By Staff

By Staff You might want to clip that and put it on the fridge -beside the “Burlington is the best city in Canada to live in.

You might want to clip that and put it on the fridge -beside the “Burlington is the best city in Canada to live in.The City’s Long–Term Financial plan contains the following key strategic objectives for the city:

2. Responsible Debt Management

3. Improved Reserves and Reserve Funds

4. Predictable Infrastructure Investment

5. Recognized Value for Services

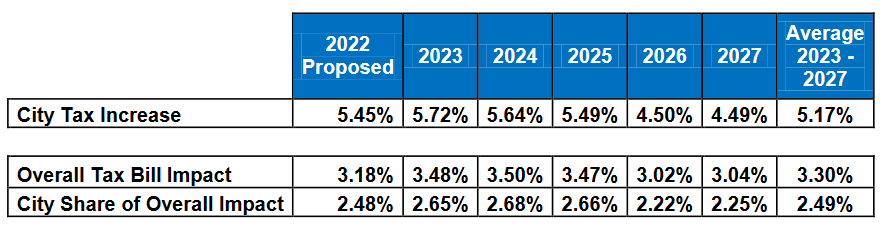

This simulation uses the 2022 proposed budget as a starting point and

adjusts the 2023–2027 forecast based on estimated budget drivers, information gathered in the Service Information Workshops and forecasted Operating budget impacts resulting from Capital projects.

As with any modeling tool, the simulation forecast has the greatest precision in the first year. It is imperative that the results are simply used as an information tool regarding major budget drivers and future projected tax impacts. It provides an analysis of what the future financial picture for the City of Burlington may look like, helps assess financial risks and the affordability of existing services and capital investments, and provides an

opportunity to analyze sensitivities to assumptions.

Magnitude and duration of COVID impacts

Senior Government Grant Programs

Changes in economic conditions and market demands

Fluctuations in customer expectations

Legislative changes

Reassessment impacts

Operating impacts from approved capital initiatives

Business process improvements

Climate change impacts

Staff have shown a realistic scenario where assessment growth is maintained at 0.6% in 2023, increasing to 0.75% in 2024 and then remaining steady at 1.0% for years 2025– 2027. These estimates are based on future development projections including an allowance for assessment appeals. Infrastructure renewal funding is consistent with the 2021 Asset Management Financing Plan Update and repurposing of the hospital levy to infrastructure renewal as the commitments for the hospital decline.

These components provided the basis for estimating budget drivers and include the following assumptions within each item:

Maintaining Current Service Levels – Base Budget

Inflationary Impacts and User Fees

With the exception of human resources and commodities (hydro, water, fuel etc.), 2.0% inflation per year has been applied to other expense categories (materials and supplies, purchased services) and 1.75% increase per year applied to contributions to Local Boards and Committees.

Most User Rates and Fees are assumed to increase at 2.0% per annum, which is dependent on the nature of the revenues and external market conditions.

However, included in years 2023 and 2024 is an estimated normalizing of

revenue based on shift in consumer behavior and ongoing operational impacts post–COVID, resulting in projected revenues losses of $500,000.

Corporate Expenditures/Revenues

An annual increase to the provisions for Insurance and Contingency Reserves of $50,000 each.

An increase in Investment Income of $50,000 per year starting in 2024 subject to a moderately increasing interest rate environment.

Additional Base Budget Expenses

The simulation highlights larger scale base budget pressures for additional detail. The main drivers are the ongoing market competitiveness initiative with a phased funding plan of $1M from 2023 thru 2025 and the $280K reversal of the one–time funding provided in 2022 to address the shortfall in assessment growth is shifted to the tax base.

Impacts of Prior Council Decisions

As some decisions approved in prior budgets have financial impacts than span further than one year, the model identifies these under Impacts of Prior Council Decisions.

These include:

Tax base support for Tyandaga (2023 & 2024) Revisions to the Private Tree Bylaw fee structure (2023)

Impacts of Previously Approved Capital Projects

There is an estimated $1.7M in funding required to meet Corporate Infrastructure and Software needs over 2023–2027. Funding schedules align with Information Technology forecasts.

Infrastructure Renewal Funding

An annual increase of 1.6% from 2023 to 2027 for Dedicated Infrastructure Renewal Funding. This provides funding for capital renewal, as per the 2021 Asset Management Financing Plan.

Includes the repurposing of the hospital levy to infrastructure renewal in 2023 ($150K), 2025 ($110K) and 2027 ($2.84M)

An annual increase of 4% to the Vehicle Depreciation Reserve Funds to sustain the City’s fleet and equipment inventory Risk Mitigation Measures

Key investment priorities identified in the simulation are classified within the 3 categories highlighted below.

Sustaining City Operations and Financing

Funding for the maintenance of Recreation facilities

As outlined in Business Case 2022–039, Maintaining Assets in Recreation Services to Meet Lifecycle Requirements and Reduce Risk, staff estimate a $700K funding shortfall to adequately maintain Recreational assets. In 2021, a phased approach was endorsed, allocating $100K in each of 2021 and 2022, with the balance phased in over 5 years 2023–2027 in $100K intervals.

Improved investments in Forestry operations

As communicated in the Service Information Workshop, Urban Forestry faces funding challenges to address the level of service required for pest management and tree planting initiatives. As such, the simulation assumes a $100K increase in expenses in each year from 2023–2026 and a provision to a Forestry Reserve Fund of $350K in 2027 to be used toward future funding gaps and new initiatives.

OMERS for Part Time Staff

Effective January 1, 2023 part–time/temporary/casual employees will have the option to enroll in OMERS without a waiting period. In the past, these employees had to meet specific hours of work or earnings criteria for a two–year period to have the option to join. Both the criteria and two–year waiting period will be removed effective January 1, 2023.

At this time, it is hard to predict how many employees will take advantage of this change. To inform the multiyear budget simulation, Finance has modelled the impact at various levels of participation and it is estimated that the impact will be $420K based on a participation rate of 67%.

Designing and Evolving Our Organization

The forecast includes the continued phased implementation of the Designing and Evolving Our Organization (DEOO) initiative to be implemented over the period 2023 – 2027.

Enhancing Services

Investment in Transit services

Does Burlington Transit need new buses ?

As per the Capital Budget and Forecast and in alignment with the 5 year Transit Business Plan, the forecast assumes an additional $836K in annual expenses for 8 Transit drivers in each year from 2023–2026 and $135K for a Specialized Transit driver in 2023 and in each year 2025–2027.

This is based on the purchase of the vehicles through the capital budget the year prior to the operating expenses being realized.

Provision to Green Initiatives Reserve Fund

In April 2019, Council declared a Climate Emergency. Burlington’s Draft Climate Action Plan identified a number of initiatives to assist the City in reducing its overall carbon footprint.

As part of the city’s reserve and reserve fund review report (F–28–20) the city created a Green Initiatives Reserve Fund. The simulation includes an estimated $550K in provisions to the Green Initiatives Reserve Fund over 2024–2027.

As we move forward, the city will need to carefully balance the increasing costs associated with being more environmentally conscious against the city’s other funding demands.

The upgrades to the Skyway arena show some of the best forward planning the city has done – the challenge is to get it funded.

Skyway Arena Revitalization

Enhancements at Skyway Arena lead to an operating budget impact of $304K in 2024.

Modifications to Service to address COVID

The simulation includes an estimated $500K in lost revenues over 2023 and 2024 as ongoing operational impacts post–COVID and a longer–term shift in consumer behavior impact City operations.

Allowance for Unknown Factors

As with all forecasts, it is imperative to recognize that there are unknown factors that will likely occur in the future that could impact the model. In order to address these unpredictable factors, an amount of $150K has been included in the 2024 forecast, increasing by $50,000 per year until 2027. This allowance has been included to recognize that factors in the simulation such as future efficiency savings and assessment growth can be increasingly difficult to predict the further out into the future they are.

Conclusion:

The 5 Year forecast is a tool that provides a high–level summary of major budget drivers and the expected tax impacts. This will be helpful to establish future budget targets, as well as provide the ability to undertake tax impact sensitivity analysis should circumstances change.