By Ray Rivers

By Ray Rivers

February 2, 2015

BURLINGTON, ON

It’s a nice change to see gasoline prices down. We’re pretty used to them going the other way and tired of all the excuses offered by the oil folks for why they have no choice. Global political instability or natural disasters are the classics. When hurricane Katrina struck New Orleans the oil industry got to double-up on excuses, blaming both the natural disaster and the storm-related destruction of the refineries and oil platforms.

Pipeline capacity was sometimes the reason for higher gas prices.

Typically the oil giants claim their hands are tied, blaming inflated selling prices on the tax man, or the speculators – derivatives, futures and hedge funds. They spit out this line as if they are innocent, even though they do much of the speculating themselves. And when the economy is healthy and growing, it’s inadequate refining capacity, depleted oil fields and limited pipeline capacity that are to blame – as if the industry has no control over these factors.

The price of oil is currently of huge importance to us. We are a free-trading, transport-intensive economy built on the automobile. The price of oil can mean the difference between economic boom or bust. Those of us old enough will recall how the late 1970’s Arab oil embargo gave us third-world-style gas pump shortages. North America and the world were plunged into recession and then wrenched back into near hyper-inflation – and then into something called stagflation.

More recently in the run-up to the 2008 recession, oil prices skyrocketed towards $150 per barrel, becoming the proverbial ‘straw breaking the camel’s back’, and triggering the debt-driven economic collapse that year. But what goes up also comes down and the price declined to one third of its value as quickly as it had risen. Then, as night follows day, prices rose again in sync with the recovering economy.

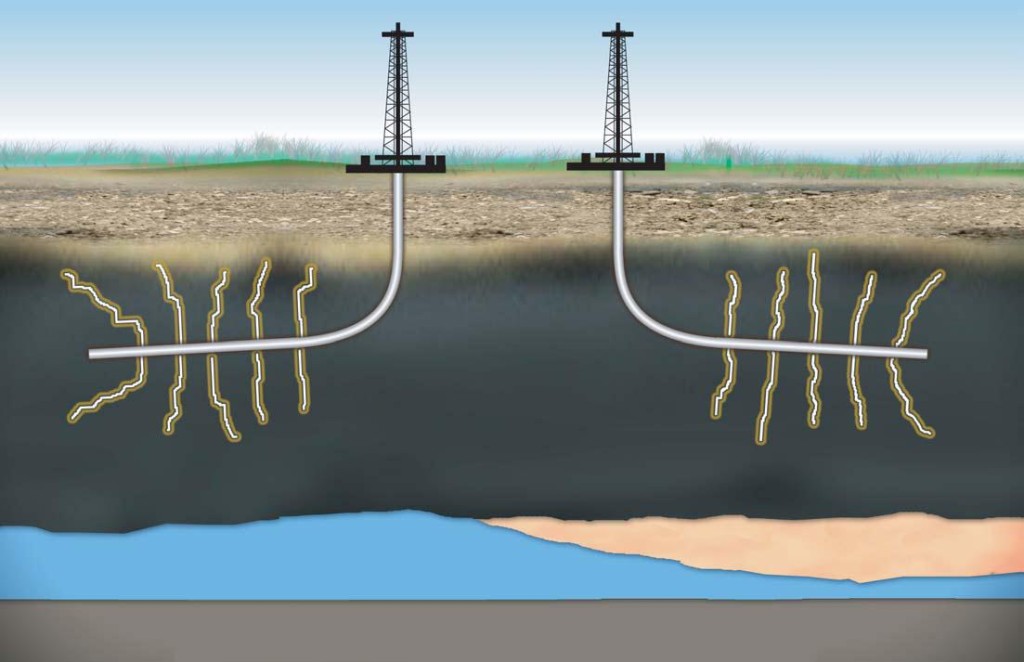

Today most of us are cheering the prices at the pump. Some experts attribute this phenomena to Saudis flooding the market in an attempt to drive American horizontal drilling hydraulic fracturing (fracking) entrepreneurs out of business. Others speculate it is the Yanks and Saudis collaborating to inflict damage on the oil-export dependent Russian economy. Since almost a fifth of Russia’s GDP and half of its budget come from oil revenues, falling oil prices may be more effective than sanctions have been at stopping the armed aggression in Ukraine.

Fracking has certainly had a huge impact on where Americans get the gas from – the damage to the environment is becoming a little clearer and it doesn’t appear to be good news.

America used to be the world’s biggest oil producer, until the low-hanging fruit in the oil fields was nearly exhausted and cheap middle-east oil came begging for a market. Thanks to ‘fracking’ the US is poised to regain that title and become self-sufficient. Of course that has implications for Canada, given that the US is virtually our only export market.

The very first oil in North American came from a well in Ontario in 1858. Today production is largely from Alberta, Saskatchewan and Newfoundland. The federal government has supported the oil industry in one way or another over the years, including the governments of John Diefenbaker, Pierre Trudeau and Stephen Harper. In addition to direct subsidies and accelerated capital write-off, the government plays a significant role in oil transport, exploration, investment, international trade and environmental management.

But, if Stephen Harper saw the development of the vast ‘tar sands’ as a solution to the vagaries of Canada’s business cycle, he couldn’t have been more wrong. Oil is as volatile as… well just look at it today. And as the US becomes self-sufficient and even competes with Canada for export markets, that volatility will just get worse and markets dry up. And then there are the new supply-side technologies, such as ‘fracking’, which will enable countries from China to Ukraine to start producing more of their own oil.

What is really exciting, though, is demand-side technology. Electricity is a better alternative for propelling an automobile, whether in pure or hybrid vehicle format. Electric motors are safer, cleaner, virtually maintenance-free, more reliable, quieter, and more powerful – as we see with the Tesla all-electric sports cars or the economical Nissan Leaf. Electric vehicles were common-place in the mid 19th century, even holding the land speed record until the turn of that century.

Oil will always be part of our economy – for fertilizer, plastics, and the other myriad of uses – but 70% of all the petroleum used today is for transportation. And those days are limited. Even the lower pump prices we see today should not forestall the inevitable move away from petroleum. The smart money is on the alternatives.

We know the roller-coaster ride in petroleum pricing will continue, lifting prices again once the industry gets its act together following this current crisis. The oil industry is a largely unregulated oligopoly (limited number of sellers), and so long as they can work together (collude), and avoid political minefields, they will manipulate the market to their financial advantage. And we can expect to hear those old excuses crop up again as they do.

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was a candidate for provincial office in Burlington where he ran against Cam Jackson in 1995, the year Mike Harris and the Common Sense Revolution swept the province.

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was a candidate for provincial office in Burlington where he ran against Cam Jackson in 1995, the year Mike Harris and the Common Sense Revolution swept the province.

Background links:

Energy 101

Oil Busts USA Oil Price of Oil

Shale Gas US Energy Reserves Canada’s Energy Policy

Re: “he couldn’t have been more wrong”… economists – and Harper likes to think of himself as an “economist” – are usually wrong.