By Pepper Parr

By Pepper Parr

March 5th, 2021

BURLINGTON, ON

It started out with;

Direct the Chief Financial Officer to implement a 2021 COVID-19 property tax deferral pre-authorized payment plan (by application) and report on the status as part of the ongoing monthly financial COVID-19 updates

Council approved property tax relief measures in 2020 in response to the COVID-19 pandemic. The assistance included extended property tax due dates, waived penalty and interest on outstanding property tax from April to August 31 and a pre-authorized payment plan to pay remaining 2020 taxes between the months of August and December 2020.

Most taxpayers continued to pay on time, while some had difficulties.

Provincial and Federal governments continue to provide residents and businesses financial assistance programs relating to COVID-19.

The Ontario government declared a Provincial COVID-19 state of emergency January 12, 2021 effective January 14, 2021, ending on February 14, 2021. The current Provincial and Public Health measures may produce a continued financial hardship for some Burlington residents and business in 2021.

Here is what Council decided to do.

They created an application-based deferral program consisting of pre-authorized monthly withdrawals to defer payment from our regularly scheduled due dates. It would apply to all property classes (residential and non-residential) to be fair and equitable.

They created an application-based deferral program consisting of pre-authorized monthly withdrawals to defer payment from our regularly scheduled due dates. It would apply to all property classes (residential and non-residential) to be fair and equitable.

Balance can include any unpaid installments from March 1, 2020 and all of 2021 taxes

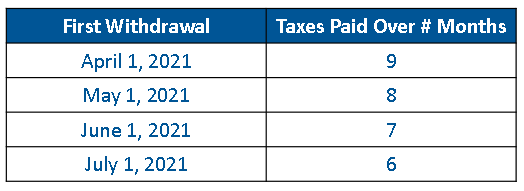

Taxes will be paid in full by December 1, 2021

Penalty/interest will be suspended for the duration of the deferral

Withdrawal start date chosen by the property owner.

Financial impact to the city is dependent on the number of applications and total tax payments deferred. It amounts to a shift in cash flow of property tax revenues to later in the year. The city will not collect penalty/interest revenue for months that taxes are deferred.

Taxes levied on behalf of the Region and school boards would still be paid on the normal schedule.

Eligibility criteria

Property taxes must be current prior to the pandemic (March 1, 2020)2

Property taxes must be current prior to the pandemic (March 1, 2020)2

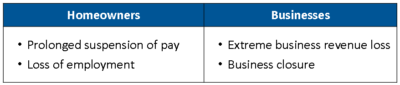

Property owners would need to attest that they are experiencing financial hardship directly related to COVID-19

The expectation is that property owners with tenants should be passing on the deferral arrangement.