By Staff By Staff

July 14th, 2016

BURLINGTON, ON

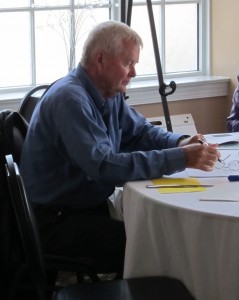

Jim Young, a 34-year resident of Burlington is an active member of Burlington Seniors Advisory Committee; he represent them on the Integrated Transportation Advisory. Young was delegating on an issue that he is passionate about – how seniors get around the city.

Jim Young – thinks the city should consider letting seniors use buses free during off peak hours. Council was listening to people who had thoughts on the cycling lanes that city is considering putting in on various parts of New Street.

“I delegate today” said Young “as a private citizen to offer my private thoughts on the issue at hand.”

“You will understand that for many seniors cycling is not an immediate or pressing issue, (for some of us walkability is challenging enough) though for many seniors it is a hobby that we would love to practice in the healthiest and safest manner available to us. To that end I believe most citizens are generally supportive of the concept, that moving forward, the City must look to promoting cycling as a viable transportation alternative that must be encouraged and accommodated safely, in line with its strategic plan as a ”City that Moves”.

“I would however ask that any accommodation for safer cycling be considered in a way that does not impede or reduce improvements to transit services. Transit is the mode of transport which, by the nature of aging and economic necessity, is probably more the transport mode of the future for seniors in Burlington than cycling.

“So when council comes to weigh the alternatives for bicycle lanes on New Street and the relatively high costs of some of them I would ask you to consider these two thoughts:

Accommodating the sixty cyclists identified in the New Street study for approximately ¾ of the year will cost between $121,000.00 and $4,950,000.00 depending on the alternative chosen. The staff recommended alternative is estimated at $210,000.00.

If you have not already received it, council will very soon be asked to consider a position paper from one of your citizen’s advisory committees titled “Improving Transit for Seniors Improves Transit for Everybody”.

Transit advocate would like the city to let seniors use the service free during off peak hours. “I have worked with many of you” said Young as he addressed members of council “and city management as well preparing the paper that will recommend free transit for seniors during off peak hours between 10.00 am and 3.00 pm, Monday to Friday. The cost for this will be between $48,500.00 and $72,750.00 per year.

Young added that “even Keith Spicer, Director of Transit, will, when his arm is twisted, agree it will probably cost less than $100,000.00. to provide this service.”

“I respectfully submit that as you consider allocating considerable sums of money to make 60 New Street cyclists happy for two thirds of the year that you consider what allocating a fraction of that money to free transit for seniors in off peak hours would do to making 35,000 Burlington seniors happy on every street all year round. (The $4.95 million option would provide free transit for the next 65 years.)”

It was at this point that Committee chairman Rick Craven, councilor for Ward 1, interrupted Young and asked that he no stray too far from the purpose of the meeting – which was cycling lanes.

Related news stories and comment:

Council couldn’t find a majority for free senior’s transit.

Citizen proposes free use of transit service for seniors during off peak hours.

By Pepper Parr By Pepper Parr

March 31, 2016

BURLINGTON, ON

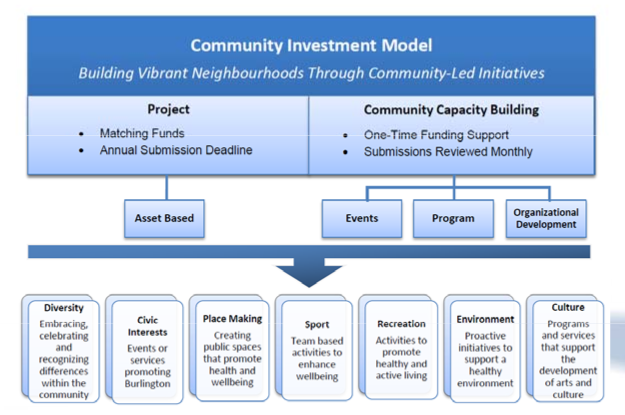

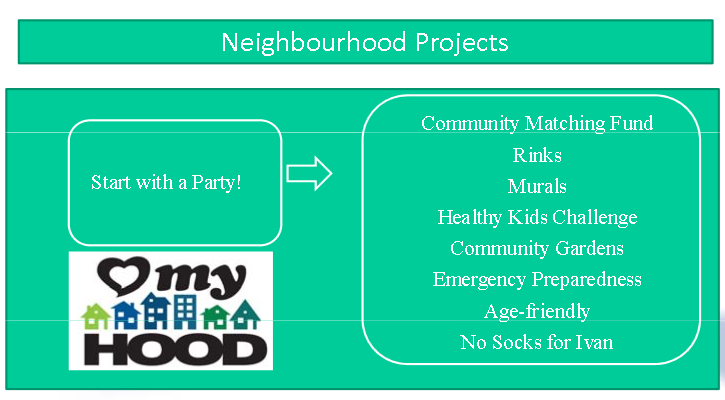

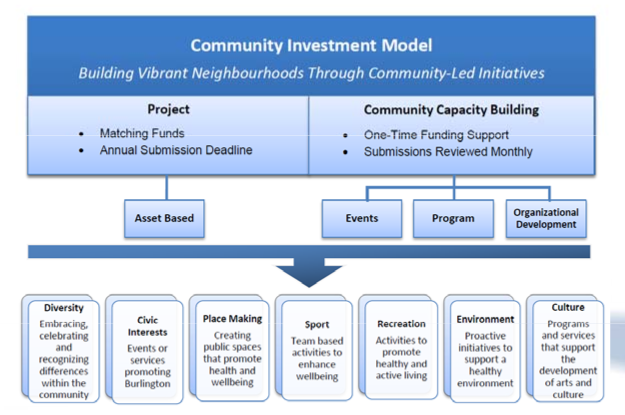

How do you build community? Doesn’t it just happen naturally? Apparently not – the city has adopted a policy that is intended to help people organize events that will pull people together for a common cause.

A house fire will always get everyone out on the street to watch the fire fighters – figuring out how to come up with something less extreme has resulted in what Burlington is calling a Community Investment Policy that provides funding for the holding of events.

In language that only a bureaucrat could write – here is that policy.

Purpose

Establish the principles and practices around how the City of Burlington will invest in our community.

Statement

The City of Burlington, (“City,”) believes that residents want to contribute to the quality of life in Burlington.

Residents have great ideas about how to create both vibrant neighbourhoods and/or communities and may require support from the City for implementation of initiatives.

The City provides support for these initiatives with one-time funding for events, programs or projects that build community capacity:

• To a registered not-for-profit corporation or a group of neighbours

• For areas within the geographic boundaries of the City of Burlington

• For projects, events and activities that occurs on City of Burlington property

• Program and services that benefit the residents of the City of Burlington and

• Organizations that do not receive any other financial support from the City of Burlington

Scope: Scope:

This policy applies to not-for-profit groups or a group of neighbours that use City owned and managed property for the benefit of residents of the City and happens within the geographic boundaries of the City.

This policy does not include boards and agencies of the City, school board property, Halton Conversation lands or lands of the Region of Halton or organizations that currently receive funding from the City of Burlington.

Definitions

Corporation Refers to the Corporation of the City of Burlington.

Community Capacity Building A process that strengthens the relevance, responsiveness, effectiveness and resilience of organizations. For example, an event, a training session, a promotion campaign.

Community A group of people bound by common beliefs, values or interests, ethnicity or place of origin, geography or other self- identified commonality.

Events A one-off single activity, occurrence or celebration typically taking place over a concentrated period of time, such as a few hours.

Not-for-Profit Is a corporation that has articles of incorporation establishing the organization as a not-for-profit corporation

One-time funding Lump sum funding or funding that is phased out over a period no longer than three years.

The community can only apply every five years for Community Investment Funding.

Programs Refers to regularly scheduled activities (minimum once per week and 4 repetitions) of a recreational, sport, leadership development, art and cultural nature as defined by the departments Leisure Services Policy (e.g. structured programs, community leagues, camps).

Principles

The following principles are taken into consideration when investing in the community:

1. Community members want to contribute to their quality of life.

2. Community members have great ideas on how to enhance their quality of life in the public realm.

3. Community groups can be informal or organized (e.g. a group of neighbours on a street or a legally incorporated not-for-profit organization).

4. Community groups sometimes need financial assistance to launch a program, project or event and the City agrees to support with one-time funding, provided that the group is not receiving any other financial assistance from the City.

5. A community group can only receive funds once every five years.

6. The funding program (approvals, amounts) will be at the discretion of the Manager of Community Development Services as identified in the policy.

EXCLUSIONS EXCLUSIONS

• Properties governed under another body, agency or business (e.g. school board, board or agency)

• Private Property

• Individuals

• On-going financial support such as operating grants

• Organizations whose purpose is related to political or religious activity

• For-profit organizations

• Foundations

• Schools, hospitals and public agencies

• An activity or project that conflicts with existing City policy

Annual fundraising events/projects

• Organizations or groups of individuals organizing an event, program, project or activity that is in furtherance of a position either for or against an issue over which the City is a regulator or may have a legal interest

• An event, program, project or activity that conflicts with City policies, Council decisions or directions

Policy Guidelines

There are two streams for funding

Community Capacity Building Projects*

Application Period Accepted at any time Accepted once a year

Review Team Community Development Section with subject matter experts as required Cross department team to review feasibility of the proposal. May evolve to include community members as neighbourhood committees are developed

Review Period Once per month Three months

Criteria for Review

• Completeness of the application including organization/event budget

• Meets the eligibility criteria requirements

• Demonstrates need

• Linkage with the City’s strategic plan • Completeness of the application

• Meets the eligibility criteria requirements

• Linkage with the City’s strategic plan

• Will provide a public benefit

• Demonstrated community interest

• Feasibility

• Demonstrates on-going maintenance and upkeep

• Ability of the community match the financial contribution from the City

• Realistic budget

Implementation Project must be completed within one year. Project must be completed within one year of the contract

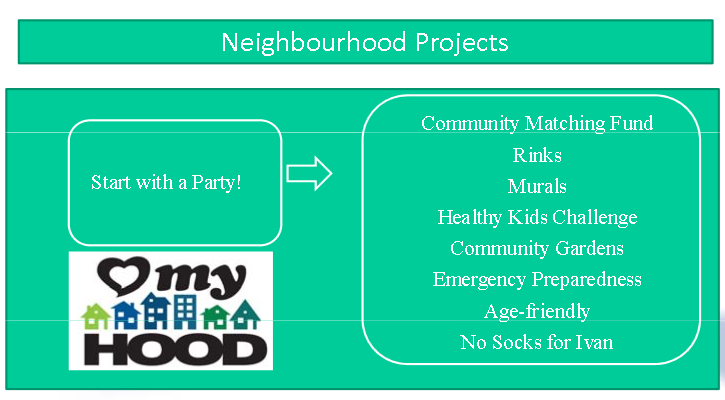

In the setting of the 2016 budget city council did approve funding for the project. There have been about 15 – maybe 20 projects.

Next week we will write about several of those projects and get some sense of what works and what doesn’t work from a citizen’s point of view. The funding allocation for neighbourhood projects is set at $300 which some people feel isn’t quite enough.

Denise Beard, Manager, Community Development Services, has a target of having 150 projects on the go in the city during 2017 – the year that Canada celebrates its sesquicentennial – this country came into being 150 years ago.

It is a brave target – let’s see how it works!

By Ray Rivers By Ray Rivers

March 25, 2016

BURLINGTON, ON

If you want to make money, you have to spend money. And that pretty well sums up the 2016 federal budget – it’s about re-investing in Canada and Canadians. Hardly revolutionary, this economic plan is corrective and moderate in its measures – a first step in the right direction.

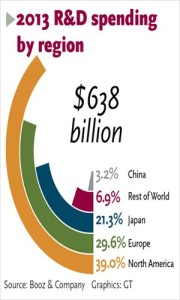

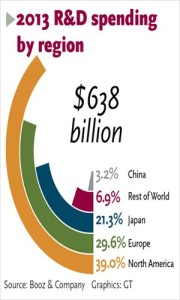

While outdated the graphic does show the impact research and development spending has on an economy. There is investment in transportation infrastructure, something which will improve our productivity, particularly in built-up areas like the GTA. There is some modest spending to improve access to education, particularly for the underprivileged. And there is a huge push to restore levels of R&D, innovation and science, which had been allowed to lapse over the last decade.

Changes to the income tax code, already in the works, modestly favour the middle class over the wealthy. This is more than an attempt to arrest and correct the growing spread between the rich and the poor; this is sound economic policy. It’s called the marginal propensity to consume – redistributing income from the wealthy increases domestic spending, driving consumption and investment, and consequently economic growth.

There is no question of the social dimension of this budget, which invests heavily in people, particularly the disadvantaged. Veterans complaints about neglect are addressed. More child care money will be going to the lower income parents who really need it. Canada’s first nations are given the opportunity to catch up to the rest of us. And age of seniority has been rolled back to 65, at the same time as greater assistance is provided to those seniors in need.

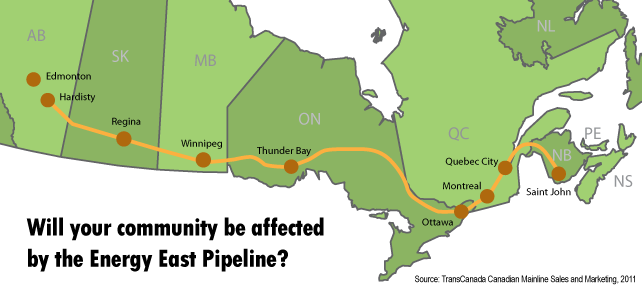

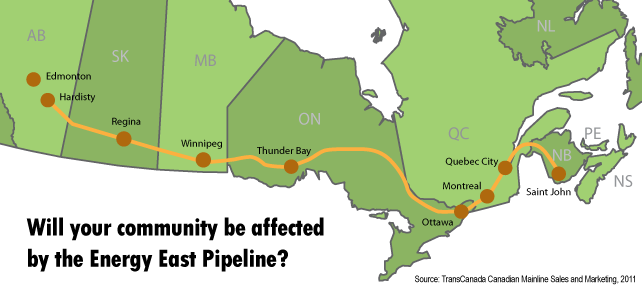

Perhaps the bigger questions is – will the country be affected by the pipeline? There is investment in the environment as well. So we’ll see our national environment assessment process restored. Ironically that might expedite the construction of the Energy-East pipeline, as that is a precondition for Quebec’s consent. And the Prime Minister has solidified his commitment to put climate change money on the table to help motivate Canada’s Premiers to action.

The price tag for this budget comes in at just below the thirty billion deficit that everyone was expecting. The largely muted response to the size of the deficit is the result of a government which has shown its ability to manage expectations, and, of course, the promises made during the last election. Only the interim leader of yesterday’s government couldn’t resist the temptation to dump on the budget.

30 Billion dollars is a lot of money, but even after another four years of deficit, Canada will still have the lowest debt-to-GDP ratio in the G7, and half the level of the US or the UK. Moreover, if the annual deficit projections in the budget bear out, relative debt levels will shadow the debt performance of the preceding government, making Ms. Ambrose’s complaint at best a case of the pot calling the kettle…

And not everyone will benefit from this package. New toys for the military are on the back burner, reflecting a lower immediate priority. There could have been more income re-distribution, even greater support for our cultural industries and a faster path for infrastructure development. But you can’t do everything. We also know that more money will still be needed for a new national health care charter and enhancements to the Canada Pension Plan, initiatives on a different timetable.

There are thousands of small solar panel installations like this across the province – they work very well and in many cases provide revenue for the owners. The budget represents a necessary investment to return Canada to a more balanced, engaging and innovative economy. The fossil fuel era has itself becoming fossilized. Coal has left the station and oil is following suit, being replaced everywhere by renewable energy. Those were yesterday’s ideas promoted by yesterday’s short-sighted leaders.

Canada’s future lies in its potential as a balanced diverse economy. Its strength lies more with our human than with our natural resources. This budget helps us move in that direction by promoting education, science, industry and clean energy. If you get stuck in the past you’ll miss the future.

Ray Rivers writes weekly on both federal and provincial politics, applying his more than 25 years as a federal bureaucrat to his thinking. Rivers was a candidate for provincial office in Burlington where he ran as a Liberal against Cam Jackson in 1995, the year Mike Harris and the Common Sense Revolution swept the province. Rivers is no longer active with any political party.

Background links:

2016 Budget in Full

Highlights

Deficit

More Deficit

Criticism

More Criticism

Analysis

An Easy Sell –

By Pepper Parr By Pepper Parr

March 22nd, 2016

BURLINGTON, ON

The Burlington Economic Development Corporation (BEDC) created a 10 year Economic Vision that is a foundational part of the strategic plan the city approved at the standing committee level last night.

The economic visions acts as both a standalone economic strategy which outlines in detail the vision for Burlington’s economy and will also be fully integrated into the City of Burlington 2015 Strategic Plan.

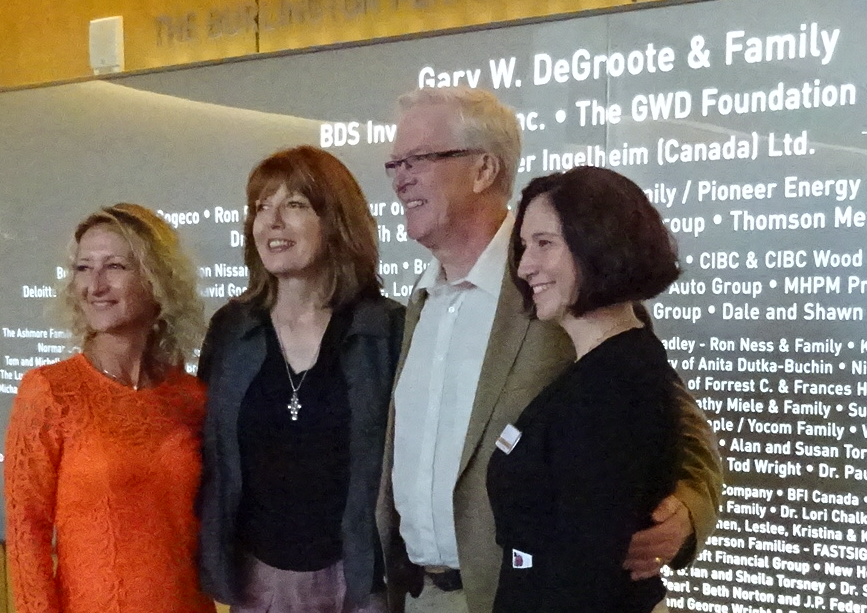

From the left: JCBourne and Norm McDonald of consultants KPMG, Frank McKeown, BEDC Executive Director, Councillor Paul Sharman, Andrea smith, Official Plan review manager and Councillor Blair Lancaster at a strategic Plan review meeting. Burlington Vision 2025 will allow the business community to better understand the economic situation in Burlington and its position in the changing global economy, create a clear direction for economic growth in Burlington, help to address the economic pressures and trends in the region and act as the roadmap to economic prosperity in Burlington. The result will be a focused economic strategy that illustrates our short and long term objectives and identifies the strategies that will allow us to achieve them.

The development of Vision 2025 was founded on two core principles:

Understanding our current situation through data analysis and

Engaging stakeholders to create a common vision that can be achieved in partnership.

An extensive baseline analysis and stakeholder engagement process was undertaken to support these objectives which engaged over 300 stakeholders through a combination of interviews, surveys and workshops. This process was overseen by the Economic Vision Advisory Committee composed of 19 stakeholders who met regularly throughout the development of Burlington Vision 2025 to review work completed and develop draft directions for the economic vision. The results of this work is set out in separate reports:

Burlington Base Analysis

Burlington Key Sector Analysis

Burlington Infrastructure & Employment Lands Analysis

Burlington Competitive Analysis

Burlington SWOT Analysis

Online Survey Summary Report

Stakeholder Interview Summary Report

Burlington Rural Strategy Background Document

These resulted in the following five Strategic Pillars and 2 Economic Enablers for Burlington Vision 2025:

Strategic Pillars

Development & Intensification of Employment Lands

Vibrant, Diverse & Growing Community

Fostering Business Growth, Investment, Innovation & Entrepreneurship

Integrated Transportation & Increased Connectivity

Developing a Unique & Dynamic Brand for the City of Burlington

Economic Enablers:

Infrastructure Planning by all Regulatory Bodies

Intergovernmental Alignment

From the left: Frank McKeown with Councillor Paul Sharman during the first creation of a Strategic Plan in 2011 BEDC Executive Director Frank McKeown was happy to see the city getting away from a brand that had defined the city as age friendly with one of the larger serniors population in the province and the largest in the Region. He wanted to see the city’s brand focused on vibrancy, innovation and growth. He added that “we have to become better at redevelopment because there is precious little greenfield development left.

McKeown said he has found that the city has a very strong working relationship with Hamilton; one that is much stronger than the one with Oakville or Milton. He hopes to create stronger bonds between both McMaster University and Mohawk College.

McKeown said he hoped council was inspired by the document and that he hopd as well that staff wouild feel inspired as well.

“We need to be more innovative” he said “and we need to attract talent to make this happen. Council has to be part of the talent attraction team.”

The success of this plan will not be seen just at city hall – it will be seen in the commercial community and that success will attract more successes.”

Frank McKeown told city council last night that he supports the Strategic Plan and pointed out that the hard part now begins” You have to execute on the plan you are about to make policy for the city.” He added that less than 10% of most Strategic Plans get properly executed.

By Pepper Parr By Pepper Parr

January 29th, 2016

BURLINGTON, ON

He is getting better as a speaker; one of his council colleagues suggested he was getting some training.

Another council colleague said “he went on to long”.

Ok – but what did he say?

There were no “announcements” – he just ran through the things that had been done, mentioned several of the senior staff additions and got one decent joke in.

There wasn’t a standing ovation.

Business people know that problems like this need a resolution – all they heard on Thursday was that more money was going to be thrown at it. The Mayor made very small mention of a possible storm water tax levy – his audience was a combination of senior city hall staff and business people.

Intensification got several paragraphs. If we understood the Mayor correctly, Burlington has already reached its 2031 target.

The Mayor made much better use of good visual aids – at one point he put up three pictures; one of Waterdown Road as it is today – with its widening and a nice new coat of asphalt; a second on what is possible in terms of height under existing zoning and told the audience that if the people of Aldershot wanted a supermarket all they had to do was go along with those higher buildings.

It is clear that the Mayor hasn’t taken in a planning meeting in Aldershot – those folks want to keep their bungalows and streets without sidewalks.

There was quite a bit of time spent on the strategic Plan – he did mention that it was late – made no mention of the cost and didn’t touch on the content – not even a couple of tease lines. The audience he was talking to Thursday morning is going to be very disappointed when they see the final document – unless there are massage changes from the draft versions.

It was a dull speech – the Mayor doesn’t do barn burners – but gosh, golly, gee could he not have said something that would have the business men and woman in the room sitting up in their chairs?

The city planning department has been working on the concept of mobility hubs and there are still those prosperity corridors being talked up.

While the city council has not actually said that the |Aldershot GO station is where the first mobility hub is going to be located – all the signs point to that location. Those start ups the Mayor is so hungry for got another mention and the Advanced Manufacturing Hub that former Prime Minister promised us is still in the works. But he didn’t drill down into just what this would mean for the business community.

The Mayor did mention the newest speaker he has coming to town – this time it is going to be Brent Toderian who has said “good planning is not a popularity contest.” Toderian will talk about the need for city’s to grow “up” and not out at the Royal Botanical Gardens February 12th.

Mayor Goldring seems to want to go back to the Burlington of the 1970’s when he knew everyone in Roseland where he lived at the time – he longs for that “small town fee”.

He touched on the Community Investment Plan that is going to put small amount of money into community groups and let them plan and run recreational event in their communities.

“We are an engaged city” said the Mayor – it would be really wonderful if the he expanded on what he means by “engaged” because Mayor Rick Goldring certainly didn’t engage his audience Thursday morning over breakfast at the Burlington Convention Centre

By Pepper Parr By Pepper Parr

January 27th, 2016

BURLINGTON, ON

Is it a good budget?

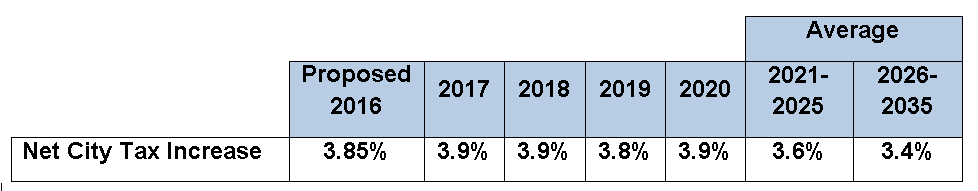

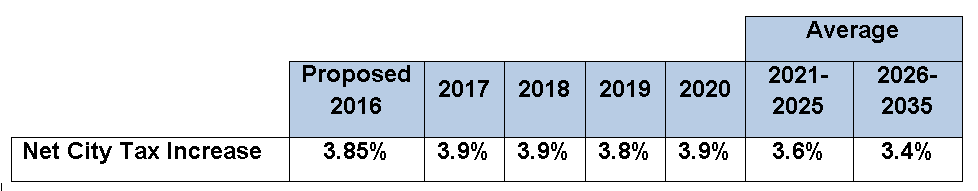

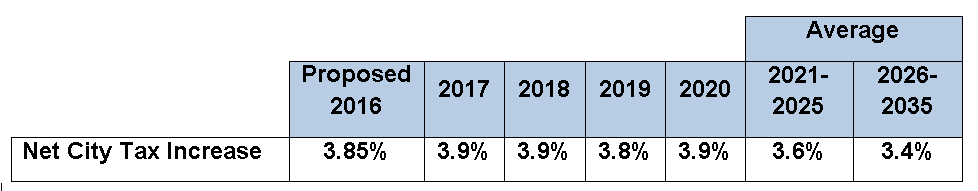

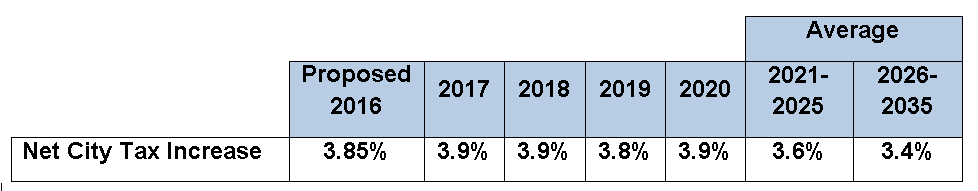

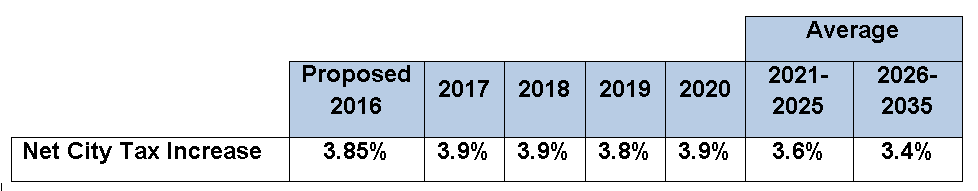

There are few taxpayers who are happy about the rate of increase over last year – and the 20 year projection calls for more of the same.

While the increase year over year is above the rate of inflation – the numbers have to be looked at carefully – they aren’t going to get much better. The biggest thing that appears to have come out of the budget exercise is a realization on the part of council members that they don’t have a tight enough grip on what they need staff to do.

Council seems to be continually blinded sided by one catastrophe after another.

Repaired at a cost of $380,000 in 2012 – the bridge is going to have to be replaced in the near future. The Drury Lane Bridge had to be repaired at a cost of $380,000 – that was for a five year patch – the estimated cost of replacing the bridge was something in excess of $2 million – which comes due any day now.

The Nelson Pool had to be closed because of problems with the steel structure and is now not going to be re-built and repaired until sometime in 2018.

The families with children that make use of the Nelson Stadium took matters into their own hands and began working with the school board to upgrade the facilities. The Stadium is on property owned by the city and the school board – two organizations who are not known for how well they get along with each other. They don’t even have a structure that has them meeting regularly to resolve shared concerns.

When a citizen’s delegation spoke at city hall they knew more about what was happening than members of council. That was not a pretty picture.

Council members expect staff to do the ongoing analysis that tells when an asset is due for an upgrade.

How did the city not know that the Drury Lane bridge needed work and how did staff did not know that the Nelson Pool was due for a major upgrade. There is asset management software out there that works all this out – and Burlington spends a fortune on software.

Do we have the right people managing this software and the way it is utilized?

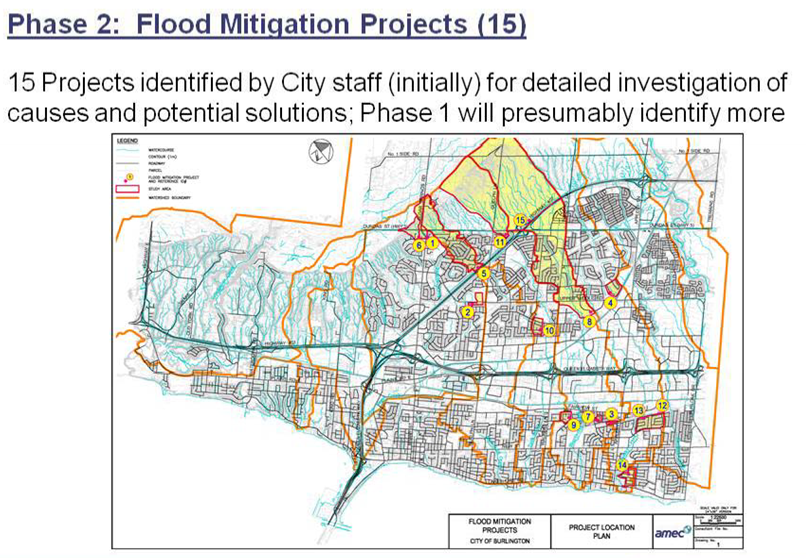

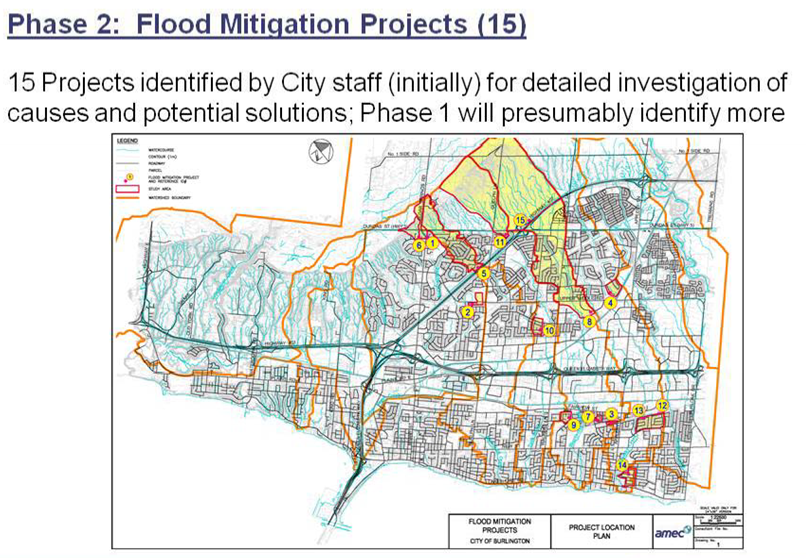

The one thing we know about the 2014 flood is that it has cost us a small fortune – think in terms of $40 million so far. We also know that climate change is likely to cost us even more in the years ahead. Managing the financial cost of the 2014 flood and coming to terms with what has to be done in the way of storm water management had $20 million thrown at it. Council has realized that it is going to take an additional $20 million to make the changes that were recommended by the consultants the city hired.

The scary word in this graph is “initially” It will probably take an additional tax levy to handle storm water. The Mayor commented that the city was going to have to take a serious look at a special tax levy for managing storm water. The realization that climate change is upon us and we no longer know what our weather is going to be – here we are at the end of January and you could be wearing shorts on some days.

As for city hall and the media people over there – they are doing it again. Messing with the numbers – and totally trashing there commitment to transparency and accountability.

The city’s media release said:

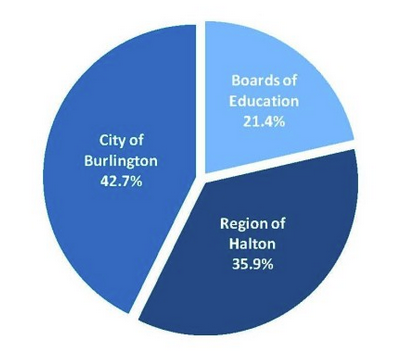

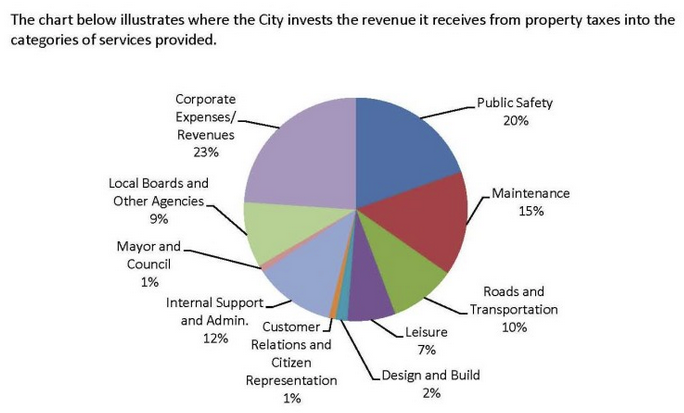

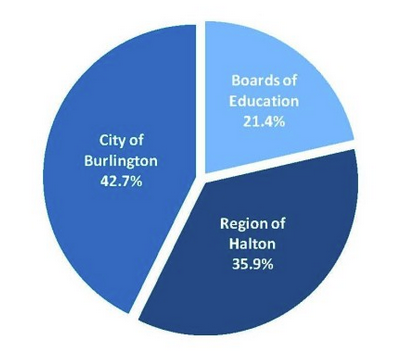

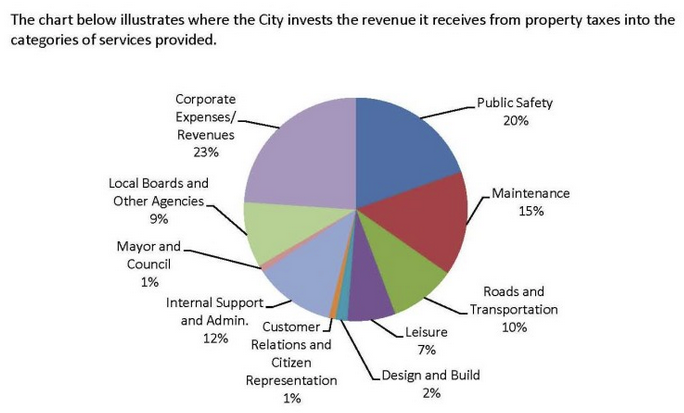

“The City of Burlington has approved the 2016 operating budget with a 3.14 per cent increase in the city’s portion of property taxes, which will result in an overall property tax increase of two per cent when combined with Halton Region and the boards of education, or $17.10 per $100,000 of home assessment value.

Highlights of the approved budget include:

• The base budget increase of 1.28 per cent is aligned with inflation (Toronto CPI 1.86 per cent) which is consistent with the Long Term Financial Plan objective of competitive property taxes.

• The base budget maintains the $4.8 million contribution towards the Joseph Brant Hospital reserve fund to meet the city’s $60 million commitment to the redevelopment project.

A 1.44 per cent increase dedicated to the renewal of the city’s infrastructure.

An additional $20 million in funding has been provided to accelerate roadway renewal needs over the next four years.

An additional $20 million of funding has been provided over the next 10 years for surface water drainage projects.

$613K in funding (0.43 per cent) to increase service levels in areas such as winter maintenance and stormwater management.

For those that qualify, the Senior’s Property Tax Rebate has increased from $450 to $525 in this budget.

“There are many competing demands for city tax dollars as well as an urgency to find inefficiencies and minimize tax rate increases,” said Mayor Rick Goldring. “We have tried to balance all the city’s needs, prioritize them and forecast with great thought and care to deliver a responsible budget that serves everyone.”

“This budget continues to provide funding to priority areas of infrastructure renewal, the city’s contribution to the hospital redevelopment and maintaining existing services,” said Joan Ford, director of finance. “In key areas, service levels have been increased.”

That’s their story and they are probably going to stick to it.

You won’t get another viewpoint on the budget – the print newspaper distributed in this city didn’t have a reporter at the meeting. My colleague Joan Little who writes a column for the Spectator will undoubtedly make a comment.

Is this an acceptable rate of tax increases? Does this Council think it can get re-elected in 2018 with these numbers? Take a look at that 20 year projection again. Did our city Councillors deliver a good budget?

The Mayor has asked the city manager to look for new revenue sources. Until he has a much better handle on how to manage the problems he has on his table now there isn’t much James Ridge is going to be able to do in the immediate future.\

He needs to get his strategic plan passed – it is close to a year overdue.

Can the current Council provide him with the advice and direction he needs? Two of the seven members have been on Council for more than 20 years. Will they run again in 2018? Will their constituents re-elect them?

2017 is going to be an uncomfortable year for this council.

By Pepper Parr By Pepper Parr

January 27th, 2016

BURLINGTON, ON.

The meeting started with a close to mammoth photo op – players from the Barracudas and the Eagles were on hand to receive certificates of appreciation for the very impressive work they did on the Giving Back project that brought in close to 300,000 lbs of food that was distributed to community organizations.

The Giving Back initiative has proven to be so successful that Brampton and Oakville are taking a look at it and there is talk about developing it as a national program

The students who were given Certificates of Appreciation by the Mayor in turn gave the city a painting that noted the 10th year of the Giving Back program. It was perhaps fitting that the young people getting the certificates of appreciation were the opening act for a city council meeting at which a budget was approved that runs quite a bit ahead of inflation. The long term projection is for budgets that are usually above 3.5% for the next twenty years.

The city finance department set out what they expected tax increases to be through to 2035. It is those energetic hockey players who are going to have to pay taxes that increase 3.5% year over year.

In 2011 when this council put out its first budget in their first term (they were all re-elected) the budget had a 0% increase.

The budget was not unanimously approved – Councillor Dennison did not vote for it and Councillors Meed Ward and Taylor were lukewarm – they wanted a different budget but couldn’t seem to pull the strings that would give them what they wanted.

The Free Monday transit for seniors was the issue that divided this council but it was not the structural issue that made this budget different.

Both Councillors Sharman and Dennison had detailed comments which they made once the budget was approved.

In his comments Councillor Dennison said he was not supporting the 2016 City Budget for the following reasons:

“I am not happy with a Burlington Tax increase of 3.19%” he said and “I had a number of recommended reductions including saving a possible $337,000 on the Transit Community Connection. He wanted the service to be paid for by users and the benefiting businesses. He pointed out that it costs $10 million to subsidize our current level of transit.

He also wanted to eliminate additional expense and staff for promotion of Canada 150 and save a potential $100,000.

Dennison wanted to reduce the amount that was being put into the Strategic Land Acquisition fund from $750,000 to $550,000 and save $200,000

Dennison wanted the provision for insurance claims reduced by $150,000. He pointed out that $500,000 from retained savings had already been put into the account and that was enough.

Dennison identified a total of $1,337,000 that could have been saved. His fellow Councillors didn’t agree with him. These changes would have brought our city of Burlington Tax increase down by 1% to 2.19%.

The city collects taxes for the Board of education and the Regional government. City council is fully responsible for setting the city tax rate; it has no impact or input on the school board taxes. Burlington has significant input on the Regional tax rate but Burlington doesn’t have all that much clout at the Regional level.  Dennison said he continues to have concerns with service-based budgeting. “There are benefits to the approach but it does not replace the need to know how individual operations are performing. Dennison said he continues to have concerns with service-based budgeting. “There are benefits to the approach but it does not replace the need to know how individual operations are performing.

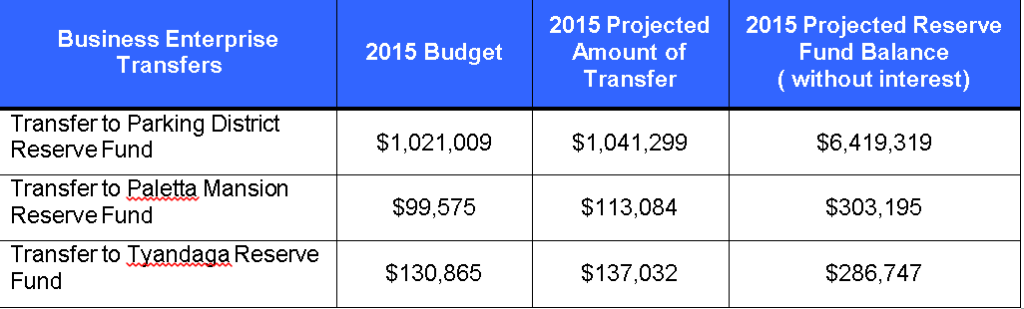

Burlington moved to a service based approach to budgeting which groups different operations making it very difficult to drill down to a line by line look at costs. He pointed to the problem comparing single-pad arenas to multi-pad arenas with respect to cost of operation and concerns with the Paletta Mansion and the Ella Foote Hall in Kilbride.

Dennison doesn’t feel that serviced based budgeting lets Councillors see all the costs and wants both service-based and individual results in 2017 so he can properly review the budget.

Councillor Jack Dennison has the best grip on where the budget dollars go – he does tend to drill down a little too deeply at times but he consistently wants to see the city spending less money. Dennison points out that “If we over-budgeted in 2015 that means that we over-taxed our assessed properties and the gross tax should be reduced by something closer to that amount and not just be put into reserves.

Just before the vote was taken, Councillor Sharman – ward 5 – said he wanted to on the record with respect to a few items:

“I fully respect and admire the work of community members who promote what they believe is a good idea. I deeply appreciate the time and effort and sometimes emotional strain undertaken by community members in delegating to Council. However, I often believe that delegations represent less than all of the opinions held by all members of the community.

“I have been and continue to be fully supportive of providing, timely, effective and affordable transportation to our community and especially those who have real needs. Perhaps as much as 37% of seniors need or desire to have use convenient transit at an affordable price, according to more thorough analysis of the Oakville free Monday Seniors Bus pilot program. That represents about 11,500 Burlington Senior residents. 63% of Oakville Seniors did not need or want free transit.

Intense to the point of making delegations uncomfortable ward 5 Councillor Paul Sharman does know how to drill down into the data and look for results. “I wonder why we should provide only one day a week free to those who need services when there is a high probability that they need it all the time. Research suggests that it should be all the time.

“I wonder about why we would not include other groups such as students. I don’t know how many people that would help, but I would like to know.

“We know that 9.5% or about 18,000 Burlington Community members live on less than the low income cut off threshold. Other people who have insufficient income to live on could push this figure up to 36,000 people who need or desire help.

“Without setting aside the legitimate desire and needs of seniors I wish to point out that we have in total perhaps in the order of 50,000 people who might legitimately be helped by Council. Split Pass provides us the way but it needs to be changed.

“Meanwhile, Burlington Transit has struggled to redesign itself to provide a viable business model that will meet the needs of all Burlington community members.

“I am not opposed to change for Transit. However, I am opposed to knee jerk inadequately thought out change. We have a chance to accomplish a properly thought out and real change when we discuss the transit service business case which we are committed to do as a result of my staff direction for Council to have a workshop to review each and every city business case.”

Other members of council had comments but they were not as extensive as those made by Councillors Sharman and Dennison.

By Pepper Parr By Pepper Parr

January 26th, 2016

BURLINGTON, ON

It was his first serious delegation, one at which he had a concern he wanted to put before city council.

Vince Fiorito, a candidate in the last federal election and a committed environmentalist who spends some of his weekends clearing out rubbish from the city’s creeks, had announced to friends that he was planning on running for city council in his home ward in 2018.

His intention was to spend the next couple of years attending meetings and networking like crazy.

Vince Fiorito was named the Watershed Steward for Sheldon creek. He now wants to become the member of city council for the ward he lives in – Sheldon Creek runs right through the middle of it. Fiorito is the Steward of Sheldon Creek, a title given him by the Conservation Authority, something he takes very seriously.

His delegation to city council was to focus on what he felt was very poor citizen engagement and he launched into his presentation. Less than 18% of the people in this city know about the ways they can be engaged in the civic process he said.

The city treasurer said she was going to inform citizens about the budget but would not be engaging them, advised Fiorito.

He explained that while he as new to the ways of city hall he expected more public participation.

It was at that point that Mayor Goldring interrupted Fiorito and explained that while he could talk about civic engagement he had to confine his remarks to how civic engagement related to the budget that council was considering.

We recall the Mayor interrupting delegations in the past but never on such a fine point,

Fiorito thought he was going to be able to talk about his concerns over the poor level of citizen engagement – the Mayor advised him that he could talk about his citizen engagement but only as it pertained to the budget – which was limiting what Fiorito had planned – but he recovered and went on to make his point – which was that the public really wasn’t in the room when the budget was being discussed

Fiorito was taken aback at first. His first comment was “Gee whiz” as he fumbled a bit to figure out how he was going to get back on track.

He did pretty well – pointing out to council that Seattle had held 38 neighbourhood meetings and involved 30,000 citizens.

This was the kind of thing he wanted to see happen in Burlington.

He also pointed out that there were no evening sessions in the committee meetings that went through the budget in detail.

The Clerk informed Fiorito that there was a planned evening session but no one asked to be a delegate.

Most of the council members hold meetings in their wards to get local input. A couple of Ward 4 residents discuss a previous budget. Councillor Dennison told Fiorito that he held a budget meeting for ward 4 residents and it attracted more people than the city meeting held at Tansley Woods. Dennison serves water and popcorn – that must be the attraction.

Councillor Meed Ward explained to Fiorito that many people send email to council members directly and questions are answered.

She and the Mayor asked for a link to the Seattle procedures.

There was to be a second delegation from Robert Lovell who had planned on talking about the need for the Free Monday transit for seniors – but he decided not to speak.

Was Lovell spooked by the way Fiorito was cut off by the Mayor?

Was it necessary for the Mayor to interrupt Fiorito? We have heard others go much further off track than Fiorito did without being interrupted.

What was most disappointing was while Fiorito had strayed – this was his first delegation and the Mayor could have cut him some slack. Mayor Goldring did approach Fiorito after the meeting and apologized for having to interrupt and did invite him to meet with the Mayor and discuss his concerns.

What was disappointing as well was that the Mayor could have said that Burlington had some distance to go to pull in stronger citizen participation.

Those that might have watched the live broadcast will probably have concluded that delegating and getting shot down was not something they needed to experience.

Vince Fiorito, delegating for the first time at a city council meeting brought back visions of the days when Councillor Meed Ward used to delegate and press council on better transparency and more accountability. Fiorito is cut from a different cloth. We saw traces of the original Marianne Meed Ward who delegated several dozen times pressing council to be more transparent and accountable before she was elected to office. And she began her climb to those august chambers several years before the 2010 election.

Fiorito seems to have decided to use the same approach. He will be worth watching. And don’t expect him to get tripped up again by the Mayor.

By Staff By Staff

January 25th, 2016

BURLINGTON, ON

The residential tax rate for 2016 is going to be $17.10 per $100,000 of home assessment value.

City council approved the 2016 budget this evening which came in at an increase of 3.19% more than 2015.

Additional details will be published early Tuesday.

By Pepper Parr By Pepper Parr

January 22, 2016

BURLINGTON, ON

It’s called being between a rock and a hard place, The rules will ‘get ya’ every time.

Your city council and the staff at city hall will say, whenever they get the chance, that they are always transparent and always accountable and that they are there to serve the people of the city.

The words “citizen engagement” are sprinkled throughout the Strategic Plan that is working its way through the bureaucracy.

Look at this situation and see if you can find the transparency or the accountability or even a smidgen of citizen engagement.

Director of Finance Joan Ford does a great job of providing the data. Burlington has a very good finance department; some of the most diligent people on the city payroll work in that department. They usually always have their fingers on whatever number a member of council might want. Whenever Treasurer Joan Ford doesn’t have a number at her finger tips or makes a small mistake she actually blushes with embarrassment and correct the error very quickly.

Our only beef is that the finance people are not particularly interested in engaging the citizens of the city – they are interested, and are very good at informing the public. These are two different approaches to civic government.

But that is not the current issue. The finance people set an aggressive agenda to get the 2016 budget completed. Debates on the budget take place within a Standing Committee.

Staff set out several days for the process of budget delegations and debate to take place.

Tuesday, January 19th: 10:30 to 6:30 – the meeting ended just after 4:30 pm

Wednesday January 20th: 10:00 am to 4:00 pm.

Thursday January 21st: 3:00 pm to 5:30 pm. This meeting did not take place; the Standing Committee was able to adjourn at 4:00 on the Wednesday when they set they recommended a tax increase of 3.16%

Delegations were held on the Tuesday during the day. For some reason they saw no reason to hold evening sessions- why not?

Why wasn’t there more in the way of public notices – the Gazette would have cheerfully run an advertisement for the city had they chosen to use our medium – which gives better value than any other media in the city – but I digress.

The delegations were strong, factual and well delivered and members of council certainly engaged those who were on hand to speak.

The Council debate took place the following day – the Gazette and the Spectator were the only media present.

It was a good debate – we saw some staff behave in a very disrespectful manner when a member of council put forward some data that was supplied by Oakville on their Free Monday for seniors program. A city Director came very close to saying he didn’t believe the numbers read out to him from the Oakville Director of transit. Our city manager, a former Canadian Armed Forces Captain, knows what insubordination is, quite why he didn’t intercede is a question he might want to answer.

When it came to a vote – those wanting the Free Monday transit for seniors lost on a 4 against – 3 for vote.

Councillor Craven is reported to have told an Aldershot resident that he liked the program – but he did not vote for it – that may have been because almost anything Councillor Meed Ward puts forward, Craven opposes. He didn’t speak at any length on the matter during the debate.

Councillor Paul Sharman voted no – he wanted more data. Councillor Sharman always wants more data before he makes a decision – there does come a point when a decision has to be made based on experience and wisdom. There was the sense that the asking for additional data was punting the ball off the field.

Councillor John Taylor – he voted no – saw free transit as social welfare which most people didn’t need. Councillor Taylor couldn’t help but see Free transit as some form of social welfare; his mind is still stuck in that old style thinking.

One wonders why Taylor does not label the $225,000 that is forgone in terms of parking fees for the free parking members of staff get every year. With that kind of money the city could make the transit service free to everyone.

Votes can be changed at city council; members can change their mind when they have new information.

But here is the rub. If council votes a second time on the budget matter of free transit for seniors on Monday’s and the vote is lost a second time – it cannot be brought back to council again for the balance of the term of office of this council – two and half years, unless the motion is brought by one of the people who originally voted against the motion – and that vote must pass with a 5-2 for vote just to get it on the table.

That is a high hill to have to climb and would make anyone who wanted to attempt to have the vote over turned at council think twice. Forcing the vote kills the opportunity for the balance of this term of office – which we suspect is exactly what some of the Councillors wanted.

A wiser mind would get into discussions with any member of Council they thought could be swayed – and if the votes were not there – then go to ground and wait for the right opportunity.

There is nothing to prevent council from asking the transit people to prepare the document that would set out what the metrics would be to measure a successful pilot program.

At one point Director of Transit said he could have the document done in a day – when pressed a bit he said he would need a couple of weeks.

Transit Director Mike Spicer, in the yellow shirt, shows Mayor Goldring what he wants in the way of new buses. The pilot program wasn’t due to start until April – so Mike Spicer, the Director of Transit has all kind of time to prepare a report – he might use some of that time to meet with his peer in Oakville and learn just how they made their program work.

There is a sliver of hope for the program. Mayor Goldring suggested that the transit people might want to use the pilot project as a marketing initiative – their response to that was they already had a number of marketing programs.

And how well are they working ? is a question the Mayor might have reasonably asked.

Rick Goldring doesn’t yet fully understand what it is to be a Mayor – as the Chief Magistrate he has a “bully pulpit” which he hasn’t learned to use. He could have and should have asked the Director of Transit to re-think his response and then invite the City Manager and the Director in for a cup of coffee and a chat.

Mayor Rick Goldring on one of the few occasions that he wore his chain of office during an interview. During the debate James Ridge, City Manager, wouldn’t touch the question. He said – and he right – “this is a political decision.”

That chain of Office the Mayor wears isn’t just a piece of bling. It is a symbol of the office he holds and the authority given him.

There was an opportunity to do something bold, something visionary and, in the words of Jim Young, a chance to show Burlington as a caring, conscientious community.

By Jim Young By Jim Young

January 21st, 2016

BURLINGTON, ON

I am speaking as a private citizen in support of Burlington Seniors Advisory Committee’s effort to reduce or eliminate Transit Fares for Burlington Senior Citizens. A proposal has been made that City Council and Burlington Transit consider Reduced Transit Fares for Seniors.

In support of, and in addition to the well-made case presented by Mr. Lovell on behalf of Burlington Seniors Advisory Committee, I would respectfully submit to Council and the Budget Committee that Seniors Transit is not just a senior’s issue but is one that affects the entire city, its residents and its reputation as a caring, conscientious community. An issue, which, if addressed effectively, will have beneficial impacts on Traffic Congestion, Road Safety, The Environment and will dovetail perfectly with many aspects of Burlington’s Strategic Plan Proposals currently under review.

As Burlington’s senior’s population approaches 30,000 and continues to grow, it is fair to say our impact on every facet of our city’s way of life is and will continue to be significant.

Jim Young Seniors Impact on Burlington’s Traffic Congestion:

There is universal agreement that traffic congestion is becoming a more serious issue in Burlington every year. As council strives to encourage continued growth and increasing population to ensure the economic well-being of our city this congestion will only become more troublesome and the economic and the environmental impact more acute. City Council recognizes this and addresses the issue in its Proposed New Strategic Plan (A City That Moves).

Seniors using affordable transit for one in five of their journeys would reduce traffic congestion by approximately 3%. While that may not sound like much, traffic flow science suggests such a reduction has a major impact on traffic flow and reduced commute times particularly at peak volumes. The more attractive any incentive to switch seniors from cars to transit, the greater that improvement will be. More seniors on transit allows working people, business transport and goods to move more efficiently, improving productivity, and supporting the vibrant business environment our city strives to encourage in that Strategic Plan.

Road Safety:

Studies indicate that as we age our cognitive abilities and response times deteriorate resulting in higher levels of traffic accidents, injuries and claims for senior drivers. The safety of senior drivers and their impact on accident rates is an emotionally charged subject we are loath to address for fear offending spouses, parents or potential voters.

Reduced transit costs for seniors would alleviate that burden by providing a dignified and affordable alternative to driving; thereby reducing the risks with all the human and monetary costs involved for their families, the city, traffic authorities and emergency services.

Reducing traffic accidents by moving seniors from automobiles to transit would also go a long way to meeting the city’s Age Friendly City and a Safe Place to Live objectives of its Proposed New Strategic Plan.

Jim Young The Environment:

Thirty Thousand Burlington Seniors driving an average of 15,000 Kilometers per year, even allowing for some spousal car sharing, emit 105,000 tons of CO2 into the atmosphere. Every car taken off the road by affordable transit for seniors reduces this annual amount by 3.5 tons.

Again, the Proposed New Strategic Plan aims to make Burlington a Greener Place to Live: an admirable objective for our city that we can help achieve by switching seniors from automobiles to transit and reducing our carbon footprint.

Jim Young has lived in Burlington for more than 30 years where he raised his family and involved himself in his community. He still has a pleasantly strong brogue accent. This opinion pice is a delegation he made during the budget deliberations at city hall.

By Pepper Parr By Pepper Parr

January 21st, 2016

BURLINGTON, ON

Robert Lovell doesn’t understand.

Robert Lovell He was interviewed for the job he has as a member of the Burlington Seniors Advisory Committee and thought he was expected to do just that – advise city council on things that mattered to seniors.

BSAC met on a number of occasions and went into the community to learn when people wanted in the way of transit services.

They researched what Oakville was doing and came to the conclusion that the Free Transit on Monday’s was a good idea and certainly worth trying in Burlington.

They then delegated to city council and made a strong case for trying the Free transit for seniors on Monday’s.

They argued that ridership would rise and the free service might convince people to try the bus. They argued it would also allow people with limited means to use the bus service more often.

Councillor Jack Dennison, Rick Craven and John Taylor voted not to proceed with a pilot project to learn how much additional ridership could be added to the transit service. All three voted for an allocation of $15,500 for the car free Sunday event that takes place in wards 4,5 and 6. A majority of city council didn’t see it that way and they voted (4-3) against the pilot program that was to run for six months.

Councillors Marianne Meed Ward, Blair Lancaster and Mayor Goldring voted for the pilot program.

Councillor Craven said very little during the debate. Councillor Taylor seemed to feel that the program was intended for those who could not afford transit – and he argued, if that was the case, there were Regional programs that gave financial support.

Taylor seemed quite prepared to have people submit to a financial means test to get support to buy a transit pass. He saw the pilot project as social welfare which he explained is handled by the Region.

Councillor Dennison has never been in favour of much in the way of support programs. Councillor Sharman said he didn’t have a problem with the program but he wanted to be sure everyone fully understood just what the outcomes and expectations were for the pilot project. He wanted the Director of transit to set out what would be measured so that a proper evaluation could be done when the six month pilot ended.

Lovell said he had been told by friends that the Advisory committees were just a sham – that they were put in place to let the public think the city wanted to hear what they had to say. “If that is the case: said Lovell, “then I am out of that committee. I am interested in working on committees that want to make a difference.”

Lovell was one of three people who delegated on the Free Transit for seniors on Monday – a program that Oakville has had in place since 2012 where it is reported to have increased transit ridership by as much as 14% in one period.

Burlington Transit has always had difficulty growing transit ridership. There have been significant price increases which has depressed ridership and route changes haven’t helped all that much either.

When the matter got to council for debate it was clear that some of the members of council didn’t hear what the delegations were saying the day before.

Jim Young was asking council to forget the cost but focus on service – he argued that it was taxpayer’s money and the seniors wanted this kind of service.

What council failed to see was the real opportunity that was being missed. Burlington has busses that travel the streets “more than half empty most of the time” if we understood what Councillor Sharman says.

A new bus is added to the fleet – city hall staff and area politicians drove over to the transit garage to give a round of applause. They get paid for this – don’t they? We own the buses, we pay a driver to be behind the steering wheel – if there was a chance to increase the ridership at no additional cost and at the same time provide a service and entice people to use the buses – why wouldn’t one at least try the pilot?

The city wasn’t going to lose any money – there would be passengers on the bus who would not pay a fare – they wouldn’t have been on the bus anyway

There is an additional benefit if ridership can be increased. The gas tax rebate the province gives a municipality is based on two measurements: the population of the municipality and the ridership.

There are currently 130 municipalities sharing $332 million dollars.

There was an addition to the 2016 budget that was estimated to cost $14,000 – they spent more than an hour

Burlington has had problems convincing people to use transit. Doug Brown maintains the city does not have a plan to increase ridership and that there really isn’t anyone within city hall who will advocate for improving transit. There is no one at city hall who fully understands transit – responsibility for transit get mentioned by the people responsible for transportation.

More than 17% of the population is over 65 and while many people are able to drive their cars well into their 90’s our aging population is likely to become subject to graduated drivers licenses.

We will get to the point where a doctor will be required to advise the department of transportation that the patient is no longer capable of driving a car. What do we do when we have a growing cohort of people who are either not allowed to drive or are no longer comfortable driving?

The transit free Monday was an opportunity to learn if people would take a bus if it were free. The driving factor behind the pilot project was to see if this was a way to increase ridership.

Old school thinking had Councillor Taylor seeing the request as a social welfare issue, while Councillor Sharman wanted a clear understanding of what the expectations of the pilot were going to be.

Ward 6 Councillor Blair Lancaster – voted for the Free Monday transit service for seniors  Ward 2 Councillor Marianne Meed Ward made her presence known to Council well before her election to office, the city knew what they were getting and she has delivered on that promise. Councillors Lancaster and Meed Ward were quite willing to let the Director of Transit take the time needed to prepare a report and if they had to move the start date of the pilot back a bit they could live with that as well. An amendment to the motion allowing for a report to be prepared didn’t pass either – the four opposed to the pilot project just didn’t want to see it take place.

When an item fails at the Standing Committee level there is always an opportunity to debate it again at a council meeting – these are usually held a couple of weeks later. However, budget meetings were slipped in and the normal rotation of meetings got jammed up. If there is going to be a change at city council – those who are behind this project will have to get a wiggle on.

The Gazette understands that the good folks in Aldershot are not at all pleased with the Councillor Craven vote against the pilot.

By Pepper Parr By Pepper Parr

January 21st, 2016

BURLINGTON, ON

What started out as a 3.85% increase in the tax rate for 2016 got whittled down to 3.15% at the end of a five hour budget meeting held at city hall on Wednesday.

The Performing Arts Centre got what they wanted, the seniors didn’t succeed in convincing the Councillors that free transit Monday’s was a good idea.

For the first time the public got some sense as to where the city manager ants to take the city of the future.

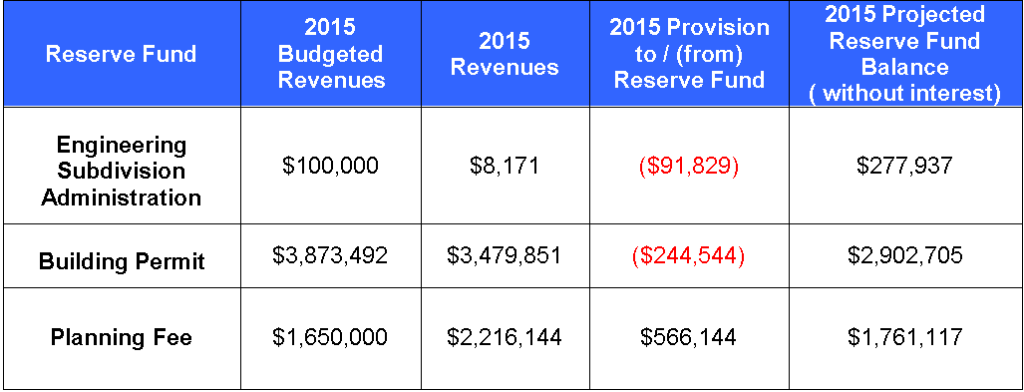

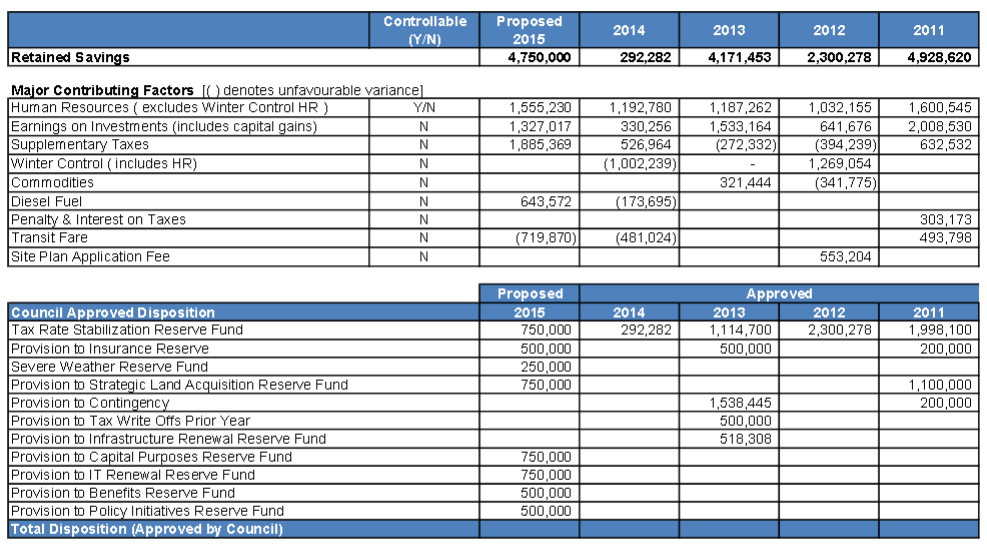

The disposition of the 2015 surplus was hotly debated – but for the most part those dollars are getting tucked into different reserve funds.

The way city hall is staffed is going to get a hard look and the city manager is going to issue mandate letters to his Directors.

The number of bylaw officers is going to change.

Plans for a program to collect data on the state of commerce in the down ton core got the chop- The Burlington Downtown Business Association (BDBA) was told they could pay for that task themselves.

And Councillor Jack Dennison actually went along with spending some money.

Councillor Sharman continued to hammer away for more data.

The Gazette will report in detail on each of these.

Council met as a Standing Committee – the decisions they made get approved at Council on Monday where they can be changed.

By Pepper Parr By Pepper Parr

January 20th, 2015

BURLINGTON, ON

It was a different day for Rick Burgess who stood before the Community and Corporate Affairs Standing Committee explaining why funds were needed for two new positions at the Performing Arts Centre.

He got a decent hearing; the Mayor is onside – Burgess was heavily involved in the Mayor’s re-election campaign.

Rick Burgess, the Mayor’s man. Paul Sharman, who sits on the Performance Centre Board didn’t seem opposed to the addition of the two people but didn’t seem all that keen on adding the cost to the Centre’s base budget.

There was a bit of banter back and forth about a how a Centre board meeting went – Sharman seemed to think the Centre should improve their revenue and pay for the new jobs out of those funds.

Burgess didn’t want to take that kind of risk – he wanted the dollars put into the base budget now and keep them there.

From the right: Performing Arts Centre Executive Director Suzanne Haines, retiring Executive Director Brian McCurdy who did a great job; Brenda Heatherington who opened the Centre and was the first Executive Director and Ilene Elkaim chair of the board. Suzanne Haines, coming along nicely as the Executive Director, appears to have broadened her role and is more involved in fund raising – even though there is a close to full time fund raiser on staff.

The public has yet to hear anything about what the fall program is going to look like – there hasn’t even been a hint.

Two years ago Burgess was getting a solid dressing down from this same committee when he pleaded for funds to cover the cost over runs and deficits that kept mounting. Council gave him the funds he needed then but it wasn’t a day that Burgess wants to remember.

He got the funding he needed then but the Performing Arts centre lost its Executive Director

Two Executive Director’s later and Burgess is back asking for additional funding – he wants the cost of a technician and the cost of a person to handle community engagement added to the Centre’s base budget.

Getting that additional funding isn’t going to be a slam dunk – there is far from a consensus among Council members that the Centre has earned the right to ask for additional support.

Last year was a good year – but it was not something Haines did – the good year – and it was a good year was made to happen by former Executive Director Brian McCurdy who resigned for personal reasons.

Haines is out in the community doing the networking and learning how culture works in this city and where the clout exists. She has a language of her own and talks of “animating” the place and making it more active.

There have been some small interesting changes. Haines needs time to get her footing and show what she is capable of doing. She has a supportive board and has come off a season that worked very well.

In her delegation to council Haines pointed out that curated performances grew from 30 to more than 100 and that there were 600 uses of the Centre.

The Pat Methany performance was sold out – it was the day Suzanne Haines started her job as the new Executive Director. She said 100,000 people have bought tickets and added that in August the Centre will celebrate its 5th Anniversary.

There is a Culture Infrastructure Fund, either set up or being set up, that will have $100,000 put into it. The Gazette needs to dig into just what that fund is to be used for and which part of the cultural community will have access to it.

Royal Wood signing CD’s after the very first commercial event at the Burlington Performing Arts Centre. The Centre people along with its supporters seem to be saying that the first four years were a time when they learned what needed to be done – and that is part of the past.

McCurdy has shown that with strong management the Centre can get by on the close to half a million it needs in the way of ongoing support.

The Centre is always going to need financial support from the tax payers.

Whether they are going to get the support they need is something council will debate today and on Thursday.

By Pepper Parr By Pepper Parr

January 20, 2106

BURLINGTON, ON

Every chance Doug Brown gets to talk about transit – he shows up. Brown is part of Bfast (Burlington’s Friends and Supporters of Transit) an organization that advocates for improved transit.

Brown is one of those people who tirelessly make delegation after delegation – he speaks with authority because he does his homework and has a good grip on transit facts and figures. Brown is one of those people who tirelessly make delegation after delegation – he speaks with authority because he does his homework and has a good grip on transit facts and figures.

More often than not, Brown will complete his delegation and Council doesn’t ask a single question. Brown turns away from the podium quietly and returns to his seat.

He must have been pleased to listen to the delegation that Robert Lovell and James Young made supporting the proposal in the budget review document that transit be free to senior citizens on Monday’s.

Brown however was surprised and disappointed to see that the budget for transit in 2016 was the same as it was in 2015 – which from Brown’s vantage point meant they were getting less because there was no allowance for inflation.

Doug Brown and Susan Lewis look over a 1982 copy of the city’s bus schedule. It is worse than that according to Brown. The province gives municipalities a portion of the gas tax they collect. The funds the municipalities get is based on a formula that includes population and ridership. the municipalities get is based on a formula that includes population and ridership.

Burlington has a population that grew a bit – but transit ridership was less in 2015 than it was in 2014 which meant we got less in the way of that gas tax funding . .

Doug Brown, chair of Bfast, wants to see more funding for transit and the development of a long term transit plan. Brown has been toiling away as an advocate for better transit but quietly says: “We have a long way to go” and point to Waterloo which has a council that understands the need for good, reliable, affordable transit.

Waterloo has a population of 97,475 – Burlington has a population that is at the 173,000 level. They can develop a progressive transit system – why can’t we?

Brown points to the city’s Official Plan and the Strategic Plan that calls for a modal split that has 11% of the transportation choices being transit. We are currently at 2%.

Free student passes are also something Brown would like to see.

If the amount of gas tax Burlington gets from the province is based on ridership – would it not make sense to boost ridership?

By Pepper Parr By Pepper Parr

January 19th, 2016

BURLINGTON, ON

It was delegation time, the occasion when different community groups get their ten minutes to wrangle with council to advance their different causes.

This time it was transit for seniors, transit and the lack of a master plan and two positions the Performing Arts wanted to fill and have added to their ongoing budget.

The Performing arts matter will get covered in a separate story.

Two very effective speakers wanted to see the idea of free Monday transit for seniors make it into the 2016 budget.

Which seniors need the free transit was the question that occupied the minds of many of the council members.

Imagine a bus service that is free to senior’s on Monday’s – it just might happen. Every senior responded both Robert Lovell representing the Burlington Seniors’ Advisory committee and James Young, a word 1 resident who spoke to the plans for transit fares for seniors.

In Burlington delegations are usually a one way street – the delegations speaks but for the most part doesn’t often engage the members of council.

There are many occasions when a delegation doesn’t get asked questions.

When Councillor Craven is chairing the meeting – delegations are kept to very few words. Not that way when Councillor Lancaster is the chair.

Robert Lovell was asked questions and council got much more in the way of an answer than they expected when Lovell pushed right back. Lovell wanted to see Burlington adopt the free Monday transit for seniors that Oakville uses and he kept chiding Burlington’s council members for not doing what Oakville has been doing since 2012.

The two delegations were both seniors – they were there to see that the senior’s in the city got what they felt was needed. Lovell talked of people who were not able to get out of their homes because they couldn’t afford the cost of transit.

“These people get isolated and there mental health deteriorates”, he said.

Mayor Goldring and Councillor Dennison wanted to know what percentage of the senior population lived on the $12,000 a year Lovell had referred to; he wasn’t able to say but he had a petition with more than 500 signatures.

The short delegation session Tuesday afternoon was all that was needed to handle the delegations that were made. It isn’t clear if no one asked to delegate in the evening or if the city decided it was not going to hold an evening session. So much for an engaged city.

Councillor Lancaster said in her opening remarks there was lot of consultation. There was just the one public meeting held at Tansley Woods last week.

In contrast the Strategic Plan has been put before five different public meetings as well as a very detailed on line questionnaire.

For some reason people in Burlington just accept how much their council decides to tax them.

Parents at a hockey game while three people next door were listening to a budget presentation. It’s just who we are. In 2015 there was a public meeting that focused on the budget held at Mainway Recreation Centre; it was a winter night – less than three people showed up – next door at one of the skating rinks less than 20 yards away there were several hundred parents watching a hockey game . .

Did they know there was a public meeting to review and comment on the budget? The city does advertise the events – and the Gazette certainly spread the word.

In 2014 – an election year people showed up for the budget review. In 2015 it snowed and there were just three people in the room plus two people who had run in the last election and were keeping tabs on the council they were not part of – this time. There have been other public budget meetings that were very well attended – however the more active citizens complained that the budget decisions had already been made – all the city was doing was explaining what they had decided to do.

There are those who think the public should be at the table helping to decide what and where their tax dollars are to be spent. And that was certainly what Robert Lovell and James Young were suggesting council do – take a much different look at transit. Make it free for seniors every day of the week suggested Young. “That’s what they do in Europe” he said. “You are looking at transit as a cost when you should be looking at transit as a service that is paid for with money the taxpayers give you”, he added. the taxpayers give you”, he added.

Several members of council wanted to know how many really poor seniors there were in the city that needed financial support to be able to use the transit system. The figure was said to be 6%. support to be able to use the transit system. The figure was said to be 6%.

Mayor Goldring pointed out that 17% of the population is made up of seniors – he seemed to be worried that they all might want to get on a bus on the Monday’s when service would be free – which is exactly the point Lovell and Young were making.

There comes a time pointed our Lovell when you lose your license – what do you do then? The frequency of the bus service really limits how much you are going to be able to get around. If the service were free and frequent you would have people out of their homes spending money , going places and being active in the community, said Lovell , going places and being active in the community, said Lovell

The Mayor, who said he was a senior, one of the younger set – but he does hold a membership at the Seniors’ Centre, told the delegation that he was once carded and asked to prove he was a senior.

The Mayor’s concern was with how many seniors the city will have in 25 years and how a city would manage to deliver the services they will need. The challenge is to develop plans today that will provide the services needed.

One thing became very clear Tuesday afternoon at city hall – if Robert Lovell is representative of the baby boomers who are entering retirement city councils of the future had better be ready for some very local people who expect much more in the way of services And they are not going to be quiet or docile.

Joan Gallagher Bell spoke of a new vision for an age friendly city – for her the minimum was the free transit on Monday.

And that was what Councillor Meed Ward had put forward an adjustment to the budget to make the free service available this year.

Cost – no one was sure but $40,000 seemed to be the number. James Young pointed out that it wasn’t a real expense – it was just revenue the city wasn’t going to get.

Councillor Meed Ward just might deliver a real benefit to the senior citizens with this budget. There is a side bar to this event. More than a year ago – on a December 18th of 2014 when city council was deciding who was going to sit on which committee, Meed Ward represented the city on the hospital board and she very much wanted to retain that committee responsibility.

Her colleagues didn’t see it that way and gave that task to Councillor Sharman and gave the job of representing council on the Seniors Advisory Committee to Meed Ward. of representing council on the Seniors Advisory Committee to Meed Ward.

Meed Ward has delivered big time for the seniors – she will be rewarded when she decides to run for a different role on city council in 2018. when she decides to run for a different role on city council in 2018.

TO:  Burlington Community and Corporate Standing Committee Burlington Community and Corporate Standing Committee

FROM: Tom Muir

Subject: City Budget 2016

Tom Muir wasn’t able to get to the Standing committee and his schedule didn’t allow him to get to the one public meeting held to “inform” the public abouit the contents of the Operating budget. So he took to the media that is open to every opinion out there and sent the following to the Clerk of the Standing committee to have his comments put on the record. Council tends not to listen to Tom Muir.

Councillors;

Since residents did not enjoy city public engagement on the budget, but have just been informed of spending and taxing plans, I have had to spend significant time finding a focus of my concerns.

It’s far to much to cover all the details, however, the big picture over the 20 year forecast is of particular note and concern to me.

1. The compounded average tax rate increases will double the tax take before the forecast period of 20 years is elapsed. Use the rule of 72 to figure that out. The average tax rate increase over the entire period is 3.62% and this leads to the doubling over 20 years.

Using the example bungalow residence in the budget document, the city tax take will go from $1415 to $2854.

If the other tiers of the total tax burden go up as well, the total tax bill could go from $3410 to $6878.

I have to ask you to ask what residents and businessmen think about that exponential curve trend upwards of this tax burden?

Can business double the price for goods and services over the same time period?

I hope your net income is increasing by more than 4% a year for the next 20. Mine is not.

Is this really raising taxes in an affordable manner?

This is really inflationary, in fact, and is shifting income from residents and business to the city for them to spend.

It seems like Council isn’t really thinking about this cumulative trend, in and of itself, and the consequences, at all.

No comment or request in the budget papers that I saw.

And residents were not asked what they thought, they were not “engaged”, just “informed” – this is what we are doing and here’s the tax take.

I would like to see Council pay a lot of attention to this trend. We need Council to tell the Managers to find the cuts needed to shave this to the inflation rate. And don’t tell me there’s no fat to be found.

Tell them a doubling of city taxes over the next 20 years is not to be tolerated.

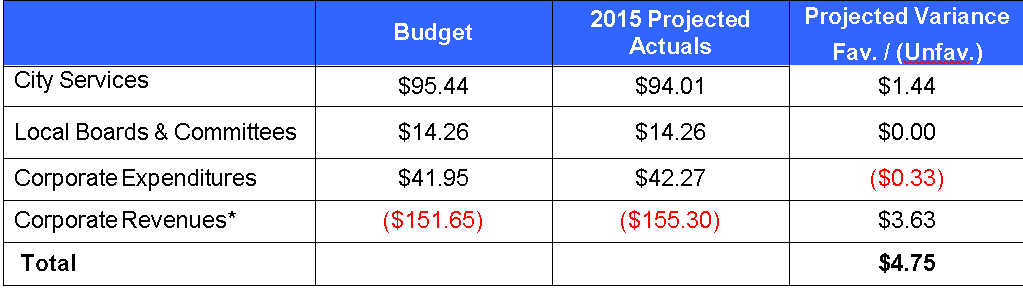

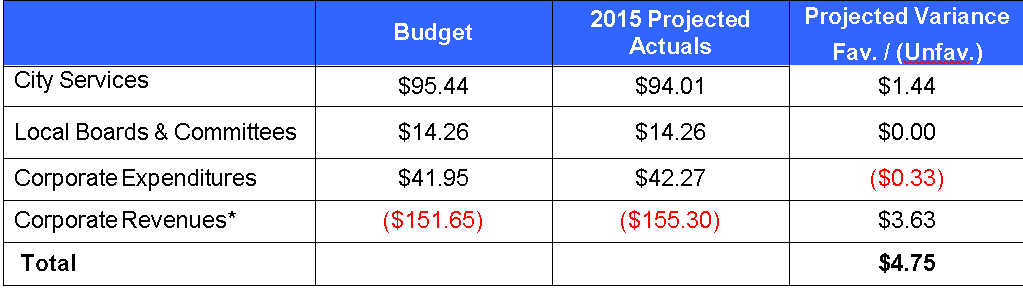

2. Regarding the 2015 surplus reported, this $4.75 million is 3.23% of the net tax levy of almost $147 million. Taking $3 million of this and subtracting it from the tax levy, would bring the increase down to about the 2% inflation the city claims.

From the of view of the residents and business people, adding all of this to reserves is akin to adding more fat to the city finances. We don’t need fat there, as the reserves look fat as they are.

I see no explanation of some disaster lurking.

The 20 year trend of exponential tax increases that double the tax take, also has fat, for sure, somewhere, but while there are certainly some Councilor requests for amendments and some cost cutting, overall Council doesn’t appear to have asked Management to go find sufficient cuts needed to stay within inflation.