By Pepper Parr By Pepper Parr

February 24th, 2021

BURLINGTON, ON

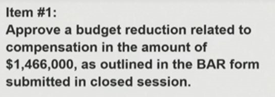

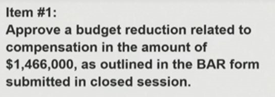

Just what was the hullabaloo all about? It was about a possible $1,466,000 savings that had something to do with city hall staff remuneration.

Ward 4 Councillor Shawna Stolte had some ideas on where savings could be found – wasn’t allowed to talk about them. They had to do with how much the city pays its staff. Details on just what was behind that idea were not made public because Ward 4 Councillor Shawna Stolte was not given the opportunity to talk about her proposal in a public session.

We are never really going to know the whole story but based on what is available we can say this: no one in the city knows the Municipal Act better than Clerk Kevin Arjoon who managed to find several sections on the Closed meeting provisions to keep Ward 4 Councillor Shawna Stolte from speaking publicly about her idea for reducing the size of the tax bite for the current year.

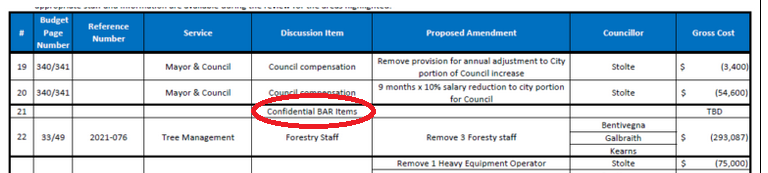

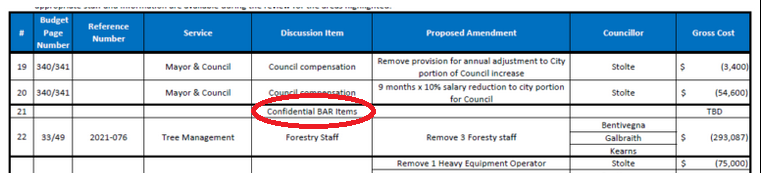

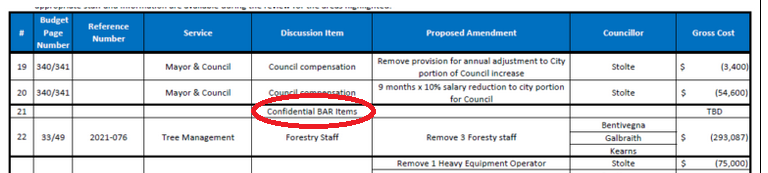

Stolte had an item on the BAR forms that didn’t have an amount next to it. It did have a note that it was to be discussed in a CLOSED session.

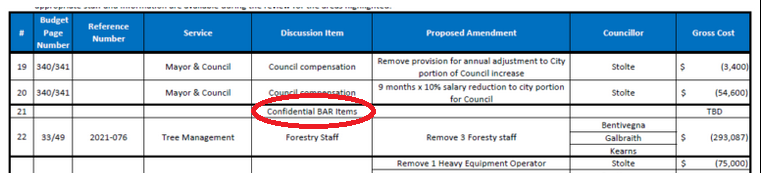

The items Stolte had in mind were broken out by Staff who created a list of four items.

Council then went into a CLOSED session to debate. We do not know what Stolte said, if anything, in the CLOSED session of a Standing Committee that lasted 12 hours.

There is a report that Stolte did not speak to her own motion while Council was in CLOSED.

Item 1 Defeated.

Item 2 – withdrawn

They then recessed until 6:30.

After the recess they then went back into Closed session to debate the other two items.

Based on what we have been able to piece together, we know that the proposal had to do with staffing.

City manager Tim Commisso appears to have out the interest of his staff ahead of the taxpayers. The city manager was adamant in wanting to get the discussion off the public table and have the views of Council members, particularly Stolte, away from the public.

More to follow on this one. There are very serious grounds for the way large parts of the meeting were held, including Chair of the meeting, Rory Nisan, who called the vote on a Stolte motion but did not allow her to speak until after the vote – and then cautioned her on several occasions about what she was going to say.

More details on what happened will be the focus of a follow-up story.

The big issue for the Mayor at this point is where she is going to find the $343,735.00 to get the tax increase down to 3.99%. As it is now it stands at 4.18%

More on that as well.

By Pepper Parr By Pepper Parr

February 23rd, 2021

BURLINGTON, ON

It was late; 9:45 pm. They had been going at it since 9:30 in the morning.

City Council was doing their best to get a budget increase of 3.99% that they could take to council on March 3rd.

They didn’t make it in Tuesday.

The budget number when the adjourned was at 4.18% – they needed to find $343,735 in savings to get to the 3.99%.

The schedule called for a follow up meeting on Thursday – maybe they will find the savings then.

At times it was a bit of a gong show. At one point they were arguing over how they would vote against something that had no amount attached to it.

On another occasion the Chair, Rory Nisan, went to call the vote on an item and had to be informed that it had been withdrawn. Nisan had stepped away from his seat.

Everyone needs a break – the Gazette will get up bright and early on Wednesday and report on what they did get done. Everyone needs a break – the Gazette will get up bright and early on Wednesday and report on what they did get done.

We will tell you all about the budget item that had to be discussed in a CLOSED session.

We also learned that the city does not have an employee suggestion box. Does that say something?

By Pepper Parr By Pepper Parr

February 19th, 2021

BURLINGTON, ON

Have you ever seen something like this before?

BAR forms (Budget Action Requests) are documents Councillors use to bring forward changes they would like to see made in the budget Staff have put forward.

The Gazette has learned that the Clerk has informed a member of Council that the item that was put forward must be treated as confidential.

Confidential matters are determined and governed by the Municipal Act and usually relate to matters that involve a named individual or a property matter.

There is much more to this story.

By Pepper Parr By Pepper Parr

February 18th, 2021

BURLINGTON, ON

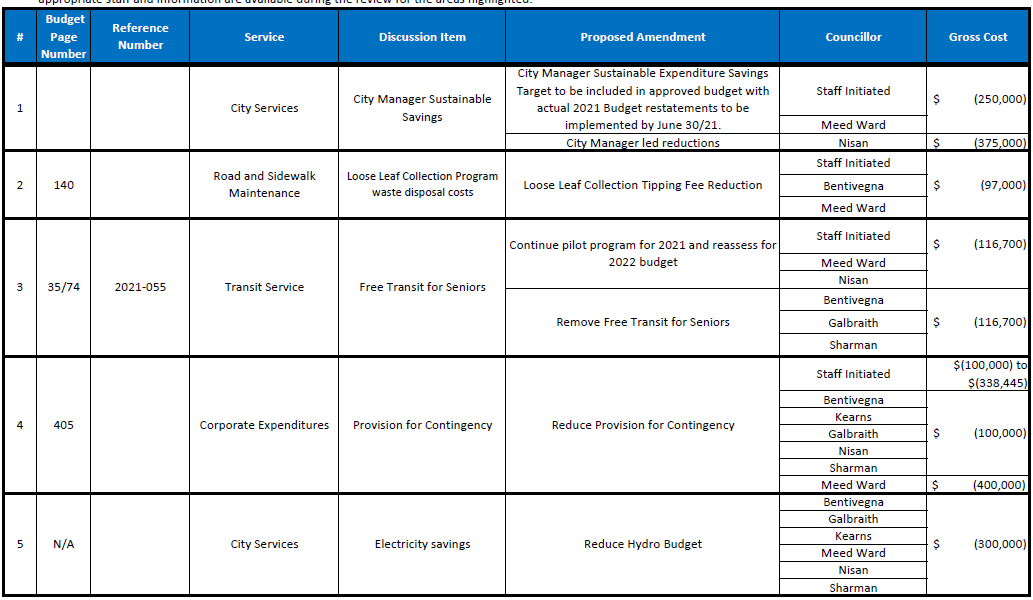

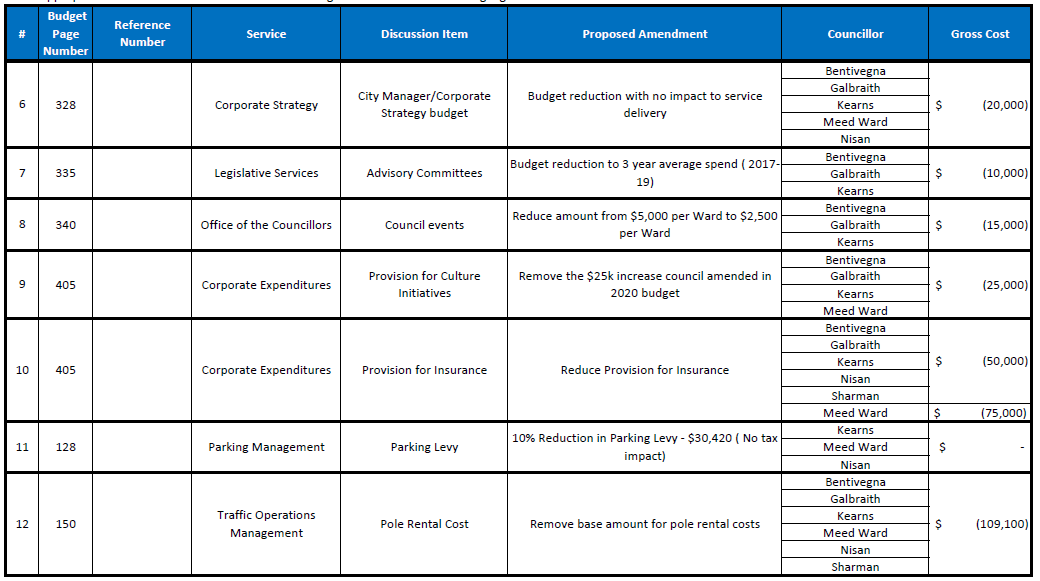

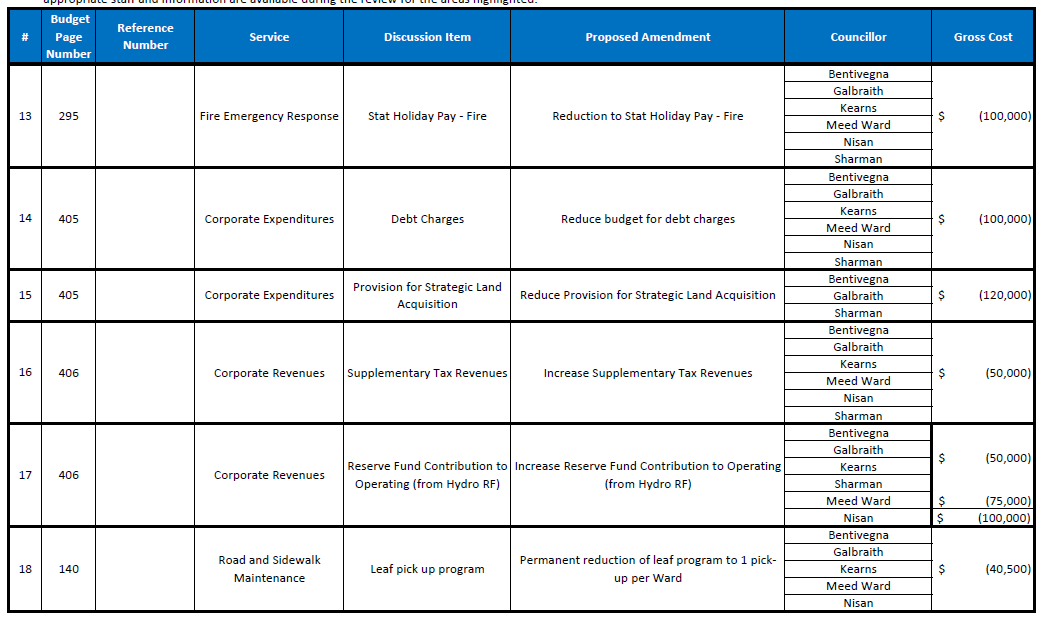

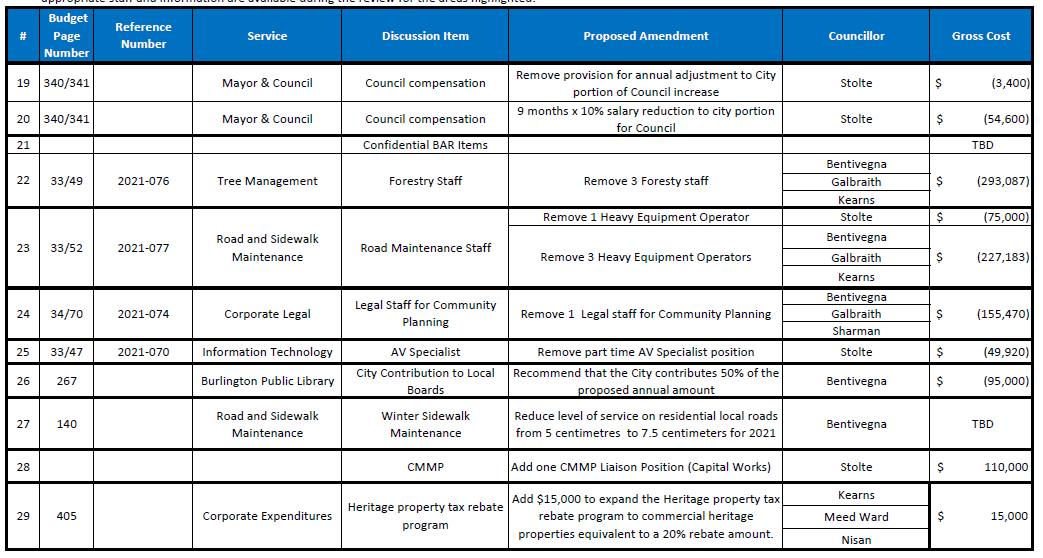

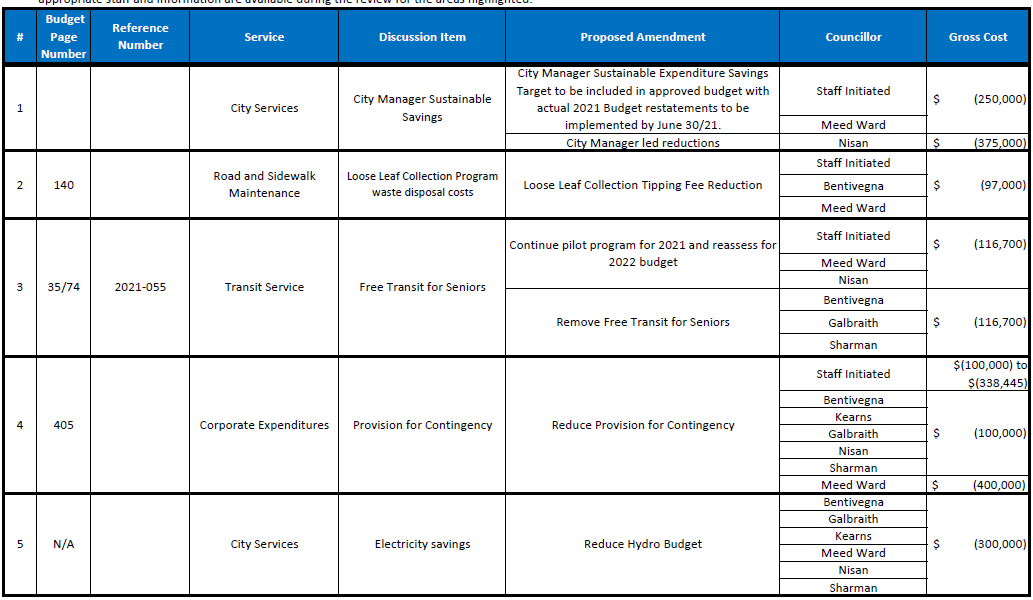

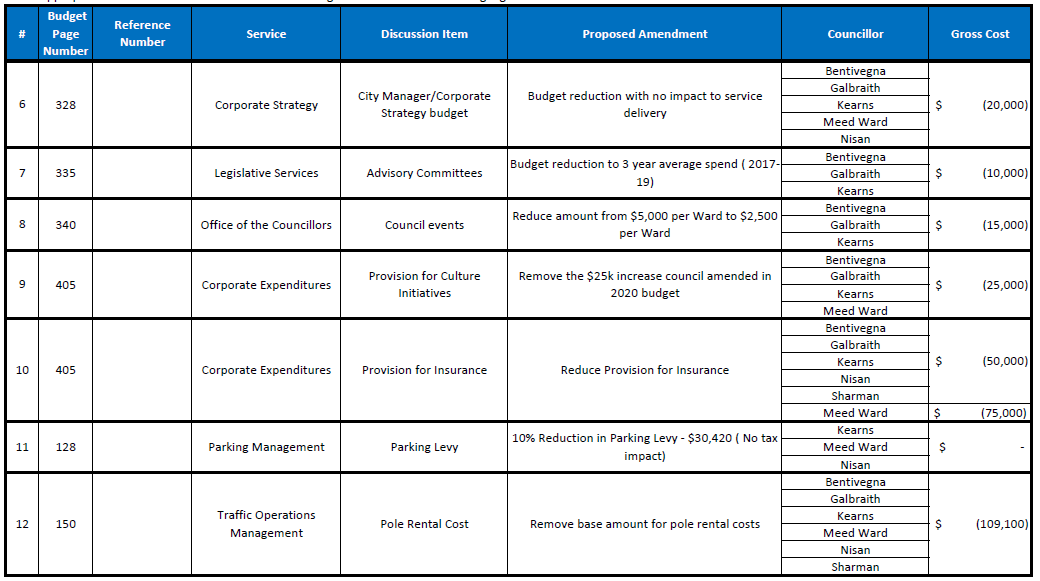

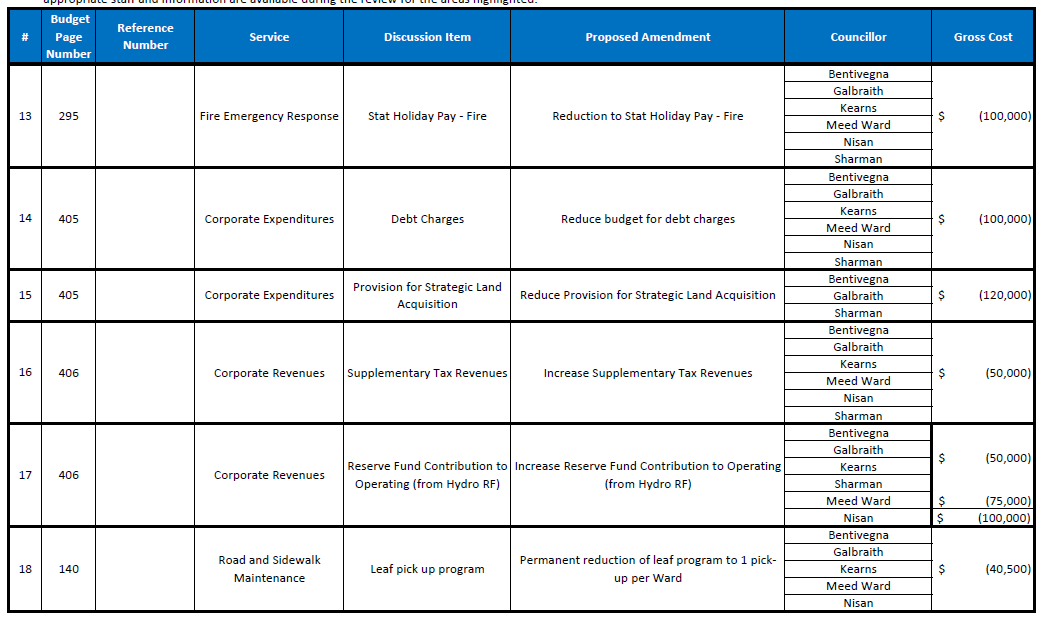

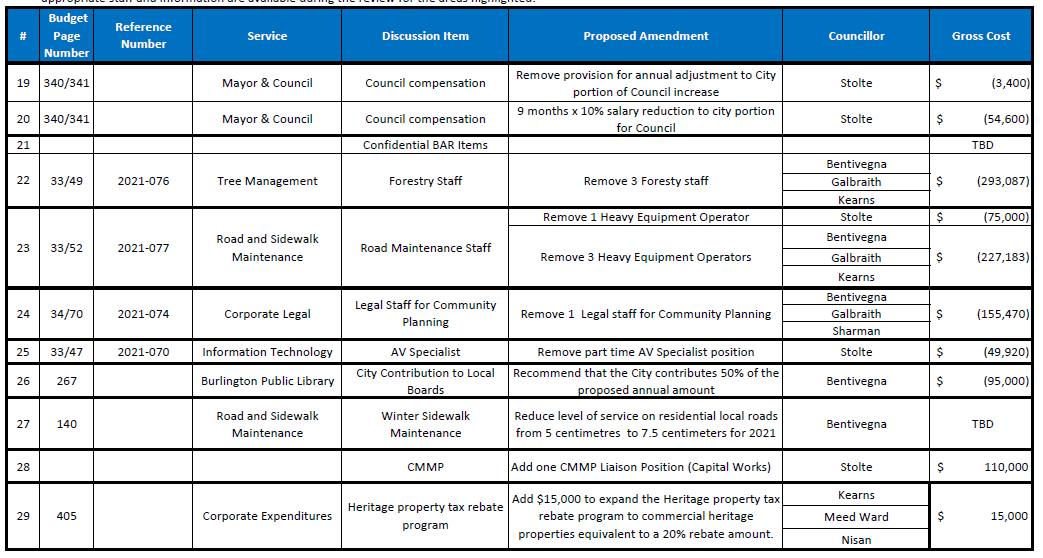

They are referred to as BAR (Budget Action Request), forms that each Council member can submit asking for an increase or a decrease to the budget brought forward by Staff.

At this point – before there is a serious debate on the budget, the increase is 4.99% over what the city taxes were last year. Mayor Meed Ward told Staff that she wanted them to come back with a budget that had a 3.99% increase over last year – and to include some ideas on how to get to that point.

There was something quite a bit different this year many of the 29 items were submitted by all the members of Council. In previous councils a member would push for an item they wanted to deliver to their ward – re-election for this crowd is just 20 months away, not a lot of time in the world of politics.

The following list of items, requested by Councillors on the BAR forms.

Are the changes asked for enough to bring the tax increase down to that 3.99% the Mayor wanted – maybe even lower?

Each of these will be debated, with Staff on hand to advise. Note that for many of the items Staff is in agreement with what a majority of the Council members want to do.

Of note is this. Ward 4 Councilor Shawna Stolte did not join her colleagues on the BAR items they put forward but did put forward three of her own – all were suggesting decreases in salary for the Members of Council. She wanted members of Council to take a pass on the annual increase they get each year and to take a 10% cut of the salary they currently get for 9 months.

The sum total for the two BAR amounts to $629,000.

There are two situations where Council asked that funds be added to the budget. Stolte wanted $110,000 added to the Capital Works budget while Kearns, Nisan and Meed Ward wanted $15,000 added to the Heritage Property Tax rebate program.

Look for the Mayor wanting to take a victory lap when the budget is approved in March.

By Pepper Parr By Pepper Parr

February 12th, 2021

BURLINGTON, ON

The Communications people at City Hall provide a service that amounts to a listing of events taking place during the week ahead. It is published every Thursday and usually consists of meeting notices. Members of Council sometimes place an event they are holding on the list.

The Gazette scans the list – there is a lot of stuff going on – and noticed that the list released yesterday had three notices for basically the same thing but at different times.

The meetings were intended for the residents of ward 6.

Meeting number 1` – about the budget  Meeting number 2 – about the budget  Meeting number 3 – about the budget

Ward 6 Councillor Angelo Bentivegna We thought this was a clerical error and brought it to the attention of Kwab Ako-Adjei, Director, Corporate Communications & Engagement who got back to us and confirmed that the Councillor’s office has scheduled three Zoom meetings to talk about the budget.

The events run for between an hour and an hour and a half. It is a big budget with some critical issues. The Mayor wants to keep the tax increase to less than 4%.

Angelo Bentivegna is a Councillor who watches the pennies and has grown to the point where he can disagree with the Mayor

The residents of ward 6, and any one else who wants to listen will get a chance to see how well their Councillor understands the budget he is going to vote on.

By Pepper Parr By Pepper Parr

January 29th, 2021

BURLINGTON, ON

Oakville North-Burlington MP Pam Damoff in full election mode Pam Damoff, the MP for Oakville North Burlington will be holding an on-line Town Hall on the federal budget.

The event is part of the federal government’s pre-budget consultations and will take place on Thursday, February 11, 2021, from 6:00pm – 7:00pm.

All residents of Oakville North-Burlington are welcome to attend. To register for the virtual Town Hall and for additional details about the discussion please click here.

At this point in time the federal government is throwing billions into the economy to keep things as stable as possible while everyone works at beating the COVID19 virus which keeps sprouting variants which makes the job very difficult.

Damoff explains that “when COVID-19 is under control, our government has a plan to make smart, targeted investments to jump start our economic recovery, restore growth, create jobs, build a greener, more competitive, inclusive and resilient economy and repair the damage done by the pandemic.”

Over the coming weeks, the government will host virtual round tables with diverse groups of people from a range of regions, sectors and industries, including those hardest hit by the pandemic, to allow our government to hear the best ideas from Canadians and experts across the country about how Budget 2021 can best support Canadians through the pandemic and help us build back better. The round tables are an opportunity to discuss the very real challenges Canadians are facing and listen to the ways that the government can ensure a robust recovery that leaves no one behind.

Participants will be able to share their ideas and priorities about how the government can best invest to create jobs, strengthen the middle class, and build a greener, more competitive, more inclusive, more innovative, and more resilient economy.

Pam Damoff: “After the virtual Community Town Hall, my office will compile a report detailing the suggestions from Oakville North-Burlington residents to submit to the office of Federal Finance Minister and Deputy Prime Minister the Hon. Chrystia Freeland. The number of participants is capped at 100 and priority registration will be given to residents of Oakville North-Burlington.

“All Canadians are invited to share their ideas through an online questionnaire at LetsTalkBudget2021.ca, which will be available until February 19, 2021.

“In last year’s 2020 Fall Economic Statement, our government committed major federal transfers to the Provinces. Below, I have outlined the federal transfers to Ontario for reference.

“In Ontario:

• $16.2 billion through the Canada Health Transfer, an increase of $616 million from the previous year; and

• $5.8 billion through the Canada Social Transfer, an increase of $182 million from the previous year.

• $5.1 billion for Ontario through the Safe Restart Agreement:

o $1.2 billion support with the costs of increasing testing capacity, perform contact tracing, and share public health data that will help fight the pandemic;

o $466.0 million to support health care system capacity to respond to surges in COVID-19 cases and to support and protect people experiencing challenges related to mental health, substance use, or homelessness;

o $287.4 million to address immediate needs and gaps in supportive care and provide health and social supports for other vulnerable groups;

o $776.6 million to support municipalities with COVID-19 operating costs

o $1 billion to ensure critical transit services are maintained;

o $1.2 billion to ensure health and non-health workers have access to the personal protective equipment that they need; and

o $234.6 million to address the reduced availability of childcare spaces and the unique needs stemming from the pandemic.

• Up to $763.3 million available through the Safe Return to Class Fund

• $1.1 billion through the Essential Workers Support Fund

Pillars of Canada’s COVID-19 Economic Response Plan by the Numbers in Ontario:

• Canada Emergency Business Account: as of January 21, 323,617 loans provided to businesses, worth a total of $16.35 billion.

• Canada Emergency Wage Subsidy: as of January 10, 791,810 applications, for a total of over $23.32 billion in subsidies paid out, helping protect 1.72 million jobs.

• Canada Emergency Response Benefit: as of October 4, over 3.5 million Ontarians supported. In a population of 14.7 million, this is nearly 1 out of every 4 people.

• Canada Recovery Benefit: as of January 10, $3.3 billion provided to 682,080 Ontarians.

• Canada Recovery Sickness Benefit: as of January 10, $94 million provided to 110,220 Ontarians.

• Canada Recovery Caregiving Benefit: as of January 10, $375.2 million provided to 106,690 Ontarians.

By Staff By Staff

January 27th, 2021

BURLINGTON, ON

During February City Councillors will be debating the Operations budget which threatens to come in at more than 4% higher than last year.

Councillors are now going through the 436 page document and preparing BAR forms (Budget Action Request) that set out what changes different members of Council want made.

This is the place where pet projects get advanced. If a council member can drum up enough support and get 4 of the seven votes the project becomes part of the budget.

What will get a little tricky is the desire to keep the tax increase as low as possible and at the same time deliver something that matters to the people who voted for you at the same time.

These will get debated during the month.

The plan is to have an agreed upon budget before city council to be approved on March 3rd.

This year, the City is piloting an educational budget simulation tool, Balancing Act, to educate the public on the City’s budget and highlight the challenge of maintaining and improving services to the public, with limited sources of revenue. Using this tool, the public can simulate where they would recommend City Service budgets be amended to either increase or reduce overall spending and revenues.

The “simulation” exercise lets people decide what should be kept in the budget and what could be left for another time. This is an exercise for people to see what the impact of their choices would be – it won’t be taken by city hall as your advice to them.

It’s a little on the complex side but it is worth the effort.

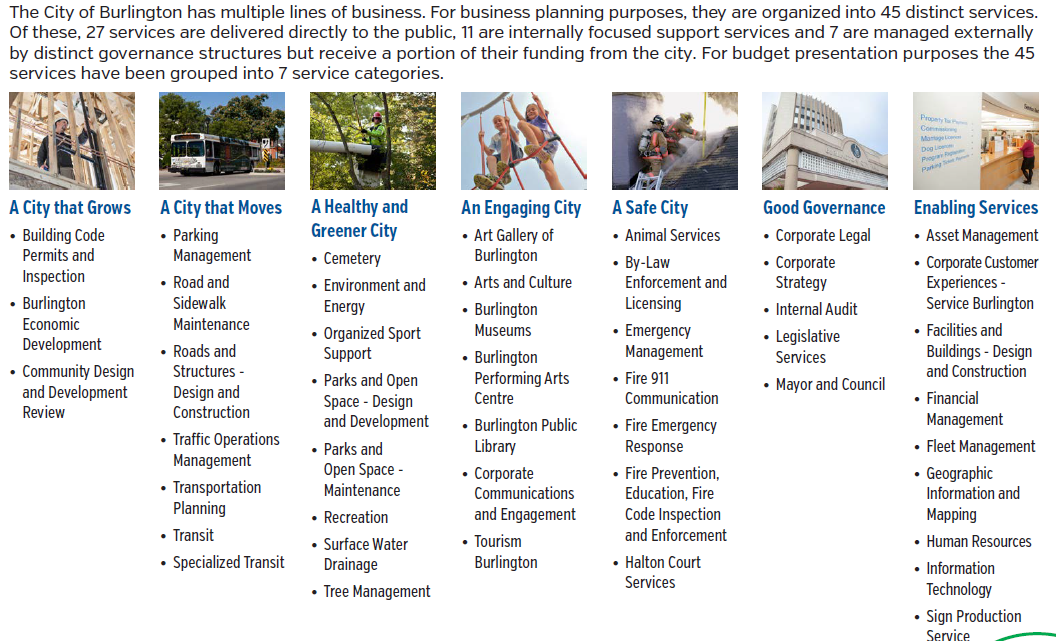

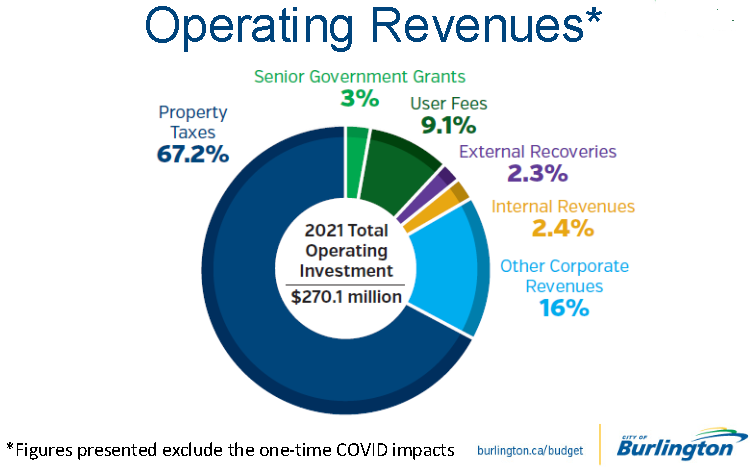

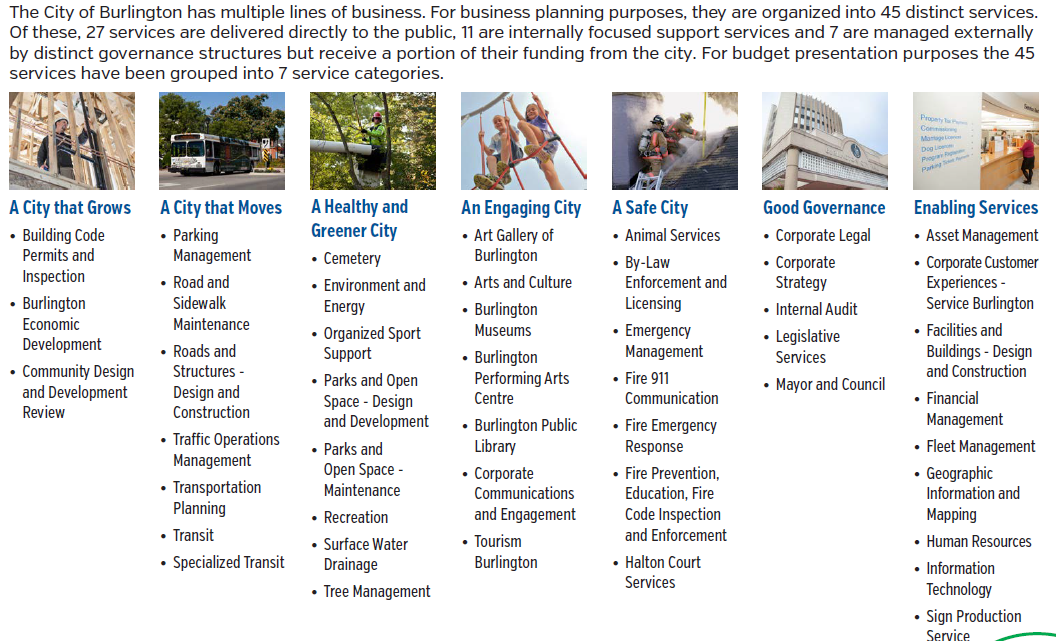

The approach the city takes to the creation of the budget is to present it in what they call a Services Delivery approach. All the expenses are pulled together into one of seven categories.

You will see a list of where the city spends the tax money and other sources. There are seven categories.

The Service Delivery categories put the spending into groups that make it easier to see where the tax dollars are going.  See if you can come up with a different allocation of the tax money and still have a balanced budget. Have fun. There is a link to get to the simulation program.

Anyone who thinks they might have what it takes to be a member of council is well advised to try their hand at budget making.

By Pepper Parr By Pepper Parr

January 22, 2021

BURLINGTON, ON

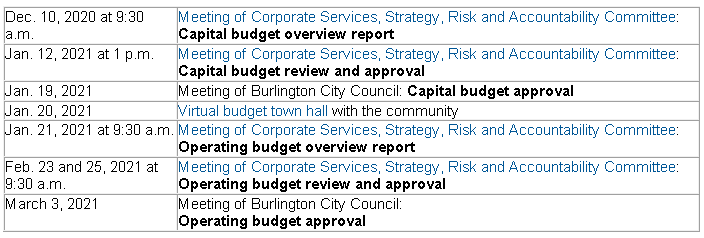

Council heard just what the city is up against as they prepare to craft the Operations part of the 2021 Budget. The Capital Budget was approved last week.

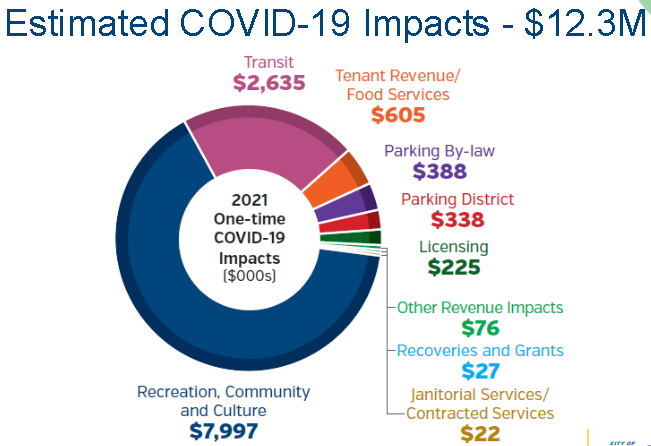

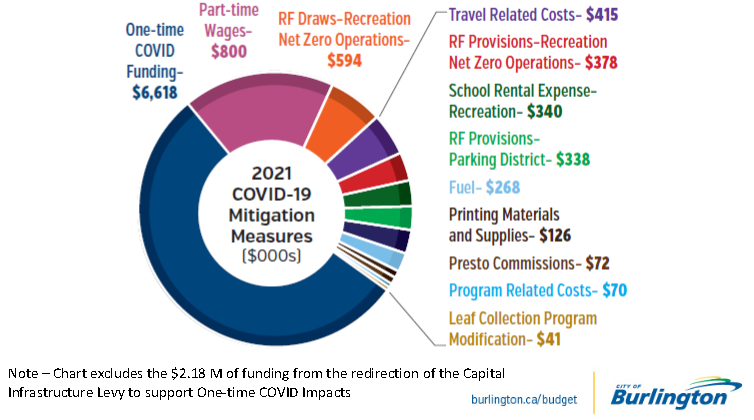

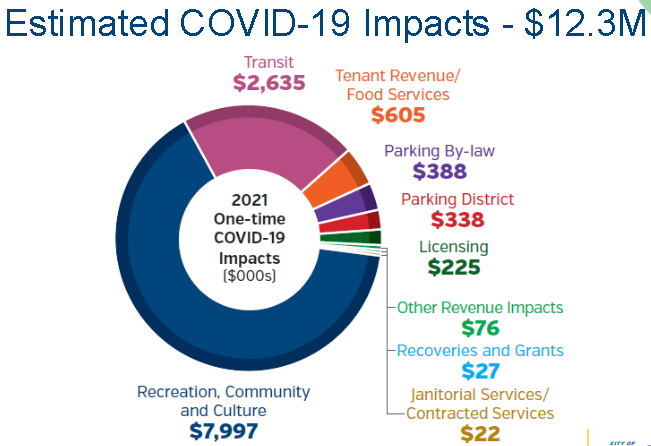

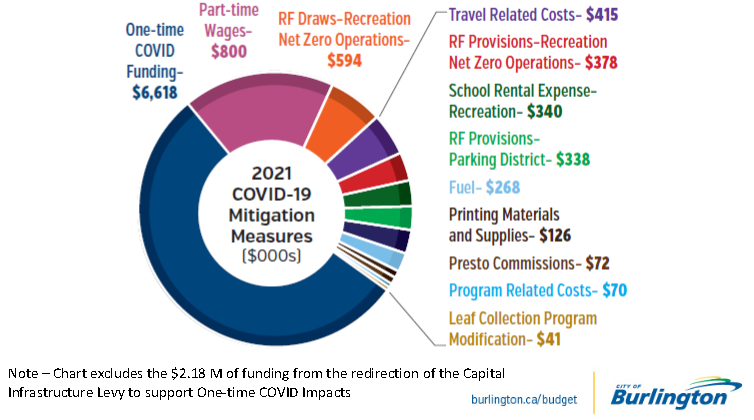

The struggle to come to terms with the COVID pandemic has changed almost everything we do. The city Finance department has created two budgets; one that assumes normal circumstances and another that assumes an ongoing COVID scenario.

This was not a simple task.

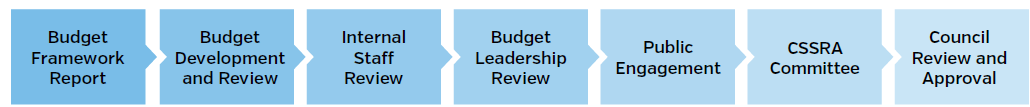

The steps to develop the 2021 budget were as follows:

Base Budget -The budget was first built under traditional business as usual assumptions with all City services adjusting their ongoing base budgets to reflect service efficiencies and standard inflationary pressures offset with “normal” changes to revenues based on fee changes and volumes.

COVID Budget –All City services were asked to separately identify one-time budget adjustments required as a result of COVID. These adjustments include one-time reductions in budgeted revenues and changes in expenses to recognize temporary Service redesign plans required to protect the health and well-being of residents, businesses and staff.

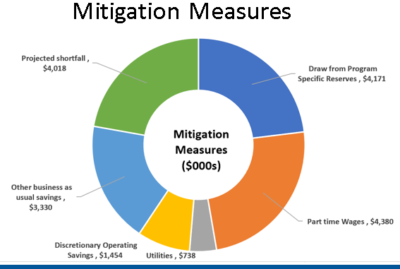

These are revenues that were not going to be realized. Department heads and Finance Department had to figure out how the city could be run with all the financial shortfalls. Finally, services were asked to make a further one-time budget adjustments to expenditures reflecting continued travel restrictions and additional savings resulting from remote working such as decreases in professional development given virtual training opportunities, meeting expenses and mileage.

The net result of these one-time COVID-19 impacts have been shown separately from the ongoing base budget throughout the budget documents.

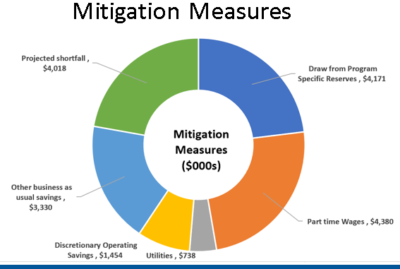

Mitigation measures – steps that were taken to cut costs The ongoing 2021 budget results in a tax increase while the one-time 2021 COVID budget has been offset by temporary cost savings and a one-time funding plan.

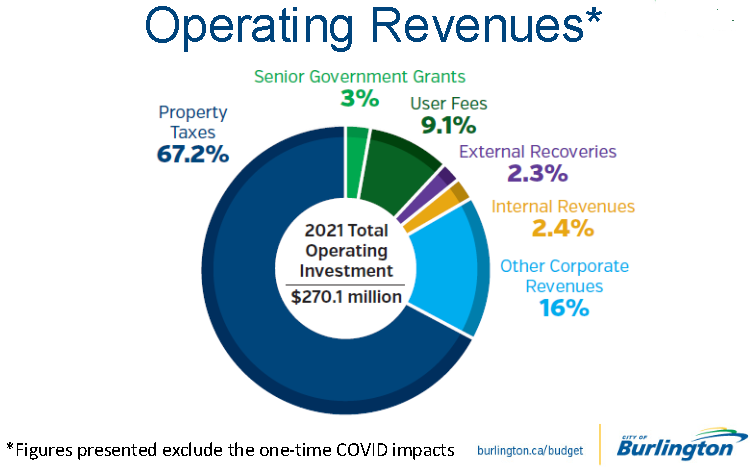

The budget is again presented in a service-based format allowing Council and residents to see how our services meet the growing demands of our community.

The identification of revenues and expenditures by service ensure staff and Council is considering service adjustments when making budget decisions, as well as providing increased transparency and awareness to the public.

The policy and budget principles come out of a number of documents; the first being the 25 year Strategic Plan and the Vision to Focus (V2F) which is the four year terms of council portion of the Strategic Plan.

The Asset Management Plan and the Long Term Financial Plan guide the decision making process as each city department does its early first draft of the budget.

What is called the Base Budget is reviewed by the Chief Financial Officer (CFO) and the Service Leads. The review done this year identified $2.34 million in savings.

The Corporate/Strategic Review then goes over the budget to ensure that risks have been thoroughly vetted.

Council will meet formally and virtually to debate the budget staff have prepared. There will be additional public engagement events as well.

During the briefing Finance department gave council there were some eye opening graphics. A selection is set our below.

The city uses the word investment – it is really the tax money they are going to use. Spending is broken out into seven groups. The graphic shows how much of the money is spent and the portion that is funded by the tax payers.

The tax payer provides the bulk of the revenue. There are other sources.

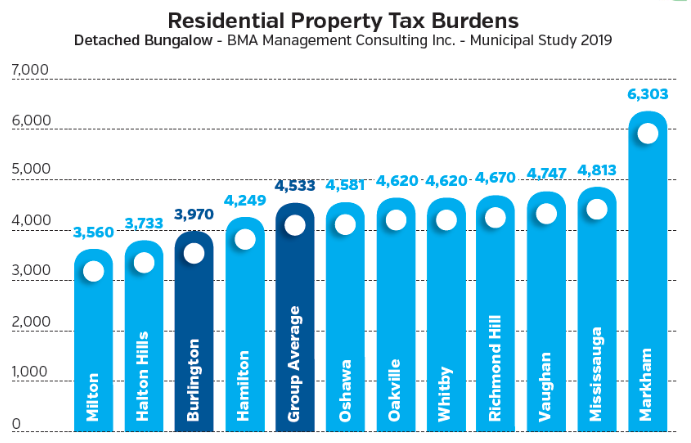

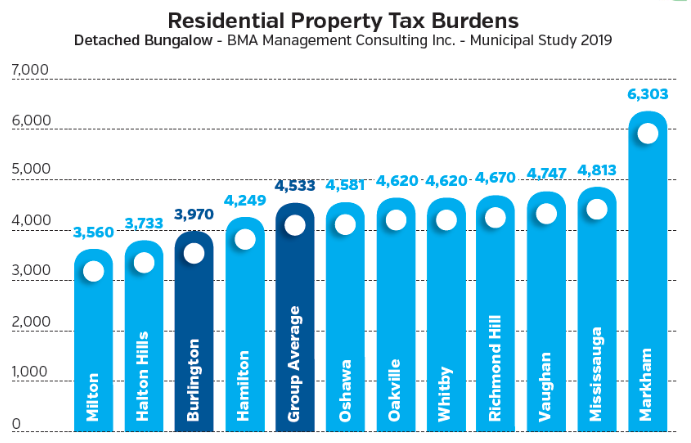

Burlington taxes compared to other municipalities. A heck of a lot better than Markham.

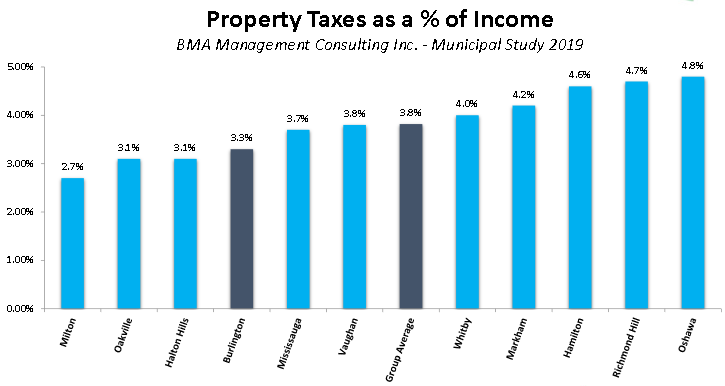

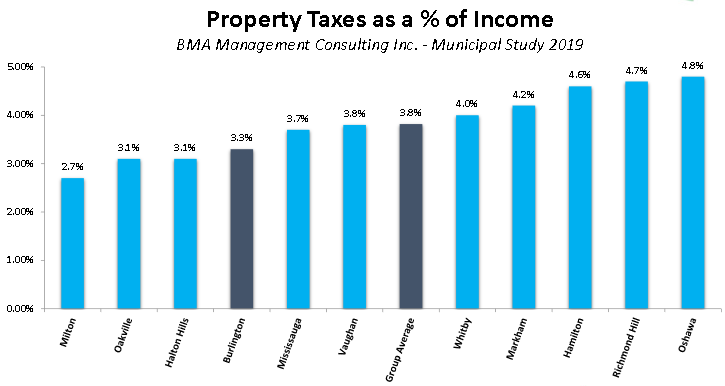

Incomes in Burlington are higher – making the tax bite a little easier to love with.

By Pepper Parr By Pepper Parr

January 20th 2021

BURLINGTON, ON

Mayor Meed Ward doesn’t like the look of 4.99% tax increase and has advised her council colleagues that she will be bringing the following Staff Direction to Council tomorrow

Direct the Chief Financial Officer to provide a list of 2021 budget reduction items for Council’s consideration that could decrease the overall proposed tax impact (city, region, education) from 2.88% to 2.43% (representing a city tax increase of 3.99%) with the list being provided to members of Council by February 1, 2021 and included for public reporting as part of the February 23, 2021 Corporate Services, Strategy, Risk & Accountability Committee -Operating Budget Review and Approval. Direct the Chief Financial Officer to provide a list of 2021 budget reduction items for Council’s consideration that could decrease the overall proposed tax impact (city, region, education) from 2.88% to 2.43% (representing a city tax increase of 3.99%) with the list being provided to members of Council by February 1, 2021 and included for public reporting as part of the February 23, 2021 Corporate Services, Strategy, Risk & Accountability Committee -Operating Budget Review and Approval.

Staff will have to squeeze every department in the city and maybe even look at some of the reserve funds that are a little on the fat side to get the 4.99% proposed tax increase down full percentage point.

By Pepper Parr By Pepper Parr

January 20th, 2021

BURLINGTON, ON

A picture is worth 1000 words. What is a chart worth?

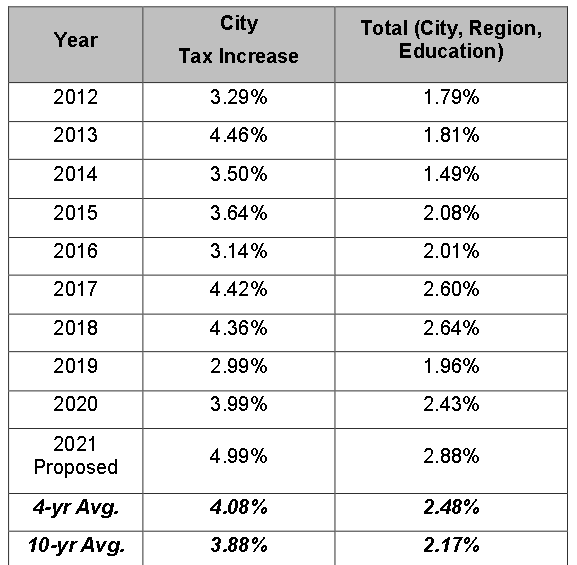

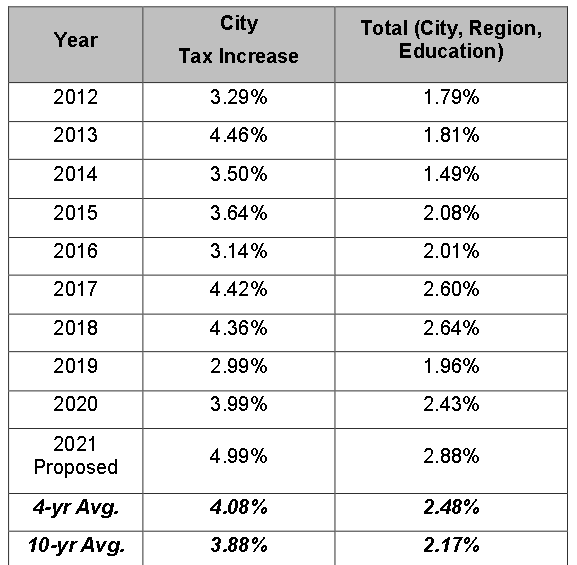

The chart below is from a report Council will receive on Thursday morning. It sets out what tax increases have been over a ten year period.

If averaged over 20 years they could have gotten the number even lower. Council will begin work on a draft budget that proposes a tax increase of 4.99% for the 2020-2021 Operations budget.

There will be a Virtual Town Hall this evening at which participants can ask questions. Unfortunately the public has, at this point very little in the way of information on which to base their questions.

The meeting this evening is putting the car before the horse.

By Pepper Parr By Pepper Parr

January 19th, 2021

BURLINGTON, ON

When the Corporate Services, Strategy, Risk and Accountability Committee was ready to adjourn last week after recommending that the Capital budget be approved, Ward 6 Councillor Angelo Bentivegna, who voted against the $80million Capital budget, said he was disappointed but that “he would get over it”.

Lisa Kearns – before she was a member of city council. Lisa Kearns, Councillor for Ward 2 said: This was a big exercise, a challenge for all of us noting that there wasn’t a single delegation adding that it was evident the public trusted council.

Tom Muir, a frequent Gazette commenter didn’t see it quite that way and said: “I think that Lisa does not have the full sense of what she claimed about everyone being budget happy just because no one showed up.

“False logic indeed.

Tom Muir brings decades of experience in municipal matters to his thinking. “Has she completely forgotten that COVID has changed everything, including public engagement and delegations. There’s no real life left in these things.

“You don’t get to meet with all the people, see the body language all around, group conversations before and after, feel the sense of the room and so on. Now that’s fact as we all know, but it goes to the heart of Lisa’s thoughtless (in my view) remark.

“In my experience, I have no actionable desire to delegate to these virtual meetings, and especially, at this time, about the budget. This budget document is very large and takes a very long time to read, and even longer if you want to criticize. People more or less can’t really do this, and with COVID have indicated so.

“I have done so in the past and from the reaction I got it was a waste of time.

“I still see the percent increase expressed in terms of the overall Regional and Education budget amounts. This increase and the way it is expressed is a perennial complaint from people – the answer is always: we are looking into it. Doubling the tax take for Burlington is not a concern of City.

Tom Muir: Knows false logic when he sees it. “Also, I still see $43 million budgeted for transit for buses (16 new and 52 replacements) that for many routes nobody rides. Good to go to Hamilton and back but that’s about all. What I have been told is that they are working on it and walking, busing and biking – the integrated mobility plan – is the future.

“Has anyone up there given any thought to COVID changing all of the basis of all of the planning that is based on getting back to “normal”? I see no signs of this anywhere, including, especially, the province, who wants to double down on the past, no change.

“But of course, COVID is busting budgets all over, and we have to pay. These holes are getting deeper and deeper and will have to be paid back and this will take a long time. Like it or not, COVID, being global, will be endemic and mutating, and is not going away.

“The economy and society we had is basically not compatible and sustainable without drastic changes, but I only see these changes being forced by the virus, and not in the plans and policies that I see that only try to support what exists.

“Reopening the economy, or trying to, will be another dangerous time in the not too distant future. I have said before that we cannot have an economy that works until we eliminate this virus.

“The only real cold comfort I get from the budget future is that I trust Joan Ford. Chief Financial Officer to figure it out.”

By Pepper Parr By Pepper Parr

January 4TH, 2021

BURLINGTON, ON

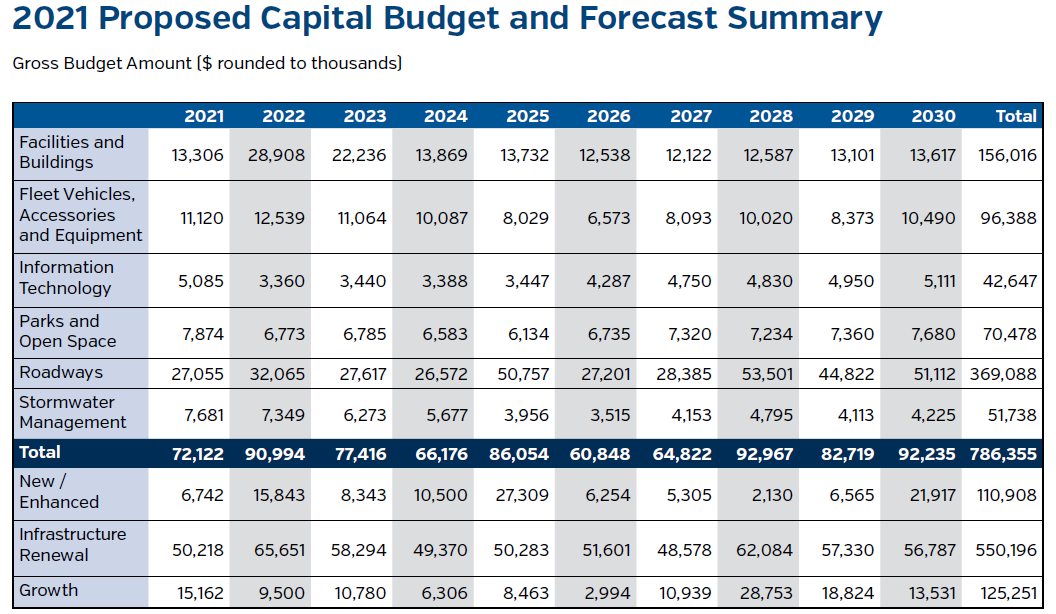

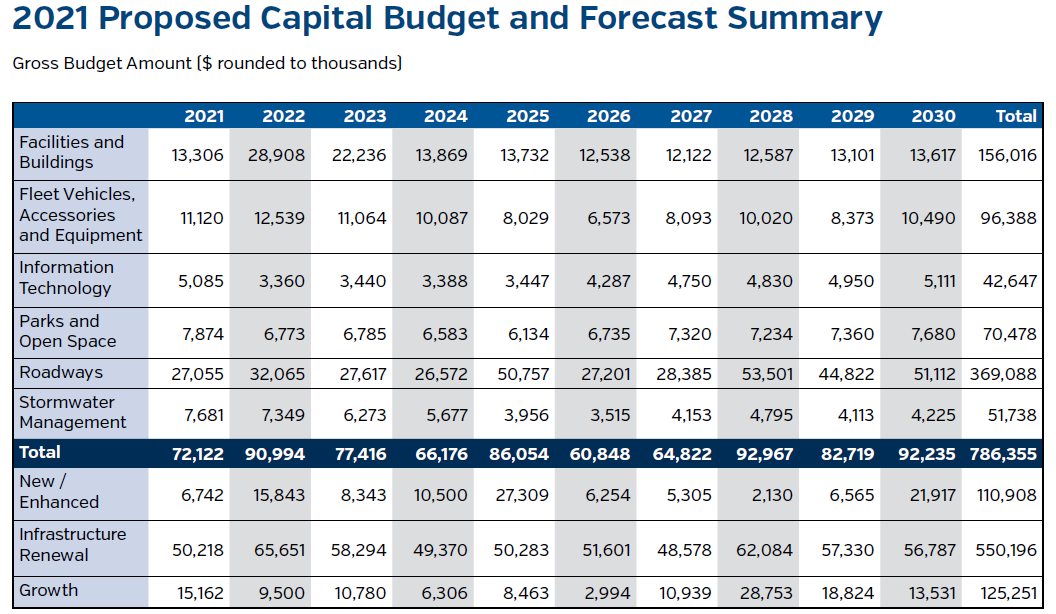

We learn next week how city council wants to handle the budget request for $13,306,000 in Capital spending.

That covers the cost of roads, buildings and the spaces used to run the city.

The budget breaks this amount into three parts.

New/Enhanced facilities – $566 million

Infrastructure renewal – $12,684,000

Growth – $56 million

In the graphic below the city’s finance department also sets out what they expect to be require in the way of Capital Spending through to 2030 INSERT GRAPHIC FROM PAGE 27

The bottom three entries for each year set out the category of spending falls under. The Capital spending the city does has to be put in context. The forces driving the expenditures and the requirements of the Municipal Act.

The city put a 25 year Strategic Plan in place in 2015. Council working with Staff created what they call V2F – Vision to Focus which boils down to which parts of the Strategic Plan this council will focus on.

Five focus areas were created:

1: Increasing Economic prosperity

2: Improving Integrated City |Mobility

3: Supporting Sustainable Infrastructure

4: Building more citizen engagement

5: Delivering Customer Centric Services

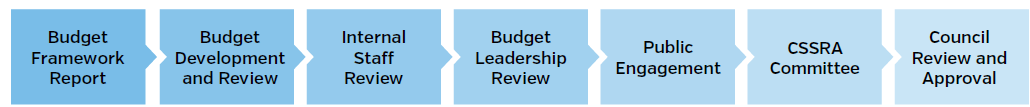

The 2021 budget process began with a Budget Framework Report. This was presented to Council for consideration and

approval in September 2020, after which staff began the preparation of the budget.

The next step was a comprehensive review of the budget by internal staff teams. The capital budget was reviewed by

the Corporate Infrastructure Committee which is made up of the Asset Category leads and members of the Finance team.

This review ensured the proposed budget was submitted and aligned with the City’s financial policies and that capital

projects were prioritized according to the City’s Asset Management Plan and coordinated across asset categories.

Following the internal staff reviews, the budget was then forwarded to the Leadership Budget Review Team where

it was reviewed from a corporate perspective.

Then Public Engagement. There are weaknesses on both sides of the engagement issue. The city has yet to come up with a way to put the information out in a format that truly engages the public. That is not because they aren’t trying – they just haven’t come up with a way to make the review something that draws the public.

Citizens gather for budget discussions. This meeting involved a number of city firemen who were attentively listened to by then Councillor Craven, on the right in the blue shirt. There was a time when budget public meetings drew large audiences. On the other side – few people really care – those that do argue that the decisions have already been made – the public engagement events that take place amount to the city asking questions and looking for approval.

It is interesting to note that the city has numerous Advisory Committees but does not have one related to budget matters.

The City says it is continuously looking for ways to improve and increase transparency for the public. Staff continue to use the City’s website as a communication medium through videos, webcast and online surveys.

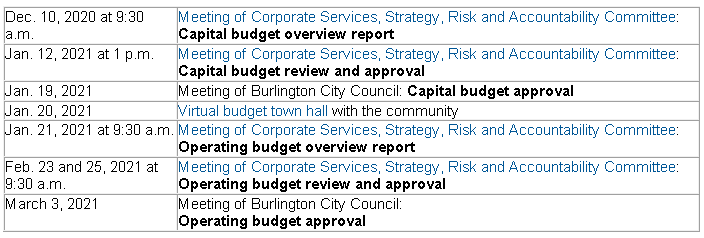

The City will be hosting a Virtual Budget Town Hall on Jan. 20, 2021. This event will allow residents, organizations and business owners to learn more about the 2021 budget.

The “Budget Basics” video continues to be available on the website which explains how the City develops its budgets.

In addition, a revised version of Burlington Open Budget, on the City’s website, is available to the public to allow residents to view the 2021 budget data in an intuitive and illustrative form.

Burlingtonians will show up for public meetings and take an active part in any discussion – but they have to be given background briefings and decent oportunity to study and prepare. Budgets are long, complex documents – far too much to be taken in at one gulp.

The Gazette will follow up with detail on:

Where does the money come from – yes – it all eventually comes from the pockets of the tax payers.

Where are the pinch points?

Specific examples of Capital spending.

By Pepper Parr By Pepper Parr

December 18th, 2020

BURLINGTON, ON

In the municipal world, a deficit is not permitted.

When revenues do not cover all the expenses then treasurer people have to draw down funds from a reserve account.

Burlington, like every other municipality in the province, has dozens of reserve accounts.

The 2021 Operating budget that is being put together (it will go to Council in January) did not look all that good – a higher than the 2% tax rate the public finds they can live with looked as if it was going to rise – 4% was possible unless spending was cut drastically or if there was an infusion of cash from higher levels of government.

Burlington was advised this week that it would get more financial relief from the Province during COVID-19.

Premier Ford meets Mayor Meed Ward – smiles all around. The province announced yesterday they are allocating an additional $695 million to provide financial relief for municipalities and help ensure they do not carry operating deficits into 2021 as a result of the COVID-19 pandemic.

Burlington is one of 48 (out of 444 municipalities) to receive the “full” phase 2 funding allocation. The City is receiving an additional 2020 operating funding of $5.4 million, plus $1.9 million to help with 2021 COVID-related operating pressures.

This funding is in addition to $2.2 million in transit-related money provided to help with local transit pressures, which was also secured through the City’s phase 2 application through the Safe Restart program.

These funds build upon the first phase of the federal-provincial Safe Restart Funding Agreement announced this summer and will help municipalities deliver critical services during COVID-19.

The federal-provincial Safe Restart Funding Agreement is a historic partnership that secured up to $4 billion in emergency funding for Ontario’s municipalities to help them on the road to a safe recovery during the pandemic.

Tim Commisso, City Manager “… great news for our City”, said the Mayor, who added that “the Province listened to us. This additional funding will help us as we enter a difficult 2021 budget to maintain and enhance the services our residents expect, while keeping it affordable.

Tim Commisso, City Manager pointed out that “… we still have a challenging 2021 operating budget forthcoming in January, this funding is a huge relief for the city as we continue to deal with the financial impacts of this pandemic.”

By Staff By Staff

December 13, 2020

BURLINGTON, ON

Those that got the message and were aware – came out in small groups.

Families gathered on the streets with the older ones running alongside to keep up. The traffic on Twitter was heavy – so the word was being passed around.

Santa was in town – making visits to different parts of the city.

Kudos to the Parka and Recreation people for making this happen.

Use of face masks was spotty.

But people did have fun.

If a picture is worth a thousand words – here is several thousand.

A little warmer and it could have been a picnic.  That child had the best view on the street.  Santa had quite a welcoming crew on this street.

The old Ho Ho man himself  The snow man waves to Santa as he passes by.  The message that was there for everyone to read – Stay Safe – Follow the rules. Photography was done by Denis Gibbons who recently wrote a piece on how he thought the Canadian teams in the National Hockey League should be organized for the next season

Worth reading.

Gibbons on bringing the game back home.

By Pepper Parr By Pepper Parr

December 2nd, 2020

BURLINGTON, ON

The finance department is ready to take their numbers to city council and begin the process of setting the budget for 2021.

The budget consists of both an operating budget for the delivery of services to the community and a capital budget to invest in the construction and renewal of city assets and infrastructure.

An overview of the capital budget will be presented to Burlington City Council at a Corporate Services, Strategy, Risk and Accountability Committee meeting on Thursday, Dec 10 at 9:30 a.m. A livestream of the virtual meeting is available on the City’s website, along with a copy of the report being presented.

Proposed 2021 capital budget

The proposed 2021 capital budget is approximately $72.1 million, with a ten-year program of $786.4 million. From the 10-year capital program:

• 70% is focused on infrastructure renewal projects, e.g. repair, refurbishment or replacement of an existing asset to extend its useful life, in accordance with the city’s asset management plan

• 16% is for growth projects, e.g. capital to service growth in the city

• 14% is for new or enhanced projects, e.g. increases to current service levels that are not the result of growth.

A copy of the proposed 2021 capital budget will be available at burlington.ca/budget.

Impacts of COVID-19 pandemic on 2021 budget process Impacts of COVID-19 pandemic on 2021 budget process

The ongoing COVID-19 pandemic is placing considerable pressure on the city’s financial position with a forecast of over $18 million in revenue losses by the end of 2020. While a large portion of these losses are being mitigated with an on-going expenditure restraint program and support from senior levels of government, the City is projecting an unfavourable variance at year end of over $2.7 million. It is anticipated these challenges will continue to impact city finances until such time as a vaccine is developed and provincial restrictions are fully lifted.

To partially mitigate the 2021 impact of COVID-19 on the city’s operating budget, the planned increase to the city’s dedicated infrastructure renewal levy in 2021 (1.25%) has been temporarily redirected to the operating budget for one year. This will provide $2.18 million of one-time funding to offset the anticipated one-time COVID-19 impacts in 2021, reducing the amount of 2021 capital funding.

City seeking community input

Through the budget process, choices are made to ensure the appropriate balance between affordability, service levels and financial sustainability is maintained. In a challenging budget year where the city has fewer options for how to spend its money, community feedback about which services are a priority for residents is more important than ever.

To gather feedback from residents, the City will be hosting an online survey at getinvolvedburlington.ca, open from Dec. 2 to Jan. 8, 2021.

Residents can also share their ideas and thoughts at a virtual budget town hall on Wednesday, Jan. 20, from 6 to 7:30 p.m. Hosted by Mayor Marianne Meed Ward, the live event will provide residents with an opportunity to learn more and ask questions about the proposed 2021 budget. More details about the town hall, including a link to join the meeting will be available on getinvolvedburlington.ca in the coming days.

As residents continue to rediscover many of their favourite spaces and activities in the city, City services may look different as we work to stop the spread of COVID-19.

The City’s commitment to providing the community with essential services remains a priority. Sign up to learn more about Burlington at Burlington.ca/Enews and download the free City of Burlington

By Pepper Parr By Pepper Parr

September 17th, 2020

BURLINGTON, ON

The city will be short about $2.9 million with its 2019-20 budget but there is enough money in various reserve funds to get us through.

The concern is with the 2020-21 budget – assuming we are still dealing with COVID-19 – which the Mayor is certain we will be dealing with into 2022.

Director of Finance Joan Ford City Treasurer Joan Ford laid out the numbers.

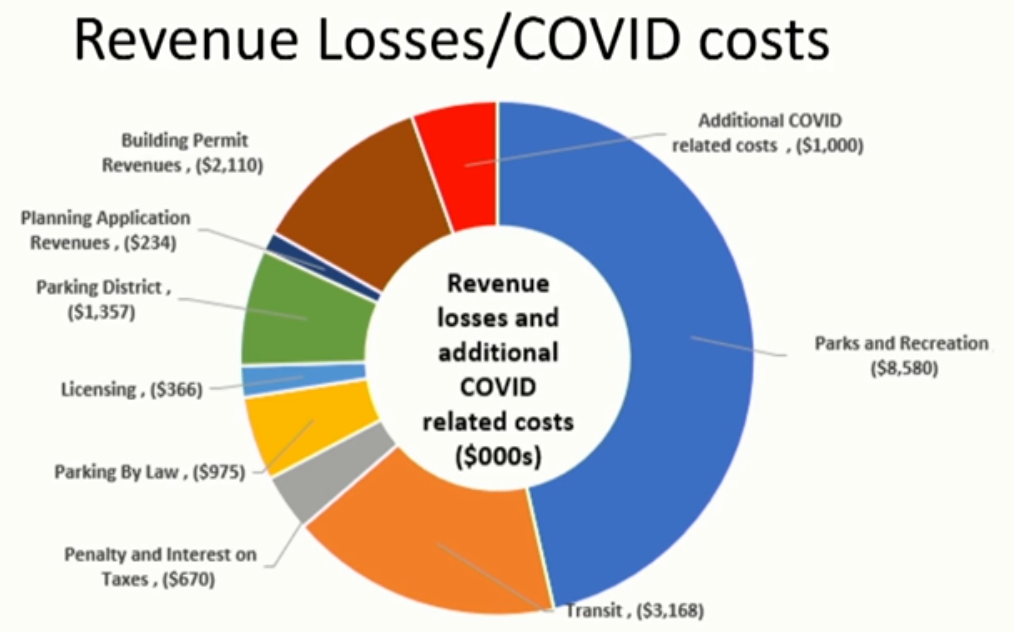

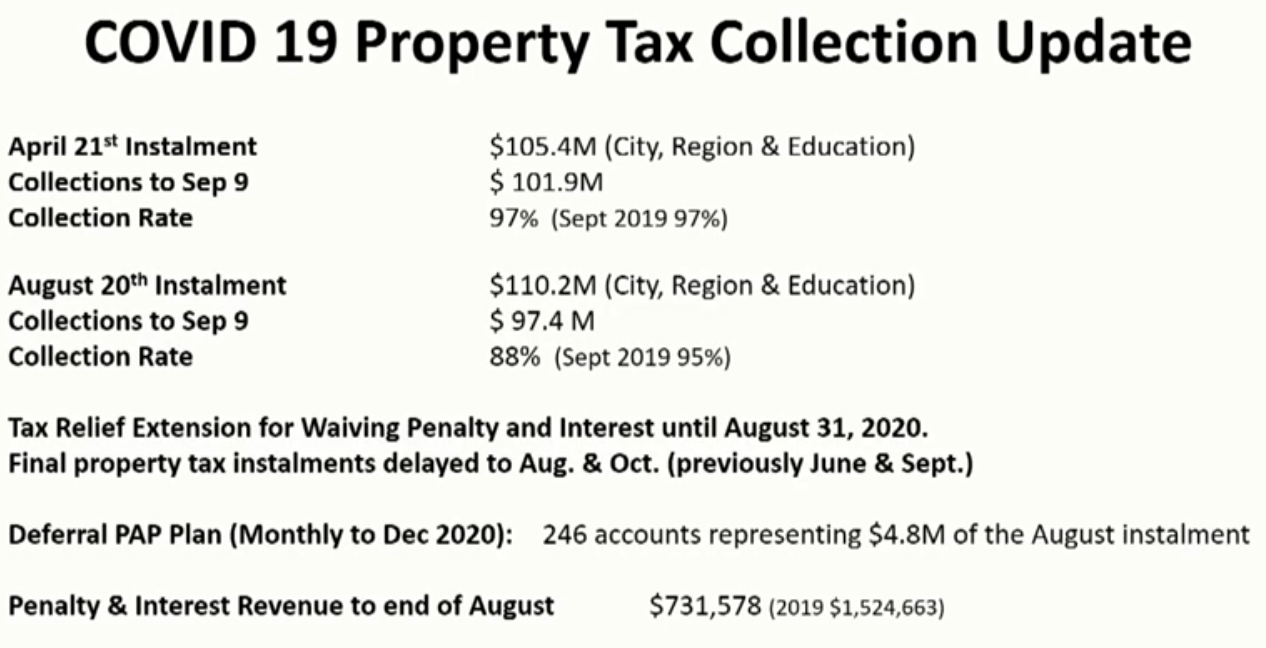

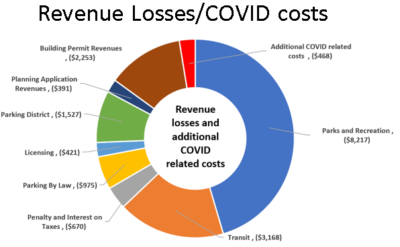

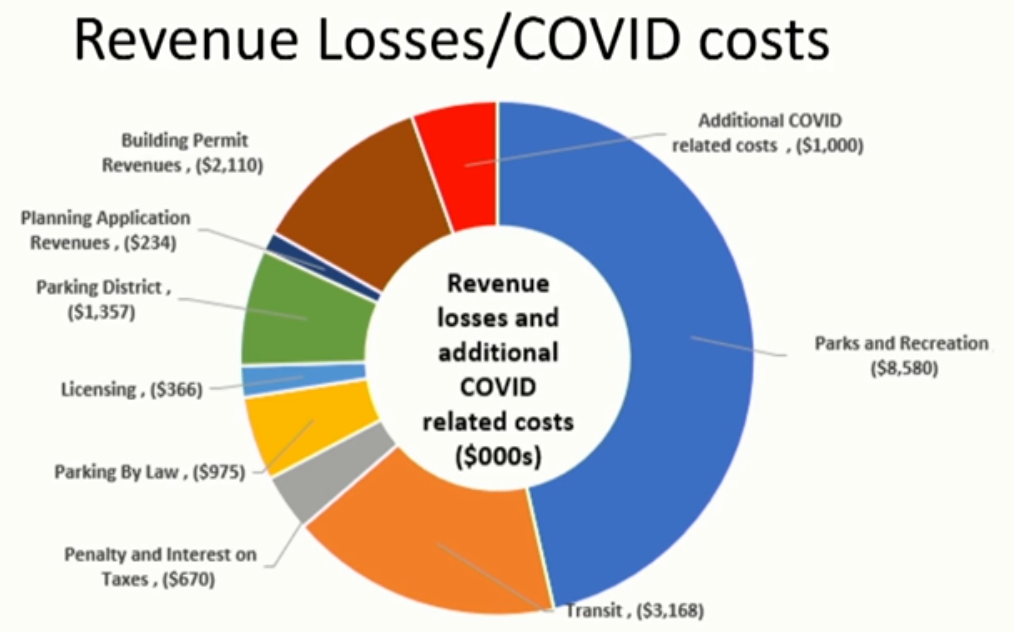

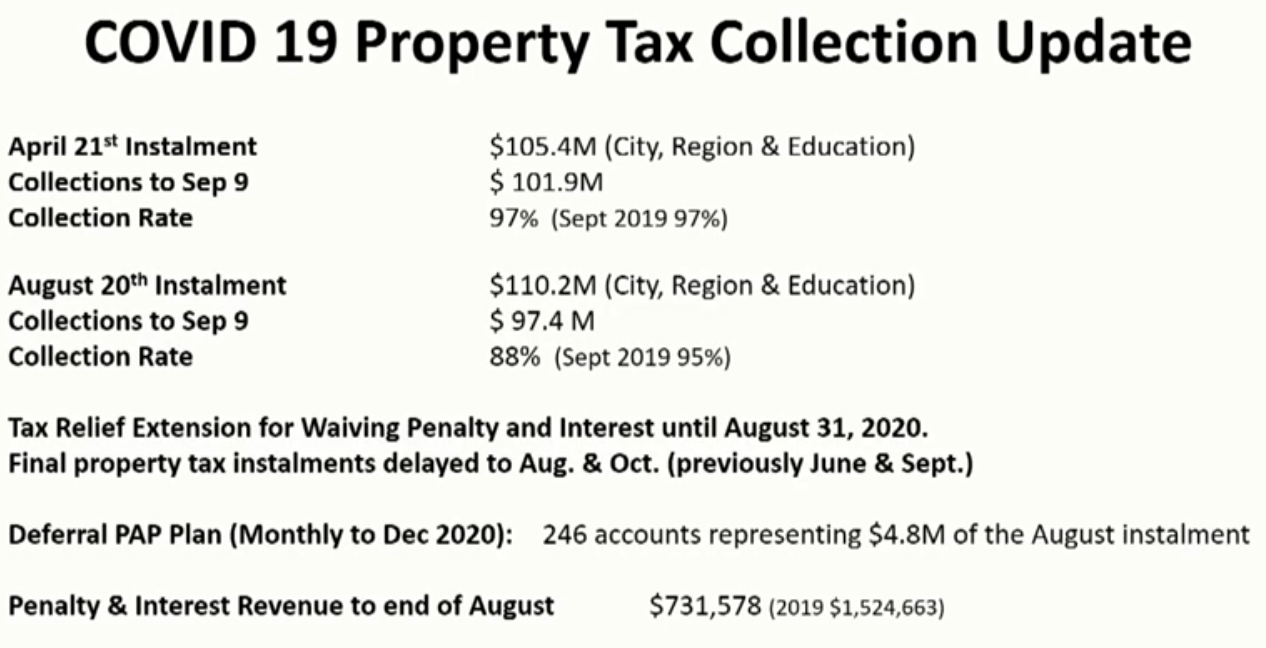

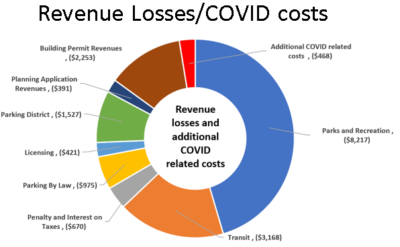

This is the money the city didn’t get.  Where the city was able to save; normal expenses that were lower and funding available from other levels of government. There was a fair amount of good news. Tax collections for the period ending in April were at 97%.

There is adequate tax revenue to meet the day-to-day costs.

On the down side, the revenue loss was $18.5 million

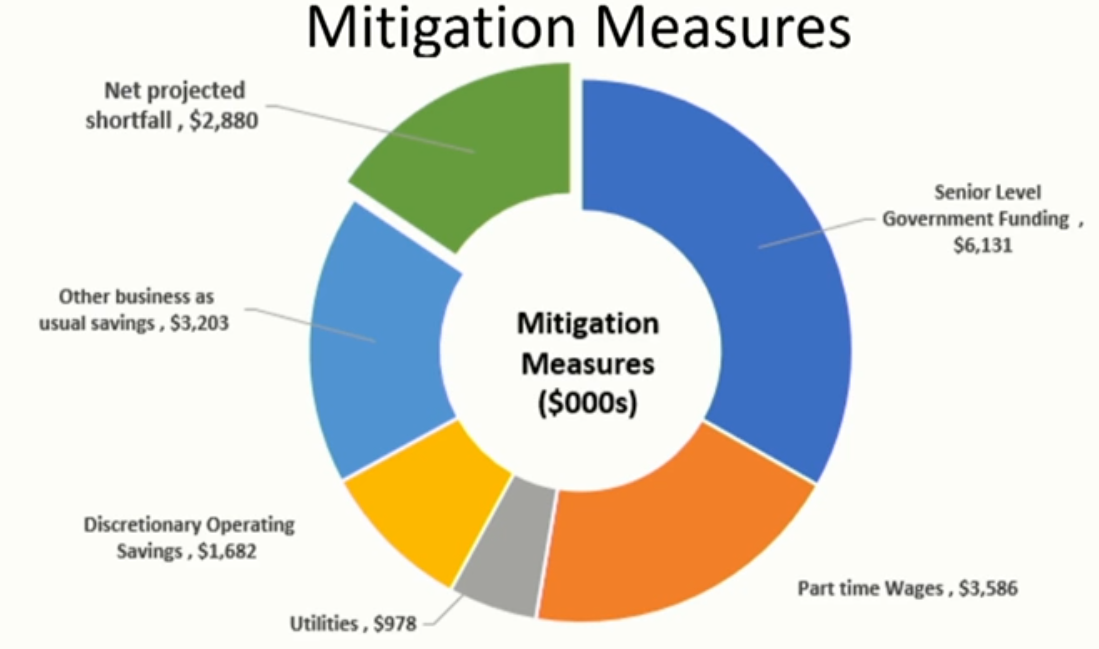

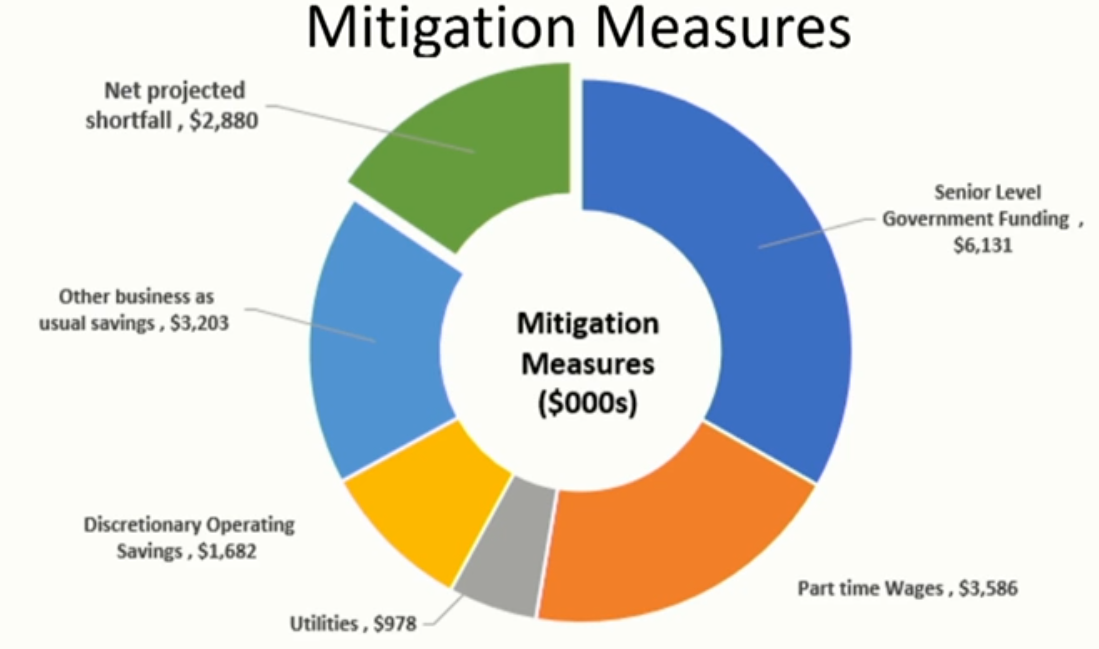

Money that didn’t have to be spent was $9.5 million leaving a balance of $9 million as the shortfall.

There was some federal money – from the Safe Start Funds – $6.1 million which got the shortfall to that $2.9 million level.

Treasurer Ford and City Manager Tim Commisso both made mention of additional funding from the federal government.

Some interesting questions were asked. Ward 6 Councillor Angelo Bentivegna wondered aloud what would happen to the malls when some (perhaps many) of the tenants turned in their keys.

Treasurer Ford explained that it is the mall corporation that is taxed – they collect from their tenants – but it is the mall that is responsible for paying the taxes.

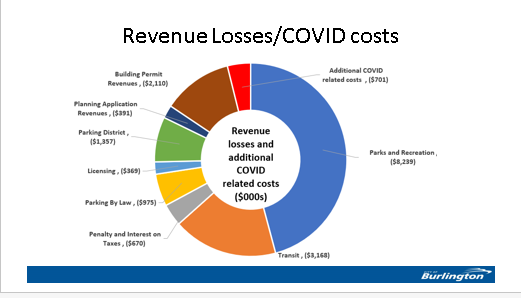

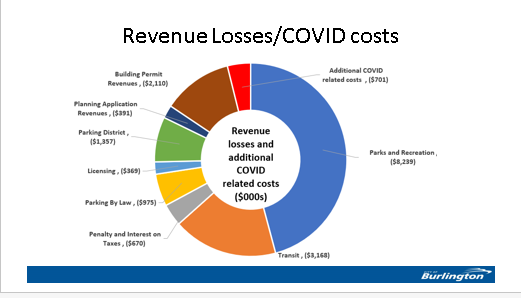

Tax collections are holding. The biggest hits to the city on the revenue side were Parks and Recreation fees that couldn’t be collected – programs had to be cancelled. Transit had a serious shortfall – ridership fell badly.

The city collects all the taxes – including the Regional tax levy and the Board of Education levy.

The city was able to hang on to those funds for a period of time. The money collected for the Boards of Education has to be paid in December. No word yet on just how much has to be paid.

By Pepper Parr By Pepper Parr

August 14th, 2020

BURLINGTON, ON

So how deep is the financial hole going to be?

The city treasurer put some numbers on the table – they don’t look all that good.

Earlier in the week the City got a big chunk of money from the federal and provincial governments. More than $4 million was to cover some of the costs of running the City.

Revenue has been low – mostly from the Parks and Recreation services the City provides.

Here is what Joan Ford, City Treasurer gave Council on Thursday.

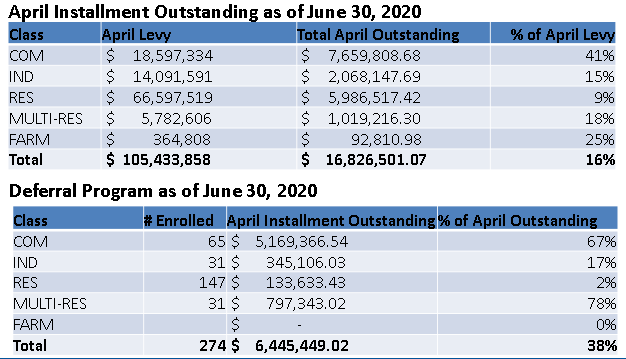

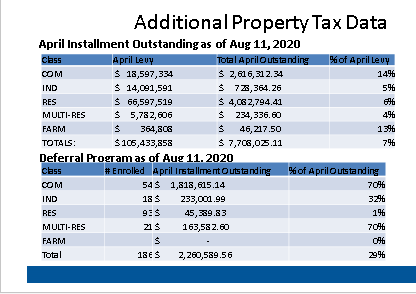

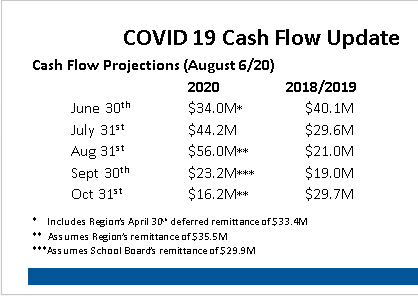

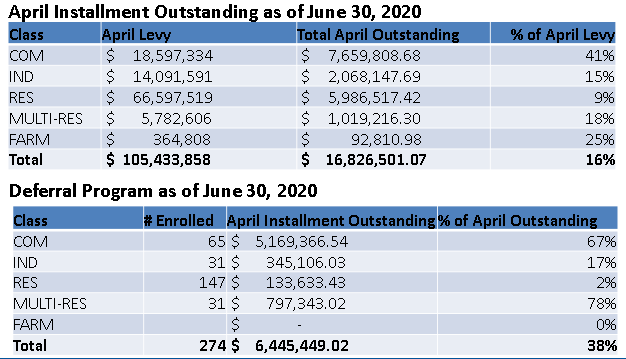

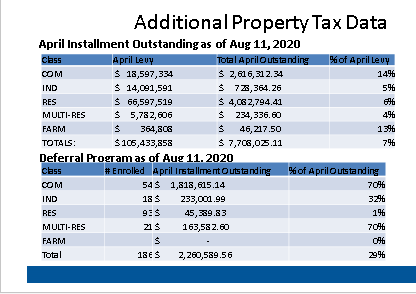

The city has been very generous on the time people have to pay their taxes. There have been deferrals on due dates – which can get a little confusing. The Table below shows what the shortfall is on the April tax levy.

There is a total of $7, 708,000 + outstanding from the April tax levy. A number of people and organizations enrolled in the Tax deferral the city put in place. That amount comes in at $2,260,000 +

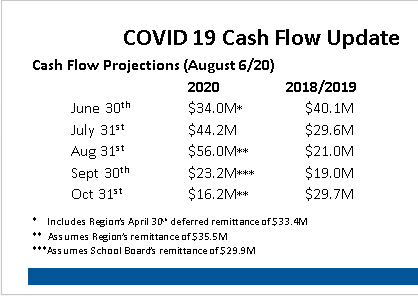

Ford set out for Council what all this was doing to cash flow. The table below shows the Cash flow projections that were in place for the 2018/2019 fiscal year and what Ford and her staff think the projection will be for 2020.

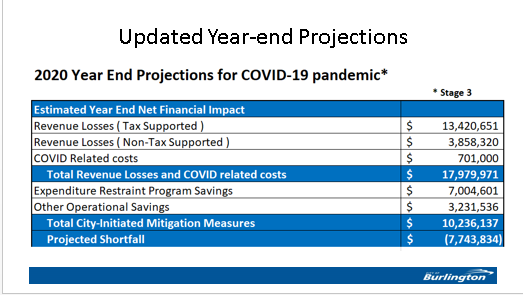

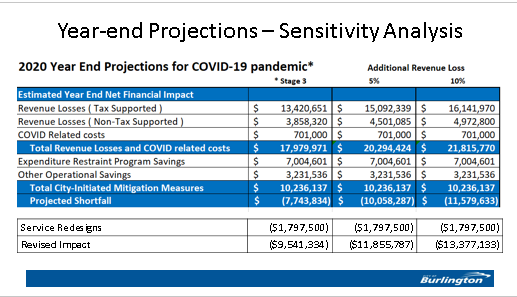

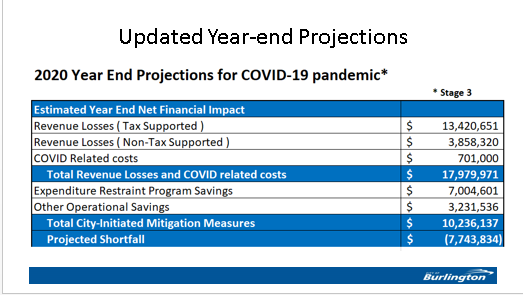

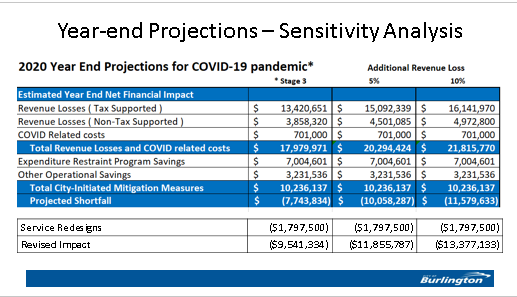

Using the data they have the Finance people set out the estimated revenue loss from tax supported and non-tax supported programs – then added to that what they expect to have to spend on COVID-19 matter. Ford told Council that to date the City has spent about $400,000 on Covid-19 tasks.

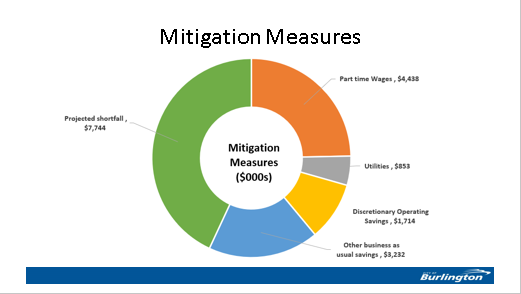

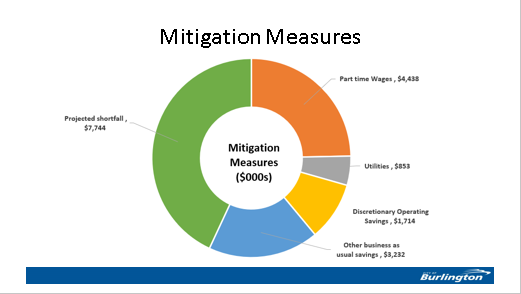

Seven million was saved on what they called “expenditure restraint”. Unless it was absolutely necessary – funds were not spent even though they were in the budget.

That still leaves a shortfall of $7,743,834.

Standing back from the detail and looking at the bigger picture – where is the pain? Parks and Recreation. Transit, the orange marker wasn’t as deep but substantial nevertheless The service was offered free of charge. That changes in September but at this point the transit people have no idea what revenue might look like.

The Parks and Recreation revenue losses were a surprise.

The city let all the part time people go shortly after the Emergency legislation was passed. Discretionary spending was cut and almost $3.2 million was saved in other “Business as Usual” expenses.

There is only so much that can be squeezed out of a budget. Also there are found expenses that occur the moment you turn the lights on.

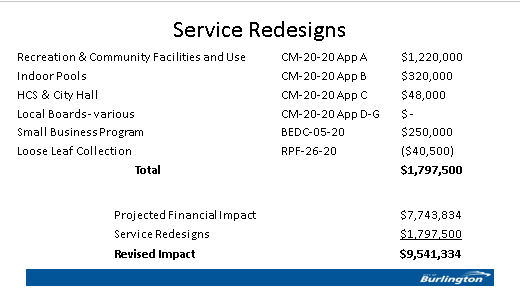

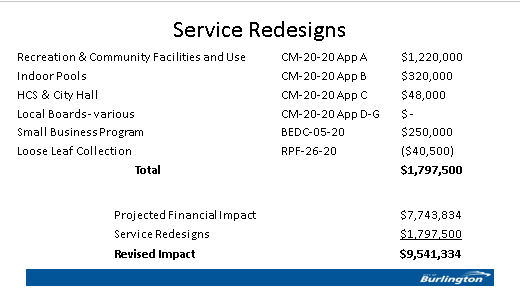

There is a very bright and tough minded crew of people who look at the services that are provided and ask: How can we redesign this service so that the public gets what they expect and we can be more efficient.

The most recent re-design resulted in an additional $1.7 (almost $1.8) million being added. Some savings with leaf collection – always a contentious issue in Burlington – were made.

That now has the shortfall at $9,541 + million.

Getting a handle on the damage COVID-19 is doing to the City’s finances in a situation that is both dynamic and fluid leaves the city with what cannot be described as a pretty picture.

The finance people know that things will not remain the same – normal is no longer a state of affairs that can be seen as certain.

The Finance department did a sensitivity analysis. Starting with what they see happening now that we are into Stage 3 they looked forward and did a calculation based on an additional 5% revenue loss and then a 10% revenue loss.

Those numbers are set out below.

Members of City Council need now to take those projections to bed with them and think long and hard: Are they ready to tell the public that there is going to be a $13 million revenue loss. If they have to make that kind of a statement they had better have some solutions and not just assume that a tax hike will cover that off.

City Council might be approaching that point of desperation that many in the commercial, especially the hospitality sector, are experiencing. City’s cannot go bankrupt nor can they run a deficit. Should they reach that point the province sends in regulators who take over. That’s when a staff reduction is given a hard close look.

By Staff By Staff

August 13th, 2020

BURLINGTON, ON

City Council does have to come up with a budget before the end of the year.

The Province of Ontario announced as part of the federal-provincial Safe Restart Agreement that the City of Burlington will receive $4,470,700 to support municipal operating pressures for Phase 1 and Burlington Transit will receive $1,571,213 to support municipal transit systems for Phase 1.

Joan Ford, the city’s Director of Finance doesn’t have to worry as much about where the money to pay the bills is going to come from. Senior City staff will be presenting the monthly COVID-19 verbal update to the Corporate Services, Strategy, Risk and Accountability Committee Meeting on Thursday.

At the last monthly update to Burlington City Council on July 9, the City was estimating revenue losses of $18 million. The City was able to mitigate $9.9 million for a projected year end shortfall of $8.1 million before needing to draw from reserve funds.

If memory serves us correctly the shortfall was in the $4 million range

Municipalities will be provided with up to $1.6 billion as part of the first round of emergency funding under the Safe Restart Agreement.

This funding will help municipalities like Burlington protect the health and well-being of residents, while continuing to deliver critical public services to our community and assist with economic recovery.

Through the Safe Restart Agreement with the federal government, $695 million will help municipalities address operating pressures related to the COVID-19 pandemic through the first round of emergency funding, and over $660 million will support transit systems. The province is also providing an additional $212 million through the Social Services Relief Fund to help vulnerable people find shelter.

There will be money for the transit service – will there be passengers willing to ride the buses – especially if they are crowded. In addition to the support for municipalities, the government is providing over $660 million in the first phase of transit funding to the 110 municipalities with transit systems. The funding can be used to provide immediate relief from transit pressures, such as lower ridership, as well as for new costs due to COVID-19, such as enhanced cleaning and masks for staff.

In the second phase, additional allocations will be provided based on expenses incurred to ensure the funding meets the needs of municipalities. As part of the Safe Restart Agreement with the federal government, up to $2 billion is being provided to support public transit in Ontario.

Mayor Marianne Meed Ward said: “This is exactly the support we need from our upper levels of government to continue to provide the services our residents need, in the midst of COVID-19. Today’s funding announcement for Burlington will allow us to continue to serve our community without service cuts, unacceptable tax increases or depleting reserves.

By Staff By Staff

July 23rd, 2020

BURLINGTON, ON

Earlier this month the Regional government announced that it was going to aim for a budget increase for the 2020-2021 budget of not more than 2%

The 2021 Budget Directions Report provides guidelines to staff to maintain existing service levels for Regional programs with identified pressures, including COVID-19.

Regional Chair Gary Carr at an event in Burlington Regional Chair Gary Carr said: “The 2021 Budget Directions Report is an important step in our budget development process as it lays the foundation for our next Budget and Business Plan. Throughout COVID-19, there has been a number of uncertainties, but this Report provides guidelines that help us maintain our strong financial position, keep property taxes low and continue to support residents and businesses in our community as we recover from the pandemic.”

This Report guides the Region’s investments in 2021 to ensure resident access to essential services and supports critical program enhancements and financing plans to address community growth. It also ensures that Halton’s upcoming Budget will align with strategic themes, objectives and outcomes outlined in the 2019–2022 Strategic Business Plan.

Financial pressures related to the COVID-19 pandemic are also identified in the Report. Regional staff continue to closely monitor these pressures in coordination with the Region’s projected recovery plan, to identify any anticipated impacts that may extend to 2021. This will continue the Region’s history of addressing program pressures, reallocating resources to priority areas and maintaining service levels while maintaining tax rate increases at or below the rate of inflation.

Some of Halton’s budget priorities for 2021 include:

Public Health: maintaining service levels while continuing to respond to COVID-19.

Paramedic Services: addressing increased costs associated with inflation, rising call volumes, maintaining response times, population and other growth pressures.

Children’s Services: maintaining service levels following reductions in Provincial funding and uncertainty around funding levels for 2021.

Indigenous initiative, inclusion and diversity: creating an initiative with an Indigenous consultant that will support a comprehensive response to the Federal Truth and Reconciliation Commission’s 94 Calls to Action and the report of the National Inquiry into Missing and Murdered Indigenous Women and Girls.

Climate change emergency: continuing to make corporate operations as carbon neutral as possible, using land use and transportation planning to design climate friendly communities, designing and building climate resilient infrastructure, and planning to respond to weather related events and other emergencies.

Community safety and well-being: continuing to deliver the objectives of the Community Safety and Well-Being Plan (CSWB) in collaboration with community partners on a wide range of issues to support residents who are vulnerable to negative social, economic or health outcomes.

Skyway Waste Water Treatment plant in the Beachway. Waste Management: continued planning and implementation for the short-term options recommended in the Solid Waste Management Strategy, and planning for the transition of the Blue Box program to full Producer responsibility with integration into the medium and long-term strategy options of the recommended final Solid Waste Management Strategy.

Transportation: investment to support increased costs associated with road maintenance, the road resurfacing program, and in the state-of-good-repair for existing roads and expansion to accommodate growth.

Growth of the water and wastewater system: support for costs associated with upgrades and treatment plant expansions, further improvements to levels of treatment and new and expanded pumping stations.

Burlington experienced flash floods in 2014 – managing these natural events is an expensive challenge. Basement flooding mitigation: continuation of the Region-wide Basement Flooding Mitigation Program to help prevent basement flooding caused by severe weather.

Water and Wastewater state-of-good-repair: continuing to invest in the state-of-good-repair program to maintain the condition of assets as infrastructure ages and expands due to growth.

Staff will continue to focus on core services, ongoing improvement and finding efficiencies across all program areas to achieve these targets.

The 2021 Council Budget Meeting is scheduled for December 9, 2020, and the 2021 Budget and Business Plan is scheduled to be considered for approval by Regional Council on December 16, 2020.

Two percent eh! The proof will be in the pudding

By Pepper Parr By Pepper Parr

July 13, 2020

BURLINGTON, ON

Tax due dates are be made a little longer, there are deferrals, and there is tax money that is just not coming in

On the other side of the ledger the expenses are not as high. All the part time people were laid off, there was no transit money coming in nor was there much revenue on the Parks and Recreation side

The books were pretty messy.

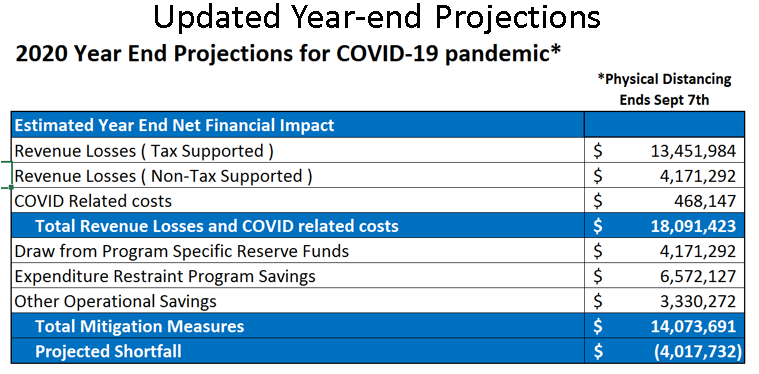

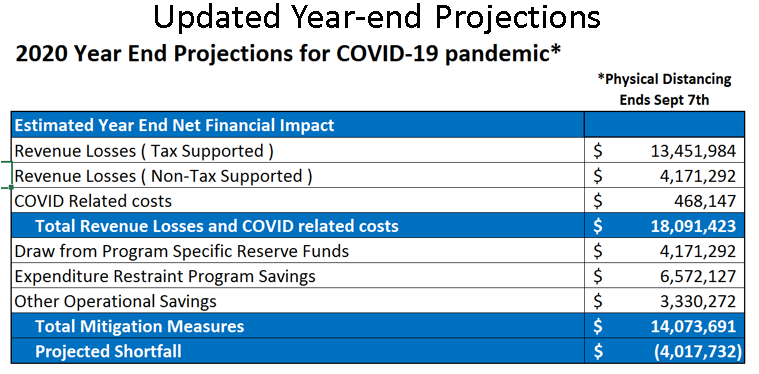

Treasurer Joan Ford prepared a presentation for a Standing Committee lat week and put two critical numbers forward. $18,091,423.00 and $4,017,732.00

The eighteen million is the total revenue losses and COVID related costs.

The four million is what the Treasurer expects to see as the shortfall – money the city will not have to to pay its bills.

Somehow Mayor Marianne Meed Ward convinced herself that the city was $18 million in the hole. She called it the “delta”.

There was also an Expenditure Restraint amount of $6,572,127 and Other operational savings of $3,330,272.

When these two are added to the withdrawals from Program Specific Reserve funds the shortfall of $4,017,732 which the Finance people are confident can be made up by withdrawing from other reserve funds.

This graph sets out where the revenue didn’t come from.  Treasurer Joan Ford did point out that treasurers are usually comfortable with total reserves of 15% – those total reserves are now at the 9% level. They are going to have to be built back up at some point. Treasurer Joan Ford did point out that treasurers are usually comfortable with total reserves of 15% – those total reserves are now at the 9% level. They are going to have to be built back up at some point.

The general message was that while things are tight – the city feels that they will come though the COVID pandemic with some change in their pockets.

Property tax collection did take a hit – some of the larger properties were either not able to pay their taxes the way they had in the past, several took advantage of the deferral program.

Many of the smaller businesses just didn’t have the cash flow. Burlington has always followed a lenient approach to the collection of taxes – they bend over backwards to help a property owner get their taxes paid. Treasurer Joan Ford told Council that in al her years wit the city they have only had to force the sale of a piece of property because the taxes were not paid.

Data on the property tax collection level. That assumes that things do not get worse – and with the current COVID situation – they just don’t know where things will be in 60 days.

The Treasury people have worked both long and hard and very creatively to keep the financial situation quite stable.

|

|

By Pepper Parr

By Pepper Parr

Everyone needs a break – the Gazette will get up bright and early on Wednesday and report on what they did get done.

Everyone needs a break – the Gazette will get up bright and early on Wednesday and report on what they did get done.

Direct the Chief Financial Officer to provide a list of 2021 budget reduction items for Council’s consideration that could decrease the overall proposed tax impact (city, region, education) from 2.88% to 2.43% (representing a city tax increase of 3.99%) with the list being provided to members of Council by February 1, 2021 and included for public reporting as part of the February 23, 2021 Corporate Services, Strategy, Risk & Accountability Committee -Operating Budget Review and Approval.

Direct the Chief Financial Officer to provide a list of 2021 budget reduction items for Council’s consideration that could decrease the overall proposed tax impact (city, region, education) from 2.88% to 2.43% (representing a city tax increase of 3.99%) with the list being provided to members of Council by February 1, 2021 and included for public reporting as part of the February 23, 2021 Corporate Services, Strategy, Risk & Accountability Committee -Operating Budget Review and Approval.

Impacts of COVID-19 pandemic on 2021 budget process

Impacts of COVID-19 pandemic on 2021 budget process

Treasurer Joan Ford did point out that treasurers are usually comfortable with total reserves of 15% – those total reserves are now at the 9% level. They are going to have to be built back up at some point.

Treasurer Joan Ford did point out that treasurers are usually comfortable with total reserves of 15% – those total reserves are now at the 9% level. They are going to have to be built back up at some point.