![]() By Staff

By Staff

January 2, 2018

BURLINGTON, ON

The announcement from city hall was pretty straight forward – the review of city’s proposed 2018 operating budget will take place January 18.

Then the kicker – Proposed city tax increase of 4.19%

How much longer can Burlington smack the tax payers with property tax increases of more than 4%.

It just isn’t sustainable.

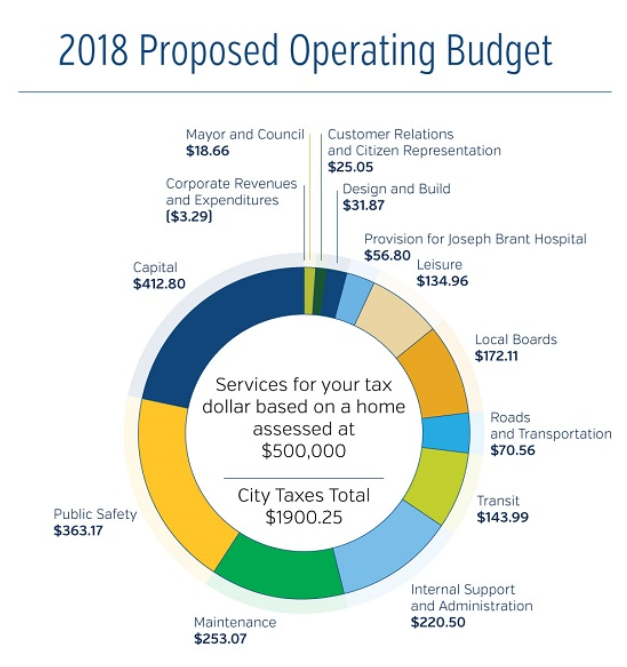

The 2018 operating budget delivers a base budget to maintain city service levels.

Other impacts to the 2018 operating budget include:

Other impacts to the 2018 operating budget include:

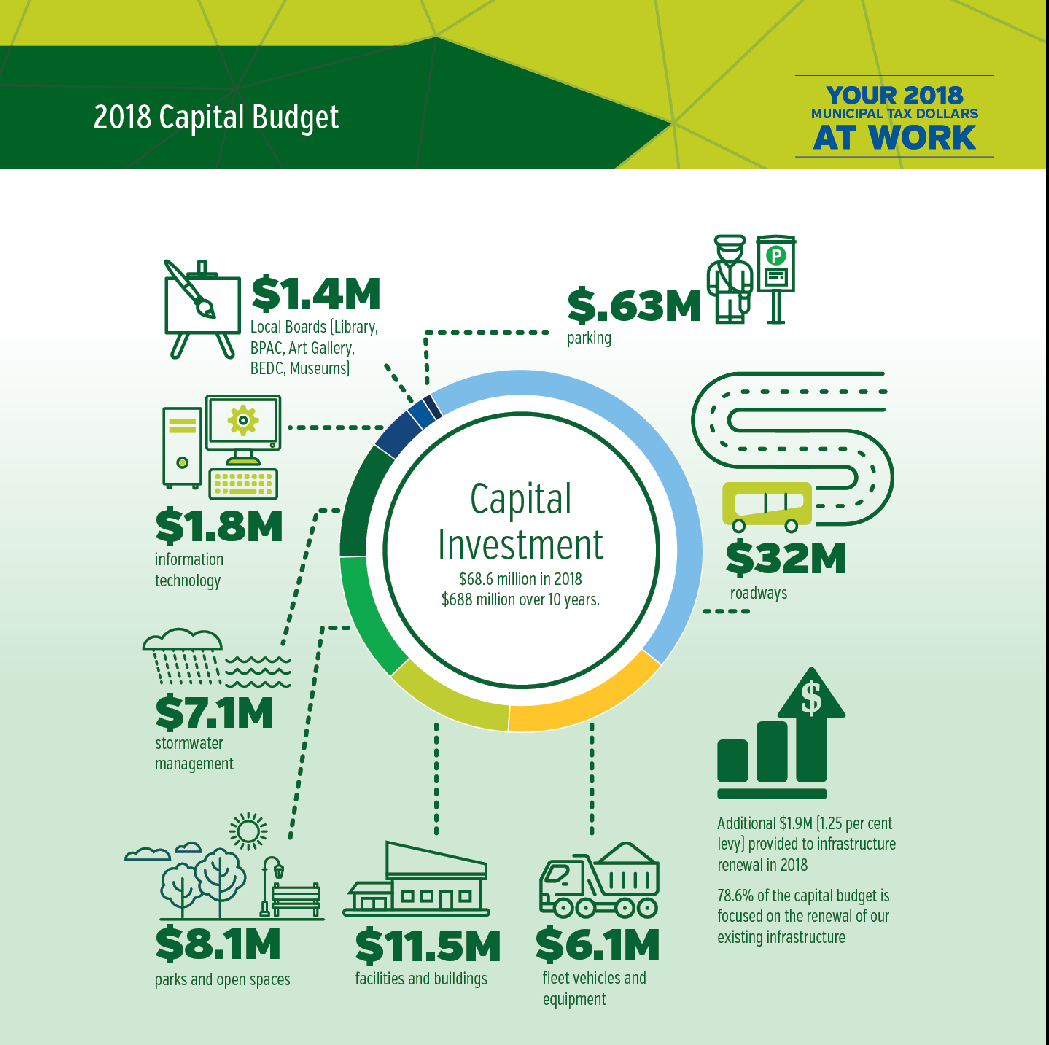

• $1.9 million or an additional tax increase of 1.25 per cent dedicated to the renewal of city infrastructure as outlined in the Asset Management Plan.

• $1 million or an additional tax increase of 0.65 per cent for legislative changes to the Employment Standards and Labour Relations Acts (Bill 148) including increases to minimum wage.

• $1.3 million or an additional tax increase of 0.84 per cent for changes in transit to provide operational sustainability.

• $1.2 million or an additional tax increase of 0.78 per cent for impacts from the 2014 arbitrated Fire settlement.

• $320,000 or an additional tax increase of 0.21 per cent to enhance maintenance standards on city sports fields.

The total city tax increase in the proposed 2018 operating budget is 4.19 per cent. When combined with Halton Region’s proposed tax increase and no change for education, the overall tax increase is projected at 2.49 per cent or $21.03 per $100,000 of Current Value Assessment.

The total city tax increase in the proposed 2018 operating budget is 4.19 per cent. When combined with Halton Region’s proposed tax increase and no change for education, the overall tax increase is projected at 2.49 per cent or $21.03 per $100,000 of Current Value Assessment.

There is an ongoing fallacy that gets trotted out each year by Joan Ford, Director of Finance: “Despite a number of significant budget pressures like the increase to Ontario’s minimum wage effective Jan. 1, 2018, and funding needed to address operational challenges in transit, Burlington’s proposed operating budget continues to ensure our assets are renewed and maintained in a fiscally responsible manner. Since 2011, overall tax increases in Burlington have averaged 1.9 per cent. In a comparison of property taxes in municipalities in the Great Toronto Hamilton Area, Burlington’s property taxes are the third lowest for a residential single-family detached home.”

Every word of that is true – however neither Burlington’s finance department nor its city council can do a blessed thing about the demands the school board or the Region make on the pocket books of the tax payers: Burlington is asking for an increase of 4.19% – they have been asking for more than, or very, very close to 4% for the past four years.

Ward 5 Councillor Paul Sharman was tough enough in 2010 to keep the tax increase to 0.

There was a time, back in 2010, when the tax increase was zero! Councillor Sharman was the driving force behind that effort. Council did it once – they should be able to do it again. It’s called belt tightening.

Members of the public who would like to speak at the Committee of the Whole budget meeting as a delegation can register by calling 905-335-7600, ext. 7481 or visiting burlington.ca/delegation. The deadline to register as a delegation for the Jan. 18 meeting is noon on Jan. 17, 2018.

Council approval of the proposed 2018 operating budget is scheduled for Monday, January 22, at 6:30 p.m.

All this bull on one of the reasons to increase taxes, that being the increase in the minimum wage. Well, so much for the fixed income that the Senior’s live on in order to pay these increased taxes, and the now increased prices everywhere due to the minimum wage increase. The Senior’s sure get hit with the brunt of it all without any increase to their OAS. Don’t get old, we are the forgotten struggling pioneers who made this country what it is today and struggle for survival. Cutting the high end costs of pomp and ceremony for the unnecessary would easily cut a few % points off any tax hikes. Ask the pioneers for a few pointers on how to cut extravagance, it can be done!

The “Public Safety” portion should be dramatically cut. There’s like one fire a year in the city, and we have the lowest crime rate in Canada. Why are we paying so much for police and fire services?

Police and Fire services are basically untouchables. Service levels are related to population, settlement spread and service reach, and union pay settlements and influence, not fire and crime rates.

This issue has been raised before because the costs are high per employee, but, as I said?

Ask city hall and see what they say.

You’re probably right, Tom. If City Hall folds so quickly to developers, I can’t even imagine how a negotiation with a public service union would go. It’s a shame we have to continue to pay for their feeble negotiating acumen, not to mention their lack of intestinal fortitude.