April 21st, 2017

BURLINGTON, ON

Since the time of Adam and Eve I had been doing my own taxes. But every year it just gets more difficult – like swimming upstream against a current of bureaucratic nit-picking and think-speak. So I finally got a good accountant and that got the Canada Revenue Agency (CRA) off my back.

I hate manually filling-in all the forms and schedules – hate the repetition – hate the tedium of it all. So back as far as the eighties I wrote a program that paralleled the official one but reduced the quantity of white-out I’d have to use. Eventually I just adopted one of the available commercial spreadsheets. I suspect that annoyed the CRA crowd, even though I still used their line numbers as points of reference.

There is nothing illegal in using another format to file your tax declaration, though it is likely more challenging for the tax man. And although the CRA folks were mostly polite about my little eccentricity, CRA registered its discontent with my non-conformist behaviour by hitting me with one audit after another, almost before I could say non-refundable tax credits.

The other day my accountant forwarded me the tax return he had prepared for review. And after I’d printed the entire software file my printer ran out of toner – one hundred and nineteen pages. I’ll bet even Donald Trump has fewer pages to his returns, even with that messy US tax code. Not that anyone is likely to ever see them.

So, as I was poring over these 119 pages, trying to stay awake, with one eye on The Daily Show, this guy, Austan Goolsbee comes on the big screen. He is a professor of economics and was the former chair of President Obama’s Council of Economic Advisers. So he should know something about the economy. Then he gets asked about President Trump’s plans to reform the US tax code.

“The best thing government could do is to actually prepare our tax returns for us”. His point was that the authorities have collected all of the information from employers, brokers, banks and charities and have trained staff at the ready. Gestalt – just what I was thinking – what they do in New Zealand. Of course such a ground-breaking innovation would send the share price of H & R Block through the floor. But I don’t have any of that company’s stock anyway.

“The best thing government could do is to actually prepare our tax returns for us”. His point was that the authorities have collected all of the information from employers, brokers, banks and charities and have trained staff at the ready. Gestalt – just what I was thinking – what they do in New Zealand. Of course such a ground-breaking innovation would send the share price of H & R Block through the floor. But I don’t have any of that company’s stock anyway.

Still something tells me that isn’t going to happen – it makes too much sense. But really, shouldn’t filling out your tax return be as easy as balancing your bank account? So if CRA won’t fill out our forms for us, the least they could do is make it easier for the rest of us. How about a standardized CRA software package which you can access online for free – or placing the tax form itself online in a conversational fillable format?

Now that CRA has stopped mailing out tax forms, shouldn’t they replace the old 19th century manual forms with something more modern and user-friendly. And what could be more convenient for most of us than an app for our laptops, I-pads or smart phones. And a program that avoids generating 119 pages for a relatively simple tax return.

Our tax system is long overdue for re-invention. Brian Mulroney was the author of the last major change to our income taxes, back in the late eighties. Most folks will remember him for introducing the dreaded GST. But as importantly he undertook the ‘simplification’ of our tax system.

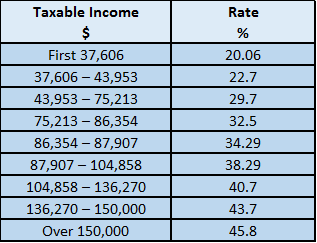

So instead of personal deductions, which we all understood, we now have these complicated and confusing credits and non-refundable credits. In the end his reform was about cutting taxes for the wealthy. Simplification was a ruse, a diversion from his real plan of cutting tax brackets and taxes for the wealthiest Canadians.

The only simplification was to make the system less progressive. After all cutting taxes and remaking the social state was a fashionable conversation piece with him and his pals Margaret Thatcher and Ronald Reagan. And that made him the architect of the ongoing trend of widening the income gap between the wealthiest and the rest of us in Canada.

Mr. Trudeau has cut an ambitious agenda for his government. And tax reform is probably not the highest priority. But his last budget was greeted with sound of yawns all across the country. Oh and emerging protests at the 300 page size of his financial bill, for a government that has committed to eliminate omnibus legislation, is not doing him any favours.

Tax reform is long overdue. Trudeau’s first budget inadvertently started the process of making our taxes more equitable and even a little less complicated, with the elimination of some Harper era tax credits. So why not do what Mulroney failed to do? Why not take a shot at really simplifying our tax system, perhaps along the lines of what New Zealand has successfully done.

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was a candidate for provincial office in Burlington in 1995. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Tweet @rayzrivers

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was a candidate for provincial office in Burlington in 1995. He was the founder of the Burlington citizen committee on sustainability at a time when climate warming was a hotly debated subject. Tweet @rayzrivers

Background links:

Income Taxes – Rationale of Taxation – Simplifying – Sales vs Income Tax –

More Sales Tax – One Tax – Eliminating Tax Credits – Last Budget –

New Zealand Tax Simplification –

I agree completely. The tax system in Canada is Draconian. . In my experience, when I’ve made a mistake on my tax return they correct it for me, even if it is in my favour. So if they are checking your numbers anyway, then why even bother? Having lived in NZ for several years, I can safely say this system works. There is nothing to stop you from doing your taxes should you choose to do so and it’s as simple as clicking an icon on a website (if you choose a third party to do it like I did). I also never heard of anyone ever being audited, unlike here where everyone and their cat is at risk of a costly and annoying audit! But alas, the Canadian government prefers to stay firmly rooted in the dark ages.

Amen, Brother Rivers.

That’s a subtle way of thnnikig about it.

Goolsbee’s suggestion that the government should prepare our tax returns for us is brilliant. Banks, financial institutions and brokerage houses would just send the T-3s and T-5s directly to CRA. Ditto charities and receipts for donations. That way the government would ensure all receipts are properly accounted for. Individual taxpayers could then complete a one page summary highlighting any special needs or factors deserving of consideration (e.g. disabilities) that would then be taken into account in determining any tax refunds or amounts owing.

I agree with Steve that a flat tax is probably long overdue. The so-called “progressive tax system” really is no incentive to create or sustain wealth.

Ray can complain all he likes about Mulroney but at least Brian told us what he was going to do and then did it, like it or not. Justin makes promises and then either reneges on his commitments (e.g. parliamentary democratic reform; new fighter jets; only a $10 billion deficit) or else uses our tax money to buy votes (e.g. child bonuses).

Steve speaks of a flat tax, though I’m not sure of the visuals in that idea. That sounds similar to the “Fair Tax” idea floating around the U.S. for several years. I’m told it has pitfalls, though not being an economist or accountant I would not presume to judge.

Every year or so figures are published showing how many people fall below the line at which they pay no taxes at all. It is startling. But more startling are the numbers of people, such as Trump’s accountants, who know how to game the system to their advantage.

For years I’ve known of the Italian off-the-books economy and it may well devolve into that before anything fair is done.

This forum needed shikang up and you’ve just done that. Great post!

A flat tax for all.