November 24th, 2015

BURLINGTON, ON

When a new tax is created more than one department at city hall gets involved.

The Finance department is gathering data to determine how a tax to cover the cost of managing storm water is justified; what the tax should amount to and how it should be administered.

The Capital Works department works at determining what has to be done to protect people and property from storm water damage in the future.

The Engineering department is costing out the work that has to be done and creating time lines for construction and repair.

It is now understood that climate change is going to result in much different weather patterns. We are now paying the price for all the carbon we let into the atmosphere.

The three departments will prepare a staff report that will be a complete review and detailed plan including significant public engagement for the potential implementation of a user fee.

Municipalities tax property and use that revenue to run the city. The higher the value of the property – the higher the tax.

Storm water management taxes will be based on the size of the property and how much ground there is – people in condominiums will pay less than those with large yards and extensive driveways.

Figuring all this out will be the task of the Finance department.

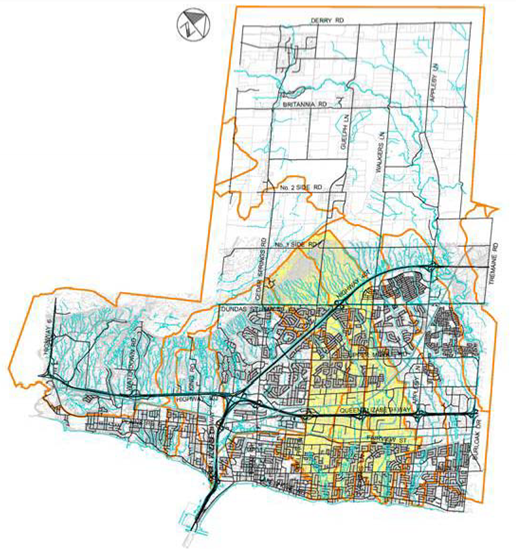

Allan Magi, Executive Director of Capital Works uses the often precise language engineers bring to their work. “We need to determine the ‘conveyance capacity’ of the creeks and many of the culverts” he explains.

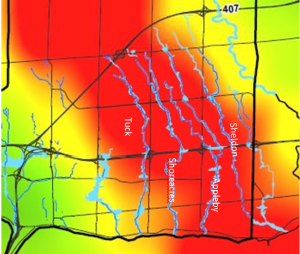

Tuck Creek is going to get a lot of attention with Roseland, Shore Acres – just about everything in the east end of the city getting a very close review.

The city had a policy of not grooming the banks of the creeks all that much – the policy was to let small vegetation take a natural process and work its way into the soil bed. Under normal circumstances that was a good policy – but with thousands of gallons of water rushing through the creeks towards the lake all that vegetation got pushed forward and in some cases became damns that produced floods.

Culverts that had been in place for years and thought to be the right size proved to be far too small – they needed upgrading. Bridges have to be rebuilt and water pipes up graded.

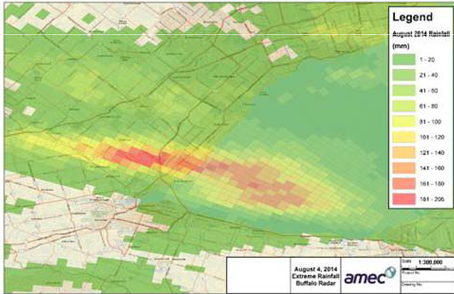

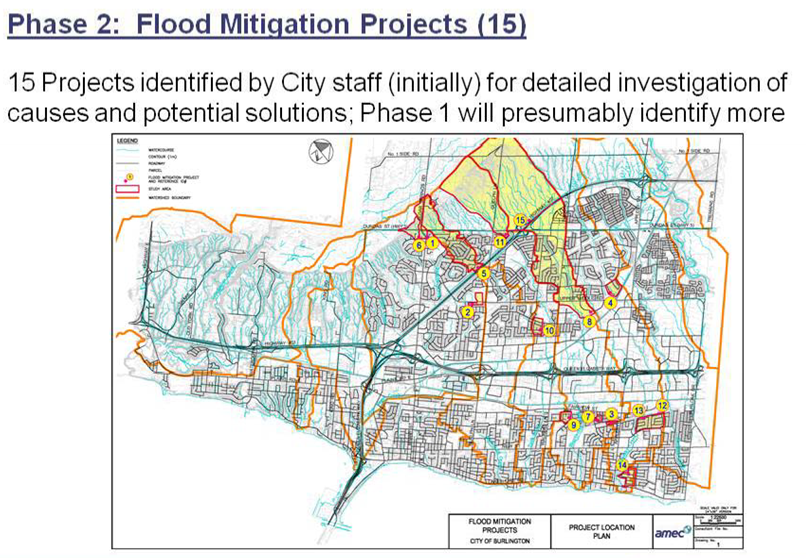

The city hired a consulting group to prepare a detailed report on what happened and why. The Conservation Authority reported on what happened at the watershed level. The city had to focus on the many creeks that run from the edge of the escarpment through the city and into the lake.

The consulting firm, AMEC, produced a report that set out what had to be done to prevent the flooding and the engineers began to work through the costs.

The AMEC report, which is a document that is not easily read or understood and hasn’t been given the circulation it deserves. The consulting firm that did the work chose not to be available for any interviews which made it difficult to gain a solid understanding of the magnitude of what happened and what has to be done.

Both Finance, Capital works and Engineering are planning on holding a Workshop for Council that will set out what the issues are and discuss some of the options. There hope is that the full report can go to council sometime next summer.

Included in the thinking being done at this point is a closer look at the “asset management plan”. Everything the city has is considered an asset – front end loaders, building – city hall itself is an asset and pipes in the ground – these are all assets that have to be managed. They each have a life span and the city keeps track of what has to be repaired, upgraded or replaced. There is some thought being given to creating a reserve fund that would set aside monies needed to maintain these assets. A portion of any storm water fee might include funds that would get put into the reserve.

Burlington is currently struggling to get its roads up to a standard – have you driven down Guelph Line south of the QEW recently – and has chosen to use gas tax funds which it gets from the province that are normally used to fund transit – but has used some of it to get caught up with the huge infrastructure deficit.

The thinking is that creating a reserve now will prevent that kind of problem in the future.

The system of pipes were unable to handle the volume of water and so up it came through the sewer system.

Overland flooding, the way the insurance industry is looking at the problem, a closer look at the flood plains in the city and housing that sits on those flood plains are all part of the work that is being done.

There is a lot more to report on this subject. City council has a significant task ahead of it.

Ah, first the Joseph Brant Hospital Tax morphs into the Infrastructure Renewal Tax, followed by the new Storm Water Management Tax. Coming soon, the Hot Air Ventilation Tax to help refresh Council Chambers? It is getting a little stale in there.

“Storm water management taxes will be based on the size of the property and how much ground there is – people in condominiums will pay less than those with large yards and extensive driveways.”

The size of the property has little relationship to the amount of storm water runoff it creates.

A hectare of land with an average residential home has the capacity to absorb far more storm water than a hectare of paved parking.

“Municipalities tax property and use that revenue to run the city. The higher the value of the property – the higher the tax”

These taxes are based on assessed value, determined by MPAC every four years, and have little relation to the cost of city services. For the same services, a condo assessed value of $400K pays half the amount of a large property assessment of $800K.

If the city requires additional revenue to manage storm water, that would be a capital project in the annual city budget.

Lets just call it what it is, a property tax increase.

If climate change is the reason for the weather anomalies that have caused the flooding, then surely it will also cause other weather related disasters as well. Why not be honest then, and call the new tax the climate change tax?

What about houses that have no services, like in the rural parts of north Burlington and north aldershot – there’s no sewers, storm drains, etc…..people in the country should have these services before they are taxed for them. Will there be any consideration for this?