By Staff By Staff

March 31, 2014

BURLINGTON, ON.

Each year the province requires municipalities to publish a list of all those who earn more than $100,00 annually. The data is presented as the salary paid and benefits given that are taxable.

Burlington civil servants were given a 1% salary increase in the 2014 budget.

Councillor Marianne Meed Ward brought a motion to Council that was approved asking the city manager to look into the free parking and free transit passes that are given city employees. Meed Ward is of the view that this benefit is taxable and should be treated as such.

The first figure shown after each name is the annual salary, the second is the taxable benefit.

ADCOCK ALAN Firefighter $102,172.28 $487.27

ALDHAM JUDY Field Services Supervisor $104,070.38 $2,225.26

ALLDRIDGE BRIAN Platoon Chief $124,140.31 $649.80

ANTONIOW PHIL Manager of Program Development, Budgets and Contracts $112,680.32 $622.77

AXIAK ROB Manager Facility Operations and Special Projects $105,876.99 $552.03

BAKOS MICHAEL Captain $108,247.81 $571.12

BARRY PHILIP Captain $108,610.77 $573.86

BAVOTA ANTHONY Fire Chief $157,572.65 $1,906.95

BAYLOR MARK Captain $110,816.79 $570.96

BAYNTON STEVE T. Captain $111,727.68 $586.64

BEATTY DAVID N. Fire Chief $105,836.89 $3,409.68

BEDINI CHRIS District Supervisor $105,298.61 $662.70

BENNETT RANDY Manager of Information Technology Infrastructure and Operations $117,305.77 $640.34

BENNITT JAMES District Supervisor $101,209.87 $764.12

BERDAN MICHAEL Transit Supervisor $103,954.97 $456.07

BIELSKI BIANCA Manager of Development Planning $131,198.38 $739.08

BIRCH CHARLES T. Captain $112,490.88 $585.12

BLACK JEFFREY Manager of Field Services $105,641.57 $3,398.73

BOYD LAURA Human Resource Manager $106,215.06 $590.76

BRILLON SYLVAIN Firefighter $100,870.86 $484.09

CAUGHLIN DEBORAH Manager of Council Services $104,747.58 $582.24

CHOLEWKA CHRIS Captain $107,542.24 $564.00

CLARK CARY Manager of Development and Environmental Engineering $109,618.58 $550.80

COULSON ANN MARIE Manager of Financial Planning and Taxation $133,138.56 $702.66

CRASS JOHN Manager of Traffic Services $106,854.96 $599.16

DI PIETRO ITALO Manager of Infrastructure and Data Management $118,340.36 $655.44

DONATI DERRICK Firefighter $101,799.93 $495.31

DOWD TIMOTHY Captain $117,192.97 $585.12

DUNCAN JOHN Transit Manager $120,963.15 $1,069.52

EALES MARK Captain $106,407.96 $559.95

EICHENBAUM TOOMAS Director of Engineering $165,413.29 $877.56

EVANS FRANCES Manager Halton Court Administration $104,071.88 $575.45

FIELDING JEFF City Manager $249,940.24 $8,898.60

FIORAVANTI LEANNE Solicitor $105,949.26 $510.32

FORD JOAN Director of Finance $153,457.30 $838.93

FRYER E. TODD Firefighter $101,929.55 $519.12

GLENN CHRISTOPHER Director of Parks and Recreation $132,997.91 $731.28

GLOBE DARREN Captain $107,508.37 $573.49

GOLDRING PATRICK Mayor $168,155.78 $2,511.56

GRISON GREGORY J. Captain $111,727.66 $585.74

HAMILTON SCOTT Manager Design and Construction $111,514.22 $618.78

HAMMER CHAD Firefighter $101,951.54 $493.89

HAMMOND BILL Fire Training Supervisor $107,840.61 $562.56

HART TIMOTHY Firefighter $103,027.20 $492.49

HAYES DENNIS M. Platoon Chief $127,478.73 $617.46

HEBNER PETER B. Captain $114,146.11 $585.12

HURLEY BLAKE Assistant City Solicitor $134,557.07 $644.83

JAMES MICHAEL Training Officer – Fire $102,489.52 $570.96

JONES SHEILA City Auditor $123,574.30 $664.26

JONES STEPHEN Captain $107,384.25 $550.83

JURK ROBERT Senior Project Leader $105,261.62 $581.57

KEANEY THOMAS Firefighter $100,775.57 $486.09

KELL DONNA Manager of Public Affairs $114,486.31 $630.35

KELLY JOHN Captain $110,246.84 $579.30

KIPPEN MARK Firefighter $100,628.48 $496.85

KOEVOETS MATT District Supervisor $106,906.64 $1,394.19

KRUSHELNICKI BRUCE Director Planning and Building $160,581.87 $891.60

KUBOTA ERIKA Assistant City Solicitor $134,346.99 $644.86

LAING BRUCE K. Captain $111,727.68 $585.12

LAPORTE N. JASON Captain $109,433.52 $571.25

LASELVA JOHN Supervisor Building Permits $103,581.39 $578.01

LONG MARK Captain $114,237.26 $591.85

MACDONALD GARY F. Captain $111,727.68 $585.12

MACKAY MICHAEL J. Captain $111,727.68 $587.71

MAGI ALLAN Executive Director of Corporate Strategic Initiatives $172,840.24 $967.56

MALE ROY E. Executive Director of Human Resources $182,946.28 $1,012.56

MARTIN CHRISTOPHER Captain $108,414.44 $553.46

MATHESON JAMIE Firefighter $100,671.68 $492.84

MCNAMARA MICHAEL J. Captain $112,644.56 $585.12

MERCANTI CINDY Manager of Recreation Services $113,175.87 $568.20

MINAJI ROSALIND Coordinator Development Review $100,370.93 $560.67

MONTEITH ROSS A. Deputy Fire Chief $136,019.93 $1,601.85

MORGAN ANGELA City Clerk $140,406.98 $753.15

MYERS PETER R. Captain $111,727.67 $593.09

NICELIU KENNETH Firefighter $104,681.45 $514.61

NICHOLSON J. ALAN Captain $111,727.68 $585.12

O’REILLY SANDRA Controller and Manager of Financial Services $113,228.22 $591.60

PEACHEY ROBERT Manager Parks and Open Space $111,558.40 $623.32

PHILLIPS KIMBERLEY General Manager $212,612.61 $8,730.36

POLIZIANI MATTHEW Captain $107,950.52 $557.81

REILLY PETER Captain $114,474.01 $589.90

ROBERTSON CATHARINE Director of Roads and Parks Maintenance $146,163.10 $1,304.38

SCHMIDT-SHOUKRI JASON Manager of Building Permit Services and Chief Building Official $135,620.24 $738.61

SHAHZAD ARIF Senior Environmental Engineer $100,995.97 $560.26

SHEA NICOL NANCY City Solicitor $168,958.55 $814.29

SHIELDS LISA Assistant City Solicitor $134,626.43 $638.32

SLACK CRAIG D. Platoon Chief $128,234.10 $649.80

SMITH CLINT Platoon Chief $127,352.17 $649.80

SMITH SIMON Firefighter $100,129.68 $498.05

SPICER MIKE Director of Transit $134,021.48 $708.84

STEIGINGA RON Manager of Realty Services $113,120.85 $618.84

STEVENS CRAIG Senior Project Manager $101,835.28 $570.98

STEWART SCOTT General Manager $217,635.03 $10,462.48

SWANCE JEFFREY W. Captain $111,727.67 $585.12

SWENOR CHRISTINE Director Information Technology Services $163,040.20 $861.42

TAGGART DAVID Manager Facility Assets $111,045.99 $610.32

THANDI JAZZ Manager Procurement Services $101,688.67 $561.61

VRAKELA STEVE Field Services Supervisor $101,325.60 $1,691.68

WEBER JEFF Deputy Fire Chief $139,961.19 $5,933.10

WHEATLEY RYAN Captain $110,407.44 $570.96

WIGNALL T. MARK Firefighter $102,867.06 $512.74

WINTAR JOSEPH Chief Fire Prevention Officer $110,934.32 $621.60

WOODS DOUGLAS S. Captain $112,106.48 $585.12

ZORBAS STEVE General Manager $167,678.00 $923.12

ZVANIGA BRUCE Director of Transportation Services $145,292.33 $775.86

By Pepper Parr By Pepper Parr

March 12, 2014

BURLINGTON, ON.

During the time of Jesus in first century Israel, there were tax collectors who could walk up to a man and tax him for what he was carrying. These tax collectors were hated and despised because they were usually fellow Jews who worked for Rome. There were many taxes needed from the provinces to administrate the Roman Empire. These taxes paid for a good system of roads, law and order, security, religious freedom, a certain amount of self-government and other benefits. The men who did this work were called publicans.

It isn’t all that much different today. The province of Ontario requires the municipalities to maintain roads and water treatment plants; we have to have a police force, we have to have a Medical Officer of Health who administers rules the province puts in place.

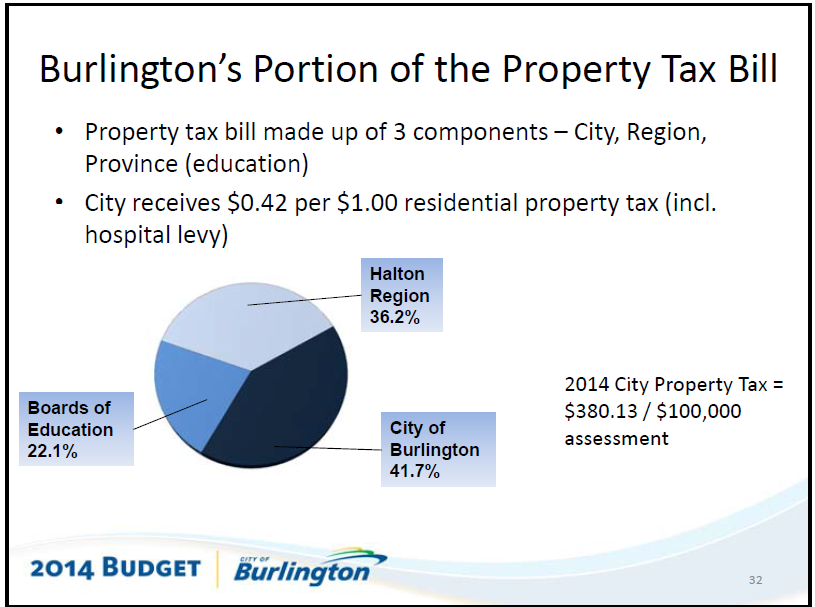

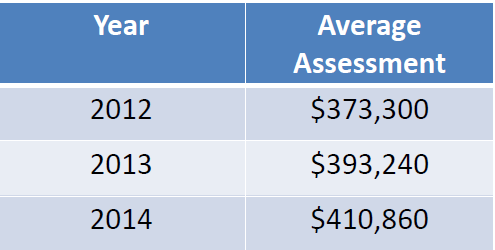

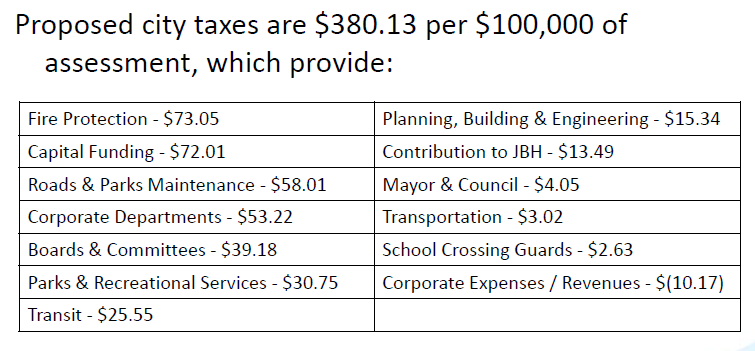

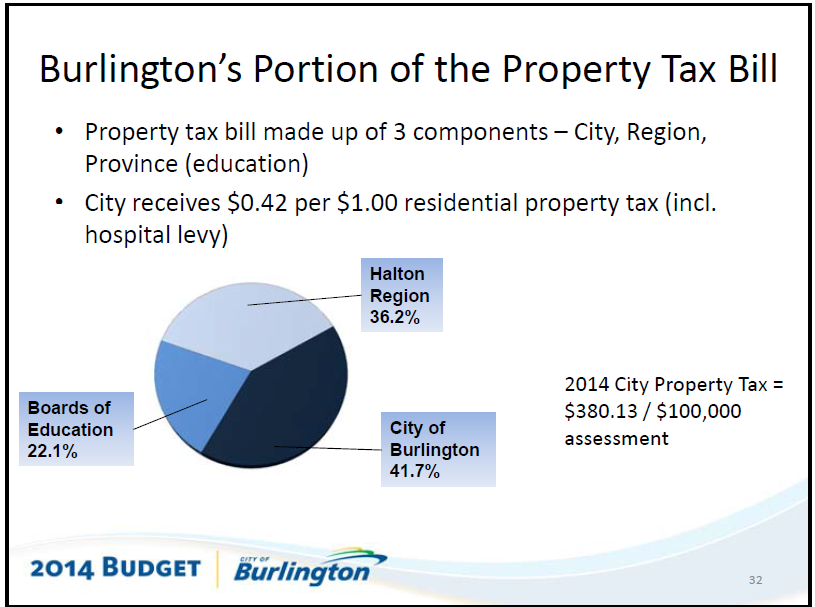

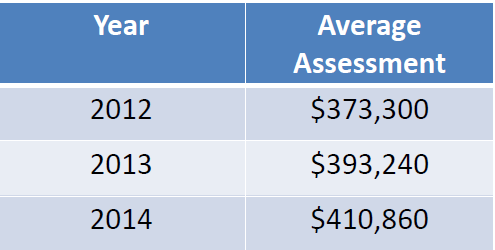

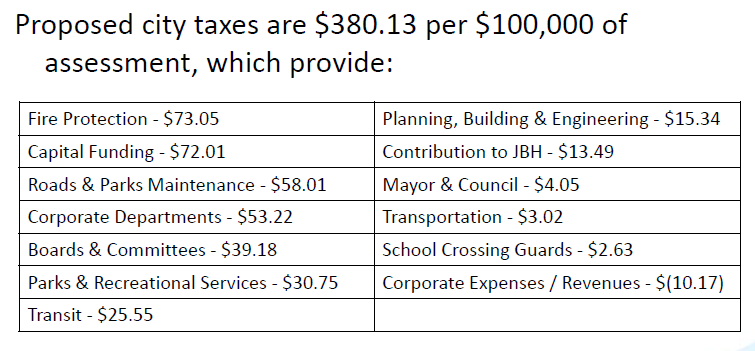

The city of Burlington levies taxes. City council recently passed a budget that set a budget of $133,816,211 for current operations and $67 million for capital expenditures and determined that home owners will pay a tax of $12.78 for every $100,000 of property valuation. That property assessment is set by MPAC – the Municipal Property Assessment Corporation..

Every property owners know what the taxes are on their homes – what most people don’t know is that different types of property pay a different amount of tax

Residential property is taxed at what they refer to as 1; which means they pay that $12.78 for every $100,000 of property assessment.

There are eight different classes of property:

Residential (1.0)

New multi-residential (2.0)

Multi-residential (2.26)

Commercial (1.45)

Industrial (2.35),

Farmlands (0.20)

Managed forests (0.25)

Pipelines, (1.06)

This Enbridge pipe line runs from border to border of the city – they pay .06 more on their assessment than you do for your house. What is the pipeline asses at? We don’t know that. Those numbers in brackets represent the tax ratio rate, with residential always set at 1. So for a property assessed at $200,000 that is residential that rate would be 2 x $12.78 a property that is classed Commercial the rate would be 2.35 x $12.78 assuming the same $200,000 assessment

This isn’t exactly the middle of a farm field is it. Land that could be taxed as commercial gets a farmland tax rate even if it is in the middle of town – all you have to do is cut the hay and bale it. Take a look at that farmland rate and recall driving by one of those vacant lots on the South service Road where you may have seen round bales of hay that never seems to get taken away. That property managed to get itself classes as farmland and all they have to pay is 0.20 of that $12.78 tax rate. Now you know why developers can hang onto land and are patient while its value increases. They get it classified as farm land, have someone cut what is really low, low quality hay and pay 1/5th of the rate you are paying for your property.

Those tax rates are set by the Regional government. Burlington has seven seats on the 20 member council – but don’t expect our team to suggest a different tax structure for farmland held by developers or for that matter, land in those large estates north of 407. Huge homes where people live in the lap of luxury – which is fine. Heck they earned their money (didn’t they?) and if they can afford that kind of space good on them – but have them pay the same taxes as those poor shmucks in the suburbs south of Dundas.

Things used to better in Burlington; there was a time when the city levied a tax on telephone poles. “we can’t do that anymore” advised the Director of Finance. There was a bit of a wistful look in her eye when she made that statement.

By Pepper Parr By Pepper Parr

March 5, 2014

BURLINGTON, ON.

The John Street transit terminal will remain in place – for now. On a vote of 5-2 (Sharman, Dennison were prepared to let people stand out in the cold) The city is currently looking at the matter of transit hubs – there are four that are being avidly discussed – with the John Street location seen as one of the more critical locations. The Burlington GO station has more bus routes going through it – 16 as opposed to the 8 that run through the John Street location. The Mayor sees it as a critical part of the downtown core.

There was a time when a much larger bus terminal existed 25 yards to the left of this small terminal on John Street – it was where people met. There were fewer cars, Burlington didn’t have the wealth then that it has now. We were a smaller city, as much rural as suburban. The times have changed and transit now needs to change as well. The transit people wanted to shut the terminal down because the drivers wouldn’t need the facility and the public would be able to get answers to their questions at the Harvester Road transit office which is open longer than the terminal and has staff available on Sunday. What Spicer kept calling “fare media” when he meant bus tickets, would be available at local retail locations in the downtown core. The Queen’s Head and Coffee Culture are the closest retail locations that are open long hours but Spicer told council that his people had not approached anyone yet.

Were the terminal to be closed, tickets will be available at city hall – but the hours there are limited. What was startling was no mention whatsoever about customer comfort. In this brutally cold weather that has been with us for more than a month the outdoor shelters just don’t cut it. The terminal is a warm place to wait for a bus.

Mayor Rick Goldring said transit had to have a meaningful presence in the downtown core and added that he talks to a lot of people who use the John Street terminal.

The Mayor and Meed Ward were the only two people to talk about the terminal. Meed Ward then moved on to part two of her transit mission: where was transit in the Transportation Master Plan review which has focused a bit on the creation of four mobility hubs. Burlington’s friends and supporters of transit (Bfast) couldn’t see it in the proceedings so far.

Mobility hubs at the GO stations is close to a no brainer – it is the possible hub in the downtown core that has yet to be thoroughly thought through. Council decided that closing the terminal on John Street to save $8000 a year was not a bright idea. Meed Ward was the chair of the committee reviewing budget submissions which means when she has a question she turns the gavel over to her vice chair Paul Sharman who behaved like an enforcer on a hockey team and appeared to feel his job was to keep the puck away from Meed Ward and if she did get her hands on the thing – then his job was to knock her down. It was particularly deplorable behaviour during which there was precious little respect shown. We have seen this kind of behaviour from Councillor Sharman in the past.

With the gavel in his hands Sharman challenged her right to bring a new matter to the committee meeting. The Clerk ruled that Meed Ward could bring a new matter and given that transit was being discussed and her matter was related to transit she wanted to proceed.

What became clear during the discussion about the John Street terminal is the difficulty the city is having with just what it wants to do, will have to do and can afford in terms of public transit.

The transit advocates maintain that the city had not made it perfectly clear that transit was part of the Master Transportation Plan the city is currently reviewing.

General Manager Scott Stewart put that dog to rest when he made it perfectly clear that transit is a vital part of the transportation thinking.

Doug Brown, chair of Bfast – Burlington’s friends and supporters of transit, can read a bus schedule better than most bookies can read the Racing Guide. He meets with Susan Lewis a transit user. Doug Brown Bfast chair said he has been asking if transit was being considered within the Transportation Master Plan and hadn’t been given an answer. Last November Brown sent the following questions to everyone he felt was involved. He says he has yet to get an answer. Bfast wants to know:

1) Will the Transportation Master Plan (TMP) develop a comprehensive long-term transit plan, including funding, to guide the growth of a robust transit system?

2) Will the TMP fully analyze and assess all opportunities to minimize road and intersection widenings and the construction of additional parking facilities through investments in transit, active transportation, and Transportation Demand Management?

3) Will the TMP be evaluated against criteria demonstrating that implementation of the TMP will:

a) meet the City’s own planning objectives (ROPA38 requirement to increase local transit to 11% modal split from current 2%);

b) meet the objectives of the City’s Strategic Plan (walkable, liveable, inclusive communities; GHG reduction targets)

c) will be environmentally and economically sustainable by determining all costs and benefits of proposed transportation options

4) Will the TMP look at successful measures in other cities (i.e. Portland, Ottawa, Victoria) to increase transit and active transportation modes.

Meed Ward read these out at the budget meeting. Stewart said he wasn’t aware of the questions; Meed Ward said she would send them to him.

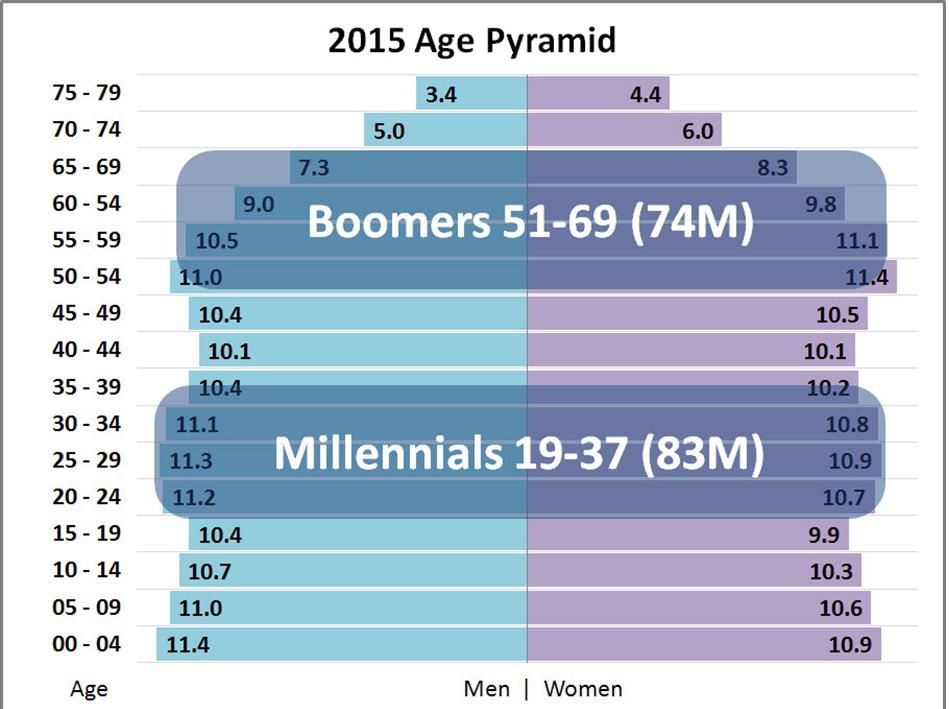

The discussion around what the transit issue really is was instructive. Burlington is expected to increase the transit part of its modal split (that is the number of people who use different forms of transportation) from 2% to 11% by 2031 and that can only happen if transit ridership increases by 10% each year.

Blend into that the fact that transit ridership was lower in 2013 than it was in 2012.

City manager Jeff Fielding points out that our population is only going to grow by 1900 a year for the next ten years and then asks: “Do you really think you are going to get a modal shift from 2% up to 11% in the next 20 years. I can’t see it, I really can’t see it and I’m a big transit supporter. There may be some other approaches we need to look at.”

Councillor Taylor was just as direct. He said we are not going to get new people to take transit. If transit is to grow it will have to come from the existing population – and that is going to mean changing our communities and intensifying. The one way you can change transit said Taylor is to make it more convenient for the users.

Councillor Sharman was both direct and blunt. Burlington is a great city and a place where wealthy people want to live. Wealthy people have cars. No one moves to Burlington to get around using transit. Councillor Sharman was both direct and blunt. Burlington is a great city and a place where wealthy people want to live. Wealthy people have cars. No one moves to Burlington to get around using transit.

Those views sum up the predicament and the challenge that transit faces.

That brought Meed Ward back into the conversation with a question for staff: “Can they tell us with some specificity how transit will be handled within the Transportation Master Plan?” Stewart was able to oblige her. Transit will be part of the Transportation Master Plan discussions but there will not be a transit business case coming out of the TMP.

Stewart undertook to get answers to the Bfast questions; when, asked Meed Ward. Not in March, that’s for sure responded Stewart; probably in April or May.

Transit is due to produce their first report card on how the service is doing in June. Add to that the news that transit is currently working with the providers of a technology that will give the transit managers real-time data on who gets on and off a bus and exactly where this happens; data Burlington Transit says is vital if they are to effectively allocate the resources they have.

As the discussion was coming to a close Sharman, filling in as chair of the meeting, asked Meed Ward if she had a motion. No, she replied and I now want to withdraw the motion I might have had. She had made her point – transit was now very much on the table and a part of an upcoming agenda.

Viewpoints that were not known before were now public.

The city does have a transit advisory committee – problem with that committee is that it can’t manage to meet which increases Stewart’s frustration level.

Susan Lewis a consistent transit user, she doesn’t drive, was asked to join the Transit Advisory committee and headed downtown in January for a meeting. When she got to city hall she and one other person were the only people in the room; the meeting had been cancelled and not everyone was told. Susan Lewis a consistent transit user, she doesn’t drive, was asked to join the Transit Advisory committee and headed downtown in January for a meeting. When she got to city hall she and one other person were the only people in the room; the meeting had been cancelled and not everyone was told.

Mayor Goldring and Councillor Meed Ward want clarity, the transit advocates want a clear policy commitment and better funding. The city manager doesn’t want to provide that money because he doesn’t see value in it and the bulk of this council don’t have a lot of time for transit. They spent more time talking about the removal of snow.

There is one sliver of hope. The city manager is a transit supporter and he would very much like to have some bold ideas to work with. The Bfast people, who can be a bit pedantic at times, do know what moving people around on public transit is all about.

If Stewart does manage to get all the players in the room he just might find that the Bfast people have a lot to offer; he just has to manage the frustration that overcomes him on occasion. He might think in terms of making Bfast the transit advisory committee. It couldn’t be any worse than what he has now – and the transit staff would be well served to listen carefully to these people. More respect for each other would go a long way as well.

The discussion really wasn’t a budget issue; Meed Ward was pushing the rules, but she brought to the table a discussion that has been needed for some time. Councillors Lancaster and Dennison had nothing to say; it will be a long time before you see either of them on a bus.

Back to those mobility hubs and the John Street terminal. The hubs and hinged to the GO stations which makes sense – the downtown hub was the location that council wasn’t as certain about. Back to those mobility hubs and the John Street terminal. The hubs and hinged to the GO stations which makes sense – the downtown hub was the location that council wasn’t as certain about.

One of the “big picture” tasks the city is working on is opportunities to develop the north end of John Street where the city owns a parking lot that abuts the plaza at the top of John Street.

Medica One or the Carriage Gate project – pick the name you like best – will go up at the top of John Street and consist of a medical offices building, an above ground garage and an apartment/condo complex. It will bring significant change to the intersection and drive redevelopment of the plaza to the immediate north, A transit hub a couple of blocks to the south then makes a lot of sense. The Carriage Gate group is expected to break ground soon on its medical building, parking garage and apartment/condo tower which will make the Caroline and John Street part of town a busier place.

Parking lot # 3 at the top of John Street just south of the shopping plaza is being given a very close look for redevelopment. The Carriage Gate development will draw people to the area creating a John Street that could undergo significant development. There might be life in the downtown core yet. Some of the city thinking has the plaza at the top of John Street being given a massive make over and that portion of John Street north of Caroline a cleanup – it looks more like a laneway right now. All this thinking will impact what happens at the south end of John, where just blocks away the Delta Hotel and the Bridgewater condominiums are about to see some real construction activity.

A John Street mobility hub then would be a critical part of any makeover of this part of town which is all very much a project that is in the thinking through the ramifications stage.

The Mayor wants to stay with this one; get in front of it and lead the parade.

By Pepper Parr By Pepper Parr

March 5, 2014

BURLINGTON, ON.

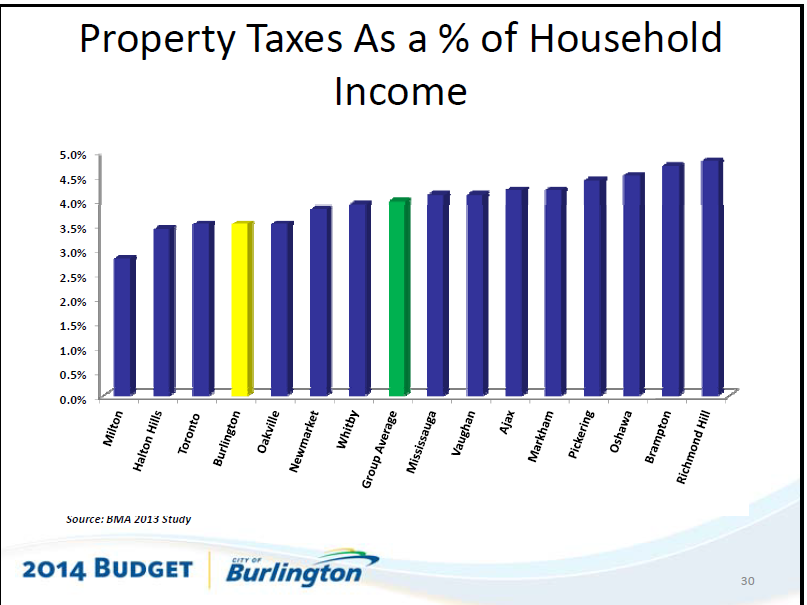

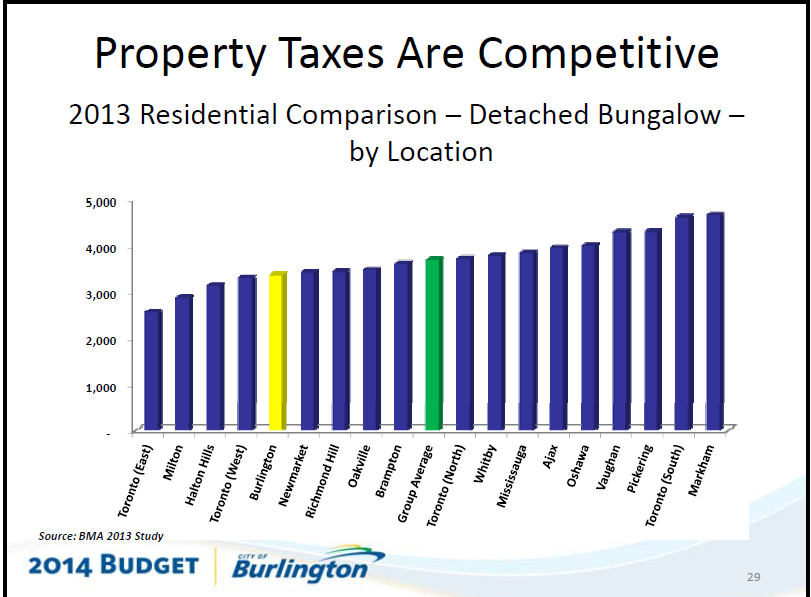

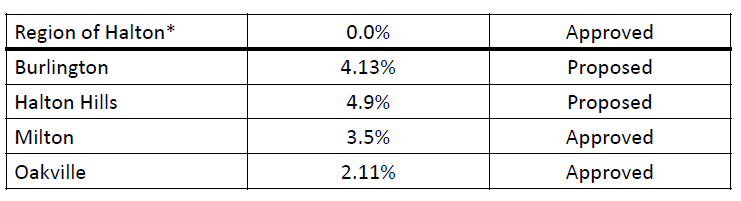

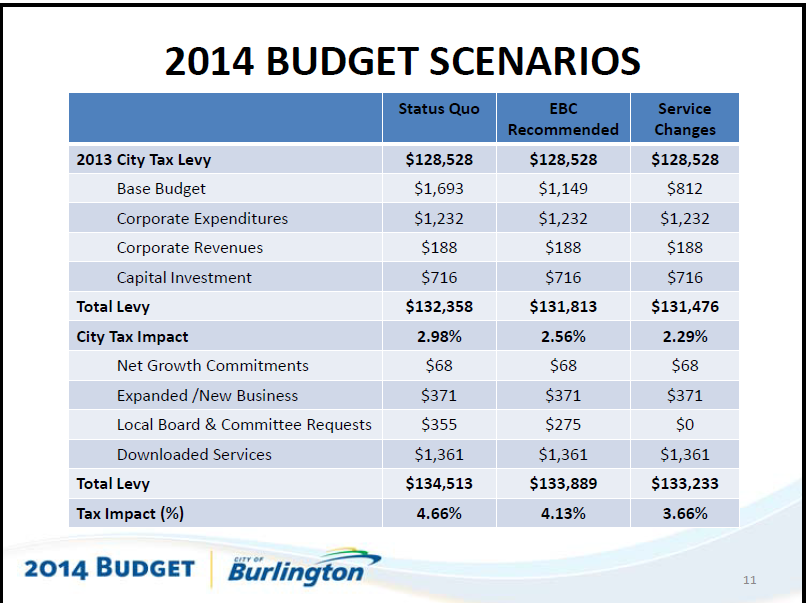

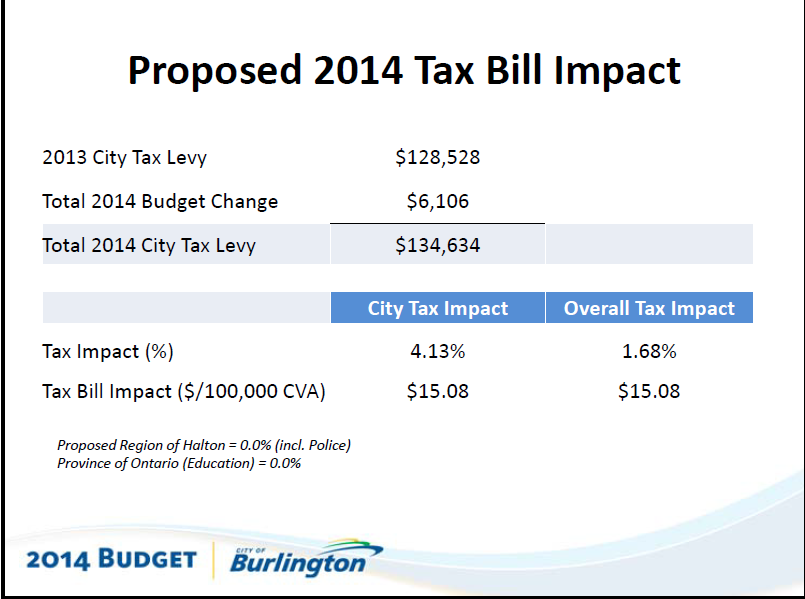

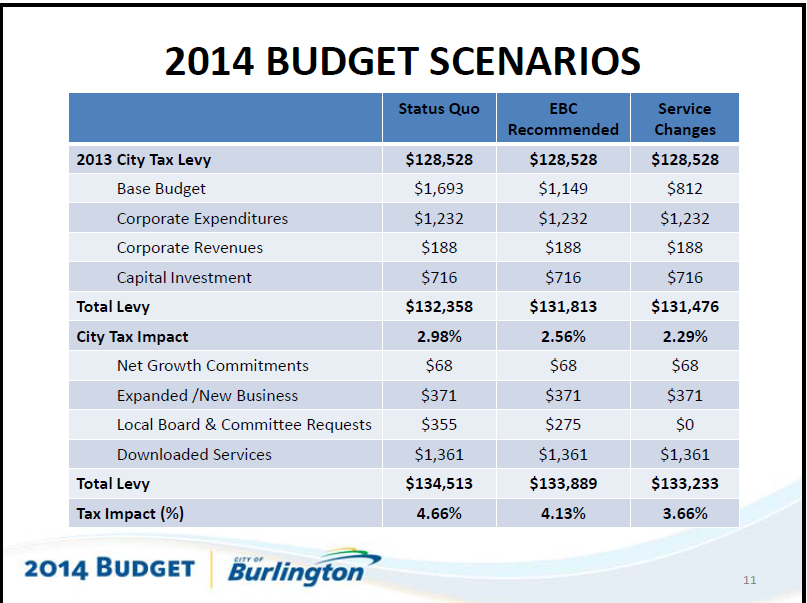

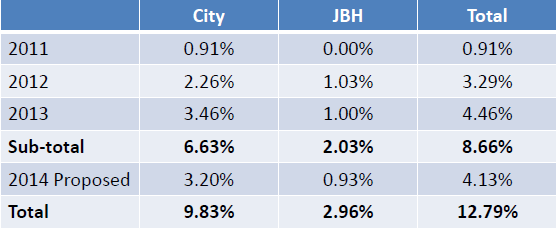

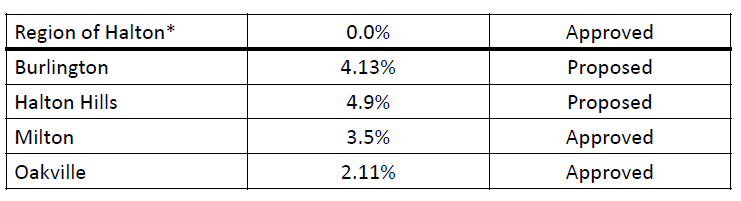

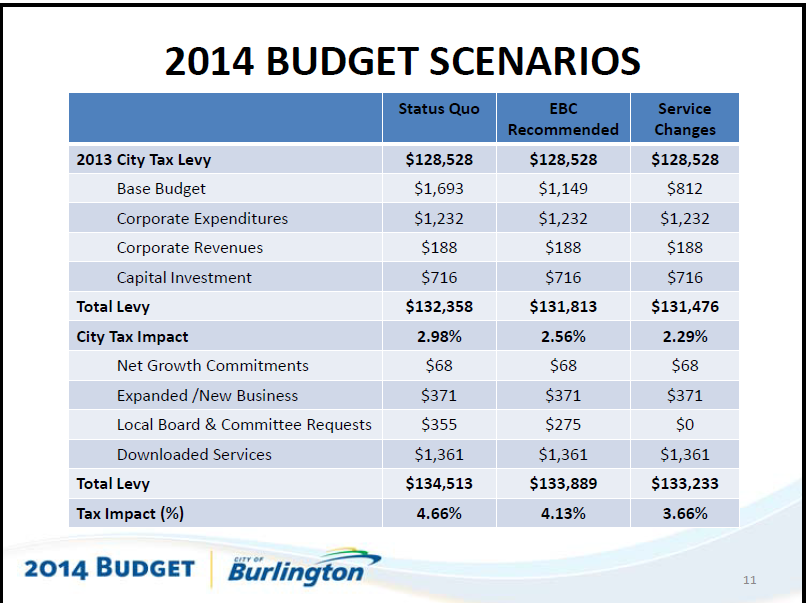

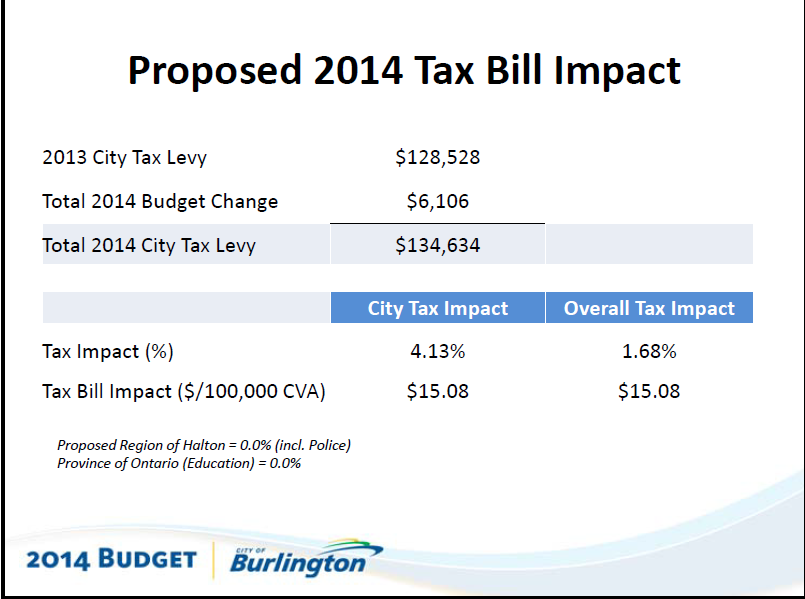

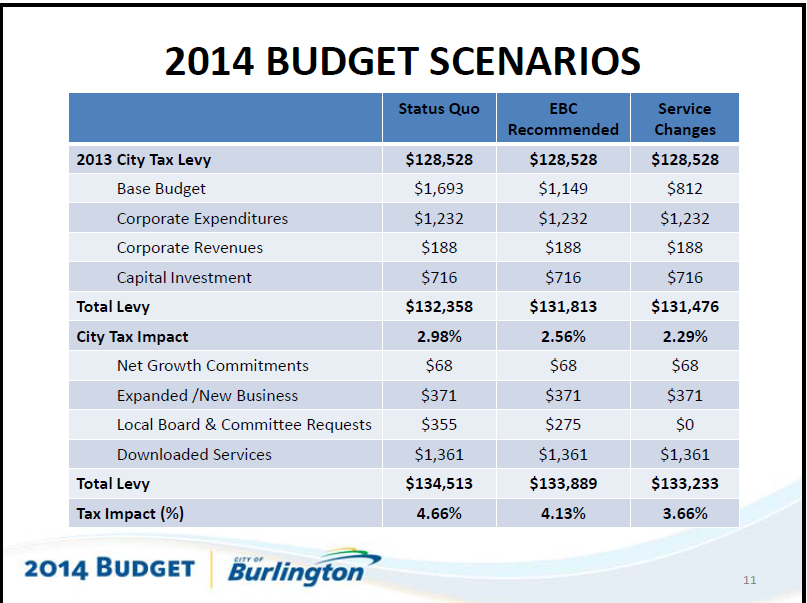

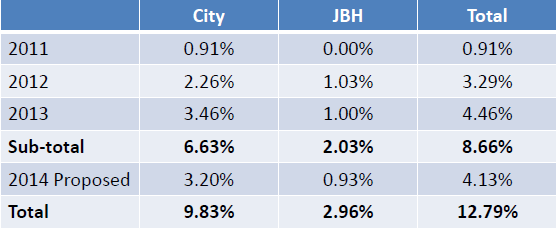

What started out as an ask of $134,513,000 as a total tax levy, which called for a tax increase of 4.66%, got pared down to $133,889,000 which would have meant a tax increase of 4.13% finally came in at $133,816,211 and a tax increase of 3.5% which works out to $12.78 for each $100,000 of residential urban assessment – it took close to two months to whittle that number back.

The number represents an increase of 3.5% which over the term of this council totals 10.13% over the four-year term – slightly higher than the 10% the Mayor went on record with. Expect to hear that point made regularly by this council during the election we will have in October. The number represents an increase of 3.5% which over the term of this council totals 10.13% over the four-year term – slightly higher than the 10% the Mayor went on record with. Expect to hear that point made regularly by this council during the election we will have in October.

Budgets however are a lot more than just numbers; the deliberations that get a council to their total are an honest look at the values these seven people bring to the job they do. At times the view was exceptional but all too often it was disappointing, limited and showed a timidness and an inability to come up with the bold yet creative ideas that would both grow the city financially and at the same time maintain the quality of life people who live here expect.

The hope for Burlington was seen at a Committee of the Whole Meeting that took place while Council was going through the budget deliberations.

In its media release the city included all the pat on the back stuff – and staff did do a fine job of making all the parts come together – but this was not a great budget. It was adequate.

There were more than a dozen citizen delegations – it is hard to identify those that were listened to with the exception that the city manager did promise he would come back to the arts and culture community no later than June and let them know if he has been able to find a full time equivalent to use as the spot for a cultural manager. That spark of creativity didn’t come from anyone on this council.

Highlights that the city points to include:

One-time funding of $86,000 for Community Development Halton for social programming, including North BurLINKton and the Chill Zone

$115,000 one-time and $25,000 ongoing funding for an extra round of loose leaf collection in areas north of the QEW

$643,000 toward infrastructure renewal.

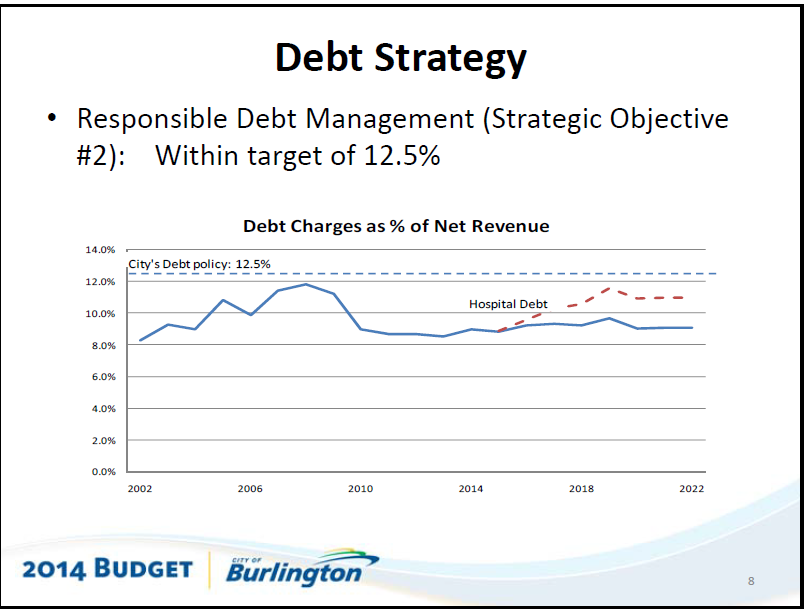

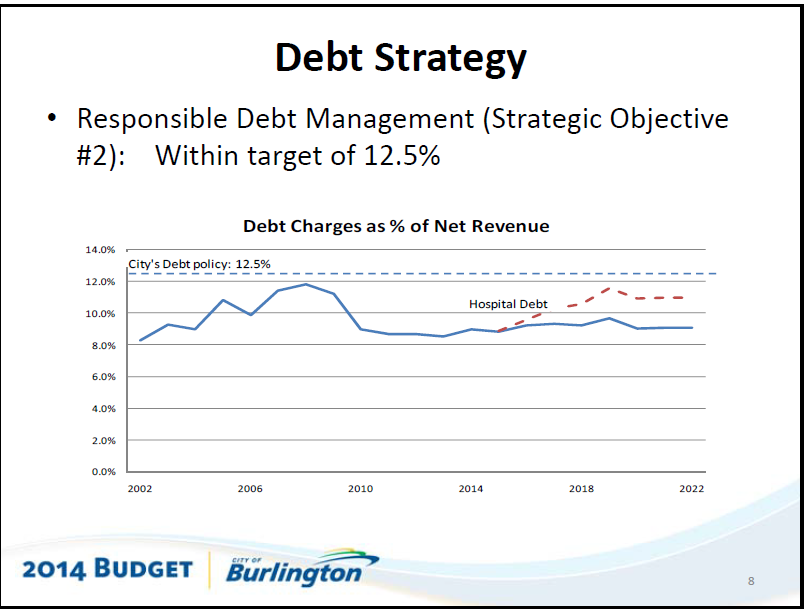

Back in 2010 the city was told they had to come up with $60 million as its share of the redevelopment price for the Joseph Brant Hospital. That amount has been paid out during the past year with the levy rising each year to what will be a $1.2 million increase this year which brings what we are setting aside this year to $4.8 million. That levy by the way is not likely to ever disappear – once they have their hand in your pocket they will find a way to keep it there.

This year there was very little, if any, mention of “shave and pave” that process we use to keep the cost of maintaining our roads manageable. This year there was very little, if any, mention of “shave and pave” that process we use to keep the cost of maintaining our roads manageable.

The budget this paid much more attention to culture than it did to the state of the roads; an exceptionally heavy winter resulted in a lot of discussion about what we want to do about snow removal.

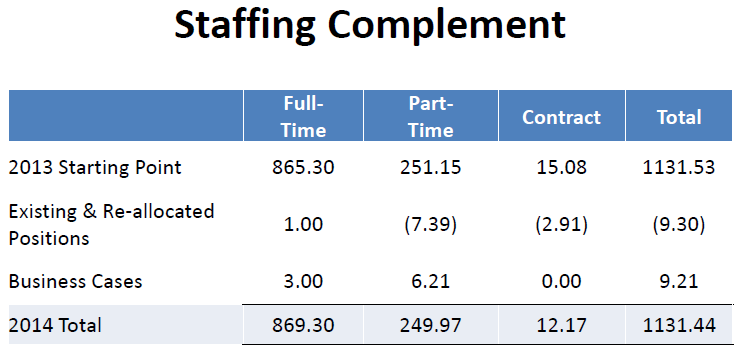

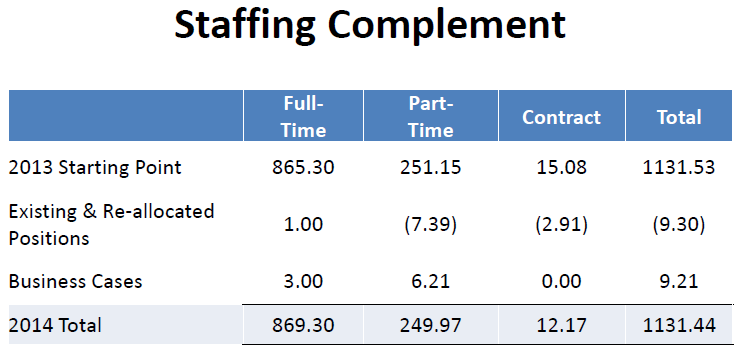

The size of the staff compliment was always on the table. No new hires but a lot of re-evaluating positions and redeveloping the job done. We learned during the budget deliberations there was going to be a total workforce review to determine what the city has and what it needs in terms of a workforce and how to use what it has to get what we need done.

By Pepper Parr By Pepper Parr

March 3, 2014

BURLINGTON, ON.

She is serious. Ward 2 Councillor Marianne Meed Ward is moving with some dispatch on her desire to see the city show the free parking staff get as a taxable benefit.

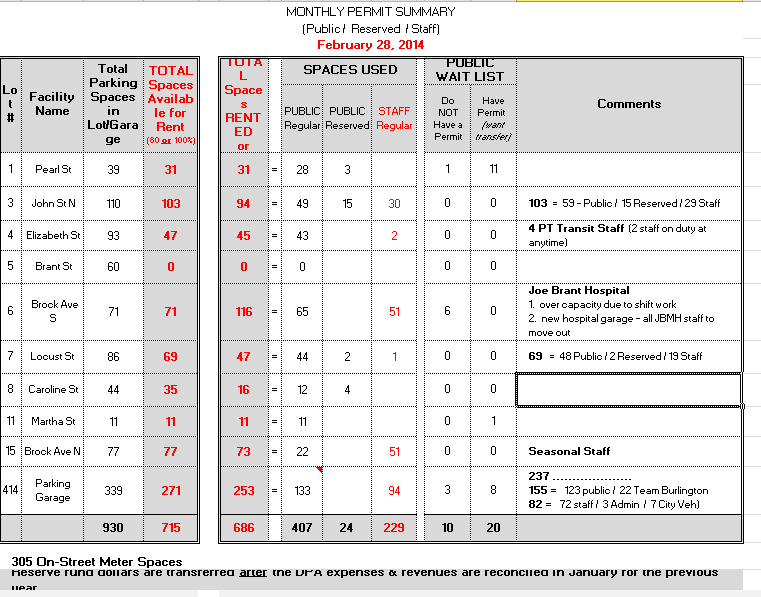

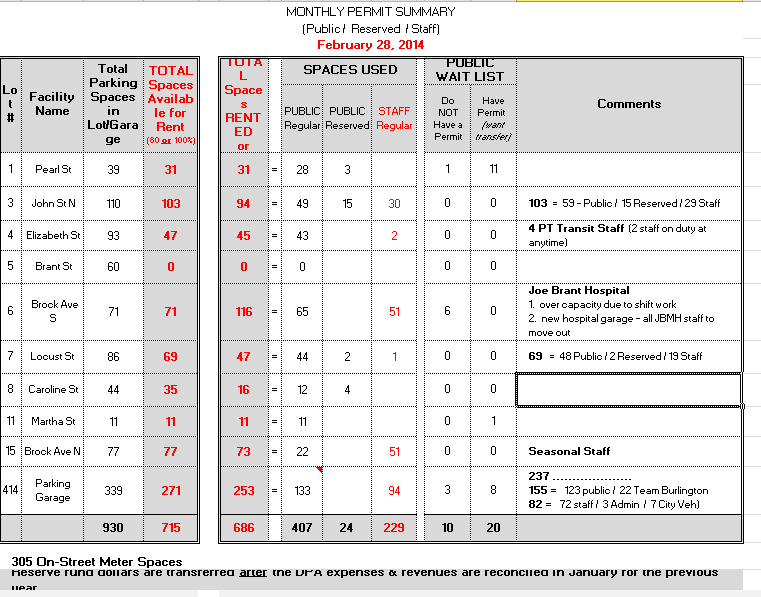

Lot of staff in the Locust Street lot. Covered space is a prime perk – Council member wants to tax it. In a note to her colleagues she said: Upon further discussion with staff, staff have advised that employee parking in the downtown has been provided on a scramble basis which is open to interpretation. Therefore, Council has the option to direct staff to review and address in 2014 employee parking with respect to the taxable benefit status, specifically for union and non-unionized city employees, downtown local board employees and members of Council including implementation issues such as notification requirements, options and, other related impacts.

Meed Ward created a data sheet for her council colleagues pointing out WHAT All of these details could be outlined in an implementation plan staff would bring back to council. Thus the wording of the motion for tomorrow’s meeting, to keep it simple, is as follows:

“Direct staff report back on an implementation plan in 2014 for employee parking as a taxable benefit.”

Now we get to see just how the other six members of council treat this matter. Teachers get free parking – we don’t know yet if this is treated as a taxable benefit. The legislation certainly suggest it should be treated as such.

In her note to her colleagues Meed Ward brings up the issue of “parking on a scramble basis” which is when the first person to get to a space can take it. And as long as there are spaces available – a person can park. When spaces are not available – they are out of luck.

Expect to see considerable discussion around that issue.

If the city manager were smart – and he is – he should just fold on this one and thank Meed Ward for her contribution and advise that the city will resolve this issue quickly – in favour of the tax payers.

Ward 2 Councillor Meed Ward is looking at the financial side of the city much more these days. As chair of the Community and Corporate Services committee she shepherds the budget review through the Standing Committee and has brought a much more feisty approach to that process. For those that watch the goings on at city hall – it would be easy to get the impression that Meed Ward just might be positioning herself for a move. She has yet to file nomination papers as a candidate in ward 2 – but then that applies to everyone else on Council except for the Mayor who filed early in January.

Meed Ward brought up the matter of free staff parking and said she thught it should be debated during the budget cycle. This Council hopes to make the budget final on Tuesday – this issue puts a fly in that ointment.

Background links:

Is Meed Ward looking at her chess board and plotting her next move?

Meed Ward suggests free staff parking is taxable.

By Pepper Parr By Pepper Parr

February 22, 2014

BURLINGTON, ON.

There will be a heritage planner – a full time heritage planner but getting the position secured was easier said than done.

The question in front of city council as they worked their way through the budget was: how much did they want to spend on a heritage PLANNER – $206,000 or $103,000.

The city already has a heritage planner who spends half of her time on heritage matters and the rest of her time on other planning work; she is swamped. She gives the city far more time than she gets paid for and has done a lot of superb work.

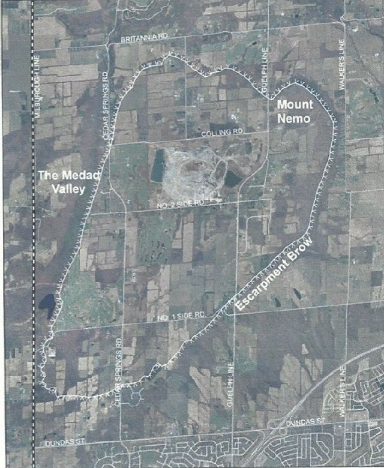

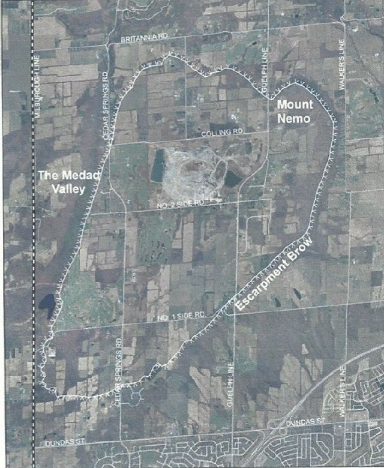

Heritage has become a sort of favourite flavour of the moth in this city. The Heritage Advisory Committee is much more active – at times they think they need a full time planner. When the decision was made to go forward with the idea of a Conservation Heritage District for the Mt Nemo Plateau the work of the heritage planner suddenly got much bigger.

The question then was – how much staff resource are needed? For some reason council wanted to get right into the weeds on this one. They first talked in glowing terms about the job the current heritage planner has been doing and then began to map out her career for the next ten years until they were told that wasn’t council’s job.

It was about 15 months ago that rural Burlington began the discusion about what it wanted to be. Some things were clear – others not as clear. The early draft of a vision got put on a huge board and for the most part the community liked the look of what they had said to each other. Council had gotten into the weeds on this one the way they do far too often. For a bit it looked like they were going to start running the department. Should the current planner become full time on heritage? a full time role and contract someone for an additional half day; no that’s not good use of human resources. OK look for someone within the department and have them pick up the development work the planner was doing – the rationale for that view was that development is off so there must be bodies in planning with nothing better to do.

General manager Scott Stewart who signs off on everything that comes out of planning, struggled to get a grip on all the ideas flying around when the city manager pipes up with his position: it isn’t pretty.

“You don’t Jenna, she does; she decides what she wants to do. You have asked us to manage – then let us manage; that is not your job; this is not the type of discussion we should be having; you have me here to tell you things like this.”

A heritage planner was critical if a Conservation Heritage District bylaw was ever to get passed. First part of that effort got through a Standing Committee. The proposal to think about turning the Mt. Nemo Plateau into a Conservation Heritage District which is just at the information gathering stage will require a lot more of a planner’s time. That file has the potential to become a lot messier than it would at first appear – when individual land issues are on the table get ready for noisy meetings.

Councillor Taylor is a big advocate on for making the plateau a conservation district – he wanted the planning resources available.

While council was digesting that blast from the city manager, Scott Stewart the general manager invited the Director of planning to “take it outside” where they worked out the possible time/task splits

The proposal was to have 1.5 heritage planners – then it looked like they were looking at two planners. Then there was a tussle over what this planner would be doing. The issue was where the planner was going to come from and the amount of work that was going to get created by the Mt. Nemo Conservation District task that is now on the table – or look as if it is going to be on the table.

A motion to hire more people failed, the amended motion to make the existing half time planner into a full-time position and distribute other work she was doing within the existing staff compliment passed 6-1 with Taylor voting against the decision made. He wanted more in the way of human resources than his colleagues were prepared to pay for.

Residents look at a large map of their community during a Rural Summit more than a year ago. That meeting was the genesis of making the Mt Nemo Plateau a Conservation Heritage District. Some members of council wanted to know why staff just didn’t do the staff allocation. It was a new position – they were moving from a half time heritage planner to a full-time heritage planner and that was a decision council had to make, explained director of finance Joan Ford. What Ford was trying to say in a polite way was that council had to decide on the expenditure – staff would then decide who should be doing the job.

Councillor Meed Ward said she had “difficulty with the process that got us here”.

Was the spend going to be $103,000 or was it going to be $206,000 and would the new position be added to the base staff compliment or would they go outside and contract with someone, or would they look within the planning department and find someone who wasn’t all that busy.

Councillor Lancaster thought the city was moving too quickly on this file. Her view was that council needed to be more reflective and to take some time. But that wasn’t the view that Councillor Taylor brought to the horseshoe. The Conservation District would be in his ward and he is fully aware as to just how powerful the people in North Burlington can be. They were the folk that hung in and fought the Nelson Aggregate quarry expansion. Those people know how to dig in and for them a Conservation District would solve a lot of their concerns or they think it will.

It took $2 million out of the legal department’s budget to pay for the tear long tribunal that decided the Jefferson Salamander was important and that an expansion of the existing quarry should not be permitted. It was rural Burlington residents who were the force behind that battle – they were not to be trifled with. The expansion to the quarry was going to be in the lower part of this topographical map Councillor Dennison said that “we didn’t ask for this, we don’t need to get all gung-ho about it. He wasn’t all that keen on the “foremost specialist the city hired to do the first cut of the research presented at the January meeting. Get ready to see this as a file that becomes very contentious.

At the community event in January city planner Bruce Krushelnicki explained that a Heritage Conservation District was created through a bylaw passed by the city. No one else has any input on that bylaw he explained. The city can pass a bylaw to create something and they can revise that bylaw anytime they wish.

What the planning department has to do is do the research necessary to figure out how best to craft a bylaw that will stand up to scrutiny – and at the same time ensure that the community wants such a bylaw and understands the ramifications. There are both ramifications and consequences – some of them unintended.

Once e a bylaw is in place it tends to take on a life of its own – which is what the rural life advocates want to see.

Making that happen requires a lot of hard work, a lot of research and a lot of public opinion massaging.

The first battle was to get the planner in place so that some of the early research work could get done.

There will be a planner, working full-time on heritage matters. The planning department will figure out a way to reallocate day-to-day work in the department.

Our significant seven weren’t seen at their best on this issue and they needed the sharp rebuke from the city manager to remind then what they were supposed to be doing.

At times one wonders how we manage to stay out of serious trouble.

Background links:

Rural Burlington figures out what it wants to be.

By Pepper Parr By Pepper Parr

February 22, 2014

BURLINGTON, ON.

When they brought things to a closer on Thursday we had a CURRENT budget of $134,339,651 agreed upon at the Standing Committee and a tax increase of 3.9%. Staff had asked for a tax increase of 4.3%

Council may whittle down the staff budget request when they resume budget deliberations early in March. At that time they get to decide what they want to do with the $2.7 million surplus – money not spent in 2013. The finance staff call these “retained savings”.

Photoshopping at its very best – the Significant Seven have never got along as much as this photograph would suggest. Several of then can’t stand one another. Mayor has said he would be quite happy to see them all re-elected. What has council done so far? The Cultural Manager was off the table, the Museums of Burlington got the contract person onto the staff roster. The Economic development people got their money but there were some strings attached.

An assistant supervisor for school crossing guards wasn’t approved but the Heritage Burlington property tax rebate did get the green light it was looking for. The Performing Arts Centre is going to get a closer look.

Bus cleaners were going to get $65,000 a year but they would be doing other work as well

Community Development Halton did get the $85,000 they were seeking (they got the same amount last year) but Councillor Taylor had to promise that he would not be asking for the same amount of money next year.

Of the 47 items that council members wanted to discuss – less than 20 got covered – so there is quite a lot of ground to cover.

On Monday the 24th, Council meets as the Development and Infrastructure committee.

Tuesday they meet as the Community and Corporate Services committee.

Thursday they do a significant session as a Committee of the Whole and focus on just where we are with the Economic Development Corporation – which is, as one real estate professional in the city put it a “disastrous embarrassment”. The economic development chicken has finally come home to roost.

The first week of March council meets on the 4th to complete the budget review and hopefully approve the document and set the tax rate for 2014.

For some reason the budget agendas this year have had the feel of a bit of a hustle to them. Usually a Standing Committee meets and recommends a budget, the public gets a few days to read, review and reflect on the document and if there are serious concerns people can delegate at the Council meeting that will approve the budget.

This year the Standing Committee will turn itself into a Council meeting and pass the budget on the spot. We don’t see much community engagement in that process. For Councillors who are up for re-election one would think they would be a little more solicitous and ensure the public gets a chance to voice their opinions. Guess you are all going to have to wait to make your opinion known on election day – October 27th.

By Pepper Parr By Pepper Parr

February 21, 2014

BURLINGTON, ON.

There isn’t going to be a Cultural Manager in Burlington during 2014 – perhaps in 2015, but a Standing Committee just didn’t see a compelling case for hiring a new person for a job that wasn’t as clearly defined as it could have been.

The arts and culture community brought its existence to the surface – the city learned a lot more about who they were, what they are and what they do. Their lobbying efforts blew hot and cold. They certainly pulled the Mayor into their circle – but that wasn’t enough.

Staff, particularly general manager Kim Phillips, who is the lead on culture in the city, didn’t do all that much to support the creation of the position.

Council seemed to feel that a full-time cultural planner was enough for now and would revisit the needs of the cultural community next year.

What was nascent and budding – has been stunted at the administration level. It is going to be up to the artists to create whatever structure is needed. What the city will see is various initiatives – and there is some very solid work being done by individual artists, but people who are not always the best at administrative stuff aren’t going to be able to market and move the idea that Burlington is a legitimate cultural centre forward very much. What was nascent and budding – has been stunted at the administration level. It is going to be up to the artists to create whatever structure is needed. What the city will see is various initiatives – and there is some very solid work being done by individual artists, but people who are not always the best at administrative stuff aren’t going to be able to market and move the idea that Burlington is a legitimate cultural centre forward very much.

There is some hope but it doesn’t exist at council nor at the senior staff level.

The unveiling of the Spiral Stella outside the Performing Arts Centre on a bright summer day was thought to be the beginning of a breakthrough point for the arts and cultural community. Hasn’t worked out that way, yet – but art perseveres – their day will come. Discussion on this item that was on the books for $128,000 + a one time set up cost of $8,320 started with Councillor Lancaster saying she was not on for this one – mostly because she didn’t think there was all that much to manage –and on that point she was right. The arts community saw this as a person who would do some ground breaking and seed planting.

Mayor Goldring followed Lancaster saying he would not support the expense – at least not this year. Councillor Sharman said he was where the Mayor is – not at this time.

Councillor Craven wanted to know what the impact would be without a Cultural Manager – he seemed to think that with the cultural planner in place whatever had to be done would get done.

General manager Phillips conceded that the Cultural Action Plan that Council has approved will certainly proceed much slower. She added that there is some cultural mapping being done –people are adding data on who they are and what they do to the web site.

Councillors Taylor and Dennison took a pass – made no comment.

The city’s cultural planner is all the arts community has at this point. There is some cultural mapping being done – which is useful in itself but won’t do all that much to build the tremendous potential culture has in this city. Angela Papariza will use her well-developed culture background and training to work with people like Trevor Copp – not likely to see much more in 2014. For Councillor Meed Ward – it was also a “not now – re-evaluate later” an odd decision given that much of the cultural activity is in the downtown core which is her bailiwick. Meed Ward could see where this was going.

The question now is – what is the cultural planner going to do? The current occupant of the position certainly has cred within the arts and culture community but Burlington has had good people working the culture file in the past – and they have all moved on.

The hope for many was that with the surprising energy that was seen within the arts and culture community (it was always there – just not seen or appreciated) the time had come to get serious and develop the opportunity.

The Arts and Cultural Collective did as much as they could – and then some. Trevor Copp sent out a last-minute plea to the Collective membership: “Without this position, Arts & Cultural Grants, an outside Arts body, use of space and bylaw reviews in our favour is seriously jeopardized. All our work may go up in smoke. Let them know how you feel please”.

What happens next will depend on the kind of energy and leadership that comes from the general manager handling this file. Don’t get your hopes up.

Background links:

Turns out the art community didn’t get anything from the cookie jar.

By Pepper Parr By Pepper Parr

February 20, 2014

BURLINGTON, ON

Doug Brown knows more about what Burlington hasn’t managed to do with its transit service than anyone else in the city. He has personal files that cover more than 25 years of transit history. He brings a strong personal commitment to public transit and can tell you how difficult it is to get about not only the city but the Region if you rely on public transit.

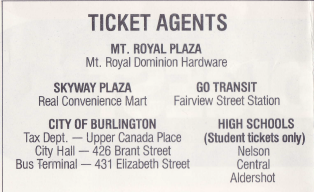

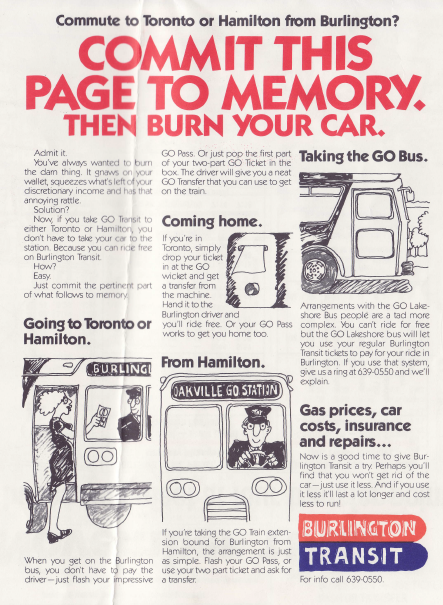

Doug Brown and Susan Lewis look over a 1982 copy of the city’s bus schedule.  They called the bus schedule the Digest in 1982 – a time when Burlington had 18 bus routes and a schedule that fit on one large piece of paper. The current bus schedule is 28 pages long – many of the bus drivers don’t understand the thing. We met with Doug Brown and Susan Lewis to talk about the delegations each of them had made to the Community and Corporate Services Committee Brown brought along a copy of the 1982 transit schedule – which at that time was called the Burlington Digest

Last year Brown and a group known as Bfast , Burlington for Accessible Sustainable Transit, made presentations to the Standing Committee that was reviewing the budget for 2013. In their presentations, they presented what they believed was clear evidence that Burlington had continually underfunded transit. They presented the findings of consultants reports, and compared Burlington’s capital and current transit budgets against peer communities (the same communities used in the City’s budget report to compare tax rates). Bfast had hoped the City would carefully weigh the facts and either make some adjustments to the transit budget, or explain to them why they should not be influenced by the facts. To the dismay and disappointment of the Bfast people Committee members had no questions for the delegation, and adopted none of the recommendations.

Bfast hoped the committee reviewing the budget for 2014 would follow the guidelines in the recently adopted Engagement Charter and give citizens meaningful involvement in the budget process. We expect Council and staff to “walk the talk”.

Bfast was of the view that 2013 witnessed a step backwards for transit in Burlington. Despite some restoration of operating funds in the operating budget, there were many route changes which riders found confusing, resulting in reduced service on some routes. Also, the 8.4% fare increase, which was not supported by any analysis or staff report, resulted in Burlington Transit riders paying fares even higher than Toronto’s TTC. Transit users were not consulted about any of these changes. The net result is widespread dissatisfaction with Burlington Transit and a loss of riders from both actions.

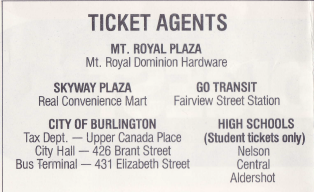

In 1982 there were a number of ticket agents throughout the city. Today there is one bus terminal which the transit people want to close; the public would have to troop over to city hall to buy a ticket. City hall closes at 4:30 pm – never opened on weekends. The 2014 budget does not increase the City’s investment in its transit system. The fulfillment of Burlington’s Official Plan and Strategic Plan require significant additional investment in transit. ROPA (Regional Official Plan Amendments) 38 requires that the transit modal share go from its current 2% to 11% by 2031. This will require an average annual increase in ridership of 10%.

The growth of transit in Burlington requires a long-term plan and funding commitment. The ongoing Transportation Master Plan is an opportunity to develop a long-term transit plan, however, we have been advised by Transportation Department staff that the Transportation Master Plan will not do this. Since the termination of the Transit Master Plan in January 2012, the City has lacked any long-term transit plan.

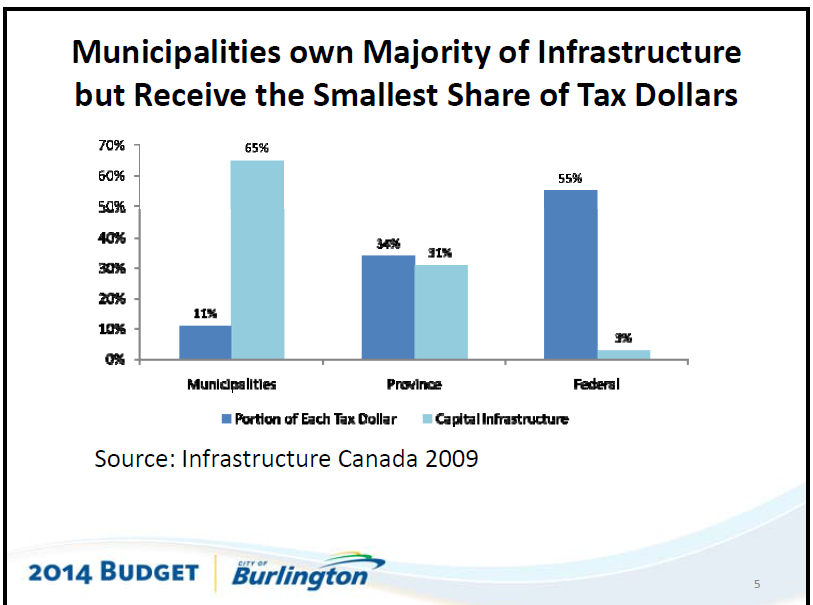

The budget according to Bfast, continues to treat transit in isolation to the other parts of the City’s transportation system (roads, parking, and active transportation). The majority of the capital budget is for roads, (increasing in 2014 to 54% from 51% in 2013), while transit’s small share of the capital and current budgets does not even get shown in the budget pie-charts.

During the 2013 budget deliberations Bfast we recommended the City look at traffic demand management (TDM) as a means of reducing the very costly widening of roads and intersections in the 10 year capital budget. In the case of the Appleby/Harvester EA, we have been told by the project engineer that TDM was not being looked at or considered.

There are some budget items that reflect the City’s low priority for its transit system.

We note that the funds approved in the 2013 capital budget for transit priority measures ($100,000 for 2014) have been quietly removed from the 2014 budget. Transit priority measures should be part of the Transportation Master Plan and the current Appleby/Harvester intersection plan, as such measures will reduce the car traffic and forego the need for expensive road widening.

Bus Cleaning: It is not clear what is being proposed or if more or less money is required. Bfast fears that that the City may be considering a lower standard of cleaning for the buses. This would be unfair to both drivers and passengers, and sends a wrong message to current and potential transit users. However, Bfast does support the proposal to have the cleaning done by city staff rather than by external contract provided bus cleaning is not compromised.

There was a time when the car did not rule and the transit department saw bus service as something that was vital. The marketing people certainly took a different approach. Imagine something like this coming out of the transit department today? Back-end loading of transit in 10-year capital budget. Bfast points out that 75% of bus purchase expenditures occur in 2018-2023 and only 25% occur in 2014-2017. Similarly, a large proportion of bus stop location upgrades and bus shelter expenditures occur in 2018-2023.

To be fair, the city has said it will be doing a total revision of the current capital budget –so anything in that budget beyond this year has to be seen as something that will be getting a very close look. Bfast might want to begin developing its own long term capital plan and prepare to take that to the city.

It appears that the City is planning to close the Downtown Terminal on John Street which Bfast describes an important place of shelter, information, tickets, and washrooms for passengers and drivers. While not a major budget item, the Downtown Terminal is very important to transit users and for the development of a walkable, liveable downtown. Ward 2 councillor Marianne Meed Ward has said she will be speaking very strongly for the retention of the John Street terminal.

Bfast argues that city council has not yet seen a detailed business case for the closing of the terminal downtown and more significantly, neither the general public nor transit users have yet seen a business case for the closing of the terminal. Bfast adds to that the Official Plan process that is holding meetings on potential mobility hubs with the downtown as one of four such mobility hubs. One of the fundamental parts of a mobility hub as defined by the City’s Official Plan process and Metrolinx is that they contain a transit terminal. Further, the Master Transportation Plans is integrating all modes of transportation including transit and at this point we do not know how that plan will deal with transit and the downtown terminal.

If there was ever a place to locate a transit terminal – that would be John Street where the only terminal in the city is now located. Transit department is recommending it be removed and tickets sold at city hall. Ward 2 Councillor Marianne Meed Ward isn’t buying that business case Bfast suggests this Council is not in a position to determine whether a downtown transit terminal may indeed be a necessary part of an effective transit system that can grow and serve the public effectively in the long run. Any decision to close the downtown terminal now to obtain efficiencies which translate to only $16,000 annually might create long term problems and cost the City far more if the City then has to re-introduce a terminal in the downtown. Bfast is recommending that the future of the downtown terminal be deferred until the Council is more clear on the direction of the Mobility Hub concept re the downtown and the Master Transportation Plan ideas re transit in the downtown. Further, Council needs to direct staff to consult with transit users and the public regarding a possible closing of the terminal.

In their remarks to the committee hearing budget delegations Bfast points out that the 2014 capital budget does include a major investment ($3.4M) in street-scaping in the area of the Downtown Terminal. Surely, this is an opportunity to redevelop the present “kiosk” into a first-rate terminal facility.

There are parts of the transit portion of the budget that confuse Doug Brown, part of the Bfast committee. Referring to a part of the budget about Restoring Transit Services, Brown says “it is unclear exactly what is meant by the item, we haven’t seen the separate report referred to in the Budget document. It would be logical to assume that the Restore Transit Services item comes from the lost capital revenue from changing the federal gas tax funding from a 70-30 split to 80-20. ($500,000 for two years gives $1,000,000). This shouldn’t be regarded as an additional funding option since the funding is already there, just diverted to roads.

Bfast believes Burlington Transit needs to put money into new, (replacement and additional), buses, more shelters, real-time schedule information online and at bus stops, and, more marketing.

When Burlington created its first really relevant Strategic Plan it had no idea how readily the citizens would take to the document. There are very few delegations made that don’t refer to the document. Bfast puts a firm grip on the making Burlington “a walkable, liveable community”. Brown points out that this view has been reinforced by some thoughtful presentations at the bat the Mayor’s Inspire Series where Christopher Hume and Gil Penalosa spoke. Brown wants to see at least some of the ideas that were brought to the city adopted. If we aren’t going to pay any attention to the experts we bring to Burlington to talk to us – then why bother bringing them?, asks Brown.

Dan Burden, an urban planning expert, was engaged by the City to “set the tone” for the Transportation Master Plan. Burden recommended the City create narrower streets to create street life and make the streets safer and more useable by pedestrians and cyclists.

However, the 2014 Budget includes very large expenditures for widening the roads and intersections ($21M for Walkers Line & North Service road and $23M 10 yr. total for Harvester – Appleby to Guelph Line) while, transit, sidewalks, and safe cycling facilities have been underfunded.

Doug Brown, chair of Bfast, wants to see a bus schedule with routes that work for people and not the current bus route set up in place. It doesn’t work claims Brown. Susan Lewis, who does not drive looks on. There are places she just cannot get to in the city because transit doesn’t work – at least not for her. Brown makes a point that many make on the budget review process Burlington has in place. “Public input on the Budget has again come at the 11th hour, when large changes to the budget are not possible. We encourage the City to provide their citizens with a much earlier opportunity to help shape the budget in the future.”

Doug Brown is chair of Bfast. He brings degrees in science and engineering to the volunteer work he does. What boggles a lot of people is that Brown isn`t used by the city as a significant source of information and advice. Doug Brown was riding the bus in Burlington before the current Direct of Transit Mike Spicer even got to this city.

The city has an asset it needs to consider leveraging.

There is a lot more to be written about transit and how people like Susan Lewis get around in the city. Let’s see what city council decides to do with the current transit budget.

By Pepper Parr By Pepper Parr

February 19, 2014

BURLINGTON, ON.

You can`t fault Councillor Jack Dennison for trying – and try he does. During a Standing Committee last week when discussions on the capital projects the city will take on in 2014 as they spend the $67 million plus that council is expected to approve Tuesday evening, Dennison felt there were opportunities that were being missed and wanted the city to consider selling the Tyandaga Golf course property.

Ward 4 Councillor Jack Dennison always has an eye open for an economic opportunity – sees a great one for the city: sell the golf course. “This isn’t a business we should be in” Dennison commented, echoing remarks city manager Jeff Fielding had made more than a year ago. While Tyandaga is currently running at a bit of a profit that was not the case a couple of years ago. At that time the golf course juggled its business model and tightened up its management practices and the profit and loss statement began to look better.

Dennison just doesn`t think the city should be in the golf course business and pointed to the “40 golf courses” in the surrounding communities – that number might be a stretch, but Burlington certainly has its share of golf clubs that are a 15 minute drive from the downtown core. Should the city be in a losing business when there are plenty of very good private golf clubs in the community?

Ward 4 Councillor Jack Dennison sees 200 homes on the Tyandaga golf course property and thinks the Catholic Diocese property that front on Brant Street could be made a part of the project as well. Dennison saw the 110 acre Tyandaga property as prime residential development land and talked of being able to get something between $12 and $18 million for the land alone. He added to that the immense development charges that would accrue to the city and then the tax assessment which he pegged at $200 million.

Dennison told his colleagues that the property had 33 acres of land that could be developed and because of the location he saw at least six houses on each acre getting pretty close to 200 homes on a prime site that would have 76 acres of parkland.

Before we knew it Dennison had $1.6 million in additional tax revenue in the city’s coffers.

The golf course wants to spend $150,000 this year on upgrading parts of the golf course – Dennison wanted to defer that spending while the city took a closer look at the property and the opportunity he felt it offered. The golf course wants to spend $150,000 this year on upgrading parts of the golf course – Dennison wanted to defer that spending while the city took a closer look at the property and the opportunity he felt it offered.

The rest of Council wasn’t as gung-ho as Dennison. They Mayor said it looked like a “cash grab” to him but didn’t explain what was wrong with wringing cash out of an underperforming asset.

The rest of Council didn’t get very excited either. Ward 1 Councillor Rick Craven was delayed in getting to the Standing Committee meeting and missed a discussion that would have taken a major public recreational service off his plate.

Councillor Sharman took the high road and said the selling of the golf course had to be looked at in a “broader context” but didn’t elaborate on what that meant other than to say that the city was “not ready for the discussion”.

Councillor Meed Ward piped in with her view that adding residential assessment isn’t always a good deal for the city. “For every dollar of tax revenue we pull from residential properties we end up, over time, spending a $1.40 Dennison came back with “that argument doesn’t really hold all that well”.

Council needed some input on just what the planned spending on the golf course was for and called Director of Parks and Recreation Chris Glenn to the podium. Odd as it may sound Glenn wasn’t able to say just how many golf courses there were in Burlington, nor could a member of his staff come up with a solid number.

Were anyone to ask a privately operated golf course what their competition was you would expect them to tell you exactly how many competitors they had and be able to tell you which were their closest competitors in terms of course usage and revenue. The mindset of the private sector is a lot different from the mindset of the public sector where the renewal of an asset is based on a chart or a schedule that dictates when an asset has to be renewed. The private sector operator would wring every possible nickel out of a piece of equipment. Any expenditure comes out of the bottom line which tends to be the owners pockets. Were anyone to ask a privately operated golf course what their competition was you would expect them to tell you exactly how many competitors they had and be able to tell you which were their closest competitors in terms of course usage and revenue. The mindset of the private sector is a lot different from the mindset of the public sector where the renewal of an asset is based on a chart or a schedule that dictates when an asset has to be renewed. The private sector operator would wring every possible nickel out of a piece of equipment. Any expenditure comes out of the bottom line which tends to be the owners pockets.

Glenn explained what the $150,000 was going to be used for – and added that it wasn’t really a capital expenditure from the city’s point of view – the expenditures were going to come out of reserves the golf course had in place.

For Dennison it was an opportunity that was being missed; he wanted to see the asset being used in a much different way. He didn’t manage to convince his colleagues to go along with him – the motion to defer the item was lost on a 4-2 vote. But Dennison did manage to plant a seed – the city manager is way ahead of him on this one. When city council decides what businesses it wants to be in – the golf course business is not likely to be one of them.

Another question is: will Jack Dennison be on Council to see this kind of development take place.

At the Tuesday evening Council meeting the Capital budget was approved for 2014. There are loads of items in the longer term capital budget that will be getting a much different look during the year. City hall will begin the process of totally recasting capital expenditures as it reorients itself to its new financial reality. Among the projects in that capital budget that will be getting a closer look are the railway underpasses on Mainway and Burloak – neither is going anywhere in 2014 – both will be getting a closer look as the longer term capital budget gets its remake.

On the books for the 2015 to 2023 capital spending is a massive $494,012,195 in capital spending. City manager Jeff Fielding looked at the cookie jar and knew pretty quickly that the number wasn’t possible – thus the decision to totally recast what we want to do, what we have to do and what we can do in the way of capital spending for the next 15 years.

Lori Jivan, on the right, Acting coordinator budget and policy with the city explains the 2014 budget at a public meeting. With the capital budget of $67,973,902 nailed down – let’s look at where the money is going to come from: Lori Jivan, Acting coordinator budget and policy explains:

External other: These are monies the city gets from other place, could be the provincial government, the Region or some other municipality we are doing a joint project with. If Tremaine Road was having work done on it – because it is our border with Oakville they might be paying part of the cost. We pick up $10,089,000 from this source.

Debt: We sometimes decide to borrow money to pay for a capital project. This year the city projects they will borrow $6,903,000

Cash from the current budget: This is tax revenue – money the city collects as taxes. A portion of the tax money gets pushed into the Capital account. For 2014 they are moving $16,684,000 into capital expenditures

IRRF – this is the Infrastructure Recover Fund which amount to $2.000.000 the city gets from Burlington Hydro. It comes to the city from Hydro as a dividend which the city places in the Infrastructure Recovery account. $2,000,000

SCD: Special Circumstances Debt. This is an estimate of the amount of debt the city will have to take on for special project – one time situations that might get taken on. The Performing Arts Centre is an example of a one time Special debt.

FGT: Federal Gas Tax. The portion of the federal gas tax that the city receives. For 2014 that is set at $4.774,000

Provincial Gas Tax PGT: The portion of the provincial gas tax the city receives. For 2014 that is set as $850,000.

Reserve funds will be used with $20,648,000 coming from the development charge reserve and $5,027,00 coming from what the city calls “other”.

By Pepper Parr By Pepper Parr

February 11, 2014

BURLINGTON, ON.

City manager Jeff Fielding has to be a happy camper today. Council gave him $67 million and change for the various capital projects he has on the go. Actually he got $67,973,902.

Council like to go through these budgets and lop off a bit here and a bit there to leave the clear impression that have a grip on the spending. Part of the budget process is to have council members send in the items they want more information on – there were 25 pages of those. If a Council member wants then to debate the item they put it on a list.

This year there were 17 items from just two council members: Dennison and Taylor of ward 3 – both whom have been on council individually for more than 20years This year there were 17 items from just two council members: Dennison and Taylor of ward 3 – both whom have been on council individually for more than 20years

Ward 4 Councillor Jack Dennison, who knows the Tyandaga part of the city very well – used to represent that part of the city – wants to see a couple of hundred million dollars home on the land. His thinking appears to be aligned with that of the city manager. Capital projects are all those roads, buildings and vehicles the city needs to keep things moving. At one point it looked as if Fielding was going to have an additional $10 million in savings when Jack Dennison, ward 4 came up with an idea that would have the city out of the golf business and sell of the Tyandaga property and get a couple of hundred high-end single family dwellings built. Dennison had figured out everything except the potential development charges but his colleagues weren’t buying it – too premature they said.

However, the writing was on the wall for Tyandaga – too many people see it as land that can be put to better use. Dennison said there were 40 golf clubs in the area – that number seemed high – Parks and Recreation Director Chris Glenn wasn’t able to say how many golf clubs there were in the city, which seemed odd.

Sometime last year city manager fielding did say that he had some ideas about the Tyandaga property – felt there was more value for the place than the city is getting from operating a golf course.

There was a $250,000 capital expenditure related to what city hall – staff and elected council members want to do with city hall – but the lips got kind of tight when that subject came up. Dennison wondered of part of that quarter of a million couldn’t be moved back to 2015 but Allan Magi, Executive Director of Corporate Strategic Initiatives explained that there was a report that would get produced and presented in June that would set some of the “high priorities” and “options” for the city.

Because this is a real estate matter fielding didn’t want much said by anyone to anyone. He told Council he would get back to them with a confidential memo that would tell all – but it wouldn’t be telling all to everyone.

Get ready for some interesting ideas on a significant city hall initiative – maybe a new one. Bet on it staying in the downtown core.

There will some of that stuff that is known to hit fans in the late Spring or early summer – which is when Council members will be gearing up their re-election campaigns. One of the ways to deflect the details on the pier and its legal fallout would be to get all warm and fuzzy about a brand new city hall that is going to (finally) revitalize the downtown core.

Marianne Meed Ward chaired the meeting – she runs a swift, no-nonsense meeting; this is a council member that has learned a lot in the four years she has served the city. Much more focused when it comes to running a meeting. As chair she gets to talk as long as she wants – and to the delight of her colleagues she has learned that 50 words can often do as much as 500 words. Marianne Meed Ward chaired the meeting – she runs a swift, no-nonsense meeting; this is a council member that has learned a lot in the four years she has served the city. Much more focused when it comes to running a meeting. As chair she gets to talk as long as she wants – and to the delight of her colleagues she has learned that 50 words can often do as much as 500 words.

By Pepper Parr By Pepper Parr

February 10, 2014

BURLINGTON, ON.

With the city budget determined as both capital costs and Operating costs – it can still be very confusing.

Council members have tons of questions. Rather than have some questions asked several times city staff pull

together all the questions and consolidate them – letting staff dig out the answers and put the collection in front of council

– it runs to 25 pages.

Markings identifying portions of the street intended for cyclists. Future plans for bike lanes:

Setting aside part of roadways for cyclists is still a work in progress in Burlington. The cycling advocates

lost the battle to have dedicated lanes on Lakeshore Road – something to be remembered come the

civic election.

Question: Provide a consolidated breakdown of capital funding sources and total cost to install bike lanes for the projects identified in the capital budget.

Response: Preliminary Bike Lane forecasted costs

Ref # 2 Appleby Line @ Harvester Intersection

$ Costs if part of road expansion

Standalone costs (no planned expansion)

Year 2018 $22,000 $822,000

Ref #

|

5

|

Harvester Road @ Guelph Line IntersectionYear 2017 |

$22,000 |

$148,000 |

| Ref # |

6

|

Harvester Road – South Service Road to CenturyYear 2017 |

Drive$161,700 |

$823,200 |

| Ref # |

7

|

Harvester Road – South Service Road to WalkersYear 2017/2020 |

Line$365,200 |

$699,500 |

| Ref # |

8

|

Lakeshore Road – Maple Avenue to City LimitYear 2015/2017 |

$451,000 |

$957,000 |

| Ref # |

11 |

North Service Road @ WalkersYear 2014 |

$187,000 |

$277,000 |

| Ref # |

12 |

Waterdown Road NorthYear 2016 |

$528,000 |

$818,000 |

| Ref # |

13 |

Waterdown Road WideningYear 2014 |

$72,600 |

$312,600 |

| Ref # |

16 |

Plains Road Reconstruction |

|

|

| Year |

2015 |

380 m @ $220 /m = |

$83,600 |

$1,005,000 |

| Ref # |

17 |

South Service RoadYear 2016/2017 |

$52,800 |

$209,600 * |

| Ref # |

19 |

Brant Street @ Plains RoadYear 2017 |

$22,000 |

$66,000 |

| Ref # |

20 |

Harvester Road @ WalkersYear 2016 |

$22,000 |

$272,000 |

| Ref # |

21 |

King Road – SSR to NSR |

|

|

|

|

Year 2019 |

$57,200 |

$2,532,000 * |

| Ref # |

23 |

Walkers @ DundasYear 2016 |

$22,000 |

$52,000 |

| Ref # |

24 |

Walkers @ Upper MiddleYear 2018 |

$22,000 |

$122,000 |

| Ref # |

25 |

Waterdown Road Bridge Widening at Hwy 403 |

$17,600 |

$1,500,000 * |

| Ref # |

28 |

Burloak Drive Grade SeparationYear 2020/2021 |

$44,000 |

$2,000,000 * |

| Ref # |

31 |

Lakeshore Road ReconstructionYear 2019 |

$37,400 |

$179,100 |

| Ref # |

32 |

Plains Road @ York Blvd RoundaboutYear 2023 |

$33,000 |

$83,000 |

| Ref # |

33 |

Walkers Line – Hwy 407 to No 1 SideroadYear 2020 |

$239,800 |

$824,800 |

| Ref # |

85 |

Eastport Drive Cycling ImprovementsYear 2017 |

$11,000 |

$1,000,000 * |

|

|

TOTAL

|

$2,473,900 |

$14,702,800 |

Harvester Road corridor:

Question: Harvester Road Corridor Improvements and Widening. Provide the total cost of all works proposed along the Harvester Road corridor.

Response: The total gross cost of projects along the Harvester Road corridor is $ 27,489,500.

Sealing cracks on roads is one of the preventive maintenance tools before a road has to be rebuilt. Shave and pave have proven to be money well spent – and we are spending a lot of money on this tool. Road repairs – sealing cracks:

Question: Provide the list of suggested roads that will be crack sealed.

Response: The following table identifies the proposed 2014 crack sealing candidates

| Road |

From |

To |

| WILLOWBROOK RD |

PLAINS RD |

ENFIELD RD |

| GLENWOOD AVE |

NORTH SHORE BLVD |

TOWNSEND AVE |

| RICHMOND RD |

MAPLE AVE |

HAGER AVE |

| POMONA AVE |

LAKESHORE RD |

SPRUCE AVE |

| PINE COVE RD |

SPRUCE AVE |

NEW ST |

| ROCKWOOD DR |

WOODVIEW RD |

WALKER’S LINE |

| TURNER DR |

LONGMOOR DR |

BENNETT RD |

| GRAPEHILL AVE |

WALKER’S LINE |

STRATHCONA DR |

| MELBA LANE |

SPRUCE AVE |

STRATHCONA DR |

| LINDEN AVE |

HAWTHORNE AVE |

SPRUCE AVE |

| REEVES RD |

WHITE PINES DR |

TOTTENHAM RD |

| MAPLE |

LAKESHORE |

FAIRVIEW |

Downtown street lights:

Question: Is the sum of $884,000 in addition to the $1.9 million included in previous budgets to complete Decorative Street Light Restoration works on the downtown?

Response: The sum of $884,000 is new funding. The restoration project is to start in 2016 and continue yearly for 4 years with an expenditure of $222,000 per year. The previous Capital funding was for the reconstruction of Brant Street, burying utilities and installing Decorative Street Lights.

Central Arena Facility Renewal/Enhancements – Skyway

Question: Is money needed for these arenas? What is the future direction of Skyway?

Response: Funds for Central Arena are identified for 2015 and funds for Skyway Arena are identified for 2017. Staff will be conducting an ice needs review in 2014 to determine if the current inventory will meet customer needs for the next 5-10 years. The results of this review will be presented to Council. If the review warrants major renovations to either arena, staff will submit a business case in conjunction with the 2015 budget submission.

The capital budget will be recast in 2015. As such, the 2014 capital budget and forecast focused on 2014 projects. The project in the capital budget assumes a revitalization of Skyway Arena based on life cycle renewal requirements. However, prior to proceeding with this a strategic review of the need for this facility vis-a-vis ice user needs as well as other community needs will be under taken as directed by Council.

Longer term thinking has city hall being replaced but for the immediate future improving the sound system in Council chamber – FINALLY! and improving some of the meetings rooms is where capital dollars will be spent this year. City Hall:

Question: What work is being done on the city hall building for the $250k in 2014?

Response: A City Hall Administrative Study is underway which will provide a recommended strategic option for City Hall needs. Funding identified in 2014 is to advance the high level option recommended in this study to design development including costing for capital budget purposes.

Looking at what to do with city hall long term doesn’t mean it will be left to disintegrate.

Question: Provide the detail of the work being done in 2014 for public meeting rooms and council chambers.

Response: (a) Meeting rooms on 3rd floor: Replacement of carpeting, furniture and technology. (b) Council Chambers: Audio equipment only.

Now the biggest park the city has – and the furthest from the bulk of the population. City View Park: