By Ray Rivers

By Ray Rivers

February 11th, 2024

BURLINGTON, ON

“Spending under the Ford government has consistently been higher than it was under Wynne—whom Ford criticized frequently as a big spender during the election in 2018. Between 2017 and 2022, per-person spending (inflation-adjusted) has grown from $12,151 to $12,969.” (The Fraser Institute)

Ontario was already one of the most indebted jurisdictions in Canada. According to the the conservative think thank, The Fraser Institute, last year we paid out over $12 billion in interest payments alone. Even worse, that is projected to climb to over $15 billion annually by the time we head to the polling stations again. That is close to a 25 per cent increase over that three year period.

Ontario’s debt is approaching $400 billion, more than double that of the US state of California which has a population about equal to that of all of Canada. There was a modest surplus during the first year of the pandemic, when Mr. Trudeau’s feds were paying for just about everything. But Mr. Ford is planning to run deficits of almost $6 billion over the next two years, rivalling or exceeding those of the previous Liberal government.

According to the Fraser folks….”The irony for Ford, the deficit fighter, is that had he only maintained the inflation-adjusted per-person spending at the same level he inherited from the Wynne government, he would be closer to running a surplus today.” Our growing economy has seen revenues increasing, but they have failed to keep pace with government spending. Over $10 billion of new net debt was created last year alone and another $24 billion is expected to be created over the three year period.

According to the Fraser folks….”The irony for Ford, the deficit fighter, is that had he only maintained the inflation-adjusted per-person spending at the same level he inherited from the Wynne government, he would be closer to running a surplus today.” Our growing economy has seen revenues increasing, but they have failed to keep pace with government spending. Over $10 billion of new net debt was created last year alone and another $24 billion is expected to be created over the three year period.

So Mr. Ford has decided on a new gimmick. He’s creating an infrastructure bank, along the lines of the federal infrastructure bank. The province will ante up a few billion into the kitty and then the bank will rely on deposits from private investors. The money will be spent on provincial priorities like more long term care spaces, public transportation, etc. But, it will be arms length so the decisions about those investments will be made by a board of governors rather than our elected officials.

The federal bank, established in 2017, has been anything but a success. Then again, it was created to enable the federal government to participate in economic development for activities which might be argued are exclusively provincial or municipal. That is not a constraint for Ontario. Even so, Mr. Poilievre has called for the elimination of the Canada Infrastructure Bank. So why does Mr. Ford think his provincial bank is such a good idea?

It’s really just sleight of hand, a shell game – a simple application of smoke and mirrors. By pushing provincial spending into this new bank, he can take it off the provincial books, And the new bank will pick up all that liability instead and shrink the province’s deficits on paper, but not in reality. It’s kind of now you see it, now you don’t.

This scheme will not be cost free. Private investors, who will provide the bulk of the funds being dispersed by the bank, will demand to be paid market interest, which will be higher than what the government is currently paying on its debt. After all, this will not be provincial borrowing per se backed by the provincial government. Thus, the risk to investors will be higher. And to compensate for that risk, investors will want higher interest premiums than the government would normally have to pay.

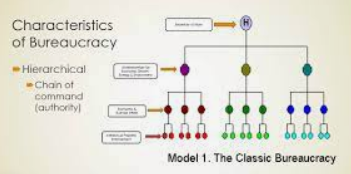

Since more of the banks funds will thus be going into servicing the bank’s borrowing, less will be available for the various purposes for which it was created, such as funding long term care construction. Additionally, there are the not insignificant costs of establishing and operating the new bureaucracy, as well as rewarding its highly salaried staff to run the bank. Bottom line – this fancy financial dancing is the least efficient and most costly way to deliver provincial programs.

Since more of the banks funds will thus be going into servicing the bank’s borrowing, less will be available for the various purposes for which it was created, such as funding long term care construction. Additionally, there are the not insignificant costs of establishing and operating the new bureaucracy, as well as rewarding its highly salaried staff to run the bank. Bottom line – this fancy financial dancing is the least efficient and most costly way to deliver provincial programs.

It would be less expensive for taxpayers if Mr. Ford just used the existing resources of the provincial government to pay its bills, rather than hiving those bills off onto an another costly bureaucratic agency. And of course, it certainly would be better if Mr. Ford simply reduced deficits and debt as he had promised to do back in 2018.

But that would involve revisiting taxation rates for some of the wealthiest Ontario residents. And most importantly, it would involve cutting out costly ‘pet projects’ such as the proposed Highway 413 and relocation of the Science Centre.

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Ray Rivers, a Gazette Contributing Editor, writes regularly applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Ray has a post graduate degree in economics that he earned at the University of Ottawa. Tweet @rayzrivers

Background links:

New Bank – Why A New Bank – Who Benefits – Federal Bank –

Fraser Institute – More Fraser – Even More Fraser – The Science Centre –

Picking and choosing which government has the worse debt levels in the West is like picking who is the worse murderer in prison (or in Californias case, out on bail), why, we have an increase in debt (or murderers) in the first place should be the question, Do we have more debt (and murderers) because of an increase in victims? Or is debt (or Murders) not considered a drag on a society’s harmony anymore? And is the destruction of harmony a risk or a goal? Which level of government is solely responsible for setting the tone of a ‘Society’s Harmony’? The collective society’s in the West are questioning the loyalty they have for their respective current leadership and rightfully so.

https://californiapolicycenter.org/california-state-and-local-liabilities-total-1-6-trillion/

According California Policy Center the total state and local debt in California is $1.6 Trillion USD (quite a bit different than suggested in the article). Also, any comparison needs to factor F/X to compare apples to apples. Converting to CDN, that $1.6T now becomes $2.16 trillion Canadian Dollars.

In the US local governments can carry debt. In Ontario, under the Municipal Act, local governments cannot carry debt and it all rolls up to the province. Therefore any comparison to a US state must account for local government debt.

Another big difference is health care, Ontario health care is government funded, the model in the US is private – yes there is various forms of “Obama Care”, but the heath services are private. Ontario carries a big liability for health care compared to most states.

You neglected to compare electricity rates in Ontario vs. California. Rates in California average $.33 USD/kw-h, rates in Ontario are about $.12 CDN/kw-hr. Plus California has had rolling blackouts and brownouts. Ask the residents how the green transition is working for them.

Perhaps an article on the Trudeau debt/spending debacle? The reduction in Canadian GDP/cap compared to the US? Or the outflow of investment capital in Canada?

Editor’s note. Municipal debt does not roll up to the province. Municipalities are required to have more than enough in reserve to cover their operating costs. When it appears that they don’t have enough they turn to the province and the feds for support for exceptional thins (Covid and housing recently on the federal side) housing on the provincial side.

It is the raiding of the reserves that has hurt Burlington – the big chunk the Mayor took from the Hydro reserves is an example – you just can’t do that and see yourself as prudent.

When a municipality gets into financial trouble – the province sends people in who take over and run the shop until the problems are solved. It does hapen – not for sometime. There is a lot in the way of checks and balances now.

I’m so glad, Ray, that you are focused on controlling spending, taxation, and borrowing. When can we expect a critical analysis of your profligate Liberal friends in Ottawa and on Brant Street?

Nobel Prize-laureate and economist Milton Friedman once said, “Keep your eye on government spending”. Friedman warned that government spending can only be supported in three ways: taxes, debt or inflation. Canadians are now experiencing all three in excessive amounts. Liberal policies that claim to be reducing the effects of inflation are in themselves inflationary.

If Ray is a Keynesian, he may believe profligate spending is necessary.

Keynes would not recognize these Liberals as practising Keynesian economics. Keynes believed in a balanced budget over the business cycle–deficits to pump demand into the economy when the rate of economic growth was slow/negative and surpluses to repay the deficits when the economy was expansionary. Liberal governments use fiscal policy NOT as a measure of economic stabilization but are primarily focused on social policy.

Thought-provoking, as always.

It is hard to know whether your title “smoke and mirrors” is a reference to Mr. Ford or your column. The increase in per person spending over 5 years (2017 – 2022) amounts to under 7%. In a time of high inflation and growing population that doesn’t strike me as being an unwarranted increase. Your numbers regarding the Ontario debt are also suspect First, we aren’t three years away from an election – we are less than 2.5 years. Second, If the interest increases by $3 billion per annum over that period we are looking at $ 7.5 billion extra interest. My calculator says $7.5 billion as a percentage of $400 billion is less than 2% – not 25%.

However, I do agree that an infrastructure bank is a bad idea. Not necessarily for the reasons you outline.

Please read this all of the Ford lovers out there.