By Pepper Parr

By Pepper Parr

January 13th, 2017

BURLINGTON, ON

It is just an opinion but it is based on significant experience and many years in the real-estate business.

Having said that here is what the Rocca Sisters and Associates have to say about the Burlington real estate market.

When all was said and done, 2016 turned out to be a good year for sellers – prices up 16%, year over year, days on market down by 34.7% – and a not so great year for buyers.

Compared to our other trading areas, however, Burlington was somewhat moderate in terms of wild fluctuations. With the exception of the Orchard, the neighborhoods with the higher increases in prices paid were those that, it could be said, were somewhat undervalued to start with.

Palmer Drive – an older community (most built in the 50’s, 60’s and 70’s) has lagged behind in terms of sale price growth.

Aldershot South, Central Burlington, Dynes, Longmoor, Tyandaga and Palmer all older communities (most built in the 50’s, 60’s and 70’s) had lagged behind in terms of sale price growth while newer communities like the Orchard, Millcroft and Headon Forest increased exponentially.

These more mature areas, with the exception of Tyandaga offered smaller homes with bigger yards but the absence of modern conveniences such as a bathroom for every member of the household and closet space to accommodate bursting wardrobes made them less attractive to many buyers.

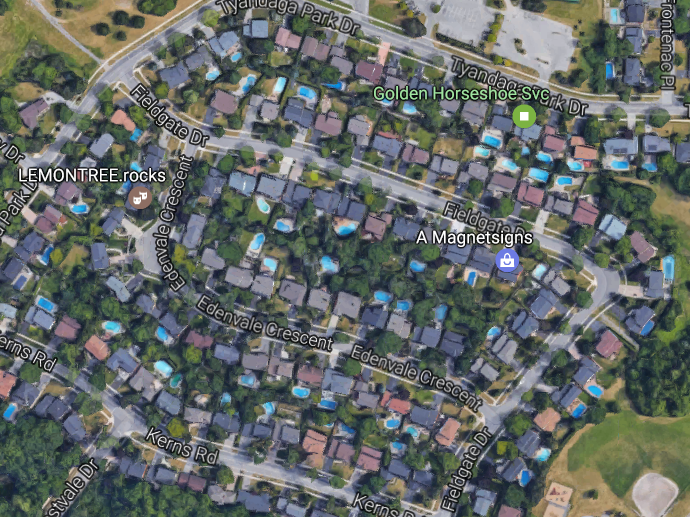

Tyandaga community saw a huge increase year over year – the biggest surprise is that it took so long.

When demand outstripped supply in the newer neighborhoods to the point that the purchase prices were swelling dangerously, these older communities became the next best thing. It’s no surprise that Tyandaga saw a huge increase year over year – the biggest surprise is that it took so long. Large gracious homes on huge mature lots with mature landscaping finally came on buyer’s radar when at the end of last year the average price of a house in Millcroft was over $900,000 and the average price of an equivalent sized house on a bigger lot was just over $800,000 in Tyandaga.

These properties, along with Roseland and Shoreacre properties still tend to take a little longer to sell – we chalk that up to a lot of non- Burlington sales reps not knowing the neighborhoods that well and just a general reticence to buying an older home. All in all, 2016 was not nearly as tumultuous in Burlington as in the rest of the world so Burlingtonians should be quite satisfied with the result.

Predictions for 2017 – many overextended homeowners are going to be re-evaluating their finances and for some, the choice will be obvious – downsize.

The result will quite possibly be a glut of move-up houses on the market later in the year, forcing a minor correction and a continued shortage of inventory in the $500-$700,000 price range.

Notwithstanding, we expect to see much of the same in early 2017 – a seller’s market for the foreseeable future.

Downsize to where? You can’t find a small bungalow or even a decent size condo for under $500,000 in Burlington.

My theory is a little different. I think most people will stay put, and the re-sale supply in Burlington will continue to be on the low side. Those who already own homes will hold onto them longer knowing that unless they’re prepared to break even or spend even more on their new home, they likely aren’t going to find anything better than what they’ve already got. The result: house prices along with demand will continue to climb, making it that much harder to justify moving if the intention is to stay within Burlington. Hold tight, or move further out of the GTA… those are the options for most people.

There is no real estate market. The demand for housing is controlled by the government via immigration and the supply is controlled via a mess of municipal laws. What you have now is the government inflating a massive real-estate bubble.

You are headed for prices of probably 1.5 million on single family houses 600k range on condos. Then a crushing of many middle class families – then – boom.

Seems I read somewhere that foreign investment is driving a lot of the fever.