![]() By Pepper Parr

By Pepper Parr

February 21st, 2019

BURLINGTON, ON

Just how does the city budget get created and passed and what do the members of council do to ensure that tax payers are getting value for money?

Staff in the Finance department present a draft budget to city council

That draft is the result of a process that has each department putting together their budgets which gets vetted by a team that consists of senior staff, the Director of Finance and the city manager.

The public get to delegate on the draft budget.There was email feedback, there was a telephone town hall, the city made use of its Get Involved service that lets people say what they think on various issues. And then there was that button-holing that politicians have to live with from residents who want something for their special interest or community.

Members of Council inevitably have questions – with the current five new members of Council there is not only a steep learning curve but also a lot of questions that are often specific to their wards.

The following is a list of some of the questions individual council members asked. The name of the council member who posed the question is not provided – unfortunately.

Service: Recreation

Question: Securing Sponsorship Funds by Naming Corporate Assets

Who is responsible for generating sponsorship funds through the naming of corporate assets?

The Haber Law Group got naming rights to the Recreation Centre in Alton for 20 years – paid millions.

Response: To date, naming opportunities have been done on a project by project basis with Parks and Recreation staff usually taking the lead. A sponsorship package is approved by council and potential sponsors are sought. Most recently the city was successful in securing a naming opportunity for the Haber Recreation Center; unsuccessful in securing a sponsor for the renovated Nelson Outdoor Pool.

Funds secured are placed in a reserve to support future capital renewal of the asset that was named. There have been differences of opinion on whether the city should secure sponsorship for the overall name of an asset, with there being more comfort with naming components within an asset.

A review of the corporate sponsorship policy will be undertaken later in 2019, early 2020

It was Regional budget dollars that paid for the re-build of New Street. Infrastructure no matter who pays – in the end it is coming out of your pocket.

Question: What would be the impact on the overall 20-year asset management plan if the increase in the infrastructure renewal levy was decreased to 1% instead of 1.25% for this year, and what is that amount worth?

Response: A 0.25% decrease would reduce $400,000 of funding to the capital program in 2019 and $8 million of funding over the next 20 years ($24 million over the 60-year Asset Management Plan). $4 million of projects would need to be removed from the 10-year capital budget and forecast.

The capital projects impacted by the reduction risk higher costs in the future to complete and additional costs by the way of minor maintenance expenditures until the work can be done. The projects timing in the capital program is based on assessed condition, warranting the required work, deferring work can impact the resident’s experience and derived quality with the asset.

Question: Provide a list of statutory and discretionary development charge exemptions and a list of ineligible services.

Response: List of statutory and discretionary development charge exemptions and list of ineligible services:

The Development Charges Act along with regulation O.Reg. 82/98 provides legislated statutory development charge exemptions for the following:

• Industrial building expansions up to 50% of the gross floor area

• Intensification within existing residential developments with up to 2 additional dwelling units permitted within existing low-density dwellings and 1 additional dwelling unit permitted within medium and high-density dwellings

• Municipalities (City and Region)

• Board of Education and local board, as defined in the Education Act

The City’s existing DC by-law (46-2014) also provides non-statutory exemptions from payment of development charges with respect to:

• Hospital, excluding any portion of the lands, building or structures occupied by the tenant of the hospital

• A place of worship

• Conservation authority

• Seasonal structure and temporary venues

• Parking garages

• Agricultural uses

• Canopy (structure with one or no walls, ie. Gas pump islands)

Ineligible services:

In accordance with the Development Charges Act and O. Reg 82/98, a development charge by-law may not impose development charges to pay for increased capital costs, prescribed as ineligible service listed below:

• Cultural or entertainment facilities, including museums, theatres and art galleries

• Tourism facilities, including convention centres,

• Acquisition of land for parks, including woodlots

• Hospitals, as defined in the Public Hospitals Act

• Landfill sites and services

• Facilities and services for the incineration of waste

• Headquarters for general administration of municipalities and local boards

• Lands for parks, includes land for woodlots and land because it is environmentally sensitive

Project: Funding for Capital Projects from Parks and Recreation Reserve Funds

Question: How are the reserve funds managed and what amount of funding is coming from them for capital projects?

Response: The Parks and Recreation Department utilizes reserve funds to partially support capital initiatives for the repair and renewal of facilities and associated program amenities/enhancements in the Organized Sport Support, Recreation and Culture service areas.

Angela Coughlan Pool

Reserve Funds related to facilities and programs are funded by a 5% surcharge place on user fees. Funds from these Reserve Funds are used to offset a portion of capital costs related to repair, renewal and enhancement of facilities and programs in the asset type, for example; surcharges collected at Angela Coughlan Pool would be placed in the “Pools” Reserve Fund and used for pools asset renewal projects.

Projects presented through the capital budget that are funded or partially funded through Reserve Funds illustrate details as such under the budget summary.

Service: Municipal Law Enforcement (additional By-law Enforcement

Question: Bylaw: getting from 6 (proposed budget) to 8: I understand Parks and Recreation have a parks enforcement office, and parking enforcement is also separate from bylaw. Can we redeploy a parks and rec, and a parking officer to bylaw to bring the total bylaw complement to 8 officers? Or redeploy one officer from animal control to bylaw to achieve one of the 2.

Response: Parks and Recreation have Park Ambassadors who work with sports groups on proper park etiquette and problem-solving issues (lights on, lights off etc). These are part- time staff who work in summer months.

Parking Enforcement is contracted out to a 3rd party provider (Core Commissionaires) and the enforcement officers are not City employees.

Moving an animal enforcement officer would result in service reductions to customers and Animal Control Enforcement overall. This would impact the work the animal enforcement officers do on investigations, ticketing, and coyote management (as examples).

Service: Road and Sidewalk Maintenance

Would this stretch of sidewalk qualify?

Question: What would be the cost of plowing the pathway at Brant Hills Community Centre? Are there any other locations not currently maintained in the winter?

Response: The additional cost to maintain this pathway is minimal and could be accommodated however there are significant safety concerns during freeze/thaw conditions given the hilly nature of the pathway.

There is a further 57 km of footpaths not in the road allowance that are not maintained in the winter. To maintain all of these pathways in the winter would require significant resources including additional staffing and capital equipment.

Given the significant amount of work and resources required to partially implement the new minimum maintenance standards on sidewalks adding additional footpaths is not recommended at this time.

Service: Transit

What would free transit cost the city?

Question: What is the cost to provide seniors with free transit between 9:30 am and 3:30 pm Monday to Friday?

Response: The estimated cost is $300,000 for conventional transit and $60,000 for para-transit service.

Service: Recreation

Question: What expansion have we done to the pickleball program to address demand?

Response: We have been successful at obtaining grant funding to support a program expansion at various locations throughout the city. To date, we have also considered partnering to maintain this program expansion as well as looking to convert outdoor tennis courts, in specific target areas, to outdoor pickleball courts. Funding ends after this year. To date, all program expansions have had to be funded by grants which is not sustainable.

Service: Recreation and Organized Sports

Question: Have we been able to meet the community need in terms of fee assistance and other similar type requests?

Response: To date, we are able to meet the demand we receive through the various funds available such as Community Matching Fund, Fee Waiver and Fee assistance programs. Financial assistance is supported in part by the tax base and also by external funders / donors.

Service: Local Boards

Performing Arts Centre get a substantial subsidy.

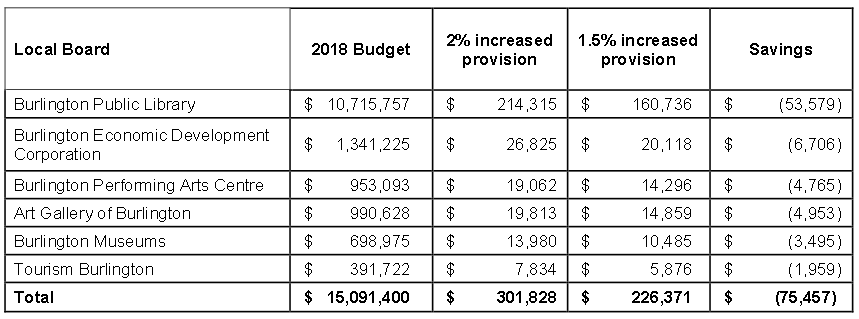

Question: What savings would be achieved by holding the boards and Committees to 1.5% across the board instead of 2%?

Response: The total savings of reducing the city’s contribution to the local boards to a 1.5% increase instead of a 2% increase would be $75,457 as detailed below:

Service: Corporate Expenditures (VDRF)

Question: Can the provision to VDRF (Vehicle Depreciation Reserve Fund) be reduced? Showing a $402K increase.

Response: The Vehicle Depreciation Reserve Fund is used to fund the replacement of the city’s Fleet vehicles (excluding conventional buses). The policy approved in 2018 is to increase the provision by 4% annually. In addition, $270,000 of tax supported funding previously required for debt charge repayment (see $500k reduction in debt charges) was restated to support the Handi-van renewal requirements. Handi-vans were previously replaced using funding from gas taxes.

Service: General – HR Budget Summary

Question: Why is HR up 7.1%? Is this the head count increase?

Response: 7.1% HR increase includes business case requests as well as the base budget. Base budget increase is 4.8% and when you exclude the regulatory/contractual obligations as well as the 2 staff for Halton Hills fire communications and the road patroller that is funded by the Region, the base budget increase for HR is 3%.

Question: What is the total amount of budget reductions required to get the increase to 2.99%?

Response: $1.6 million of on-going savings would be required to reduce the proposed budget from 3.99% to 2.99%.

The challenge for this new city council is determining what will be cut? Will this council focus on projects in their wards or will they take a longer term approach and structure the budget to ensure that the public gets value for the money spent.

We will report on that debate which takes place today.

The seven members of city council who sit in this renovated council chamber will decide just what your tax bill is going to amount to.

Regarding the Question and Response on free transit (nothing is free), but we do need a better answers than the one that was given:

Question: What is the cost to provide seniors with free transit between 9:30 am and 3:30 pm Monday to Friday?

Response: The estimated cost is $300,000 for conventional transit and $60,000 for para-transit service.

I believe the idea of providing free transit to seniors was based on the assumptions that no new costs would need to be added because:

(1) These were off peak periods and the buses were running close to empty any way.

(2) No additional costs in terms of personnel would be required per (1).

(3) No route changes would be required

What am I missing, the response should have included full details on the additional $360,000 required to provide the free service? Running empty buses represents a fixed cost with no return.