By Pepper Parr

By Pepper Parr

January 22, 2021

BURLINGTON, ON

Council heard just what the city is up against as they prepare to craft the Operations part of the 2021 Budget. The Capital Budget was approved last week.

The struggle to come to terms with the COVID pandemic has changed almost everything we do. The city Finance department has created two budgets; one that assumes normal circumstances and another that assumes an ongoing COVID scenario.

This was not a simple task.

The steps to develop the 2021 budget were as follows:

Base Budget -The budget was first built under traditional business as usual assumptions with all City services adjusting their ongoing base budgets to reflect service efficiencies and standard inflationary pressures offset with “normal” changes to revenues based on fee changes and volumes.

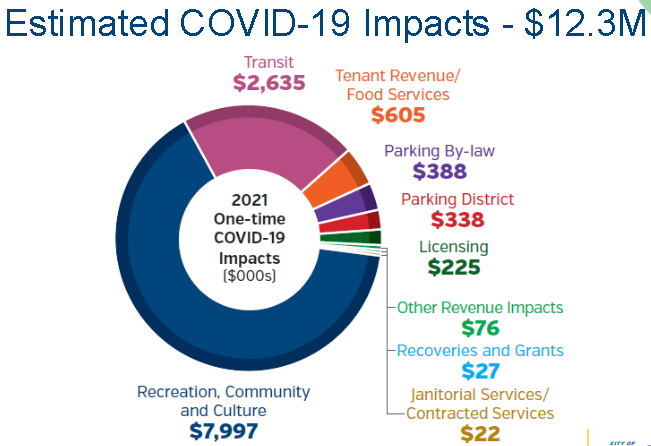

COVID Budget –All City services were asked to separately identify one-time budget adjustments required as a result of COVID. These adjustments include one-time reductions in budgeted revenues and changes in expenses to recognize temporary Service redesign plans required to protect the health and well-being of residents, businesses and staff.

These are revenues that were not going to be realized. Department heads and Finance Department had to figure out how the city could be run with all the financial shortfalls.

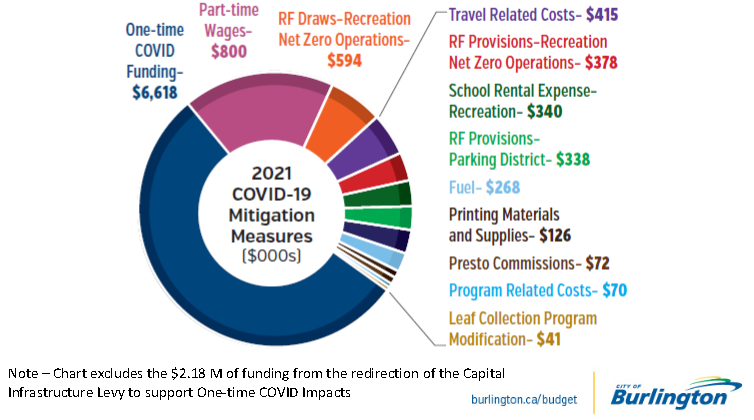

Finally, services were asked to make a further one-time budget adjustments to expenditures reflecting continued travel restrictions and additional savings resulting from remote working such as decreases in professional development given virtual training opportunities, meeting expenses and mileage.

The net result of these one-time COVID-19 impacts have been shown separately from the ongoing base budget throughout the budget documents.

Mitigation measures – steps that were taken to cut costs

The ongoing 2021 budget results in a tax increase while the one-time 2021 COVID budget has been offset by temporary cost savings and a one-time funding plan.

The budget is again presented in a service-based format allowing Council and residents to see how our services meet the growing demands of our community.

The identification of revenues and expenditures by service ensure staff and Council is considering service adjustments when making budget decisions, as well as providing increased transparency and awareness to the public.

The policy and budget principles come out of a number of documents; the first being the 25 year Strategic Plan and the Vision to Focus (V2F) which is the four year terms of council portion of the Strategic Plan.

The Asset Management Plan and the Long Term Financial Plan guide the decision making process as each city department does its early first draft of the budget.

What is called the Base Budget is reviewed by the Chief Financial Officer (CFO) and the Service Leads. The review done this year identified $2.34 million in savings.

The Corporate/Strategic Review then goes over the budget to ensure that risks have been thoroughly vetted.

Council will meet formally and virtually to debate the budget staff have prepared. There will be additional public engagement events as well.

During the briefing Finance department gave council there were some eye opening graphics. A selection is set our below.

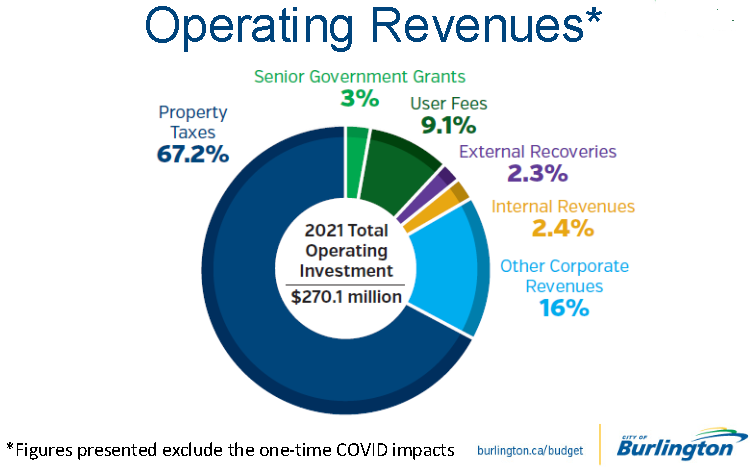

The city uses the word investment – it is really the tax money they are going to use. Spending is broken out into seven groups. The graphic shows how much of the money is spent and the portion that is funded by the tax payers.

The tax payer provides the bulk of the revenue. There are other sources.

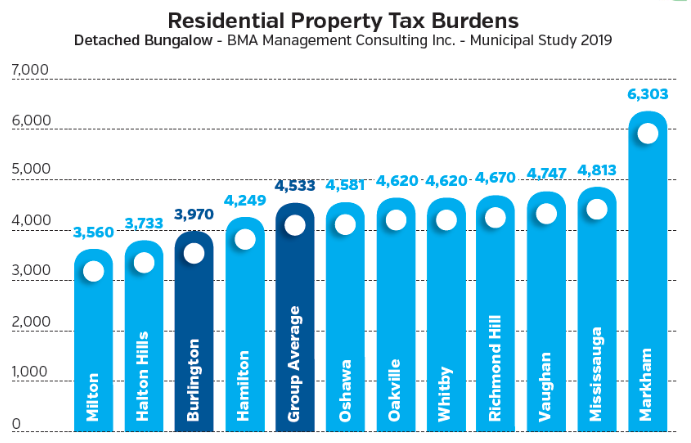

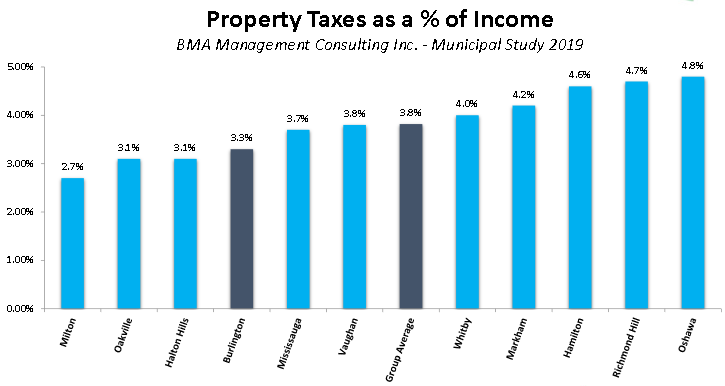

Burlington taxes compared to other municipalities. A heck of a lot better than Markham.

Incomes in Burlington are higher – making the tax bite a little easier to love with.

Well, I’d vote for Phillip. Seriously.

A selective use of statistics by the City. The main purpose of these stats is to provide the Mayor and Council with political cover to keep raising taxes at twice the rate of inflation. I love the selective comparison comment with Markham–why not compare us with Milton or the City of Toronto, which has conveniently been omitted from the comparatives. The fact that Burlington up to the past few years has been fiscally responsible is why our property taxes are below the selective average that is presented here—is this a justification for now raising them so that we can be above average? I note also that the City ‘FORGOT” to do a comparison of the rates of tax increases–I wonder what those stats would reveal?

Another problem with these statistics–while absolute incomes are used in a PRE-PANDEMIC analysis of property taxes as a percentage of incomes, the analysis does not reflect what has happened with incomes during the pandemic. Nor do “average incomes” reflect the reality for different income categories within the City.

The City’s statistical analysis does not show the growth in spending that is leading to these unconcionable tax increases. Perhaps spending is the problem that needs to be confronted.

And lastly, what economic theory, apart from the Liberal economic orthodoxy of tax and spend, dictates raising taxes during a recession?

As Harry Truman once noted (with apologies to Benjamin Disraeli), “there are three kinds of lies–lies, damn lies, and statistics”.

perry,

I was referring to the article with respect to the declining revenues and the obvious inability to cut enough costs while services were gutted. The numbers speak for themselves.

Calling it a rant is belittling. Please provide a counter argument about how the Mayor has done a good job fiscally in the last year (or two).

Thank you for a content-free rant.

From my perspective the fiscal governance by the City through the pandemic has been a total failure. Anything short of the resignation of the Mayor and City Manager would be too little.

The fiduciary responsibility of the senior leadership has been completely abdicated from my view.

The Pandemic is a huge issue there is no doubt. However, the taxpayer money still matters.