability.

Offshore casinos? None of that. It’s the Wild West, and that’s being generous.

Age Matters

The first rule is clear. If you’re under 19, you cannot play online slots in Canada. That’s the law. It doesn’t matter if you find a site that doesn’t verify IDs. If you’re underage and gambling, it’s illegal.

Ontario enforces this hard. Licensed platforms will allow you to go through identity verification: ID, address, the whole thing. It’s a bit of a hassle, but that’s what legal compliance looks like.

Underage gambling is a gateway to addiction, and that’s not some overblown moral concept. Every major study on the subject backs it. That’s why the rules are strict.

Spotting a Legal Platform

So, how do you know a site is legal? Here’s the checklist: So, how do you know a site is legal? Here’s the checklist:

- iGaming Ontario Logo: Should be visible at the bottom of the site. No logo? Bounce.

- AGCO Listing: You can Google it. The Alcohol and Gaming Commission of Ontario publishes a running list of every licensed operator.

- Responsible Gambling Tools: Legal sites have deposit limits, time trackers, self-exclusion options, and direct links to support services that provide 24/7 mental health and addiction support.

Licensed platforms are upfront about these things because they’re required to be. If a site hides this info, doesn’t verify your ID, or pushes you to deposit with sketchy payment methods? It’s offshore, and you’re gambling without a safety net. No protections. No guarantees. And when things go sideways, no one’s coming to help.

This Isn’t Just About Rules, It’s About Risk

This system exists for two reasons: player safety and money.

Let’s start with safety. Unregulated sites are a breeding ground for scams. Payouts can vanish. Odds can be rigged. Customer support? Don’t count on it. And if these sites shut down overnight, which happens more than you think, you’re out of luck and probably out of cash.

Regulated sites in Ontario play by the book. Their games are audited. Their RNGs (random number generators) are tested. And if you hit a snag, there’s a formal complaints process through iGaming Ontario that doesn’t vanish into thin air.

Then there’s the money. Part of that revenue goes to Ontario’s public budget every time you play on a licensed platform. We’re talking hundreds of millions that fund healthcare, infrastructure, and public education. In the 2024–2025 fiscal year alone, Ontario’s regulated iGaming market brought in $3.2 billion in gross revenue.

Offshore sites? They take your money and run it through tax havens.

The Blueprint of Legal iGaming

Now that we’ve gone through the basics, let’s talk about legal online gambling.

BetMGM is one of Ontario’s flagship licensed operators. It’s reputable, fast, and secure. It offers hundreds of online slot titles from big-name developers. More importantly, it runs on AGCO-approved software. If you win, you get paid.

You can set your limits. You can take a timeout. You can self-exclude entirely. Every move you make is logged and protected.

BetMGM isn’t your back-alley corner bookie. It’s a transparent, regulated online gambling platform built for people who want to play responsibly without getting burned.

Play Smart, Play Legal

If you live in Ontario and you’re still gambling on sketchy offshore sites in 2025, you’re playing yourself. The province has built a legal system that works. It protects players, it keeps the odds fair, and it gives back to the community. Ignore it, and you’re not just risking your wallet; you’re risking your identity, peace of mind, and future. So yeah, play online slots if you want. But play smart. Play legal. And don’t fall for the illusion of “easy access” on some unlicensed site run out of nowhere. You’re not being slick. You’re being scammed. If you live in Ontario and you’re still gambling on sketchy offshore sites in 2025, you’re playing yourself. The province has built a legal system that works. It protects players, it keeps the odds fair, and it gives back to the community. Ignore it, and you’re not just risking your wallet; you’re risking your identity, peace of mind, and future. So yeah, play online slots if you want. But play smart. Play legal. And don’t fall for the illusion of “easy access” on some unlicensed site run out of nowhere. You’re not being slick. You’re being scammed.

By Pepper Parr By Pepper Parr

May 26th, 2025

BURLINGTON, ON

Every time I get something from the city’s communications people that has the word “vibrant” in it – my knees begin to wobble and I reach for my dictionary.

Vibrant: lively, energetic, and full of life.

This is what it’s all about. People sitting outside and enjoying the Sound of Music. Vibrant? Naw! I’m not buying it. Sound of Music isn’t vibrant – it is a wonderful, laid-back occasion when you get to listen to music you’d never heard before.

Nevertheless, the city is going to craft a new Culture Plan to guide the next decade (2026–2036) of arts and culture growth. This plan will help shape the future of Burlington’s arts and culture programs, services and investments. The Culture Plan will contribute to a future that is vibrant, inclusive and rooted in Burlington’s community.

The City is inviting residents and artists to get involved in the creation of its new Culture Plan.

Public Engagement

The City will be offering many ways for residents and the Arts and Culture community to share their ideas for Burlington’s arts and culture future. Over the next six months, staff will be connecting with residents, artists, cultural professionals, organizations and communities across Burlington.

Tuesday, June 24, 2025

1 to 2:30 p.m.

In-person sessions – Art Gallery of Burlington

1333 Lakeshore Rd., Burlington

Tuesday, June 24, 2025

6 to 8:30 p.m.

or

Tents set up in Civic Square during a cultural event. Wednesday, June 25, 2025

11:30 a.m. to 2 p.m.

RSVP to participate in a Culture Jam Workshop

Event booths and pop-up

Over the summer, staff will be visiting busy parks, festivals and events to hear directly from residents. There will also be self-directed activities in public spaces such as libraries and community centres.

Residents can subscribe for updates at getinvolvedburlington.ca/cultureplan to get updates as information is added to the page.

Quote

By Staff By Staff

May 26th, 2025

BURLINGTON, ON

The Ontario government is taking action to protect communities and build a stronger and more resilient province by reintroducing the Emergency Management Modernization Act, 2025. The proposed legislation will enhance public safety and disaster response measures, including making Ontario Corps a key function of emergency responses in the province.

Jill Dunlop, Minister of Emergency Preparedness and Response. “Extreme weather events like the ice storm this spring are unfortunately becoming more frequent. Our legislation reflects the need to be more prepared in the event of an emergency,” said Jill Dunlop, Minister of Emergency Preparedness and Response. “That’s why our government is recognizing the critical need for Ontario Corps, so they can be deployed at a moment’s notice to help protect families and build a stronger, safer and more resilient Ontario.”

Ontario Corps brings together experienced non-governmental partners and skilled volunteers to enhance on-the-ground emergency response that can be deployed quickly to support communities across the province. During the spring ice storm, Ontario Corps partners volunteered over 6,000 hours, delivering generators, providing 3,725 meals and food hampers, conducting over 4,100 wellness checks, providing tree-clearing services and supporting evacuation reception centres. Ontario Corps brings together experienced non-governmental partners and skilled volunteers to enhance on-the-ground emergency response that can be deployed quickly to support communities across the province. During the spring ice storm, Ontario Corps partners volunteered over 6,000 hours, delivering generators, providing 3,725 meals and food hampers, conducting over 4,100 wellness checks, providing tree-clearing services and supporting evacuation reception centres.

Following the establishment of the Ministry of Emergency Preparedness and Response as a standalone ministry with a dedicated minister in March, this legislation, if passed, would enable a more effective, coordinated and comprehensive approach to provincial and community emergency management. The changes would prioritize community-led approaches that help municipalities design emergency management programs that reflect their unique needs and capacities.

Enhancing Ontario’s emergency management capacity is part of the government’s plan to build a stronger and more resilient province with the necessary tools in place to ensure the safety and wellbeing of people across the province.

Registration for Ontario Corps

Quick Facts

- The proposed Emergency Management Modernization Act, 2025 is the first comprehensive update to Ontario’s emergency management legislation in more than 15 years.

- The legislation is informed by valuable feedback from partners, best practices in emergency management and lessons learned from past emergencies. The province engaged with more than 550 partners, including municipalities, First Nations communities and emergency management organizations. The ministry also received 91 written submissions on a publicly posted discussion guide.

- The legislation builds on the government’s Provincial Emergency Management Strategy and Action Plan that outlines key actions the province is taking to ensure communities are safe, practiced and prepared before, during and after emergencies.

- Ontario is building a new Emergency Preparedness and Response Headquarters. The new state-of-the-art complex will be designed to support the province’s work to prepare for and respond to all types of disasters that will operate 24 hours a day, 7 days a week, 365 days of the year. It will include dedicated training rooms and warehousing and aviation infrastructure and will be built to withstand all types of disasters including earthquakes, tornadoes and floods.

By Staff By Staff

May 26, 2025

BURLINGTON, ON

Volunteers will be required to attend a 1-hour virtual training session on May 29 @ 6:30PM

Register here: Marsh Volunteer Planting 2025

The first planting event is scheduled for May 31. BARC is excited to launch our 2025 Marsh Volunteer Planting (MVP!) group for another fun summer of nature restoration!

Since the 1990s, volunteers have played an essential role in helping Bay Area Restoration Council (BARC) and Royal Botanical Gardens (RBG) plant native wetland species in Cootes Paradise and Grindstone Marshes to provide food and shelter for wildlife and improve water quality by stabilizing soil and reducing erosion.

We are excited to launch the 2025 Marsh Volunteer Planting group for another fun summer of nature restoration! Be aware that planting can get very muddy – it is messy but rewarding work! BARC provides rubber boots, hip waders, or chest waders depending on site requirements.

What is the time commitment for joining Marsh Volunteer Planting?

Volunteers will be required to attend a 1-hour virtual training session on May 29 from 6:30-7:30pm.

Three to four planting events will run throughout the summer, and we ask that you commit to attending at least one 2.5 hour planting event. There will be a mix of daytime, evening and weekend events.

The first planting event is scheduled for May 31.

How strenuous are Marsh Volunteer Planting events?

Marsh Volunteer Planting events require moderate to high activity levels. Planting sites are located in a wetland environment and the terrain can be rugged and difficult to navigate. Please consider your own physical fitness level and medical history to decide if this activity is right for you. If you have any questions about accessibility, please contact BARC staff and we will do our best to accommodate you.

How old do you need to be to attend an event? Due to the nature and location of the planting sites, these events are not suitable for children. You must be at least 16 years old to participate. An adult guardian must sign a waiver for anyone under 18.

Why volunteer as a Marsh Volunteer Planter? The Hands-on experience in planting native marsh vegetation is a chance to visit and learn about unique marsh ecosystems with BARC and RBG staff

The opportunity to connect with like-minded individuals who care about the environment

Refreshments and all necessary equipment provided by BARC

Sign-off for volunteer hours if requested.

A Certificate of Completion is available to volunteers who complete the orientation session and attend a minimum of 2 marsh planting events in one summer.

Interested in joining this cohort of MVPs? Please complete the registration form: Marsh Volunteer Planting 2025

Questions? Please email kaeley@bayarearestoration.ca

By Staff By Staff

May 26th, 2029

BURLINGTON, ON

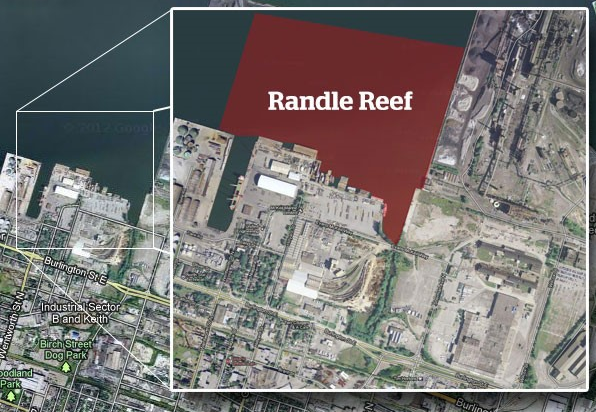

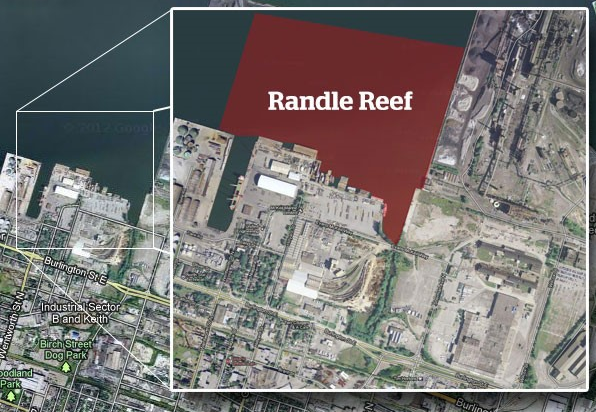

Exploring the Randle Reef Project with featured guest speakers Roger Santiago from Environment and Climate Change Canada and Sara Yonson from the Hamilton-Oshawa Port Authority

Thursday, June 5, 2025 @ 5:30PM

Site of the contamination. Randle Reef—once the largest and most contaminated site in the Canadian Great Lakes is in the southwest corner of Hamilton Harbour

Cleaning up Randle Reef is one of the biggest steps to remediate the Hamilton Harbour Area of Concern, and it is now in its final stages.

The third and final stage to remove sediment at Randle Reef is underway.

The $150-million project is cleaning up of the once-most contaminated site on the Canadian side of the Great Lakes.

Randle Reef had over 615,000 cubic metres of sediment — enough to fill a hockey rink three times over. The contamination dates back to the 1800s, after years of industrial pollution.

The clean up started in 2016 and was originally set to be done by 2022 but the pandemic resulted in some delays.

The last step involves removing and treating the remaining water from the container before releasing it back into the harbour and installing the final capping of the container.

The project, now expected to be completed by 2025. The Great Lakes are an essential to the health and well being of millions of Canadians, our ecosystems and the economy. Pollution has been putting all this at risk.

An opportunity to learn about the Randle Reef problem, and one of the largest sediment cleanups in Canada and how they decided to solve the problem.

Steel pilings were driven into the floor of the harbour. This multi-year, multi-million dollar project ($150 million) is a joint initiative involving the Government of Canada, the Province of Ontario, City of Hamilton, Halton Region, City of Burlington, Hamilton-Oshawa Port Authority and Stelco.

Register for free by clicking the link below.

This event is presented by the HHRAP and hosted by Conservation Halton.

Click HERE to register

By Pepper Parr By Pepper Parr

May 26th, 2025

BURLINGTON, ON

OPINION

Back to that engagement issue – and how the city communications department missed the point on this one.

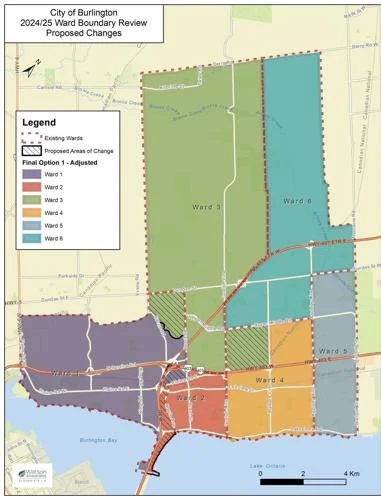

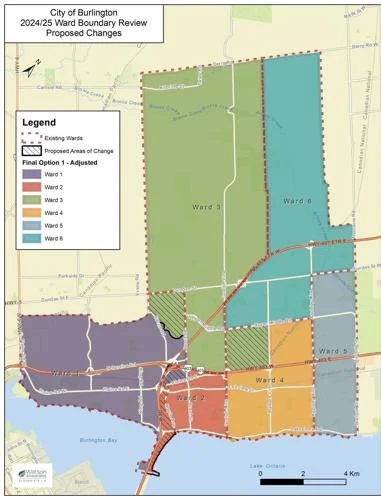

Last week the city’s communications put out a media release on the decision the city had made in the ward boundaries that will be in place for the October municipal election in October of 2026.

- The community in North Tyandaga will move from Ward 1 to Ward 3

- The Leighland community will move from Ward 2 to Ward 1

- The west side of the Palmer community will move from Ward 4 to Ward 3

- The Maple Beach community will move from Ward 1 to Ward 2

For each of these, we asked – be more specific please – what are the boundaries

Doesn’t tell you nearly enough does it?

We responded to the communications people for more detail – they sent us to maps that they must have thought would make everything very clear.

The areas where changes were made is shown in the \\\ shading. What is required if people are to fully understand where they are to vote is something similar to what the federal government does when they are explaining a constituency boundary.

Example:

Consists of that part of the City of Burlington lying southeasterly of a line described as follows: commencing at the intersection of the southwesterly limit of said city (Kerns Road) and Dundas Street; thence northeasterly along said street to Highway 407; thence southerly along said highway to Guelph Line; thence southeasterly along said line to Upper Middle Road; thence northeasterly along said road to Walkers Line; thence southeasterly along said line to Queen Elizabeth Way (Highway 403); thence northeasterly along Queen Elizabeth Way to the northeasterly limit of said city (Burloak Drive).

For a city with such a poor municipal election voting record, every opportunity to tell people where they will be voting is important. You can never start too early.

By Staff By Staff

May 26th, 2025

BURLINGTON, ON

Current OPP location in Burlington There will eventually be a new Ontario Police detachment in Burlington.

Where it will be located, who will actually build it and when will building start – unanswered questions at this point.

In addition to building a new regional headquarters in Thunder Bay, the government is building 12 other new detachments one of which will be in Burlington.

The provincial government explains that: “This project demonstrates a shared commitment with our government to ensure the OPP is as effective as possible at keeping communities safe,” said OPP Commissioner Thomas Carrique. “Providing our officers, civilian and volunteer members with these modern new facilities will better position the OPP to evolve as we strive to be our very best at delivering on our public safety mandate.”

Burlington OPP location 24/7 In partnership with Infrastructure Ontario, the province is launching a competitive process to find qualified teams to help design, build, and finance the new detachments.

By Natalia Buriy By Natalia Buriy

May 26th, 2025

BURLINGTON, ON

Walk into a home with gleaming hardwood floors, and you instantly feel a sense of quality and warmth. It’s a feature many homebuyers actively seek and homeowners cherish. But beyond the immediate appeal, does laying down timber planks in your home truly stack up as a sound financial decision? Let’s get to the bottom of whether hardwood flooring is a worthwhile place to put your money.

Hardwood makes a statement. The Initial Question: What Makes Flooring an “Investment”?

When we talk about an “investment” in home improvements, we’re usually looking at two things: first, will it increase the monetary worth of your property? And second, how much will it enhance your quality of life while you live there? A true investment should ideally offer a return on both fronts. This piece will explore if hardwood flooring hits that mark, looking at everything from resale value to daily enjoyment.

The Financial Upside: How Hardwood Boosts Your Home’s Worth

For many, the primary driver for any significant home upgrade is its impact on the property’s bottom line. Hardwood flooring generally performs very well in this arena.

Increasing Resale Value: What the Numbers Suggest

Many real estate professionals will tell you that homes with hardwood floors often command higher prices. While the exact percentage can vary by market and the quality of the wood, it’s widely accepted as a value-adding feature. It’s not just about recouping the cost; it’s about making your property more attractive and potentially more profitable.

Attracting Potential Buyers: The “Wow” Factor

Picture two otherwise identical homes for sale. One has worn carpets, the other has polished hardwood. Which one makes a stronger first impression? Hardwood floors are a significant visual draw. They create a sense of luxury and permanence that can make your home stand out in listings and during viewings, drawing in more interested parties.

Potential for Faster Home Sales

Because hardwood is such a desired feature, homes that boast it can often spend less time on the market. Buyers may see it as one less renovation project they need to undertake, making your home a more turnkey solution and potentially leading to quicker offers.

Durability and Longevity: An Investment That Lasts Generations

Hardwood isn’t just about looking good for a sale; it’s built to last, making it a long-term player in your home’s story.

The “return on investment” for hardwood isn’t just counted in dollars. The Lifespan of Well-Maintained Hardwood

Unlike carpets that might need replacing every 5-10 years or laminate that can show its age, solid hardwood floors can endure for decades, even a century or more. Their inherent strength means they can handle the daily traffic of a busy home and still look fantastic.

The Ability to Refinish and Renew

One of hardwood’s most significant advantages is its capacity for a comeback. When scratches or wear eventually appear, the floor can be sanded down and refinished, bringing it back to its original glory. This process is often more cost-effective than completely replacing other types of flooring, offering remarkable long-term value.

Beyond Monetary Value: The Lifestyle Benefits of Hardwood

The “return on investment” for hardwood isn’t just counted in dollars; it’s also measured in daily enjoyment and practical benefits.

Improved Indoor Air Quality

For families concerned about allergens, hardwood is a breath of fresh air. Unlike carpets that can trap dust, pet dander, and pollen, hardwood surfaces are easy to clean thoroughly, contributing to a healthier environment inside your home.

Warmth, Comfort, and Underfoot Feel

There’s an undeniable natural warmth and comfort that wood brings to a space. It feels solid and pleasant underfoot, a quality that synthetic materials often struggle to replicate.

Ease of Cleaning and General Maintenance (with caveats)

Generally, a quick sweep or vacuum and occasional mopping with a wood-appropriate cleaner are all that’s needed to keep hardwood looking its best. While it does require some mindfulness to prevent damage (more on that later), daily upkeep is straightforward.

Counting the Costs: Understanding the Initial Outlay and Long-Term Expenses

It’s true that hardwood flooring often comes with a higher price tag upfront compared to some other options.

Upfront Purchase and Installation Costs

The decision to buy hardwood flooring involves considering the price of the materials themselves and the cost of professional installation. Solid hardwood, particularly exotic species, will typically be at the higher end of the spectrum.

Factors Influencing Cost (Type of Wood, Plank Size, Finish, Installation Complexity)

Not all hardwood is priced equally. Common domestic species like oak or maple might be more budget-friendly than imported woods. Wider planks, intricate patterns like herringbone, and the type of finish chosen can also influence the final bill, as can the complexity of your room layout.

While durable, hardwood isn’t indestructible. Factor in the potential cost of refinishing every 10-20 years (or as needed) to keep it pristine. Maintenance Costs Over Time (Refinishing, Repairs)

While durable, hardwood isn’t indestructible. Factor in the potential cost of refinishing every 10-20 years (or as needed) to keep it pristine. Minor repairs for deep scratches or gouges might also be necessary over its long lifespan.

Potential Downsides and Considerations: When Hardwood Might Not Be the Best Fit

Despite its many advantages, hardwood isn’t universally the perfect choice for every single situation or room.

Vulnerability to Scratches, Dents, and Water Damage

Sharp objects, pet claws, and dragged furniture can scratch or dent hardwood. Spills, especially if left unattended, can lead to water damage and staining. This means a certain level of care and vigilance is needed.

Noise Considerations (Can be louder than carpet)

Sound can travel more readily on hard surfaces. In multi-story homes or apartments, this might be a concern, though area rugs can help mitigate this.

Suitability for Specific Areas (e.g., bathrooms, basements – or the need for engineered hardwood)

High-moisture environments like full bathrooms or below-grade basements are generally not ideal for solid hardwood due to the risk of warping or cupping. Engineered hardwood, with its layered construction, often offers better stability for these trickier spots.

Look carefully at your specific circumstances and preferences. Lifestyle Factors (Pets, Young Children – impact on wear and tear)

A bustling household with active pets and young children will inevitably subject floors to more intense wear. While hardwood can handle it, you might opt for harder wood species and a durable finish, and be prepared for more frequent signs of life.

Making the Right Choice for Your Situation

Deciding on hardwood flooring requires looking at your specific circumstances and preferences.

Assessing Your Home’s Current Value and Neighbourhood Trends

Consider if hardwood is common or expected in homes in your area and price range. If so, not having it could be a disadvantage when it’s time to sell.

Evaluating Your Budget and Long-Term Plans for the Property

If you plan to stay in your home for many years, you’ll reap the long-term lifestyle and durability benefits. If it’s a shorter-term prospect, focus more on the potential for resale value uplift.

Comparing Hardwood to Other Flooring Alternatives

Weigh the pros and cons of hardwood against options like luxury vinyl plank (LVP), laminate, or tile, considering factors like your budget, the room’s use, and your aesthetic preferences.

The Importance of Professional Installation for Investment Protection

To ensure your hardwood floors look their best and last as long as possible, proper installation is key. This is where turning to seasoned flooring experts can make all the difference, safeguarding your investment from the outset. They understand the nuances of subfloor preparation, acclimatization, and fitting that are crucial for a lasting result.

Rich deep colors lend comfort and prestige to rooms. The Verdict: So, Is Hardwood Flooring a Smart Move for You?

For a great many homeowners, installing hardwood flooring is indeed a smart and rewarding investment. It offers a compelling combination of enhanced home value, exceptional longevity, timeless style, and improved living quality. While the initial cost can be higher than some alternatives, and it requires a degree of care, the long-term benefits often significantly outweigh these considerations.

Ultimately, the “best” flooring is subjective. But if you value enduring beauty, robust performance, and a feature that consistently appeals to homebuyers, hardwood flooring makes a very strong case for itself.

Ready to Explore Your Hardwood Options?

If you’re considering the warmth and value of hardwood, take the time to research the best types for your home and lifestyle. Speaking with professionals can clarify your choices and help you understand the full scope of bringing this beautiful material into your space.

By Staff By Staff

May 25th, 2025

BURLINGTON, ON

Housing experts are pushing back against a federal cabinet minister’s recent claim that home prices don’t need to go down in order to restore housing affordability.

Gregor Robertson – Minister of Housing – Asked if “home prices need to fall” Answered “No, I think that we need to deliver more supply”. Gregor Robertson, the former mayor of Vancouver who was elected to the House of Commons in April, sparked the debate after he was sworn in as housing minister earlier this, when a reporter asked him whether he thinks home prices need to fall.

“No, I think that we need to deliver more supply, make sure the market is stable. It’s a huge part of our economy,” he said.

Robertson added that Canada lacks affordable housing and championed Ottawa’s efforts to build out the supply of homes priced below market rates.

Mike Moffatt, founding director of the Missing Middle Institute, had a different answer when asked whether housing can be made more affordable for the average Canadian without a drop in market values.

Mike Moffatt: “…it would take 18 years to return to more affordable home price-to-income ratios…” “The short answer is no. It’s simply not possible to restore broad-based affordability to the middle class without prices going down,” he said.

Moffatt crunched the numbers last month on how long it would take for housing to return to 2005 levels of affordability if the average home price holds steady while wages grow at a nominal pace of three per cent annually.

Across Canada, he said, it would take 18 years to return to more affordable home price-to-income ratios — while in Ontario and British Columbia it would take roughly 25 years.

In B.C. and Ontario, Moffatt said, wages and home prices have become so detached from one another that it’s not “realistic” to rely on wage growth to catch up to housing costs.

While Moffatt said he welcomes policies that encourage more housing for vulnerable Canadians and those experiencing homelessness, efforts to build more below-market housing units won’t address the “middle-class housing crisis.”

Days after Robertson weighed in, Prime Minister Mark Carney was asked the same question. Rather than offering a yes-or-no answer, he asserted instead that he wants “home prices to be more affordable for Canadians.”

There is a lot of personal equity in these homes: should the prices fall – there will be a lot of unhappy property owners. If the prices do not fall there will be millions of young people who will never be able to afford a home – which is the challenge Prime Minister Mark Carney and the Liberal government face. He cited Liberal election campaign pledges to drop the GST on new homes and offer incentives to municipalities to cut development charges in half.

The Liberals are looking to lower the cost of homebuilding with the aim of doubling the pace of housing starts in Canada. The government wants to scale up the use of prefabricated parts and other technological advances to streamline housing development.

Carney said that this boost in supply would “make home prices much lower than they otherwise would be.”

Moffatt said he agrees that lowering the cost of homebuilding would help to make homes more affordable.

In fact, he said, if the cost of building doesn’t go down and if home prices stagnate or decline, development will immediately cease to be profitable for builders, causing housing starts to dry up.

“I think that should be the primary focus of all three orders of government … figuring out how we can reduce the cost of home construction in order to create affordability and to lower prices,” he said.

Moshe Lander agrees: “…home prices must come down if the government hopes to see broad affordability restored to the market over the next generation.” Concordia University economist Moshe Lander agrees with Moffatt that home prices must come down if the government hopes to see broad affordability restored to the market over the next generation.

But he also questions whether the federal government should be the arbiter of housing affordability in the first place, given that so many of the political decisions are out of its control.

Lifting regulatory barriers to boosting supply is largely a matter for provincial and municipal governments, as are efforts to encourage more students to develop skills in the trades.

“And so for the federal government to say, ‘We’re going to try and incentivize this,’ I think they’re going miss the mark in whatever they’re trying to do because really, at the end of the day, it’s not their issue,” Lander said.

Lander said he also understands why politicians of all stripes are reluctant to come out in favour of lowering home prices.

Any explicit government effort to bring down housing prices down would be seen as an attack on homeowners’ equity — an asset many use to fund retirements or other long-term savings as they pay off their mortgages.

“Homeowners will not accept it,” Lander said. “And you risk alienating a very sizable and influential voting bloc.”

At the local level, he said, politicians tend to seek the support of homeowners because — unlike renters — they tend to stay put in a riding or district.

Lander said that most efforts to win renters’ votes tend to be “tepid” at best and “counterproductive” at worst. Policies that target the demand-side of the equation — helping Canadians become homeowners — tend to put upward pressure on home prices at the same time, he said.

Lander said part of the path to affordable housing has to be a shift away from the narrative that Canadians have been fed for generations — that home ownership is a lofty goal to aspire to and renters are “second-class citizens.”

“I don’t think that we’re being clear with society that this is what that might look like,” he said.

By Pepper Parr By Pepper Parr

May 25th, 2025

BURLINGTON, ON

The Ontario Land Tribunal said in their final decision that there was “more work to be done” before a project like this could be approved. So – is it really over?

Not if you read the fine print.

Here is the wording from the Ontario Land Tribunal decision released recently.

The words that caught my attention were: “There is more work to be done”

Good Planning and In the Public Interest

The Tribunal finds that the Proposed Development as currently contemplated does not represent good urban design and good planning. However, the Tribunal finds that with certain modifications, informed by further technical work, as discussed in this Decision, could result in an outstanding mixed-use re-development linking the City’s Downtown to its Waterfront, enhancing public spaces, worthy of the distinction of its Landmark location, providing a positive contribution to the City and the Region.

Several issues have been discussed in this Decision, and several findings have been arrived at by the Tribunal. Many of the findings pertain to the sorts of modifications and/or revisions that could be made to the draft Alternative OPA and a future revised plan/design for the Property so that it may address issues of land use compatibility, and may be able to satisfy the statutory requirements for approval, and will result in a re-development that represents good planning. It is up to the Applicant and the City to work towards such an outcome.

CONCLUSIONS

Simply put, the Proposed Development and Planning Applications push the limits beyond what is good planning. The Tribunal finds that the Planning Applications do not satisfy the statutory requirements under the Act, and that the Proposed Development represents an over-development of the Property.

Based on the evidence before it, the Tribunal finds that the Proposed Development is not of proper intensity, scale and height, does not “fit” in this location and planning context, nor is it compatible with the adjacent public park lands and private lands east of Elizabeth Street, and it does not represent good planning.

The Tribunal concludes that there is much “more work to be done” on the Proposed Development, involving technical study and re-design.

The Tribunal has had regard for City Council’s decision of refusal, albeit it on an earlier proposal.

The Tribunal finds that the Planning Applications are lacking in merit and are not consistent with the PPS, do not conform with the Growth Plan, do not conform with the ROP, and are not in keeping with the policies of the COP, as amended.

The Tribunal has found that the opinion evidence provided in the Hearing supports a finding that a mixed-use tall building with two towers in this location, of heights in the range of 25 – 27 storeys, could be appropriate from a planning and urban design perspective in the event that a re-design addresses the issues discussed herein.

The Tribunal has had regard to matters of Provincial interest under s. 2 of the Act and is not satisfied that the draft OPA will promote high-quality urban design and facilitate intensification in an appropriate location, scale, intensity and height on the Property. As noted above, the Planning Applications do not represent good planning.

In terms of the public interest, the City’s COP policies for the Property should be updated in the near term, to provide assurance to the Public and the Applicant, all of whom have put in considerable time and effort to date. As noted previously, the Participants support the findings and Preferred Concept from the WHPS. The Tribunal did look at the alternative OPA and ZBLA presented by Mr. Smith, but the City did not ask that the Tribunal consider an approval of these draft amendments, and that said, the Tribunal did not find them to be appropriate based on the evidence in the Hearing in any event.

The Tribunal finds that the appeals pursuant to s. 22(7) and s. 34 (11) of the Act should be denied for the reasons set out above.

FINAL ORDER

- THE TRIBUNAL ORDERS THAT the appeals are dismissed and the requested amendment to the Official Plan for the City of Burlington and the requested amendment to the City of Burlington Zoning By-law 2020, as amended, are refused.

- The effective date of the Tribunal’s Final Order is October 17, 2024.

|

|

Burlington Residents’ Action Group (BRAG) is in the process of dissolving the not-for-profit corporation.

Burlington Residents’ Action Group (BRAG) is in the process of dissolving the not-for-profit corporation. And then ECoB fell apart – they weren’t able to get to the point where there was strong representation at the ward level.

And then ECoB fell apart – they weren’t able to get to the point where there was strong representation at the ward level.