![]() By Pepper Parr

By Pepper Parr

February 1st, 2018

BURLINGTON, ON

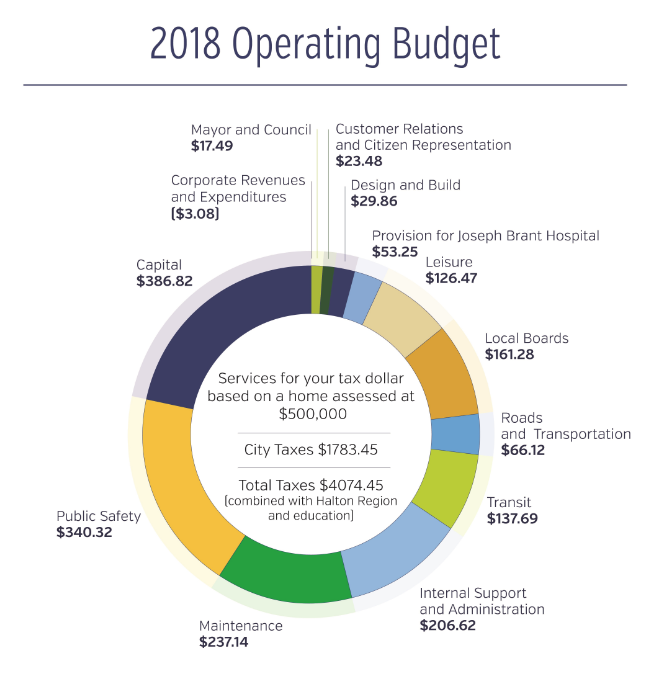

Council added more money for transit and sports fields maintenance to the 2018 operating budget after committee deliberations January 18th and approved an operating budget at city council on January 29th that sets the operating budget with a 4.36% increase in the tax to be collected over last year.

Burlington tax increases have been hovering at the 3 to 4% annual tax increases for much of the two terms the current council has been in office.

Burlington tax increases have been hovering at the 3 to 4% annual tax increases for much of the two terms the current council has been in office.

This year the city manager had to deal with three cost increases that they should have seen coming.

The arbitration that gave the fire fighters significant increases.

$1.2 million, or an additional tax increase of 0.78 per cent for impacts from the 2014 arbitrated Fire Department settlement

The provincial decision to set a minimum wage increase.

$1 million, or an additional tax increase of 0.65 per cent for legislative changes to the Employment Standards and Labour Relations Acts (Bill 148)

The need to improve transit service.

$1.55 million, or an additional tax increase of 1.01 per cent for changes made in transit to provide operational sustainability and increased reliability of service

The pressure from these three requirements meant there weren’t going to be any business cases put forward for new services. The departments were told to look for way to cut spending – a 5% tax increase was something that had to be avoided.

The 2018 operating budget focuses on:

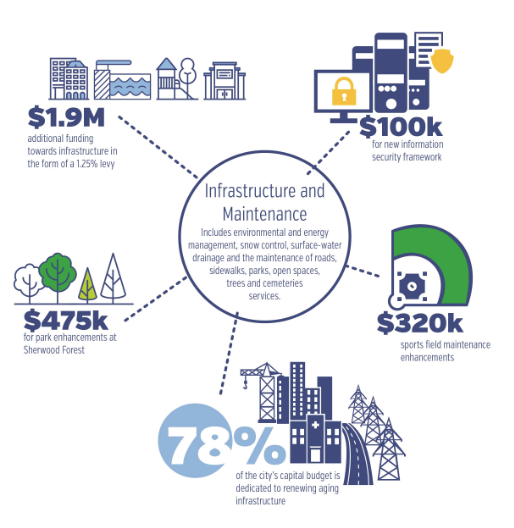

• Investing in infrastructure and maintenance – in accordance with the city’s Asset Management Plan, the dedicated infrastructure levy has been increased by 1.25 per cent or $1.9 million. Of the $160.1 million collected through the tax levy, $34.72 million will fund the capital program and renewing Burlington’s aging infrastructure.

• Investing in infrastructure and maintenance – in accordance with the city’s Asset Management Plan, the dedicated infrastructure levy has been increased by 1.25 per cent or $1.9 million. Of the $160.1 million collected through the tax levy, $34.72 million will fund the capital program and renewing Burlington’s aging infrastructure.

• Transit and transportation – strategic investments to improve the city’s transit service, including $1.55 million for changes in transit to provide operational sustainability and to improve reliability of the service.

• Community investment and growth – to provide an additional investment of $320,000 to enhance the maintenance of sports fields.

• Community investment and growth – to provide an additional investment of $320,000 to enhance the maintenance of sports fields.

• Financial sustainability – Burlington’s operating budget is committed to ensuring the city has competitive property taxes. Since 2011, overall tax increases in Burlington have averaged 1.9 per cent. In a comparison of property taxes in municipalities in the Greater Toronto and Hamilton Area, Burlington’s property taxes are the third-lowest for a residential single-family detached home.

• Financial sustainability – Burlington’s operating budget is committed to ensuring the city has competitive property taxes. Since 2011, overall tax increases in Burlington have averaged 1.9 per cent. In a comparison of property taxes in municipalities in the Greater Toronto and Hamilton Area, Burlington’s property taxes are the third-lowest for a residential single-family detached home.

There is a little creative license blended into that 1.9 % increase. It reflects the Regional and Education taxes – what matters to the people at city hall is how they determine what the city tax rate is going to be.

The increased spending on transit became necessary when a new employee with an MBA began to look at and analyze the transit spending – he discovered a number of serious problems that the city manager realized he had to act on. City hall has not been known for its commitment to transit. The problems that were brought to the surface had to be dealt with immediately.

Not to mention that the council members talk about the public having to learn to use public transit and bicycles but not putting real dollars into transit. That situation has changed.

When Burlington learned that it was going to have to come up with $60 million for the re-development of the hospital city council put a special levy in place which was shown on the tax bill. When that was put in place the indication was that this was just a one-time thing.

Good luck on that one. When the hospital levy has raised all that was needed to cover the $60 million – the levy will stay in place and be directed to bringing the infrastructure up to standard.

Councillor Sharman said at a budget meeting that Burlington went for seven years without a tax increase (that was well before he was elected to office – in his first year as a Councillor he pushed his colleagues into a 0% increase) and that we were now paying for that decision. The infrastructure was not given the resources it needed and it was time to catch up.

City of Burlington property taxes for a home assessed at $500,000 are $1,783.45. When combined with the proposed Halton Region increase and no change for education, overall property taxes for a home assessed at $500,000 are $4,074.45.

During the Jan.29 council meeting, some members of council spoke proudly about the “deep dive “that had occurred into a specific budget area, as though it was a breakthrough. In business this happens as a matter of course across each business segment and without celebration.