By Ray Rivers

By Ray Rivers

June 25th, 2018

BURLINGTON, ON

“When people think whatever they happen to believe constitutes a fact, there goes a reasonable chance at having a meaningful discourse.” (Kevin Mathews, Care2)

Even if, true to his election promise, Mr. Ford doesn’t fire a single civil servant, they will all be retiring one day. And that will cost the government a whack of money in pension payouts, right? We know public pensions come from the government so they must be paid for with tax payer money.

Burlington has a senior citizen population that is growing faster than neighbouring communities.

That is gospel because we hear that opinion all the time – reading the National Post, The Sun and Globe and Mail; or just listening to some of my readers of this column. So I thought I’d try a back-of-the-envelope calculation, using the federal pension system as an example, just to get a handle on the facts around pensions. Most defined-benefit pension plans operate in a similar fashion.

Federal employees each contribute about 10% of their annual salary into their pension fund. And like most other employers, the government matches that amount, thereby doubling the contribution. For employees starting out at age 20 and assuming an average $50,000 salary over their working career, they would contribute about $5000 annually. After 30 years of service the employees would be eligible for retirement (85 formula) having added some $300,000 in total to the pension fund.

At retirement, when the employees are 55, they would receive 2% of their average last five years’ salaries multiplied by their years of service. In this highly simplified case that would amount to an annual pension of $30,000 per year (2% X 30 yrs. X $50,000). Of course pension plans are a platform for investment which can earn capital gains, dividends and interest.

So even at a modest 3-5% return over the initial thirty years of paying into the fund, the retirees’ initial endowment would double or more over all that time. That would give the pensioner over twenty years of getting back their own money – taking them well beyond their 75th year before their pension contributions finally run out.

Indexing the pension for inflation, which has been insignificant over the last two decades, would affect that calculation in the other direction. And while those pensioners who live a long life will be a drain on the plan, those who die prematurely will allow the pension fund to accelerate.

There are competing types of pension funds. Though under attack by right-wing think tanks, the defined benefit, with a fixed payout, is still the modus operandi for pension plans for teachers, hospital workers, provincial and municipal employees, crown corporations, financial institutions (banks and insurance companies) as well as a number of larger private sector organizations.

There are competing types of pension funds. Though under attack by right-wing think tanks, the defined benefit, with a fixed payout, is still the modus operandi for pension plans for teachers, hospital workers, provincial and municipal employees, crown corporations, financial institutions (banks and insurance companies) as well as a number of larger private sector organizations.

The defined benefit is also the formula used by our highly successful Canada Pension Plan. However the current favourite of the chattering classes and the investment industry is something called a defined contribution plan, where the payout will depend strictly on how well the money had been invested. This is akin to hiring a financial advisor, giving him/her your money and accepting the vagaries of the markets and the whims and/or skill of the advisor – the Casino Rama pension plan.

Still two thirds of Canadian workers don’t even have a workplace pension plan at all, let alone a defined benefit plan. Former premier Wynne understood the frustration of those who had been excluded from the security provided by a registered pension plan. She had proposed to ensure that all Ontario workers were covered by a plan comparable to the one government employees receive. But the premier was forced to compromise in the face of opposition by other provinces, though not before forcing the federal government to increase CPP payouts for all Canadians.

The failure of Sears as a corporation impacted pension benefits – Why?

There are a mess of private pension plans out there and why not? What better way to get your corporate hands on a whole bunch of cash in a hurry, to pursue some risky investment or bail the corporation out in an economic downturn, than dipping into a find you control. And because pension plans are tax-deductible, dipping into those assets is like getting money for nothing – at least the taxable amount.

Nortel pensioners have had to take on a protracted court case to get some of their benefits.

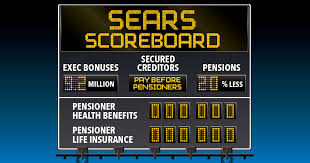

And then there are the consequences of bankruptcy. Look at Nortel, Stelco and now Sears – just the latest private plans to abuse the trust of their pensioners. When it comes to collecting pensioners fall behind secured creditors, banks and bondholders in getting compensation after bankruptcy.

And if/when the companies eventually go into receivership it falls to governments to bailout the pension fund, as the Ontario government has done a couple times with Stelco. But bailouts are never what the pension should have been – usually compensate to a fraction of entitlements. And, of course, bailouts are undertaken with taxpayer dollars. That is a fact and not an opinion.

Ray Rivers writes regularly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Tweet @rayzrivers

Ray Rivers writes regularly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Tweet @rayzrivers

Background links:

Fact Vs Opinion – Pension Facts – Federal Pension Rules –

Conversion of Plans – More on Pensions –

Perhaps before all is said and done for the Civil Service Pensioners is that they will follow the route that Sears took for their pensionable employees (losses, reductions, etc. etc.) – huge disaster!!!!

Really good questions. i think Hans is on the right track. A King Donald of Canada might remove registration from all workplace pension plans, including the public ones, and beef up the CPP to make up the difference – maybe 2.5% or even 3%.payout Perhaps government should share the employer contribution in hopes of eliminating OAS in turn except for those in particular need. How is that for starters.

and your point is what??

“Casino Rama” describes DC pension plans – where the employee assumes all of the risks and has no control over investments – perfectly.

It is indeed an area where better regulation is long overdue; a friend, who belonged to a Defined Contribution plan, found after retirement that the plan’s investments had not been successful and came very close to having to sell her modest home to survive.

Well, yes? But in “your opinion” what is the answer to these problems? A day late and dollar short here.