By Ray Rivers

By Ray Rivers

April 5th, 2018

BURLINGTON, ON

”So, just think: a family of five will be paying $1,000 more in new taxes,” he told the news conference. “We know that they’ve increased the taxes $200,”…”Times five is $1,000”. (Doug Ford at his post budget news conference)

Yeah – maybe if Ford’s hypothetical five family members, including the children, each earned at least $130,000. Then the household income would be at least $650,000. Not your traditional 5 person family. He was clearly grasping to make a point on which he obviously hadn’t given (enough/any) thought.

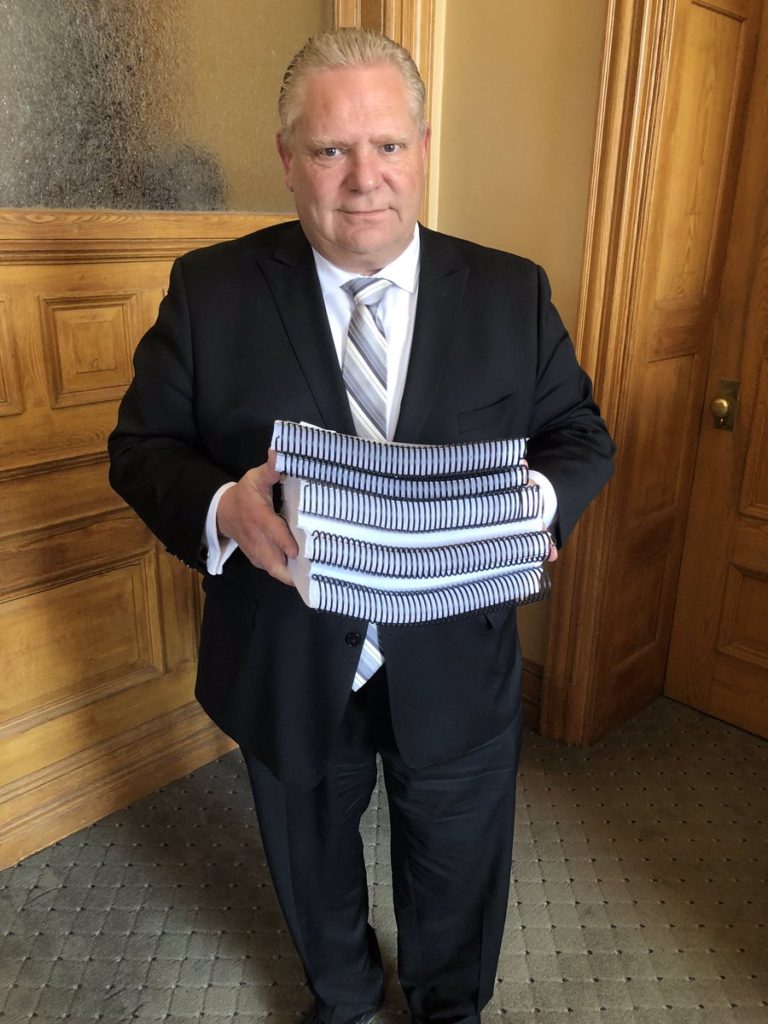

Doug Ford – Progressive Conservative candidate for Premier of Ontario

We all mistakes and we could give Mr. Ford a mulligan, being the newbie running for that top provincial job. But it is worrisome for a potential premier to stumble on something so simple. We expect the CEO of Ontario Inc. to be good at thinking on his/her feet. And just as importantly to be able to sort through the weeds and grasp complex solutions to complex matters. But we haven’t seen that option yet on our latest model Ford.

So it’s not surprising that he has little patience for the sophistication and intricacies of Ontario’s cap and trade climate change program, now in its second year of operation. Of course supporting any climate change initiative requires a belief in global warming and a determination to do something about it. Ford has mused positively on the former but has shown little interest in the latter.

For a man not big of documents and reports – this would have been a challenge.

In December 2016, the Government of Canada and provinces making up over 80% of the Canadian population signed onto the ‘Pan-Canadian Framework on Clean Growth and Climate Change’. Under the plan, each province has to implement carbon taxes of $10 per tonne in 2018, rising by $10 each year thereafter until 2022. If a province doesn’t implement a carbon tax the federal government will do it for them, collect the revenue and return it to the province in some, as yet undefined, form.

Saskatchewan is the only province which has refused to join so far. A province can opt for an explicit carbon tax/levy as B.C. and Alberta have done, or a cap and trade program as Ontario and Quebec have undertaken. The argument for cap and trade is that it ensures the targets are met, it is more efficient and less costly for the final consumers and it is much more business friendly. But it is more complex to administer and needs a large enough allowance market to function effectively.

Large greenhouse gas (GHG) emitters have to buy annual GHG allowances – a license to release a tonne of CO2. The number of allowances provincially available depends on the national targets, established by the Harper government, back when they were in power, and adopted by the Liberals since. The number of allowances declines over the years consistent with the GHG emissions targets.

The revenue from the sale of allowances goes into a green fund which homeowners and businesses can then use to partially pay for beefing up their attic insulation, installing more efficient windows, and so on. Of course that revenue from allowance sales could be re-directed anywhere. B.C. channels revenue from its carbon tax back in reduced income tax points and Alberta does a little of both – income tax cuts and funds for more greening.

When the PC’s were led by Patrick Brown he wanted to scrap cap and trade and implement the federally prescribed and more lavish carbon tax worth about $4 billion in its first year. That was primarily because Brown planned to recycle the cash he would collect into his promised 22% income tax cuts for the middle class.

But Ford wants nothing to do with any darn carbon tax and promises to also scrap cap and trade. Further, he has threatened to sue the federal government if they even think about carbon taxing in Ontario.

Doug Ford: don’t let anyone tell you he is stupid.

Of course Ford may just be playing coy. After all there isn’t a snowball’s chance in a tar pond that the three amigos on the right: Ford, Sask. premier Scott Moe, and federal Conservative leader Scheer would win such a law suit. And that means the federal government will have to implement its own carbon tax in Ontario and likely turn the money over to the province.

So Ford may not be good with numbers or stun us with quick thinking on his feet, but don’t let anyone tell you he is stupid. Quite the contrary, even after his lawsuit flunks the legal smell test, he can still claim to have resisted and fought the feds on the carbon tax. And if he plays his cards right, he’ll also have the $4 billion in cash he needs to make his promised tax cuts while almost balancing the budget.

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Tweet @rayzrivers

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was once a candidate for provincial office in Burlington. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Tweet @rayzrivers

Background links:

Ford’s Fumble – Ford – a Puzzle – Carbon Taxes –

First, I am not a conservative and have no intention of voting for their party. Secondly, I read- and it just may be true- that Ford will get rid of CBC- a radio and tv service paid for by the Federal Government. Sorry Ford, you’ll be in provincial politics and although you may not realize it- you will be involved in provincial changes only. Maybe you better read up on what is under federal jurisdiction and what is under provincial. I rely on CBC for great news coverage and think it’s a good way of spending tax dollars.

Elizabeth…do you realize that the CBC is a federally regulated Crown Corporation that comes under the auspices of the federal government? Ford has nothing to do with it. Even if he wanted to get rid of it he couldn’t. The Ontario government has no control over broadcasting matters.

Good points Stephen – I’ve wondered why the HST is being used as an incentive. Carbon taxes will only be effective if there are reliable non-fossil alternatives and if the taxes are high enough. But if they are too high the government implementing them won’t long be in office. Thanks.

Admittedly I’m not an eager fan of Doug Ford. However, putting that aside for a second, there are legitimate concerns being raised around the federal and provincial governments’ carbon pricing and cap and trade policies.

Concern #1. It is inflationary. It adds 4.3 cents per litre on a price of gasoline, and about $80 annually on a home heated with natural gas. That gets passed directly onto consumers. I don’t see a corresponding offset in terms of personal income taxes to all segments of the population. I recognize Kathleen Wynne is still doling out her pre-election goody bag, but that doesn’t get applied equally across all households.

Concern #2. The revenue raised is going into the general revenue fund to be spent on …heaven knows what…maybe pre-election goodies! I thought the idea of carbon pricing was that the monies were to be spent on green environmental programs and energy conservation and efficiencies. Hmmm…..

Concern #3. It hasn’t worked in B.C. Greenhouse gas emissions have gone up every year since 2010. The average rebate to low income households amounts to little more than $115. Moreover, tax rebates go disproportionately to the wealthier segments of the population and corporations.

https://thetyee.ca/Opinion/2016/03/08/BC-Carbon-Tax-Failure/

Concern #4. Credits purchased under the cap and trade agreement Ontario, Quebec and California go to places like California….an estimated $466 million over the course of 3 years. I’m happy that Governor Brown is seeking to reduce pollution in his state, but frankly, I don’t want to pay to fix his problems.

https://www.bnn.ca/ontario-signs-agreement-to-join-quebec-california-on-carbon-cap-and-trade-1.863827

Admittedly, if Ford doesn’t like the existing program he needs to develop a better alternative. One option may be to tax energy efficient products (e.g. automobiles, electrical appliances, etc.) at a much lower rate than less efficient offerings (e.g. 3% PST instead of the current 7%). A second option would be to offer transportation tax credits to those using public transit….like the one Finance Minister Morneau scrapped in a previous budget.

Just because it is branded with adjectives like “green” and “environmental sustainability” doesn’t make it right or beyond criticism.

Interesting article Mr. Rivers.

I suppose many voters will only remember the attention grabbing 5 X200= $1000.00 per family part of his comment.

Seems that omitting pertinent details is an all to common and successful campaign tactic.