By Pepper Parr

By Pepper Parr

August 14th, 2020

BURLINGTON, ON

So how deep is the financial hole going to be?

The city treasurer put some numbers on the table – they don’t look all that good.

Earlier in the week the City got a big chunk of money from the federal and provincial governments. More than $4 million was to cover some of the costs of running the City.

Revenue has been low – mostly from the Parks and Recreation services the City provides.

Here is what Joan Ford, City Treasurer gave Council on Thursday.

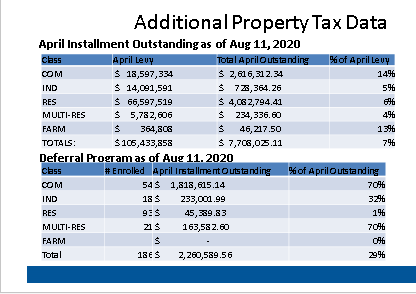

The city has been very generous on the time people have to pay their taxes. There have been deferrals on due dates – which can get a little confusing. The Table below shows what the shortfall is on the April tax levy.

There is a total of $7, 708,000 + outstanding from the April tax levy. A number of people and organizations enrolled in the Tax deferral the city put in place. That amount comes in at $2,260,000 +

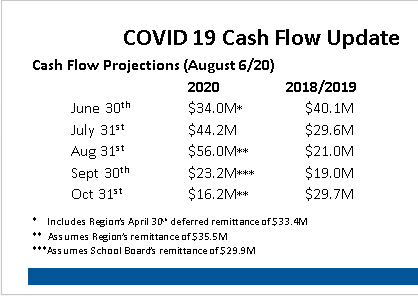

Ford set out for Council what all this was doing to cash flow. The table below shows the Cash flow projections that were in place for the 2018/2019 fiscal year and what Ford and her staff think the projection will be for 2020.

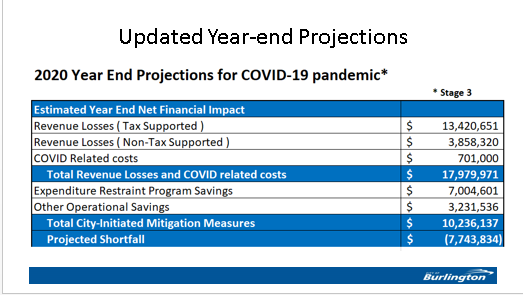

Using the data they have the Finance people set out the estimated revenue loss from tax supported and non-tax supported programs – then added to that what they expect to have to spend on COVID-19 matter. Ford told Council that to date the City has spent about $400,000 on Covid-19 tasks.

Seven million was saved on what they called “expenditure restraint”. Unless it was absolutely necessary – funds were not spent even though they were in the budget.

That still leaves a shortfall of $7,743,834.

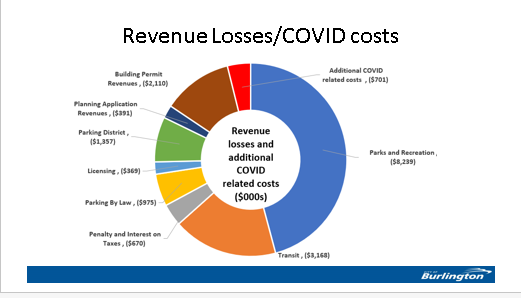

Standing back from the detail and looking at the bigger picture – where is the pain? Parks and Recreation. Transit, the orange marker wasn’t as deep but substantial nevertheless The service was offered free of charge. That changes in September but at this point the transit people have no idea what revenue might look like.

The Parks and Recreation revenue losses were a surprise.

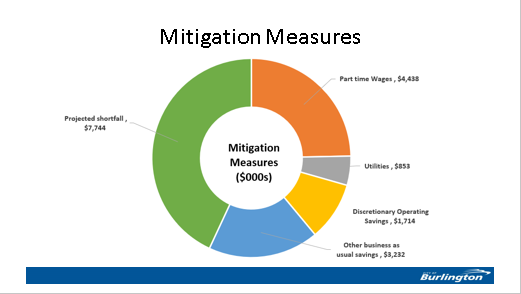

The city let all the part time people go shortly after the Emergency legislation was passed. Discretionary spending was cut and almost $3.2 million was saved in other “Business as Usual” expenses.

There is only so much that can be squeezed out of a budget. Also there are found expenses that occur the moment you turn the lights on.

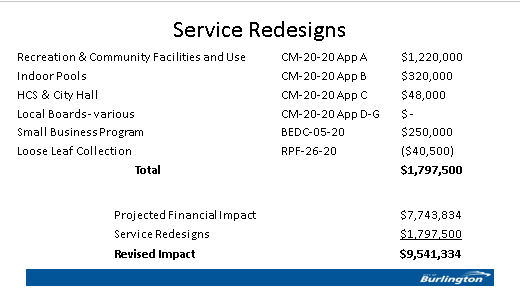

There is a very bright and tough minded crew of people who look at the services that are provided and ask: How can we redesign this service so that the public gets what they expect and we can be more efficient.

The most recent re-design resulted in an additional $1.7 (almost $1.8) million being added. Some savings with leaf collection – always a contentious issue in Burlington – were made.

That now has the shortfall at $9,541 + million.

Getting a handle on the damage COVID-19 is doing to the City’s finances in a situation that is both dynamic and fluid leaves the city with what cannot be described as a pretty picture.

The finance people know that things will not remain the same – normal is no longer a state of affairs that can be seen as certain.

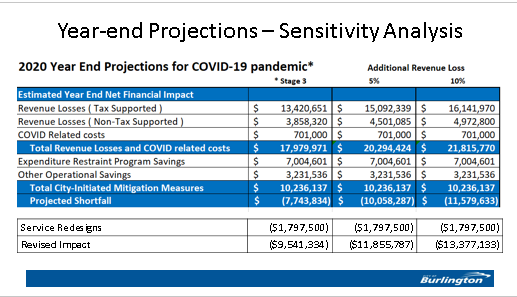

The Finance department did a sensitivity analysis. Starting with what they see happening now that we are into Stage 3 they looked forward and did a calculation based on an additional 5% revenue loss and then a 10% revenue loss.

Those numbers are set out below.

Members of City Council need now to take those projections to bed with them and think long and hard: Are they ready to tell the public that there is going to be a $13 million revenue loss. If they have to make that kind of a statement they had better have some solutions and not just assume that a tax hike will cover that off.

City Council might be approaching that point of desperation that many in the commercial, especially the hospitality sector, are experiencing. City’s cannot go bankrupt nor can they run a deficit. Should they reach that point the province sends in regulators who take over. That’s when a staff reduction is given a hard close look.

If taxpayers are having a hard time now making their property taxes, how will the City’s go-to solution–raising taxes some more, be effective?