February 27th, 2018

BURLINGTON, ON

City budget are not like corporate budgets. Cities are not permitted to run a loss – they get around that by tucking millions of dollars into reserve funds that can be drawn upon when needed,

The city doesn’t use the words profit or loss, they use the phrase retained savings which is money they budgeted to spend, based the tax rate on and then found that they didn’t spend the money.

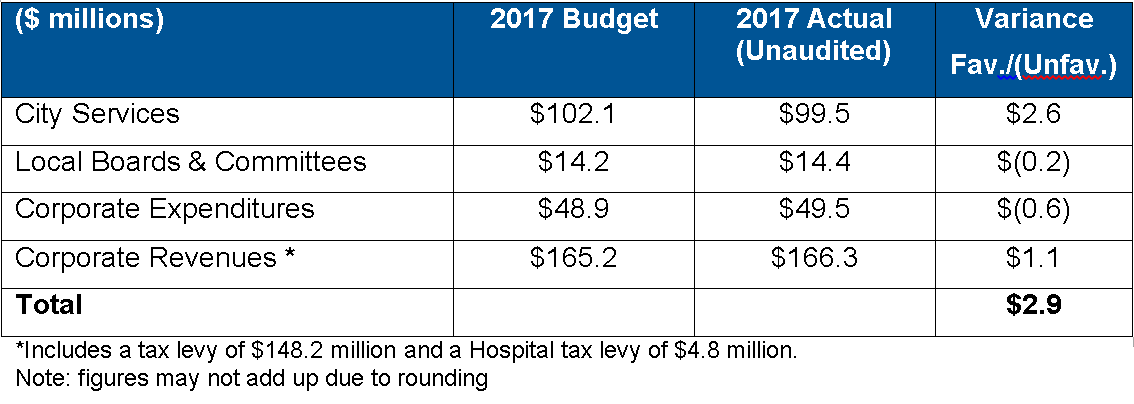

For the 2017 fiscal tear the city had $2,889,106 in retained savings. No – they don’t give it back – they put it into various reserve funds. The city has more than 25 reserve funds – several that the provinces requires them to have in place for that rainy day.

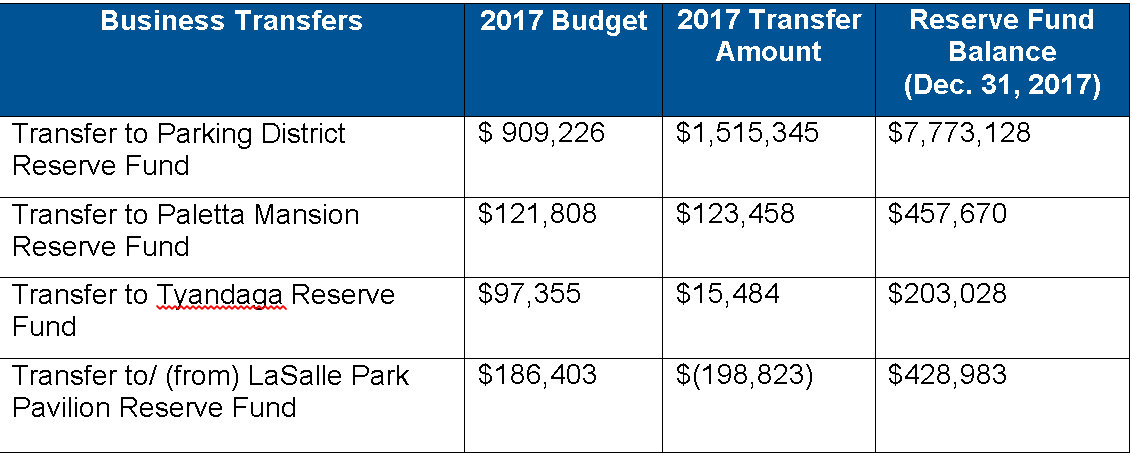

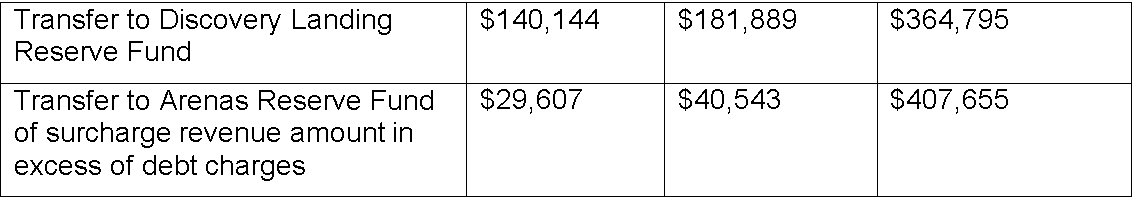

The retained savings report shows routine year-end transfers made prior to the calculation of the year-end retained savings for net zero activities.

Note the 2017 transfer from the LaSalle Park Pavilion reserve fund is a result of the mid-year transition of the banquet and conference services provider.

Note the 2017 transfer from the LaSalle Park Pavilion reserve fund is a result of the mid-year transition of the banquet and conference services provider.

Development Application Reserve Fund

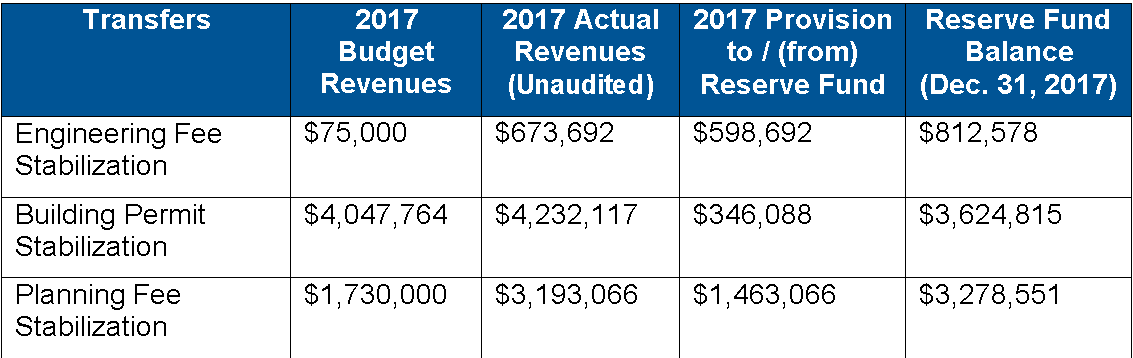

In 2005, the Engineering Fee Stabilization Reserve Fund, the Building Permit Stabilization Reserve Fund and the Planning Fee Stabilization Reserve Fund were created to ease budget pressures should development revenues slow down due to economic and/or market conditions.

That certainly hasn’t happened. The Planning department is being flooded with development applications that will pump millions into the city coffers.

As of December 31, 2017, the following year-end transfers were made prior to the calculation of the year-end retained savings.

Engineering Fee Stabilization Reserve Fund

The increase in Subdivision Administration Fees has resulted in a provision to the reserve fund of $598,692. One large subdivision administration fee was received in February; however, long term reliance on this revenue source is unsustainable as Burlington shifts from Greenfield Subdivision development to infill and intensification sites. The 2018 budget for subdivision administration fees has been increased to

$200,000.

Building Permit Stabilization Reserve Fund

The Building Permit revenues for 2017 were $4,232,117. The revenues are offset by expenditures (both direct and indirect as per the Bill 124 model), with the resulting provision to the reserve fund of $346,088. The 2018 budget for building permit revenues has been increased to $4,237,863.

Planning Fee Stabilization

Planning fee revenues experienced a positive variance of $1,463,066 due to increase in site plan applications fees, subdivision fees, official plan amendments and rezoning fees. A significant portion of this favourable variance was realized in December when a number of Planning applications were brought forward in advance of pending changes to legislation regarding OMB reform. This resulted in a provision to the reserve fund of

$1.46 million. The 2018 budget for planning revenues has been increased to $1.8 million.

During 2017, departments and service owners (a service owner is a group of people with a specific responsibility) closely monitored expenses and found ways to reduce operating costs.

Human Resources

Total City human resources costs (excluding Winter Control) have a favourable variance of $1,386,569. The city experienced a number of vacancies throughout the year. Some of those vacancies were people the city let go – there was a salary and benefit savings until a replacement was found. The favourable variance was primarily attributed to the period of time from when the position became vacant to being filled after the competition was complete.

The report does not make mention of additions to the staffing compliment.

Earnings on Investments

Investment income exceeded budget by $1,062,950. This positive variance is attributed to $2,253,608 of realized capital gains, of which $1,190,658 was used to meet the budget of $5.3 million. The city has relied heavily on capital gains to meet budget from 2013-2017.

Winter Maintenance

As a result of mild winter conditions at the beginning of 2017, Winter maintenance had a favourable variance of $936,421. The favourable price of salt had a minor role in the positive variance, however the main driver was the large reduction of salt consumption (4,000 tonnes) and improved salt management practices.

2017 Recommended Retained Savings Dispositions

Note: Where reserve fund balances are provided, they reflect the balance prior to recommended disposition.

• $1,000,000 Provision to Allowance to Prior Year Tax Write Offs

In 2017 there were a significant number of prior year appeals and write offs processed which drew down the City’s balance sheet account to zero. The allowance for prior year’s tax write offs requires a balance to cover tax write offs for the next year. To do so, staff propose $1 million of the 2017 retained savings be provided to fund next year’s obligations.

• $500,000 Provision to Strategic Plan Reserve Fund

The City of Burlington approved its 25 year Strategic Plan in 2016. The Financial Plan for the Strategic Plan established a long-term approach to funding strategic objectives including the establishment of a Strategic Plan Reserve Fund. The report recommended that a minimum of $500,000 be provided to this reserve fund in years when the city’s retained savings was in excess of $1 million. The balance in the reserve fund is $236,562.

• $450,000 Severe Weather Reserve Fund

As mentioned above, the winter maintenance budget had a favourable variance of $936,421. This report recommends transferring $450,000 to the Severe Weather reserve fund in order to assist with future weather events that are unpredictable in nature. The uncommitted balance in the Severe Weather Reserve Fund is currently at $3,360,543 which is below the targeted balance equivalent to one year’s budget for Winter Control.

• $939,106 Provision to Tax Rate Stabilization Reserve Fund

It is recommended that $939,106 be set aside to finance one-time expenditures. Over the last few years numerous spending commitments have been placed on the Tax Rate Stabilization Reserve Fund (those that are budgeted as well as those that have been approved in-year). The provision will assist in increasing the balance in this reserve fund while continuing to allow unique one-time needs to be addressed without affecting the tax rate and without being built into future budget years. The uncommitted balance in this reserve fund is $3,203,674.

That’s a lot of cash that will get spent – close attention will have to be paid as to just how they do that. The bureaucrats are pretty good at slipping something through.

In the first chart, $165.2 minus $166.3 does not equal a positive value of $1.1, as per the third column. It should be a negative value of ($1.1) which makes for a total variance of $0.7, not $2.9.

Just saying.

Someone needs to give the Burlington taxpayers an explanation as to why the necessity for such an increase for our 2018 taxes when you have such surpluses in your kitty?? Hopefully the citizens will be happy if consideration of these surpluses goes towards purchase of the Waterfront Hotel, saving the waterfront and expanding Spencer Smith Park. Great explanation for the rate hike!

Toronto even kept their taxes down below the COL. Think we are taxed to the cleaners!!

2.9 million….. that should just about “cover” the potholes!