BURLINGTON, ON. June 6, 2013 Robin Hood, legend has it, stole from the rich to give to the poor, doing what we call ‘redistributing income’. England, at the time, was run by Prince John, a greedy SOB and a very poor fiscal manager who ran up record deficits to pay for his brother’s crusading activities and his own extravagant lifestyle. During his reign, as national growth plummeted and unemployment skyrocketed, he taxed the poor to death (literally) while allowing the rich to hoard their wealth.

Robin, on the other hand, understood that income is either spent on consumption or stuffed away as savings. He knew that the poor spent everything they earned, so every penny or half-crown they could lay their hands on was being plowed back into the economy – creating employment and domestic product. The rich, who couldn’t possibly spend all they made, stuffed their savings into a strong box or under the mattress. Robin was often heard to say, “If you want economic growth you need to redistribute” – the Robin Hood Clause.

Taxation, I know, sometimes feels like highway robbery. But not all taxes are created equal – some help our economy and some hurt. Sales taxes are regressive. They hurt, disproportionately, the middle-income and poor and thus, the economy. Stephen Harper understood this when, in his first term as PM, he cut two percentage points off the GST in order to grow the Canadian economy. By contrast, income taxes are progressive – you pay more only if you make more. Consumer demand and economic growth are largely unaffected, in comparison to sales taxes.

Our Premier was looking in the wrong places to help Toronto, the city that won’t help itself, get real public transit. The last thing the recovering Ontario economy needs is an increase in our regressive HST. I guess Jim Flaherty agrees with me, although I suspect he also had other reasons for turning down the Premier’s request to raise the HST.

So, why not look at income taxes? Provincial rates are about the lowest they’ve been in three generations. In the US, President Obama has long been trying to ratchet up income taxes on the wealthy. Even the normally conservative US Federal Reserve Chair (Bernanke) has been making noises that he supports a doubling of the tax rate on the richest Americans. Is it only a matter of time until we will need to catch up with the Americans again?

So Premier Wynne, let’s get ahead of the game. Why not get serious about reversing the damage done to our economic potential over the years by the ruthless cuts to the most important tax system we have?

Raise the progressive rates on those with the highest earnings; those who can best afford to pay. Didn’t the NDP already force Dalton McGuinty to apply a token surtax on the wealthy in his last budget? Does that then leave Andrea as the closest thing we now have to a modern-day Robin Hood? And if so, why is she silent now?

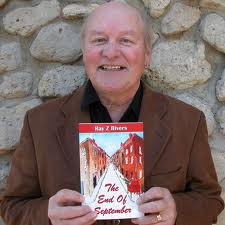

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat after which he decided to write and has become a political animator. Rivers was a candidate for provincial office in Burlington where he ran against Cam Jackson in 1995, the year Mike Harris and the Common Sense Revolution swept the province.

Ok, everybody now, one, two, three, hip hip hooray for more taxes (got to feed those cancelled gas plants and federal senators)! I can’t hear you. Once again. Let’s hear it for increasing taxes! Surely, you can do better than that. Again. Three cheers for more taxes! Hey, where you are going? Why is everybody leaving? How are we going to get public support if you don’t buy into this?