Assume a residential Current Value Assessment (CVA) of $417,645,000 – the tax bill would amount to $1, 625.18

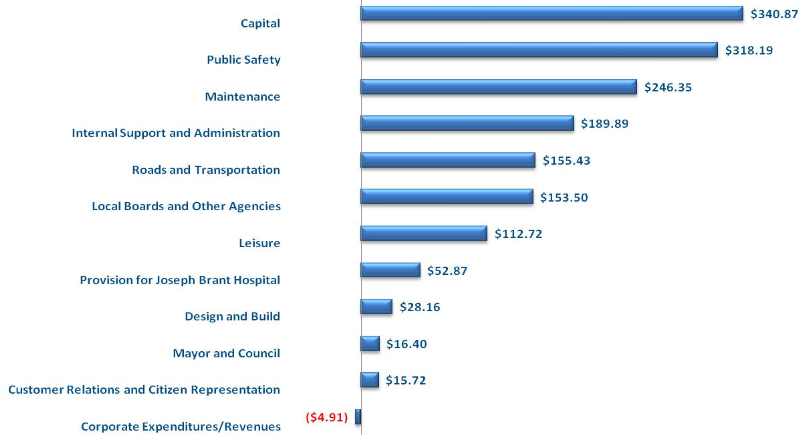

Here is how the city allocates and spends that money.

The provision for the hospital will stay in place for a few years – and when the $60 million the city had to raise as its portion of the re-development/re-build of the hospital has been paid – council has already decided that the tax will remain in place and be used to get the large backlog of infrastructure work done.

It would have been nice if they had asked you.

I opposed the JBH levy and stopped contributions to JBH as I was being forced to contribute to a facility that is less a part of the community and more self serving.

Now I am paying the forced levy into a fund I would call – the Pier Overage Fund.

Councillor Sharman was elected with fiscal control promise – it appears the promises have been long fogotten

Citizens should never be surprised that governments create a “one time” tax for a single purpose, only to continue that tax for some other miscellaneous purpose when the first purpose has been completed.

I approve keeping the hospital tax going to maintain infrastructure. We need to maintain what we have. We spent a lot of money constructing it over the years and if it is not maintained, it will eventually stop working and collapse. I do not want to leave a ghost town to the next generation!

Governments do not have a revenue problem they have a spending problem.